Things are moving, but they’re not really moving.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Things are moving, but they’re not really moving.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

We eagerly await the results of the Bessent/China meetings this weekend in Geneva. Some sort of China tariff cut as a goodwill gesture has been floated in various media outlets and this morning Donald Trump tweeted

“80% Tariff on China seems right! Up to Scott B.”

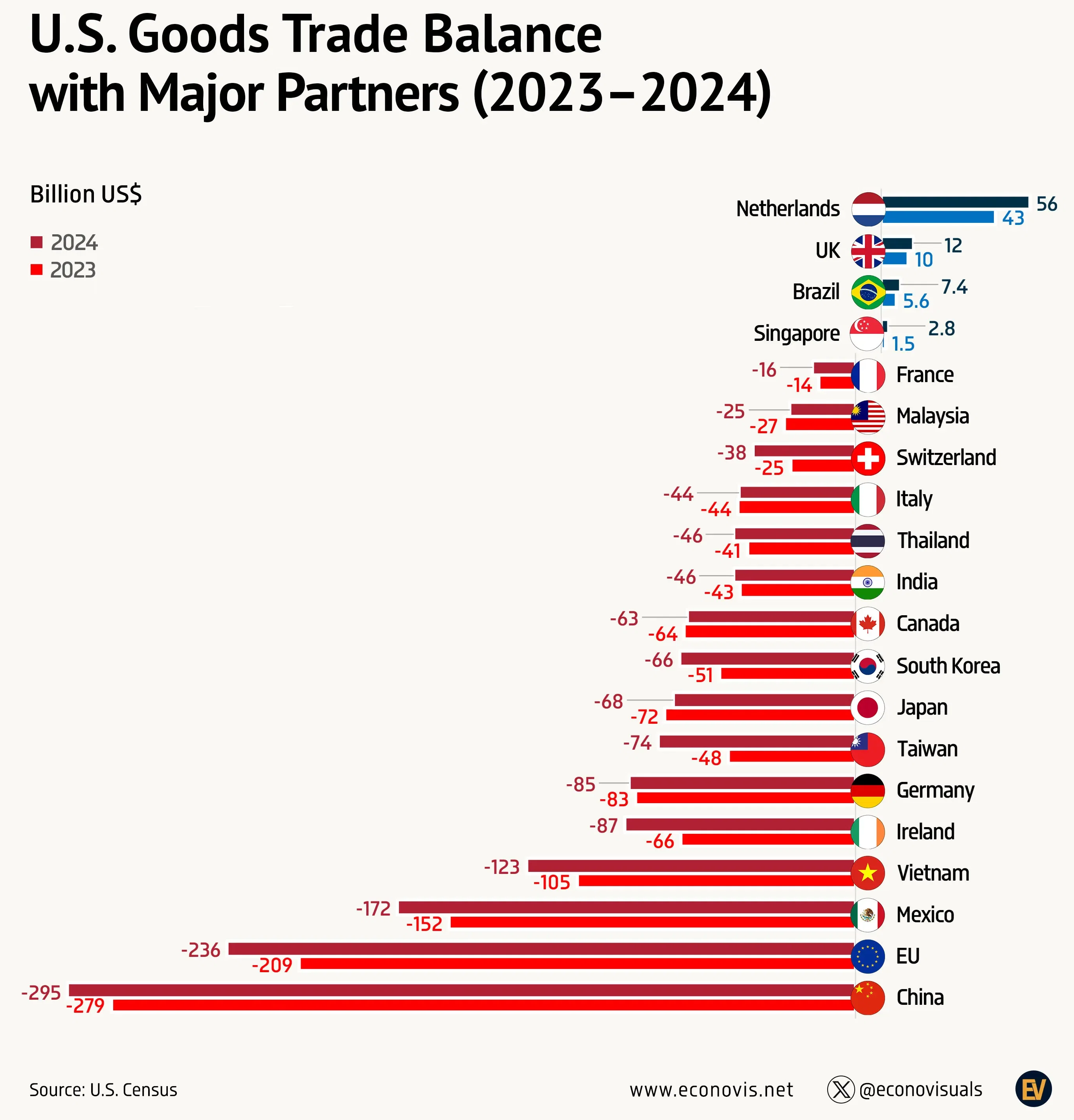

Hard to see why any of this matters, other than the obvious headline risk, as these deals are all leading to the same endgame. 