The market leaned into rate cuts but having been burned so many times by rate cut bets that got slowly sucked out by strong data, we bounced.

Push and Pull

It was a week of crosscurrents and contradiction

The market leaned into rate cuts but having been burned so many times by rate cut bets that got slowly sucked out by strong data, we bounced.

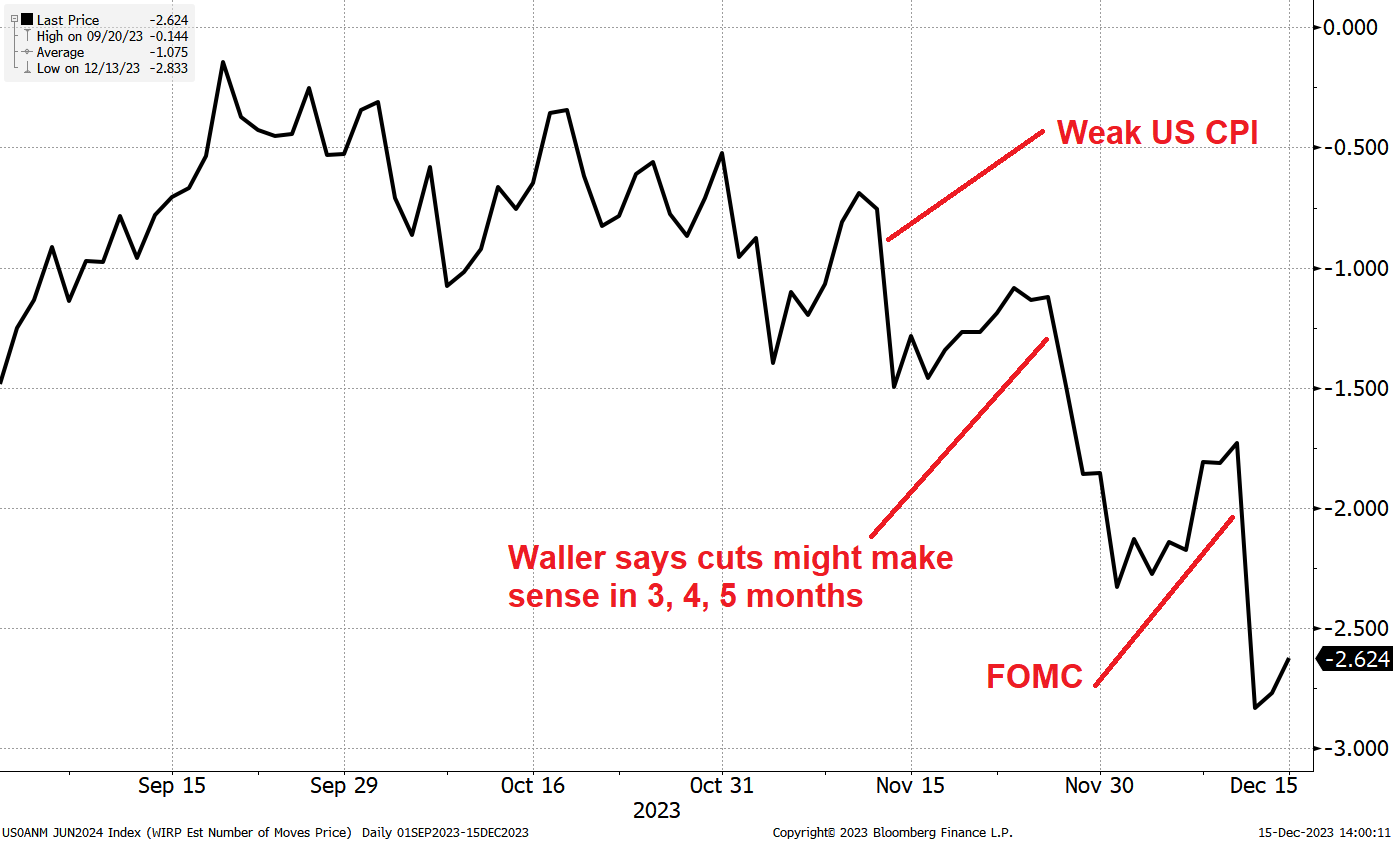

A few weeks ago, we talked in here about how Waller was signaling rate cuts in Q1 of 2024. The market leaned into it but having been burned so many times by rate cut bets that got slowly sucked out by strong data, we bounced.

