Stocks at all-time highs. Just about zero risk premium in any market. Volatility in the toilet. Everything is awesome.

Push and Pull

It was a week of crosscurrents and contradiction

Stocks at all-time highs. Just about zero risk premium in any market. Volatility in the toilet. Everything is awesome.

Before we get started, some news:

I am now co-host of the Macro Trading Floor Podcast with Alfonso Peccatiello. Let’s go.

We will release the pod every Friday for your weekend listening pleasure.

This week, we discuss the outlook for the US economy, and how market pricing has adjusted to reflect the odds of a soft landing. Is there a trade? We also talk Canada, Europe, New Zealand, and China. Every week you’ll get two trade ideas and the most useful/stupidest thing we heard that week.

You can listen to the first episode of the new reboot on Apple, Spotify, Google, etc. Thanks.

https://themacrocompass.org/the-macro-trading-floor-podcast/

It’s hard to remember this because time flies, but we closed January on a down note with SPX at 4850. Twenty-nine days later we’re busting through the all-time highs and trading at 5100. Amazing.

Everything is awesome. Stocks at all-time highs. Just about zero risk premium in any market. Volatility in the toilet. The cover of The Economist is asking how high stocks can go.

There is a confusing disconnect with this magazine cover because the article itself is bearish, but still… That’s not a magazine cover you see at the lows! There is a famous investor you might have heard of whose first name is Warren. He says when others are greedy, you should be fearful. This aphorism, like Minsky’s “Stability leads to instability” is correct, but also very difficult to trade or invest in because timing the transition from stability to instability (or greed to fear) is the only way to make money.

You need to detect and react to the transition from stability to instability before others do. You can’t just say “Everyone is greedy; I am going to go short.” You will lose a lot of money doing that because the greedy period can last months or even years. While many think this is a repeat of 1999, maybe we’re in early 1996?

What you can do for now is say: “I see quite a lot of greed out there, so I better closely monitor the fundamentals and the narrative because there is a lot of room for pain if perceptions shift.” That is, be on high alert but don’t get sucked into doomerism.

“It has gone up a lot” is not a valid short thesis.

That said, not long ago we were pricing 6 or 7 rate cuts and everyone on TV was telling us that something was going to break and recession was imminent. Now, the prevailing narrative is somewhere between Goldilocks and full-on reacceleration. The narrative makes sense! But the bar for higher yields is now much higher than it was at the start of the year because we are fully priced for the Everything is Awesome scenario.

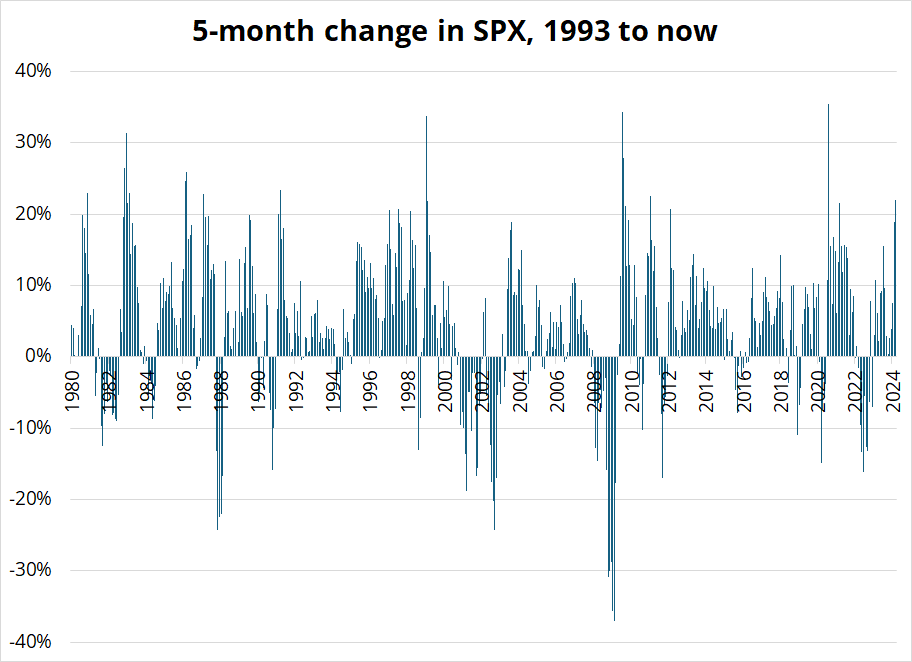

The S&P is up 21% in five months. If your first reaction to that is that we are due for some mean reversion, that’s a bad reaction. This is how stocks trade in bull markets. See here:

We are nowhere near historical maximums, and you can see that if the current period is similar to the 1990s, the bulls could just keep on running. Bull markets are crazy like that.

