They are trading as a package for the first time since the 1990s

Strobogrammatic numbers are numbers that are rotationally symmetric.

They are trading as a package for the first time since the 1990s

Strobogrammatic numbers are numbers that are rotationally symmetric.

Long 11MAY 168/163 put spread in CHFJPY

~31bps off 175.25

Long EURUSD 1.1277

Stop loss 1.1084

TAKING PROFIT TODAY

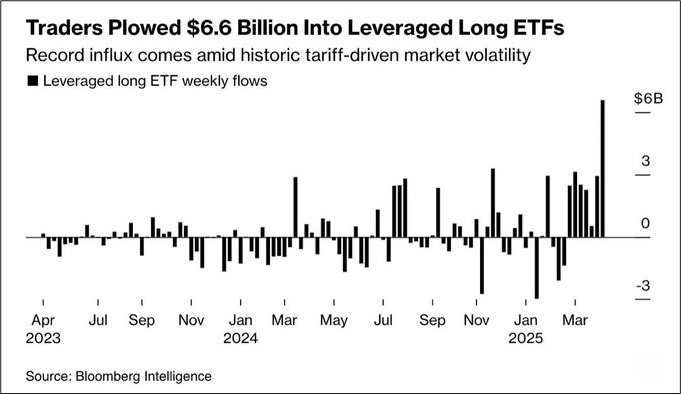

It is an interesting setup in equities right now. Retail surveys like AAII show max bearish but yet … retail has never bought the dip in TSLA and leveraged long ETFs this aggressively. Even as TSLA earnings approach, sales growth plummets, and the brand value drowns, Pavlov’s dogs are not to be denied.

Meanwhile most HF and institutional people I talk to are either optimistic on tariff delays—or bearish, but too scared to be short because of topside headline convexity. So it’s the rare “most are bearish, few are short” setup.

This could mean that instead of the normal positive drift, stocks have negative decay as no news on trade deals means probability of supply chain and small business bankruptcy Armageddon rises. Stocks are becoming an increasingly binary call: recession or no recession.

As long as we’re below 5500 SPX, I’m likely to remain bearish but I too am scared of bullish headlines so I have been sticking mostly to intraday shorts with automated stops. That has worked well so far.

Last night’s price action was informative as the path of least resistance appears to be lower USD, lower US stocks, and lower US bonds. Trump’s threats to fire Powell add to the Sell America theme and Asia seems to have an endless appetite for gold and any currency not labelled USD.

Vitriolic feedback to a strong view can be indicative of a strong and wrong consensus. Paulo Macro, a person worth following on Twitter, posted this bond bearish tweet, and was flooded with angry replies. Here’s his reply to the replies: https://x.com/PauloMacro/status/1913833378878574754.

I continue to believe that short equities and short dollars are simpler trades than short bonds because the economic impact of tariffs is likely to be strongly negative for growth. That said, if we are in an emerging markets regime for US assets, falling growth will be bad for US bonds. Meanwhile, check out the CPI fixings here (via PDS on Twitter).

Some crazy CPI figures coming. Even if these represent one-time jumps in the price level, they could lead to more inflationary psychology, wage hikes, and price rises in services as rising prices after Trump’s massive import tax hikes open the door to opportunistic price hikes elsewhere.

I am sympathetic to bonds going lower, but with the confusing and scary economic story and rising 10-year yields more likely to trigger a policy response than a falling dollar or tumbling stock market, it still seems easier to be short those two, not fixed income.

The dollar is tumbling as Asia sells aggressively and no news is bad news on trade deals. I have written a few times about how trade deals don’t just get signed over the phone or in a single meeting, and Torsten Slok has mapped out the history of how long it took to sign various well-known trade deals. Sure, Bessent could soon sign some kind of MOU with Japan as a stopgap, but the US negotiating position is weak as most countries (especially China) could elect to simply run out the clock and let things play out via US capital market self-destruction.

This week’s meeting between Scott Bessent and Japanese Finance Minister Katsunobu Kato looks set for this Thursday, according to Nippon. The full economic and earnings calendars follow today’s main text. Note in the calendar that there is some Swiss news this week as we will get Sight Deposits tomorrow morning (an early indicator of whether or not the SNB intervened as that critical 0.9210/40 level held like a rock) and Martin Schlegel (chairman of the SNB) speaks at 4:00 a.m. NY time on Friday at the SNB’s Annual Meeting. Overnight or 1-week EURCHF calls are something to consider.

While I have been a steadfast EURUSD bull since 1.0540, I am not the type to just sit on something forever because that’s just not my style. The risk is I will miss parts of a move by taking profit early, but the advantage is that it helps me remain intellectually flexible and that flexibility has higher utility for me than the ability to hold onto trades for umpteen big figures.

