Q1 Big bang, or vol- and soul-crushing chop? It depends on tariff announcement(s).

Push and Pull

It was a week of crosscurrents and contradiction

Q1 Big bang, or vol- and soul-crushing chop? It depends on tariff announcement(s).

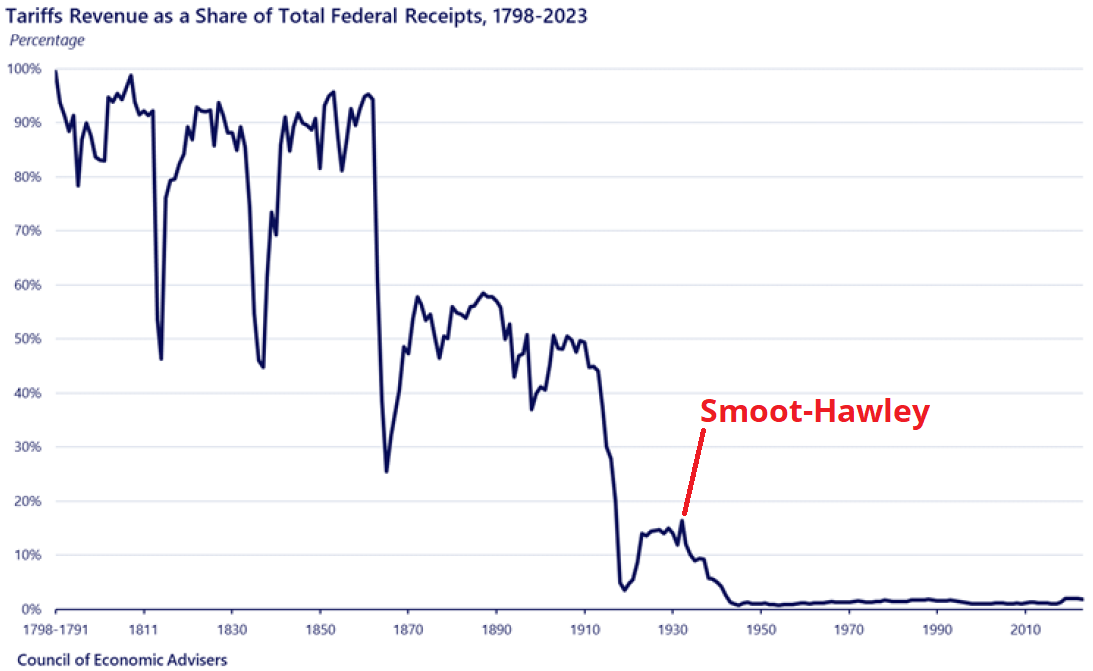

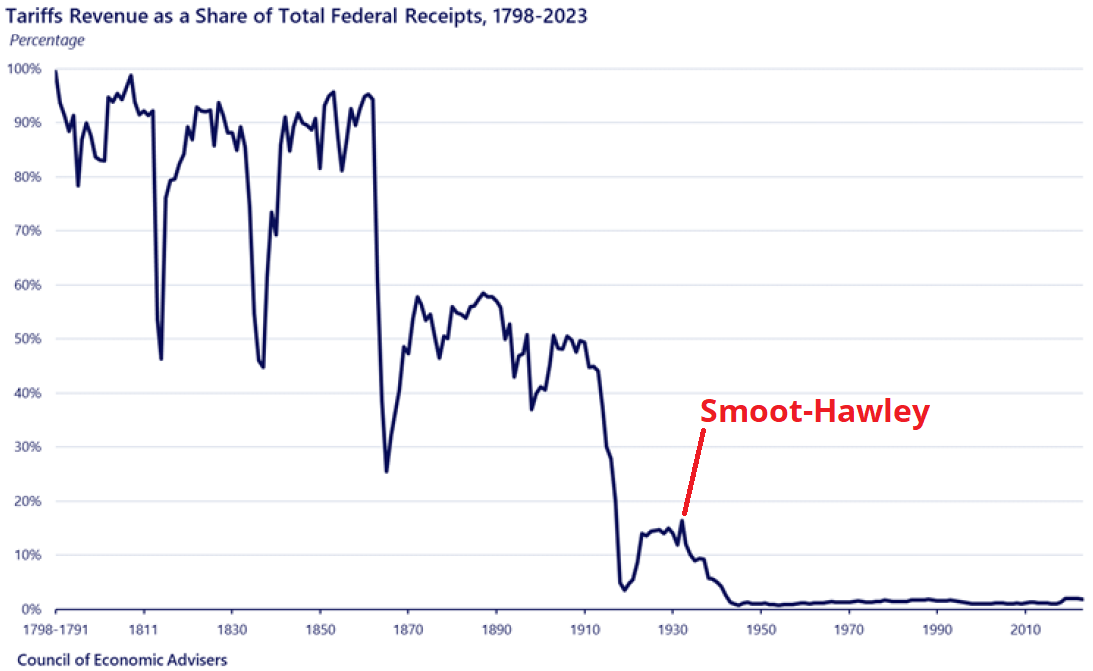

Tariffs as a percentage of US federal receipts, 1791 to now.