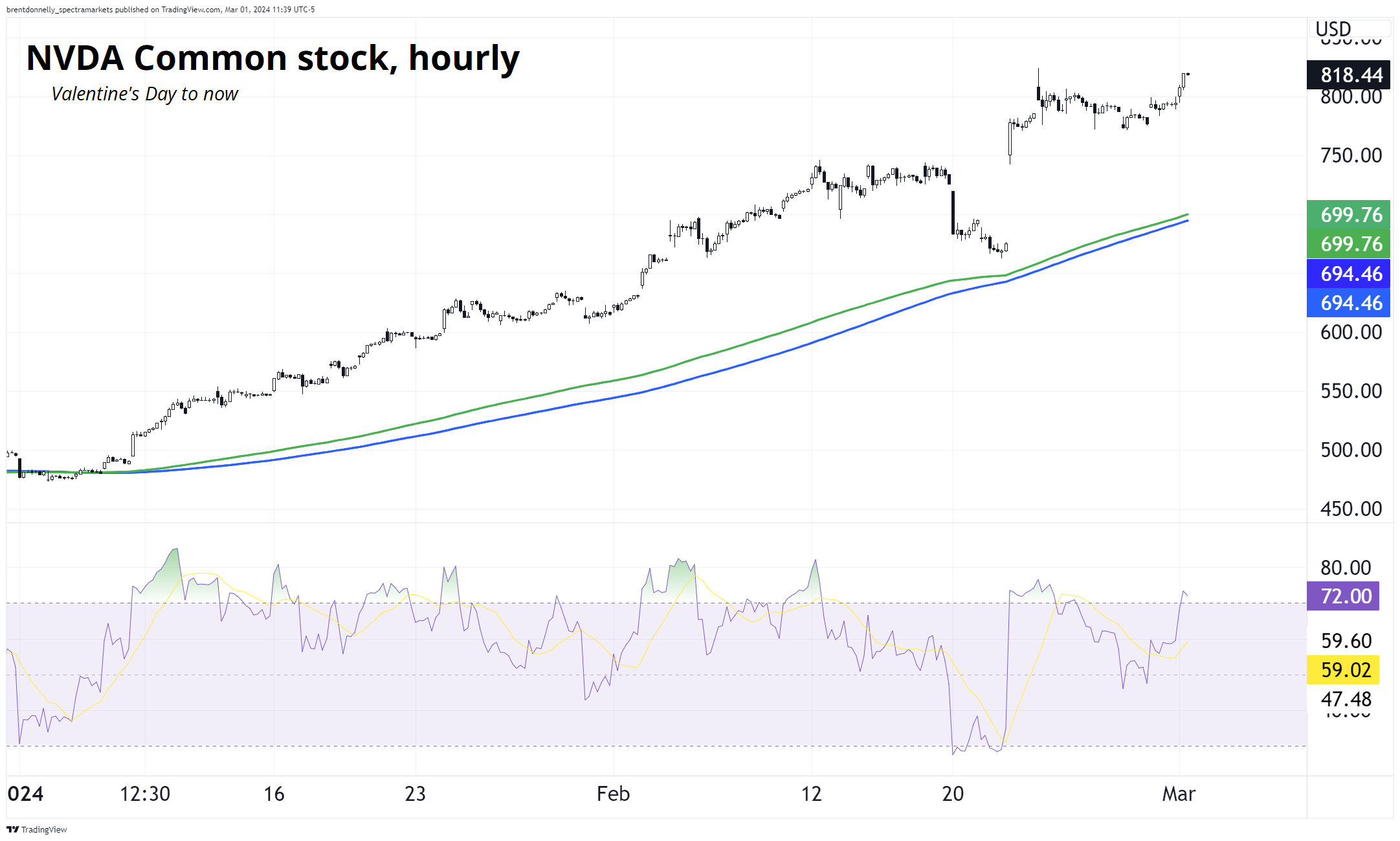

While the broad indexes push to all-time highs, NVDA took a bit of a breather this week as last week’s gap was never challenged but new highs were not quite achieved yet either. This chart shows the NVDA stock price on top and the RSI in the bottom panel.

