Miran will expound, stock bulls unwound, bonds flail around

www.mariascrivan.com

Miran will expound, stock bulls unwound, bonds flail around

www.mariascrivan.com

Long 10MAR 104.30 CADJPY put ~64bps

NEW: Covered ½ the notional at the strike.

Short gold at 2940

Stop loss was 3011 now 2976

Take profit 2805

Note for today, something that was not on my weekly calendar. The Senate Hearing on Stephen Miran for Chairman of CEA starts today at 10:00 a.m. He will be asked about the talking points in his famous paper. It includes ideas like forcing foreigners to buy super long bonds and/or the Mar-a-Lago accord to weaken the dollar.

The market is taking the essay, which was more a brainstorming session from a hedge fund manager, as a whitepaper for coming Trump policy. It’s questionable whether that’s what the paper is. It could be that, or it could be a bunch of brainstorms from a hedge fund manager. He admits throughout the paper that many of the ideas present challenges when contemplating execution in real life. The idea of revaluing or selling gold, raised in the essay, has already been pooh poohed by Bessent. The market will be keen to hear whether the essay is a blueprint for policy recommendations, or just a guy spitballing pre-election.

Of particular note will be Miran’s comments on the dollar. The market is excited about the sequencing of 1) tariffs first, leading to a stronger dollar and 2) a series of policies and global diplomatic efforts to then weaken the dollar afterwards. Be ready for a dollar reaction if Miran endorses USD weakness — or doesn’t.

Miran’s views on tariffs will be noted, but given the torrential downpour of noise from Trump on the topic, Miran’s views on tariffs are unlikely to be market moving.

There is mass confusion on Canada and Mexico tariffs now as Monday Trump said they were on schedule (meaning March 4) and then yesterday he said they are coming April 2. It is probable that he misspoke, and the March 4 deadline is still in force, but we be confused. White House officials subsequently contradicted Trump’s statements so the official line does appear to be that March 4 is still in play.

Asked for clarification, a White House spokesperson said tariffs on Mexico and Canada are still expected to take effect on Tuesday. “That [timeline] is still intact. He’s still reviewing progress,” made by Canada and Mexico to address Trump’s concerns, said the official, who was granted anonymity to share details of internal discussions. “I think things just got muddled in there,” the official added.

“Reciprocal tariffs are still on for April 2,” they noted, referring to tariffs Trump has said he plans to impose on all trading partners, based off the trade barriers they impose on U.S. goods.

It looks to me like both stocks and bonds have done enough and the repricing of a possible growth scare and peak capex have been rapidly incorporated for now. Bear markets need fuel and from here I would think the path of least resistance is higher stocks in the short run. The technical damage is minimal for now as we have simply gone back to the bottom of the range in NASDAQ, retraced the post-earnings move in PLTR, and reversed 55 of 70bps in 10s.

I do not think we recapture all-time in stocks in the next few months—I think stocks are in a major topping process and you sell rallies as the stagflationary combo of rising prices, rising inflation expectations, and slowing fiscal impulse are bearish for stocks and somewhat bond-neutral.

But the NASDAQ is oversold at the bottom of the range. Reloading closer to 21700/21800 in NQ feels right, though if the Canada/Mexico tariffs go into force at 12:01 a.m. on Tuesday (i.e., very late Monday night NY time) then all bets are off. USMCA tariffs will quickly silence the chuckling over trade policy credibility.

On bonds, the market can only deal with four themes at a time, so it has forgotten Theme 5: There is still a bit of a sticky inflation problem in the USA. I think that puts a floor under yields in the 4.12%/4.20% area, even though nobody is talking about it this week. To get 10-year yields through 4.10%, we will need more than just a few weak surveys and fear about DOGE cuts. Also, next week’s NFP release is unlikely to reflect much or any DOGE impact because the reference period for NFP is 12FEB and Initial Claims that week were flat. Job cuts announced are not instantaneous, and most of the DOGE stuff hit after 12FEB.

Selling TLT strangles or similar will probably work over the next month or so as the crosswinds are still significant in bonds and it’s not completely obvious yet how much growth will rerate. Next week’s data calendar is lit.

I am still bearish gold, as it’s finally looking ready to release a bit to the downside. I moved the stop loss down to $2976 because a new all-time high at this point almost certainly means the idea is wrong. The moving averages on the hourly chart are all rolling over and crossing, and the last time we were below them was $2600 in late 2024. So I don’t think a swift move to $2805 is too much to ask here. If you are in a tighter risk control state of mind, you could even move the stop to $2933, guaranteeing a win on the trade and exiting if we breach the moving averages.

