Peak fear to sugarplums in two weeks

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Peak fear to sugarplums in two weeks

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Before we get started. My daily note is called am/FX and I would like to offer a free trial to anyone who has never signed up for it before. If you sign up for the note, you’ll get it free until the end of the year.

Click here to sign up for a free am/FX trial — now ‘til 31DEC25

am/FX features my daily thoughts on global macro, FX, stocks, crypto, and more. Includes trade ideas, trading psychology, and practical, real-time, forward-looking analysis. The trial is risk free and you don’t need to give me your credit card information or anything scammy like that.

Okay, lets’ get started.

*******

We have gone from full on panic in equities and max fear to

“Santa Claus Rally and 7000 SPX!”

In two weeks. What looked like an AI Capex freakout was really a rotation out of OpenAI and into GOOG. Many retailer results have been excellent in the meantime with Kohl’s, Ulta, Abercrombie and Fitch, Dollar General and a litany of other consumer-focused stocks delivering upbeat outlooks. The S&P 500 is suddenly zipping higher just short of the all-time highs as the Fed is priced for another cut and everything is awesome.

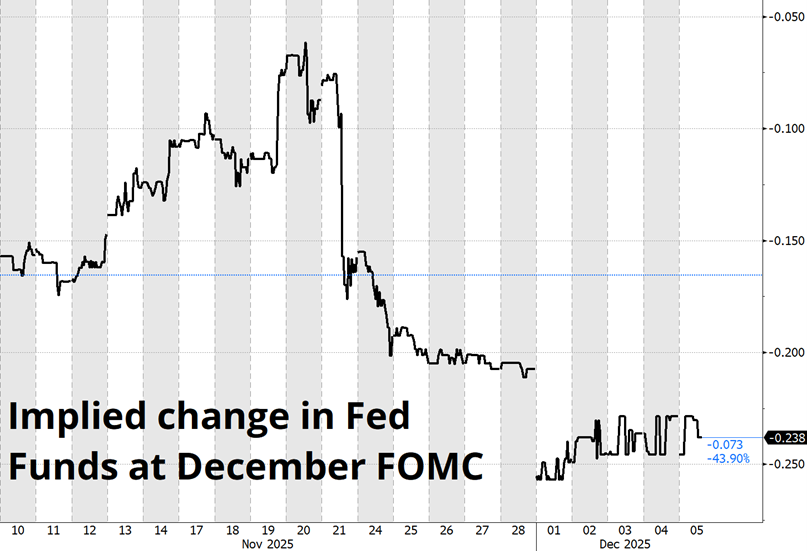

The Fed story was temporarily a weird one as the market briefly took out the December cut, despite the fact that if you went down the list of voters, they almost surely always had enough votes for a 25bp reduction. Rates markets got momentarily confused, and then returned to where they should have been the whole time.

Meanwhile, most other central banks around the world are done cutting for now as the RBNZ came in hawkish, Canadian data is on the rebound, and the ECB is on permahold. The Bank of Japan, in contrast, is looking like they might hike in December. I would be careful with that one as it reminds me of December 2024, when a BOJ hike was expected, the BOJ passed, and USDJPY spiked 400 pips.

The US data has been all middle ground as ADP shows a negative number for US job creation, but Initial Claims remain low despite evidence of some layoffs in the highly-unreliable WARN data and weakness in the always useless Chicago PMI.

The real question for macro going forward is what Powell plans to do with his last few meetings. Does he come in with a hawkish cut next week, or does he simply capitulate and go with the dovish flow? Any idea that he might want to preserve his inflation-fighting credibility in the final innings is off the table. The 2% inflation target has been abandoned now for years. A dovish cut would be more surprising than a hawkish cut as Powell continues to pretend he is concerned about inflation while he continues to cut rates. I suppose the Powell Fed will be best remembered for its “transitory” call in 2021 and the never-ending series of trading scandals. These last few meetings won’t matter, so maybe Powell just gives Waller and Williams the reins and goes full dove. Let’s see.

It’s that time of year again.

The fourth annual handbook has arrived…

The 2026 Spectra Markets Trader Handbook and Almanac is live

Use The Spectra Markets Trader Handbook and Almanac as a trading journal/day timer, and as your guide to seasonal patterns and key economic events throughout the year. It will anchor your process on proper journaling and planning—and help you thoughtfully assess your performance at the end of each month. Goals and plans written down are much more likely to come true than a flurry of ideas and thoughts and hopes swirling around in your head.

