Powell was hawkish now he’s dovish

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Powell was hawkish now he’s dovish

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Jerome Powell has had a change of heart. July 30th, he was saying that breakeven levels of employment are low and inflation is an issue. Two days ago, the FOMC Minutes said:

“A majority of participants judged the upside risk to inflation as the greater of these two risks, while several participants viewed the two risks as roughly balanced, and a couple of participants considered downside risk to employment the more salient risk.”

“Several participants noted concerns about elevated asset valuation pressures.”

Today he decided that employment is actually totally the bigger concern and so inflation is fine. It’s a bizarre volte face that has the conspiracy theorists wondering is a squadron of FBI drones did a flyby over Powell’s family home. Regardless of your view of whether he should be hawkish or dovish given the current state of the economy and financial conditions, it’s hard to argue that inflation has cooled in the last three weeks and is therefore not a problem. You can definitely look through the inflation if you are worried about the jobs market, but Powell has been reaffirming the idea that the labor force is in balance because the immigration crackdown and other factors are reducing the supply of labor as demand falls.

Anyway, here we are. 52 months in a row of inflation above target and they are confident enough in their estimate of r* to say rates are restrictive even with credit spreads tighter than 1999 and stocks on the moon, etc.

If they are correct, they’ve made one hell of a call that inflation will be transitory. If they are wrong, we are going to have an inflation, high wages, and operating margins problem in 2026. We will see!

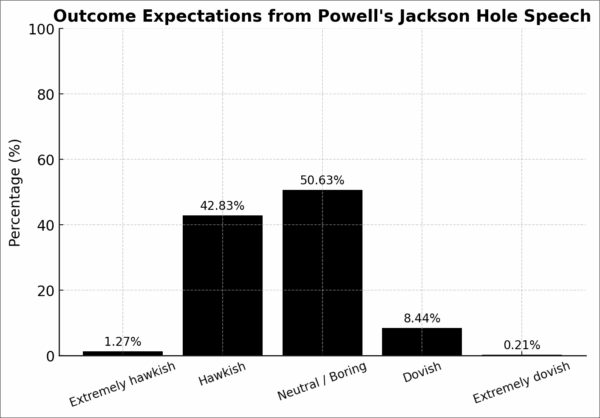

The craziest thing going into Jackson Hole today was the unanimity of consensus. I have been running event surveys for more than 20 years, and I don’t remember an event ever being so skewed. This is not hindsight, I wrote about it in am/FX this morning and pumped it on Twitter and LinkedIn. Look at this survey result:

Numbers don’t quite add to 100% because a couple of people answered the same question twice

Normally, these things might be split 60/40 or so and this one was 43/8. Unreal. This shows how poor the Fed communication has been and how this Powell speech is quite the flip flop from past comms.

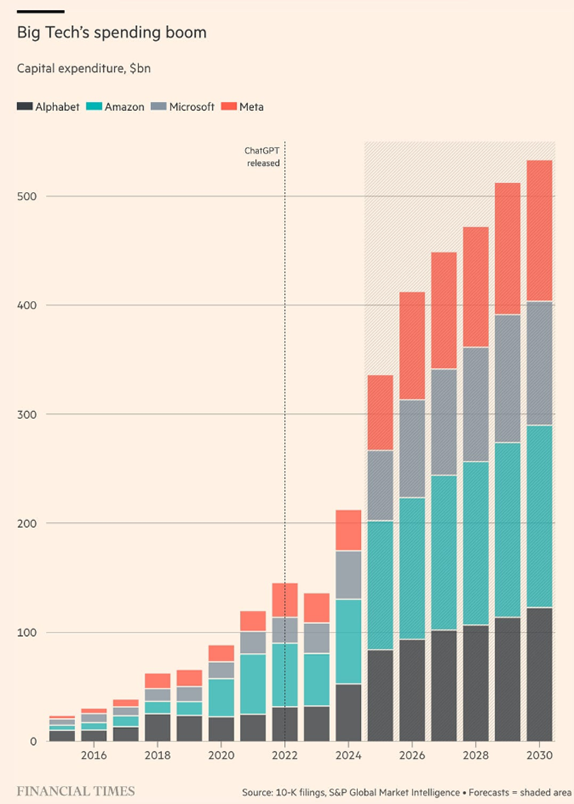

Needless to say, the zippy momo unwind that was the theme of the week did a V-shaped reversal on the news. We spent most of the past few days worrying about whether Palantir had finally topped and NVDA was stalling and MIT put out a report saying that the payback is a B when it comes to AI.

https://web.archive.org/web/20250818145714/https:/nanda.media.mit.edu/ai_report_2025.pdf

But all that was blown to smithereens by a dovish speech delivered to a hawkish crowd.

