Stocks got rinsed and could do OK for a week or two now. Then back down.

January is named after the Roman god Janus.

He is the god of beginnings, gates, transitions, time, duality, doorways, passages, frames, and endings.

Appropriate!

Stocks got rinsed and could do OK for a week or two now. Then back down.

January is named after the Roman god Janus.

He is the god of beginnings, gates, transitions, time, duality, doorways, passages, frames, and endings.

Appropriate!

Flat

The cleansing in equities could be complete in the short term as the very start of the new year tends to be bullish for stocks. The first 10 days of January show solid bullish seasonality with the first few days of the year particularly strong. Then, stocks languish into March. Overall, I am worried about stocks in Q1 given extreme positioning, extreme sentiment, rising yields, no Fed support, high valuations, bubbly crypto assets, and general craziness and froth. Any tiny negative catalyst will see a hard rain fall on stocks.

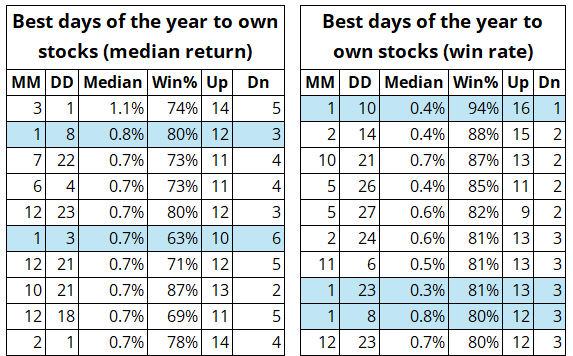

In case you’re curious, here are the best days of the year to own stocks. Days in January are marked in blue. This is NASDAQ data, but the SPX data is highly similar as you might imagine.

If you’re looking for beaten down stocks that might benefit from the turn-of-the-year effect as tax loss selling abates, WBA, INTC, MRNA, DLTR, HTZ, and SGML are possible candidates for a short-term rebound in the first two weeks of January. They are some of the worst-performing 2024 stocks (that you might have heard of). DYOR!

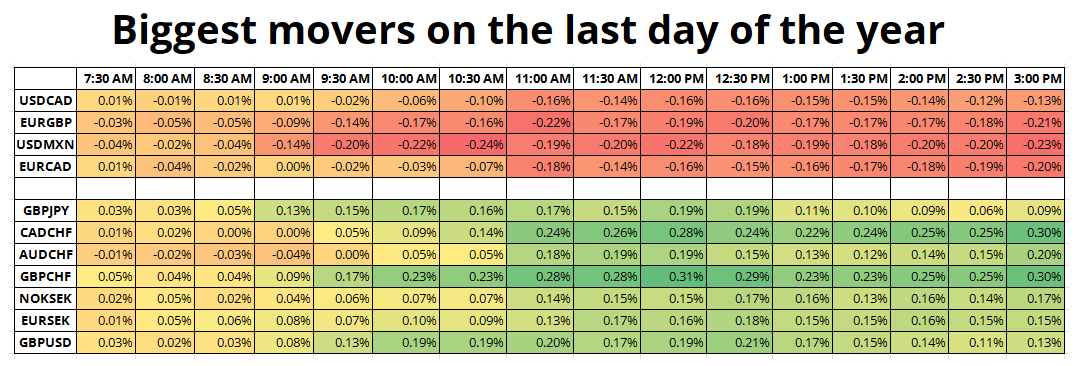

For your guide, here are the largest average moves for FX on the last day of the year. These are filtered for the biggest cumulative moves 7 a.m. to 11 a.m., looking at the 40 most important FX majors and crosses. I looked at the medians to see if there are any crazy outliers affecting the averages, and there are not.

I would expect to see some CHF selling today as the franc is now by far the best funder in G10 and many were waiting for a dip to buy EURCHF. There was no dip.

The EURSEK and AUDNZD seasonality trades made money (see here for the original 21NOV24 writeup). They were not home runs, but these trades rarely are. Thanks to those that did the trades with me—I appreciate that.