10% global tariff, huge tariffs on China that fall short of an embargo (with plenty of outs possible if they drop Vietnam to zero, as they probably will), and some sector-specific tariffs. All these meetings and announcements feel more like noise than useful signal. The UK looked particularly keen to roll over yesterday as the amounts of money being discussed are tiny and the UK runs a trade deficit with the USA anyway, so it’s pure theatre. Maybe a deal with Brazil, next?

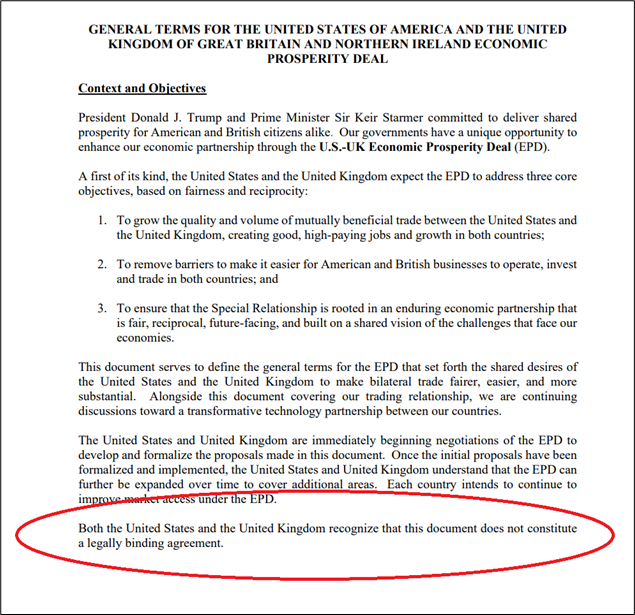

It’s easy to be glib about all this, but part of the challenge here is to separate the signal from the noise and in this case, I would argue peak glibness is warranted as the UK/US trade agreement is entirely without substance. To whit:

