It’s all gone Pete Tong despite okay results from NVDA and NFP

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

It’s all gone Pete Tong despite okay results from NVDA and NFP

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Before we get started. My daily note is called am/FX and I would like to offer a free trial to anyone who has never signed up for it before. If you sign up for the note, you’ll get it free until the end of the year.

Click here to sign up for a free am/FX trial — now ‘til 31DEC25

am/FX features my daily thoughts on global macro, FX, stocks, crypto, and more. Includes trade ideas, trading psychology, and practical, real-time, forward-looking analysis. The trial is risk free and you don’t need to give me your credit card information or anything scammy like that.

Okay, lets’ get started.

*******

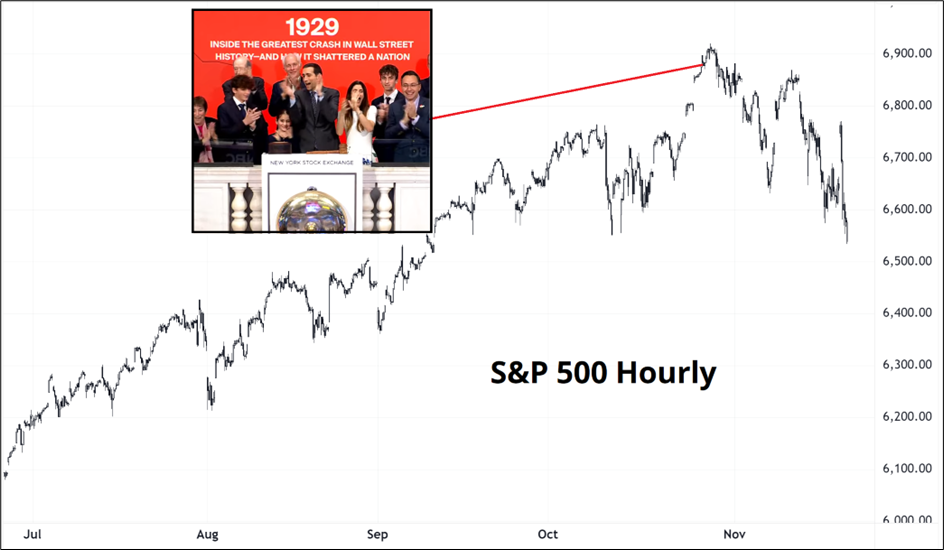

The idea that we live in a satirical simulation operated by a 12-year-old continues to gain traction. We are destined to live on the funniest timeline. More proof: stocks peaked the exact day that Andrew Ross Sorkin rang the bell at the NYSE.

Note that he was ringing the bell to celebrate the release of his new book, 1929, which outlines how stocks crashed on the back of retail gorging on leveraged risk as corrupt bankers attempted to keep the bubble inflated and government insiders manipulated the Federal Reserve into staying dovish when the appropriate policy was hawkish.

The book explains how a fascination with a new technology wildly inflated valuations and how the democratization of investing allowed wider retail participation than ever before. He explains how megarich celebrity businessmen boosted the stock market’s visibility and how tariffs and weak financial oversight set the stage for a historic crash that unwound all the excess of the post-pandemic stock surge in the 20’s.

I mean, who greenlighted this? There is an aphorism that says “they don’t ring a bell at the top.” But they literally rang a bell at the top.

It remains to be seen whether that was a top or the top. But man.

Sour grapes from me this week as I was bearish from mid-October to mid-November as the crypto treasury scam unwound, META earnings showed the market no longer loves all AI capex, PLTR beat, raised, and crapped out, and the Fed squashed December cut hopes. Then, I flipped bullish mid-November on the thought that the end of the government shutdown would bring liquidity back just as everyone had gone max bearish. That was wrong. My foray into GOOG was OK, but I also bought MSTR and some deflated crypto nonsense that deflated even more.

