March 30, 2023

Dedollarization is not a thing

Every now and then there is a story like that Reuters clip below that came out this week.

These stories inevitably kick off a brief hysteria about the USD and its inevitable collapse under the weight of the twin deficits, reckless spending, crazy policies, and/or… -insert whatever you dislike about USA here-. It’s worth remembering that there are stories like this every single year.

Here’s a nice once from 2012:

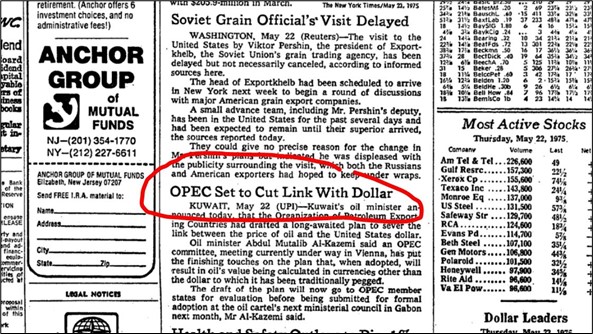

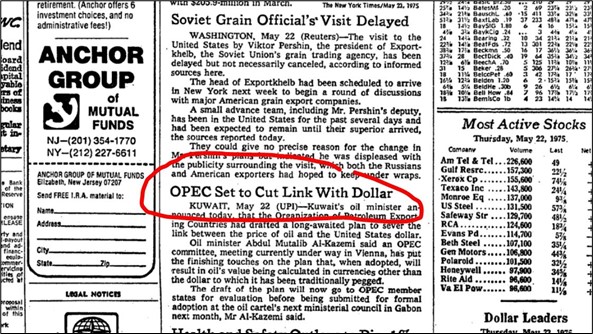

And one of my personal favorites from the dollar doom hysteria genre:

I could easily find one of these stories for every year from 2001 to now but I won’t because that would be boring.

