We are back to the “it’s coming in two weeks” nonsense of 2017/2018

Jobs are not plentiful

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

We are back to the “it’s coming in two weeks” nonsense of 2017/2018

The haircut emoji looks potentially injurious…

24JAN 158 EURJPY put

31bps off 160.30 spot

24JAN 21.10 USDMXN call

55bps off 20.80 spot

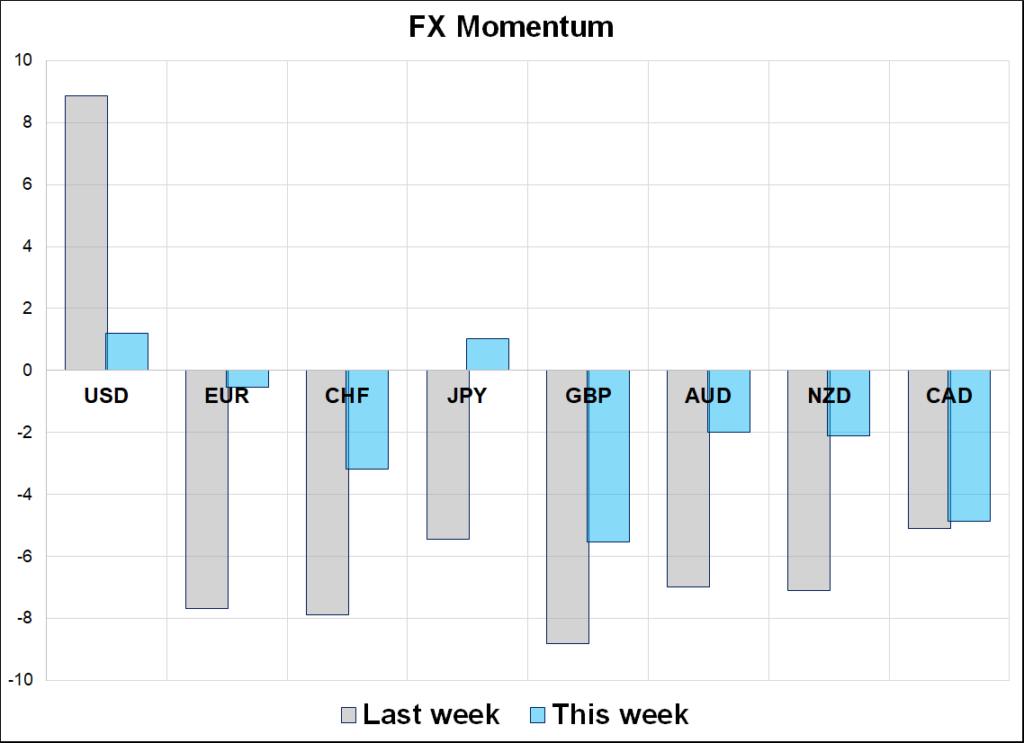

2017 Redux continues as the market sits long USD waiting for the shock and awe and instead there is mostly blah and blah. The threat of tariffs continues to hang over markets, but the rapidly declining half life of headlines shows you the market is already numb to the shenanigans.

