People love to dump on magazine covers and point them out as contrarian indicators but some publications are reverse indicators, and some are not.

Push and Pull

It was a week of crosscurrents and contradiction

People love to dump on magazine covers and point them out as contrarian indicators but some publications are reverse indicators, and some are not.

I tend to read darker novels and various non-fiction mostly, but I am reading “Watership Down” right now for the first time. It’s a wholesome, beautiful, classic kind of book.

Suitable for kids and adults.

Welcome to Rabbit Hole #12. The Rabbit Hole series offers deep dives into random macro topics that fascinate me. Today: People love to dump on magazine covers and point them out as contrarian indicators but some publications are reverse indicators, and some are not.

8-minute read – forwarding of this piece is encouraged

I have been intrigued by the perennial reliability of covers of The Economist as reverse indicators over the years and have published empirical studies showing that this effect is persistent and works out of sample. See here, for example.

https://www.spectramarkets.com/amfx/the-magazine-cover-indicator/

https://x.com/donnelly_brent/status/1786136501547413797

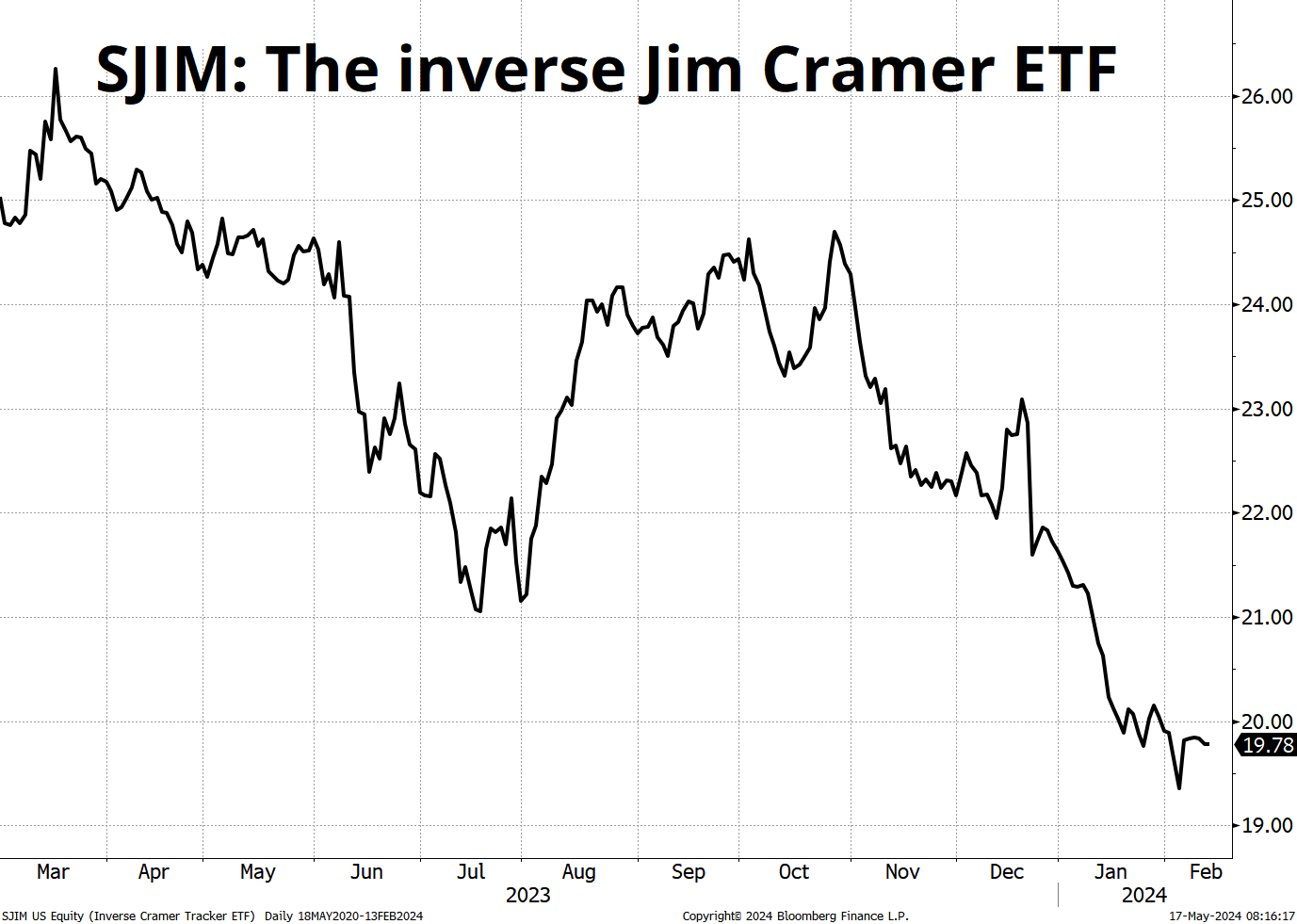

The reason Greg and I did the original study of magazine covers in 2016 is that it’s fun to talk about magazine covers as reverse indicators but there can be a cherry-picking, generally. People remember hilariously bad calls, but forget the good calls. This is the reason the Inverse Jim Cramer ETF was an outright failure. Everyone loves to crap on Jim Cramer’s bad calls, but the reality is that he makes many, many calls and some of them are good and some are bad. FinTwit laughs at the bad ones and ignores the good ones.

