Some takeaways from Day 1 of the Crypto and the Future of Finance conference in Sarasota, Florida.

Degrossed

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Some takeaways from Day 1 of the Crypto and the Future of Finance conference in Sarasota, Florida.

Achievement Unlocked:

Selfie with a Fed Governor

20JUN USDCHF

0.8850 digital put @ 20%

spot ref. 0.9275

21JUN USDJPY

123 digital put @ 20%

spot ref. 131.30

I am reporting live from Sarasota, Florida today. More specifically, from the University of South Florida (Selby Auditorium). I will be here for two days and will do my best to report back on anything interesting. These events are usually more about bigger picture learning and less about actionable short-term takeaways.

After opening remarks from David Kotok, Dr. Karen Holbrook (regional Chancellor of the University) and Major General David Scott Gray, US Air Force, I joined Dave Nadig, Ian Katz, and Katie Stockton for the first session.

—

Session I: Cryptocurrency in the USA: Investments, Markets, and Regulation

Brent Donnelly, President, Spectra Markets

Ian Katz, Managing Director, Capital Alpha Partners

Dave Nadig, Financial Futurist, VettaFi

Katie Stockton, Founder and Managing Partner, Fairlead Strategies LLC

Moderator: Dr. Eddie Sanchez Jr., Muma College of Business, USF

Ian and Dave are both super tapped in to the state of crypto regs and here are some keywords that came up a lot in the discussion on US regulation: abysmal, lagging, adversarial, hostile, opaque. This was a sentiment shared by most people at the conference and I found it interesting to hear this from DC and finance people.

I know the Gensler hate is Hades levels of hot in the world of crypto, but I didn’t realize how unsympathetic non-crypto people are to what is seen as a weirdly adversarial, ineffective, and opaque approach by Gensler. The US is lagging badly and Gensler almost seems to wear this as some sort of badge of honor. Not only is he failing to provide clarity to those in the industry, he’s failing to protect noob retail from an ongoing series of massive frauds. Not good.

There was some discussion about the role of crypto in a traditional investment portfolio and I put forward my view that crypto is a good, high-vol hedge for MMT and aggressive fiscal/monetary policy. Such policy will become increasingly orthodox with each cycle and BTC serves as some sort of gold/NASDAQ proxy when Stephanie Kelton’s acolytes will inevitably grab the steering wheel in the future, every time the US economy hits a patch of ice.

When new spending ideas come out of Congress, nobody even bothers to ask “how are we going to pay for it?” anymore. The US has been stumbling towards accidental MMT¹ since the 2017 Tax Cuts and Jobs Act took the radical step of increasing US deficits at the peak of the economic cycle. The normal Keynesian approach is dead.

It used to be that you stimulate via deficits when the economy is weak, and pivot to more austere fiscal policy when times are good. Now there is only a gas pedal and a more gas pedal.

This is particularly good for BTC in the long run as it serves as the first mover, OG store of value in crypto. Every other coin, token, or “object” as Christopher Waller called crypto assets, has competition. BTC does not.

Dr. Waller’s use of the word “object” as a group noun for crypto tokens, coins, etc. was a not-so-subtle acknowledgement that the US has failed to properly define crypto assets and nobody knows whether they are securities, currencies, commodities, or what.

As we wrapped up, Dave Nadig pointed out the irony that as we talk about the sorry state of US crypto regulation today, Europe has just passed landmark regulation to provide clear, unified regulation for crypto in the EU. He didn’t mention the irony of David Kotok scheduling a crypto conference on 4/20, though. For a guy who’s over 70 years old, David sure knows how to troll his audience with a subtle Easter egg.

—

Session II: Cryptocurrency Outside the U.S.

Nicholas Colas, Co-Founder, DataTrek Research

Jessica Rabe, Co-Founder, DataTrek Research

Paul O’Brien, Former CIO, Abu Dhabi Investment Authority

Moderator: Michael Drury, Chief Economist, McVean Trading

My friends in crypto often tell me that my view on crypto is way too North America centric. I have lived exclusively in countries where inflation is low, the currency is stable, the banking system works, and the sovereign doesn’t default. So the ability to transmit $15,000 cross-border at lightning speed feels like a niche use case to me, not an overly compelling feature of crypto. This panel opened my eyes to the fact that living under such a stable monetary regime is a privilege shared by only a certain percentage of the world.