You can see we reprice on a particular event and then grind tighter as people unwind bets or get bored. Then the next event hits and we do it again. The FOMC release was more dovish than almost any expectation as the Fed’s dot plot now reflects three cuts for 2024, compared to 1 or 2 expected by the market going in.

If you don’t know what the dot plot is, here’s a well-written explanation. The dot plot was supposed to be forward guidance on steroids and now just about everyone agrees that forward guidance is a bad policy that overpromised and underdelivered in 2021/2022, but yet the Fed just keeps on keeping on. Similar to the way traffic lights get put in… But they never get taken out. New taxes get added, and they never get removed. New service charges get tacked on by Hyatt…

The Fed adds new communication tools but never takes any out. So the communication just gets thicker and thicker. They need a complete rethink of their communication strategy at this point with so much micromanaging, noise, leaks to journalists etc. Human beings always think of improvement through addition—but very often the answer for more significant improvement is subtraction.

This abstract of a paper in Nature gets to the heart of the cognitive issue. I bolded some bits because you are so lazy sometimes you can’t even read a single large paragraph without nodding off or thinking about how fun last Thursday night was.

Abstract of “People systematically overlook subtractive changes”

Improving objects, ideas or situations—whether a designer seeks to advance technology, a writer seeks to strengthen an argument or a manager seeks to encourage desired behaviour—requires a mental search for possible changes. We investigated whether people are as likely to consider changes that subtract components from an object, idea or situation as they are to consider changes that add new components. People typically consider a limited number of promising ideas in order to manage the cognitive burden of searching through all possible ideas, but this can lead them to accept adequate solutions without considering potentially superior alternatives. Here we show that people systematically default to searching for additive transformations, and consequently overlook subtractive transformations. Across eight experiments, participants were less likely to identify advantageous subtractive changes when the task did not (versus did) cue them to consider subtraction, when they had only one opportunity (versus several) to recognize the shortcomings of an additive search strategy or when they were under a higher (versus lower) cognitive load. Defaulting to searches for additive changes may be one reason that people struggle to mitigate overburdened schedules, institutional red tape and damaging effects on the planet

Capitalism has programmed us to always think more … more … more … moar … Moar … MOAR … MOAR …………………………………… MOAR!

This pileup of comms on top of comms can sometimes lead to a comical level of contradiction and oversplaining and is a great example of the fact that more information does not mean better decisions. Instead of sending a clear message via a strong leader, you have as many as 10 or 15 Fed deputies parading around in a given week all flexing their personal worldviews and tossing around clever soundbites holus-bolus in an attempt to achieve enough celebrity that PIMCO or Blackrock will pick them for a treasured speaking role post-retirement.

Today, for example, Williams was on CNBC contradicting the boss who had spoken 36 hours earlier. Possibly on direct orders from the boss!

Williams said:

We aren’t really talking about rate cuts right now. We’re very focused on the question in front of us, which is– as Chair Powell said — the question is: Have we gotten monetary policy to a sufficiently restrictive stance to ensure that inflation comes back down to 2%. That’s the question in front of us and that’s the question we’ve been thinking about for the past five months and that’s the question we will be thinking about for some time. That’s the topic of discussion for the committee….the discussion really at the FOMC right now is about ‘do we have monetary policy at the right place’ not speculating about what will happen in the next year’.

… This is basically nonsense after Powell just had the opportunity to push back less than 36 hours ago and did not push back.

