US assets may suffer scarring from repeated policy shenanigans.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

US assets may suffer scarring from repeated policy shenanigans.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

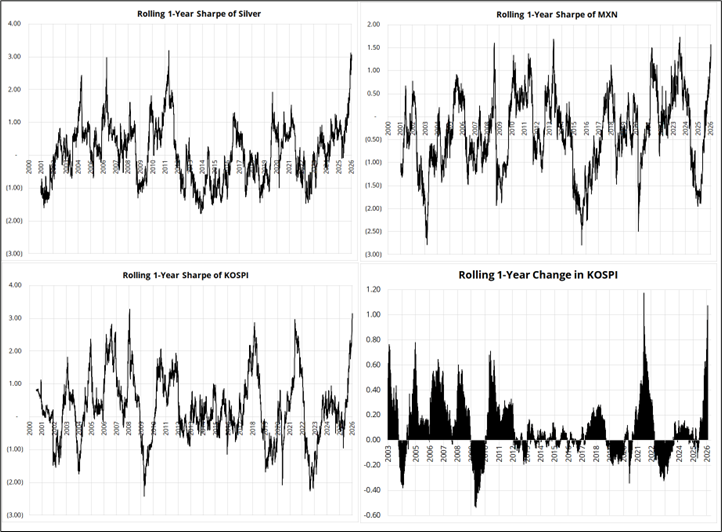

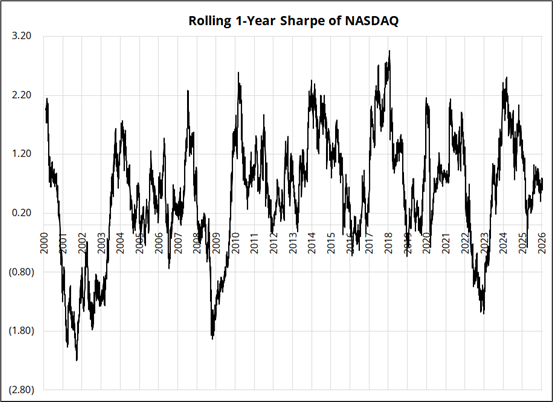

The most salient feature of markets these days is that with nagging questions about the investability of U.S. markets, there are not enough places for investors to put their money. This is creating a demand shock in assets like silver, MXN, and KOSPI (to name just three). While those are big markets, they are not big enough to handle the influx of money searching for a non-US destination.

The charts above show three Sharpe ratios (XAG, MXN, KOSPI) and the 1-year rolling returns of the KOSPI. There are many, many assets throwing off Sharpes of 3+. Meanwhile, the NASDAQ, which was the epicenter of the TINA trade for years, is annualizing at a Sharpe of 0.61.

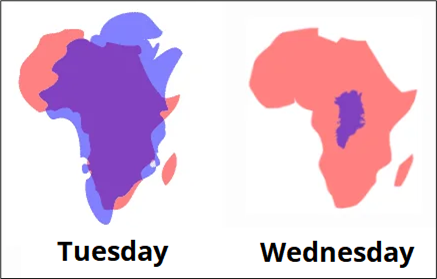

MAG7 is flat vs. last September. The huge bounce off the April 2025 lows and the still-stable capital flow data for U.S. securities obscure the fact that there has been substantial underperformance by U.S. assets, especially for unhedged foreign investors. This week’s Greenland shenanigans will add to the overall feeling that U.S. assets, while still obviously very investable, are perhaps a bit less investable than they used to be. There is irreversible scarring from the policy uncertainty and that makes global diversification more attractive.

There is a strong behavioral element to investment in the USA. The feeling of “there is no alternative” has pervaded for years because the U.S. has outperformed so consistently. Anyone who tried to take the other side got fired. Now, the question is how many months or years of U.S. underperformance are required before it’s “safe” to diversify? As this continues, the “all-in USA” people will start to feel the fear of getting fired and looking stupid—and diversification will slowly feel a bit more like the safe play if you want to stay in the middle of the herd.