Next week, all eyes will be on NVDA.

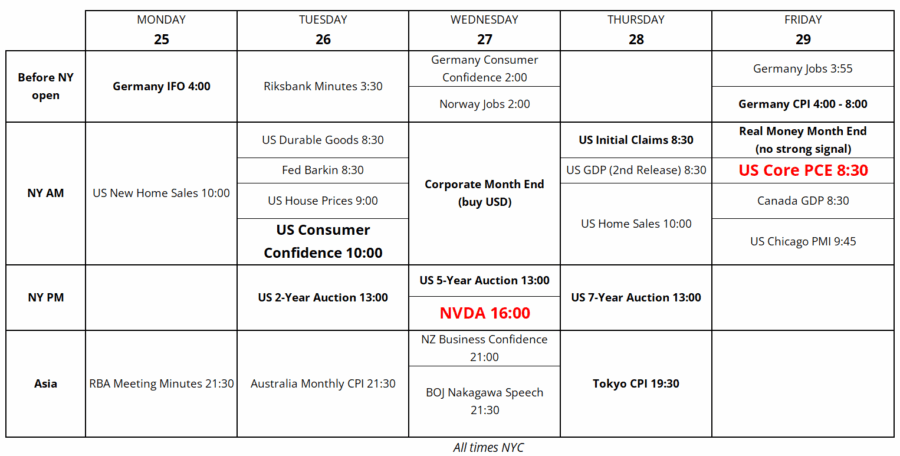

Trading Calendar for the final week of August 2025

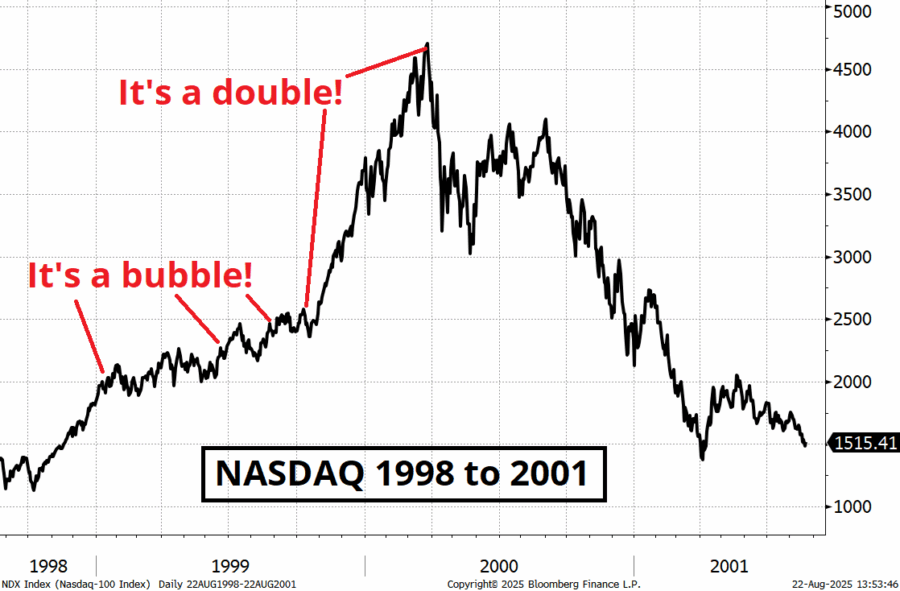

What you’ve got here for now is a Fed that has decided, out of nowhere, to run it hot, despite 52 straight months of above-target inflation and zero clue of where the neutral rate might actually be. While earlier in the week we were comparing markets to 2000, maybe 1999 is the more apt comparison as the Fed juiced an already-juicy bubble with massive liquidity as Y2K insurance, leading to a 2-bagger in the NASDAQ in exactly one year.

I don’t want to overreact to one day’s worth of rhetoric, though. The Fed could pivot back to a hawkish stance if NFP and CPI come in strong in early September. When you hold two compasses in your hands, and one points north and one points south, you will often find yourself getting lost. Wandering aimlessly. Going off target. Such as the beauty of the dual mandate. You can always pick which one you like best on any given day.

This might all sound like the sour grapes of a guy caught short, but that’s not the case here. I was short at 7 a.m. this morning and when I saw the crazy skew of the survey results, I squared up pre-JHole. If you want this kind of info in real-time, sign up for am/FX. We saved some clients decent cash today with this survey information.