The Inverse Jim Cramer ETF was a disaster due to churning, fees, and a trolling premise not backed by data. In the period where the ETF lost 20%, the S&P was up 30%. It doesn’t pay to just fade people or magazines blindly. The Inverse Cramer ETF shut down.

While the evidence clearly shows it does pay to fade The Economist, but not Jim Cramer… What about Barron’s?

Whenever a new Barron’s cover comes out, I get a zillion DMs and emails asking whether it’s time to fade XYZ because it’s on the cover of Barron’s. But Barron’s is not the same as The Economist. It’s more like Jim Cramer. Barron’s are market in-group. They make tons of calls, and people just remember the bad ones.

The project of collecting all the Barron’s cover data back to 1997 was too daunting for me to contemplate, so I outsourced it to Brian Lago, a furiously curious quant-leaning reader of am/FX who is about to start a Substack. He went through all 1,300+ covers and assessed whether or not they unambiguously talk about an asset, security, or tradable instrument and a specific direction.

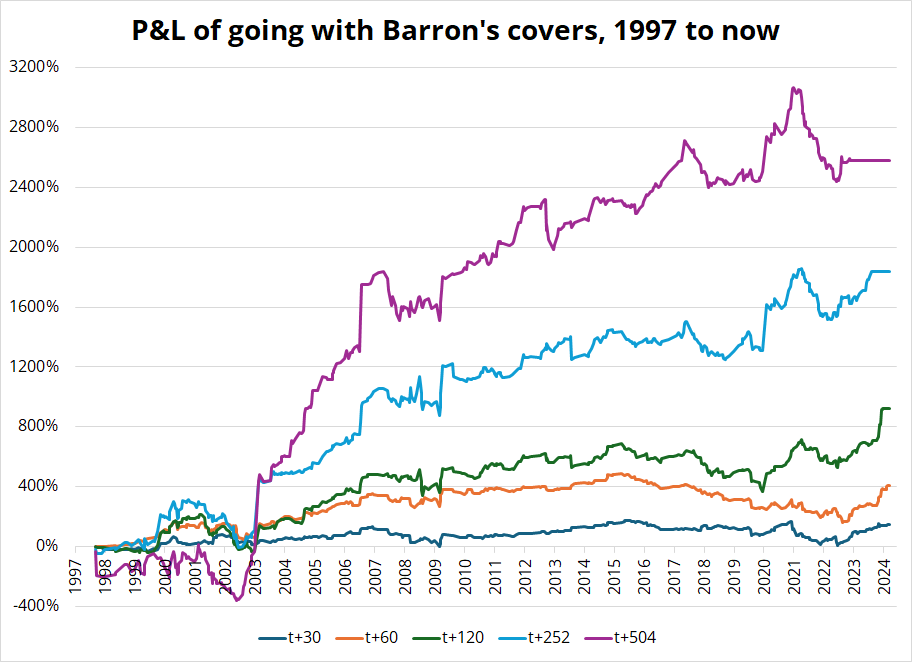

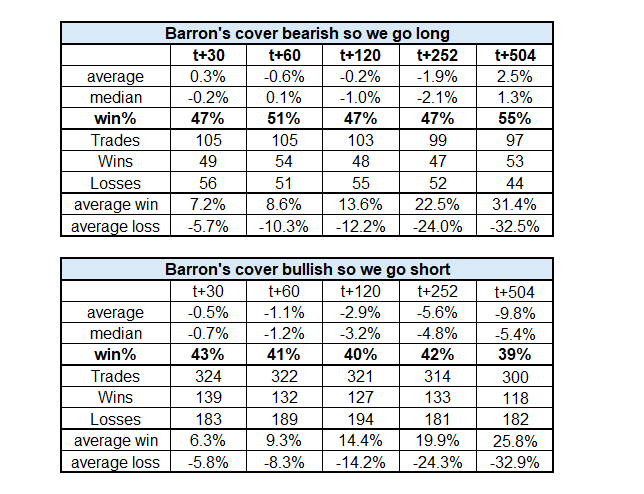

Then, Justin and I gathered all the historical data and did a variety of testing. Long story short is that Barron’s covers are not contrarian. There are a few caveats and details worth noting, however. First up, let’s look at the P&L of simply doing whatever is on the cover of Barron’s. If the cover is bullish, you buy. If it’s bearish, you go short. After 30, 60, 120, 252, and 504 trading days, here’s the P&L.

