NASDAQ sharply unchanged in quiet trading this month.

A macro trader and an economist brace for volatility

NASDAQ sharply unchanged in quiet trading this month.

A macro trader and an economist brace for volatility

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

My pals at Grant’s are holding one of their signature distressed investing events. Here are the details:

https://grantspub.com/events/index.cfm

I do not receive compensation for this ad, though they do run the odd am/FX ad on my behalf, for free.

Holy crap. What a month. Some measure of calm has been restored to markets this week as the market digests the new American policy and the economic tsunami that may or might not be on the horizon (depending on who you ask) has yet to appear. The next 3 months will deliver critical information as to whether or not the United States economy can survive a trade embargo with China and whether or not the global economy can muddle through.

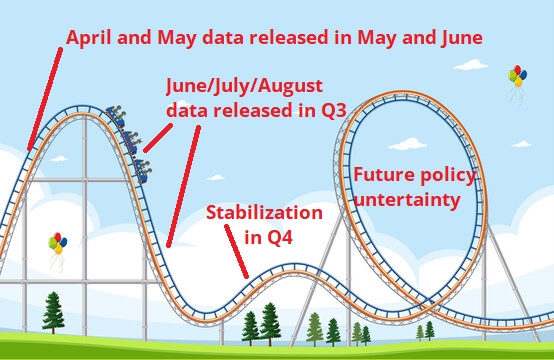

The soft (sentiment) data is uniformly morose as investors, consumers, and businesses are frozen by policy uncertainty. The 90-day tariff pause put a bottom under stocks and now we await the July 8 pause expiry and the influx of hard (real) economic data. There is a major issue in determining what the heck is actually going on in the economy now because while hiring and investment freezes will lead to some contraction in economic growth, the first impact will be a rush to buy goods before the tariffs hit. Therefore, you could actually see a string of strong economic data points that show a mini-boom in consumption.

Therefore, economic data releases like Retail Sales and Personal Consumption are effectively meaningless and could be subject to the Roller Coaster Effect, a term I just made up right now while typing this. The Roller Coaster Effect stipulates that when faced with known and imminent price increases, consumers will buy whatever they can and businesses will build inventories as much as they can reasonably afford to do so. Once ships arrive with tariffed goods, nobody will want those goods because a) they already bought what they needed and b) those goods are now more expensive than they used to be. Elasticity and substitution effects will dampen price rises but will not fully absorb them.

The Roller Coaster Effect

How do you trade or invest in the meantime? Do you position for a recession now? Do you wait for better levels because 401k money might keep flowing in and might push stocks higher now that the macro community is aggressively short? Do you just wait and see?

