The market is a bit less sure that yuge deficits are guaranteed.

Push and Pull

It was a week of crosscurrents and contradiction

The market is a bit less sure that yuge deficits are guaranteed.

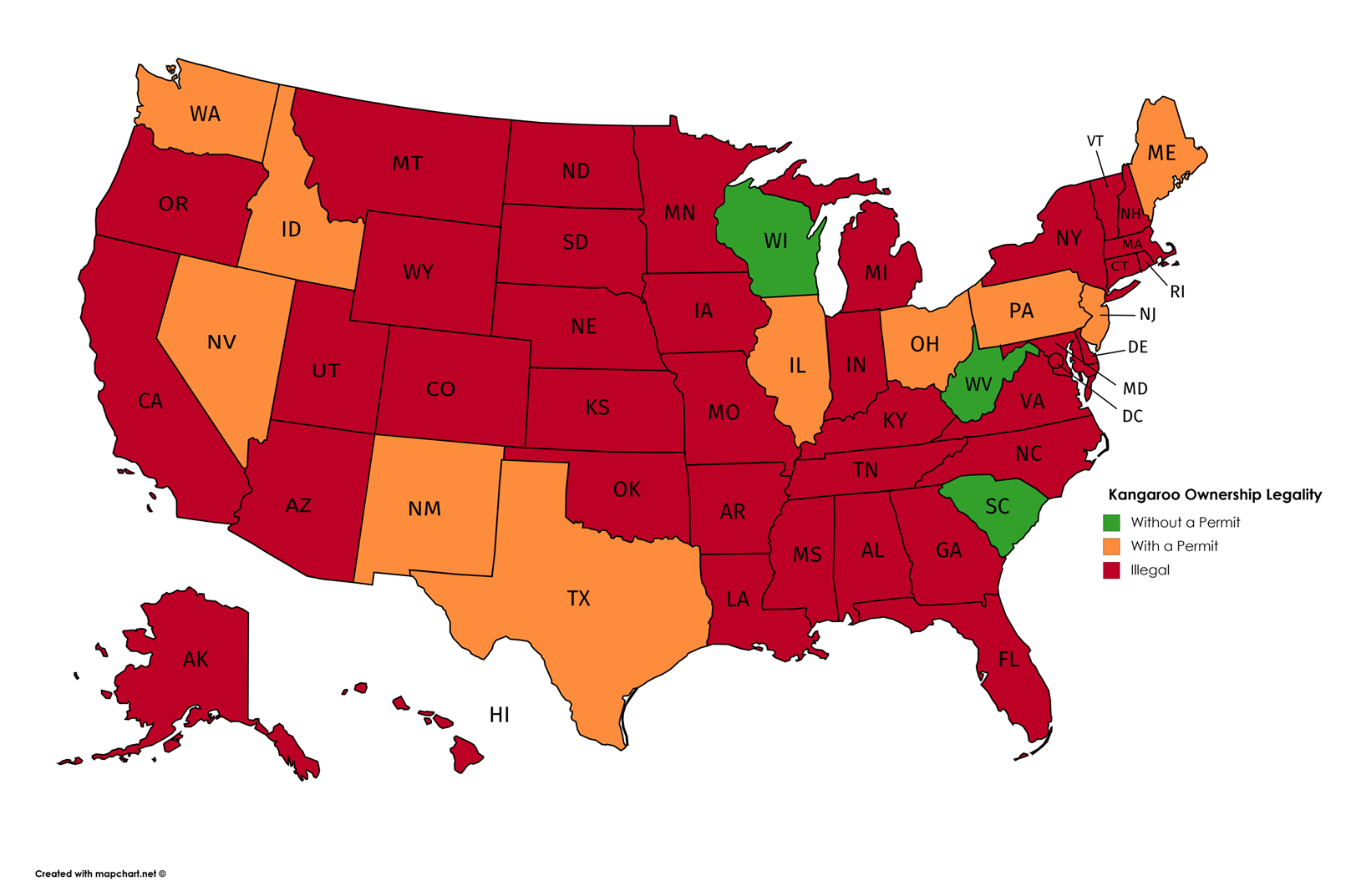

Legality of owning a kangaroo in the USA, by state

Flat

The market put on the Trump 2 Trade just about instantly as the expected value of stocks is higher given lower expected tax rates and yields went higher on expectations of gigantic deficits and a continuation of strong US growth. Taking a look at current pricing as we go into today’s Fed meeting, we now have an implied policy rate of 4% by May 2025, with no meeting showing anything lower than 3.75% all the way out to July 2026.

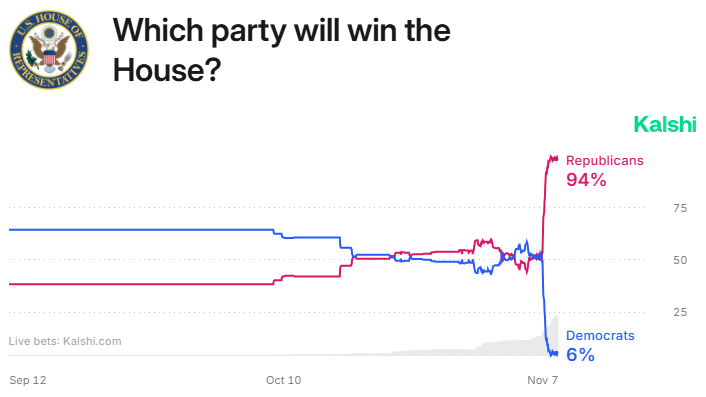

Obviously, there are a lot of assumptions being made here, but we have the 2016 playbook to follow, along with a flurry of statements and forecasts to work with. The House race looks to be over.

Now, the question is: What will policy actually look like, and when will we have some visibility? The nominations of Steve Mnuchin (2016) and Janet Yellen (2020) to treasury both came on the 30th of November, immediately after the election. Geithner was nominated November 24, 2008. Secretary of State and Treasury Secretary are generally the first two announcements. The hearings take place in January and confirmation is shortly after, depending on how that goes.

The front runners for Treasury Secretary are:

Scott Bessent, Key Square founder, current adviser to the Trump Campaign. He advocates targeting 3% growth, 3% deficit/GDP, and a domestic energy production increase of 3 million barrels per day (currently 21 mio).

