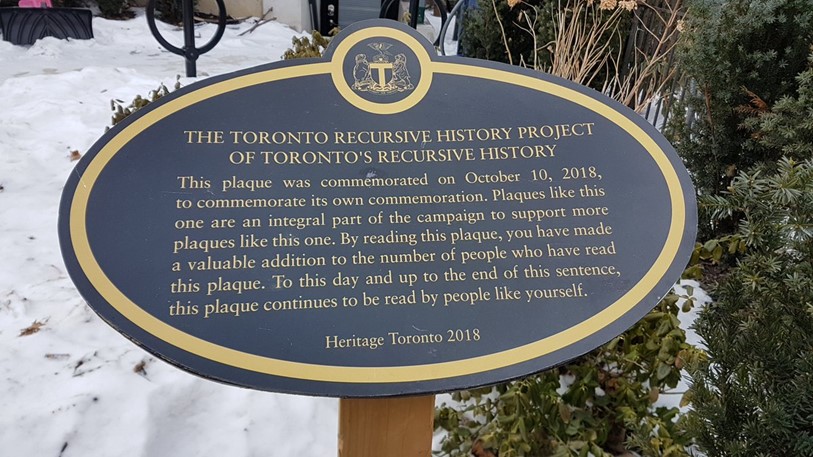

FOMC today .. Here is my grid of subjective probabilities for Fed and market outcomes.

Push and Pull

It was a week of crosscurrents and contradiction

FOMC today .. Here is my grid of subjective probabilities for Fed and market outcomes.

In order to understand

recursion, you must first

understand recursion.

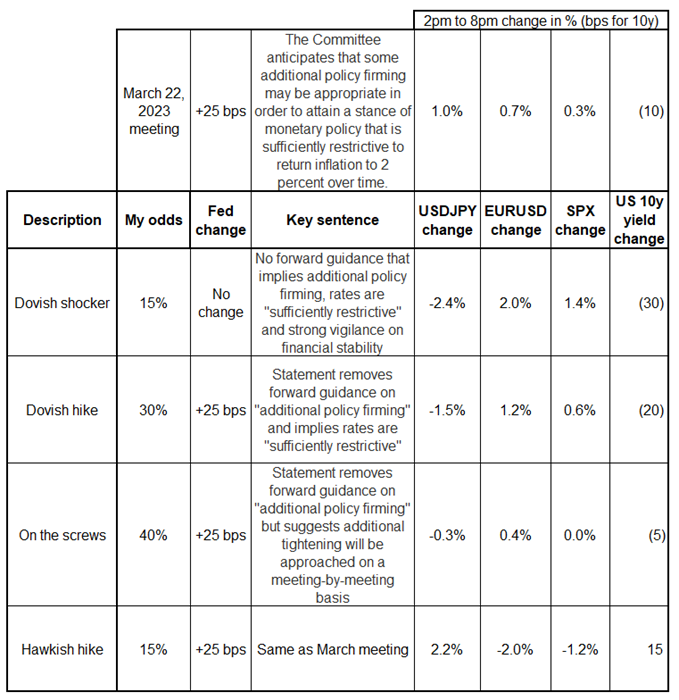

20JUN USDCHF

0.8850 digital put @ 20%

spot ref. 0.9275

May 3, 2023

Reality and markets are forcing the Fed to make a choice between an ironclad commitment to bringing down inflation and the regional banks. They cannot choose both. The Fed was willing to use a forward-looking approach in Summer 2021 to predict inflation would be transitory. It seems like with lending standards tightening, deposits fleeing, deep curve inversion, supply chains fixed, oil half off its year-ago highs, goods prices falling, rents peaking, food price inputs like fertilizer falling, global energy prices at the lows, Fed Funds up 500bps, and global shipping costs below 2019 levels…

It wouldn’t be crazy to think they might see inflation returning to target all on its own at this point. But the hit to their credibility from the erroneous forecast has scarred them, it seems, and now current, not future inflation has become the focus as they have less faith in their forecasts and/or don’t want to be wrong in the same direction twice. Here are the main Fed and market outcomes and my subjective probability for each.

This grid yields a USD-negative expected value because my lean is towards a dovish outcome. If the Fed is on hold today, I don’t think the rally will last long.

The only thing that matters today is FOMC, so I don’t want to add any extraneous information. Before I started at Spectra, am/FX was almost always just one or two pages but now I have more time because I’m not getting given 100 USDJPY at 6:55 a.m. or doing the morning meeting or whatever… so am/FX is often longer. I think that is fine, but it’s also fine for me to keep it tight sometimes. This maintains variety and hopefully makes the best use of your time.

Have an infinitely recursive day.

HT GITT

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it