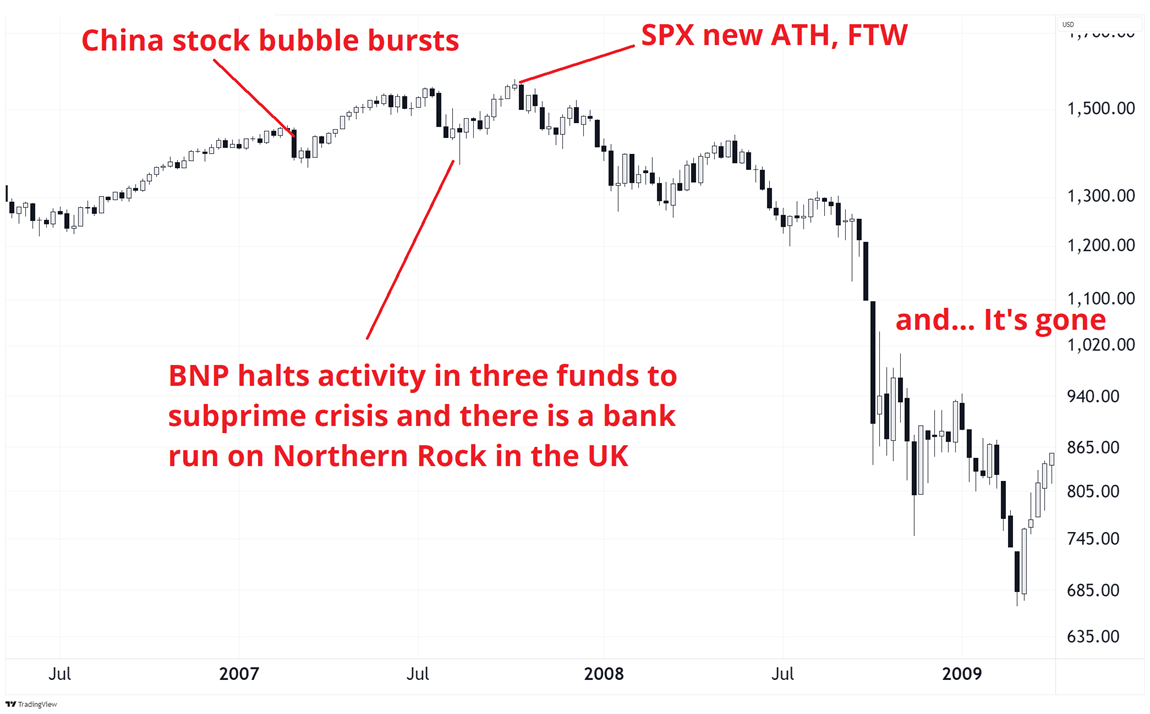

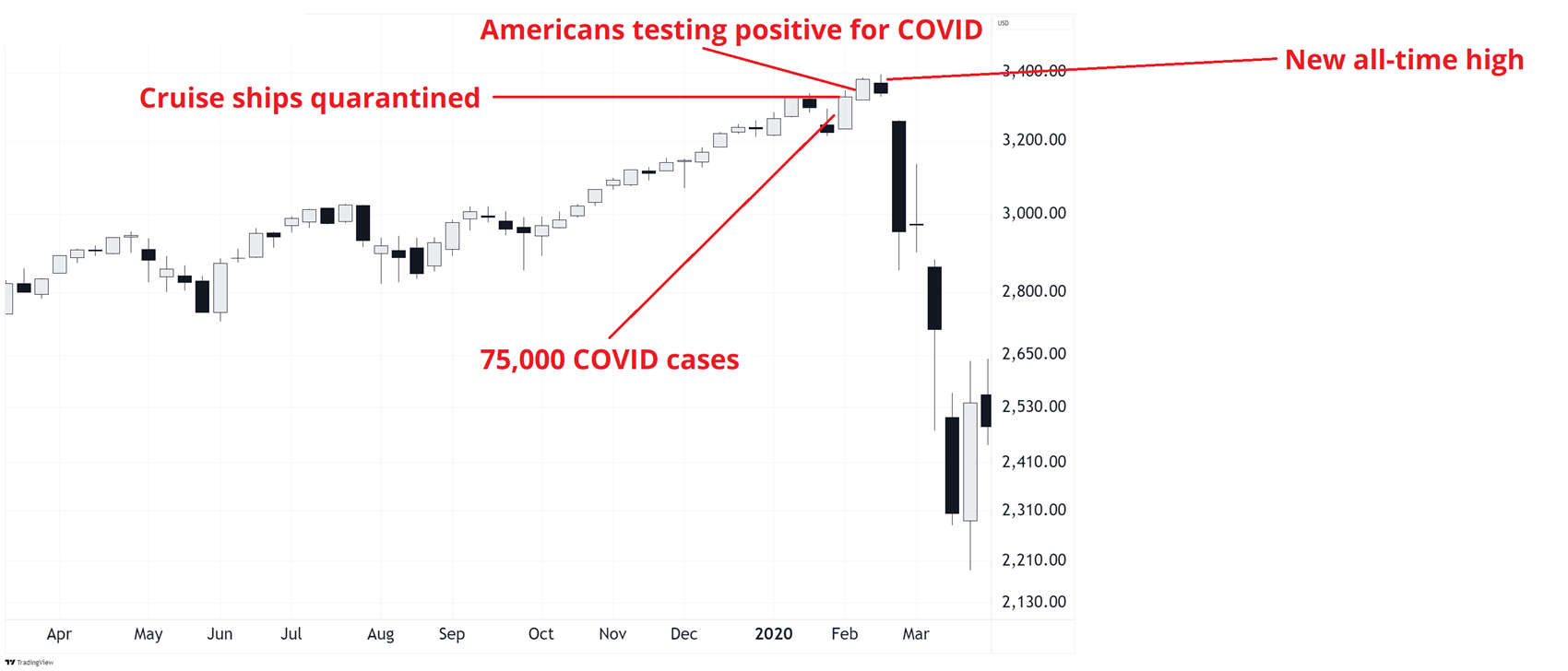

It’s tempting to front run the recession, but even if there is a recession, keep in mind that even when things were quite clearly not looking so good in 2007 and in February 2020, the stock market subsequently posted a new all-time high just to inflict maximum pain on both bulls and bears. In 2007, it was EXTREMELY clear that the financial system was wobbling and yet stocks remained resilient.

And in 2020 the buildup was much shorter, but there were equal levels of disbelief as the economic tsunami was roaring across the world and stocks were making new all-time highs.

So however bearish you want to be, weird stuff happens along the way and the only way to be right is to be right on time.

In the world of central banking, Cleveland Fed President Hammack tossed the market a bone saying June could be in play if things get bad fast enough and the ECB cut again but didn’t promise anything going forward. They are getting close to neutral now and every meeting will be a decision taken closer to the day of the meeting. Prior cuts were on autopilot but nothing is predetermined anymore.

I have been writing that below 5500 in SPX, the bears are in control and above, the bulls are in control. SPX is exactly 5500 as I’m typing this. Man oh man. The crazy thing is that if a journalist wanted to write a headline about this month’s stock market action, they could plausibly write:

US stocks unchanged in April as rest of the world rallies on US policy moves.