Williams says the “FOMC is not speculating about what will happen in the next year” but that is exactly what the dots do. They speculate about what will happen next year. And the market reacts to that speculation. So I believe Williams is a fade and the data is all that matters. The reaction function is clear and the bar for further hikes is Everest high and the bar to cut is floorboard low.

Scheduling a deputy to go on CNBC 36 hours after an official meeting is too much. Cacophonous micromanagement. I would ignore Williams and focus on the data and the reaction function.

Anyway, here is a chart of what bond yields did this week.

When permabears see bonds rallying they shout: “WhAt dOeS tHe FEd kNoW!??!” But there is enough empirical evidence to know that the Fed’s ability to forecast the economy is almost identical to the private sector. Bank forecasters and Fed forecasters and private consultants all predict roughly the same thing in aggregate and make the same mistakes, in aggregate. The Fed knows what everyone else knows. Inflation is falling and real rates are high. If inflation goes lower, they can cut rates and maintain real rates well above zero. There is no economic calamity implied here, in fact, this is how a soft landing works.

It’s fun because permabears are claiming that the fall in yields is bad news because it “guarantees recession is on the way” or “the bond market knows something” or something. Whereas when bond yields were going up, they claimed it was bad news because it “guarantees recession is on the way.”

Here’s a secret from a former market maker at a bunch of big banks: Stock, bond, and currency traders all talk to each other. Some of them even sit on the same trading floor.

Bond traders don’t sit in a secret office with two Navy Seals guarding the front door and special iris-scanning technology that prevents equity and currency traders from entering. Bond markets don’t have any secret information! Dammit. Cmon.

Neither does the Fed.

Note for pedants: There could be a few exceptions to this with the Fed at times of extreme stress. Like on September 14, 2008, they knew more than the public, of course. But don’t pick a hyper rare exception to imply there is a rule. 99.999% of the time the Fed and everyone else have the same info.

My view last week was that things are overcooked and that was wrong. They were cooked just the right amount and continue to sizzle. The Fed Pivot that started with Waller and has continued despite Williams protesting too much and we are near or through the ATH in many indexes. The bad breadth became, quite suddenly, amazing breadth.

It’s hard not to hear “bad breath” when commentators speak of bad breadth, much like when people talk about sharding in crypto.

