Much to discuss today

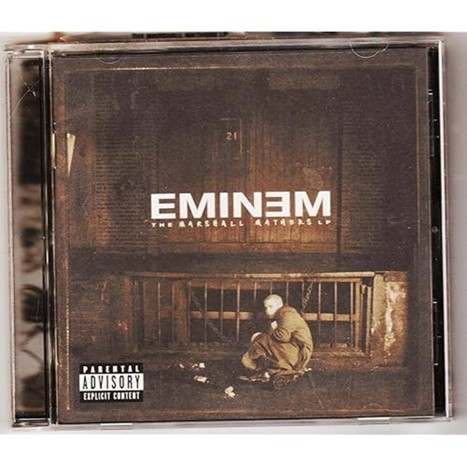

This month marks the 25th anniversary of the Marshall Mathers LP.

It is the best-selling horrorcore album of all time.

Songs like Kim, Stan, and Kill You still remain impressively chilling works of art.

Much to discuss today

This month marks the 25th anniversary of the Marshall Mathers LP.

It is the best-selling horrorcore album of all time.

Songs like Kim, Stan, and Kill You still remain impressively chilling works of art.

Long PLN5 @ 1071

Stop loss 964

Take profit 1264

First, the NZDJPY worked out OK overall, though what feels like it should have been a home run trade was not. Taking profit at 86.61 makes for a win, but not a huge one. Not a humblebrag, just a sigh of disappointment as a pretty spicy idea yielded a non-spicy profit.

In the interest of looking at how trade structuring can impact P&L, here’s how various trades risking the same amount of money would have fared. Recall the idea (published Tuesday, here) was that equities would rip higher on seasonality, the RBNZ would be hawkish, and the JGB auction would go fine. Two out of three were super true, yet NZDJPY didn’t go up all that much. Herein, a brief analysis that I hope will be useful and/or educational. Assume we are risking $500,000 on the trade.

2-day NZDJPY option

Option notional 226 million NZDJPY

Cost, 37.1 bps = $500,000

Took profit at 86.61

Net P&L: $295,000

Another idea would have been to simply buy NZDJPY cash.

Cash NZDJPY trade

Long 72 million NZDJPY @ 85.87 stop loss 84.87

Took profit at 86.61

Net P&L: $367,000

Then again, if I had done NZDUSD…

Cash NZDUSD trade

Long 82 million NZDUSD @ 0.5954

Take profit 0.5961

Net P&L: $57,400

Finally, if I had simply bought NQ futures… The P&L would be closer to $500,000.

Takeaways:

