The March FOMC meeting has some interesting nuance. Plus: Taiwan and US election info.

Degrossed

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

The March FOMC meeting has some interesting nuance. Plus: Taiwan and US election info.

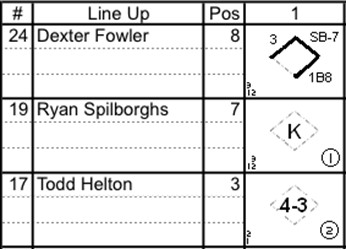

Riddle: What do potassium and a strikeout in baseball have in common?

January 10, 2024

The market’s Fed narrative is coalescing around a March announcement of a slowing in QT because reverse repo drawdown is front of mind, the BTFP expires March 11, and Lorie Logan said this on the weekend:

I’d note that the current pace of asset runoff is around twice what it was in the first half of 2019. And while the current level of ON RRP balances provides comfort that liquidity is ample in aggregate, there will be more uncertainty about aggregate liquidity conditions as ON RRP balances approach zero.

So, given the rapid decline of the ON RRP, I think it’s appropriate to consider the parameters that will guide a decision to slow the runoff of our assets. In my view, we should slow the pace of runoff as ON RRP balances approach a low level. Normalizing the balance sheet more slowly can actually help get to a more efficient balance sheet in the long run by smoothing redistribution and reducing the likelihood that we’d have to stop prematurely.

If you take the pace of reduction since the peak in April, and extrapolate it, you get a chart that looks like this:

NY Fed Reverse Repo Total O/N (actual vs. slope)

I have seen articles saying the thing will hit zero in June; my chart shows it hitting on May 21, so that window is the x-date for O/N RRP. The FOMC Minutes and Logan have turned the narrative to March reduction in QT, but that raises the question: Do they want to cut rates and do the QT thing at the same meeting? That’s perhaps unnecessarily aggressive in a world where they are pushing back against six cuts.

All of this is data dependent, obviously, but there is a pretty good argument for a combo of short USD and pay March FOMC or even: Short USD, paid March FOMC, receive December 2024 FOMC type of thing. If they are reducing QT, a somewhat complex communication challenge, just as they are trying to maintain optionality on rates, a super dovish March meeting message without a cut kind of makes sense.

We get Williams this afternoon, and while I put it in large font in the calendar, I suppose you could argue that we already heard from Williams doing post-FOMC meeting damage control for his boss on CNBC on December 15 and his views should be the same as they were then. The red headlines that day were:

*WILLIAMS: ‘PREMATURE’ TO BE THINKING ABOUT MARCH RATE CUT

*WILLIAMS: MKT REACTING MAYBE MORE STRONGLY THAN FORECASTS SHOW

*FED’S WILLIAMS: “WE AREN’T REALLY TALKING ABOUT RATE CUTS” NOW

*WILLIAMS: IF PROGRESS ON INFLATION, NATURAL TO NORMALIZE RATES

Ironically, given the hawkish nature of Williams’ comments on 15DEC, the real story today would be if he is dovish. This sounds ludicrous given he was trotted out to put a hawkish spin on the 3 cuts Fed vs. 6 cuts market divergence, but there have been plenty of ludicrous communication flip flops including that 13DEC / 15DEC one!

We have a long list of elections this year, with the first up this weekend in Taiwan. While Taiwan is at or near the top of everyone’s list of potential geopolitical hotspots, it’s hard to get overly excited about the short-term implications of this election. Here are a few pieces you can read if you’re interested. I offer a super tight excerpt or summary for each.

They all read kind of the same, like: This election is potentially a big deal in the bigger picture, but probably won’t have much impact for now.

“Taiwan’s elections are one of the most important geopolitical events in 2024,” Alicia Garcia-Herrero, Asia-Pacific chief economist at French investment bank Natixis, wrote in a recent note.

She said, however, that the economic policies of the three candidates “look very alike,” and are just “part of the story,” a notable difference being on energy, with the ruling Democratic Progressive Party’s (DPP) candidate Lai Ching-te being the only hopeful opposed to including nuclear power as part of Taiwan’s effort to reach its 2050 net-zero carbon emissions goal.

“The most important difference is about mainland China,” said Garcia-Herrero, who expects Taiwan’s economy to benefit from a more favorable tech cycle, with growth reaching 2.9% this year, up from slightly over 1% in 2023.

“Whether it can further outperform depends on if the election results can offer enough comfort to businesses and investors,” she said, explaining “why we need to assess Taiwan’s economic relations with mainland China, and the potential domino effects regarding policies from the election outcome.”

https://www.chinatalk.media/p/taiwans-election-explained

AI summary: Key points of contention include whether Taiwan and China are “part of the same family,” the nature of the controversial “1992 Consensus,” and whether Taiwan should engage with China based on functional issues or stand firm on principles without preconditions for dialogue set by Beijing. There are also some areas of agreement like the need to coalesce with democratic partners globally. Ultimately, the guests articulate the nuanced but distinct positions and priorities of the DPP versus KMT as Taiwanese voters prepare to head to polls.

