Silver has its 1987 moment

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Silver has its 1987 moment

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

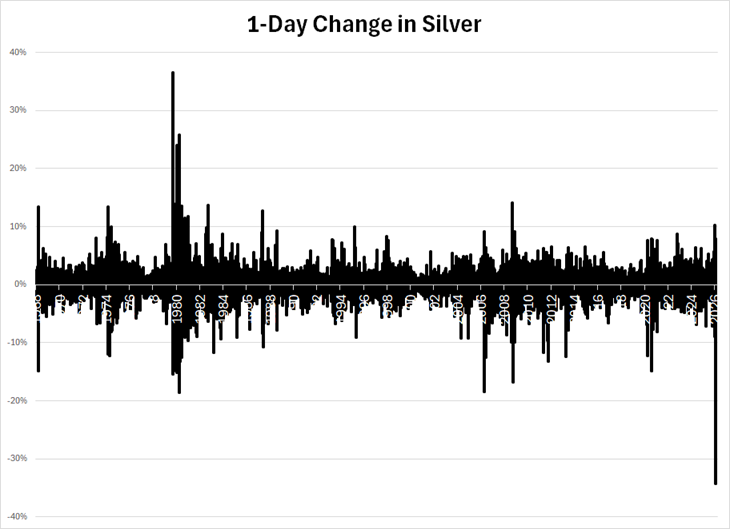

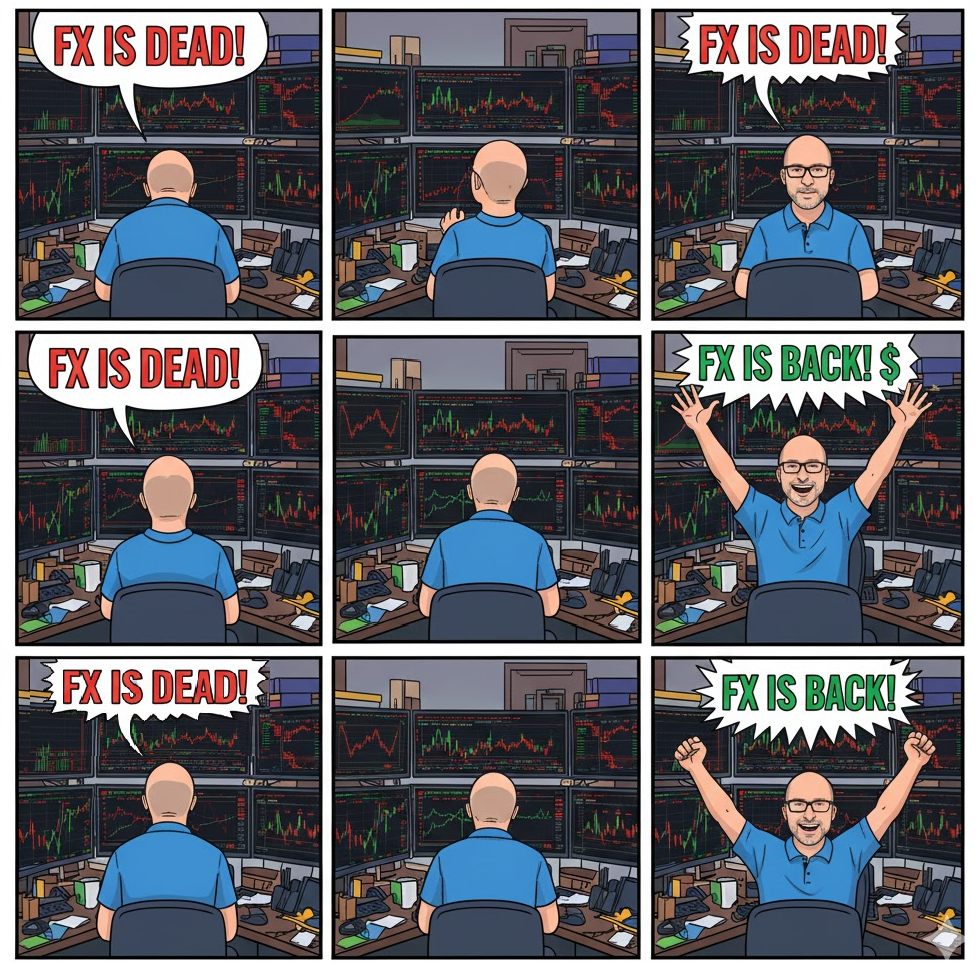

A wild week in markets as we saw multi-sigma moves in many asset classes. Remember that if someone says: “This is a 5-standard-deviation move in silver, that should happen less than once every thousand years!” the correct response is:

“Yeah, but financial market data is not normally distributed!”