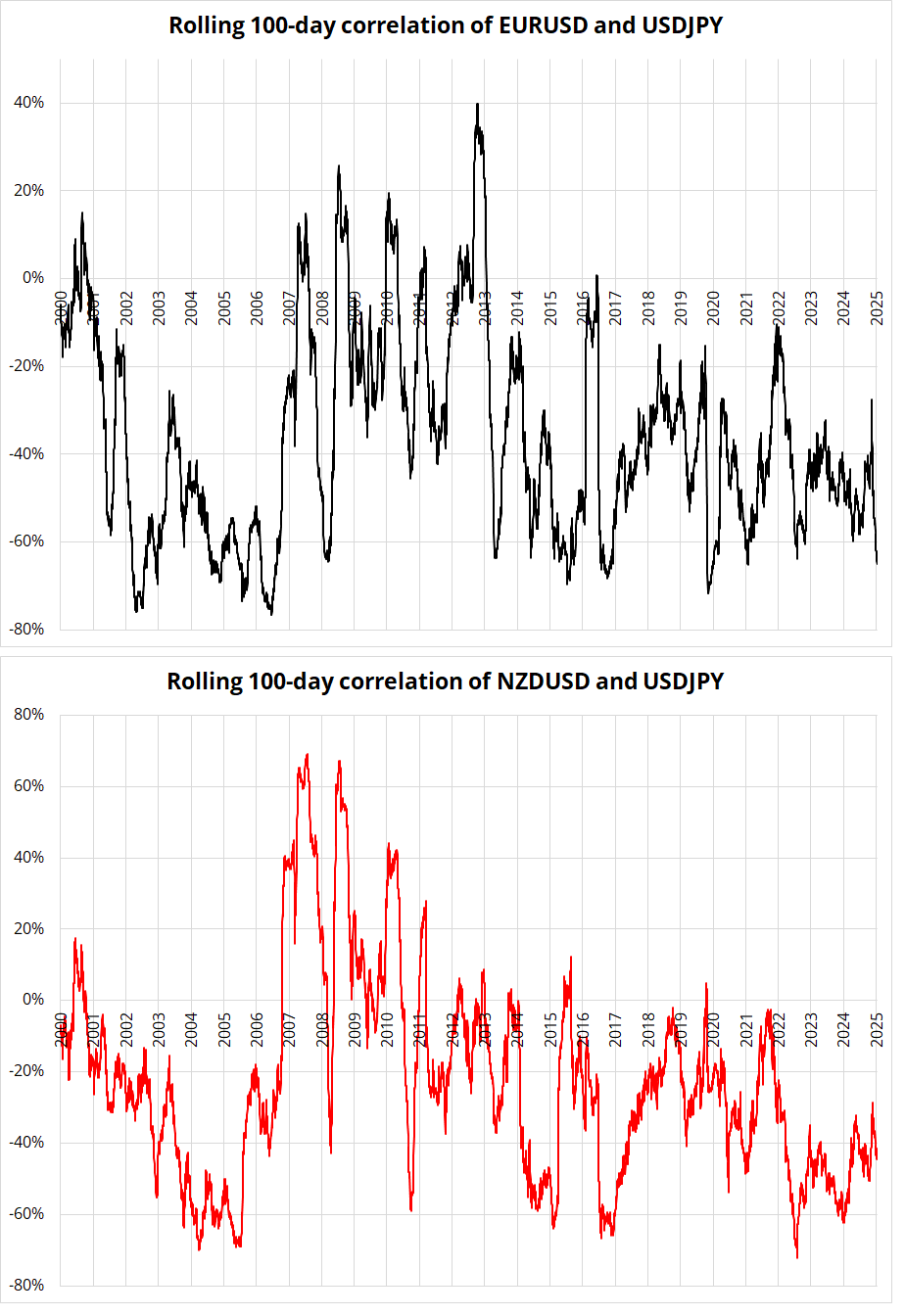

I mentioned that we are in a USD regime, not a cross/JPY regime. Here’s what I mean. Note specifically in the bottom chart (red) how periods of risk aversion see NZDUSD and USDJPY flip from negatively to positively correlated. We are not in one of those periods. Also note how during the Great Twin Deficits USD selloff from 2002 to 2005, correlation was super negative as it was DOLLAR ON or DOLLAR OFF—Not RORO like 2007-2012. We are in a regime much more similar to 2002-2005 than 2007-2012.

Rolling 100-day correlation of 1-day changes

That’s the post-mortem on the NZDJPY trade done.

The checks and balances are kicking in fast and furious right now and it’s likely that the tariff challenge is headed to the Supreme Court. There are so many questions, and you can find any answer you like out there, but for now it seems like the next 10 days will be “interesting” as the administration has only that short window to find a blocker for this ruling or halt the tariffs. Imagine trying to run a business in the United States right now!

I am not going to take a view on what happens; I’m just going to react. As we head into month end, theory says that the market should sell USD because equities are up considerably. This makes sense, but the macro backdrop is too confusing for me to get excited about short USD here. Furthermore, there is an MSCI rebalancing which looks to be bearish EUR and bullish USD, and there is no clear USD narrative other than the big picture deficit theme which isn’t tradable at the moment in my opinion. EURUSD has been chopping up and down around 1.13 with no momentum for six weeks.

Turning to SPX: There is this idea that equity rebalancing is a big deal every month and banks publish huge numbers that need to be rebalanced in stocks, and yet despite loving these sorts of trades and having made money over the years trading Corporate and Real Money month end in FX and duration extension (buy bonds into end of month) systematically for a while, I have never made money or seen anyone make money trading month-end equity rebalancing. Not sure if anyone has ever seen any research supporting any tradable edge there. If you have seen it, please send!