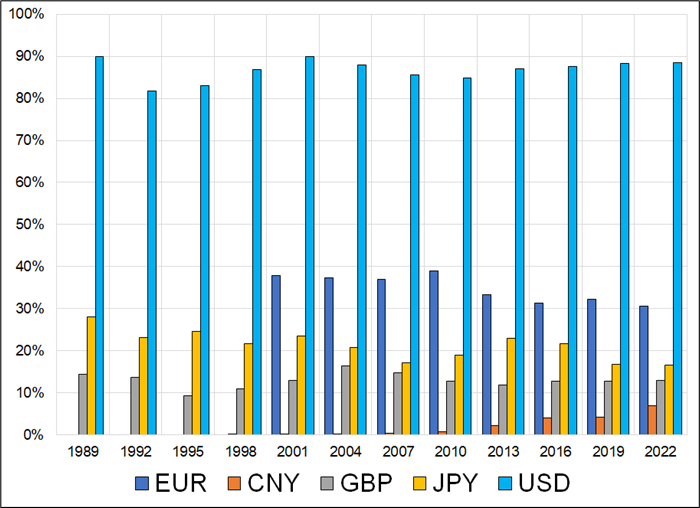

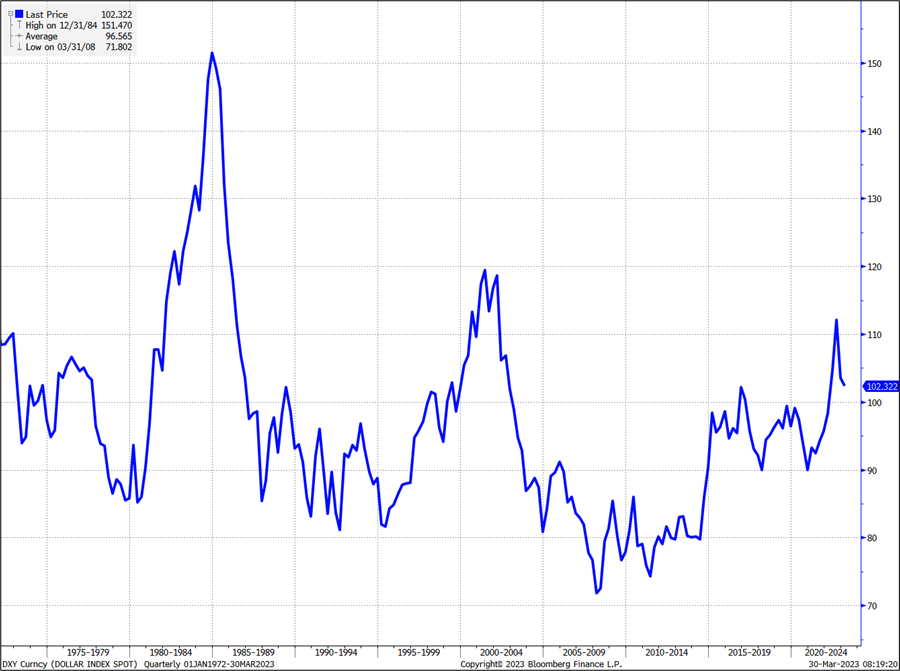

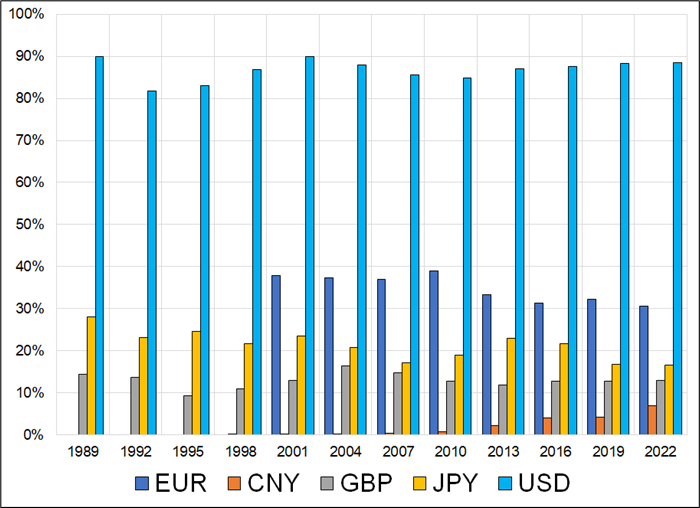

It is intuitive to think that growing debt levels are unsustainable and hegemony is always temporary. History shows that eventually a new country takes over as the global hegemon and Ray Dalio’s books cover this in excellent detail. The long-term story is of course that nothing lasts forever. The reality is that this process of change takes 100’s of years and the situation in the last 35 years looks like this:

USD, EUR, CNY, GBP and JPY: Share of international transactions (1989 to now)

Every currency transaction has two sides so grand total of all numbers each year is 200%. Chart by me, with BIS data.

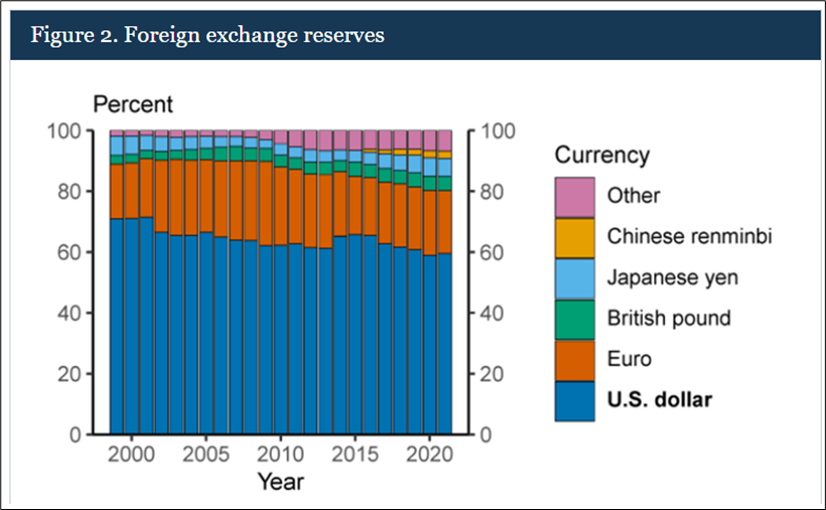

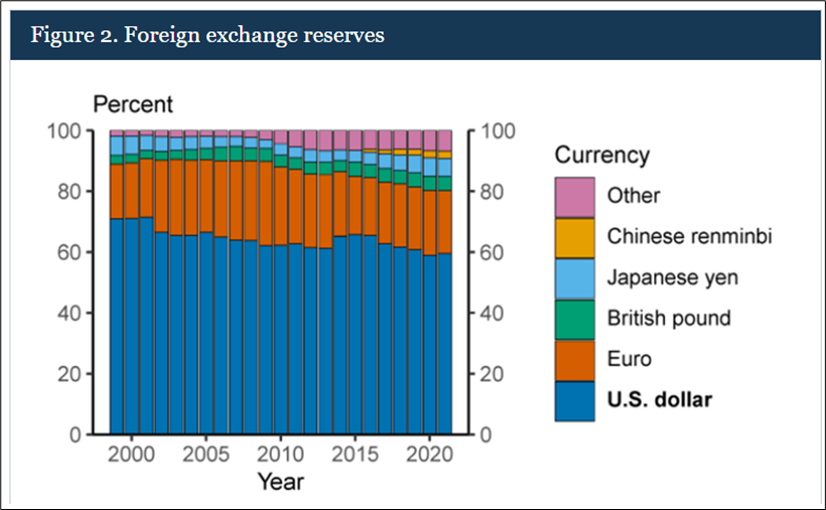

If anything, the dollar is most stable while the EUR and JPY are losing popularity around the world. It is true that central banks reduced their USD reserves from 2000 to 2010. The chart looks like this:

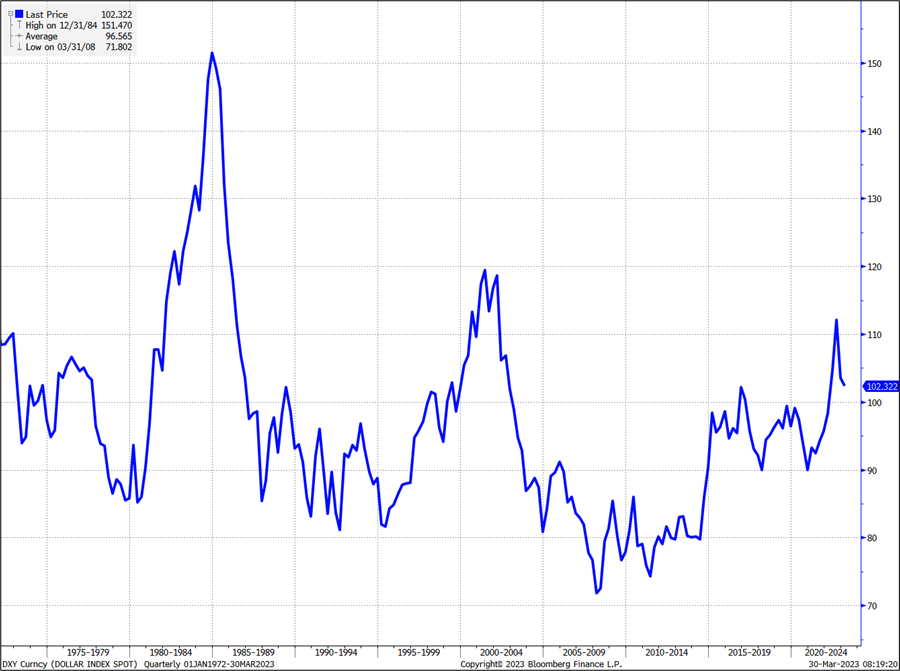

There was a meaningful reduction in USD reserves as a percentage of the overall stack in the 2000s. This was mostly centered on the 2003-2007 period as the external value of the dollar was falling and there was an off-and-on panic about the USD as a store of value in those days. Here is the external value of the USD since 1972.

Dollar Index, 1972 to now

The dollar’s demise has been imminent in many minds since the beginning of that time series.

You can believe that the USD is not doomed and also be bullish bitcoin and gold. They are not the same thing! Overall increases in the global supply of fiat currency are good for gold and bitcoin vs. every currency. They are not particularly bad for the USD specifically, and they do not signal imminent doom of any sort. They just signal that global central banks tend to lean loose, almost all the time.

While bitcoin and gold are often marketed as hedges for societal collapse, there is a middle ground where you can believe all these things at once:

- The world is not going to end just because sovereign debts are high. They have been hitting new all-time highs most years throughout my entire life. Somehow, we always figure out a combination of growth and inflation to burn the debt off in a controlled manner. Sure, there could be some nonlinear tipping point, but it’s impossible to predict and you’ll probably know it when you see it anyway.

- Monetary policy will need to be loose, generally, to allow the controlled burn of the debt.

- Bitcoin is an excellent hedge for loose monetary policy. I wrote an article about this topic and I believe that hedging overly loose monetary policy is the main useful function of BTC.

- Monetary policy is not always loose! When it gets tight, BTC is one of the worst high-beta things to own.

- No matter how scary the headlines and how visceral the FinTwit rage, rational optimism is the best human metagame.

If you are an investor, or a trader, do not worry about the death of the dollar. It’s always imminent. It’s totally irrelevant to any investment process. The external value of the dollar and its usage in global transactions is incredibly stable. You can take a cyclical view on the USD (bullish or bearish) but taking a structurally bearish view has not been and will not be the way to optimize your portfolio or your framework for decision making.

Make a distinction between A) the gradual erosion of fiat in favor of harder assets like BTC, gold, and real estate, and B) the hysteria around the end of the dollar or dedollarization. The first one is happening, the second one probably will not happen in my lifetime or my kids’ lifetimes. The gradual erosion of fiat due to loose policy required to fund large deficits is a thing. Dedollarization is not.

People like to throw around the phrase “gradually, then suddenly” as a witty rejoinder to suggest this is a nonlinear process that will unfold any day now. That only sounds smart when Hemingway says it.

To be clear: There is no structural dollar depreciation or dedollarization story. Usage of the USD is stable and changes in the value of the USD are cyclical.

CNY is gaining moderate importance in the global financial system, at the expense of other fiat currencies like EUR and JPY.

Meanwhile, the value of all fiat currencies relative to hard assets is in decline because the global supply of fiat currencies is increasing. Changes in the external value of the dollar relative to other fiat currencies are cyclical. Don’t worry about the end of the dollar. It’s always coming in 20 years but that has been true for more than 50 years.

Below, one last clip, from 1975.

What’s wrong with AUD?

As mentioned yesterday, AUD looks low. There is this nagging weakness in AUD (and NOK) that no amount of SPX joy or commodity market happiness can cure. I suppose it’s still AU rates weighing on the currency, but anyway, here’s the updated AUD vs. variables chart:

AUDUSD vs. copper, gold, and Hang Seng Index

Maybe it will take a hawkish RBA meeting on April 4 to finally jar the Oswald out of its slumber. If Aussie rates start flicking higher, AUD could be at 0.6900 in a blink.

Final Thoughts

This article on memory and probability is a good read. HT CR.

Have an amusing day.

good luck ⇅ be nimble