There is a simple explanation for this: Barron’s skews bullish and it skews toward covers about individual stocks. 1997 to 2024 has been a raging bull market, generally. Therefore, there was a much greater probability of a bullish cover leading to a contrarian strategy where you would go short a stock and get negative returns.

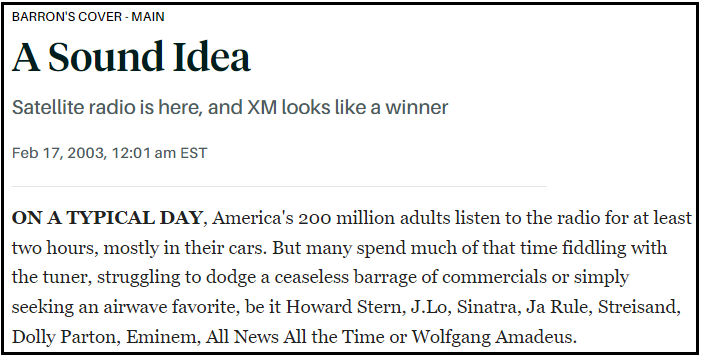

As GME shorts have experienced repeatedly, single name equity shorts can sometimes have horrendous convexity and deep, deep negative returns. A salient example of this is when Barron’s recommended long XM Satellite in February 2003.

This article was outright bullish on XM Radio at $4 and the stock soon went to $40.

There were, of course, many terrible calls, but the bullish bias of Barron’s and the rising tide lifting all boats from 1997 to now means that fading Barron’s covers was a disastrous strategy overall. To get a less biased sample, we can look at only covers where Barron’s was bearish a security and thus the contrarian strategy would have been to go long. Here are the stats in each direction.

