Looking at the results of my recent survey into the traits that differentiate experienced professional traders from noobs.

Push and Pull

It was a week of crosscurrents and contradiction

Looking at the results of my recent survey into the traits that differentiate experienced professional traders from noobs.

Stop loss 111-15

Stop loss 0.6811

Take profit 0.6555

An Alpha Trader follow-up

This is Rabbit Hole #7. The Rabbit Hole Series offers deep dives into random trading and macro topics that fascinate me. In today’s note, I look at the results of my recent survey into the traits that differentiate experienced professional traders from noobs.

A few weeks ago, I sent out a survey to see if successful traders have different personality traits than beginners. Surveys are generally boring and annoying, so I try not to send them out too often. Feedback on this particular survey was unusually strong and positive. Most of my surveys get around 250 responses and this one got ~600.

The cool thing to me is that many of the traders I know well and have a deep respect for pinged me after to tell me they completed the survey. The results show that many experienced traders completed the questionnaire, along with many other traders of various skill levels.

Before I show you the traits that differentiate successful traders from inexperienced and not-yet successful traders, let me provide a couple of excerpts from Alpha Trader for context. The survey I constructed was based on analysis from the early chapters of Alpha Trader where I attempted to dissect what makes a successful trader. Today’s piece is meant to complement my findings in the book, and hopefully add new insights.

In my book, I study success outside trading (in fields like academics, sports, and life outcomes) and I study research on success in trading to come up with this equation for trading success:

Rational + intelligent + skilled + conscientious + calibrated confidence

I then offer the following clarification (excerpted from Alpha Trader):

Note my equation for trading success excludes some traits that are important but not critical to trading success. I did not include risk appetite, for example. People at each end of the risk-taking continuum (extremely risk averse or highly risk seeking) might underperform those in the middle, but risk appetite is not an important character trait in the literature on trading performance.

Furthermore, risk tolerance can be dialed up or down fairly easily with a simple set of rules. I have seen traders at every point on the risk-taking spectrum succeed.

Before the year 2000 or so, IQ was less important in trading because trading was more skill-based and less quantitative. Now, a higher level of quantitative intelligence is required although I would argue that Wall Street currently overvalues IQ and academics, and does not focus enough on grit, street smarts and fire in the belly.

My equation leaves out many positive attributes that most certainly make for better traders. It does not include positive attitude or ability to handle stress, for example. These are useful but not critical attributes when it comes to trading success. There are plenty of grumpy, stressed-out traders that still make money. Sure, that’s not ideal (and certainly does not meet my personal definition of success), but only the indispensable traits are in the equation. Many other attributes will help you succeed in trading but the formula I laid out is the mashed potatoes—everything else is gravy.