Taiwan: Elections with Outsized Importance (State Street)

Opinion polls in the run-up to the election indicate a likely victory for the DPP in the Presidential election despite a significant proportion of undecided voters, but there is rising expectations on an opposition victory in the legislative election, an outcome that would temper many regional fears around Taiwan’s political status. This would also be the most favourable outcome for markets, including the Taiwan dollar (TWD), where a stronger showing by the opposition would cap any fallout from the event risk around the elections. Investor concerns around the elections look muted with strong cross-border equity flows and an extreme TWD overweight in place.

All in all, it feels like people want to be excited about the election in Taiwan, and it probably has important ramifications for the future… But not much impact now.

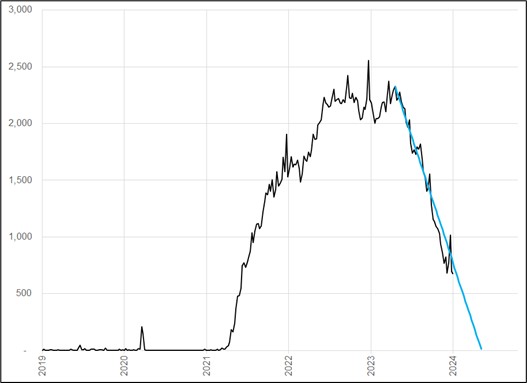

The theme for USDJPY in 2024 is the same as 2023:

Still, the performance of USDJPY vs. yields is impressive.

USDJPY vs. US 10-year yields

I noticed yesterday that USDJPY enters a seasonally weak period here from now until January 15th, but a significant portion of that effect comes from the simple fact that US Retail Sales (normally released between 10JAN and 15JAN) missed like crazy during the secular stagnation period (it missed most months, and almost every January). The seasonal effect is superficially strong, but seems mostly US data-related so I’m not sure it means much right now. Just to give you an idea, 12JAN has been up 2 times and down 15 times since 2000 (!)

The prevailing consensus and gambling markets are pointing to a big Trump lead in the 2024 election race. Early favorites have done poorly in many elections I can remember including:

Elizabeth Warren, odds to win the 2020 Presidential election (mid 2019 to mid-2020)

https://www.vox.com/2019/10/8/20905274/elizabeth-warren-frontrunner-democratic-nomination-2020

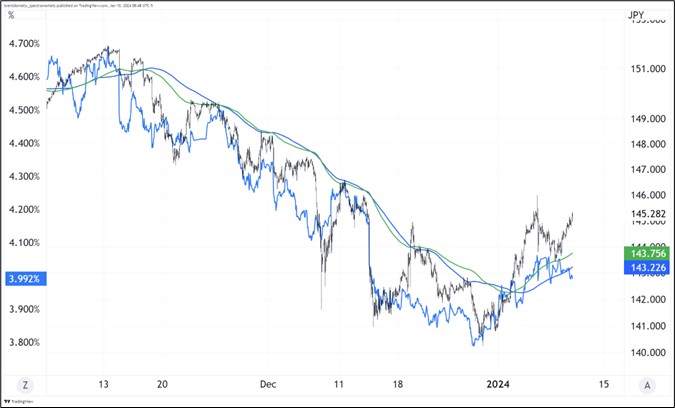

I have no view on the election, but obviously I’m following it because of the market implications. This video from Peter Zeihan offers a strong counter to the assumed Trump victory. I don’t have the political expertise to judge his analysis, but I do find he’s generally good, smart, unbiased, and pragmatic. So his conclusion (that the Democrats will probably end up winning by a wide margin) is intriguing.

The video is short, and worth the 7.3 minutes, but here’s the key screenshot. If you have any rational, non-partisan arguments for why he is wrong, I am interested!

Have a symbolic day.

Strikeouts and potassium are both denoted by the letter K.

Why is a strikeout called a K?

From Wikipedia: The use of “K” for a strikeout was invented by Henry Chadwick, a newspaper journalist who is widely credited as the originator of the box score and the baseball scorecard. As is true in much of baseball, both the box score and scorecard remain largely unchanged to this day. Chadwick decided to use “K”, the last letter in “struck”, since the letter “S” was used for “sacrifice”. In the 1860s, it was common to say a player “struck three times” when they went down swinging, so Chadwick picked the last letter in “struck” to represent the strike out.

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Taking profit on the USDJPY and looking for a way to get short GBPUSD for corporate month end.