Tail events happen all the time! That’s why Nassim Taleb is famous and wings are expensive and pods and short vol strategies blow up every few years. There is nothing particularly surprising about huge moves. They are endemic to financial markets.

The theme for most of this week was HEDGE AMERICA as foreigners do not want to let go of their US assets, but they increasingly fear regulatory, taxation, and even confiscation risk. The US government is operating differently than past administrations as the new policy of state capitalism combined with extraterritorial ambitions has put countries like Denmark in a tough spot. If you’re a pension fund manager in Denmark, you spent the last 10 years hugging the benchmark and staying fully loaded US assets unhedged because that was the safest way not to get fired. Now, US assets are underperforming (US was one of the worst stock markets in 2025) and the political winds have turned and you are having flashbacks to April 2025. You figure:

“Jeg formoder, at jeg hellere skal afdække noget af denne amerikanske eksponering, ellers sender min chef mig en vred e-mail, og hvis det går galt på Grønland, vil jeg se ret dum ud for ikke at have afdækket en åbenlys risiko!”

That is: “I suppose I better hedge some of this US exposure or my boss is going to send me an angry email and if things go sour on Greenland, I am going to look pretty stupid for not having hedged an obvious risk.”

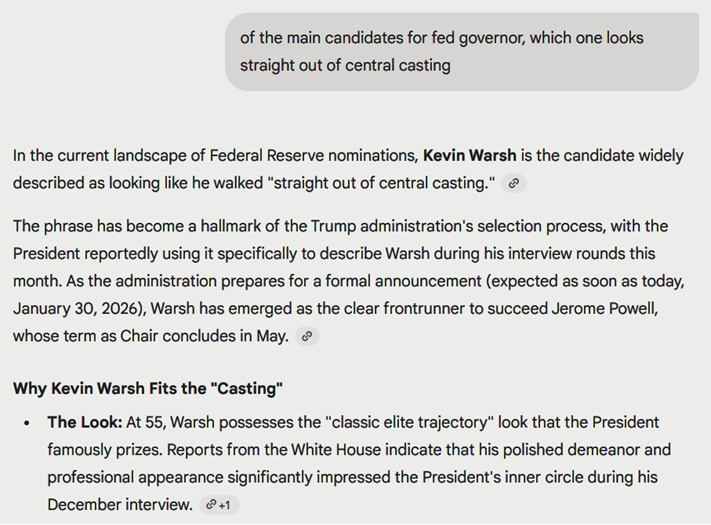

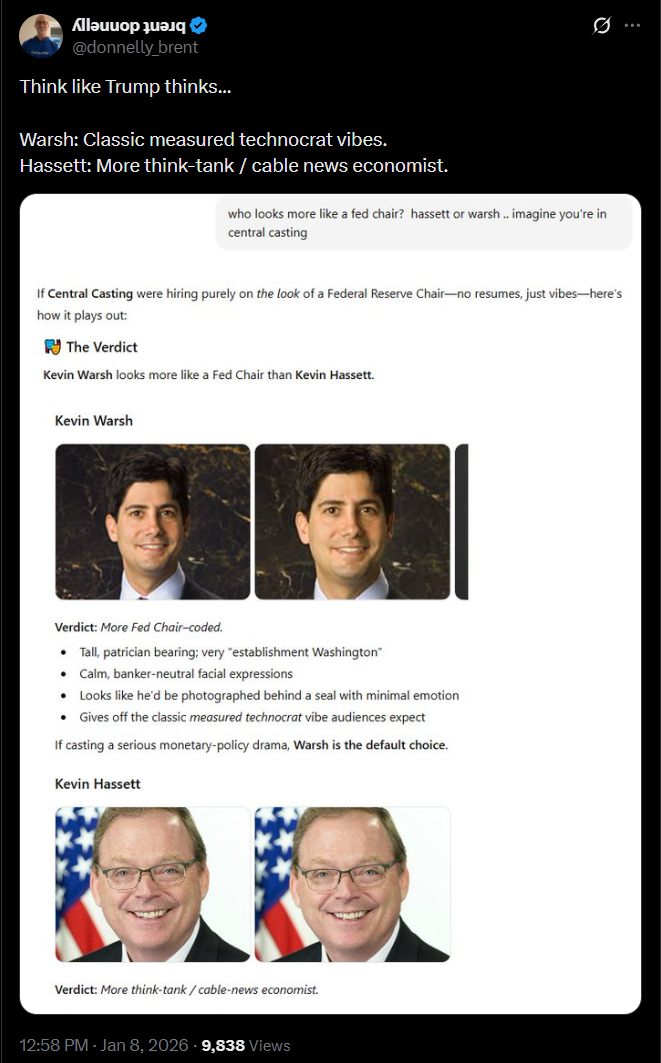

Pension funds, US asset managers, and global hedge funds got busy on this narrative and the dollar got smoked all week until Thursday when we saw a whipsaw reversal as Kevin Warsh was pre-announced as the new Fed Chair ahead of today’s actual announcement.

This is not hindsight. I tweeted similar on January 8:

So there you have it. The Apprentice: Fed Edition is finally over. The process was embarrassingly drawn out and boring and I am glad it’s done. We are left with no significant change to the fabric of the Fed as Trump ends up appointing an orthodox elite candidate who is just like the others.

Meet the new boss. Same as the old boss.