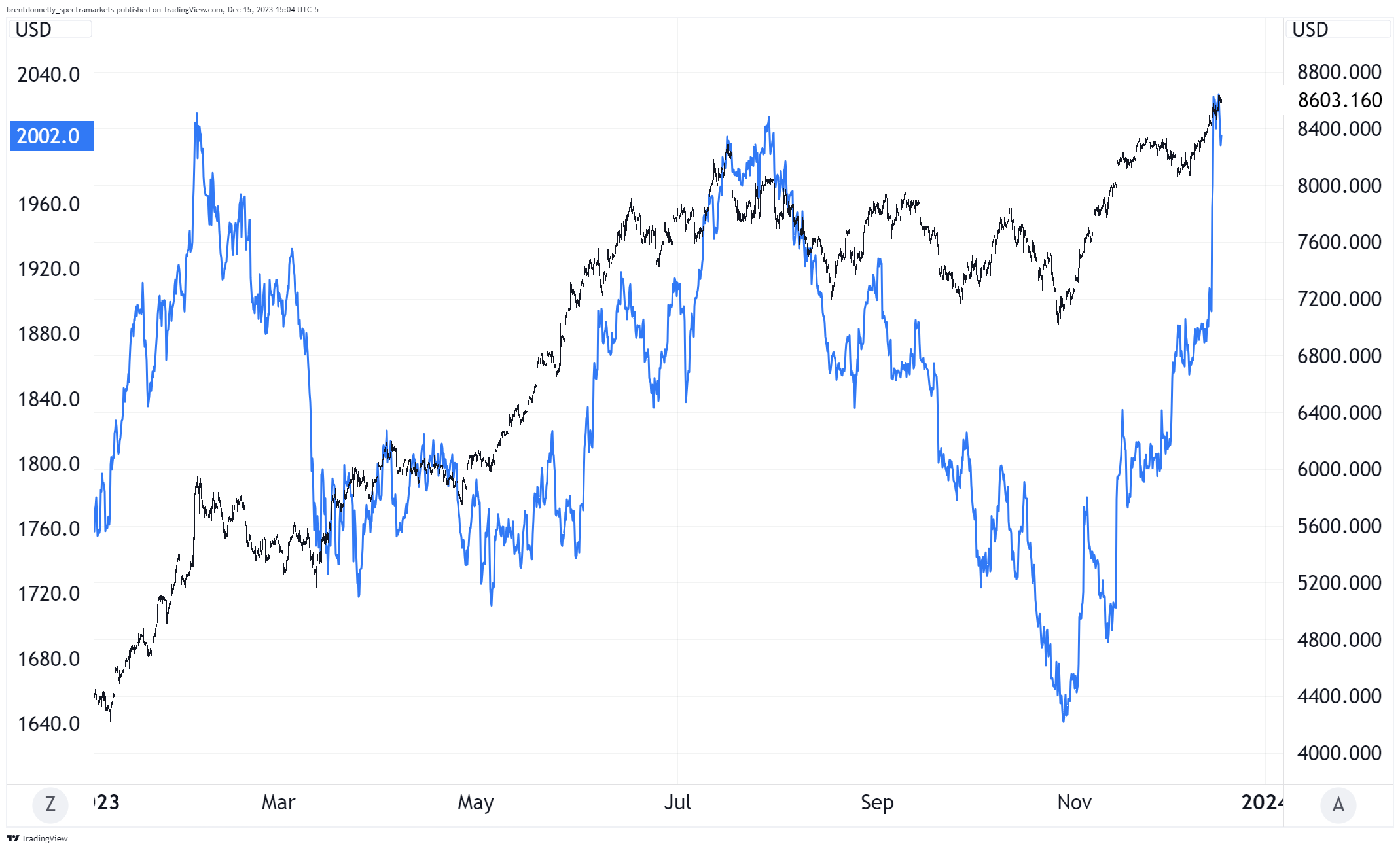

The bears were saying that bad breadth would lead to a drop in the Magnificent 7 but it turned out the 493 rallied and the MAG7 did nothing. Another way of looking at megatech vs. everything else is to simply compare FANG to the Russell 2000. Here’s how it looked in mid-October.

So bears were saying that the divergence shows that the underlying health of the market is bad. This is an argument that I have oft seen used, and that rarely makes money. If there is a sector that is too expensive or overowned or overvalued, you sell that sector or go underweight. You don’t get bearish the whole index. If you think megatech is too expensive and too big, get out of it or short it against equal weight indices. Don’t buy S&P puts.

Anyhoo. Then the Russell said hold my beer and traced out a classic Viagra formation.

Good stat from Bespoke:

The small-cap Russell 2,000 made a new 52-week high today after hitting a 52-week low just 48 days ago. That’s the shortest turnaround time in the index’s history to go from 52-week low to 52-week high dating back to the 1970s!

Whipsaw.

Here is this week’s 14-word stock market summary:

Bears eviscerated again. The wall of worry, climbed. ATH FTW.

Yields went down as Powell opened the door to cuts and Williams said “Close the fking door” on CNBC and Powell said: “Dude, that’s my line.”

The market is now just waiting for a couple more inflation prints to confirm the immaculate disinflation but the soft landers are firmly in control. The path of least resistance is a continuation of current disinflation trends and a few cheeky FOMC rate cuts. The Fed will take great glory in being right this time after being so wrong on policy in 2021 and the victory laps will bring tears to your eyes. Tears of pain.

