The immaculate disinflation and soft landing narrative remain intact, but they’re almost fully priced in and therefore what you are seeing is a lot of chop.

Push and Pull

It was a week of crosscurrents and contradiction

The immaculate disinflation and soft landing narrative remain intact, but they’re almost fully priced in and therefore what you are seeing is a lot of chop.

CPI didn’t shed much new light on the inflation story in the USA. The immaculate disinflation and soft landing narrative remain intact, but they’re almost fully priced in and therefore what you are seeing is a lot of chop as the market pricing and the market reality are the same.

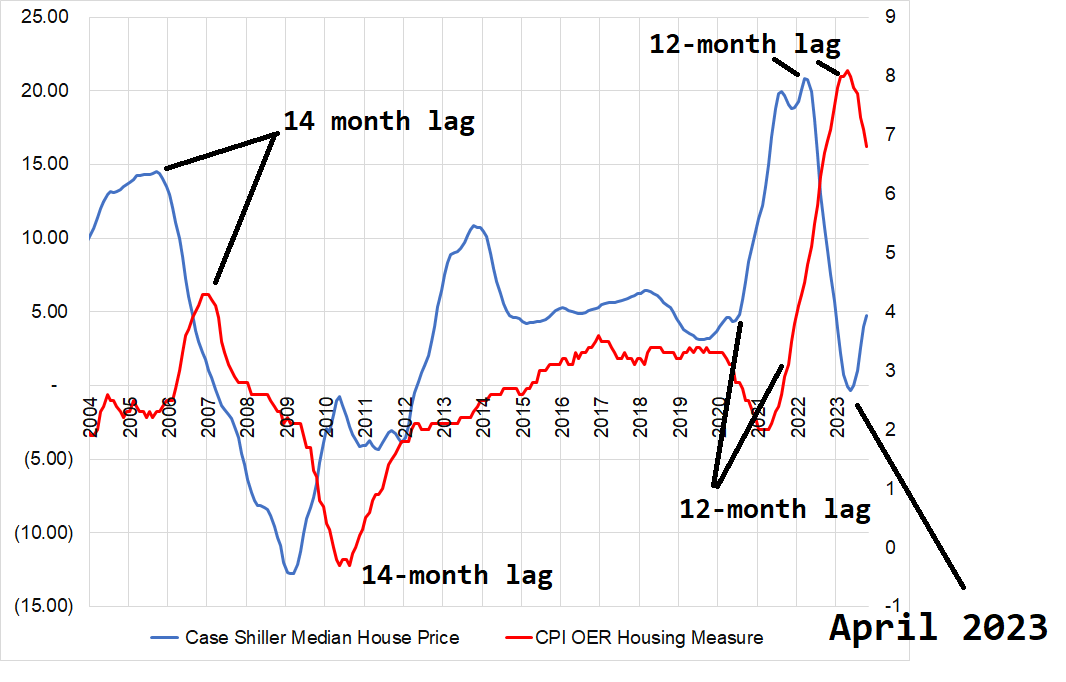

As usual, the dovish people saw the inflation release as dovish because it sets up for a soft PCE figure and confirms that the inflation spike of 2021/2022 was an aberration, not a permanently higher inflation regime. And the stupidly lagging shelter component of CPI will continue to exert a gravitational pull on the inflation data for a while.

And the hawkish people saw it as hawkish because the last mile of inflation reduction is likely to be much more difficult than previous reductions and it’s a lot easier to go from 8% to 4% than it is to go from 4% to 2%. And shelter inflation is actually going up now, so that will push inflation data higher again in the future.

The way the official data works is that it’s measurably wrong by about 12 months because of a nonsensical quirk in the methodology. Instead of using easily accessible real-world data, they use stale estimates that are 12 months off. The point of all this is that housing prices bottomed in April 2023 and therefore they will start pushing inflation back up in a few months.