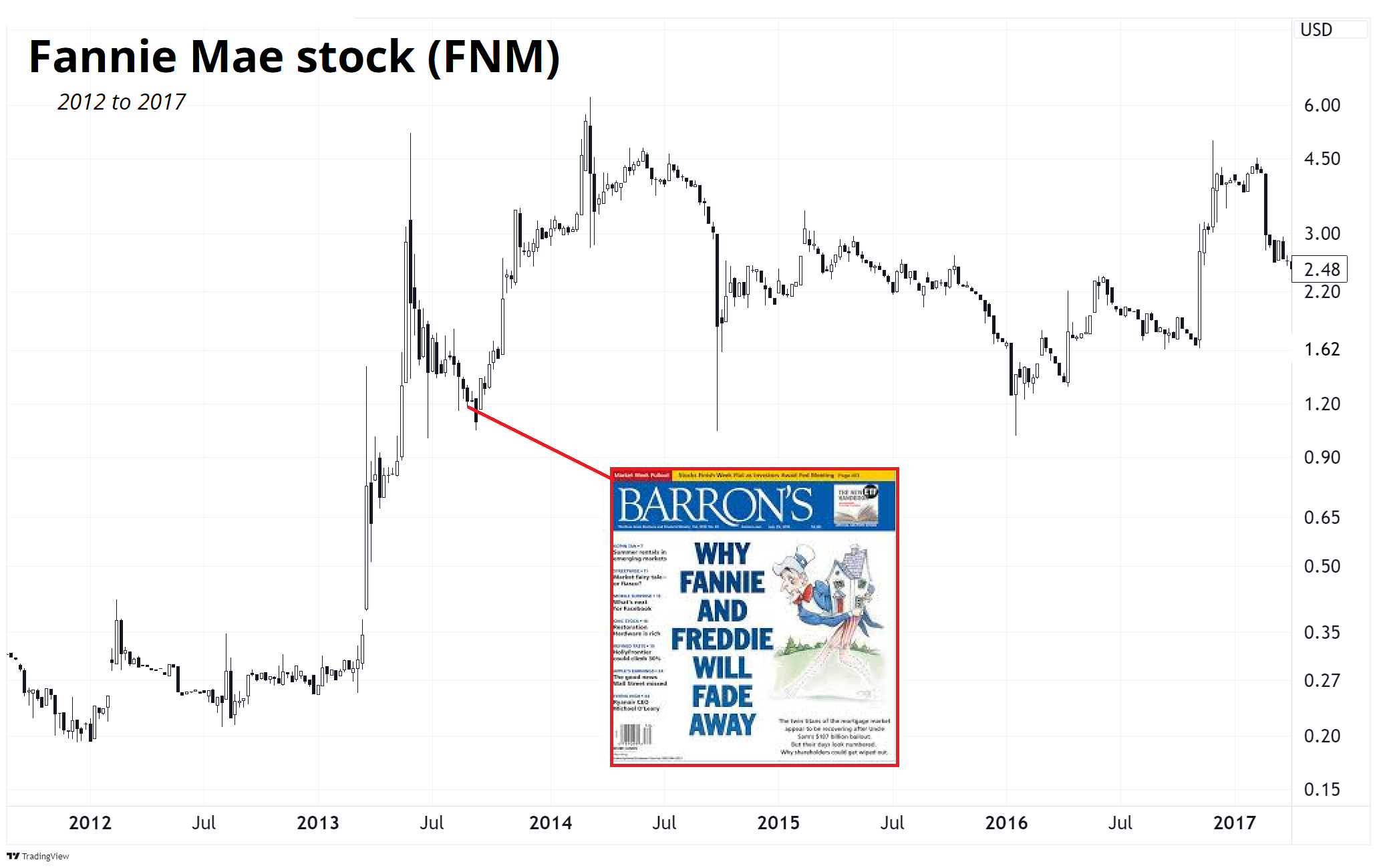

You can see that the longs are a coin toss, and the shorts are horrendous. There is no edge at all in fading Barron’s. In case you are curious about contrarian trades that did work, here’s a fun example.

Take a look at the y-axis. Oh dear. They put the “It’s going to zero” idea out with the stock at 95 cents and it went straight to six bucks. I suppose an optimist would say “at least they didn’t put the article out when the stock was at 25 cents!”.

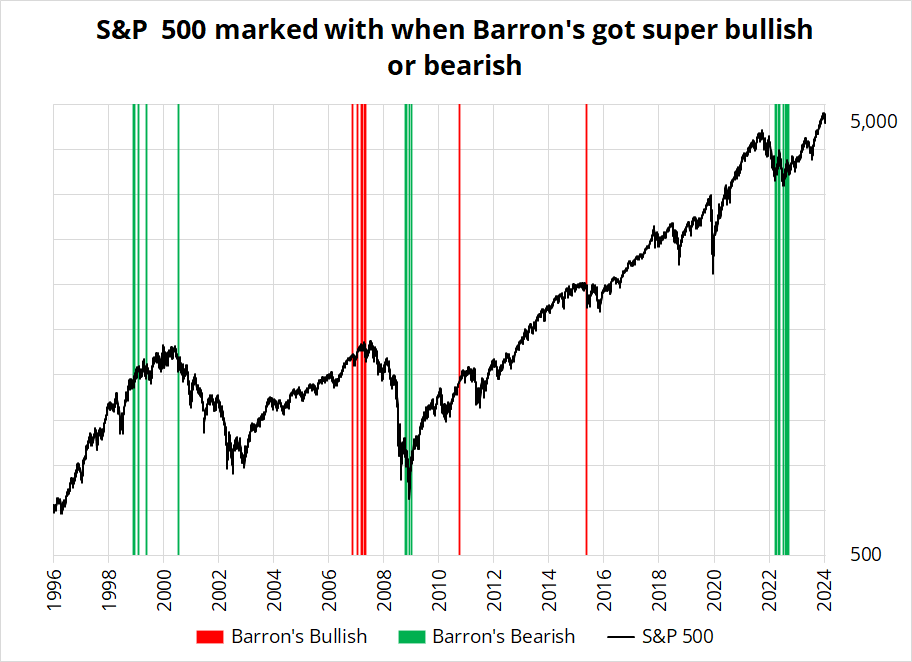

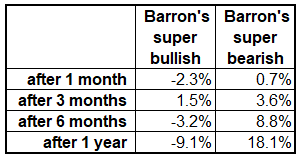

One thing I noticed as we put the giant .xls through the blender was that Barron’s gets generally very bullish near the peaks and very bearish near the lows in the broader indices. I looked at the rolling total of bullish or bearish totals over 16 weeks and then isolated the times when <2 or >14 were bullish. Here’s the chart and I will provide a table on the next page. This is a good signal!

