1999

2004

There is nothing new under the sun

Current Views

No tactical / s-t trades.

Medium-term

03FEB25 USDCNH

Put Fly 6.98/6.88/6.78

1X2X1 for 15bps (7.0565 s/r)

Welcome to Rabbit Hole #14. The Rabbit Hole series offers deep dives into random macro topics that fascinate me. Today: Time Magazine. Some publications are reverse indicators, and some are not. Time Person of the Year has a small sample, but a strong contrarian history.

8-minute read –feel free to forward this piece

Time

Time Magazine, like the Economist, is apt to place well-known market themes on its cover. The Economist does this more often than Time, and thus we can study their dramatic contrarian output using a huge sample and large out-of-sample performance. Time’s Person of the Year Issue is not as rich of a trove, but we can at least take a look. If you are not familiar with the Magazine Cover Indicator, please see this article; note that the concept has worked out of sample now for nine years.

https://www.spectramarkets.com/amfx/the-magazine-cover-indicator/

The effect does not work with Barron’s because that publication is market-focused and thus tends to be a coincident, not contrarian indicator (see full article and backtest of Barron’s here). Barron’s writes about what’s going on right now and a theme doesn’t have to be super obvious to appear on its cover. In contrast, a theme MUST be super obvious before it turns up on the cover of The Economist or Time.

In case you missed it, the 2025 Person of the Year is/are: The architects of AI. Left to right:

- Mark Zuckerberg (CEO of Meta)

- Lisa Su (CEO of AMD)

- Elon Musk (Founder of xAI)

- Jensen Huang (CEO of Nvidia)

- Sam Altman (CEO of OpenAI)

- Demis Hassabis (CEO of DeepMind)

- Dario Amodei (CEO of Anthropic)

- Fei-Fei Li (Stanford AI Institute)

The somewhat logical reaction from the crowd is to sell all these companies. Let’s take a walk down Memory Lane drive down history’s highway and see what happened before. The sample size is not huge, but it’s informative enough.

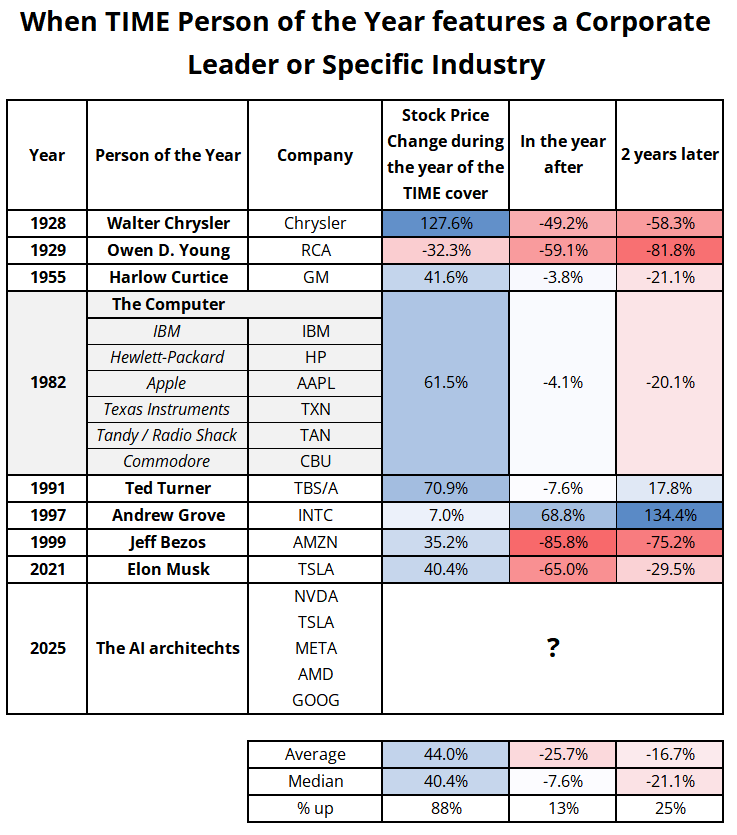

I searched all the Time Magazine Person of the Year covers for any corporate head, CEO, or industry as the winner. There are nine that fit the bill. In the interest of time, let’s cut right to it. Here are the covers and the stock performance into and after the cover came out.

The results mostly speak for themselves but let me make a few comments on particular years.

1929: The Person of the Year was Owen Young, the Head of RCA. This one is pretty amazing especially if you’ve read 1929 by Andrew Ross Sorkin. RCA was at the center of the tech bubble that led to the Crash of 1929. It had already dumped by the end of 1929 but continued its collapse from there. Its founder and Chairman was Person of the Year. Awesome. Automobiles were another transformative technology in the 1920s bubble. That’s why 1928’s choice of Chrysler was also remarkably ill-timed. Interesting that Time chose 1929 imagery this year with the Empire State Building image.

1982: The Person of the Year was “The Computer”. The six largest computer companies are listed in my sheet above, and you can see their performance after the release of the magazine wasn’t great, but it wasn’t horrible. The home computer centric stocks (Apple, Tandy, and Commodore) performed horribly, while the more business-oriented names (IBM, HP, TXN) did okay. I took the average return of the six names to get the performance for 1982.

1997: The Person of the Year was Andrew Grove, CEO of Intel. This is the only situation where the stock was higher one year later. Intel roared right into the dotcom bubble peak in 2000.

1999 and 2021: Both these covers were the exact top of huge spec bubbles. Both were put to rest by Fed hikes. If Fed pricing ever flips to hikes priced in 2026, you know what to do.