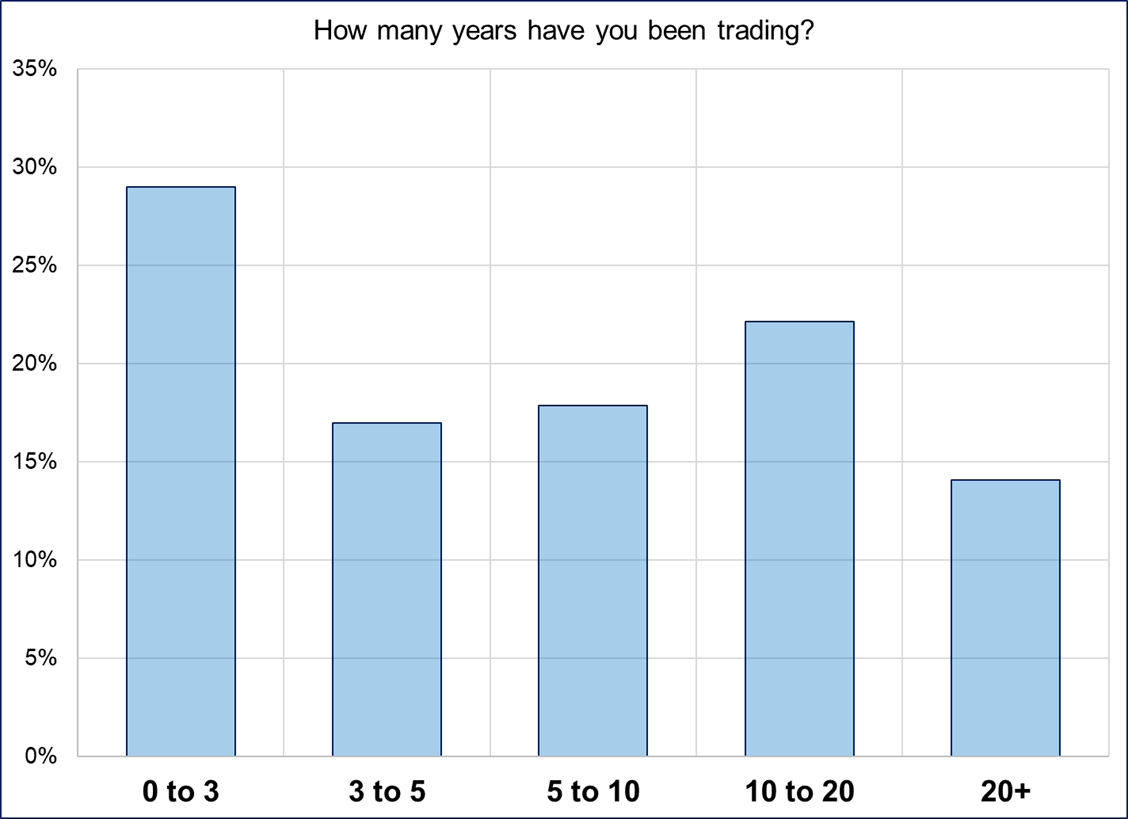

On at least one of those viewpoints, the survey results show I was wrong. But I’ll get to that in a bit. First, here’s the basic info on the traders that completed the survey. Total sample was 589. The first three questions were used to bucket traders into groups by success / experience. Here are the results:

Impressive number of traders with 20+ years of experience on my distro! I thought that was cool.