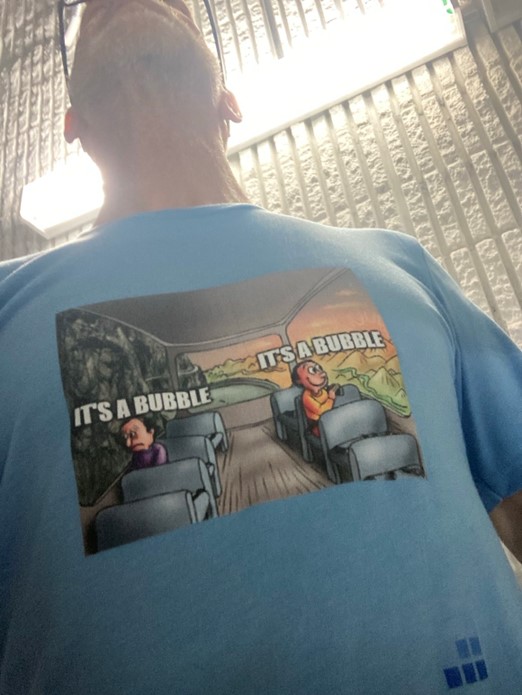

Onward and upward. I am neutral now after stopping out of all my longs. This is my brain right now:

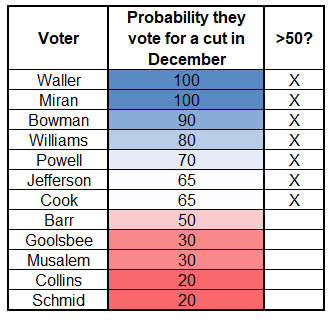

In the world of macro, we got an OK NFP release, but nobody cared because it’s from September. The Fed is still likely to cut, in my opinion. Based on Williams’ dovish comments today, here are my updated vote probabilities for each Fed voter. This makes it look like they will cut in December. These probabilities are conditional on Powell, because he can get Barr and Goolsbee onside. Even at 16bps, receiving December FOMC makes sense.

Meanwhile, the next BOJ meeting will be interesting as the weak JPY and loose fiscal approach from Takaichi make the powers that be a bit nervous in Japan. Ueda sounded more hawkish last night.

