The NASDAQ almost got there, then fell off

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

The NASDAQ almost got there, then fell off

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

I wrote last FSR that we might see a summer snoozer this week, but that was wrong. In fact, we had some zippy moves on the back of both macroeconomic and geopolitical newsflow. I will start with geopolitics.

The longer you are in the business of financial markets, the less sensitive you become to geopolitical news because most of it is noise that creates temporary risk premium and then a reversal of that risk premium. For example, Iran started its nuclear program in the late 1990s and the world became aware of it in 2002. Since then, there have been countless conflagrations, accusations, and disputations around the program and its evolution. Many of those triggered temporary risk aversion because the worst case is horrifying and so:

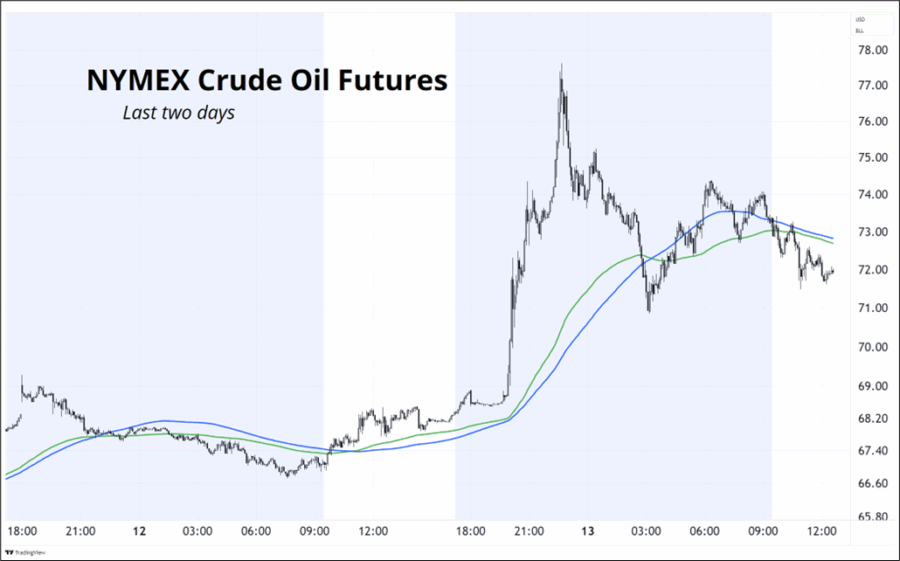

Let’s see what oil did last night:

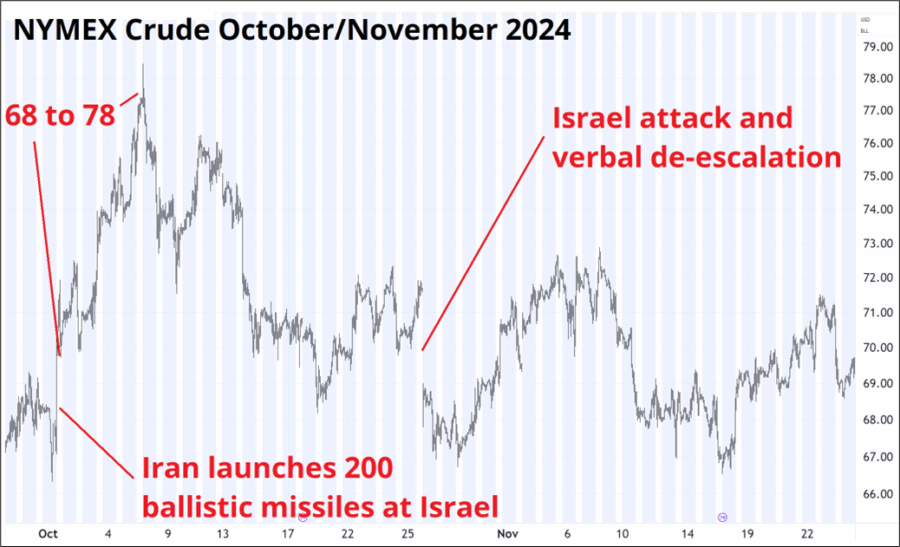

The model I suggested is what we saw happen. In October 2024, the newsflow was close to identical. Iran and Israel fought. And here’s what oil did:

The exact same thing! The move in October 2024 took longer, but it started and ended at the same place. $68 to $78. Fading these geopolitical dustups is the correct play about 95% of the time, because the worst-case scenario rarely comes true. Usually, cooler heads prevail, and we go back to counting the AI capex billions.