Most economists estimate there is no level of tariffs that could replace income tax in the United States.

Long a 1-month 1.4600 USDCAD call

for 33bps off 1.44 spot

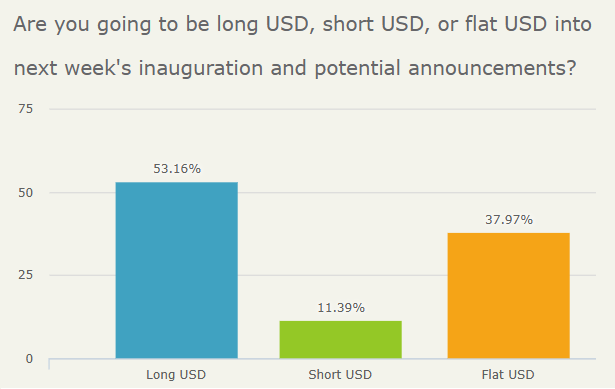

USD longs are getting nervous into inauguration as positioning shows the largest, most unanimous USD long in years, the newsflow is confusing, and the ultimate timing and scope of announcements is unknown. There is a core group of large and devout USD longs, some dabblers, and just about exactly zero USD shorts.

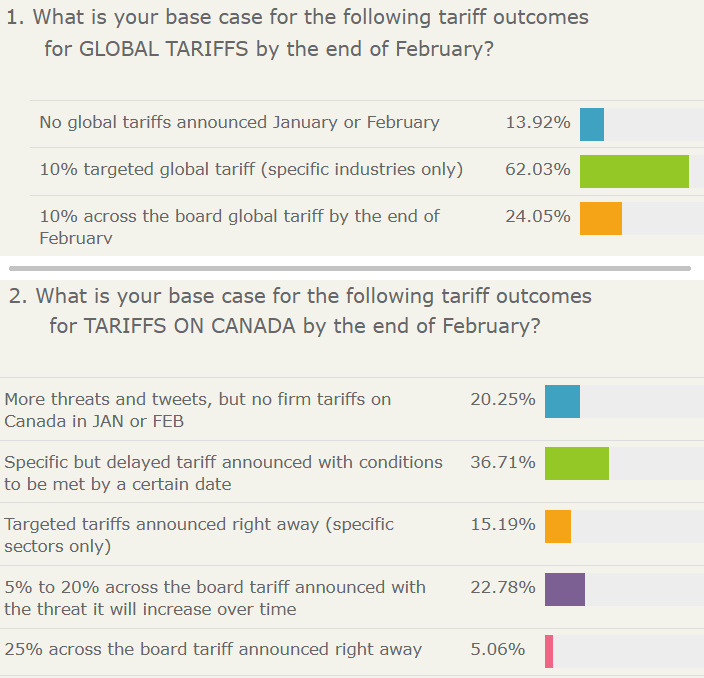

Without further ado, here are the survey results with takeaways interspersed.

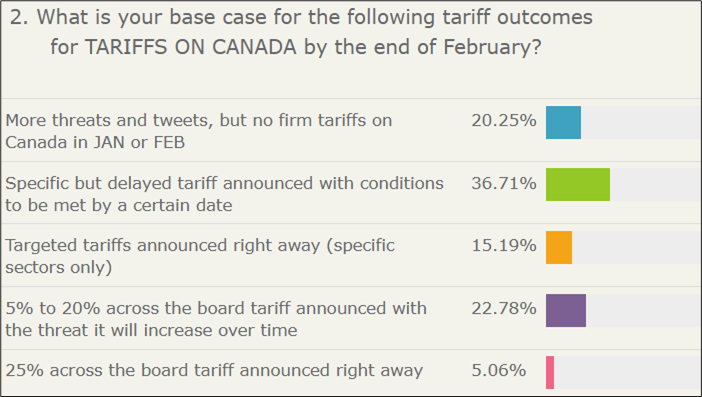

n = 93

Takeaways: More than 50% of respondents expect no Day One tariffs on Canada. Wow. And the vast, vast majority do not expect a 25% tariff on Day One, despite warnings from US and Canadian policymakers. There is a huge delta to USDCAD, then, if the nuclear option comes to pass. This heavy favoring of the “no tariffs” option helps explain why USDCAD isn’t going up despite what appears to be a bevy of clear warning signs: A majority don’t believe the hype.