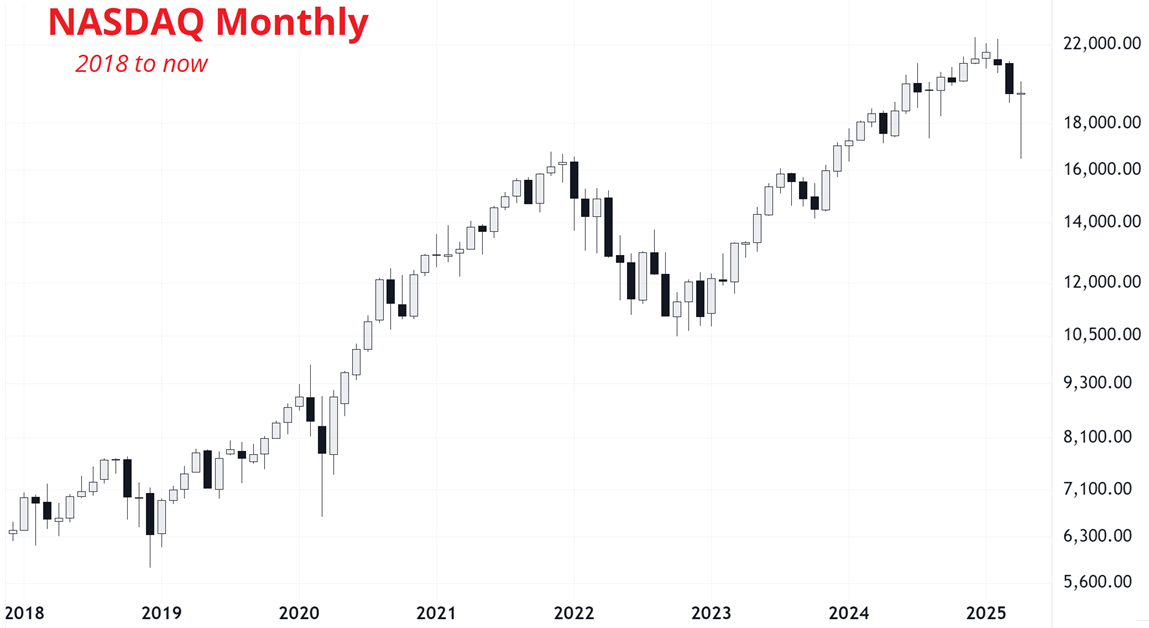

For all the hoopla and drama (and my writing has not been short of hysteria at times, I’ll admit) it was a pretty good month for global stock markets. Wanna see a helluva monthly candle?

NASDAQ unchanged in quiet trading. Meanwhile, Spain and Germany up more than 5% this month and Brazil up 7% or a hefty 12% if you include the move in the currency. Tariffs aren’t so bad!

I still think we are going to see an economic recession later this year, but the bear market has burnt itself out and I have seen too many face-ripping rallies after a selloff like this to stay pot committed to a bearish view. I was expecting that the path of least resistance would be lower for a while and it just doesn’t feel like that’s true anymore. So I’m open minded.

This week’s 14-word stock market summary:

Bullish technicals cannot be ignored, even if economy will eventually hit wall. Early = wrong.

The bond vigilantes got tired and took their ball and went home for a bit. They could be lurking like Slim Shady but they aren’t selling. Bonds are up this week and US yields are getting close to the bottom of the recent range again. The next chart shows US 10-year yields and you can see that there was a messy 4.10%/4.40% range for weeks before Liberation Day. Then, yields tanked because everyone thought tariffs are bad for growth. Then, yields ripped because everyone thought tariffs are bad for growth and good for inflation and will lead to a worsening of the US fiscal position. The flight from the US was exacerbated by the long list of countries and investors frightened by the huge tariffs.

Then, in reaction to 10-year yields getting the yips, Trump announced another policy U-turn and the market went right back to where it was before. I think the 4.10% / 4.40% equilibrium zone should hold until we get some clarity on the economy. That could be a while.

There is no end in sight to massive US deficits as DOGE has failed to make a dent in spending, entitlements are off the table, and defense spending is about to increase substantially. As such, the bond vigilantes will remain on guard and if they need to, they will force another US government policy change.

My bigger picture view is that we are entering a big USD down trend, but I took profit on the long EURUSD at 1.1525 because the theme got way too frothy, way too fast. You can simultaneously believe that a) EURUSD is going way higher and b) EURUSD is mildly overcooked here and the SELL AMERICA theme is giving off smoke. The best evidence of an overcooked narrative is always to look at the cover of The Economist magazine. As a periodical devoted to geopolitics and economics, it tends to broadcast the flavor of the day just as it’s about to turn stale. I have written extensively on this phenomenon and you can read all about it in today’s am/FX, which is free right here.

https://www.spectramarkets.com/amfx/magazine-trifecta/

Therein, I outline a few things you might find interesting:

—

If you were thinking about signing up for am/FX, but have not yet pulled the trigger, let me tempt you with $150 off for new subscribers. Use the coupon code SPEEDRUN. It expires May 15.