But it’s important to understand that fading these moves is the equivalent of selling a 5-delta option, so you need to have proper risk management in place. This is part of the reason stocks often sell off into the close on Fridays during geopolitical risk aversion: You can’t stop out of a bad trade on the weekend. Going short oil right now with an automated stop loss in the system (something I did this morning using the ETF: UCO) is fine during the day because you have fairly high certainty around how much money you are risking on the trade.

But if you go home short oil today and it opens at $114 on Sunday, you’re pooched. You can use options, in theory, but those are going to be overpriced during a flareup for the same reason oil is overpriced. The skew, vol, and convexity all work against you. So, a better strategy is to either square up before the weekend and chill, or sell volatility with controlled downside via spreads. For example, a trade I just did:

USO : Sell 18JUN 79 calls and buy 18JUN 80 calls (USO reference price $79.50 when I traded, currently $80.80 as I am about to hit send). I earned 45 cents for this trade, while my max downside is $1 for a maximum loss of 55 cents. You don’t get leverage from a trade like this, but you’re short oil and you know what you’re gonna lose if you’re wrong. Going home short USO on a Friday with Israeli planes buzzing over the Middle East might be positive expected value but it’s a bad trade nevertheless because of the gap risk.

Eliminating risk of ruin is more important than maximizing expected value because you only live one life on one timeline of the multiverse. SBF had this concept wrong and ended up in jail. Famous option sellers like Victor Niederhoffer had this wrong and ended up rekt. Risk management comes before return maximization. Take me down to ergodicity, where the grass is green but the tails ain’t pretty.

Take. Me. Home.

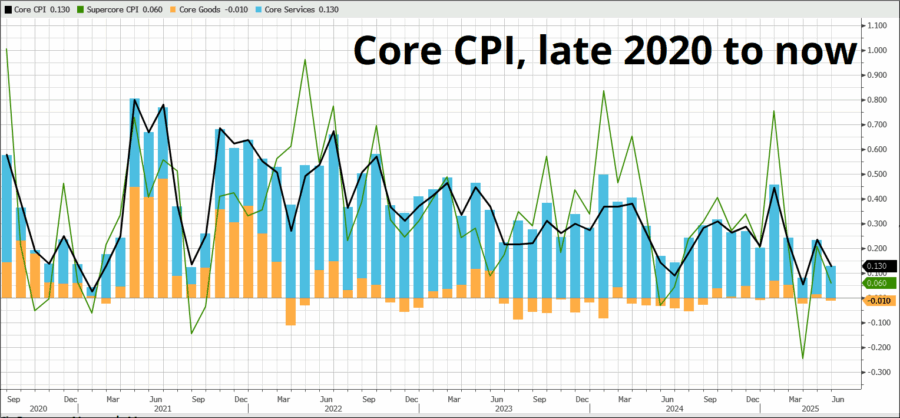

Moving on to the macro, inflation data in the USA remains subdued despite tariffs because services inflation is contracting and goods inflation is not rising. See here:

PPI confirmed that there is little if any reignition of the inflationary impulse in the system so far due to tariffs, but it’s still early. Tariffs started mid-April and this is May data. Still, economists were looking for a higher figure than the one that came out, so however you slice and dice it, inflation is better than expected in the USA for May.