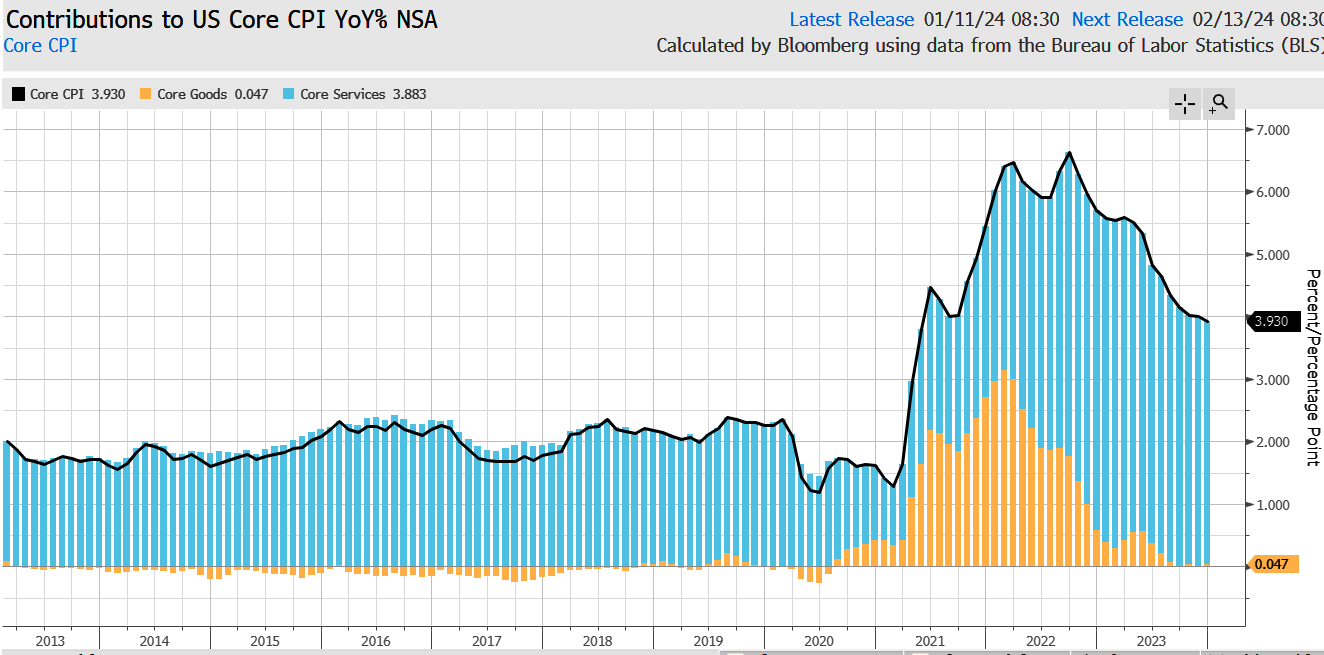

This chart is a nice aerial view of US inflation. Goods inflation is back in the toilet where it was pre-COVID, but services inflation remains kind of sticky.

Anyway, as was the case with NFP, the release being close to expectations means it tells you more about people’s biases than it does about the economic reality IRL. Sometimes data releases contain no new information, but that’s boring so people try to spin a narrative to get some clicks. If half the people say a number was hot and half say it was cold, it was probably on the screws.

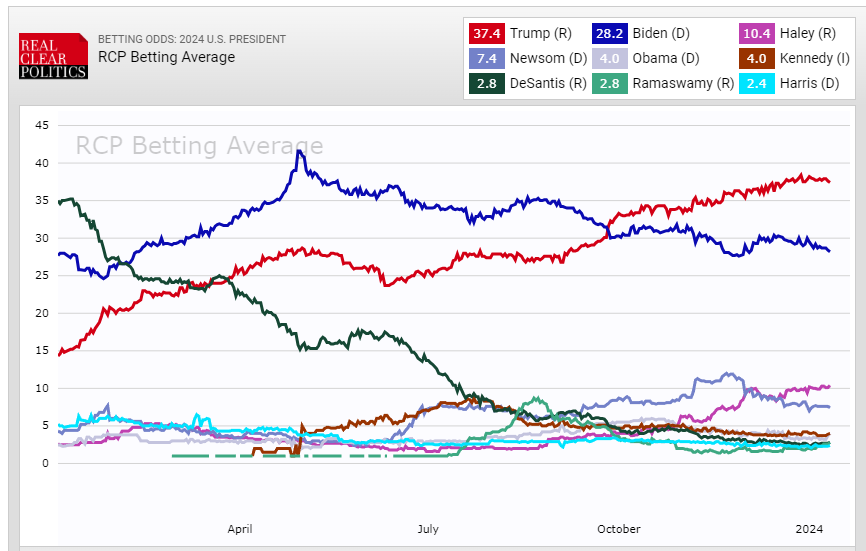

Depending on your view of whether or not the Fed is politically independent (they’re not), you might think that they are keen to sneak in a rate cut in March to bolster the economy ahead of an election where their non-preferred candidate is currently in the lead according to most polls and gambling websites.

I hate writing about politics, but sometimes you have to. Here’s what I wrote in am/FX this week concerning the US election.