The market seems to have made its peace with the fact that OpenAI’s math doesn’t work, but the AI story is still fine. HSBC piled on to the OpenAI story this week, and Deutsche put out this humdinger of a chart:

As Steen Jakobsen put it: The AI Capex trade was a long only trade and now it’s a long/short trade. That said, Oracle CDS have stalled and its stock price has rebounded smartly (so has CRWV) so even the wobbliest pillars of the AI trade have stabilized. Meanwhile, Google has been unanimously crowned as the winner of the AI war, a full 180 from when they were deemed to be the most likely to lose in 2023/2024 because Perplexity and others would surely crush their search business.

The market hated Google at 5X sales, but now loves it at 10X.

They’re all Veblen goods.

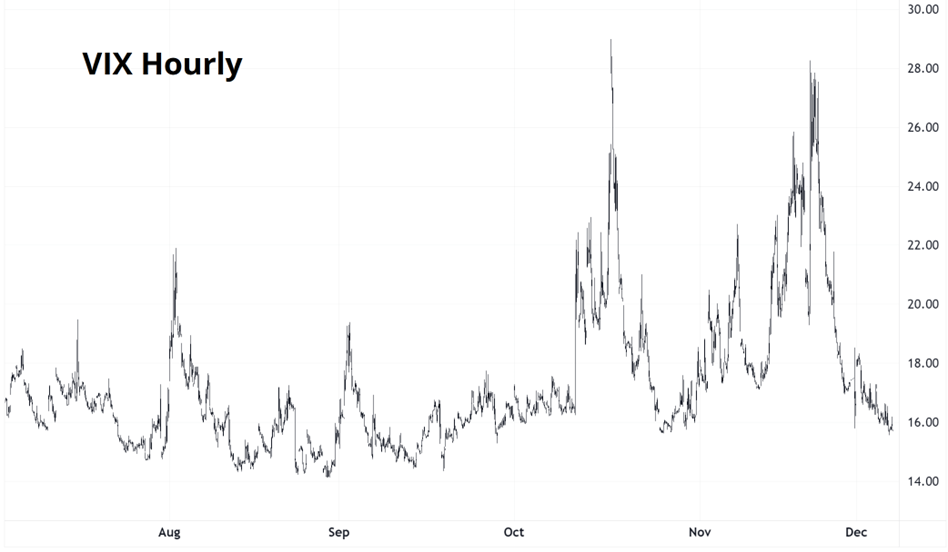

And with Fear turning back towards Greed, the VIX is back on a 15 handle. I have been bullish since mid-November, with decidedly mixed results, and I’m neutral now. The market is too bullish today just like it was too bearish two weeks ago.

Here is this week’s 14-word stock market summary:

Extreme fear has cleared and Santa will bring cheer to the end of year (?)

https://www.spectramarkets.com/subscribe/

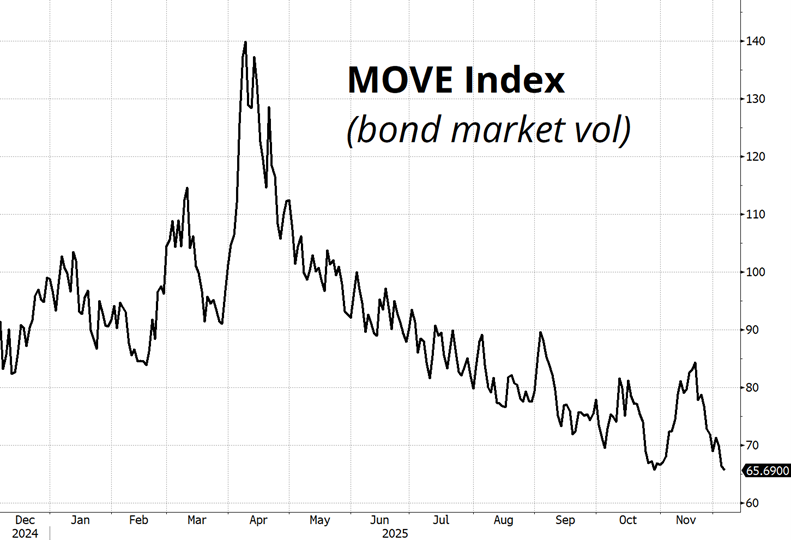

Yields are going absolutely nowhere as the data fog has not truly lifted and while there are some signs of labor market weakness in the U.S., the rest of the world looks less dovish. The market sells bonds every time the U.S. 10-year yield goes below 4.0%. There is no momentum. 10’s were 4.10% at the start of September and they’re 4.10% now. The resulting effect on bond market volatility is what you might expect…