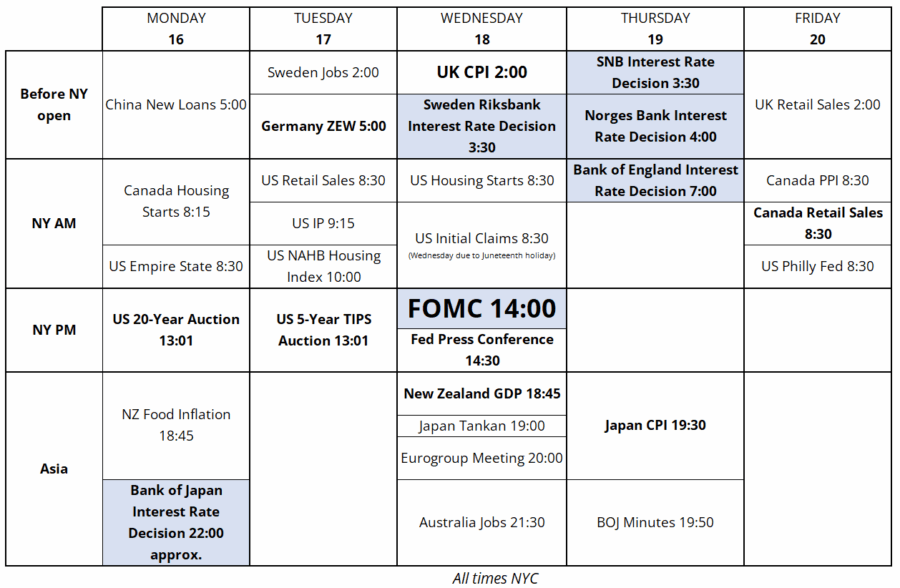

Bonds liked the news, but despite some good auctions this week they could not hold a bid and continue their one-year-plus-long random walk. Next week we get a flurry of central bank excitement with six major central bank meetings in G10. Fun.

Here’s the calendar:

HEY! LISTEN!

If you want to be in the know on macro on a daily basis, click on this rectangle and sign up. If you don’t like it, I’ll give you all your money back at any point. This is the very rare risk-free trade.

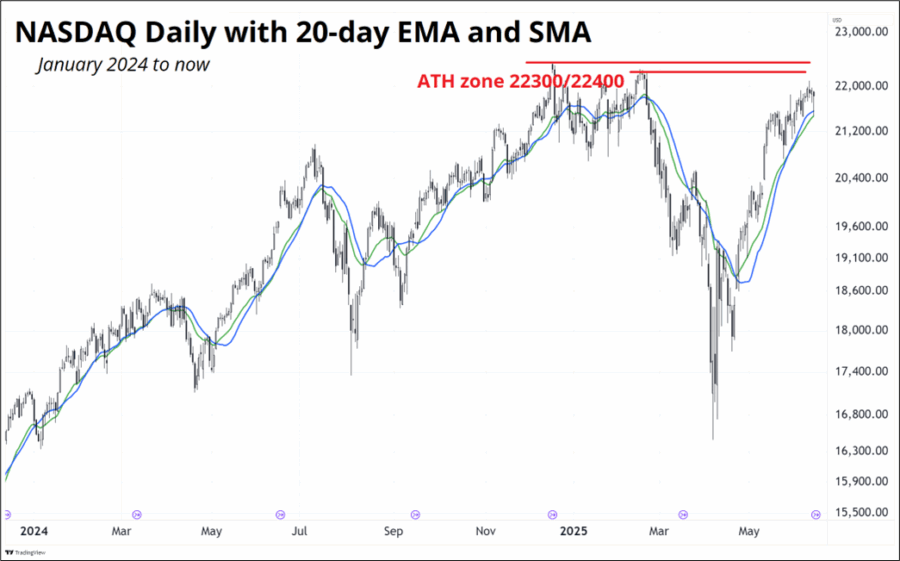

The American stock market took a break from its march back towards the all-time highs this week as we bumped into massive technical resistance just before Israel bombed Iran. This leaves a chart that might make bears salivate as you have a nice ATH double top to sell against.

I am less inclined to the bear side with the AI theme back in command, a potentially dovish Fed meeting next week, a weak USD tailwind, positive seasonality, and a market nicely cleaned out on probably-meaningless geopolitical news.

It’s hard to dismiss the geopolitical stuff without sounding flippant. I do not discount the importance of this stuff for the world, the inhabitants of the area, or the future of global alliances; I just think it’s very highly unlikely that the Middle East news that came out overnight will have any meaningful impact on technology spending, corporate earnings, or the US economy. I am always open minded, and if Israel doubles down by attacking oil infrastructure, I will change my mind.

Here’s the big bad chart of the NASDAQ:

Note the perfect touch of the 20-day moving averages overnight and stern rejections thereof.