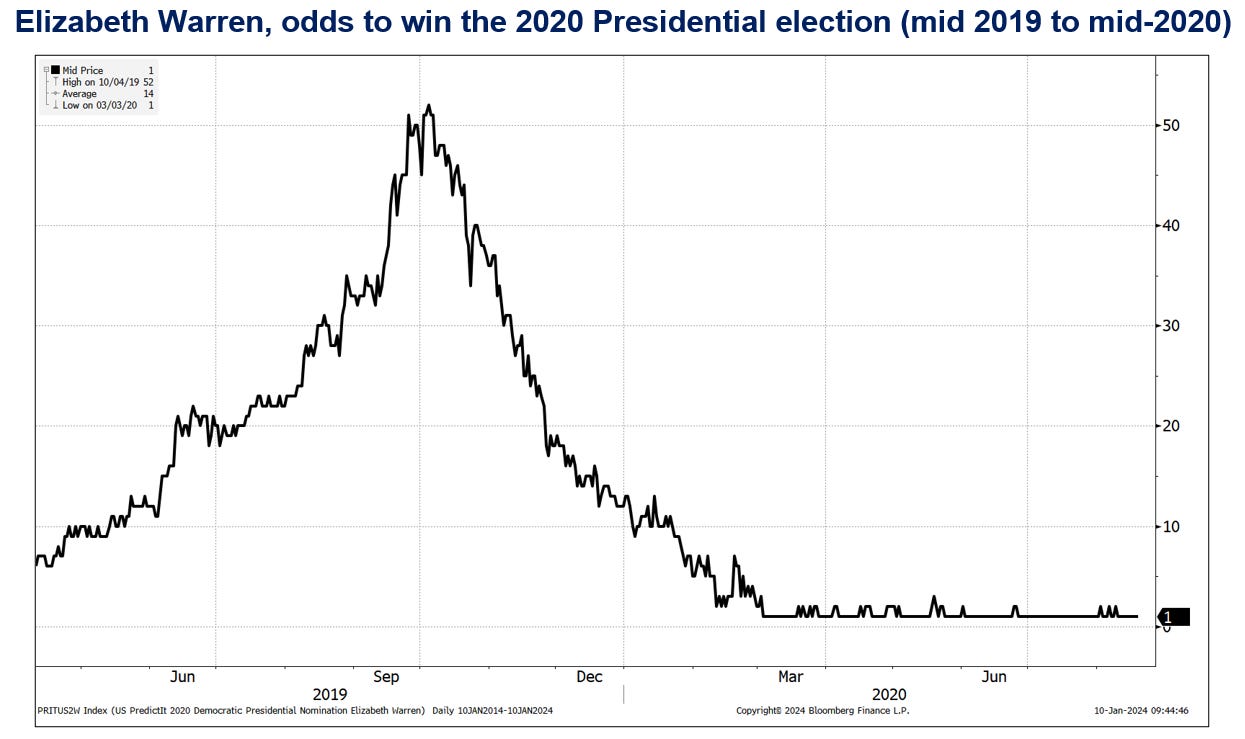

The prevailing consensus and gambling markets are pointing to a big Trump lead in the 2024 election race. Early favorites have done poorly in many elections I can remember including:

https://www.vox.com/2019/10/8/20905274/elizabeth-warren-frontrunner-democratic-nomination-2020