—

Let me tell you, am/FX is tremendous, absolutely tremendous, many people are saying it’s the best macro note in the world, and believe me, I hear from a lot of smart people—tremendous people—about these things. Nobody does macro notes like am/FX, that note is doing things nobody’s ever seen before, and everyone’s talking about it—the ratings are through the roof, just incredible numbers. The fake news won’t tell you this, but am/FX is doing phenomenal work, really phenomenal, and smart investors—very, very smart people—they’re all subscribing, they can’t get enough of it.

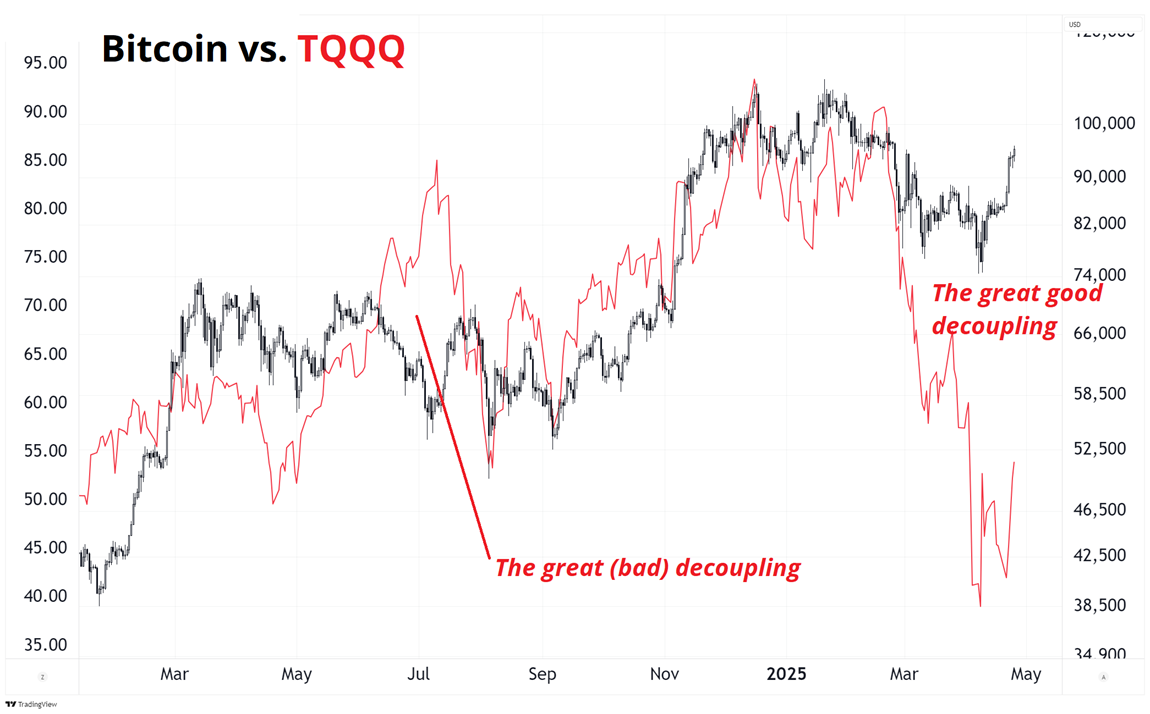

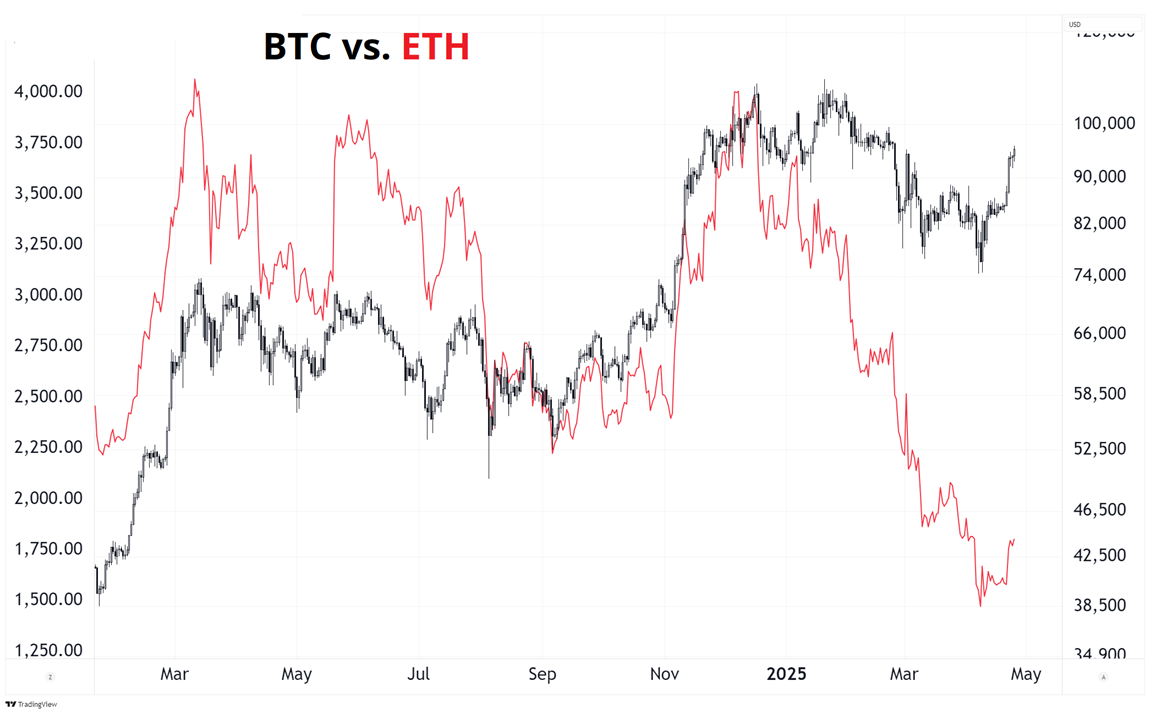

I have spent years complaining that BTC is just TQQQ, but it’s starting to look like things are changing! Let this not be the curse of death upon your crypto bags. The great decoupling is not just BTC running away from TQQQ, the korn is divorced from crypto more broadly now, too. For example:

Bitcoin’s correlation to other assets is unstable and ever changing, as are the narratives around it, but for now it looks like BTC is winning. As more corporations and governments continue to pile in, it is leaving everything else in the dust. Kudos to everyone in crypto that made the right call as there is an infinite supply of alt, meme, and shitcoins, but there is only one and will only ever be one BTC. I could replace ETH with SOL or whatever and the chart looks pretty similar. Even the most blue chip of blue chip coins, FARTCOIN, is still almost 50% off the highs despite a 500% rally since March.

Editor’s note: If you went back to Brent Donnelly 2011 and showed him that last sentence I just typed, he would likely assume that Brent Donnelly 2025 finally mushroom-portalled out of polite society and has gone functionally insane, surviving on grubs and baitfish, living in an 84-square-foot shack in the deep woods of Maine.

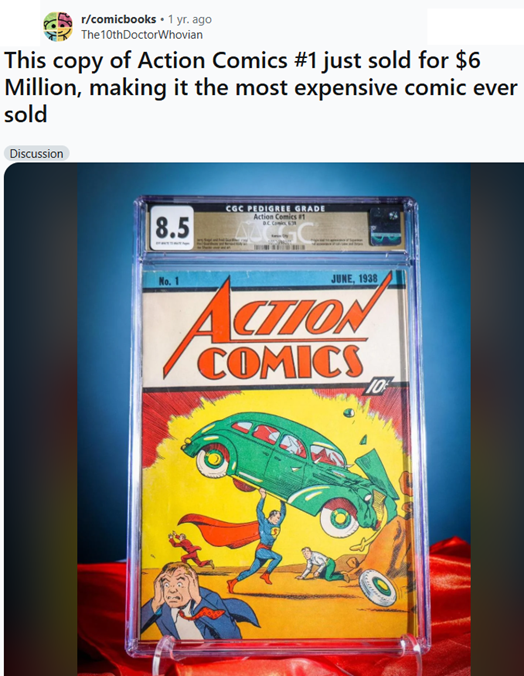

BTC is the OG, and everything else is not. Much like nobody cares about Action Comics #2, and nobody loves silver the way they love gold. Second place is the first loser, as the No Fear t-shirts used to say.