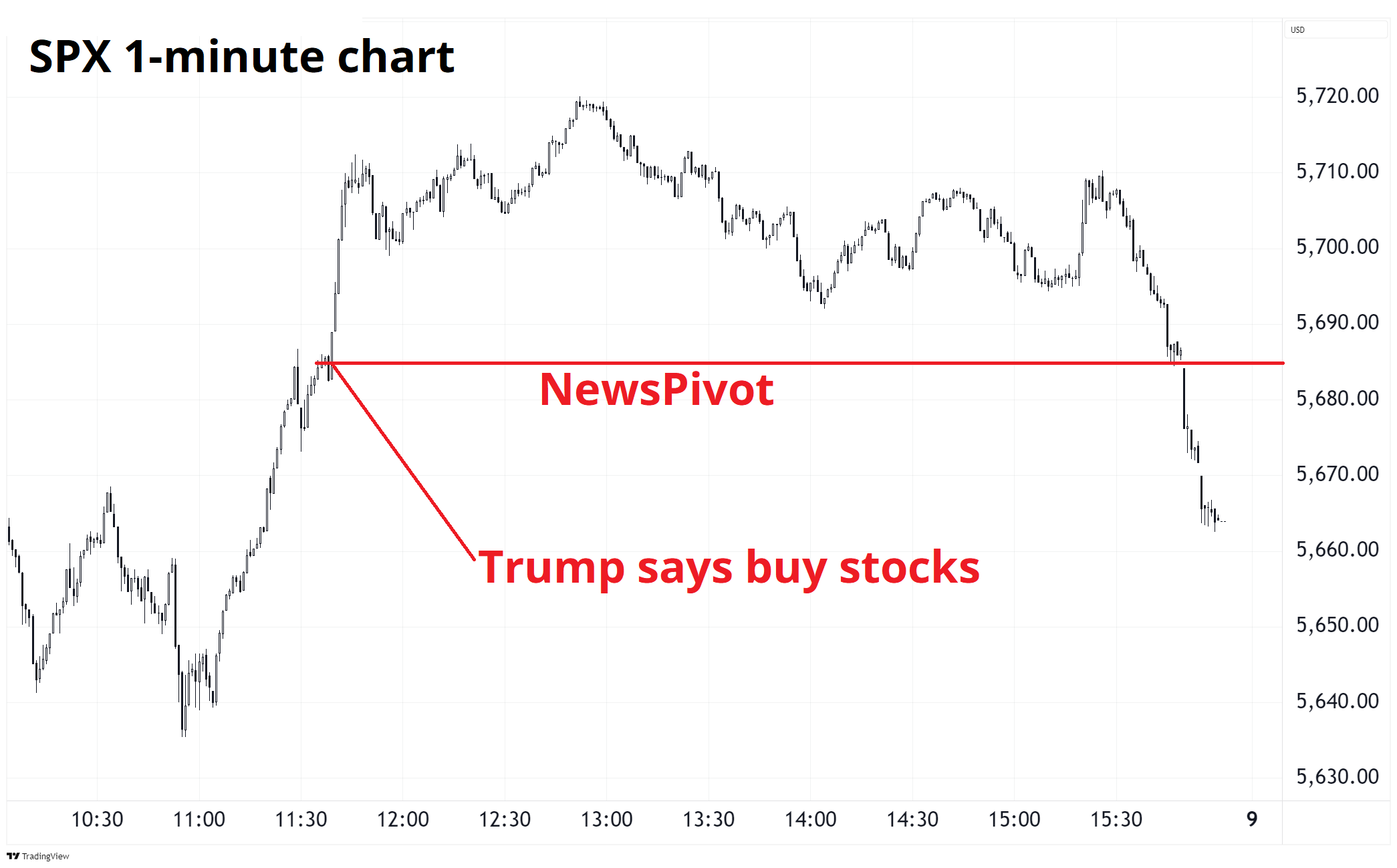

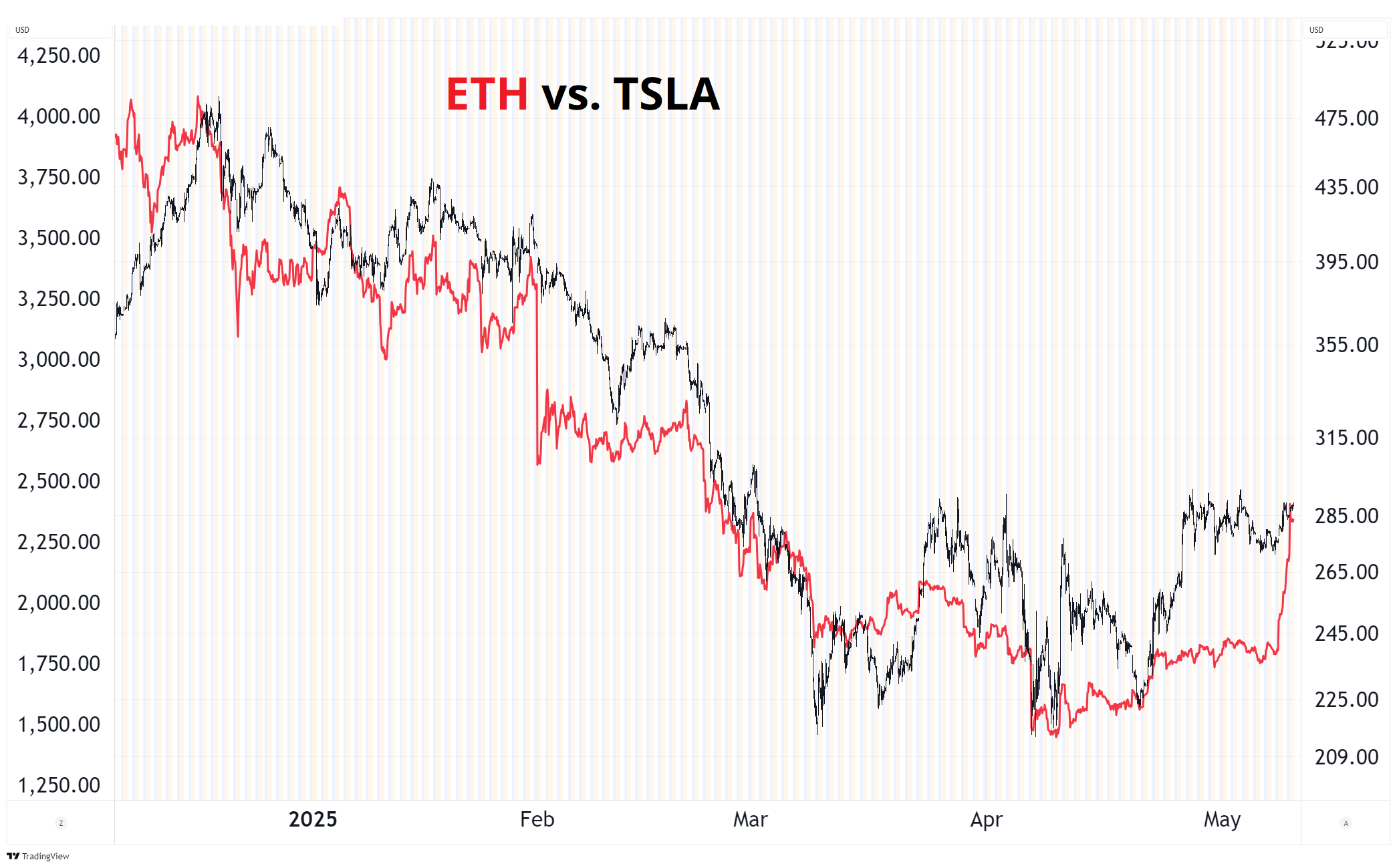

And while on the topic of signal vs. noise… We are now in a world where the President and his administration tweet buy recommendations for various securities and indexes (ETH, TSLA, SPX) and as traders we have to decide what to do. He obviously has inside information, and so it’s nuts to ignore the tweets. Then again, how do you risk manage a trade that is so brazenly idiotic?

These pumps are only relevant to day traders, and the right strategy is to get in and out quickly, because otherwise you can sit there waiting for the news that might never come. Yesterday, it was obvious the market thought the Trump tweet (BUY STOCKS!) was a harbinger of news that would land before the market close, but it wasn’t. As such, as the close neared, and post-Tweet longs went underwater on the break of 5685, there was a micro capitulation. You can see the selloff accelerated as the longs went into the red.

The strategy of following the government with a stop at breakeven, hoping for an insta-rip is correct and is a good way to trade headlines. Use the bullish announcement level as the NewsPivot and get out if we revert back below. Please see Alpha Trader for a discussion of how to use NewsPivots more generally. Yes, Trump’s April 10 tweet generated a 10% gain. But he pumped ETH at 2200, and it went straight to 1400. When Lutnick recommended buying TSLA, it ramped 20% in a straight line. But when Trump pumped ORCL and Stargate, ORCL collapsed soon after. These trades should work instantly and never go out of the money.

I will leave the myriad ethical and conflict interest issues aside because that ship sailed the night $TRUMPCOIN launched. There is no government oversight of government-led pump and dump schemes, by definition! So, I am going to concentrate on how to make money and/or avoid getting my head ripped off by these shenanigans. As repugnant as this all feels, if you are a day trader there is money to be made by simply going with the pumps and using an incredibly tight stop. I would rather try to make money on this stuff than get angry about it.