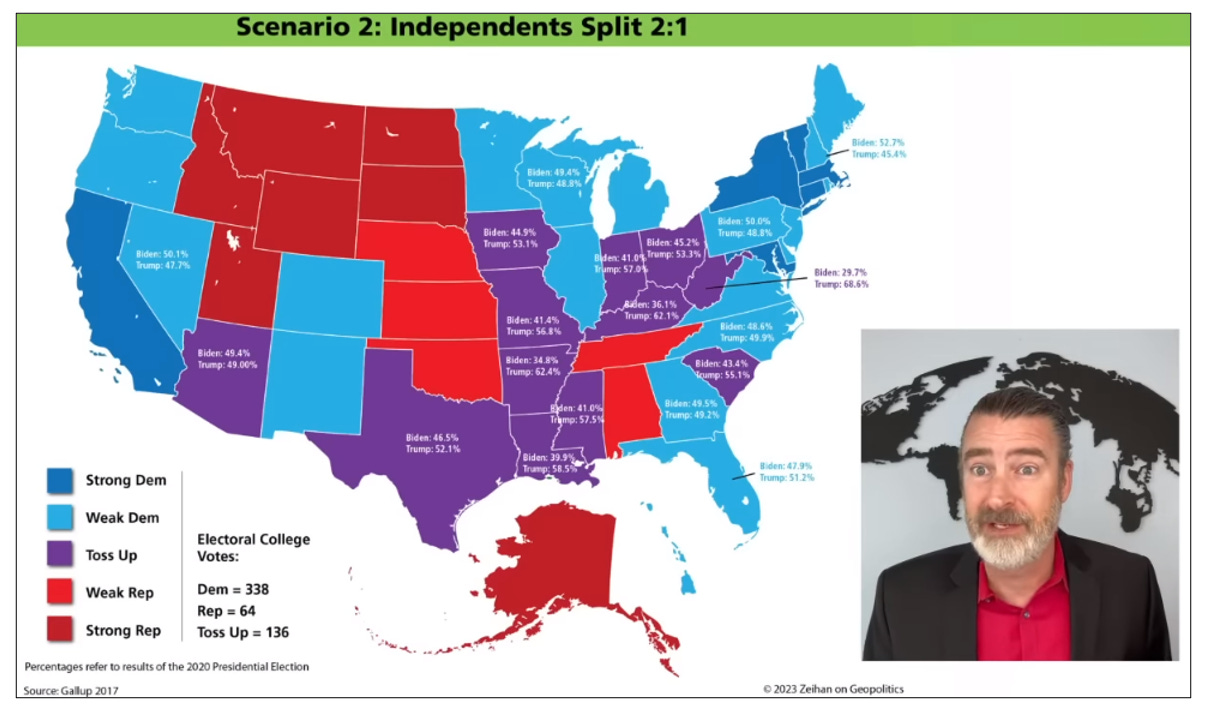

I have no view on the election, but obviously I’m following it because of the market implications. This video from Peter Zeihan offers a strong counter to the assumed Trump victory. I don’t have the political expertise to judge his analysis, but I do find he’s generally good, smart, unbiased, and pragmatic. So his conclusion (that the Democrats will probably end up winning by a wide margin) is intriguing.

The video is short, and worth the 7.3 minutes; here’s the key screenshot.

It’s early.

The market is 8-out-of-10 bullish at the highs. Feels risky. Kind of amazing that through all this sturm and drang, cash SPX is exactly where it was two years ago. And bitcoin is lower than it was. And yet you would think we are in some sort of halcyon period of exploding asset prices. One important note that people often fail to consider is that SPX has positive carry so at last you’re making 2% a year or whatever if it doesn’t move. T-bills you’re making 5%. Gold you’re making zero. That matters over time.

Here is this week’s 14-word stock market summary:

Probing the highs makes sense, but a lot of good news is priced in.