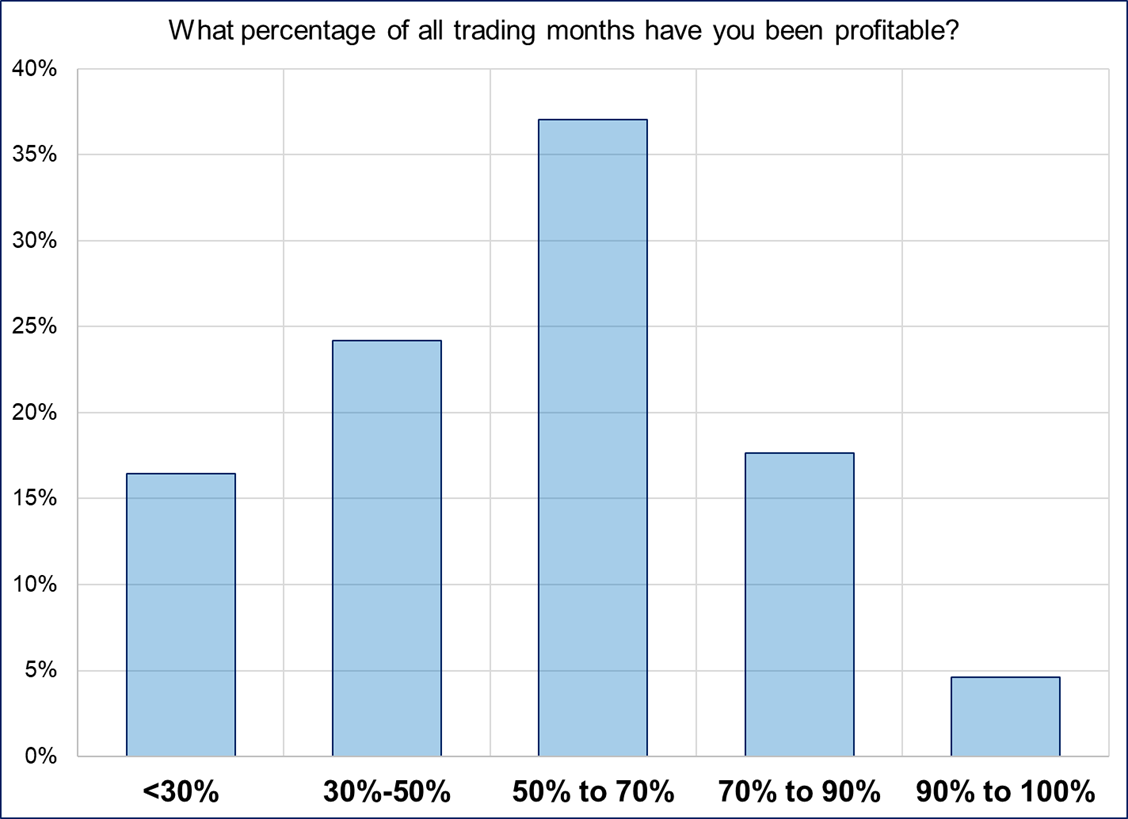

Again, decent representation from professional traders. And a lot of new traders, of course. Next, profitability:

