Talking about how the USD used to selloff into Fed events and now rallies into them.

Degrossed

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Talking about how the USD used to selloff into Fed events and now rallies into them.

Stop loss 4366

Take profit 4010

August 22, 2022

The market is becoming more and more concerned over the collapse in Europe’s current account balance, the death of the German export machine, and the coming European Winter. The ECB and BoE are in an awful position as their currencies tumble and rates rip in what looks like an EM-style trade. Meanwhile, US energy exports are at an all-time high and we’re approaching an event where the market expects Powell to reaffirm tightening guidance.

I would expect the market to continue to buy USD into Friday’s Jackson Hole speech from Powell. This is what I call “the run-up trade”. Here is a description of the run-up trade from Alpha Trader.

The run-up trade is a phenomenon where prices move in a logical and predictable direction in the days leading up to a major event. These run-up trades are often easier to predict and monetize than the events that follow.

The idea behind the run-up trade is to identify an upcoming market event and then estimate what traders will do before the event. If AAPL earnings are coming up this week, which way are traders likely to play it? If non-farm payrolls are a few days from now, what might the market do in the days leading up to the release? The run-up trade is usually a function of three things:

Positioning is currently somewhat light, even though everyone is bullish USD. Engagement levels and risk allocations to FX are low. The obvious trade is to buy USD, of course, as Fed credibility is at multi-decade lows and Powell desperately needs to reaffirm his inflation-fighting chops. The lotto ticket trade is an impulsive lurch higher in the dollar through September as the EU situation worsens, stocks retest the lows on negative seasonality after the failure of the textbook bear market rally, and the Fed reverses the unwanted loosening of financial conditions.

This is Keynes’ beauty contest. It is easier to predict what the market will do into the event than it is to predict the event itself. The run-up trade has been pretty good into Fed events over the years, as I will show on the next page.

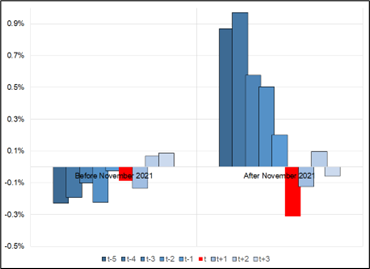

Here’s the price action around Fed meetings and Jackson Hole since June 2020. I split it into two buckets, one for before Powell dropped transitory and one for after. You can see the market sold USD into the events before and bought USD into the events after. Then, the event itself was “sell USD” as meetings, on average, end up dovish, even as the Fed is in a hiking cycle. Buy the rumor, sell the fact in other words.

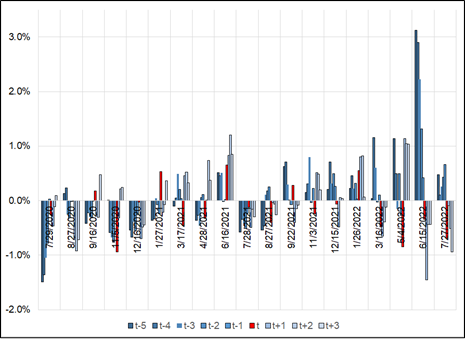

Here’s the granular data for each event. t-5 means the change in the DXY in the five days before the event, t-4 is the four-day change going in, etc. The red bar is the change on the day of the event. Then I show the change in DXY t+1, t+2, and t+3. These are all FOMC meetings except the August 27 moves which are Jackson Hole.

If you look on the left, you see mostly USD selling into the events. Things got mixed starting in June. And then every meeting since September 2021, the market has bought USD going in.

The implication here is that I expect the market to go into Powell’s Friday speech with the USD at the highs and stocks at the lows.

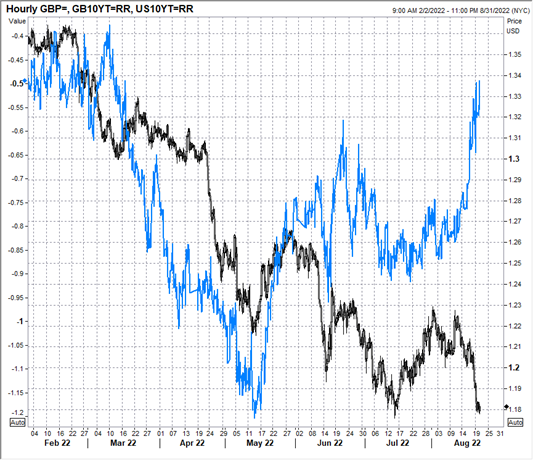

Most of the feedback I got on my Liz Truss piece was that she is a red herring, and the real story is energy. Fair enough! The market is certainly doing the sell gilts, sell GBP trade right now, though it’s hard to blame Truss as the same trade is happening in Europe. For now, it’s more of an emerging markets energy crisis and hyperstagflation trade than a play on UK policy.

This chart shows the sell Gilts, sell cable trade in all its glory as it accelerates over the past week.

If you are interested in AI image generation, this thread is an excellent comparison of three competing technologies. The use cases are endless (video game asset design, product development, efficient animation, character development, advertising, book covers, logo development). At this moment in time, AI image generation is probably more useful than all of Web3 combined. The UI is seamless, and the product is cheap and easy to use.

Have an inspired day.

I put “Modern Monetary Theory” into the Midjourney AI image generator, and this was the result.

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Taking profit on the USDJPY and looking for a way to get short GBPUSD for corporate month end.