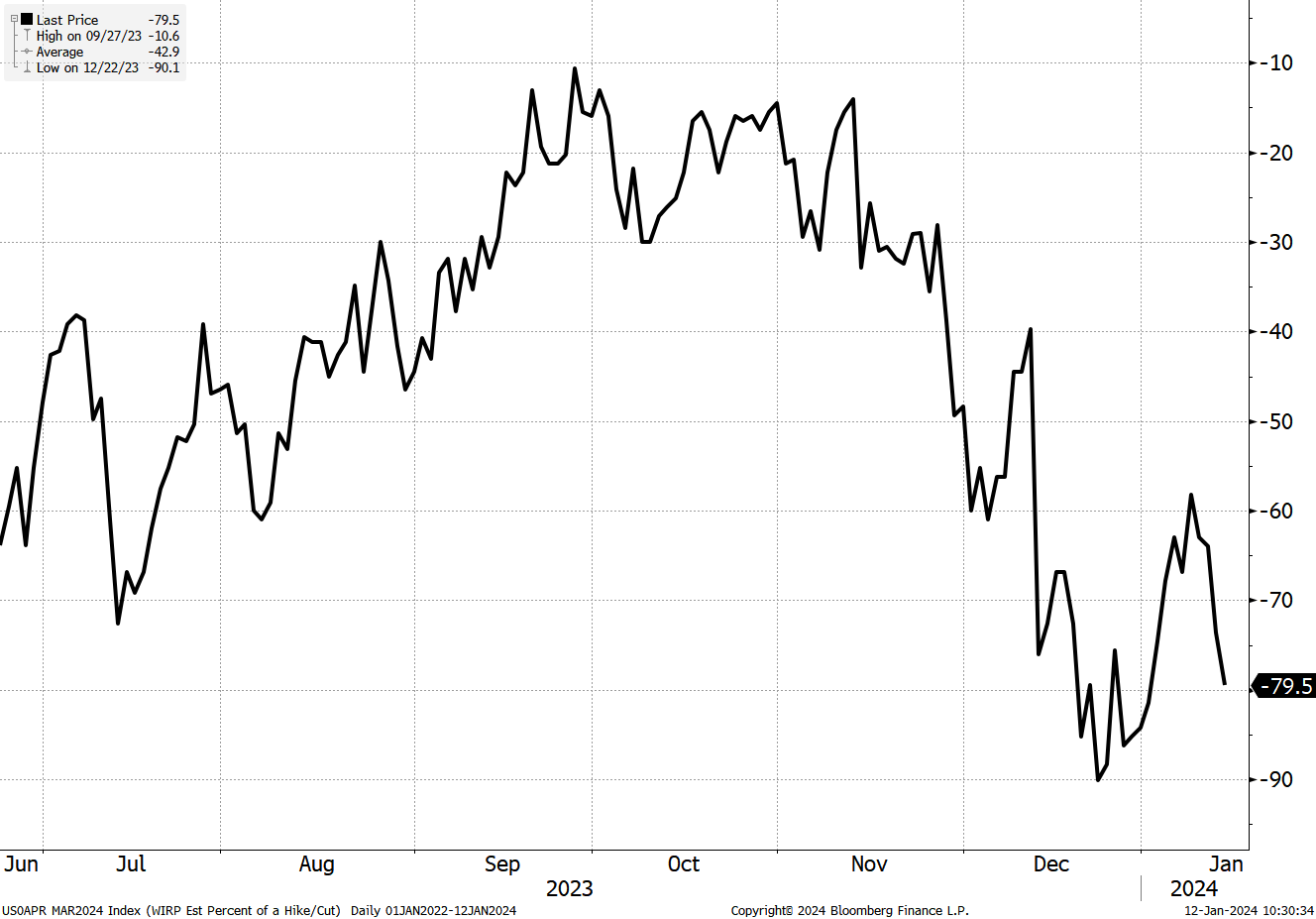

Interest rates are getting a lot of attention as everyone is trying to figure out whether or not the Fed will cut in March. That’s the key barometer right now, so let’s have a peek at whether March rate cut expectations have peaked (in case that piques your interest):

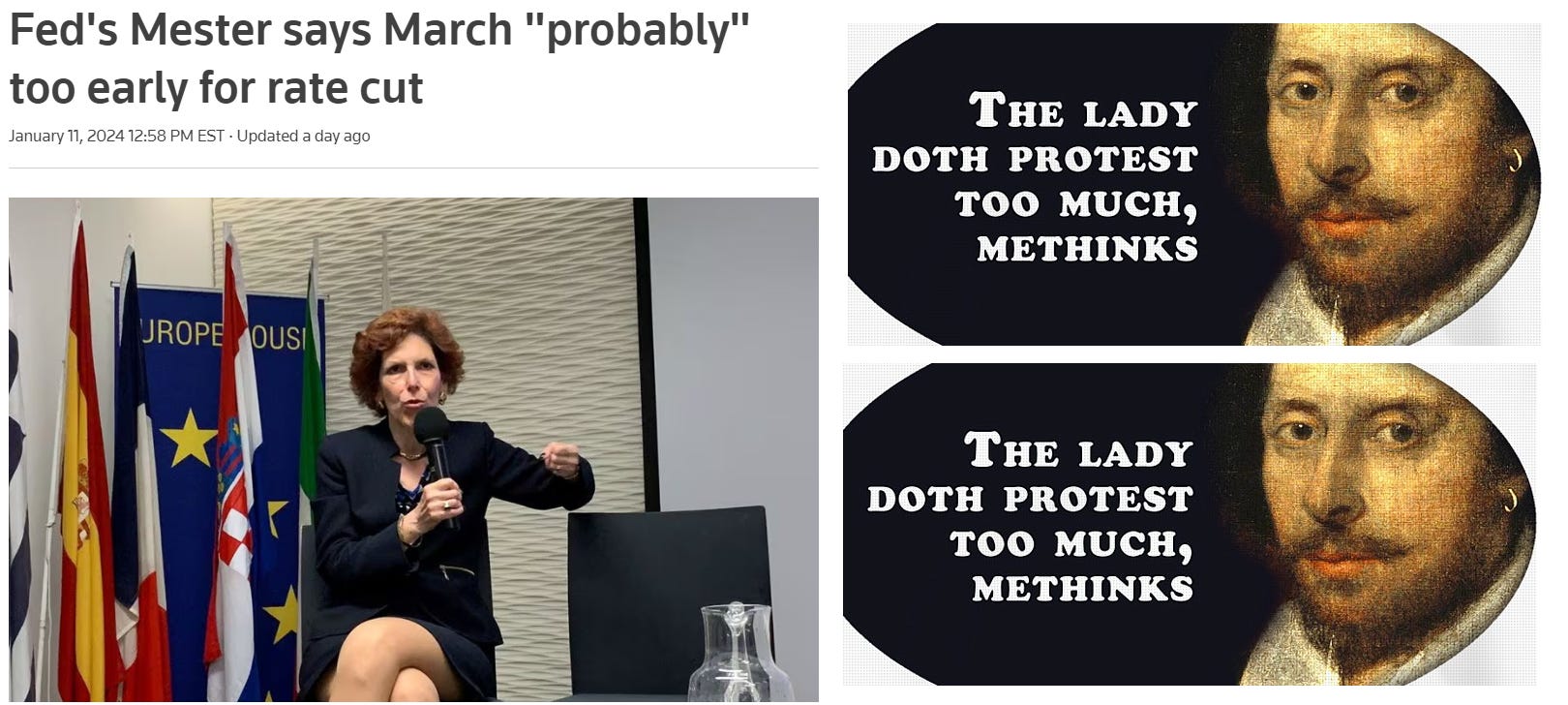

This thing shows %probability of a 25bp cut (so negative 100 means 100% chance of a 25bp cut is priced in). We almost got to 50/50 again on yesterday’s CPI but with weak PPI today and the market still thinking the bar to cut is low, we’re back to 80/20. The market wants a cut real bad and the Fed is getting pushed around a bit. Thing is, maybe they doth protest too much and they actually want to cut in March. But they can’t really admit it because their subconscious rationale is political?