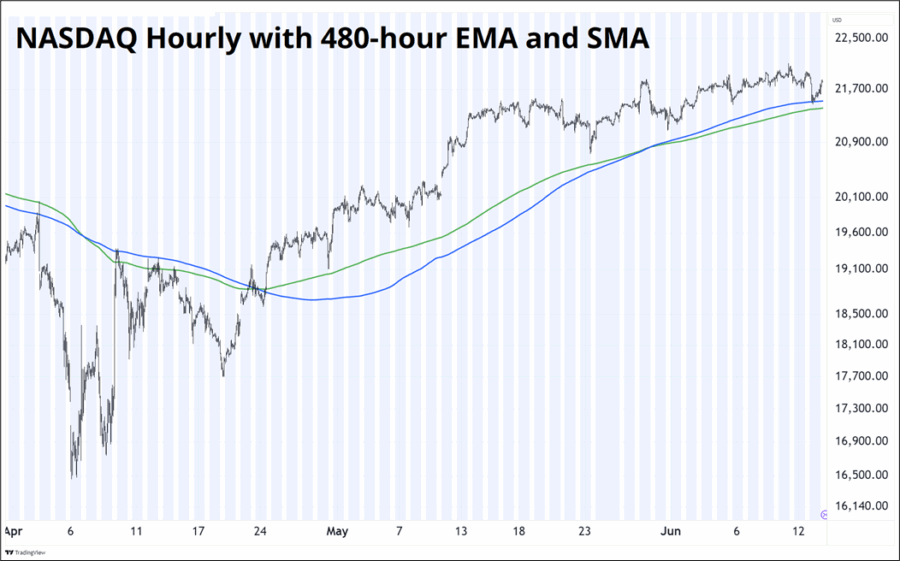

For your viewing pleasure, let’s zoom in on today’s rejection. I will show an hourly chart and in order to approximate the same moving averages, multiply 20 days X 24 hours to get 480.

‘Tis but a flesh wound.

This week’s 14-word stock market summary:

NASDAQ no-fly zone likely to be challenged by a dovish June Fed meeting.

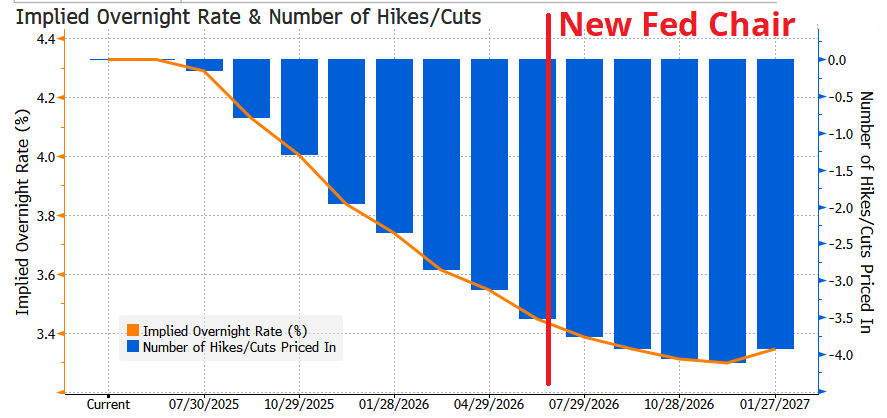

If you listen to the podcast with Macro Alf this week, you will hear some discussion of why I think the Fed will sound dovish at next week’s meeting and could be ready to cut by July.

Here’s a writeup from am/FX earlier in the week that explains my logic.

CPI came in low again, confirming evidence from State Street’s PriceStats, and it looks like tariff passthrough is minimal to zero for now. Prices of some things are going up a bit due to tariffs while prices of other things are going down due to softness in demand, cheap oil, and cooling services.

This is happy news for USD bears and carry bulls and now that we are through the bulk of the workhorse US data releases for the month of May, the bears will have to wait another month for the much-anticipated doom and gloom to appear in the real world. The impact of economic uncertainty and tariffs on real economic data has just not been big so far. The only place it’s showing up is in the sentiment data, and since equities are ripping and inflation remains low, I suppose the sentiment data might just catch back up. With the AI and quantum computing themes reborn of late, positive equity seasonality strongly in place until the end of July, and room for the market to price more aggressive Fed cuts, even from here… It’s going to be a long wait for the bears before we get the June data. And it might be fine too.

The Fed remains quite tight and if they finally decide it’s time to move, there could be plenty of justification for Fed Funds 100 points lower in 12 months. Current pricing is for three 25bp cuts by this time next year. Separately, the market will soon need to price a kink in interest rate options skew after May 2026 because the new Fed Chair is likely to be an überdove. The distribution of possible outcomes should look nonstandard after that date as some weird outcomes involving rapid, deep cuts become more possible.