Chaotic neutral, as they say.

The Fed came and went. Nobody has a clue what the economy is going to look like in Q3, so everyone is in wait and see mode.

The coupon code SPEEDRUN gets you $150 off a one-year subscription to am/FX. So instead of $690, you pay $540.

https://www.spectramarkets.com/subscribe/

Holding pattern in stocks. They tried the downside early in the week and tried the topside on the Trump tweet yesterday and ended up basically flat. Kind of like April. Hmm.

It’s hard to know what the narrative looks like from here because these “trade deals” are not really deals, China tariffs might get smaller but will remain huge, and the economic data is meaningless until at least the May jobs report on June 6. Then, the FOMC on June 18 could be interesting but man, it’s only May 9th right now! What are we going to do until then? Trade the range and the government asset pumps, I guess!

This week’s 14-word stock market summary:

The liminal space between Liberation Day and the subsequent economic reveal is kinda boring.

There has not been much focus on the bond market of late because it’s not moving much and there are two competing themes that keep jockeying for position.

![]()

I have no real view on yields. I think the Fed needs to wait as long as possible before cutting because US government policy is changing every single day and unorthodox policy impacts are hard to measure, even when the policy is well understood. Which it’s not. So the Fed will be late, on purpose, by definition, then cut like crazy if a recession hits. They could be cutting in clips of 50 and 75bps by the end of the year.

It’s binary now. Zero cuts or yuge cuts.

More pain for dollar bears this week as the USD grinds higher. A lack of catalysts and a crowded USD short has left USD bears scrambling and positioning has gone from 9 out of 10 short dollars to maybe… 2?

The one encouraging thing for USD bears is that the two big levels held (so far). Market Profile said buy EURUSD 1.1190/1.1240.

And the old resistance (now support) said buy EURUSD at 1.1200.

The low overnight was 1.1196.

And in cable, you had a similar look on a tighter time scale. The top before Liberation Day was 1.3200 and that should now be support. It was. We went to 1.3208 last night.

The best technical indicator is the horizontal line. Here’s why.

Manic explosion in ETH this week. BB described Ethereum as Semi-undead, and I dig it. That’s not a bad description!

Vitalik’s coin usually trades almost tick-for-tick with TSLA stock (both have a memecoin-adjacent investor base) but ETH lost its way in recent months. Now, it’s right back where it should be!