It’s complicated!

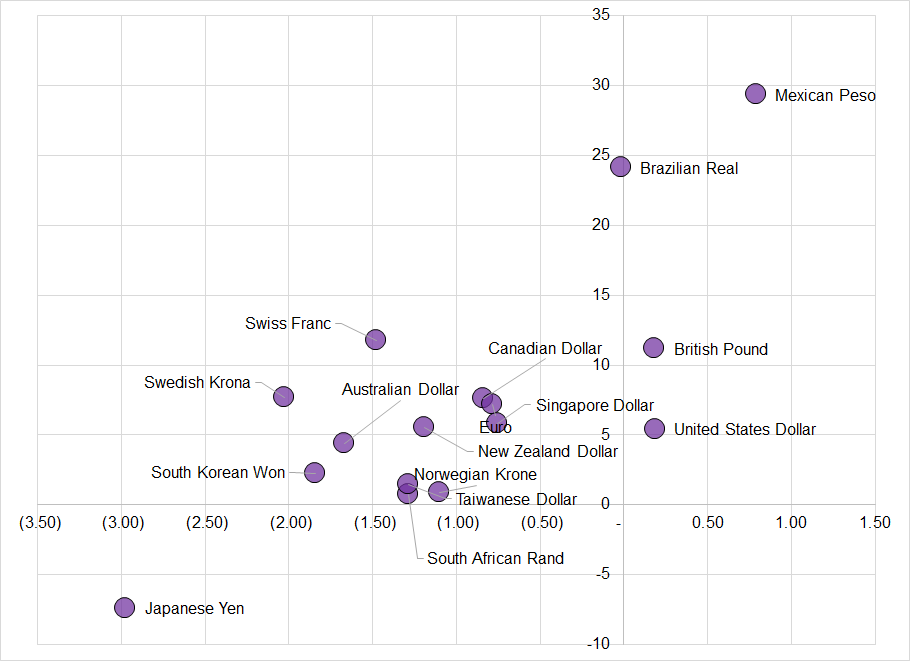

We continue to mimic 2023 as carry is in control, VIX is in the basement, and nobody in FX is having a ton of fun (yet).

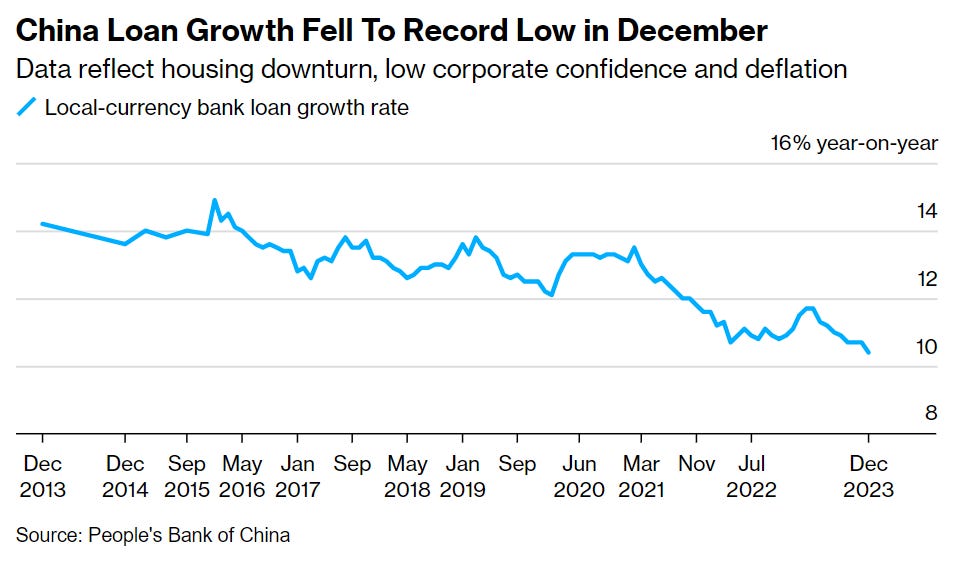

I am bearish AUD and SEK right now for various reasons, mostly because China is sucking wind (recent data confirms this, see here) and those currencies trade poorly whether the USD is weak or strong. There is a bunch of idiosyncratic reasons to be short those currencies, too. If you’re interested, I have been discussing those in am/FX for a few weeks—sign up here and grow your macro and FX knowledge exponentially.

AUDUSD has been nearly a perfect proxy for copper and it’s trading high relative to the Doctor right now. Furthermore, the 200-hour MAs have been good for trend and direction and we keep banging up against 0.6715/30 resistance.

Throw in a persistently weak Chinese economy and the flurry of Aussie economic data next week might take AUD back to 0.6550. Not investment advice. Trade your own view.