Click on the ad to subscribe. If you’re not happy, just email me and I’ll refund you. Risk free. Unlimited upside.

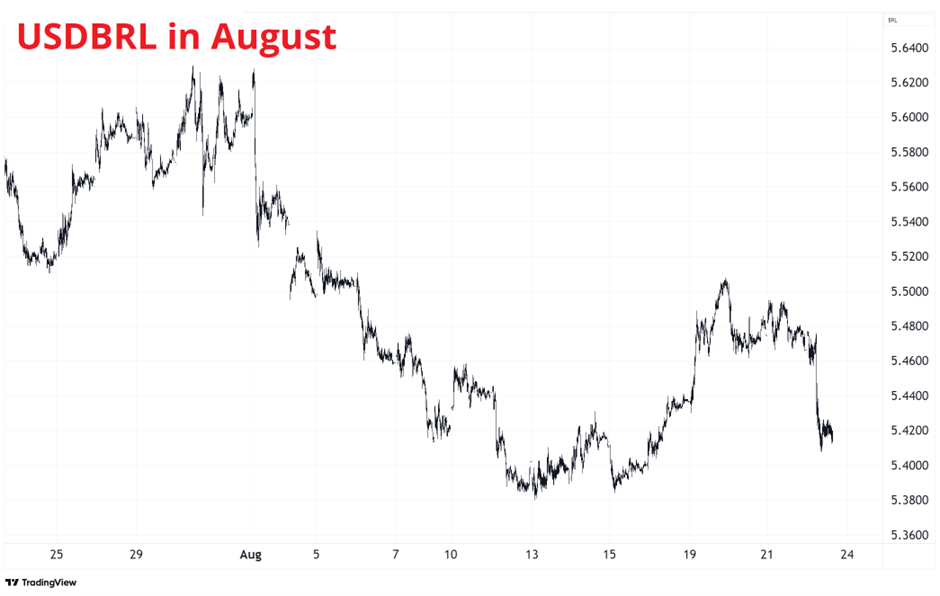

Run it hot is good for just about every number on every screen in every asset class, except long end bonds. Carry is ripping (USDBRL back to the lows, for example) and all the bombed out momo stuff has come raging back. The technical damage to PLTR and other memestocks might be too much to bear in the bigger picture, but for now everybody is back in the pool.

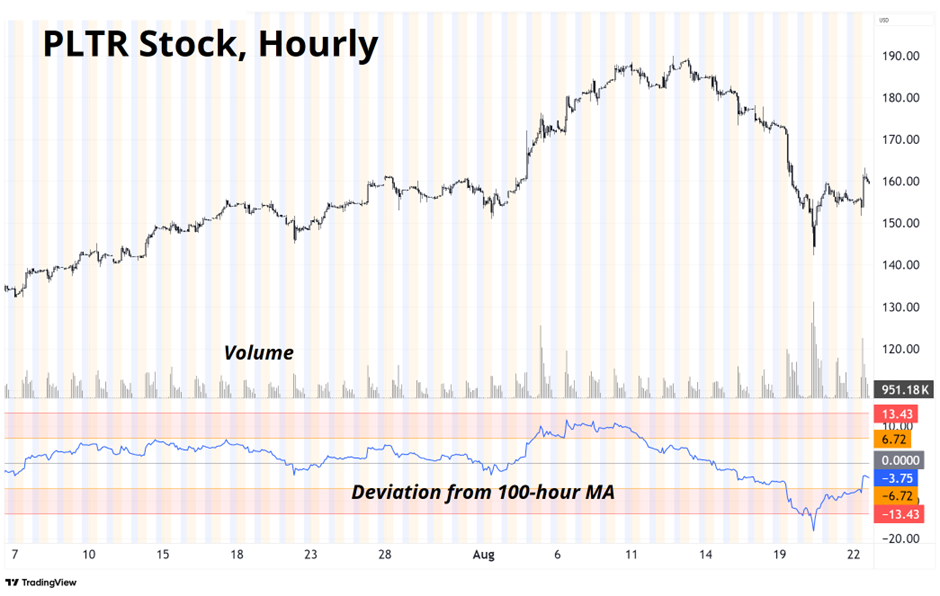

Palantir did a perfect textbook reversal on the lows with a mega volume spike and extreme oversold deviation from the 100-hour triggering at the exact same time at $146. This is not hindsight, I posted it on Twitter in real time. Volume spikes are excellent indicators of capitulation.