This chart has a lot of useful information / lessons. First of all, note how the 200-hour defines the slope of the trend fairly well. I use both simple and exponential on all my charts, but there is effectively no difference in this case. Second, note that during a massive uptrend in a single name stock, overbought on the hourly chart means nothing. If you shorted NVDA every time the RSI went above 70 or even 80, you did not have fun.

If you are using hourly RSIs to trade, it’s much better to focus on products that tend to mean revert, like USDCAD, or gold, or fixed income, or basically anything except single-name stocks and crypto. For any market you trade, make sure you have a confident knowledge of whether it’s generally a mean reverting thing or a trending thing. Different markets have different characteristics when it comes to volatility, vol-of-vol, trend vs. range tendencies, gap risk, liquidity, and so on. Knowledge of the basic microstructure of your market is critical if you want to make money trading.

Finally, note how the old resistance formed by the quintuple top at 740/750 is now major support. This is typical. Strong resistance, once broken, becomes strong support.

Here is this week’s 14-word stock market summary:

Bull market until further notice but we’re priced for perfection. All greed no fear.

The higher for longer and 1995 redux view is now totally dominant. Instead of a modal price of 4 cuts with a tail taking us to 6, now we have a modal pricing of 2 cuts and a tail taking us to 3. Very hard to be short fixed income now as the weak shorts are mostly out, things have repriced and the crazy low yields at the start of the year are now reasonable.

This is a situation where my base case matches the pricing in the market now and therefore I don’t think there is a trade to do in fixed income. If you think of the SEP-NOV 2023 move up to 5% as a bit of a market freakout, you see the dominant equilibrium has been the red zone marked on the chart (3.80% / 4.30%, approx). To me, that’s a pretty good estimate of what is reasonable going forward. That means my view is skewed to lower yields, not higher. If we close above 4.36% on the daily chart, I am wrong and I will reassess.