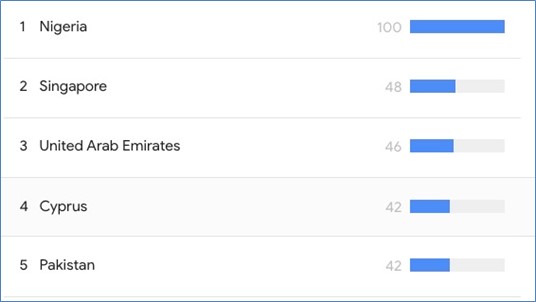

A bunch of the slides showed search popularity of various crypto terms like: Crypto, bitcoin, etc. and the USA rarely shows up in the top 20 of countries that search most for these terms (data is normalized for population size). Most of the countries that appear are countries with poor banking systems and high inflation like Nigeria, Turkey, Argentina, and so on. Here’s one example, but they showed many others.

I’m not sure what Singapore is doing in there, but you get the point

The US has a good payments system, Venmo, ACH, a stable currency, generally low inflation and so on. Those are privileges not enjoyed in all nations. Panelists also pointed out that the crash of FTX, Voyager, Celsius and others put the technology to the test and while the rampant fraud is a stain on Big Crypto, it also shows the technology is robust and antifragile and that the primary stablecoins have functioned well so far as somewhat reliable means to move USD around the world. The proliferation of USD stablecoins further enhances the dollar’s global role as a store of value.

This slide from Paul O’Brien is a good visual summary of the enviable position of the US in the global inflation game.

An interesting point that was brought up is how one of the main products that stablecoins can potentially disrupt is the US $100 bill. There are more US $100 bills outside the USA than inside because large denomination US bills are an excellent way for rich people to hedge foreign currency risk in high-inflation countries. They are also an excellent way to store proceeds from huge drug deals.

Random facts shared during the panel: A standard Zero Halliburton briefcase is exactly the right size to hold $1 million in $100s. And a million dollars in US cash (22 pounds of $100 bills) is lighter than a million dollars in gold (34 pounds).

One. Million. Dollars.

I came away from the panel with a better understanding of why the crypto use case for money transfer and remittances makes sense and why crypto is not nearly as popular or relevant in the United States as it is in many other countries. Great panel.

Further reading suggested by Nick Colas:

https://hbr.org/2015/12/what-is-disruptive-innovation

https://a16zcrypto.com/content/article/state-of-crypto-report-2023/

https://www.pwc.com/gx/en/new-ventures/cryptocurrency-assets/pwc-global-crypto-regulation-report-2023.pdf (69 pages, obv)

—

Session III: FTX Aftermath and Bankruptcy Laws

David Adler, Partner, McCarter & English, LLP

Jaynee LaVecchia, Partner, McCarter & English

This session was a discussion of the huge challenges around application of America’s 80-year-old(ish) bankruptcy laws to the spate of modern crypto bankruptcies. David Adler has first-hand knowledge of the main bankruptcies and represents creditors of Celsius. He has been personally involved in some aspects of the FTX and BlockFi bankruptcies, too, and is a fountain of knowledge on the topic. This probably sounds boring, but it wasn’t.

The main takeaway from the session is that judges are interpreting bankruptcy law on the fly and the Celsius case may end up setting a fair bit of precedent because it’s the first one to be ruled on. A weird and intriguing aspect of these bankruptcies is that the Terms of Use on the various websites changed constantly over time, so one customer could have agreed to a Terms of Use in 2018 that is completely different to the Terms of Use agreed by a customer in 2022. Determining which creditors agreed to which Terms of Use could impact the treatment of each customer differently.

Weird.

Another quirk that is as yet unresolved: Do creditors get repaid in kind (in crypto) or in fiat using the value of the crypto at the time of bankruptcy? Or do you mark to market, then pay fiat? If you mark to market, what date do you use? Petition date, effective date, or distribution date? There is no precedent.