Note how hourly volume touched a 1-month high as the deviation from the 100-hour was punctured to the downside. And then whoosh. Back the other way. It’s not exactly exploding back to the all-time highs yet, though is it?

Citron compared PLTR to OpenAI and did not like what he saw:

https://citronresearch.com/wp-content/uploads/2025/08/OpenAI-at-500B-Puts-Palantir-at-40.pdf

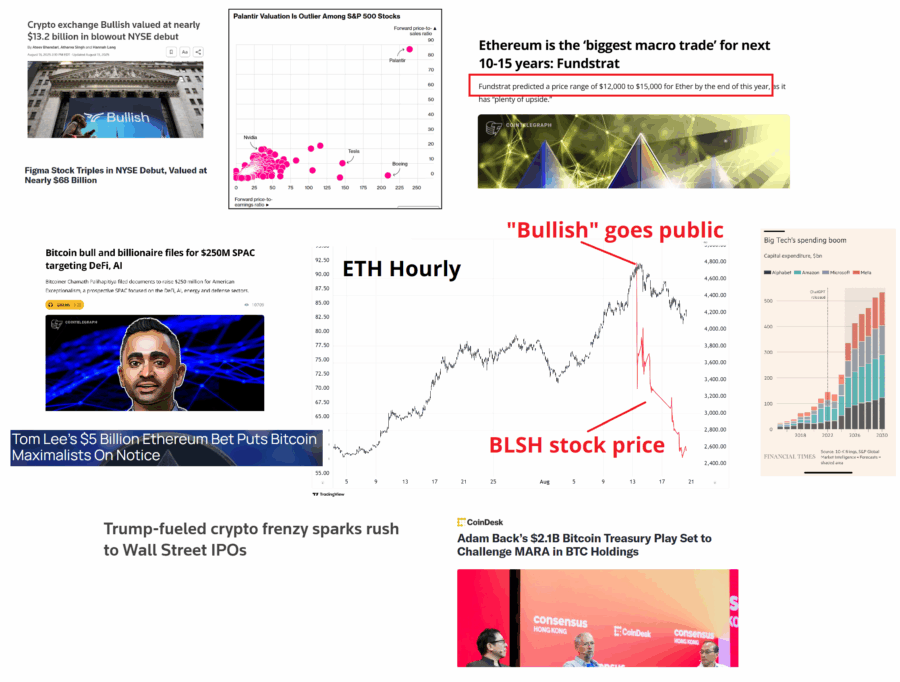

With today’s rebound, it’s easy to forget all the signs of AI and Crypto bubbliciousness that popped up over the past few weeks. I mean, a company called “Bullish” with a ticker one letter short of bullsh*t (BLSH) went public. Crazytown.

Maybe we can worry about all this stuff again when we tickle a new ATH. Note that I created the following scrapbook page before Powell, and ETHUSD is up a cool 13.13% today. Got triskaidekaphobia?

Here is this week’s 14-word stock market summary:

Momentum unwinds trigger fear trade, but Powell steps in to BTFD.

Blame it on the range that was slowly coiling.