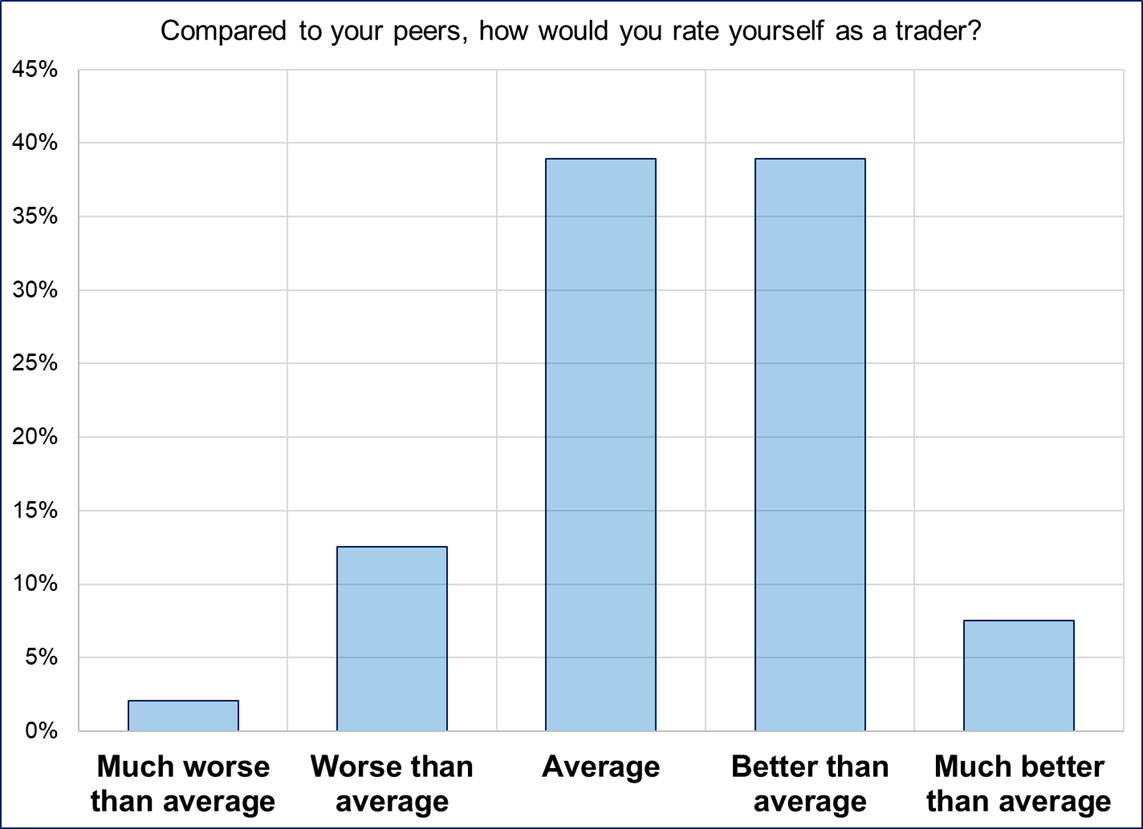

And I always enjoy throwing in this last question as a study in overconfidence bias (see next chart). Almost everyone thinks they are average, or better than average, as usual! Fun. This overconfidence bias also appears in the main data as there are very few low rankings on the scales and many, many more 7’s than you would expect in a normal distribution. The data is somewhat normally distributed, but around a mean of 7, not 5.