Maybe this is just fanciful thinking, and the board will keep the new dove in check, but I doubt it. We are moving more and more towards central planning of the economy as rapidly rising debt forces the US government towards wave upon wave of financial repression.

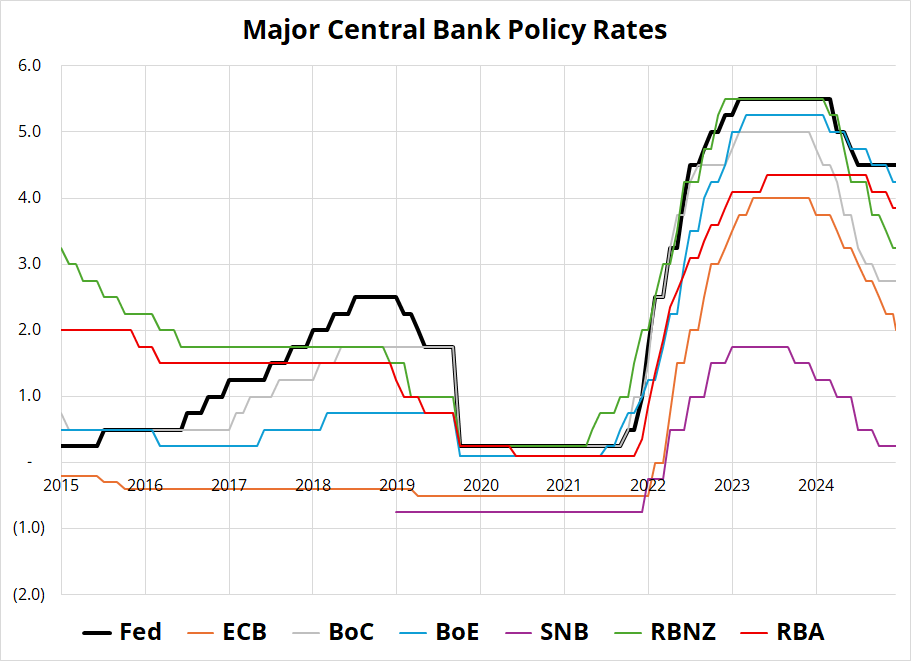

If inflation is rolling over in the US and economists (and the market) have overestimated the inflationary shock from tariffs, Fed Funds are quite high. Neutral is closer to 2.5% or so, depending on how you measure it. The rumors of Scott Bessent as future Fed Chair are also intriguing. Global policy rates tend to move as a pack, and the Fed is behind its peers due to USA-specific uncertainty and higher, stickier inflation. I would attach a higher weight to upcoming Fed speeches—a dovish pivot might be on the horizon soon.

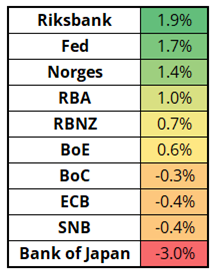

I have been mentioning how Fed policy looks tight relative to peers and if you do the simplest calculation of real policy rates using core inflation, you can see that the Fed and Riksbank stand out. The scaling of the y-axis is wide because of the megaloose policy after COVID and subsequent recalibration, so after the chart I have included a table of the current readings.

That Bank of Japan number stands out, obviously, as they have been incredibly slow and reticent to adopt an orthodox policy stance, even with rice prices exploding, a weak currency, and inflation above 3%. There is essentially nothing priced in for BOJ, BoE, Norges, or the Fed while the SNB is priced for 25bps (with a 25% chance of 50bps) while the Riksbank is 80% priced for a cut. Short EURSEK and USDSEK have been popular expressions of the short USD and long Europe trades and there is some risk that an extremely dovish Riksbank could lead to a painful selloff in SEK.

I continue to believe that next week’s FOMC meeting will sound dovish and set the table for a cut in July. The July meeting is currently only priced at 23% and I think that can go to 70% pretty quickly.