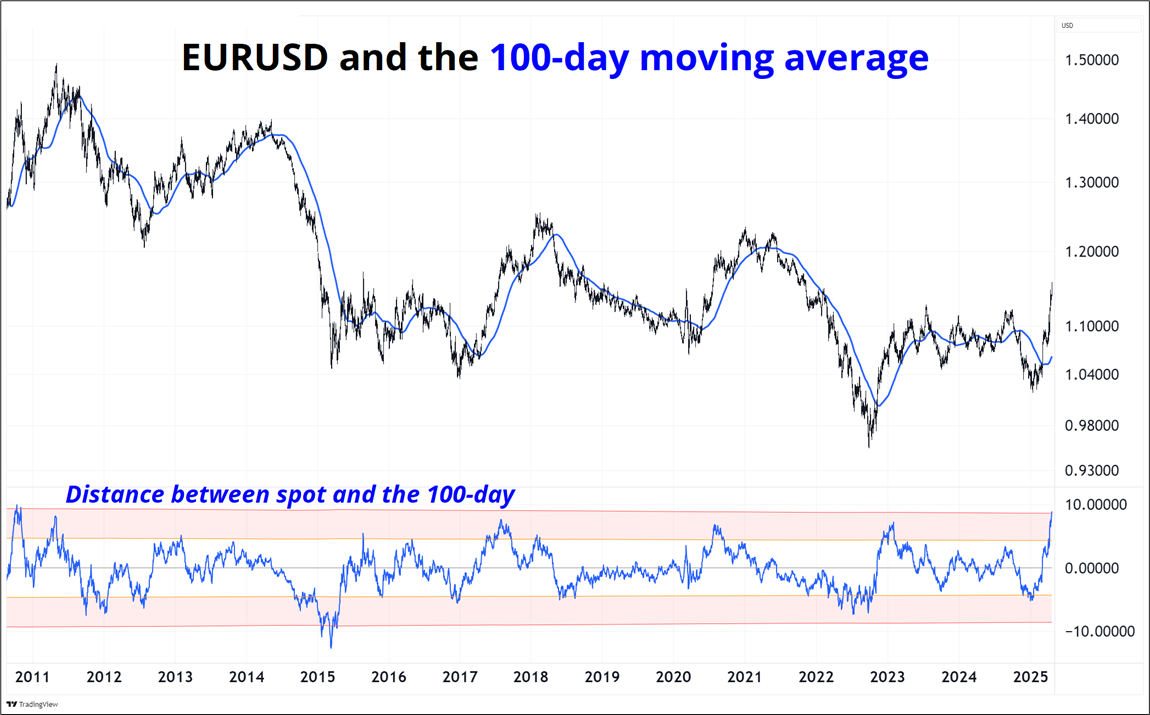

If you measure the distance between the 100-day moving average and spot EURUSD, you get an idea of how overbought it is and you can see from the next chart that we are approximately max overbought right now with spot flying 8.5% above the 100-day. I have argued in past pieces that overbought doesn’t matter during regime shifts, but we had EURUSD regime shifts in 2011, 2015, and 2017, and only one of them got crazier than the current move. The 2015 drop on ECB QE and the China reval took us to 10.3% below the 100-day before the first bounce and the final bottom was at 12.5% below. Otherwise, we are matching the 2011 recovery peak and even in 2022, when Europe was in a terms of trade shock / energy crisis, we bottomed at 7.5% below.

There’s a good chance I will rebuy at some point, but for now I am taking profit on the EURUSD long from 1.1277 right here. This does not mean I think the move is done. It just means I think I can get long again at better levels and/or keep an open mind and be long or short as the new narrative unfolds.

The Third Humbling of Humanity by Yascha Mounk.

Have a right side up day.

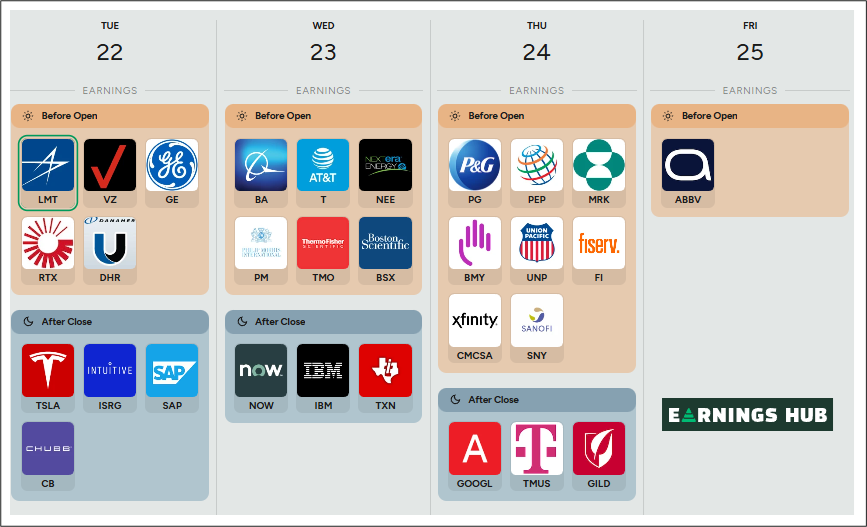

Macro and Earnings Calendars for the week of April 21, 2025

Companies with a market cap > $100B reporting this week

https://earningshub.com/earnings-calendar/this-week

Strobogrammatic numbers are numbers that are rotationally symmetric. For example

0, 1, 8, 11, 69, 88, 96, 101, 111, 181, 609, 619, 689, 808, 818, 888, 906, 916, 986, 1001, 1111, 1691, 1881, 1961, 6009, 6119, 6699, 6889, 6969, 8008, 8118, 8698, 8888, 8968, 9006, 9116, 9696, 9886, 9966…

The years 1881 and 1961 were the most recent strobogrammatic years, the next one is 6009.