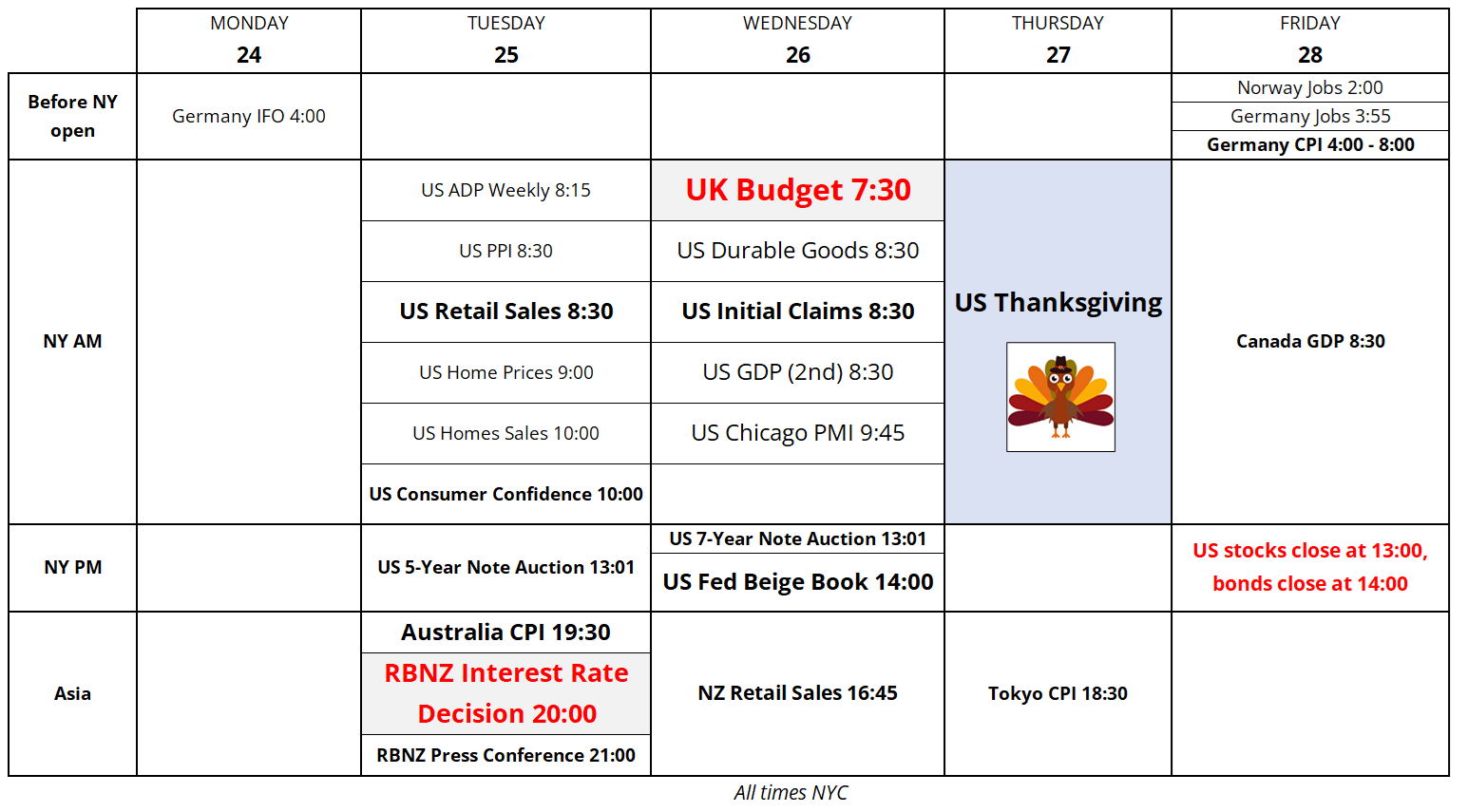

And … We finally get the UK budget next week. Here’s the calendar:

It’s that time of year again.

The fourth annual handbook has arrived…

The 2026 Spectra Markets Trader Handbook and Almanac is live

Use The Spectra Markets Trader Handbook and Almanac as a trading journal/day timer, and as your guide to seasonal patterns and key economic events throughout the year. It will anchor your process on proper journaling and planning—and help you thoughtfully assess your performance at the end of each month. Goals and plans written down are much more likely to come true than a flurry of ideas and thoughts and hopes swirling around in your head.