As always, sidebar at the top of the page has the updated parameters for the trades. Also: The BCOM vs. oil observation was good timing as it marked a major high for commodity prices (so far). BCOM is down from 108 to 104 in a few days, which is a spicy move. The CADJPY sidebar trade is a gamma play now, not a directional one.

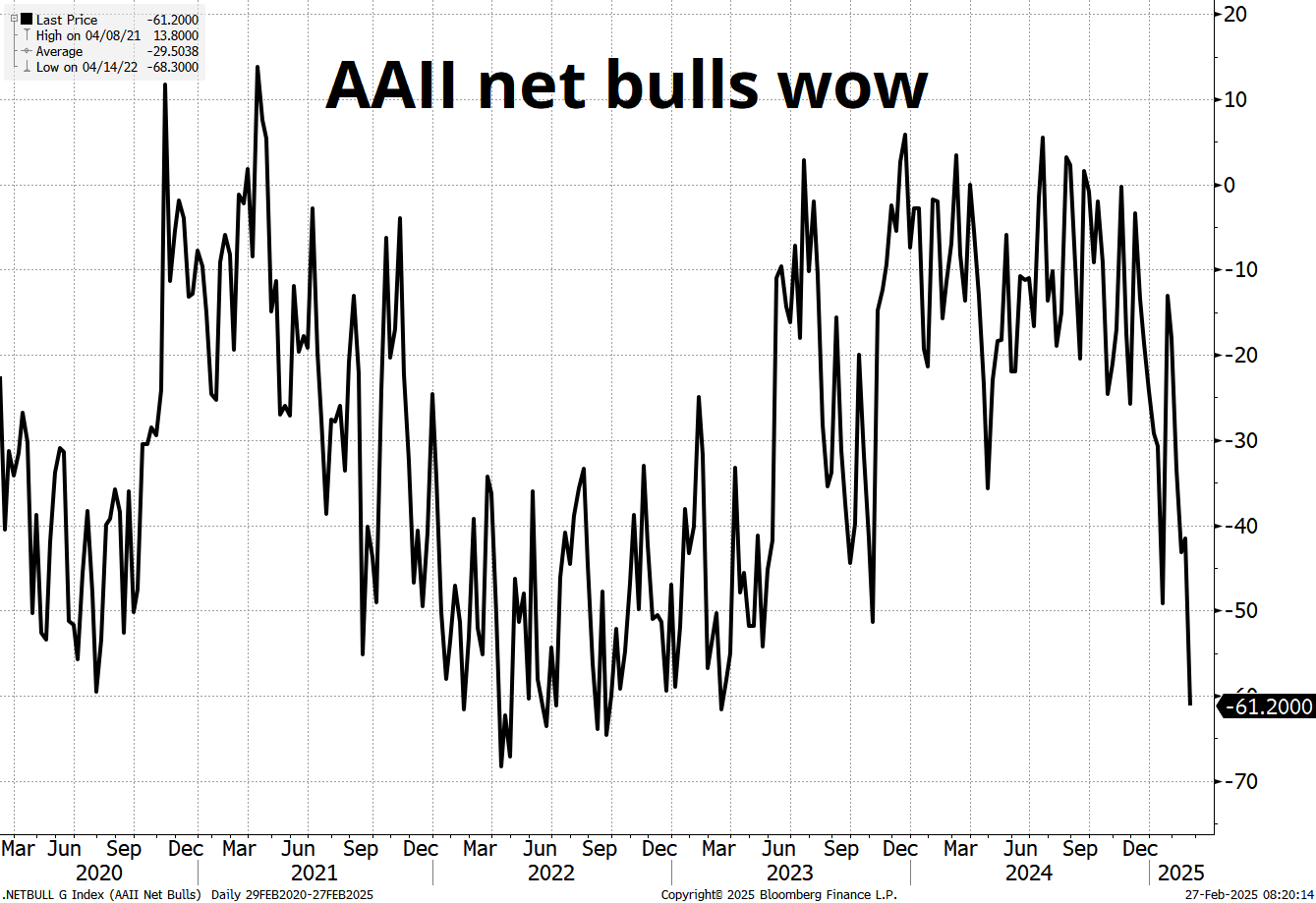

We went from max bullish in early December at 6100 S&P (see here) to max bearish at 5950 now (see chart).

Okie dokie.

Have a dogged day.

www.mariascrivan.com