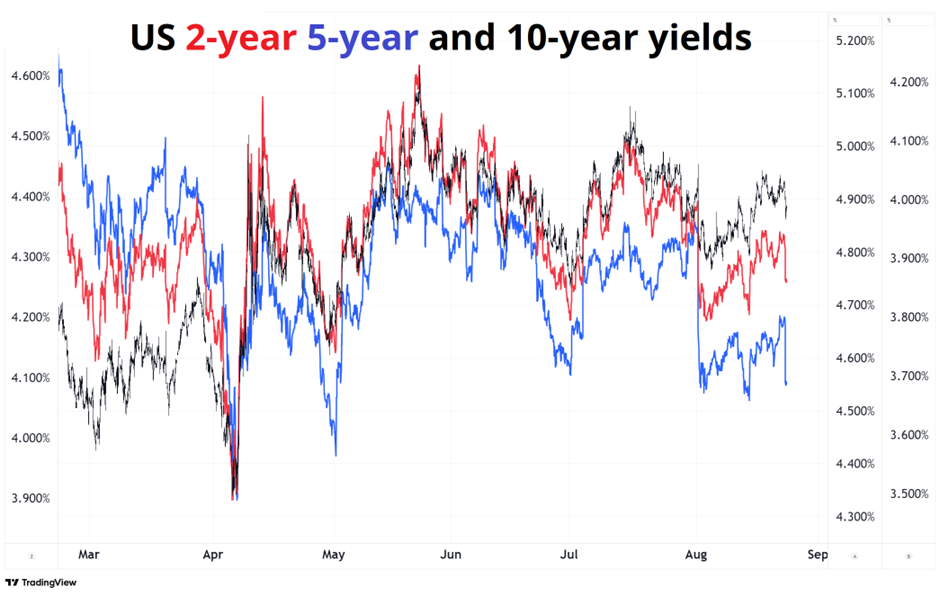

Unless you’re trading short term events or maybe some particular parts of the curve, interest rates have been a Debbie Downer for all concerned over the last six months as they trace out familiar ranges. We are getting all excited about a 25bp cut in September, but that has been more than fully priced a few times. And then unpriced and repriced. Yields are pretty much going nowhere. I refuse to make up a narrative when there really isn’t one. It’s all crosswinds…

Inflation is sticky. The Fed is all over the place. Growth is OK but not stonking. The jobs market is in balance but weakening. Debt is out of control but it has been for 10 years and will be for the next 10 years. Nothing to do in rates right now.

If you believe that the federal government and the FOMC have decided to continue to run things hot, and 3% is the new 2%, lower FX vol, strong carry performance, and mixed USD performance is the likely outcome. Accommodative central planners in the US make for yield-hungry risk-seeking investors. The USD is on the back foot after Powell today, as it should be, and the market is pretty close to flat. There is room for the market to reengage short USD and take EURUSD to 1.20 at some point soonish. Given the number of false starts, it’s a hard trade to put on.

Meanwhile, this 5-minute chart of USDBRL kind of sums things up nicely.

Brazil often struggles in August as the USD tends to rally and volatility tends to pick up, but none of those things have happened in August 2025. And there have been some negative headlines in Brazil, too, including a clickbait unsourced article saying that Bolsonaro would not endorse Tarcisio. The market has shrugged it all off and we are back down here pumping out carry and FX appreciation again.

These are the onshore odds for the 2026 election in Brazil right now:

*ELEIÇÕES 2026*

TARCISIO 33/36

LULA 31/34

RATINHO 6,5/9,5

FLAVIO 4/7

BOLSO 3/6

MICHELLE 3,5/6,5

HADDAD 3,5/6,5

ALCKMIN 1/4

EDUARDO 0,5/3

ZEMA 1/3,5

Tarcisio trades lower offshore for a variety of reasons, but he’s still in the mix however you measure it.

I have a feeling AUD is going to start performing soon as the mood music out of China feels slightly better these days and everyone has finally given up on the Oz as a viable short USD alternative.

USDJPY is a chopfest.

Accommodative Fed policy is gasoline on the crypto fire, and there is no real reason to take the other side right now. I do feel like bigger picture, the Crypto DAT fad is slowly burning itself out as the infinite supply of MSTR copycats is done generating infinite demand for ETH and BTC. While the ability of companies like BMNR to generate yield via ETH (in contrast to the zero-yield ETFs) is a theoretical reason to own the stocks, they are still offering $1 bills for $2-$4 each and so yippee about the 3% or 4% yield.

I have been vocally bearish the crypto DAT mania for six weeks or so, but most of the juice is gone from those trades as the dumbest ones all collapsed already and CRCL cratered post-Crypto Week on buy the rumor sell the fact. So I am flat the crypto DATs for now and looking to sell rallies, even as I am neutral on the coins themselves.