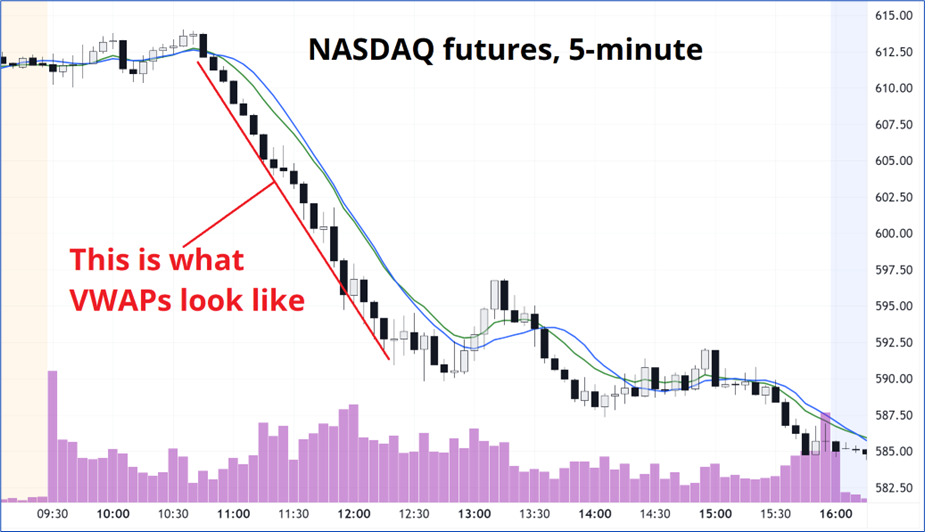

Textbook good news/bad price yesterday as NVDA put up a good number and nonfarm payrolls was Goldilocks and yet it was a VWAP sellfest all day. Yesterday’s price action wiped out the remaining short-term bulls, including me.

While the current reversal in stocks started with unwinds of the retail favorites, yesterday’s action in NY time did not look like panic retail selling or margin calls (selling that normally comes in abrupt and vicious waves), it looked like a bunch of institutional VWAPs battling for who gets to sell first. The slope of the NASDAQ selling was perfectly 45 degrees all day.

This whole thing started as a puke of the most-loved retail names but has morphed into institutional selling of the AI capex trade. ORCL remains the most-hated name as the 40% rally after the OpenAI MOU on a napkin looks increasingly stupid. And it looked stupid at the time, too. Oracle CDS are driving higher as Oracle (and CRWV) have become poster children for debt-driven AI excess.

The question now is: when does this all stop? It’s been going on for quite a while as we were talking here about the ORCL round trip as early as the first weeks of October and now the market has been selling and downgrading the debt for almost eight weeks. But given the Sam Altman credibility issues pre- and post- recent interviews, maybe this all concludes with a bunch of down rounds for OpenAI as the market realizes they can invest in Google, or Perplexity, or Anthropic, or whatever and get the exact same product without the corporate governance issues.

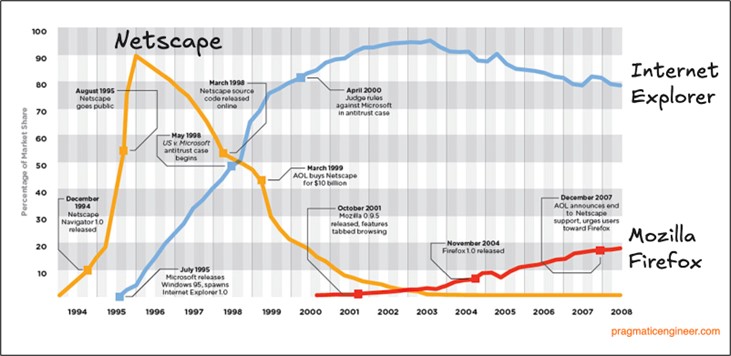

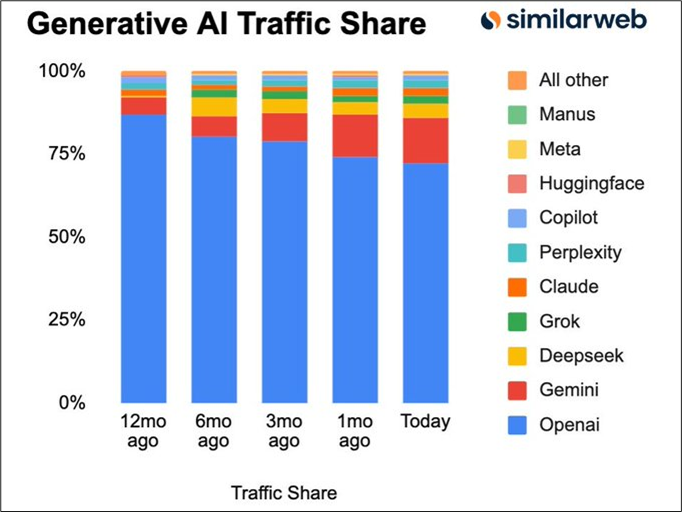

In 1996, Netscape was dominant in browser space:

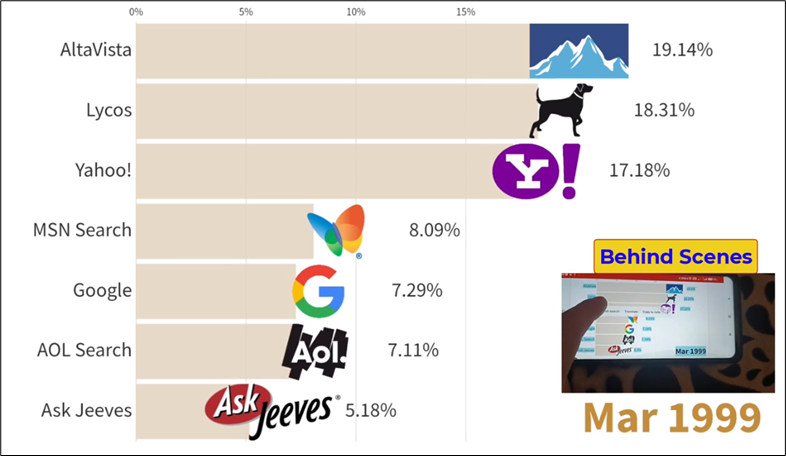

In 1999, Alta Vista was the lead search engine, with Lycos, Yahoo, MSN, Google, AOL, and Ask Jeeves all close behind.

In 2025, OpenAI is the leading LLM, with Gemini, DeepSeek, Perplexity, and Claude well behind but catching up.

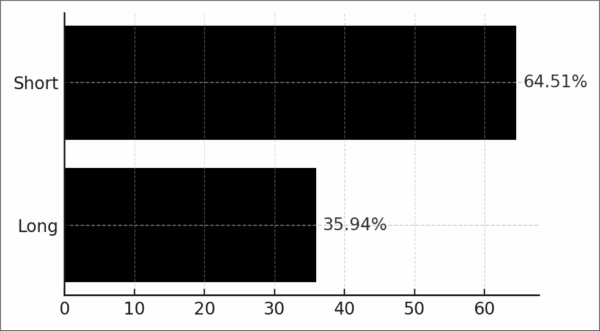

As an avid user of four LLMs, I find they are more similar than different. OpenAI has no moat. The free version of Gemini is as good as the $20/month version of ChatGPT. This explains why a majority of respondents to my survey last week would rather be short OpenAI, not long. 1100 respondents, approximately.

On a 3-year time horizon — Would you rather be long or short OpenAI at a $500B valuation?

If OpenAI does a down-round, their commitments to pay out $1.1T or whatever by 2030 become increasingly hollow. They have a lot of support from many big names in AI, but support can be fickle. Nobody knows if Altman, with his flair for exaggeration and/or lying, is more like Elon Musk or SBF or Elizabeth Holmes.

So yeah, OpenAI faces an uphill battle coming up with $1 Trillion in spending as it loses money at a WeWorkian pace and attempts to monetize a lookalike product in a commoditized and barely-differentiated LLM market.

Here is this week’s 14-word stock market summary:

I got bullish / got rinsed. Is the Sorkin High a top or the top?