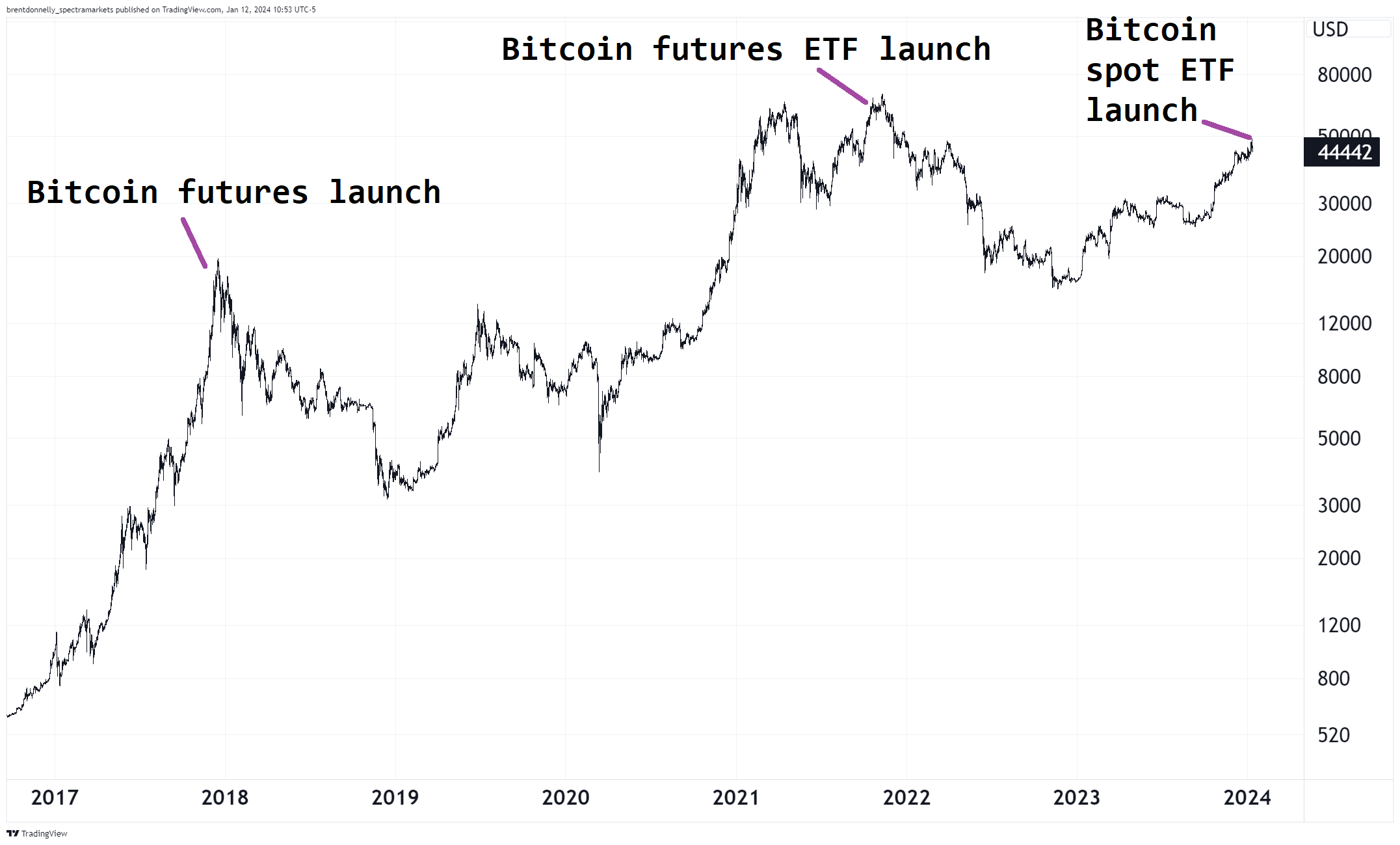

Buy the rumor sell the fact was the right framework so far. While bitcoin is getting smashed and anyone that bought spot ETFs at the open is badly underwater, the real carnage is in the listed equities. I suppose if you were hiding out in MSTR or MARA or RIOT because there is no spot ETF, you might have rotated out of those into IBIT.

The thing is, this is exactly what happened after the bitcoin futures launch and it’s exactly what happened after the bitcoin futures ETF launch. And the sad news for the opening day was that BITO (the 5-year old futures ETF) traded 10X the volume of BITI (the new and exciting, fully centralized, listed, custodied with Wall Street version of bitcoin) as the arbs and funders had some fun in the sandbox.

The thing is, bitcoin is still a grillion percent higher than where it was when Blackrock first announced its intentions.

I would say as long as BTC is above $40k, the bulls are in control, and below there it will get hairy AF super fast. It’s endlessly fascinating to watch the development of this gambling token / new Wall Street asset class for the elites to punt around / new monetary system of the future.