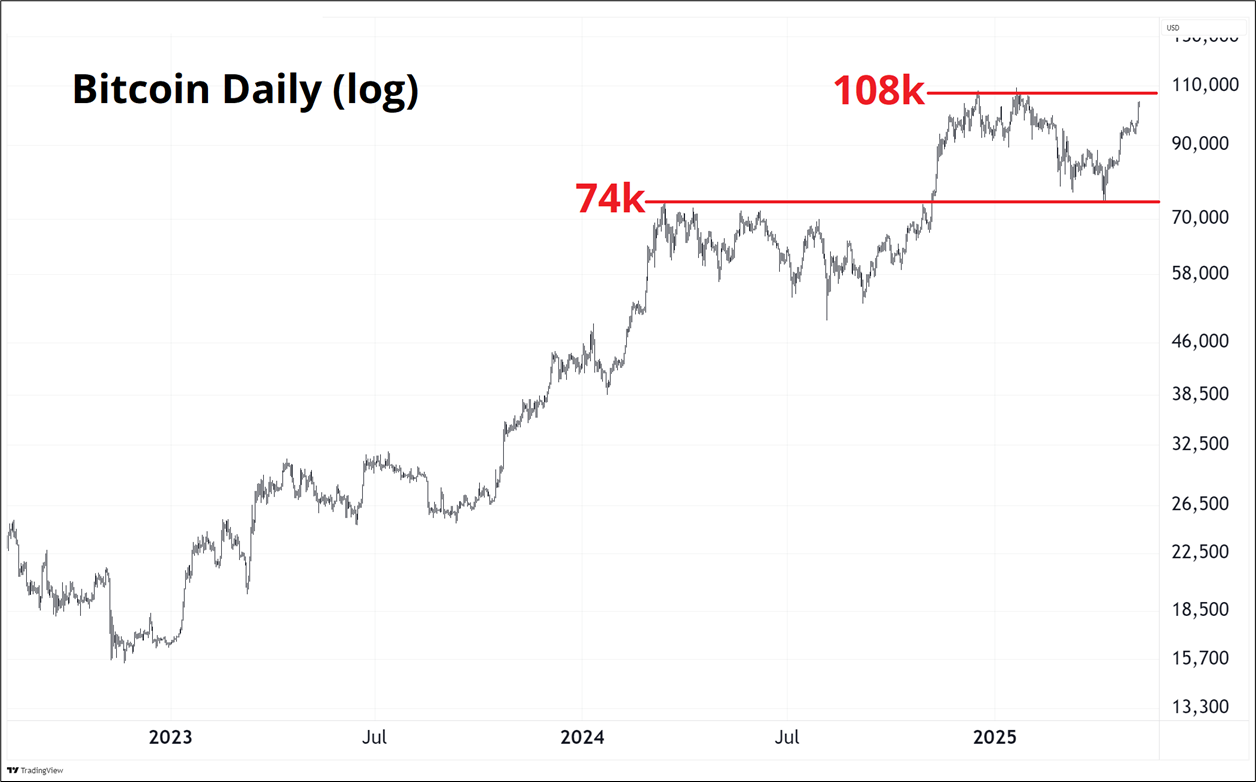

Rather spicy explosion in the ETH and BTC not too shabby either. BTC is just 4.7% shy of the all-time high while NASDAQ has 10% to recover. Bitcoin has been immune to the positioning-led correction in gold, so maybe all that corporate treasury BTC buying continues to underpin price. If BTC fails up here, it’s a 74k/108k range—if we take out 110k the next stop is $1 million?? I’m kidding.

Or am I. I don’t actually know if I’m kidding.