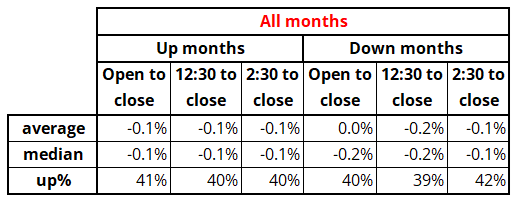

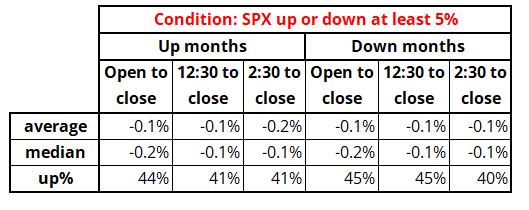

Justin and I looked at the performance of SPX on the last day of the month under various conditions, 2009 to now (SPX up on the month, SPX up X% or more on the month, vice versa, etc.). We could not find anything no matter how aggressively we mined, hacked, and snooped through the data. Two grids show average performance of SPX all day, 12:30 to close and 2:30 to close to see if there is any predictable effect on equities.

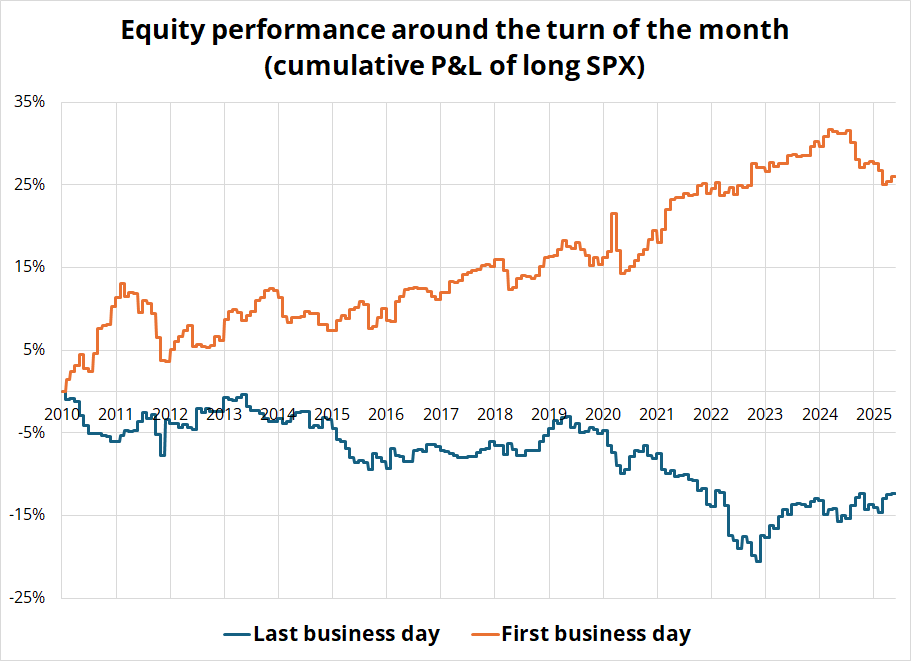

Nope. The only interesting aspect here is that the last day of the month leans bearish, which is surprising since 53% of all days are positive for SPX. Those 40%/45% win rates are shockingly low. I have long known that equities perform well at the start of the month, presumably due to payroll and 401k inflows, but I was not aware that the last day of the month is such a stinker. Here’s a cool chart:

Maybe a cool chart, but also maybe useless because you can clearly see that the effects have flattened out or reversed in recent years. Anyway, I believe that month end rebalancing in equities is a red herring but I am open to contradictory evidence if you have any.