https://www.spectramarkets.com/subscribe/

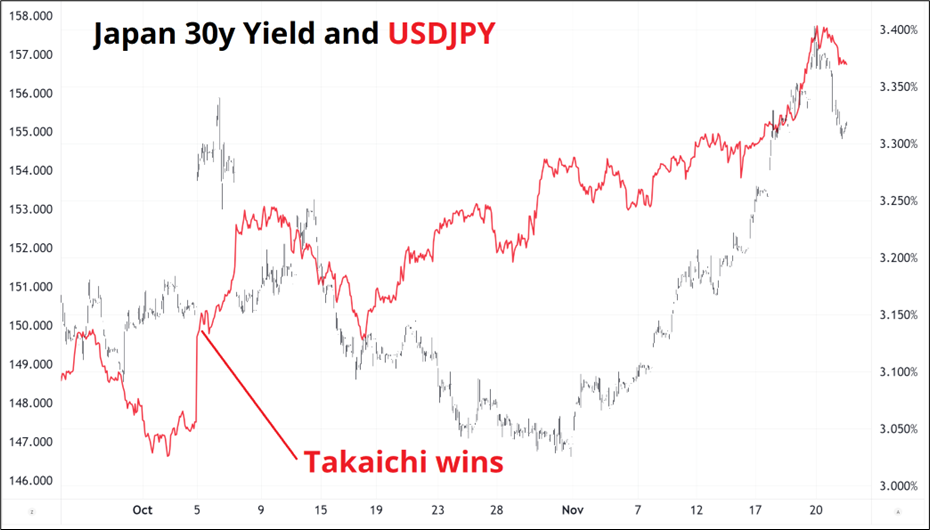

There was another mini blowup in the Japanese bond market as Takaichi unleashes yet another round of Japanese fiscal stimulus. It’s not exactly a blow up, I suppose, but more of a continuation of the ongoing dribbly down trend in the Japanese bond market.

You can see that Takaichi’s win gapped USDJPY up through 149.00 and we never went back below there. Meanwhile, Japan’s 30-year yield spiked and retraced and then went all the way back down from 3.3% to 3.0% as the market wasn’t sure whether Takaichi was really THAT dovish on fiscal. Now, the plan has been revealed and yields and the yen are weakening in synch.

Note: Red line up = USDJPY higher = weak yen.

In the USA, the Fed is in play for December and I wish they would move the meeting to allow for the 16DEC payrolls number, but I guess they won’t. So that leaves CPI on December 10 and then the FOMC meeting the same day. Funky.

As mentioned above, USDJPY is on a bit of a streak higher as the market challenges Takaichi’s desire to break the trilemma. She wants loose fiscal, negative 2% real rates, and a stable or stronger currency. But fiscal, monetary and currency policy are like fast, cheap, or good…

You can only pick 2!