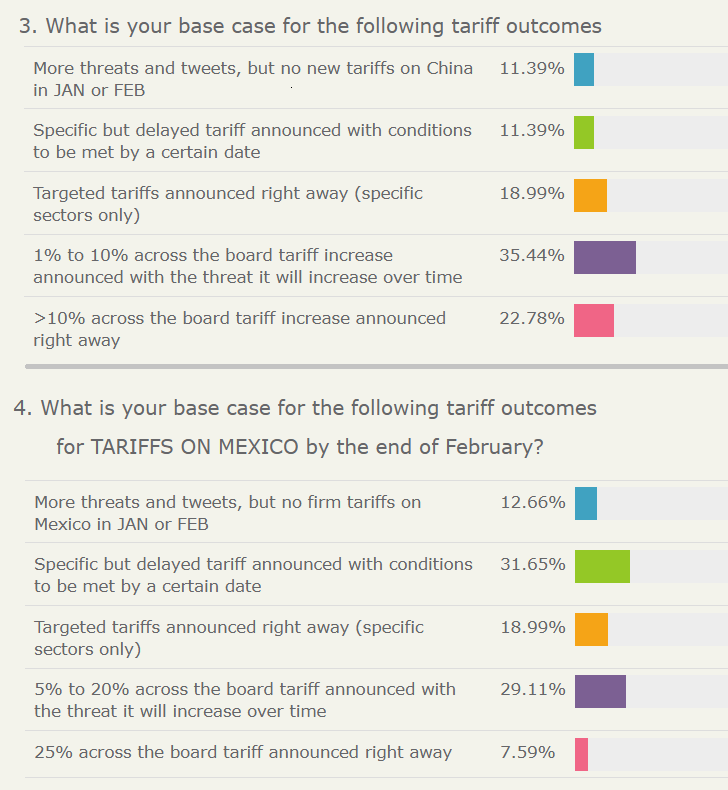

Takeaways: More consensus that China will be tariffed on Day One. This makes sense and I suppose people are using the logical but perhaps not applicable framework that Trump will hit the enemies and give the allies time to get respond or at least get ready. This may not be the right framework!

The Canada and Mexico numbers nearly match, which makes me feel like people took the survey seriously and responded with rational, consistent responses.

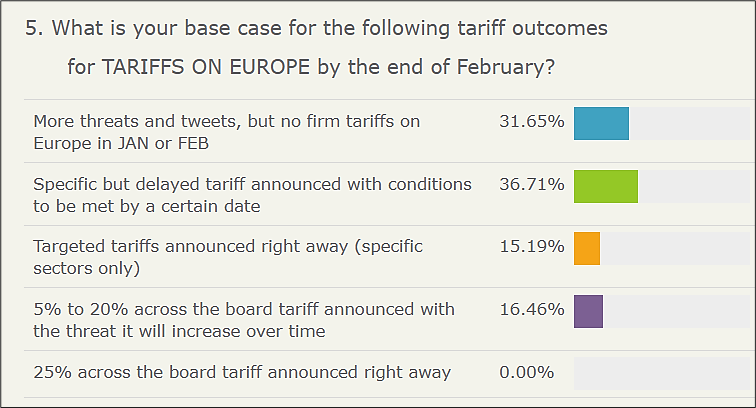

Takeaways: The blue bucket (threats but no firm tariffs) is by far the largest for Europe. This makes sense as there hasn’t been much direct talk of Day One tariffs on Europe. There were a few jabs at Denmark, but most of the specific rhetoric has been directed at Canada, Mexico, and China.