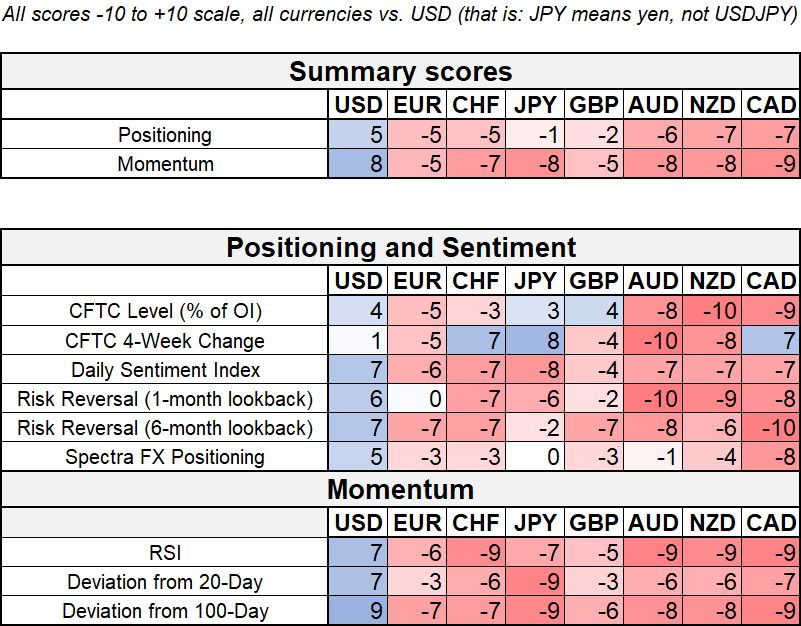

I enter the new year flat and will be on high alert for signs of whether we are getting shock and awe or something more measured and scaled from the first 100 days of DJT. If forced, I would be short USD and long bonds because of positioning and current extreme pricing and mood, but there is no point prepositioning. Waiting for news and trading afterwards is much higher EV in this case. With CAD and CAD vols having massively repriced, I abandoned my short CAD view last week and I will continue to consider the possibilities. USDCAD could easily be 1.40 or 1.48 at the end of January, but I doubt it will be 1.44.

Thank you so much for all the engagement and for all the trades this year. Without you there is no us.

Good luck in 2025!