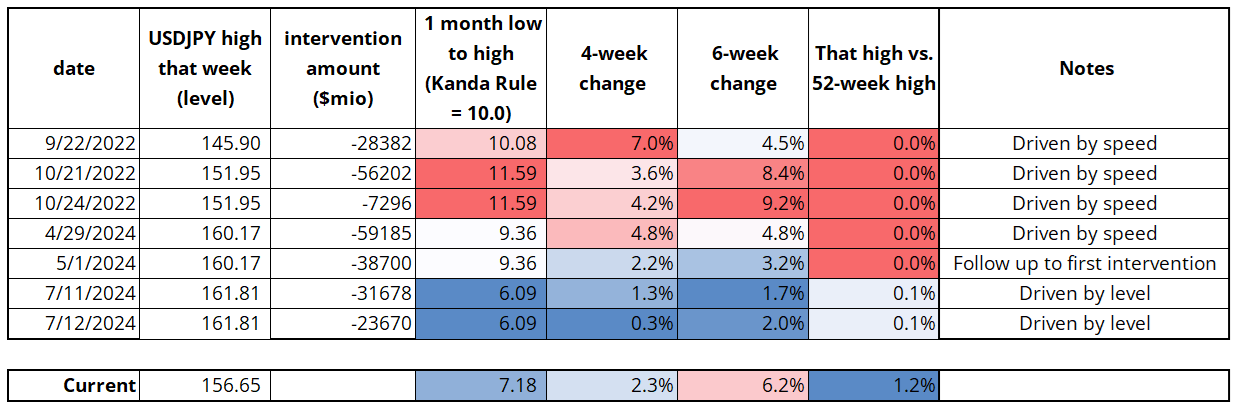

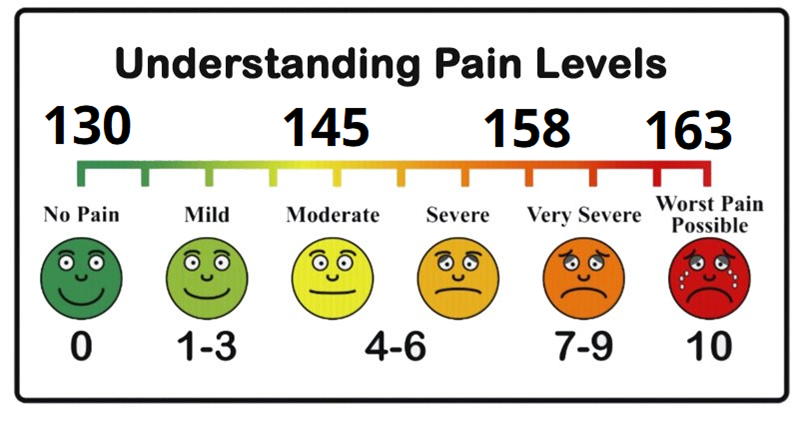

The JPY is likely to continue to weaken and while a BOJ hike in December might offer a glimmer of hope for the downtrodden yen bulls… Even if the BOJ hikes … It will be a tweak that will barely change the narrative. In terms of intervention, here are the past instances where they intervened, and some of the conditions at the time.

Elsewhere, the USD has rallied as it seems like we have two contradictory narratives these days:

Okie dokie.

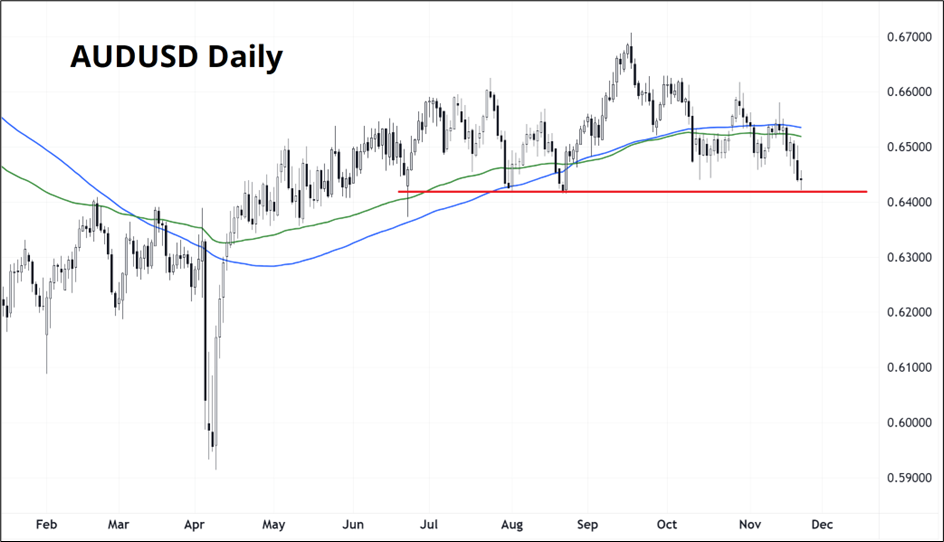

Some currencies are trying to break down through key levels, including the much-loved and always disappointing Aussie.

We have not been below 0.6400 in the Lee Harvey since the weeks immediately following Liberation Day.

Remember how super bearish April 2025 was? We all went kind of mad.

Crypto remains soggy as there is no bullish narrative.

In the spirit of open-mindedness, I tried to pick the bottom in MSTR and MARA last week as MSTR neared 1X NAV. The result was fugly.

We are nearing Michael Saylor’s average price for bitcoin, as his buying pattern has been to buy small on dips and buy massive on rallies. There is nothing meaningful about BTC going below his breakeven, but it is an interesting situation to watch. Note that bitcoin has gone below his breakeven in the past, see 2022.

