Short note today because it’s Friday.

Two Turtle Doves

Short note today because it’s Friday.

Two Turtle Doves

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC

Short EURSEK @ 11.6000

Stop loss 11.8650

Flip long today at 11 a.m.

The long USDCHF trade is stopped out. I underestimated how big the EURUSD short was and how much people would want to reduce into NFP. I ignored seasonality and positioning and got caught up in the euro bearish hype.

First, you need the right list of inputs and variables to help you think about where markets are going. But then you need to correctly weight the variables in real time. I thought that macro would outweigh positioning and seasonality, and I was wrong. The EURSEK short has worked out well. Today we flip long at 11 a.m. for the next leg of the SEAS Strategy. The AUDNZD seasonal trade is also working well as we have gone from 1.1100 to 1.0978 so far. Much time remains on that one, and I will bring the stop down to 1.1111 now to lock in something close to break even as the worst case.

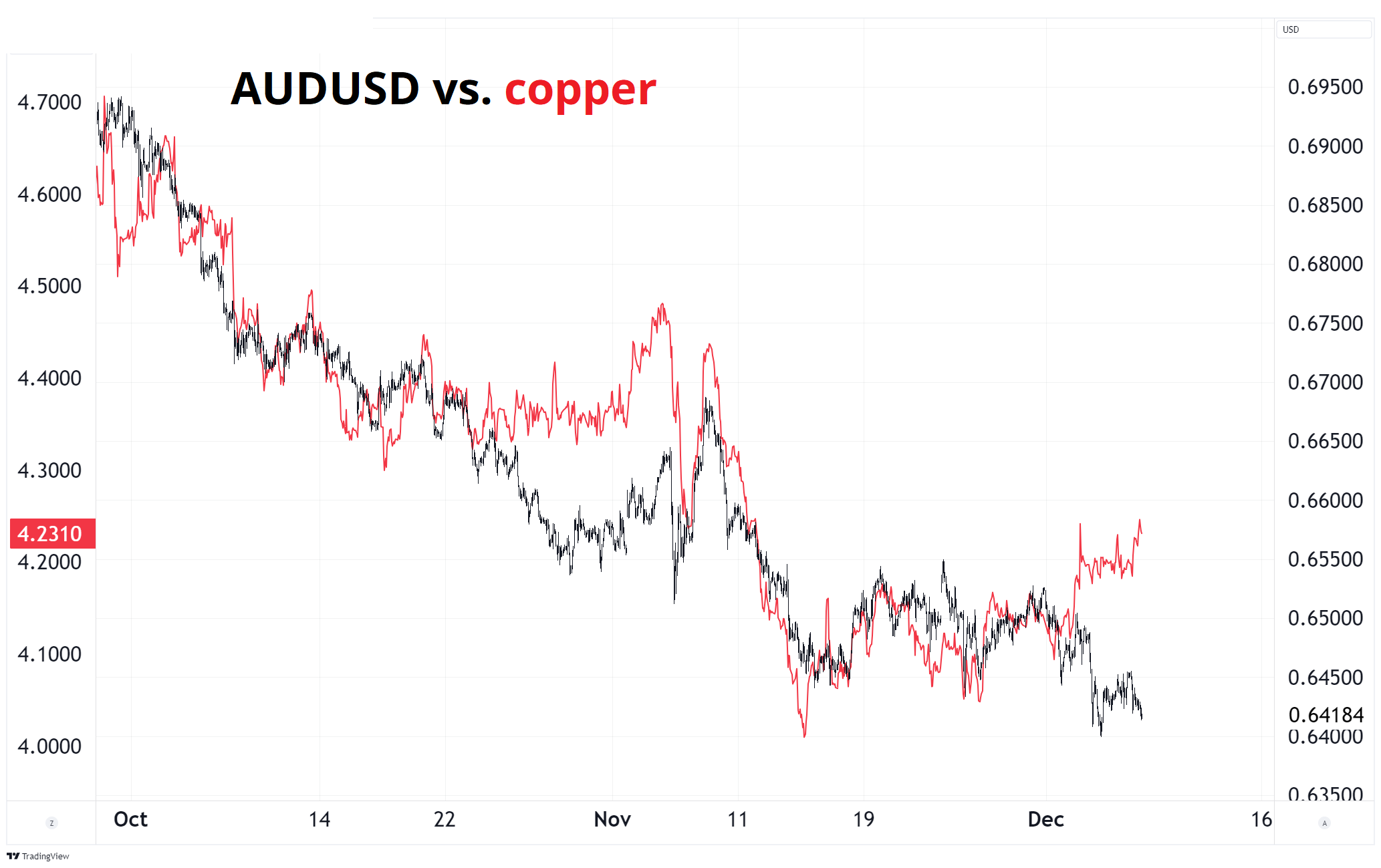

USD longs are in danger on a weak or goldilocks number today as France tightens, USDCNH rejects 7.3000 and copper rallies. 1.0590/00 EURUSD resistance likely to be vaporized on anything midrange to weak and if you are looking for data in the goldilocks zone (+140k, 4.2% UR) I would be long AUDUSD as it looks v low vs. Copper and a bit low vs. USDCNH too.

I did my usual crunching for NFP this month but could not come up with any lean or edge. The randomness around the hurricane and strike effects makes for extra noise this month and I don’t see any signs of either apocalypse or boom in the high-frequency data so that puts me around 150k, 4.2% UR… A Goldilocks result.

Canada jobs data is increasingly important as immigration is about to slow, GDP per capita is horrendous, and Trump poses a clear and present danger to the Canadian economy in 2025. People make their debt and mortgage payments when they have jobs. They don’t make those payments when they’re unemployed.

It’s a big’n next week with four central bank meetings, three auctions, two CPIs, and a partridge in a pear tree. I think the SNB will only cut 25bps next week, as explained in here.

The podcast is back! Keep an eye out for it on YouTube and Spotify as it will drop in the next couple of hours.

Hope your weekend involves some swans ‘a-swimming.

The PNC Christmas Price Index is either excellent or dumb. Or both. I can’t decide.

:]

https://www.pnc.com/en/about-pnc/topics/pnc-christmas-price-index.html#about