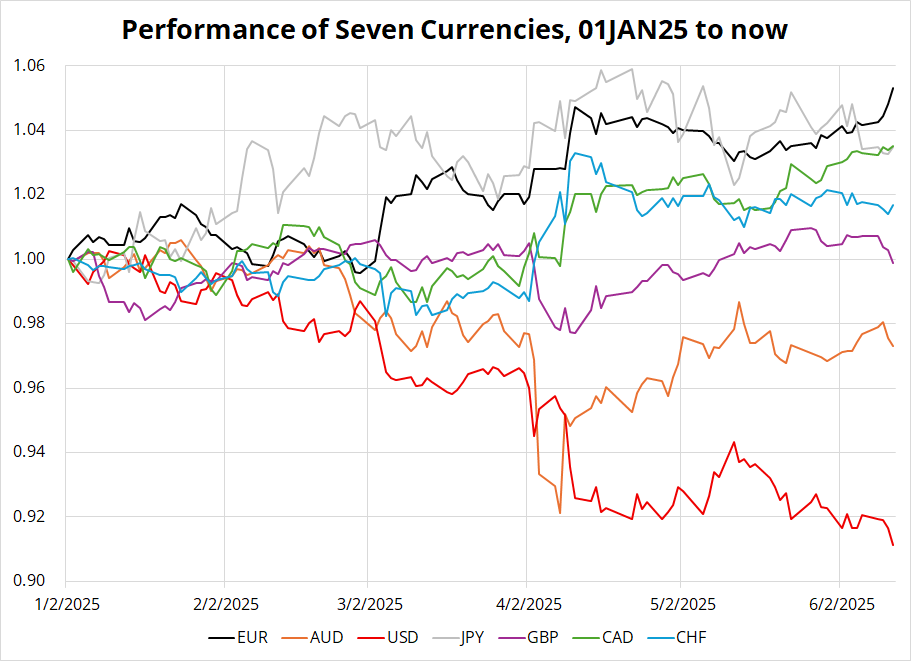

There has been striking dispersion in the performance of G10 currencies this year as the euro rips while the USD swoons and AUD is particularly soggy for reasons that are hard to understand. USD/Asia has tumbled, risky assets have been fine, commodities have held in, and emerging markets have been in favor and yet the Oz cannot buy a bucket.

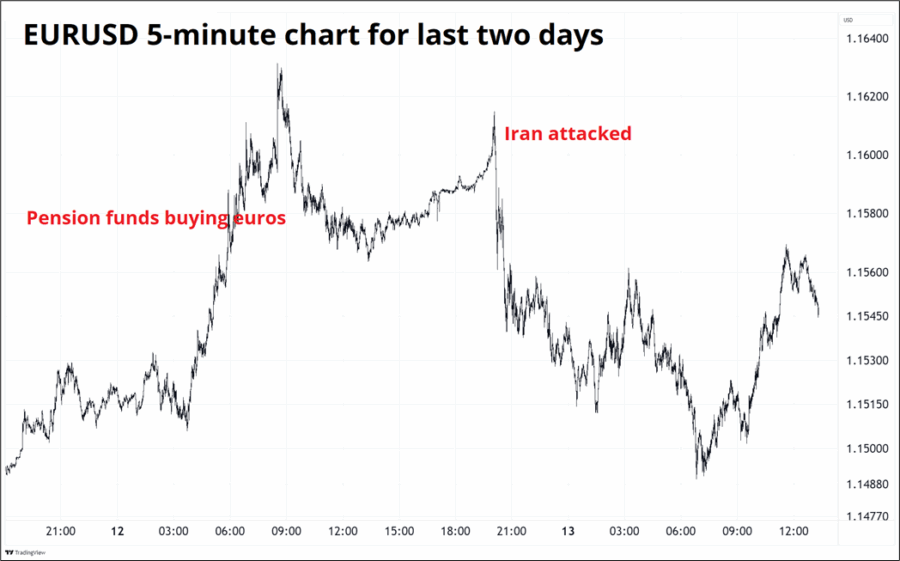

Nobody knew what to do with FX when Iran got bombed last night, and so after a quick attempt to sell the USD, the market decided to cover all existing positions and head for the sidelines. The market has been playing short USD via long EURUSD, so that pair got smoked on position squaring.

The overall theme is still foreign pension funds increasing their hedges by selling USDCAD and buying EURUSD, but the Middle East stuff threw a stick in the spokes for today. Bigger picture, the EUR still has many nice qualities from a macro perspective, while the USD has few.