John Paulson, another hedge fund manager. Advocates tax cuts, deregulation, lower government spending, and targeted tariffs.

Robert Lighthizer, USTR for Trump’s first term. Strong advocate of tariffs and skeptic on trade. Helped renegotiate NAFTA and spearhead China tariffs.

Some dark horse candidates are Jamie Dimon, Howard Lutnick, Jay Clayton, Bill Hagert, and Larry Kudlow.

A possible important disconnect between the pre-election forecasts and the rhetoric is that Trump was viewed as the gigantic deficits guy (7T vs. 3.5T for Harris), but the rhetoric and policy lean has some theoretical elements of debt reduction. Sure, these are pie in the sky, contradictory concepts (cut taxes, and reduce deficits) but one of the first things Trump said yesterday was:

We’re gonna be paying down debt. We’re gonna be reducing taxes. We have, we can do things that nobody else can do. Nobody else is gonna be able to do it. China doesn’t have what we have. Nobody has what we have.

Installing Elon Musk as some sort of “Department of Government Efficiency” czar has also been floated, and both Musk and Trump have strong admiration for Javier Milei’s approach in Argentina. If you look at what’s happening in Argentina, or what Musk did with Twitter (immediately cut the workforce by 80%)… There is a hallucinatory scenario where taxes are cut, government efficiency is dramatically increased via job cuts and restructuring, and deficits stabilize. Given how I view gold as the release valve for deficits in the post-2008 world, maybe this is why gold cratered yesterday? Maybe the view that Trump will massively expand the deficit is wrong?