Another question: Who owns what crypto? That is, let’s say Celsius had Earn/Yield clients, Borrow/Lend clients, and Custody/Wallet clients, and they all placed crypto at Celsius… Does the Celsius estate own all that crypto? Or do the borrow/lend clients still own their crypto, for example? Complicated stuff.

Another weird one is that those withdrawing assets less than 90 days before a normal bankruptcy may be subject to clawbacks. But what if you pulled your coins from Celsius 15 days before it went bankrupt, then put them at BlockFi then pulled them 15 days before that went bankrupt and plopped them on FTX then pulled them 15 days before THAT went bankrupt? Are those coins triple-encumbered and subject to three separate preference claims? Weird.

There are tons more of these strange features of a crypto bankruptcy. One other oddity: Because El Salvador officially introduced bitcoin as legal tender, BTC technically can be defined as a currency. That can matter because currencies, securities and intangible assets are all treated differently. Many jurisdictions and constituencies are fighting over how all these details get adjudicated. Good times.

—

Keynote: Cryptocurrency and Central Banks

Dr. Christopher Waller, Governor, Federal Reserve

Dr. Waller’s full speech is available here, and it’s not very long so I will let you read it yourself.

He went through the reasons that regulators need to offer balanced assessments and strategies for dealing with new technologies in finance. While proponents of new technologies tend to be blinded by use case optimism, luddites and conservatives obsess over risks while ignoring the upside of innovation.

Waller pointed to Paul Volcker’s famous skepticism on financial innovation and so I will leave you with this fun excerpt from a Volcker rant after the Global Financial Crisis. I wish more people spoke directly, like Volcker did.

I hear about these wonderful innovations in the financial markets and they sure as hell need a lot of innovation. I can tell you of two — Credit Default Swaps and CDOs — which took us right to the brink of disaster: were they wonderful innovations that we want to create more of? You want boards of directors to be informed about all of these innovative new products and to understand them but I do not know what boards of directors you are talking about. I have been on boards of directors and the chances that they are going to understand these products that you are dishing out or that you are going to want to explain it to them, quite frankly, is nil.

A few years ago I happened to be at a conference of business people, not financial people, and I was making a presentation. The conference was being addressed by a very vigorous young investment banker from London who was explaining to all these older executives how their companies would be dust if they did not realize the joys of financial innovation and financial engineering, and that they had better get with it.

I was listening to this and I found myself sitting next to one of the inventors of financial engineering who I did not know, but I knew who he was and that he had won a Nobel Prize, and I nudged him and asked what all the financial engineering does for the economy and what it does for productivity. Much to my surprise he leaned over and whispered in my ear that it does nothing. I asked him what it did do and he said that it moves around the rents in the financial system and besides that it was a lot of intellectual fun.

Now, I have no doubts that it moves around the rents in the financial system, but not only this as it seems to have vastly increased them. How do I respond to a Congressman who asks if the financial sector in the United States is so important that it generates 40% of all the profits in the country, 40% after all of the bonuses and pay? Is it really a true reflection on the financial sector that it rose from two-and-a-half percent of value added according to GDP numbers to six-and-a-half percent in the last decade? Is that a reflection of all your financial innovation or is it just a reflection of how much you pay?

What about the effect on our economies [taking] all our best young talent? In Britain, I was just talking to a high-tech company about the immense attraction to go into finance when both Britain and the United States are suffering from a basic inability to produce things competitively.

The most important financial innovation that I have seen the past 20 years is the automatic teller machine, that really helps people and prevents visits to the bank and it is a real convenience. How many other innovations can you tell me of that have been as important to the individual as the automatic teller machine, which is more of a mechanical innovation than a financial one?

I have found very little evidence that vast amounts of innovation in financial markets in recent years has had a visible effect on the productivity of the economy, maybe you can show me that I am wrong. All I know is that the economy was rising very nicely in the 1950s and 1960s without all of these innovations. Indeed, it was quite good in the 1980s without Credit Default Swaps or CDOs. I do not know if something happened that suddenly made these innovations essential for growth. In fact, we had greater speed of growth in the 1960s and more importantly it did not put the whole economy at risk of collapse.

—

¹ Copyright 2020, Sam Rines

May you unlock many achievements today.

Two views of the same exact moment in time.

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Taking profit on the USDJPY and looking for a way to get short GBPUSD for corporate month end.