The EUR theme has solid footing:

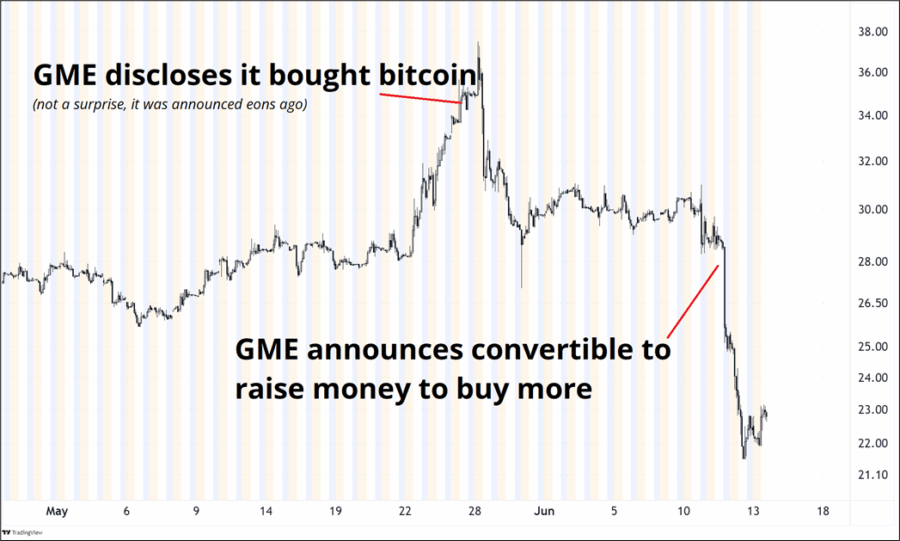

I don’t give financial advice, but last week I said please don’t buy the copycats trying to replicate MSTR. They are almost certainly bad investments, even if bitcoin goes up. When you buy GME and friends, you are buying 1 bitcoin for the price of 2 bitcoin and getting a money-losing business staplegunned to your midsection as a bonus.

The market is beginning to understand that in a world where there are spot ETFs and MSTR, you don’t need 100 other copycats yelling “me too!” This week GME did a convertible to raise money for their bitcoin buying efforts. Here’s how that went:

You can make an argument for MSTR (financial engineering) or for bitcoin (bulletproof risky asset with a new bull thesis every year) but you cannot make the argument that 1 BTC is worth 2 BTC. Only Michael Saylor can make that argument. It’s like some other artist trying to be like Kanye. There’s only one Kanye. Don’t bother trying.

A few people took my rant last week as a bearish comment on MSTR or BTC but it’s not. I am bearish the copycats and look for opportunities to short them or sell inflated call spreads. I am actually long MSTR right now as a dovish Fed play because the premium to BTC has come in and the market seems kind of bored of the MSTR game. Not investment advice. I change my views and positions like a degenerate overtrading squirrel so please always keep that in mind. I share my ideas to help you come up with your own ideas. Unless you edge is: I copy other people’s ideas and execute them better than the people I copy… You should always trade your own view.

Platinum got crowded, as you can plainly see by the price action after the Iran attacks. Gold went up 50 bucks and platinum went down 69 dollars and that probably tells you everything you need to know about platinum positioning. After a multi-sigma run, it’s done. We already talked about oil earlier and now I’m >2500 words here so let’s stop here.

That’s it for this week.

Get rich or have fun trying.

*************

In late 2024, a group of biologists stopped their work and asked colleagues to do the same. They were worried that their research on “mirror life”—cells and organisms with artificial mirrored versions of DNA and proteins—could create bacteria that would be so unidentifiable that immune systems would fail to recognize them as warranting attack. Even though the research on mirror DNA and proteins was promising, these scientists decided the risks to continuing their inquiry were too high.

https://daily.jstor.org/the-legacy-of-asilomar/

*************

This next article is written by F. Flam.

The expression “flim flam” is a term for nonsensical or insincere talk, or, to swindle … But given this is from Bloomberg, I assume this is not a late April Fool’s gag.

We Should Worry About Fungi Spores From Near the Edge of Space

*************

This is perfectly executed.

INSANE Beat box version of Better Off Alone

*************

Sane finance article from a sane finance writer.

https://awealthofcommonsense.com/2025/06/what-if-stocks-dont-go-up-in-the-long-run/

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.