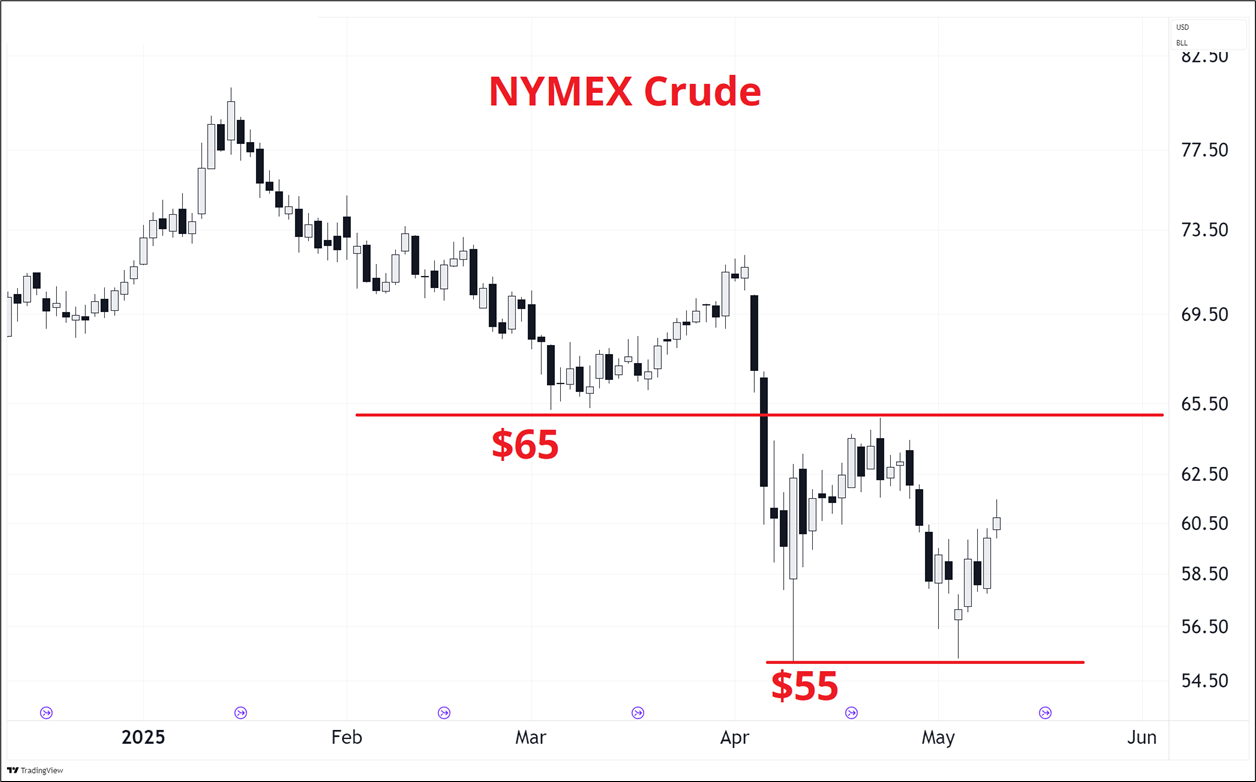

Last week I said I am bullish crude oil, as long as we stay above $54. Then, on the weekend, you had some bearish OPEC news (again) and oil gapped lower, held $54 and then rallied 15%. Sweet crude! I am not bullish anymore. That was just a short-term sentiment and technical setup that I liked. Now, I would rather respect Saudi wishes and wait to see if they keep their boot on oil’s neck.

Selling call spreads in oil is probably the play now. I think we are in a $55/$65 range.