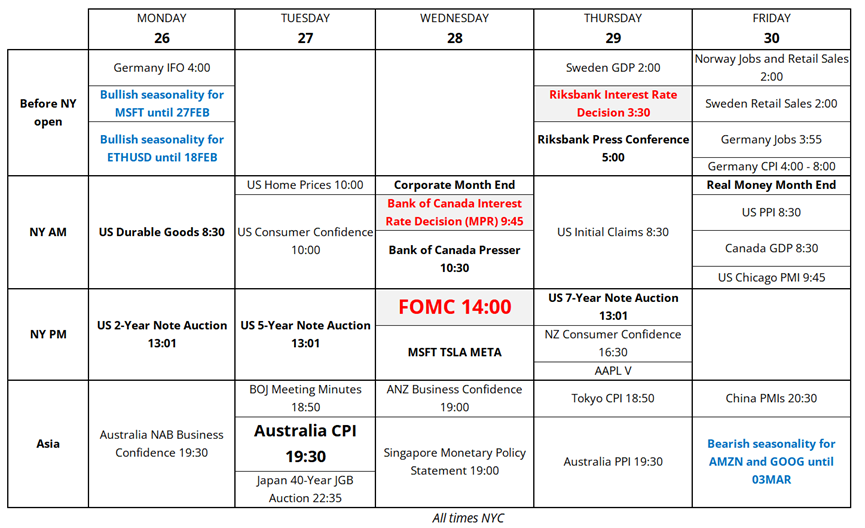

Owners of gamma should have plenty of opportunities to play Pong back and forth as we get some major earnings reports, big central bank meetings, three US bond auctions, corporate and real month end, and a bunch of other random stuff. Aussie CPI Tuesday should be strong and should take RBA hike pricing to 99%.

Here is the relative importance of Greenland Tuesday and Wednesday this week:

While it’s fun to say “TACO!” and watch this ridiculous circus unfold, there are real world consequences when you coerce former allies. The consequence is that US assets are less attractive and they underperform because the new US state capitalism and expansionism puts a question mark over everything. Most recently we saw selloffs in huge banks like Capital One, for example, as the US government threatens to impose price controls. Arbitrary tariffs that still may or not be legal come and go day by day, but investors are voting with their proverbial feet.

Again, a lot of this is obscured by the fact that liquidity is plentiful and everyone is running it hot. Primary fiscal deficits are hot. Even if we don’t hear Stephanie Kelton’s name as often anymore, policymakers around the world are all experimenting with the theories she espouses. Stock markets around the world are ripping while US stocks are ripping less.

While AI is the hot topic at Davos, the AI stock craze has thawed considerably. NVDA has been going sideways for six months, ORCL is in the toilet, and the “Andrew Ross Sorkin Rang the Bell at the top!” NASDAQ peak from October remains in place. Nice to see RGTI, MSTR, and the crypto DATs all trading lower with low vol as people lose interest.

Here is this week’s 14-word stock market summary:

USA is treading water while the rest of the world rips. Big week ahead.

https://www.spectramarkets.com/subscribe/

There has been a somewhat unimpulsive break of the key 4.20% level in US 10-year yields and I am not sure what to make of it. I expected a more aggressive rip if that level broke, but US bonds don’t look particularly scared, even as Japanese bonds look into the eyes of Sadako Yamamura.

JGB longs this week

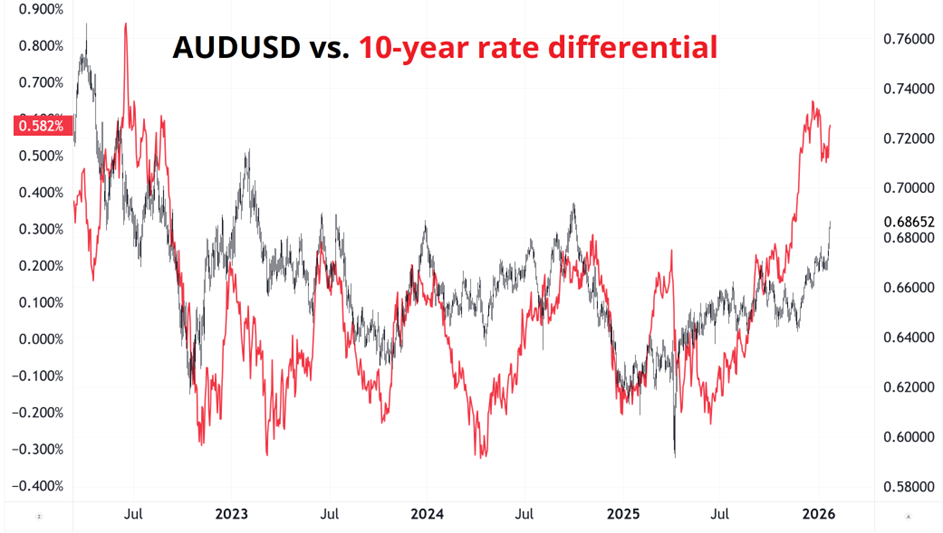

Outside of the move (a bit) higher in US yields, the most interesting story in rates comes out of Australia. Down in the Lucky Country, jobs are plentiful, inflation is rising, and the RBA is about to hike. This puts that central bank at odds with most others and has triggered the long-awaited ripper in AUDUSD. The RBA is 60% priced to hike in February and I think next week’s CPI will come in strong and that number will snap to 100% pretty quick.

Go Straya!

A rare afternoon update here. Will keep it short.

The Fed has asked for rates in USDJPY according to many reliable sources. This is USD bearish. Highly unusual. Strong signal.