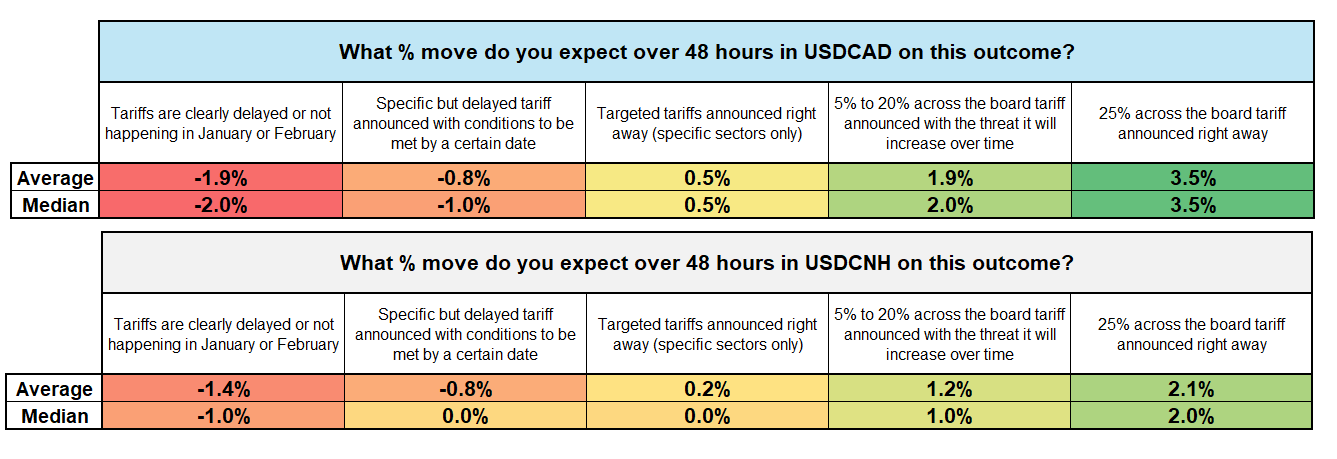

Takeaways: USDCAD is a free-floating currency pair and CNH is not. Then again, will the PBoC continue to smooth if a huge tariff is announced on Day One? It’s a good question! If they do, they are probably providing a service to speculators by offering below-market liquidity.

3.5% in USDCAD for a 25% tariff on Canada is way, way too low in my opinion, though I did say “over 48 hours” so maybe it’s not that far off. Still, a permanent 25% tariff would be worse for Canada than the Global Financial Crisis. I don’t think you should rule out this possibility as there is a nice opportunity for Trump to take advantage of the power vacuum in Canada and then make amends with his buddies in the Conservative Party when they inevitably take over Canadian government in Q2.

Here’s where I think USDCAD goes on each Question 2 result.

Using the percentages from the survey, that’s an expected value of 1.4188 for USDCAD. To get a positive expected value for USDCAD from this exercise, you need around 15% chance of a 25% tariff. Otherwise, one can argue that it’s all fully priced. I feel like these results show remarkable complacency given the relentless anti-Canada trolling from Trump and the recent comments from the premier of Alberta. We’ll find out soon.

How do we reconcile extreme USD longs with survey complacency on tariffs? Our regular positioning survey, and this survey (see result at right) and every bank survey all show speculators are max long USD. But yet expectations for tariffs are not that aggressive. Here’s why:

Another good question here is whether options are the best tool to express a bullish USD view. If the move higher in USDCAD, for example, is going to be explosive and trending, can’t you just wait for the announcement, and if it’s shock and awe, buy spot USDCAD? Probably.

Then again, there are scenarios where you completely whiff. If you’re sleeping, for example. Or if the first move is so big that you can’t bring yourself to pay that 1.4600 offer. I’m not sure which strategy is best—probably a mix of spot and options. If you’re bearish USD, be aware that most USD-bearish scenarios will also be incredibly bearish for vol.

Anything less than shock and awe will see FX implied vols get bludgeoned. Most scaled or targeted tariff plans will leave the market chopping and flopping and gasping for direction. Have a super CPI.

William McKinley was ahead of his time / back to the future saying this in ~1890:

Under free trade the trader is the master and the producer the slave. Protection is but the law of nature, the law of self-preservation, of self-development, of securing the highest and best destiny of the race of man. [It is said] that protection is immoral…. Why, if protection builds up and elevates 63,000,000 [the U.S. population] of people, the influence of those 63,000,000 of people elevates the rest of the world. We cannot take a step in the pathway of progress without benefiting mankind everywhere.

[Free trade] destroys the dignity and independence of American labor… It will take away from the people of this country who work for a living—and the majority of them live by the sweat of their faces—it will take from them heart and home and hope. It will be self-destruction.

They [free traders] say, ‘Buy where you can buy the cheapest.’ That is one of their maxims… Of course, that applies to labor as to everything else. Let me give you a maxim that is a thousand times better than that, and it is the protection maxim: ‘Buy where you can pay the easiest.’ And that spot of earth is where labor wins its highest rewards.

They say, if you had not the Protective Tariff things would be a little cheaper. Well, whether a thing is cheap or whether it is dear depends on what we can earn by our daily labor. Free trade cheapens the product by cheapening the producer. Protection cheapens the product by elevating the producer.

The protective tariff policy of the Republicans… has made the lives of the masses of our countrymen sweeter and brighter, and has entered the homes of America carrying comfort and cheer and courage. It gives a premium to human energy, and awakens the noblest aspiration in the breasts of men. Our own experience shows that it is the best for our citizenship and our civilization and that it opens up a higher and better destiny for our people.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it