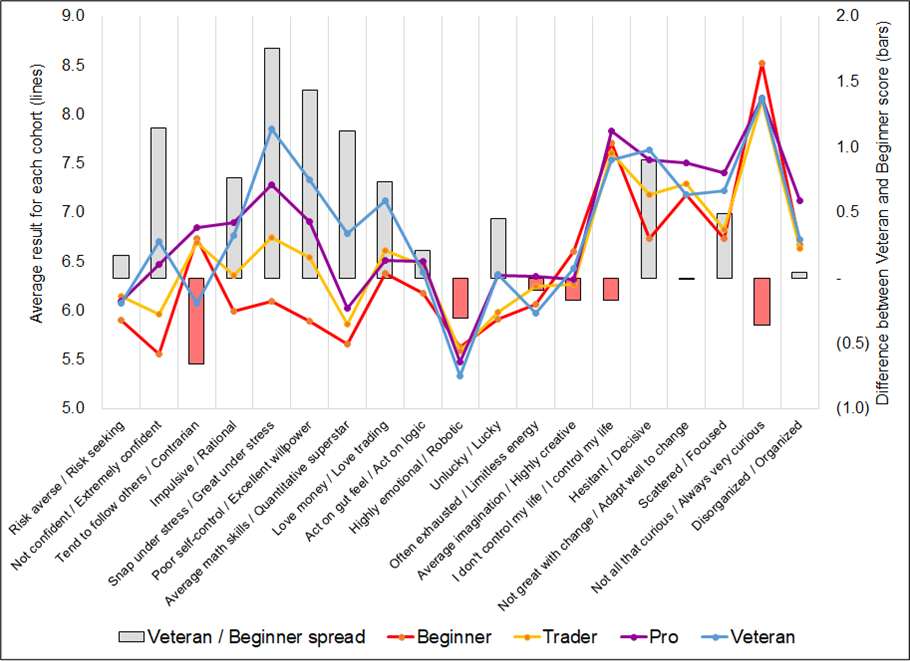

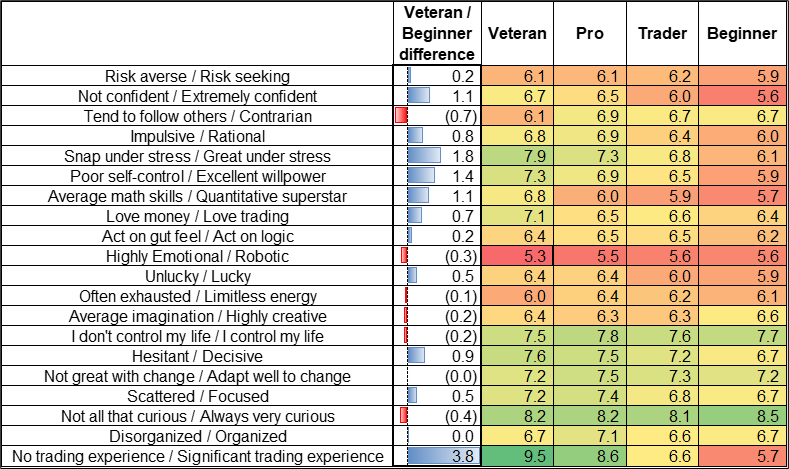

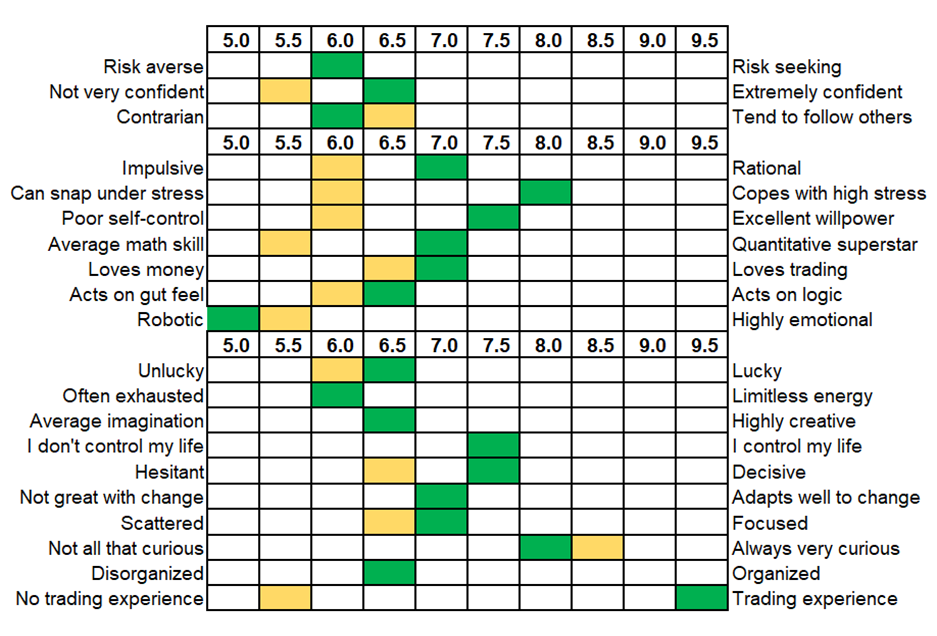

Once all the data was collected, Justin and I worked to split the respondents into four cohorts defined by experience and profitability. We called the groups: Beginner, Trader, Pro, and Veteran (ascending order of combined experience and profitability). The output I was most excited to see was the traits where there are large differences between the cohorts. The absolute responses were going to be mostly meaningless to me; I figured the relative traits comparing noobs to pros would offer the most interesting takeaway.

Some results were as expected, and there were some surprises. I am going to show the results in a graph first, then the data is provided in a table afterward, so you can see it more clearly and specifically.

Takeaways (focus on the gray bars in the chart, which show the difference between the blue and red lines):

Overall, the results of the survey provide insight into the traits and characteristics that separate professional traders from beginners. I hope you found it useful and informative. Here is the data in table form.

To wrap things up… If you read Alpha Trader, you might remember the questionnaire from Chapter 1. Here is the profile of the most least and most successful traders in my survey, structured the same way as it’s displayed in the book:

(if both the same, box is green)

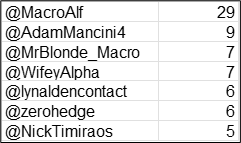

The last question I asked was: “Who is the one person on Twitter you find most useful? (please provide Twitter handle if you can)”. am/FX readers skew towards nice, so many put my Twitter handle in there. Other than me, here are the handles that came up at least five times:

Go Alf!

Thanks to all those who completed the survey and thank you to you for reading the results.

The USD is wildly bid and then hammered and then wildly bid. Chop City. Tomorrow is big!

Have a mapped-out day.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it