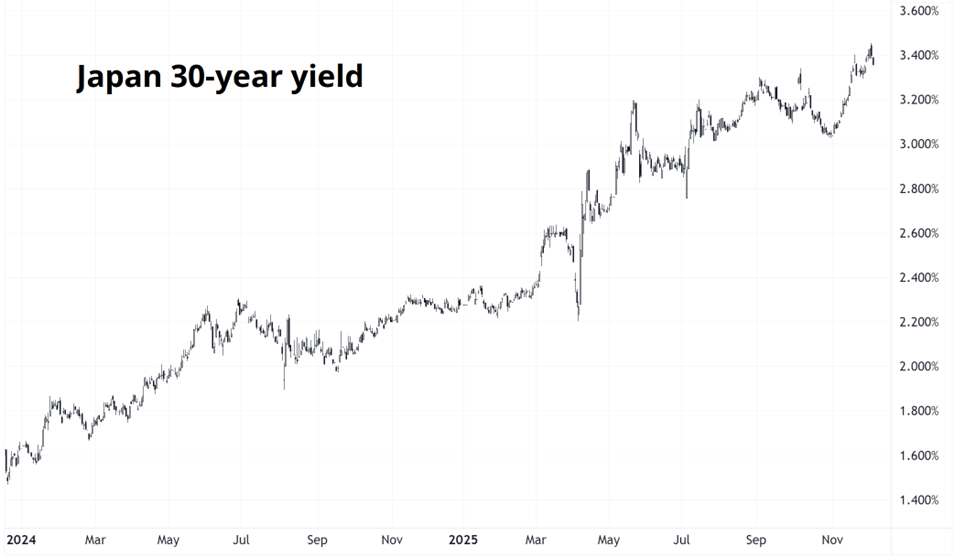

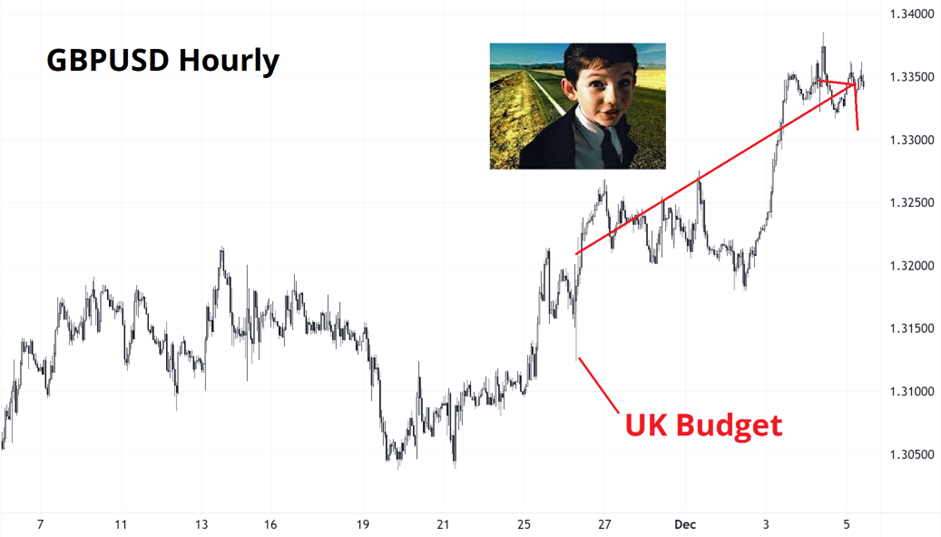

The vigilantes keep watching Japan and the UK, but the fear factor is waning. The UK delivered a budget that was about as close to a nothingburger as they could possibly have hoped, and the market has moved on from the idea that the UK is in fiscal trouble. The fiscal story in the U.S. is not improving, but the market doesn’t care. The fiscal story in Japan is getting worse, and the market cares a little bit?

I turned bearish USD in late November, and the dollar has traded pretty soft since then, but the moves are unspectacular. AUD, NZD, and CAD are particularly bid this week as the RBNZ announced the end of their cutting cycle, Canada jobs were stonking, and Australian CPI remains high. Booming commodity prices help at the margin, though the Terms of Trade effect on FX has been minimal in recent years.

AUDUSD went from “Uh oh, the bottom of the range is breaking!” to “OK, now AUD is DEFINITELY going to rally!”

It’s a weird-looking chart.

I went long EURUSD and NZDUSD on Tuesday as the market is long dollars with a run it hot Fed Chair coming, an already bad fiscal situation, high nominal rates that are about to fall, a seasonal tendency for USD weakness, and interest rate differentials at the wides. It is a bit of an obvious setup, but the market is half asleep and participation is low. So far, the trades are working and I think we can keep going for another week or maybe two.