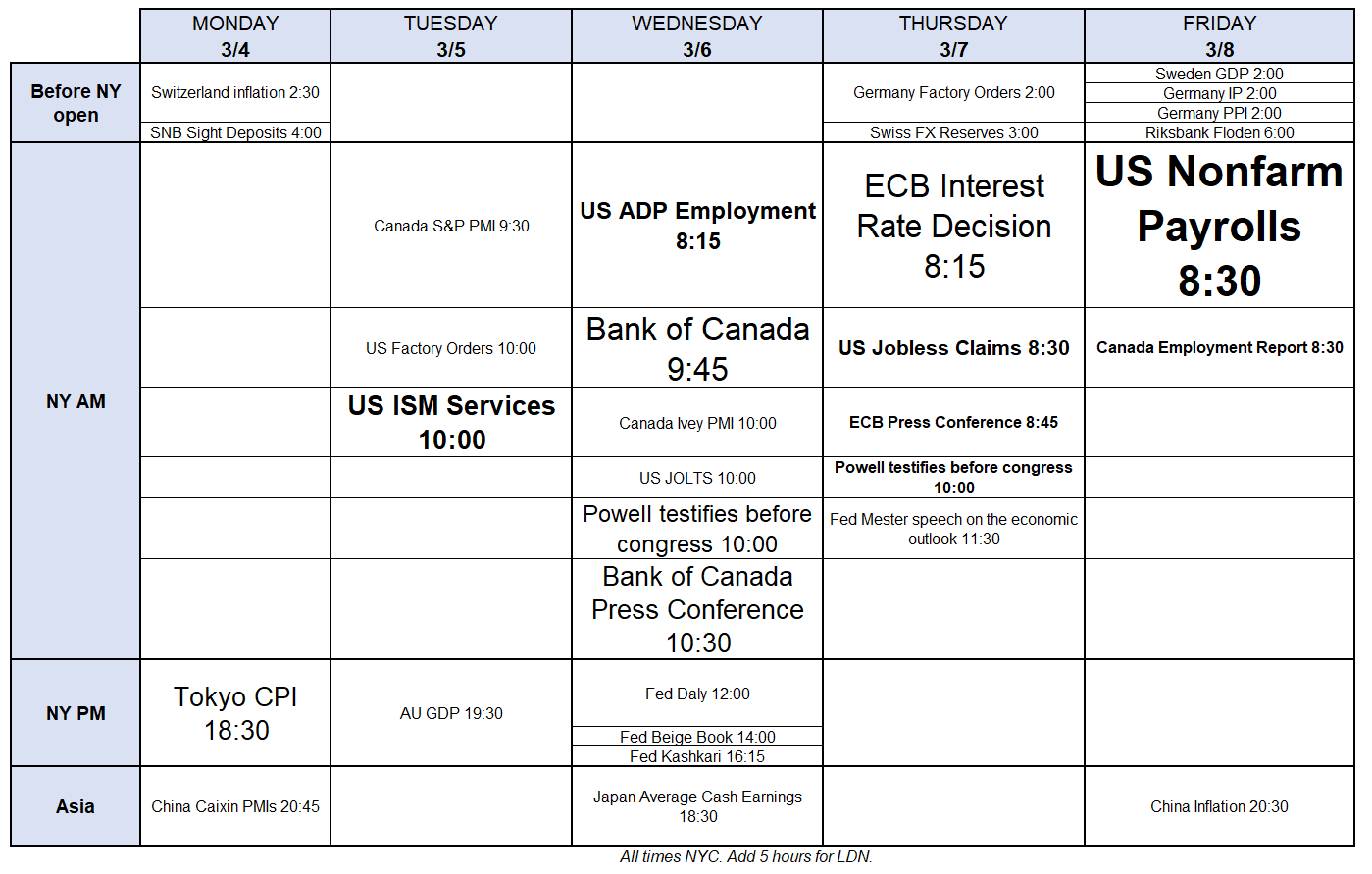

Next week looks pretty good, event-wise, as we have a variety of economic and central bank events. US ISM, ADP, and NFP plus the Bank of Canada and ECB meet to talk about when they might or might not cut. Powell is also in front of Congress.