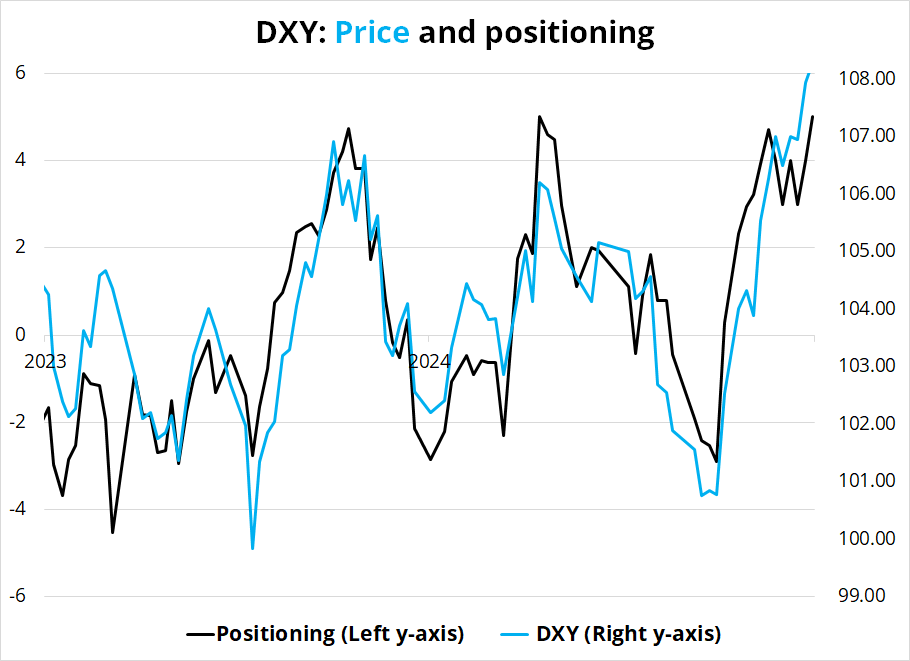

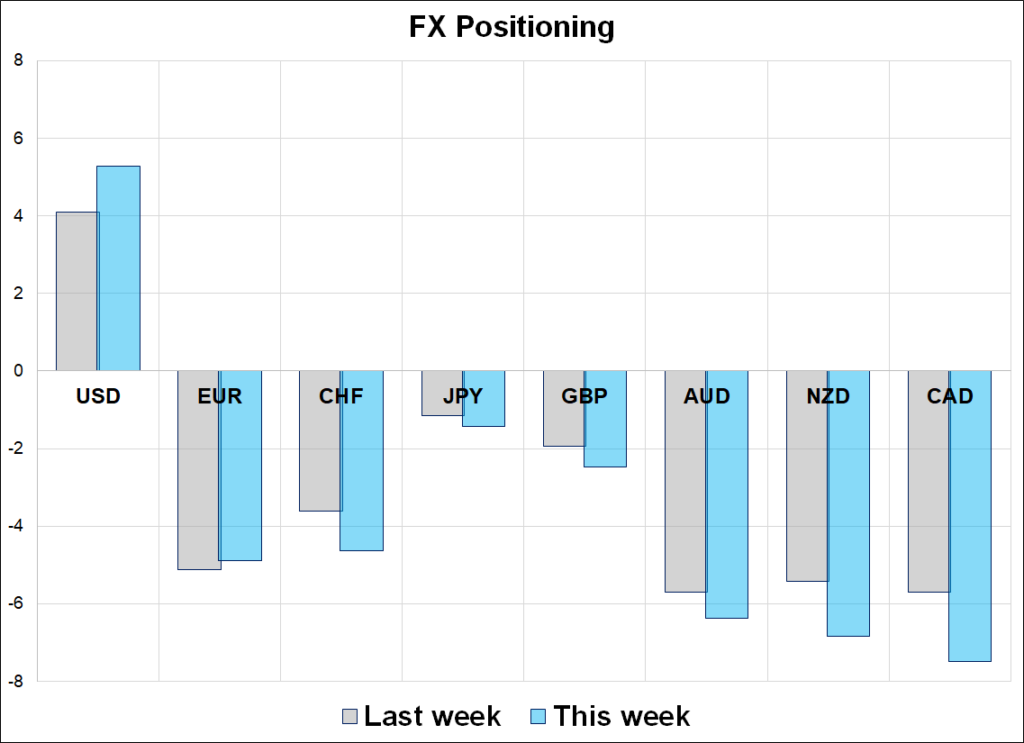

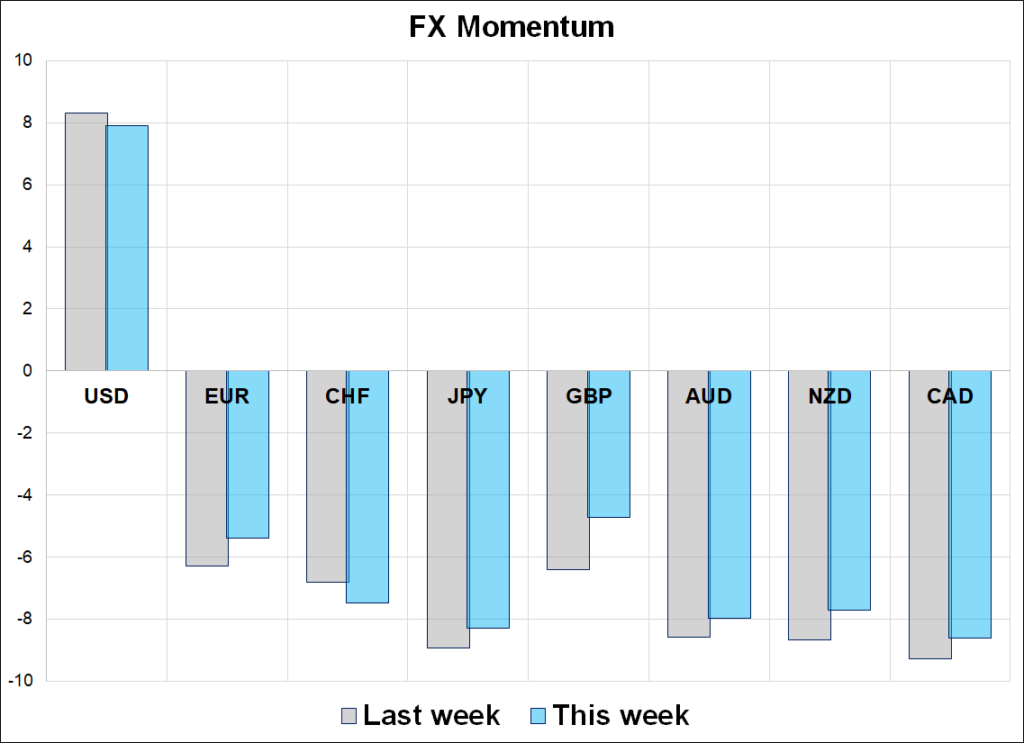

Fully loaded

Hi. Welcome to this week’s report. USD long positioning is back to the highs as the market keenly waits for the new information in January. We will find out whether it’s bigly tariffs and fiscal lassitude, or slow-played scaling of tariffs and government cutbacks in the name of greater efficiency. There is a wide range of possible outcomes, but as discussed in yesterday’s am/FX, the market is heavily positioned for dollar-positive and bond-negative outcomes.

January is named after the Roman god Janus.

Janus is the god of beginnings, gates, transitions, time, duality, doorways, passages, frames, and endings.

Appropriate!