Don’t get mad at me for saying this. I’m just saying maybe. I realize that history does not support the idea, but then again, a lot has changed since 2017. Politicians have been shown how inflation is the death knell for whatever party is in power when it happens. Maybe this administration will be more careful and methodical than people think, and we are past peak MMT? Something to think about.

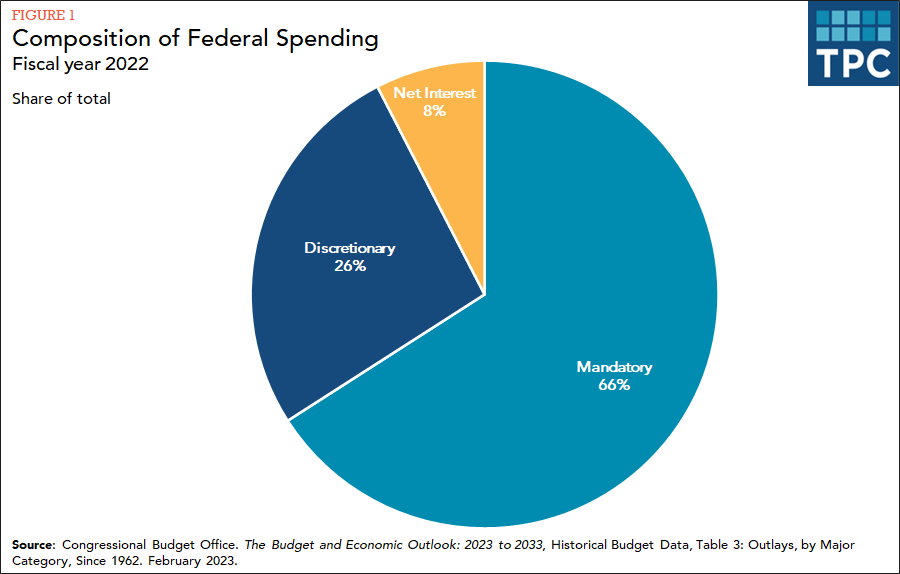

The biggest problem with this view is that most government spending is not discretionary. But some of it is.

Anyway, if the market decides that maybe deficits are not going to increase as much as initially expected, that would take the upward pressure off yields and keep gold heavy.

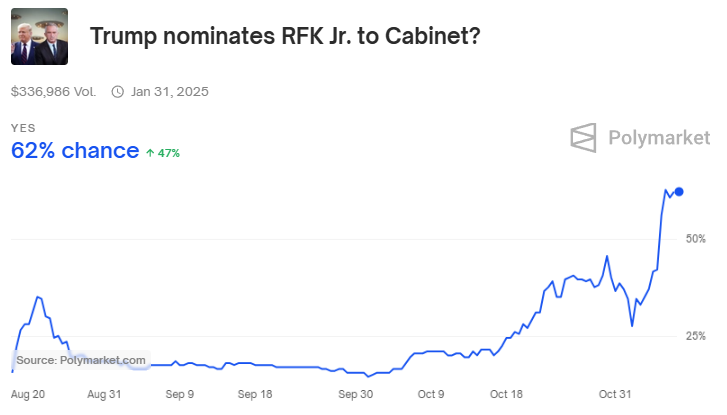

And below, note that RFK Jr. got a long shout out in the Trump victory speech and his odds of taking over US Health care services are rising.