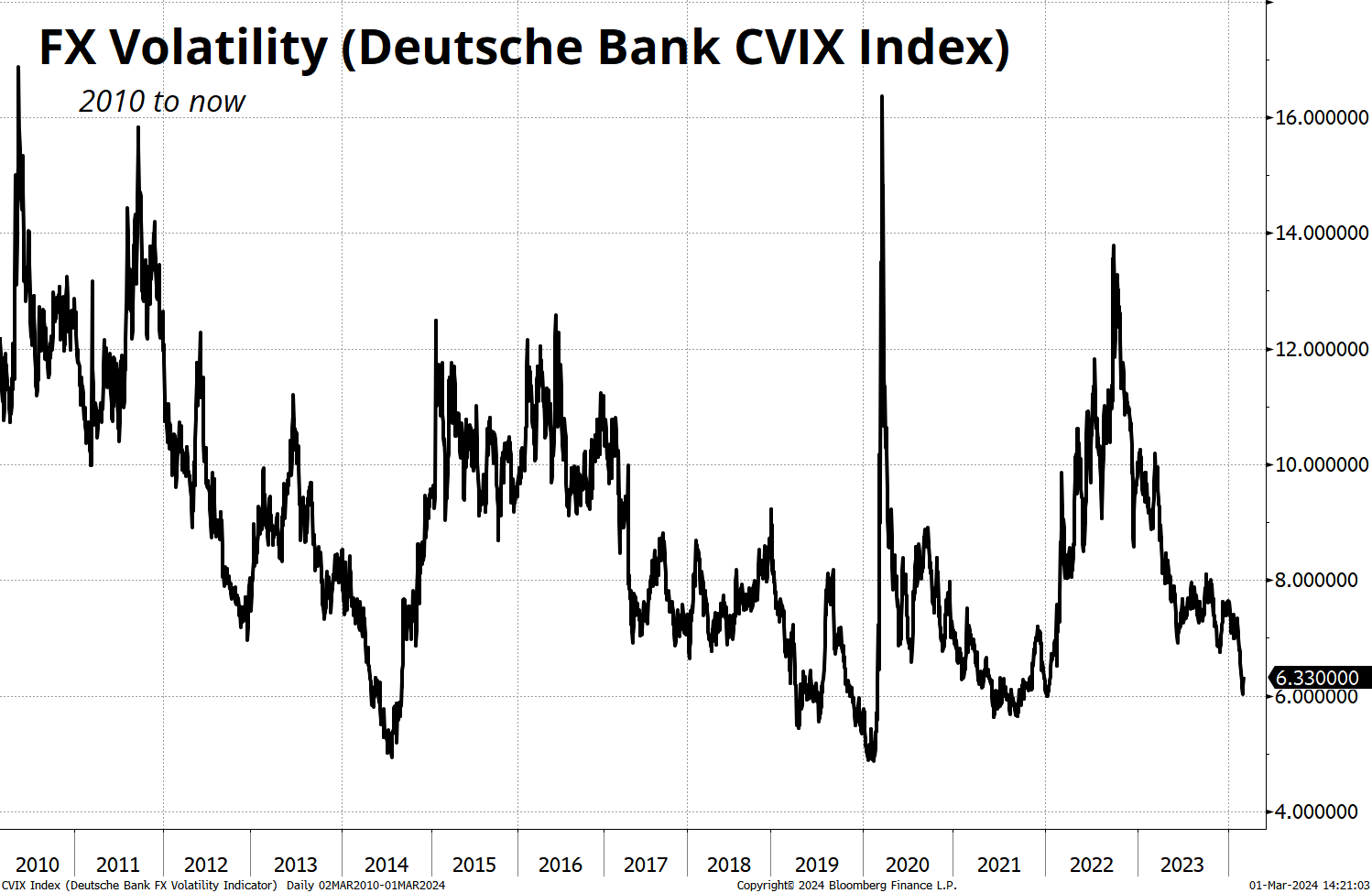

Volatility makes trading easier and more profitable. It’s much more difficult to make money when things aren’t moving. That’s why good day traders focus on the open and close in equities. And that’s why FX is breaking hearts again, like it did in 2014 and 2019.

Trading FX in these low-vol regimes (similar to 2006, 2014, and 2019) is difficult but not impossible. Carry tends to work well because vol is so low, and selling vol in reasonable ways can still work too. The temptation is to see where vol is and buy it, but any DNT you bought a month ago paid out 4:1 or 5:1. Short vol worked, despite the low starting point of vols. These low-vol regimes can be sticky. The best thing I find in these regimes is to focus on events and catalysts because stuff still moves on those days, it just doesn’t lead to a macro narrative or trend.