I want to be long AUDUSD for CPI next week.

So I am buying Wednesday 0.6920 AUD calls now for ~22.5bps.

You can see in this next chart that Aussie vs. USA rate differentials exploded out of the range in late November 2025 and the currency is finally starting to catch up.

Long AUD is one of the most popular FX trades out there (other than long EM like BRL, MXN, and ZAR)… But popular trades often work! You can see that Aussie bonds yielded less or barely more than US bonds for years and now you get a 58bp pickup in Oz. That’s helping the currency and a rate hike from the RBA would help ratify the back end move and keep the currency on the way towards testing and breaking key resistance 0.6890/0.6930.

The USD story is turning negative again as the Greenland stuff this week was a reminder to foreign asset managers that there is a base case where you do OK unhedged in US assets and the tail risk you get smoked as the USD and US asssets sell off in tandem. The more pension funds see USD vs. US asset correlation turning positive, the more they are apt to hedge in future.

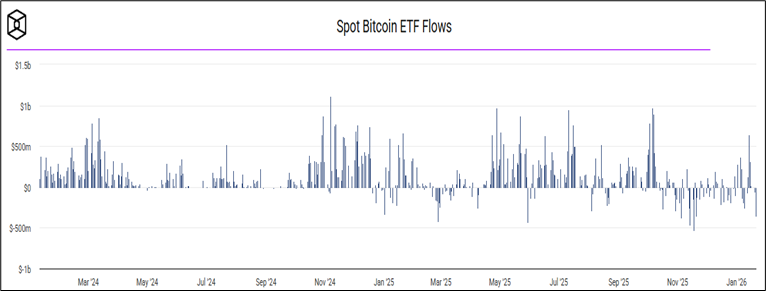

Doge has completed its silly round trip as it rallied on New Year hopes and fresh Christmas money and is now back where it started. I have been thinking about crypto a lot lately in the context of reflexivity. A new asset can be whatever people want it to be. It can be peer-to-peer cash (it isn’t). It can be a store of value (it isn’t). It can be a risky assets (maybe?). It can be digital gold (it isn’t). It can be decentralized (it isn’t). It’s whatever people believe at various times throughout the years.

What if people now believe it’s a spec asset with existential quantum computing downside risk? That seems to be the current narrative. The longer bitcoin decouples from precious metals and NASDAQ, the more the narrative shifts towards some new iteration of what the proposed use case is for crypto. Altcoins aren’t working and there is no lotto ticket trade in BTC or ETH anymore and I am starting to wonder if we’re just in another crypto winter where everything goes down 80%.

Particularly bearish was the failed retest of BTC 98400. I have talked about that level off and on, over and over, as it’s been a great pivot in both directions. This time, we rallied on another round of sloppy Saylor buys and failed right there again before the puke.

The world is witnessing a demand shock for non-US assets, especially those without counterparty risk. The fact that bitcoin cannot rally in this regime is not good! While it’s tempting to buy it because it’s lagging everything else, I tried that already once around 95k/100k the first time down. These lead/lag relationships are tradable in the short run, but the longer the dislocation lasts, the more likely it’s more structural and persistent.

The 2024/2025 bitcoin bull thesis was that Wall Street buyers, deregulation, and the Strategic Bitcoin Reserve would trigger the next leg higher. Instead, the institutionalization of bitcoin woke the whales from their comas. They woke up, looked around, recoiled at what they saw, and they dumped. The original bitcoin ethos is long dead, Blackrock and Vanguard are done buying, and crypto needs a new thesis. Until that thesis arrives, I guess it’s still sell rallies.

And if BTC recaptures 100k, the bulls are back in control.

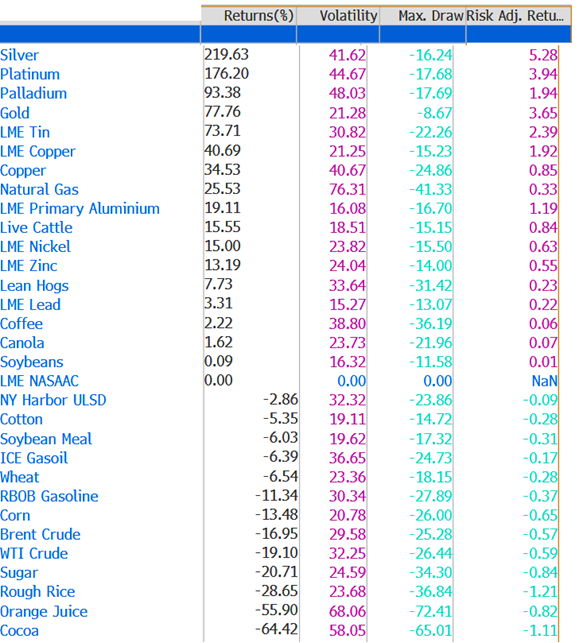

The story remains that analog bitcoin continues to skyrocket. There are few times I can remember such impulsive rallies in anything with no pullbacks. These are absolutely epic, historic rallies in precious.