The MANTA basket is the one to watch in 2026:

- Meta

- AMD

- Nvidia

- Tesla

- Alphabet

Will these Architects of AI see their stock prices jinxed in 2026, just like RCA, Chrysler, Radio Shack, Commodore, Amazon, Tesla, and many others? I will track it and revisit the story mid- and late 2026.

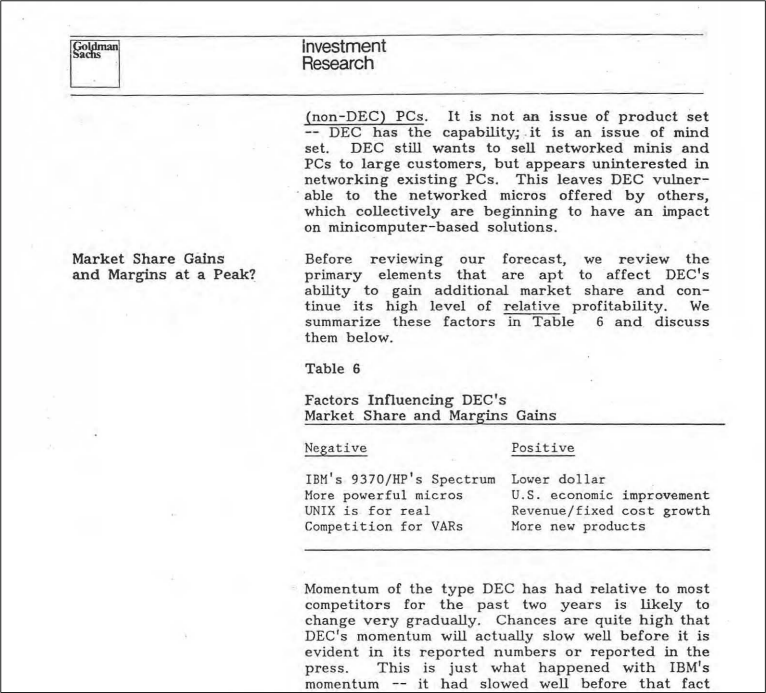

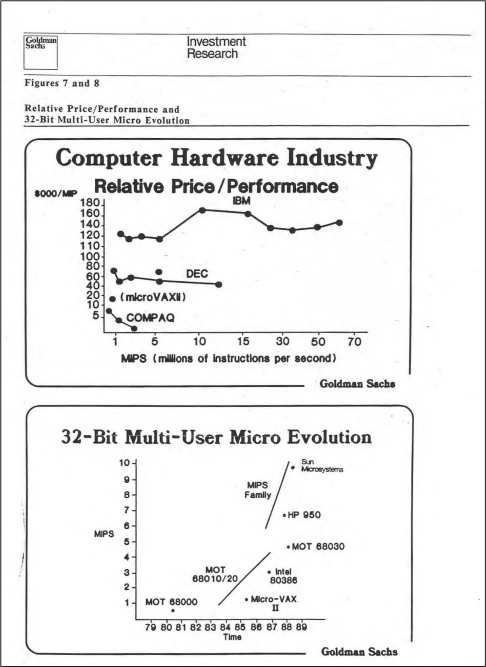

While researching today’s piece, I stumbled upon a 1987 GS Research note. Their formatting has held up well for 40 years or so! Their reports look sleeker today, but similar.

See it here: https://archive.computerhistory.org/resources/access/text/2023/06/102791369-05-01-acc.pdf

Chart design and layout has improved a lot since 1987, however!

Final Thoughts

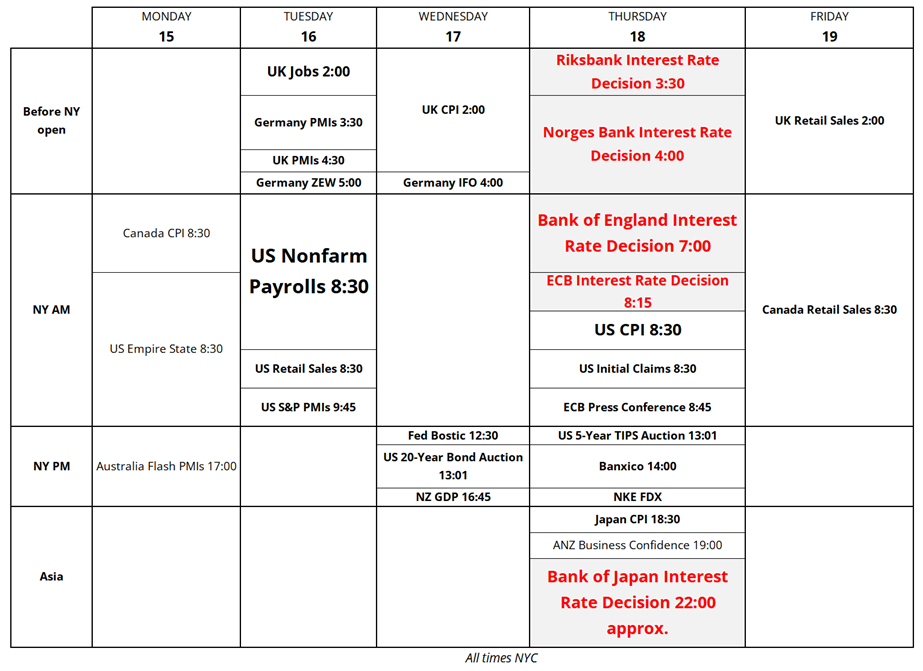

- Next week’s calendar is absolutely JAMMED. See below.

- An ounce of silver is worth more than a barrel of oil. First time ever. Wild.

- Have yourself a Merry little weekend.

Next week’s trading calendar

1999

2004

There is nothing new under the sun