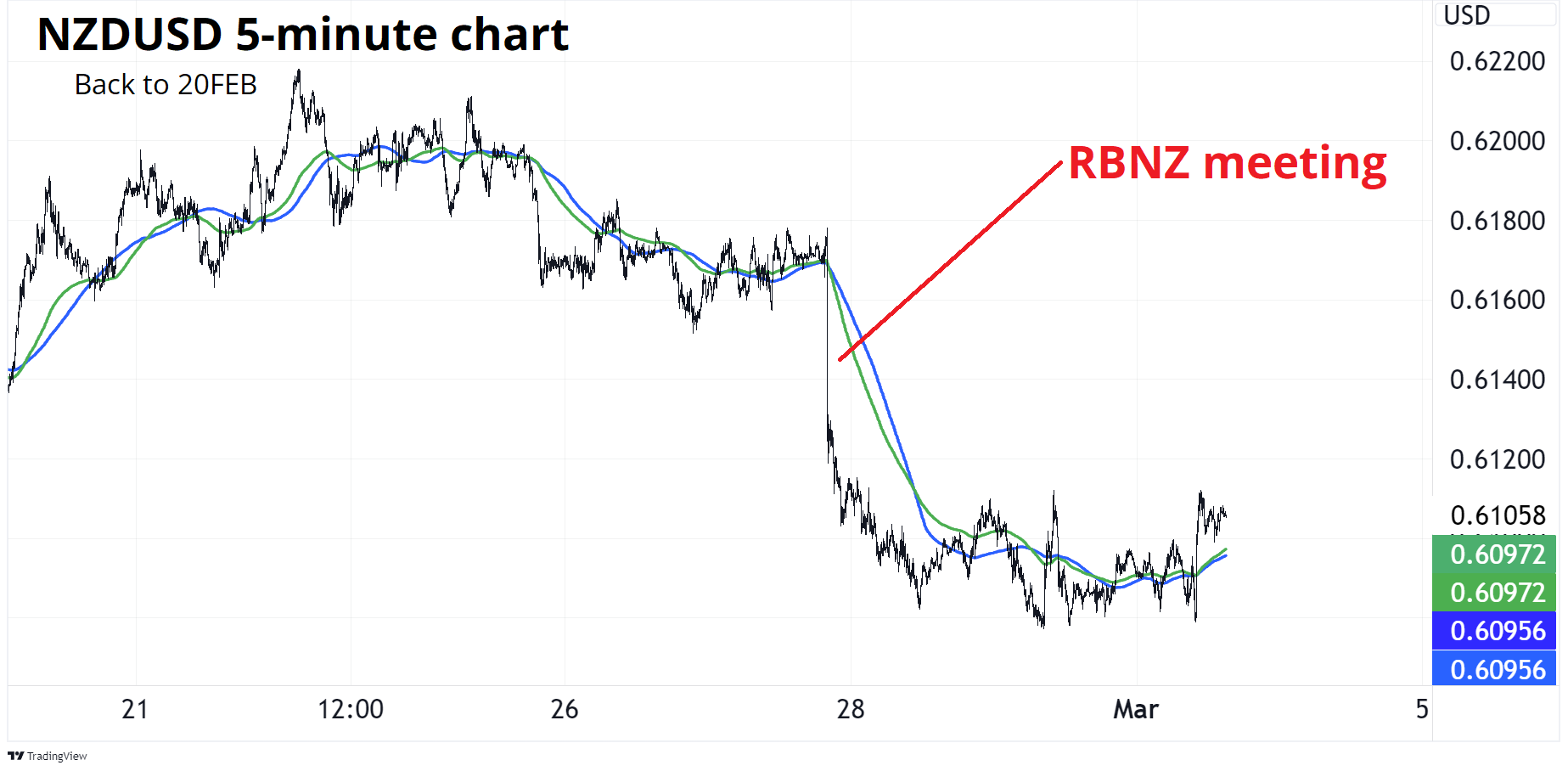

This week the RBNZ turned much more dovish than expected, and NZD was a big mover. But again, the move was concentrated in a brief window of time and after that we went back to boredom.

Outside of Japan, we are still in a period of central bank convergence where everyone turned dovish, then they turned a bit less dovish, but they’re all still ready to cut once the last mile of inflation looks doable. The RBNZ is on board the dove train now too.