LARRY FINK (head of Blackrock):

I SEE CRYPTOCURRENCY AS AN ASSET CLASS, NOT A CURRENCY.

Satoshi is laughing so hard right now. Or crying. Probably crying.

I feel like every week I’m saying how commodities aren’t doing much. I am not in the weeds on commods, but I watch them closely and every time I look at NYMEX crude it’s 72 or 73. Every time I look at gold it’s 2041 or 2052.

I guess that’s why 1-month gold volatility looks like this:

That Sunday spike a few weeks ago where I thought gold would breach the stratosphere was another brick in the wall of boring low-vol rangebound action for XAU.

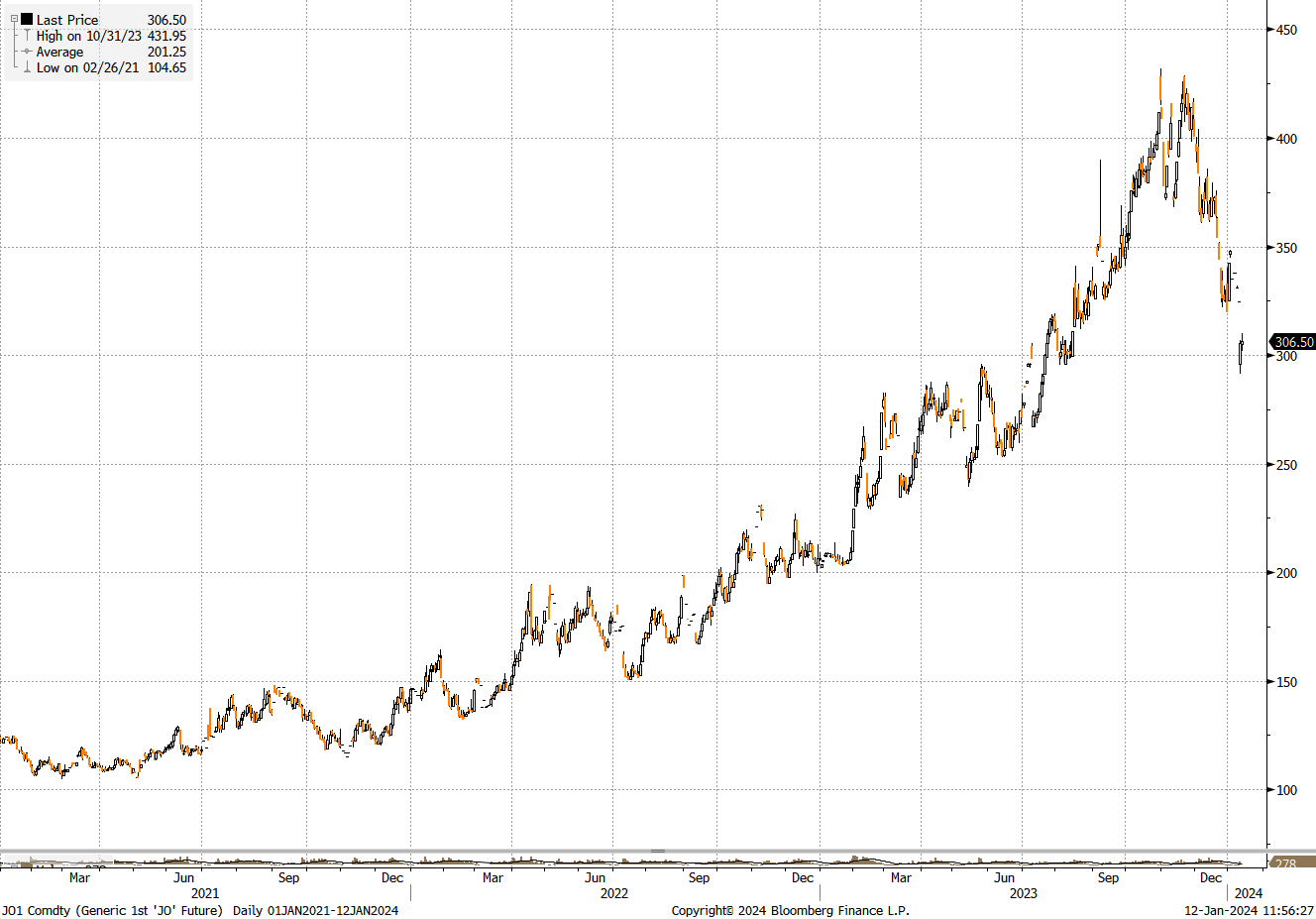

At least orange juice is exciting!

OK! That was 6 minutes. Please share this newsletter with any aspiring finance professionals that you know. Thanks!

This is the best thing I read this week.

https://www.permanentequity.com/content/2023-annual-letter

Ozzy says this is the best cover of War Pigs ever made. I agree! Must listen! His voice cracks in all the right spots, just like Postie and Kurt. HT the Aussie Jonas!

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it