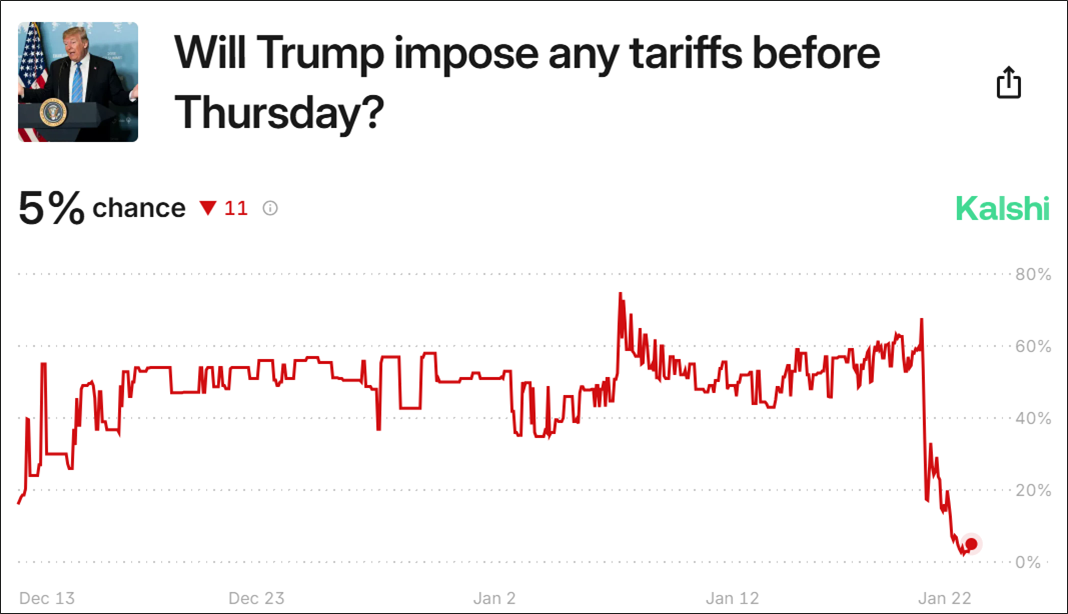

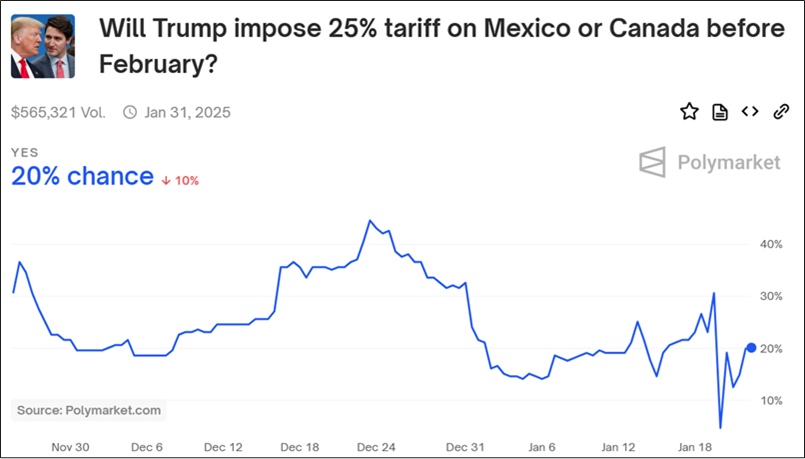

Kalshi and Polymarket both offer various contracts on tariff outcomes and it’s mildly interesting to see the turn lower in the front end, accompanied by a turn higher in the back end. The threats against Europe, China, Canada, and Mexico are consistent but the timeline is unknowable. It felt like there was some edge in betting on day one or day two tariffs, but now it’s day three and I guess we’ll see. As predicted by most people, the USD is decaying each day that passes tariff-free.

I was wondering how they would define “large tariffs”, so here it is:

This market will resolve to “Yes” if the U.S. weighted average tariff, as defined and reported by the Federal Reserve Bank of St. Louis, reaches 5% or greater for either Q1 or Q2 of 2025. Otherwise, this market will resolve to “No”.

This market will resolve once the dataset has been updated to reflect data from the U.S. Bureau of Economic Analysis (BEA) Advance Estimate GDP report for Q2, currently scheduled to be released on July 30, 2025. If no Advance Estimate GDP report for Q2 2025 is released by August 31, 2025, 11:59 PM ET, this market will resolve to “No”.

The resolution source will be the Federal Reserve Bank of St. Louis, specifically the average tariff paid as defined here: https://fred.stlouisfed.org/graph/?g=1wn5e. Revisions to the data made after the resolution will not be considered.

And here is the US weighted average tariff back to 1960.

This contract expires at midnight on January 31, 2025, so the 20% level seems kind of high given the February 1 date would most likely be the earliest and that date could obviously be rolled or deleted at any moment.