For good order, I also studied only Barron’s covers relating to macro, FX, bonds, etc. and the conclusions are all the same. Fading Barron’s is a coin toss.

Learn more about the man behind the name of Barron’s here.

So, next time someone sends you a Barron’s cover and tells you that asset class or security XYZ is going the other way, please link them to this piece. Barron’s is a real-time, coincident indicator with a bullish skew. Their ideas will outperform in bull markets and underperform in bear markets. When they go on a run of many bullish or very few bullish covers, that’s the contrarian indicator.

Covers of The Economist are contrarian. Covers of Barron’s—and Jim Cramer’s bloviating—are not.

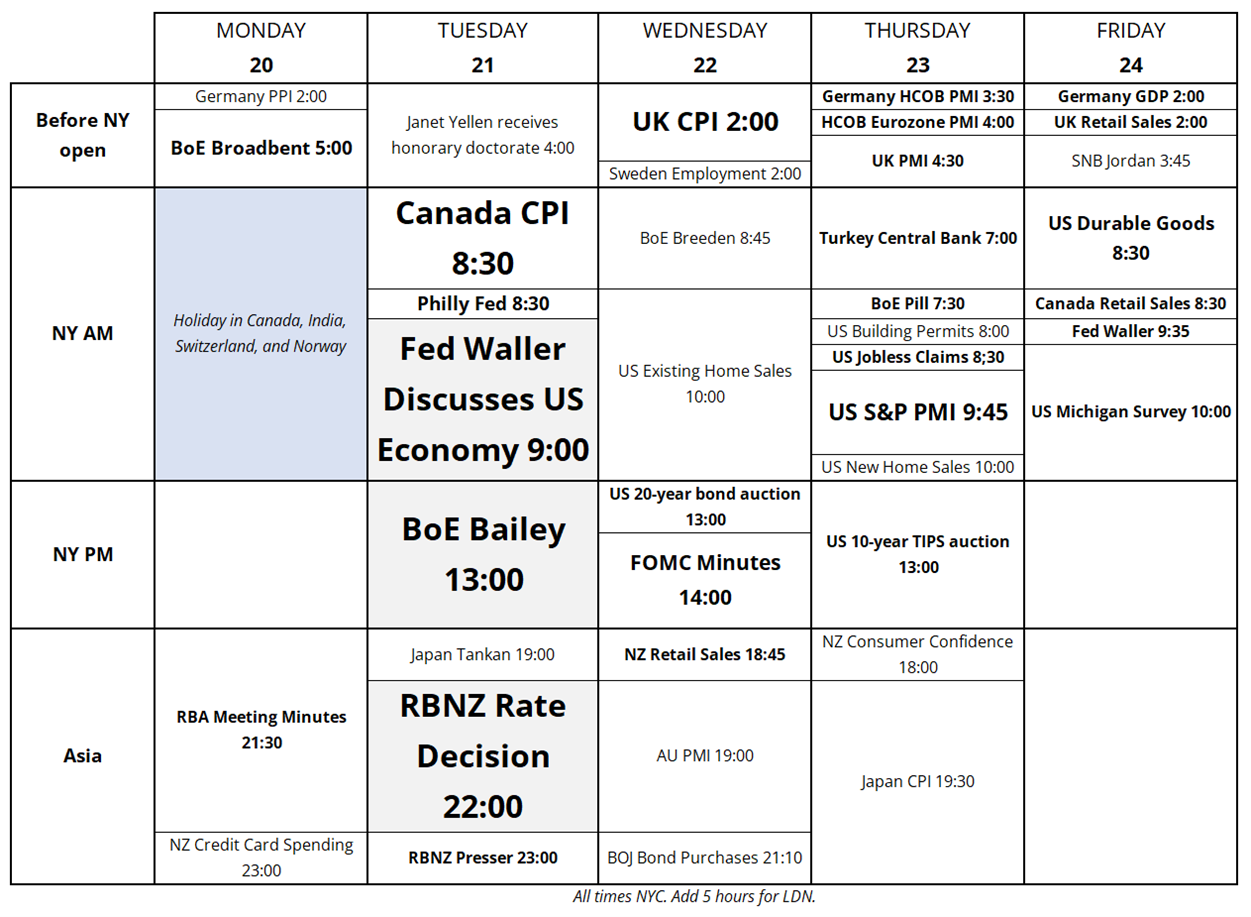

No first-tier data next week but loads of very high second-tier stuff.

35 minutes of pleasurable weekend listening for your macro earballs.

Thanks again to Brian for doing God’s work in Excel. Have a hoppy day.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it