After months and months of back and forth, and sturm and drang over loss of Fed Independence and a radical reshaping of the Fed, the president has picked the most vanilla, elite, insider Wall Street, Harvard lawyer candidate to run the Fed. A Morgan Stanley alum who has been at the Fed for 20 years, Kevin Warsh was appointed by George W. Bush and is about as steady as she goes as you could possibly get. The Fed will continue to operate much like it has always operated.

This nomination cements my view that we get a consolidation/correction phase here for the USD and precious metals as the start of February is not a great seasonal window for precious, and pension fund USD selling is likely to cool once month end is over. Pension funds are less likely to be active USD sellers next week as they have just spent a busy week putting on USD hedges and early in the month is not their busy time.

I agree with the market reaction: The nomination of Warsh is a mild USD positive and precious metals negative as it takes a more rogue candidate like Hassett out of the picture, but in the end there was nothing much priced in for the Fed before and there will be nothing much priced in for the Fed now. The US economy continues to chug along fine and after six rate cuts, Fed Funds are in their happy place. You can see that expectations for the September 2026 implied rate have really not moved since Liberation Day as the market expects Fed Funds to land somewhere around 3.0%/3.25% at that meeting.

Here’s Alf’s take on Warsh, which is more USD-bearish:

“What Bessent and Warsh have in mind seems like a LatAM way of running monetary and fiscal adapted to the US.

Reduce interest cost on debt to optically reduce spending and redirect fiscal resources, but mostly lower rates enough so that the private sector can engage in productive investments and lead growth.

These policies argue for lower USD, lower front-end rates, steeper curves, much higher equities. Let me explain the last point on equities.

Reducing the Fed B/S does nothing to real-economy money, while lowering front-end rates makes policy looser and helps Bessent to redirect fiscal resources to the private sector if he keeps issuance focused on the short-end (At lower rates) saving interest costs and redirecting fiscal impulse to the real economy. All positive for equities.”

If you would like to get in touch with Alf, ping him on Bloomberg: Alfonso Peccatiello

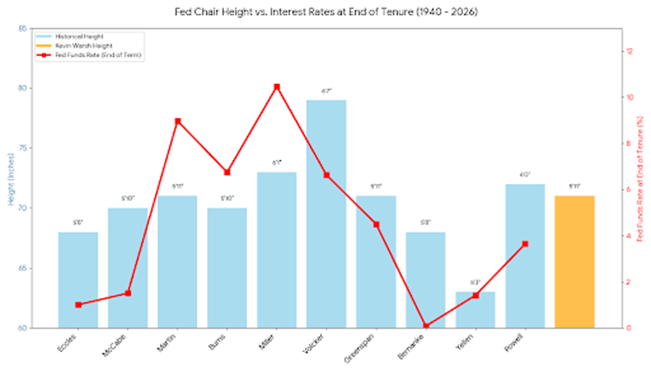

Here is a stupid chart I made:

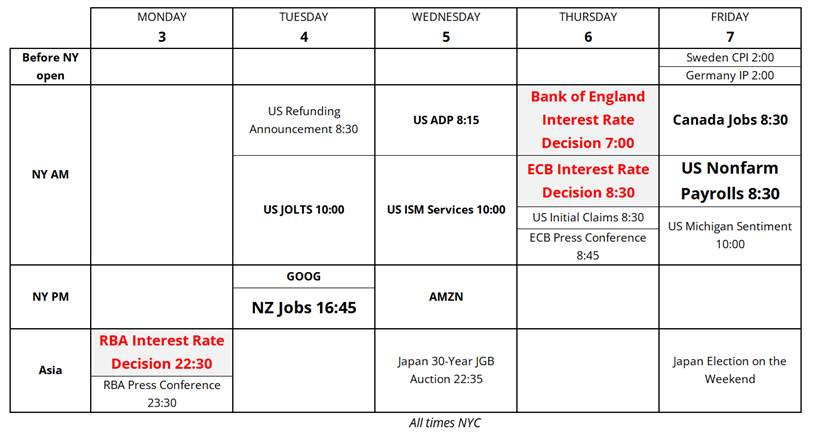

And here’s next week’s calendar.

The market is all in bullish now after buying heavily every day for a month. February tends to be a wobbly month and the puke in silver tells you that retail has finally spent their last dollar. Footballs like PLTR are sagging and my bet is that other footballs like Korean equities will dump next week in sympathy. Big ‘ol double top in NASDAQ as MSFT crapped out and the Andrew Ross Sorkin October 2025 high still looms large for Bubblicious tech.

Here is this week’s 14-word stock market summary:

I am bearish for February. Retail is full to the gills. Sell the footballs.

https://www.spectramarkets.com/subscribe/

Bonds have stabilized as institutional money in Japan has started buying JGBs at the margin and there is enough weakness in equities to bring the odd bond buyer. The break of 4.20% was lackluster, but we’re still above. RBA next week is likely to hike, but it’s close enough to priced in.

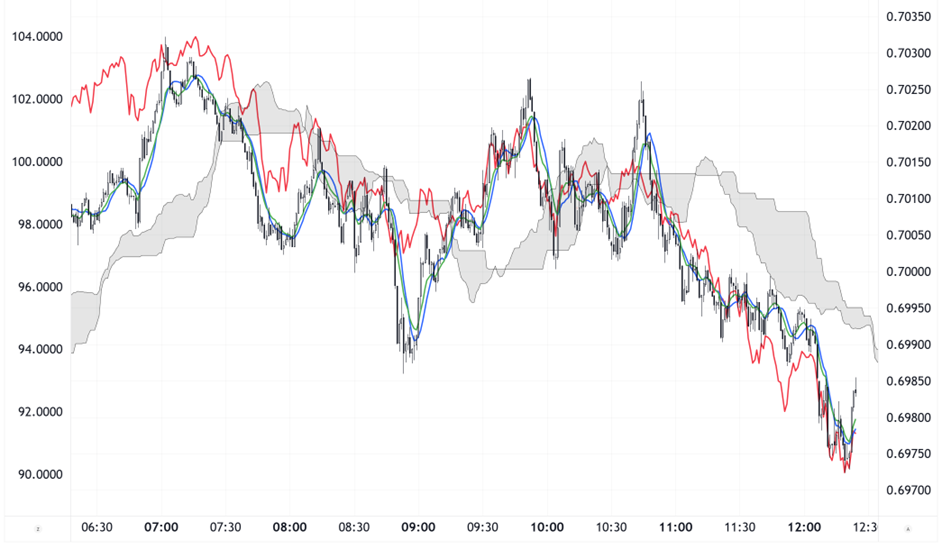

The bullish AUD call last week was pretty epic as spot outperformed massively. But now, AUD is caught in the silver collapse as the correlation between Ozzie and metals has skyrocketed. Here’s AUD and silver today (1-minute chart). AUDUSD is black and silver is the red line.