I went to a dinner this week with a bunch of smart and mostly rational financial types and one thing that came up a bunch was that maybe the Fed Pivot leads to a return of inflation and becomes self-defeating. That is, by loosening financial conditions when inflation is still above target, the Fed has stopped taking the 10-day penicillin prescription on Day 7 because they are feeling better and the medicine tastes bad. I think it’s a theory worth considering but I disagree with it because:

The other view that came up a fair bit at the dinner table was a useful way to look at the bigger picture: In the end, the Fed and the Treasury must work together to avoid a disorderly US Treasury selloff at all costs. That’s why it will never happen. The Fed and the Treasury working together have infinite power to control the market and if they believe that markets are public utilities, they will use that power. And they do. And they will.

It’s not just that they can change the issuance mix (which they did). 2008/2009 showed us they can use a combination of direct intervention and rule changes to maintain order. US bonds selling off too much? How about federal bond interest is now tax free? For example. How about nobody has to mark them to market? How about? How about?

Anyway, it’s true that a disorderly rise in US yields would be apocalyptic for the financial system—that’s why it can’t and won’t happen under the current administration.

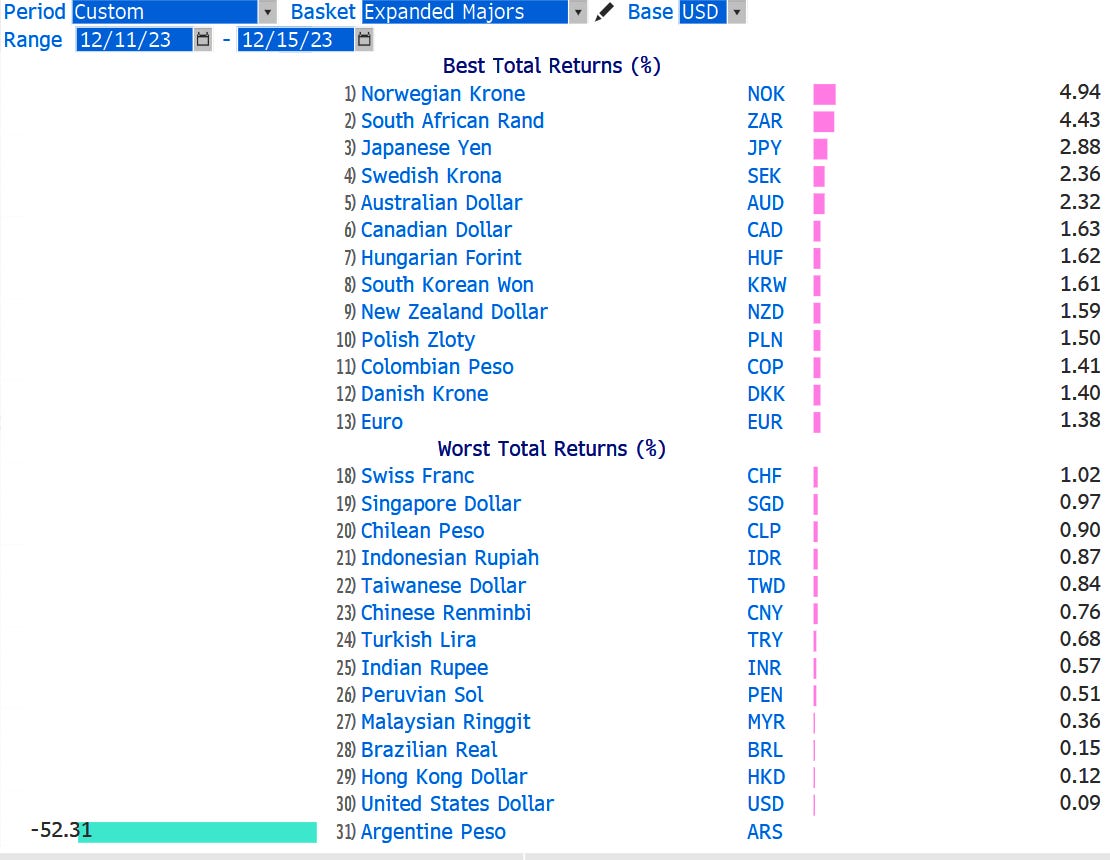

The dollar is weak, as you might expect given the news on yields and the Fed. The dollar weakness is across the board, though euro is struggling as the data there is still weak and NOK is ripping on an unexpected rate hike from the Norgest Bank.