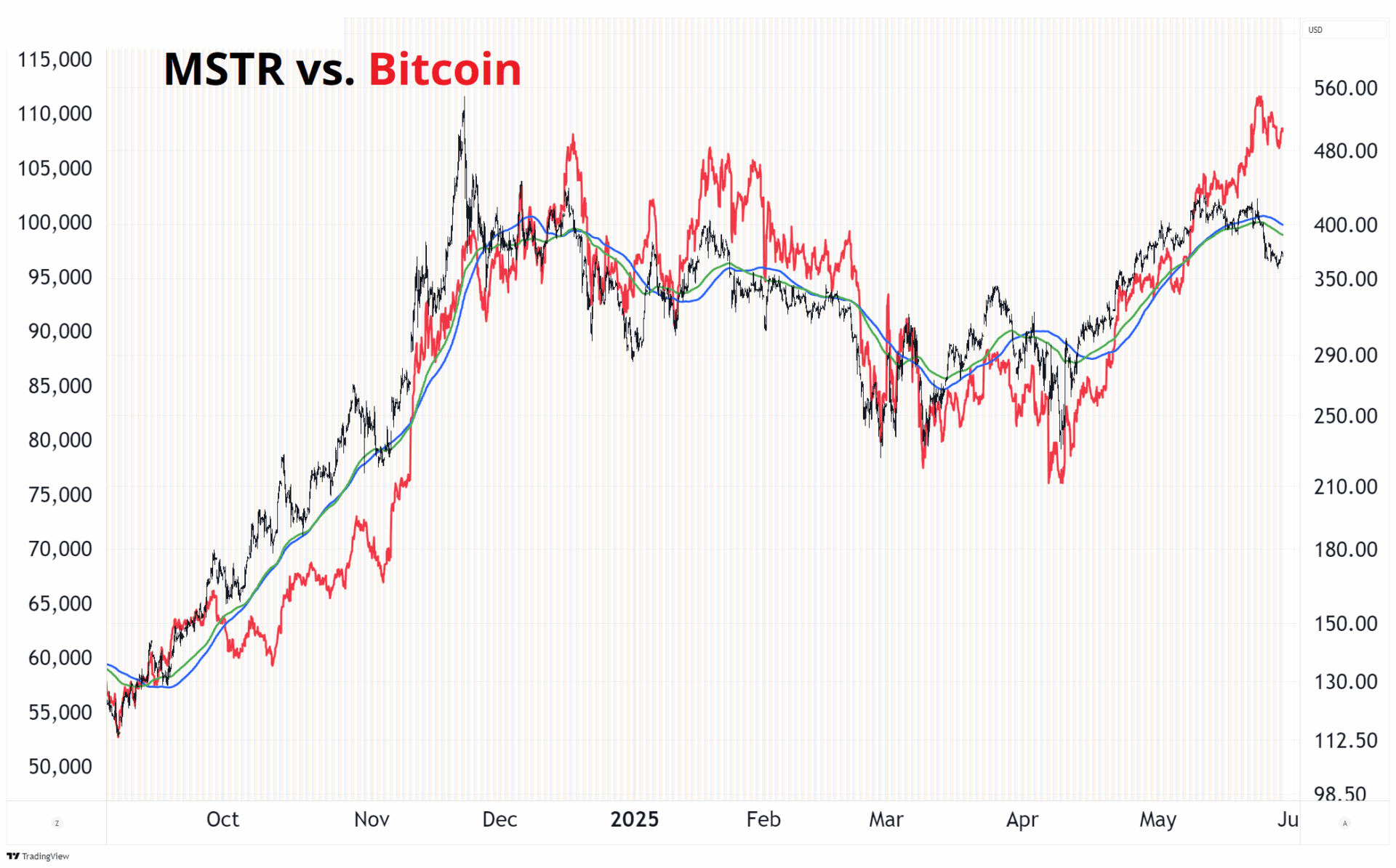

There is no reason for MSTR to trade at a premium to its NAV as it operates a stagnant software business and simply adds transaction costs and random entry points to a long bitcoin strategy. The reason it became popular was because there were zero listed ways to trade bitcoin in 2020 and this gave MSTR first mover advantage and a halo.

Now, one stale publicly-listed copycat after the other pivots from loss-making activities to bitcoin treasury. SBET is the latest offender. It is transparently idiotic for the market to assign a premium to these companies and yet, the market assigns them a premium! Oh well. The market does lots of dumb things. Gravity always wins.

In the meantime, with so many me-too! MSTR clones out there, the dumb money is getting spread thinner and thinner and this is opening up a wedge between bitcoin and Strategy™. Please setup a special purpose vehicle to buy bitcoin and short all these wannabes. At least Saylor is bold and original.

You don’t… Wanna mess with Shady… Why?

This jazz song (“Pulsion”) sounds suspiciously like the sample in “Kill You” but the French songwriter lost his copyright infringement suit nevertheless.