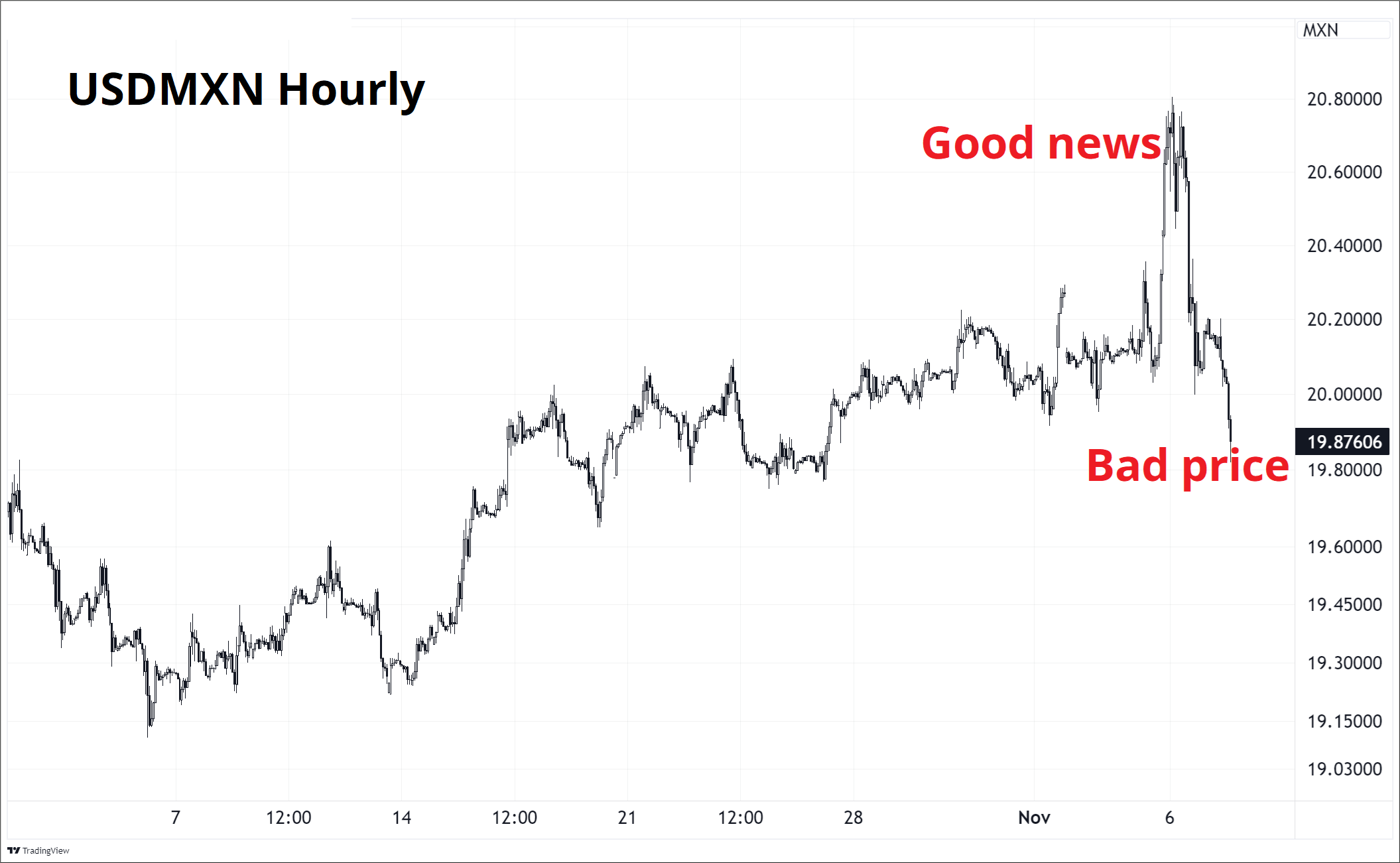

The unwind of the short USD trade has been incredible as USDMXN now trades well below pre-election levels. This is probably reflecting the fact that any policy and tariff announcements are a long way off and with vol cratering, it’s very hard to hold onto short carry positions.

While it is hard to comprehend why MXN would be stronger with Trump in power, the USDMXN price action is one of the most extreme good news / bad price setups I have ever seen, and I would not fight it. If anything, doing 1-month EURMXN downside to collect the carry as vol continues to drop could be the play. One tweet from Trump could change everything, of course.

Have a hoppy day.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it