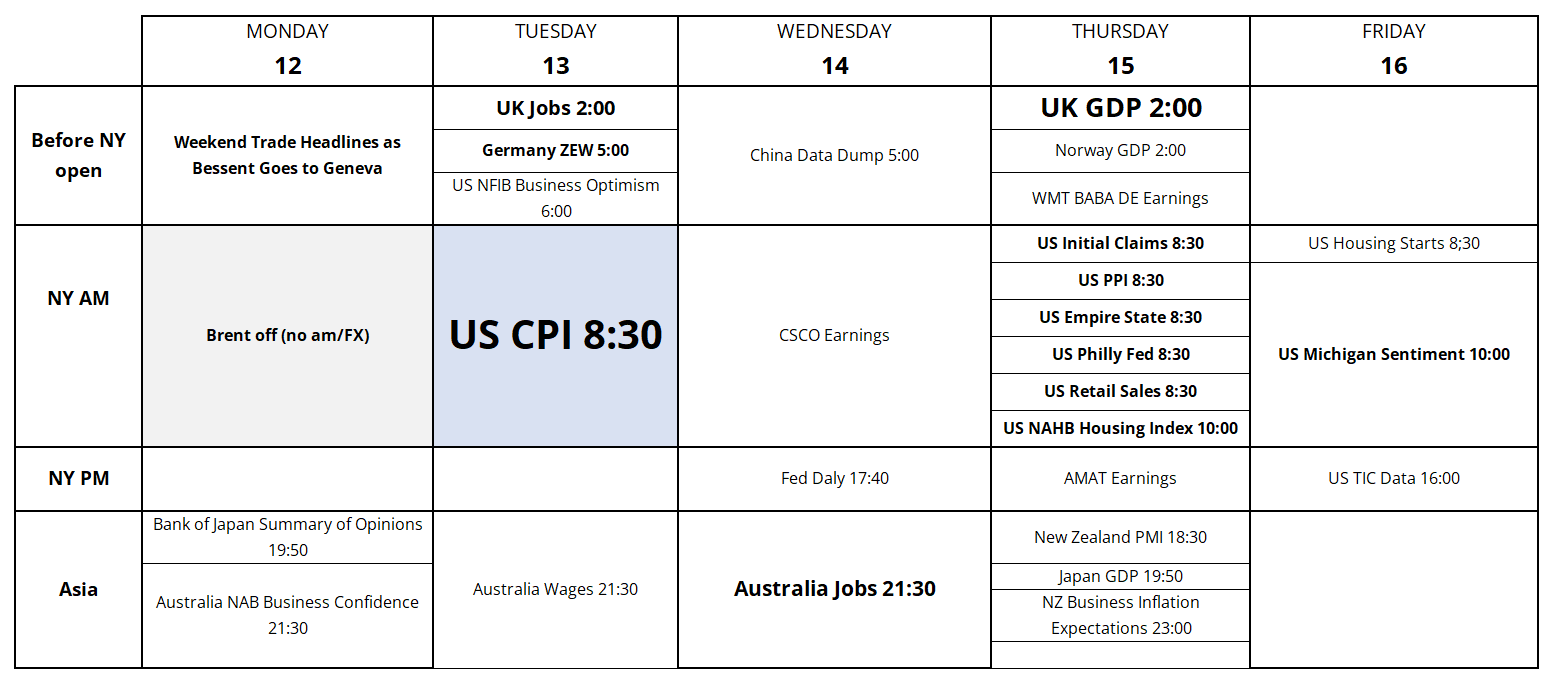

Here’s next week’s calendar

That’s it for this week.

Get rich or have fun trying.

This is a list of Unparalleled Misalignments, pairs of non-synonymous phrases where the words in one phrase are each synonyms of the words in the other.

For example:

Fish market // Poisson distribution

Dark horse // nightmare

Underdog // subwoofer

Manhole cover // buttplug

Female // Iron Man

https://rickiheicklen.com/unparalleled-misalignments.html

*************

Wholesome meme

*************

*************

*************

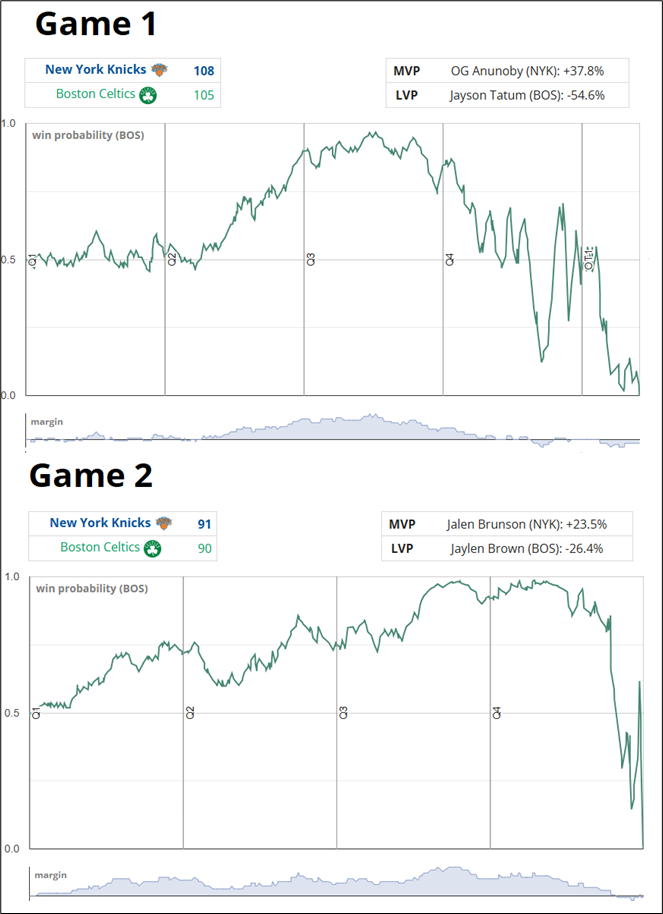

Boston Celtics win probability over the course of each game…

From inpredictable dotcom

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.