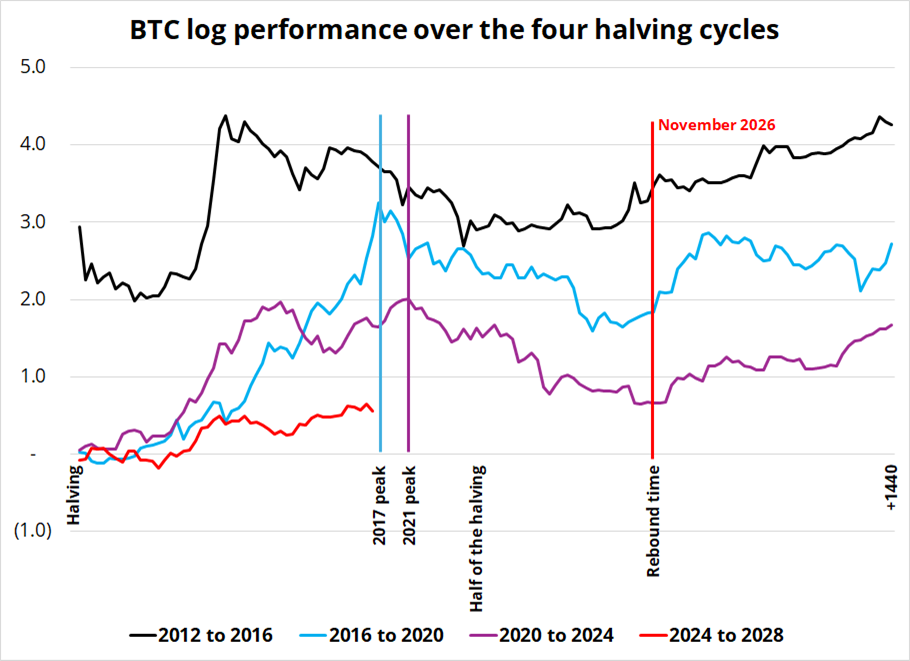

I guess if you really want a reason to be bearish crypto, there’s a double top at 124k in BTC and we are entering the crappy part of the halving cycle as you can see here:

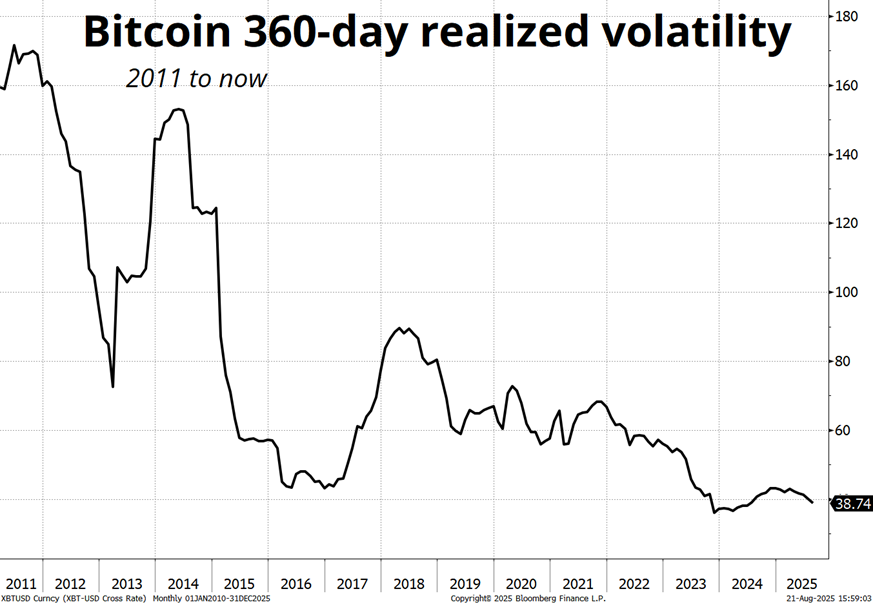

The takeaways here are that we are about as far into the halving cycle as we were when BTC topped in 2017 and 2021, and each cycle is less juicy than the prior one because volatility goes lower as the asset class gets larger. What was once a fringe libertarian price discovery asset play is now a fully institutionalized boomercoin / government plaything.

It is pretty much a law of finance that as market cap increases, volatility contracts. BTC is no exception. So I suppose if you were long a cartload, you might be a bit worried about a 2017 and 2021 threepeat. But for now, Powell is flooding an already-flooded market with more liquidity.

Corn is working a bit as the plunge after the USDA report has fully reversed. But it’s a boring trade and my patience is limited. Also, CORX, the terrible, terrible 2X corn ETF is a mega short carry trade due to rolldown, high fees, and general badness. So if we don’t make a move up towards 11.80/12.00 soon, I’m out. And if we do: I’m out.

I am also bullish silver, because it traded incredibly well during the big unwind of momo plays and has been looking solid even when gold does not. I think the market is bored of gold, China has stopped buying and silver and platinum have become the cheaper, more fun alternatives. Silver to $41/$42 next week and I’m out.

That’s it for this week.

Get rich or have fun trying.

*************

https://fakepixels.substack.com/p/market-of-words

*************

https://www.thefp.com/p/social-media-shortens-your-life-heres-how-to-get-time-back

*************

I bought some 57.50/60.00 Cracker Barrel (CBRL) call spreads as I would guess they will roll back to the old logo soon. Not investment advice.

https://www.newsweek.com/cracker-barrel-logo-maga-conservative-social-media-viral-2116817

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.