Gold is almost five thousand US dollars! Silver is almost three digits!

When I worked at a bank, I wasn’t really allowed to tweet and I had 1,600 followers on Twitter and so everyone missed my greatest tweet of all time.

I am happy to inform you that silver was $21 then and ZM was $270. They finally crossed! Silver 99 ZM 85.

Did I have the trade? No! We were not allowed to trade PA at the bank. Would I have held it? Also no! Zero chance I would have held it. But still. Cool story bro.

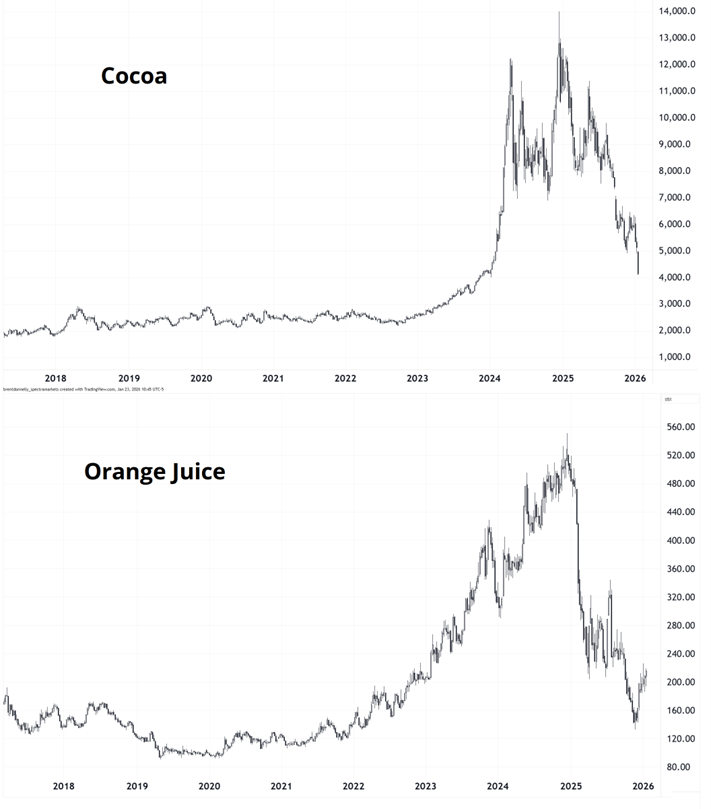

Check out the 1-year performance of commodities.

Note the two star commodities of 2024/2025 (OJ and Cocoa) have now collapsed. Never bet on Malthus in the long run. He is always wrong. Innovation always wins. That’s why the long-term charts of commodities tend to look more like charts of altcoins, not SPX.

That’s it for this week.

Get rich or have fun trying.

Read a short essay about my 5-day silent meditation retreat here: Recreational Buddhism. 9-minute read. Not finance related!

https://www.spectramarkets.com/amfx/recreational-buddhism/

*************

Mark Carney’s “Love Actually” moment..

https://www.cbc.ca/news/politics/mark-carney-speech-davos-rules-based-order-9.7053350

*************

This tweet from John Arnold about his first-ever visit to China is absolutely excellent. He focuses on robotics, manufacturing, and energy. If you have never been to China (I have not) it’s a good primer

https://x.com/johnarnold/status/2013344293377740830

*************

The phone call from the Deutsche CEO to Scott Bessent is reminiscent of how banks that rely on China and know what’s best only publish bullish reports on China. As my grandmother used to say: If you don’t have anything positive to say, don’t say anything at all.

https://www.reuters.com/business/davos/bessent-says-deutsche-bank-ceo-called-distance-bank-analysts-greenland-report-2026-01-21/

*************

I have been catching up on my George Orwell lately, for no particular reason. His short essay on writing is excellent. The six main takeaways are evergreen, good advice for all writers.

George Orwell: Politics and the English Language (1946)

https://bioinfo.uib.es/~joemiro/RecEscr/PoliticsandEngLang.pdf

*************

Initially a writeup about math nerdiness, but it leads to convincing life advice. HT Justin Ross.

https://acotra.substack.com/p/the-stable-marriage-problem

*************

New Mauboussin just released. It’s like a Kendrick Lamar album drop, for finance nerds.

https://www.morganstanley.com/im/publication/insights/articles/article_whoisontheotherside.pdf?1769087389066

*************

Below is an excellent slideshow from Steen Jakobsen at the CFA Society of Lichtenstein.

New Macro Regime: State Capitalism.

https://www.flipsnack.com/79C95EB569B/cfa-lichenstein-jan22-2026

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.