I think we enter a consolidation phase now as Warsh is not going to cut like a Hassett would and the market has loaded up on short USD as the pension funds go back into hibernation for a bit now that month end is over. The blowoff top on Trump’s “weak dollar is fine” comments is glaring at me from the hourly chart.

The USD selling will continue over time, but it’s burnt out for now.

The final bullish narrative for bitcoin was that it was lagging silver and gold. Now that they have collapsed, the next leg lower in bitcoin can probably begin. 74k/75k is the big support and I think we get there soon. There is no bullish narrative left.

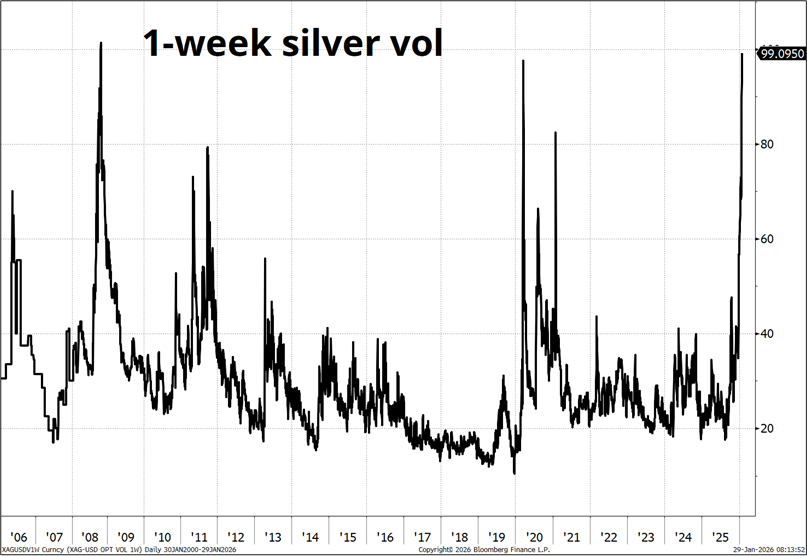

Silver has gone off the chart as r/wallstreetbets learns that something realizing 99 vols goes both ways.

Too late now, but here are some interesting tidbits from am/FX earlier this week:

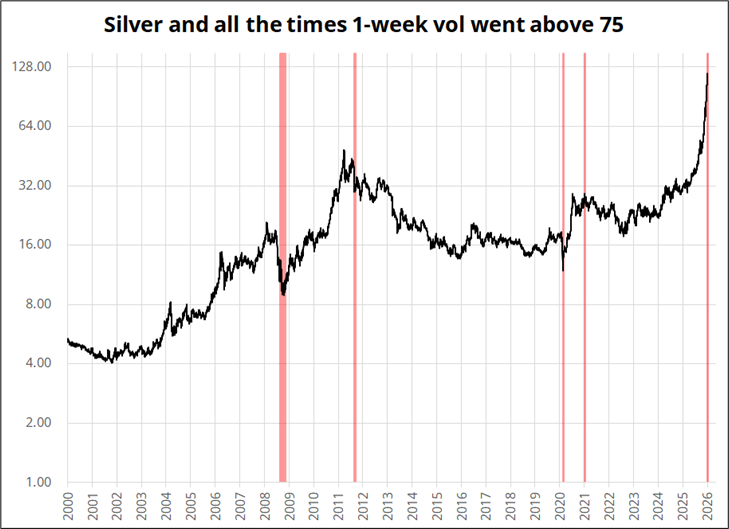

“My bet is the first week of February sees consolidation or a minor correction in precious metals and the USD as the turn of the month leads to some profit taking. The first week of February is a seasonally weak time of the year for precious, too. If you’re long precious metals, you can always sell 1-week calls against it. The vols are justifiably completely bonkers.

I suppose you could say that 1-week silver vol at 100% is another yellow flag here as it’s peaked around 75/100 at all the major turning points in silver.

Here’s silver with red bars showing when 1-week vol went above 75.”

That’s it for this week.

Get rich or have fun trying.

Ninajirachi – I love my computer

Acoustic insanity for your brainstem

Aphex Twin: Flim

A pleasant track for happy listening

*************

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.