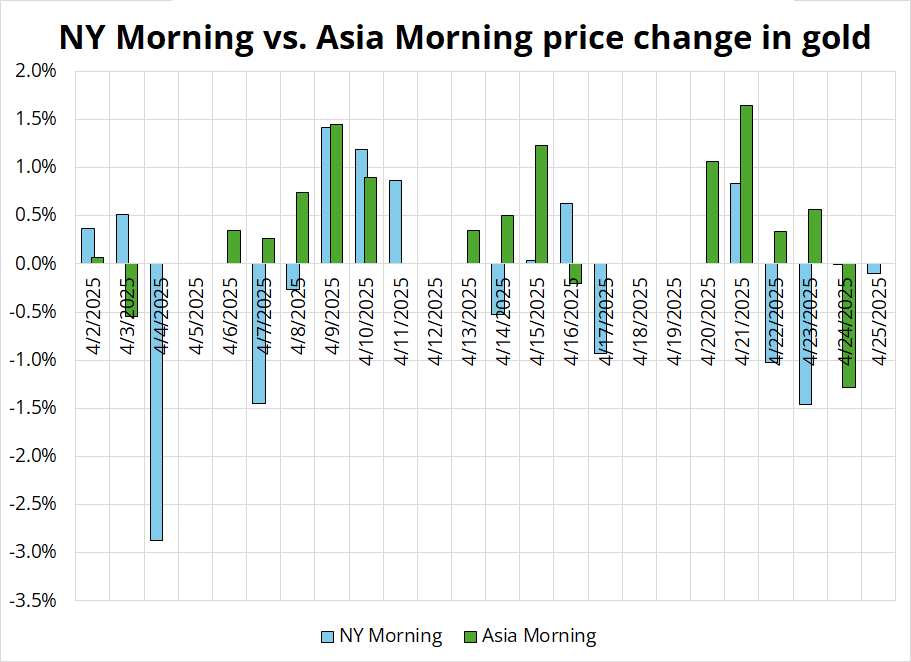

Gold is an absolute honey badger these days as it explodes in the Asian time zone almost every night, but last night saw the first selling of the month in Beijing, a potentially negative short-term harbinger.

On gold, here’s an excerpt from Tuesday’s am/FX, when gold was trading at $3,435. And if you want this stuff in real time, sign up here using code SPEEDRUN and get $150 off (regular price $690, new subscriber with coupon code pays $540 in year one). I am good at marketing. I am good at marketing. I am good at marketing.

I sometimes get complaints that I am a permabear in gold, but to be clear, I am always talking about gold as a trading vehicle here, not as an investment or an insurance scheme or anything long-term. I think you can make money long and short in up trends because massive up trends like gold, NVDA, WMT, or CSCO (for example) offer amazing countertrend moves as volatility is high and excitement levels are like it’s a 2025 Oasis concert. When the crowd is involved, the two-way action gets hot, and you can make money both ways. I have made money both long and short gold in recent months, despite the skyrocketing moonshot.

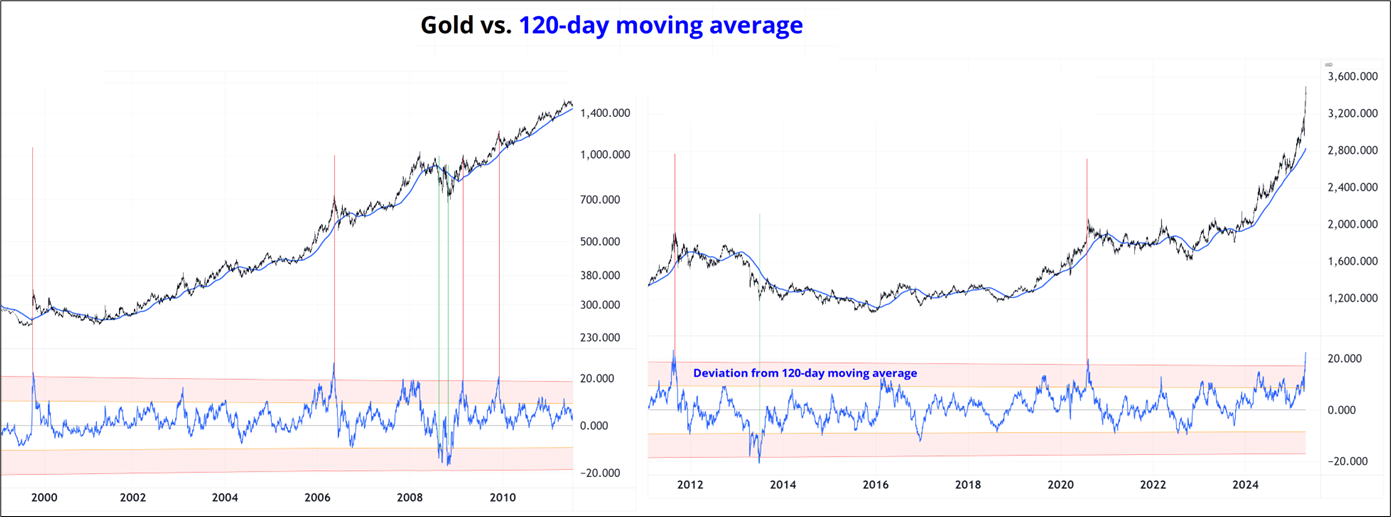

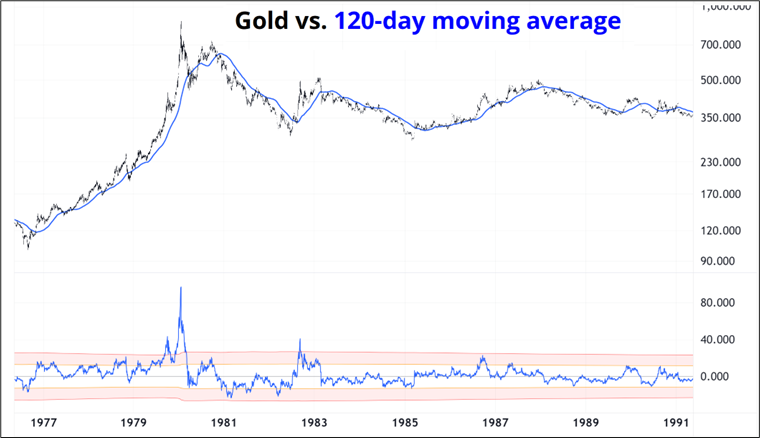

Anyhoo, just wanted to preface it that way because many view long gold as a deterministic long-term bet with a guaranteed payoff (or a religion). I just see it as a number on a screen. So right now, we are at levels of overbought that have generally signaled tops. Here’s the chart, which shows the price and its divergence from the 120-day moving average.