With the budget out of the way and nothing scary happening in the UK, GBPUSD went like the Mazda kid used to say: Zoom Zoom.

Bitcoin often decouples from risky assets in one direction or the other, but it always comes back home. This time, the divergence between BTC, QQQ, and GLD has been more prolonged than usual as there is no marginal buyer of crypto and still plenty of marginal sellers.

The Crypto DAT nonsense is finally dead as most of the crypto treasury companies are making their way towards 1.0X mNAV or something close enough. They continue to pay huge salaries to management, but will be unable to sell any more $1 bills for $2 as the market finally understands there is no there, there.

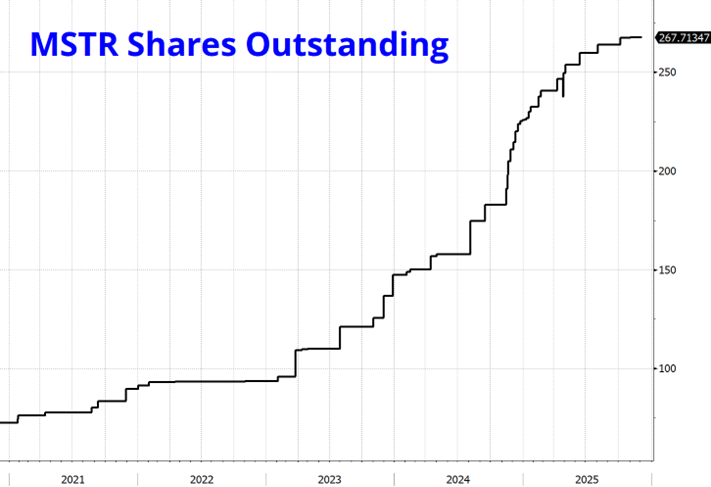

MSTR hit a speedbump this week as the market starts to question whether they can pay the bills in the future, but then they sold more stock to raise USD to create a dividend war chest and that calmed the market down. There was a massive spike in MSTR volume on a major low and I think that going forward you will see all these crypto treasury companies simply trade near 1X mNAV as they slowly leak money due to fees and compensation costs, but few specs or HODLers will sell sub 1X.

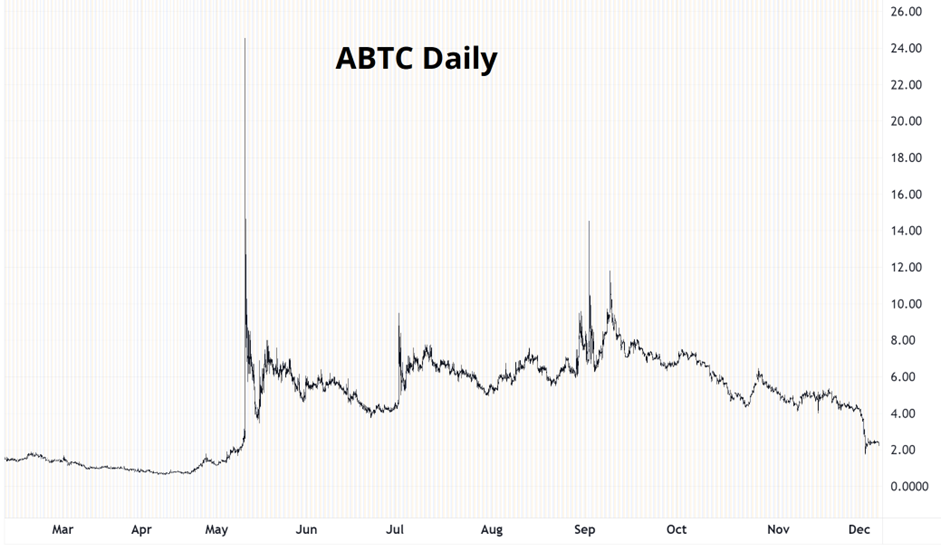

Expect the crypto DATs to fade into obscurity over time even as MSTR remains relevant due to the fascination around the preferreds (and its ability to pay future maturities) while garbage like BMNR, ABTC, UPXI, and whatever else are all just pointless proxies with procyclical qualities that will ebb and flow depending on dilution and movements in the underlying.