I don’t really see any of this being tradable anymore. It’s a repeat of 2017 until further notice. The uncertainty is definitely not good for investors in the short run, but it’s too expensive to sit around hedged for something that might never happen. It creates a bit of paralysis because it’s hard to embrace a short USD view but also expensive to be long USD waiting for Godot.

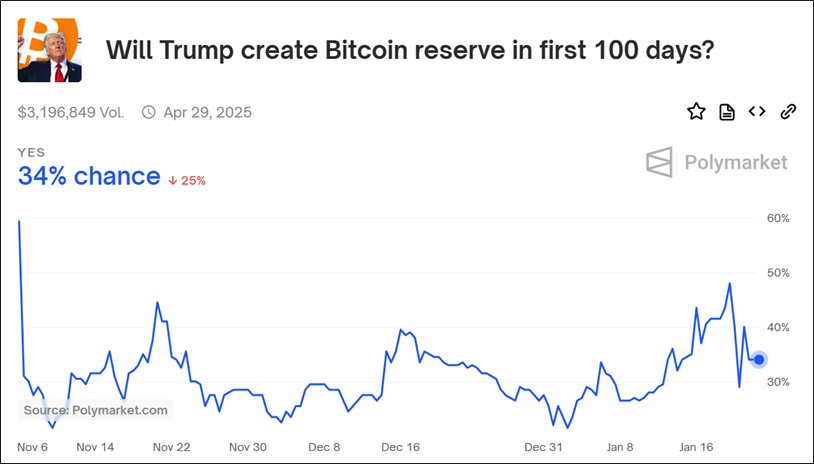

One other contract I found interesting when I was spelunking around in Polymarket was this one:

I would have guessed this trades at 8%, not 34%. It seems like the crypto world might receive a small dose of reality as that figure slowly creeps towards zero. Issuing a memecoin and pardoning Ross Ulbricht doesn’t necessarily mean you’re getting a massive and risky bet against the USD in less than 100 days. I wonder if ETH/BTC just keeps decaying year after year as infinite competitors issuing infinite competing coins finally overwhelm Ethereum.

As discussed here and there, I think the risk into this BOJ meeting is dovish. Much is priced, and there is a lot of room for a dovish message given the focus on US policy uncertainty, the approaching neutral rate (?), and the fresh pain of the August 2024 meltdown.

I was on the Forward Guidance podcast this week. Link here. Recommended for people newer to FX because much of it goes through basic frameworks on how to look at currency trading and FX markets. Experts in FX will not find it as interesting.

Have a safe day.