Bitcoin purchases by MSTR (larger bubble = more bitcoin)

The dotted red line shows MSTR’s DCA. The procyclical nature of bitcoin treasury companies is fully obvious now, as if it wasn’t obvious six months ago. They buy high and now some of them are selling low. The rubber does not hit the road for Microstrategy until they need to start paying dividends and rolling debt into a market that finds the whole scheme less humorous than it did when Wall Street and U.S. government support offered a bullish narrative.

The question of who could possibly be the marginal buyer of crypto at this point is very hard to answer. Maybe some of the whales that sold above 110k will be on the bid at 75k? It’s possible. More likely is that most whales see that crypto no longer has anything to do with the original vision and so they are happy to hold their billions of dollars in a currency that is stable and can be exchanged for goods and services. Let’s see.

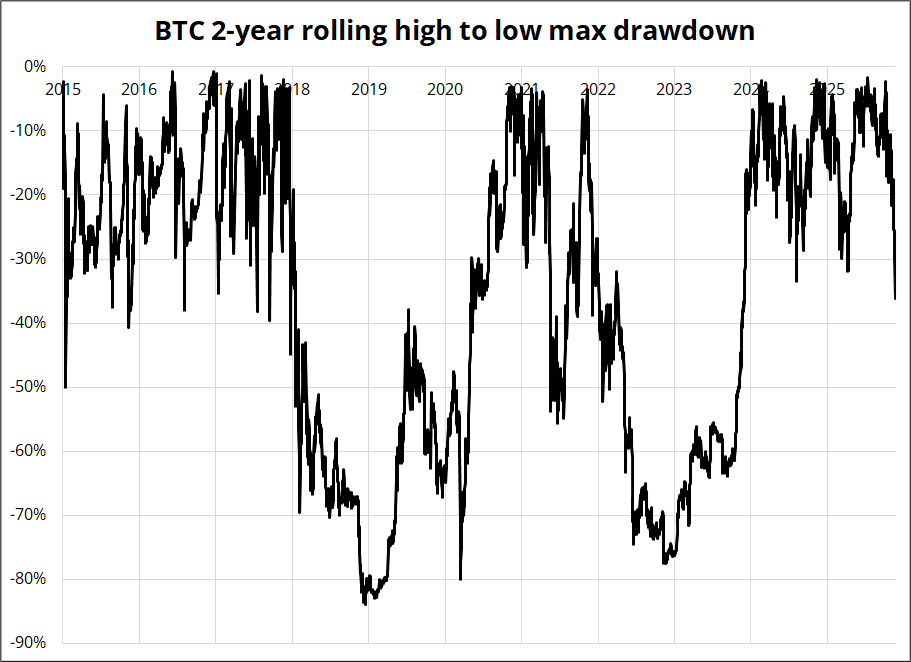

For perspective, the biggest past drawdowns in bitcoin have been in the 75%/80% area, so if we are in crypto winer again, the 25,000/32,000 area would be the extreme target for BTC. I am not saying we are in crypto winter. Just offering a reminder that 75%/80% drawdowns are part of the game in BTC.

There is a lot of high-fiving on FinTwit and elsewhere as the market loves to see Saylor stumble. His unserious approach to the whole enterprise (see his social media, for example) and his misappropriation of TradFi terms like “yield” to dupe investors make people bristle for good reason. I am agnostic. I think he’s courageous in a certain way. But kind of the same way Jesse Livermore was courageous. Like, it’s cool to watch and read about, but you wouldn’t want your money there.

Gold and silver were the belles for a while, but they have slipped from the headlines as the double top in silver confirms the margin call hikes were the whoopsies moment for momo trend following and now we are in a multi-week consolidation.

Crude is tracing out the mother of all triangles with $55 the range low and $57 the last low before the ill-fated rip to $125 when Russia went into Ukraine. Below $55 is problematic for the few remaining bulls.

That’s it for this week.

Get rich or have fun trying.

*************

If we make it through December

I miss baseball and Phoebe Bridgers

*************

*************

USDJPY intervention cheat sheet

*************

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.