There’s a feature on Bloomberg called WCRS and you use it to see which currencies performed best and worst over a chosen period. I fired it up to see the ranks this week but Argentina blew up the x-axis lol.

But you can see the rankings. Cyclical currencies dominated, with JPY also strong due to its strong link to global yields (yields down, JPY up). LATAM and Asia EM lagged.

It was either a consolidation week or a major top in crypto but we won’t know for a while. Game theory says that as the 05/10JAN window for ETF approval nears, the risk/reward of holding long crypto gets worse each day. There is a natural decay of EV because most in the market assume there will be a big selloff when the official announcements come. This is because it’s a setup known as buy the rumor / sell the fact where price climbs so much in anticipation of an event that when the event happens, the price reverses lower on profit taking.

Whether or not it’s buy the rumor sell the fact, everybody knows that everybody knows the date of the approval and so it makes no sense for a rational player of the game to stay max long into that date. Instead, each day closer to the date should bring in new sellers who will simply think “I’ll buy back on the selloff after the announcement.” We’re not yet at the point where many have done this but it will get exponentially more attractive to do so as we approach the end of December.

Oddly enough, this “I know that everybody knows that everybody knows” is completely different from the textbook buy the rumor sell the fact setups in crypto in 2021 when a good majority of crypto traders didn’t even know this concept and were naively buying on news that had been priced in weeks before.

It will be interesting to see if this slow decay / liquidation accelerates in bitcoin as January 05/10 nears.

Oil found a base again and looks more and more like it’s just going nowhere and is in equilibrium $60/$85. Falling oil has of course been cherry-picked by bearish commentators who have it as their latest reason to be bearish about the world.

The surface area of markets and economic data you can choose to look over is huge. If you have really bad confirmation bias, you can always find a bearish argument. Even as every workhorse economic data series that we have relied on for decades shows a healthy and rebalancing US economy (Retail Sales, payroll growth, Initial Claims, CPI, Core PCE, GDP, etc.) there will always be something somewhere showing the end of the world is nigh. Right now it’s crude.

Tomorrow it’ll be credit card spending or excess savings. Or cardboard box prices. Or whatever. It’s hard to get a clear view of the economy at the best of times. Wild volatility and sticky priors make it harder.

For the record, cardboard prices are showing a bullish outlook, according to the WSJ. But you get my point.

OK! That was 8.2 minutes. A bit longer than usual this week; I hope you don’t mind. Please share this newsletter with any aspiring finance professionals that you know! Thanks!

A good piece on the current state of AI and its future.

https://twitter.com/crowded_mkt_rpt/status/1735148577482068358?s=51&t=Z-boW5UHRWKGTmYteOnSkA

It’s good to have a base case and assign a probability to that base case. Then, understand the other realistic possibilities. Finally, what are some outrageous outcomes that are not impossible? While these low-odds possibilities might not be worth preparing for comprehensively, the knowledge of their existence could allow you to see them coming, or be useful in protecting you from ruin.

https://www.home.saxo/insights/news-and-research/thought-leadership/outrageous-predictions

I enjoy many genres of music. But one of my favorites is the merger of heavy metal and rap like we saw in the late 80s and early 90s. Run DMC/Aerosmith in 1986, then Anthrax and Public Enemy in 1987 and this absolute gem from 1994. This is Helmet and House of Pain (lead singer: Everlast, who made one glorious solo album after).

Raw live in Japan version here (this is awesome but a lot different from the studio version which is the next link).

That song is from the soundtrack from Judgment Night, and pretty much every song on that soundtrack is a hard rock / rap face melter. Here’s another choice track:

And finally, in that same genre… Contains bad words.

Mind-blowing stuff in here.

https://www.epsilontheory.com/ama-bitfd/

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it