You can see that prior extensions where gold went 20% above or below the MA were major turning points, every time. Sample size is only 9, but still. The chart is split into two periods, 2000 to 2011 and then 2011 to now simply because TradingView won’t let me put 25 years of daily data in one chart.

But if you’re bullish, I have good news for you. Guess the one time that gold went 20% above the MA and then kept on keeping on? Yep, 1980.

So if you believe we are in a similar monetary reset to 1980, you could argue that another doubling of gold is imminent just like gold doubled after going 20% above the MA in 1980. That was one heck of a mania, and anyone that bought gold in 1980 was underwater for the next 28 years (plus they lost the opportunity to lock in 10% yields, so it was doubly disastrous). Short with a stop above the highs might work. These are the sorts of trades you can try three times and if it works the third time, you net make a lot of money.

As a trader, I would not be long gold here, despite the persistent Asian demand and the compelling narrative. 20% above the MA was enough in the GFC, the Eurozone Crisis, and COVID. It’s probably just about enough now too. Chris Dover, who I find to have informative stuff quite often on X (but I don’t know him and cannot vouch for him), posted a similar thought process, but compared the overbought nature and positioning in gold to the oversold price of oil and the positioning setup there. From this he likes the RV trade. The tweet is here.

end of excerpt

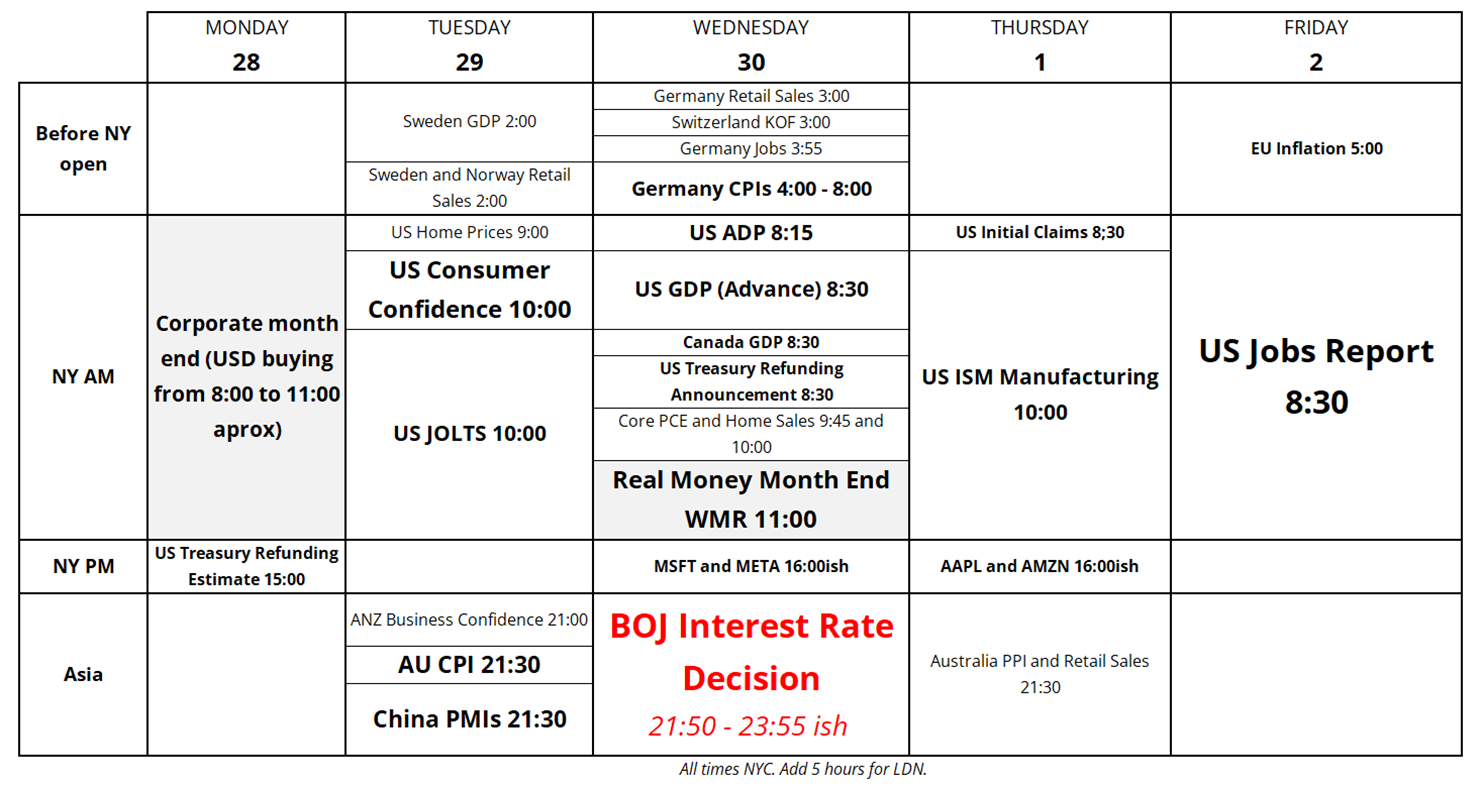

Here’s next week’s calendar:

That’s it for this week.

Get rich or have fun trying.

Music to play while going 90 mph in the car with the windows down

Don’t break the speed limit, though

*************

Good article on AI and its role in shaping humanity and art

The Third Humbling of Humanity

*************

If you want to learn to write, learn from one of the best (Sanderson)

Brandon Sanderson’s Writing Lecture

*************

Excellent tweet on coming supply chain issues

The White House has put itself and the country in a bad situation

***************

*************

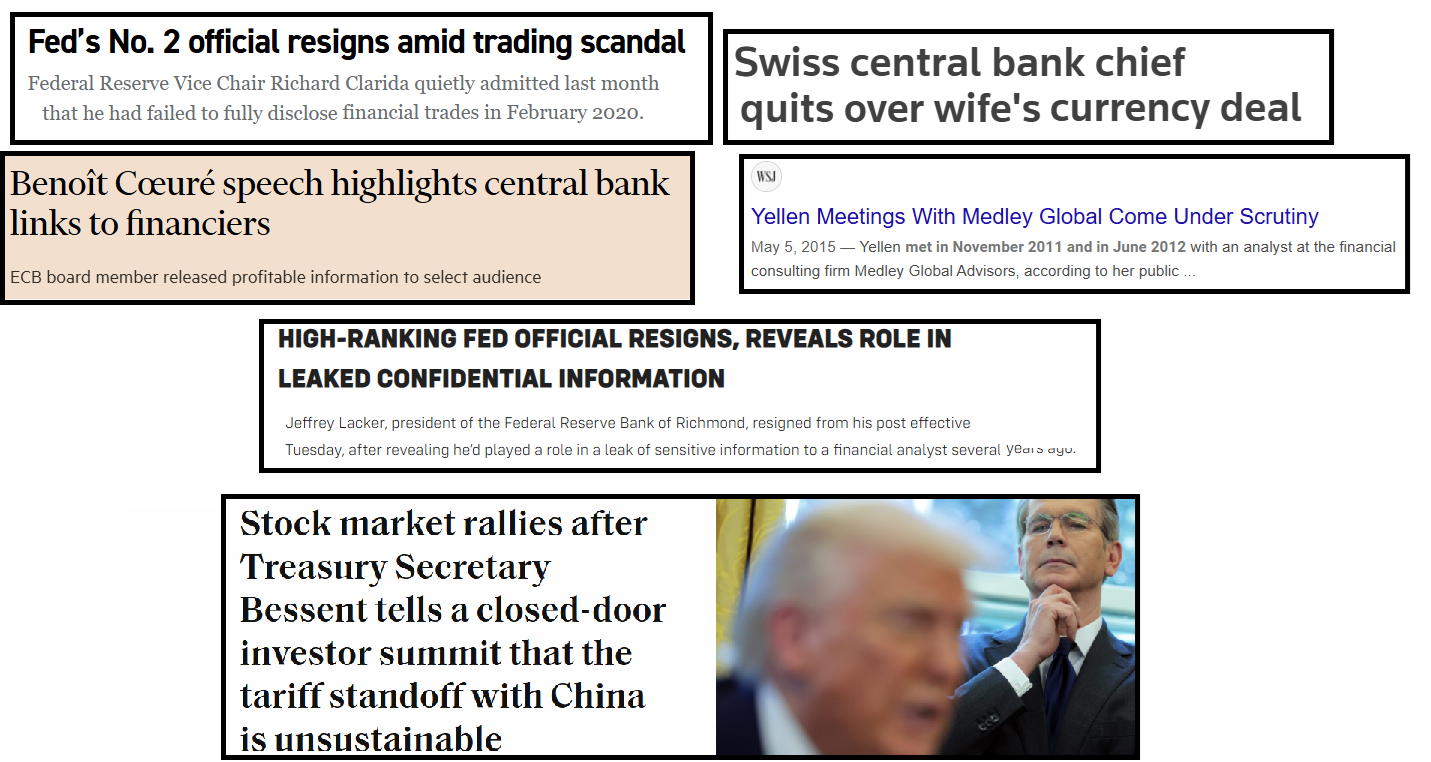

There is nothing new under the sun.

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.