USD decays over time

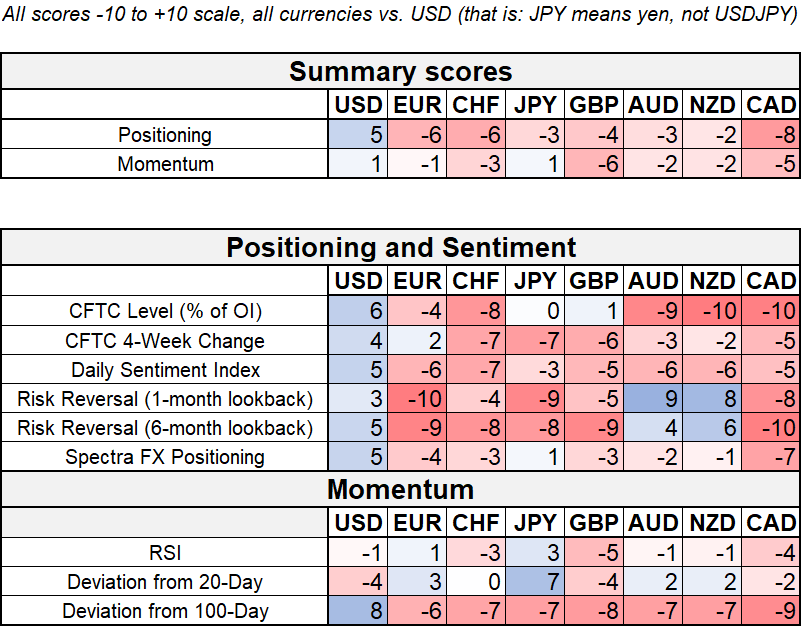

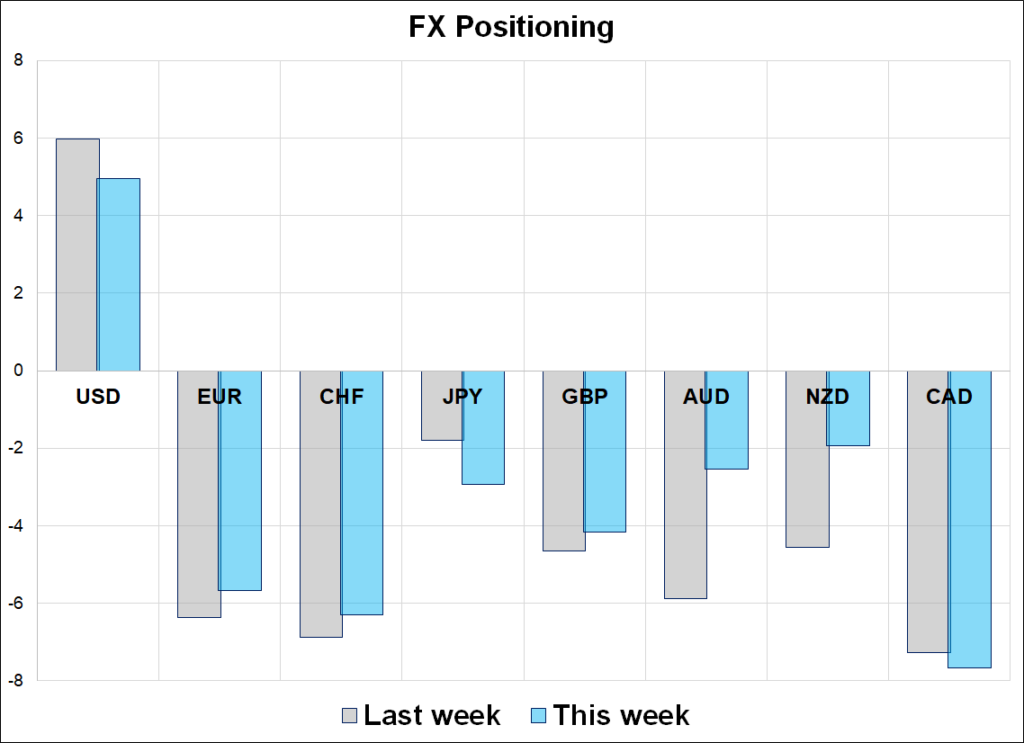

Hi. Welcome to this week’s report. The positioning report is getting a bit repetitive as USD longs remain at the most extreme levels seen in this survey for four straight weeks and the usual suspects are the denominators. EUR, CAD, and CHF remain the favored shorts while positioning in AUD and NZD has now been mostly cleaned up. Further USD gains are going to need a boost from the Donald, but so far we are seeing a repeat of 2017/2018. Promises made in 2016 were eventually kept in 2018 and the dollar rallied that year, but 2017 was a long interstitial.

Anyone that actively trades CAD vol would know this, but in case you don’t… The nature of the tariff threat means that USDCAD and CAD vol are positively correlated and are moving tick for tick. This is important if you are thinking about USDCAD puts because you want to structure something that isn’t going to evaporate on lower USDCAD + lower volatility.

Structures like 2-month digitals or RKOs in USDCAD and USDMXN will work well if spot drops, vol drops, and the whole tariff thing becomes a huge nothingburger like it was in 2017. The turn in AUD and NZD positioning could be a harbinger of further gains in spot as both those currencies got destroyed in Q4 and could be ripe for a rebound if the world starts to look at bit less tariffy.

The haircut emoji looks potentially injurious…

Especially if you add comic book motion lines and vertical flip the mouth

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

There is too much bad news for the market to keep ignoring Canada

Comments relevant to backtesters and confusion over an early UK meme