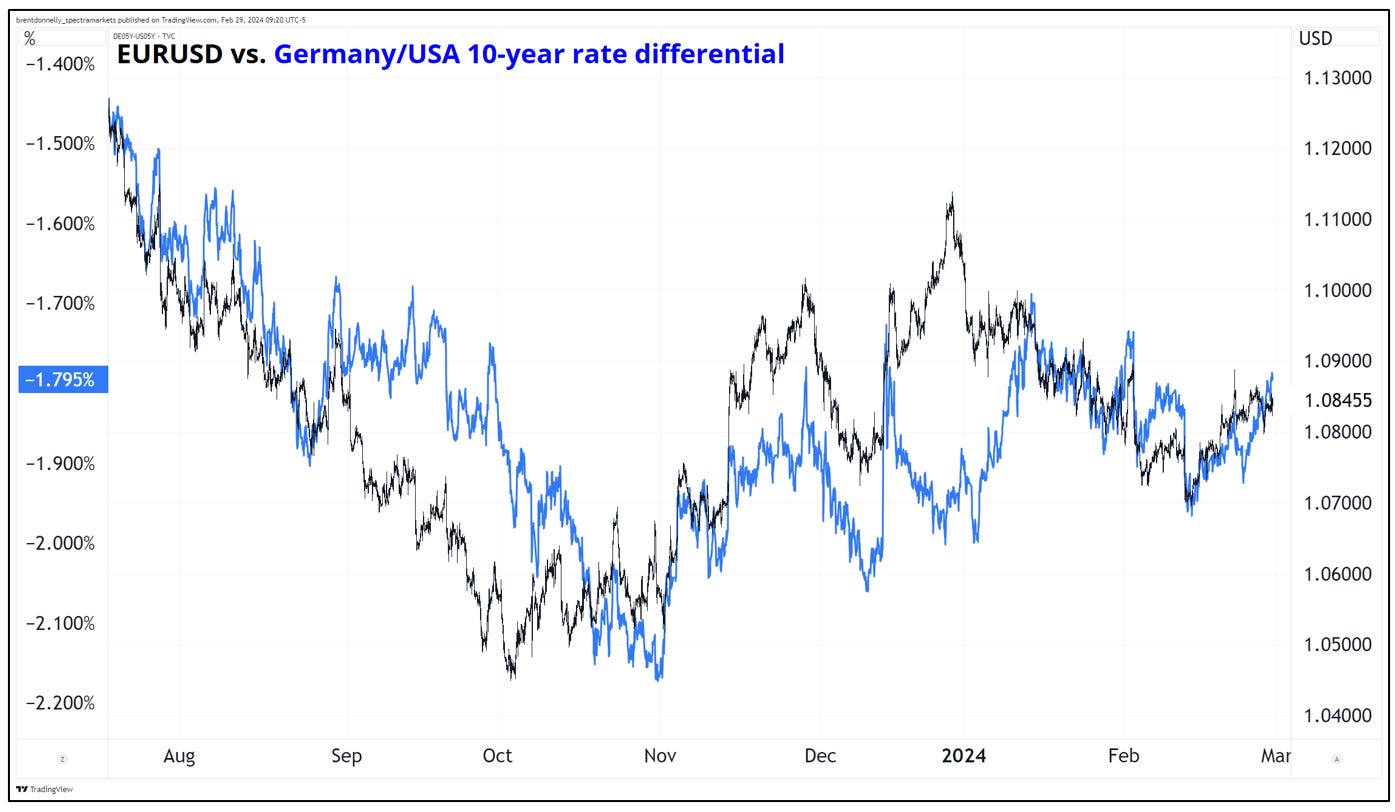

So you end up with a lot of overlays that look like this next chart. Note how the rate differential is an EKG since November as the Fed and ECB are echoing one another, saying cuts are on the table around the same time and then pushing back on a March cut around the same time.

Crypto trades like an asset class that is too small to handle one-way institutional flows. This is similar to commodities in 2007/2008 when the world decided that “commodities as an asset class” was a thing and it was time to add commodities to the list of financial assets. That caused front-month crude to rip to $150 as too much money was chasing too few futures contracts and now we have too much money chasing too few coins.

I am surprised at how much influence the flows are having but I suppose the first wave of “sell the fact” volume was enough to offset the first round of institutional / ETF lows and once that selling ran out, buyers found very few offers to lift. In a world where NASDAQ is making new all-time highs, crypto is going to perform well as bitcoin remains a high-volatility tech proxy and liquidity thermometer. We are back to a 2021-style market where everything goes up and everyone is having fun. The NASDAQ is now well above its 2021 highs and bitcoin is 7k away. The everything bubble is back.

The Fed’s decision to end the rate hike cycle before the job was completely done has rekindled the debasement trade.

The only asset class that has not yet flown up off the top of the charts is commodities. Oil is trying to do a stealth move higher now that nobody is paying attention (as discussed in last week’s Speedrun). That low-vol, Boomer bitcoin known as “gold” is perky today but remains mostly nowhere as it scuffles in the 1800/2100 range. If you want a lower volatility, less profitable, and negative carry version of BTC or ETH, gold is the perfect answer. If you want all that, with even worse returns, try GDX.

The uranium bubble has burst a bit as the Sprott Uranium Trust confirms the double top at 35 and Cameco prints $50 and goes lower. Both those assets hit similar levels in the 2007 commodity bubble and then took 17 years to get back here. If the Sprott vehicle takes out $37.50 and CCJ takes out $56.25, the next leg of the uranium bull market is on. But given the universal popularity of the theme, I think more downside comes first.

Finally, silver has been a dog for ages, but it’s approaching the apex of a triangle within a triangle and these apex moments can often lead to breakouts and higher volatility. Keep an eye on $21/$28. Whichever side breaks probably opens up a quick 20% or 30% directional move.

OK! That was 6.558 minutes. Please share this newsletter with any aspiring finance professionals that you know. Thanks!

https://x.com/graduatedben/status/1762522382130917685?s=51&t=Z-boW5UHRWKGTmYteOnSkA

If you have kids. Or if you were ever a kind once. This is sweet.

A corny but pleasing time capsule from 1981. The launch of MTV was an absolutely huge moment for US pop culture. Check out the Atari ad at 36:50. LOLLLLLL. And 1:21:55 is a highlight: “In The Air Tonight”. True classic.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it