January 15th is supposedly a big date for MSTR as MSCI may decide to knock it out of the MSCI World index. This, again, is all pretty dumb as MSCI added the company in May 2024 knowing full well exactly what the deal was. Saylor is now pleading for mercy from the index and the market will certainly eye this date given the forced liquidation that could result from exclusion. In the end, the flows matter in the ultra short run, but the price of BTC is more important to MSTR than index inclusion will be as investors will buy any steep discount to mNAV and Saylor will continue to dilute if mNav goes higher again.

![]()

Shares outstanding have more than doubled since 2021. Unlike bitcoin, there is no fixed supply of MSTR.

My hope is that all this crypto treasury stuff fades to obscurity like the NFTs of 2022, the Bored Apes of 2021, the ICOs of 2017, the fidget spinners of 2016, the Rainbow looms of 2015, and all the other silly fads of the last 10 years.

I am not bearish crypto at this stage. The divergence between BTC and QQQ is so huge that it’s way too scary to be short crypto down here. The only real trade is probably to sell vol in a bunch of crypto DATs as the market has lost interest and volumes and volatility should go lower and lower and lower asymptotically towards zero.

One for the road… Trump-sponsored crypto DAT, American Bitcoin Corporation. The lockup ended this week, and insiders are stampeding out of the stock at the lows. We are in the golden age of grift and you are on an island of pickpockets.

Silver has recovered strongly from the post-margin-hike selloff and is ripping to new all-time highs again. There isn’t much of a macro story anymore, it’s just retail demand and momentum trading and there are no natural sellers. Look at that huge gap from $54 up to $56. Wow. As long as silver is above $56, the bull trend is extremely strong, and you can use your imagination when thinking about possible price targets.

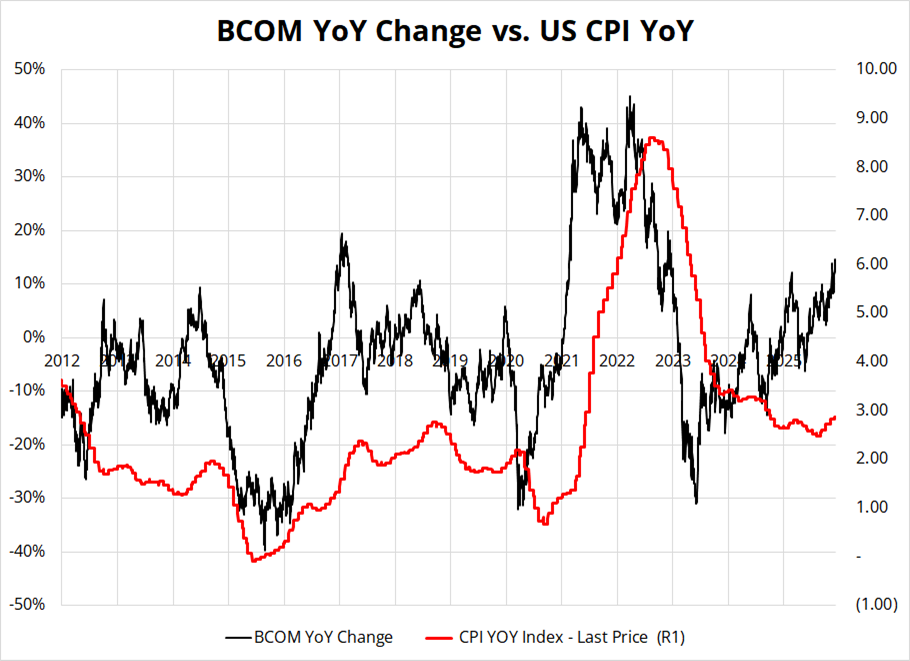

BCOM keeps marching higher and there is not a TON of media coverage around it. Even oil is climbing up off the canvas and participating a bit.

At some point, this could become inflationary as commodity prices can be a major driver of headline inflation.

That’s it for this week.

Get rich or have fun trying.

*************

“The Bank of Portugal has become aware of false publications, disseminated on social media, regarding the issuance, by the Bank of Portugal, of a banknote, worth 7 euros, in honour of footballer Cristiano Ronaldo,” reads the statement published today.

HT JMP

*************

New piece from Kuppy

*************

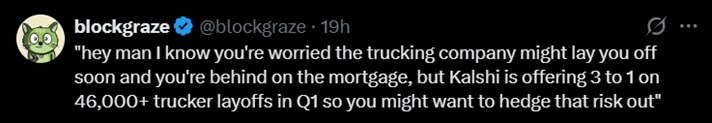

Possibly the worst tweet of the year. SBF wanted to tokenize everything now these guys want to financialize everything. They are badly disconnected from the real world.

A good reply:

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.