Bayesian update favors Harris.

Push and Pull

It was a week of crosscurrents and contradiction

Bayesian update favors Harris.

Via Grant’s

(used with permission)

Long 05DEC24 USDJPY put spread

148/144 for 45bps off 152.10 spot

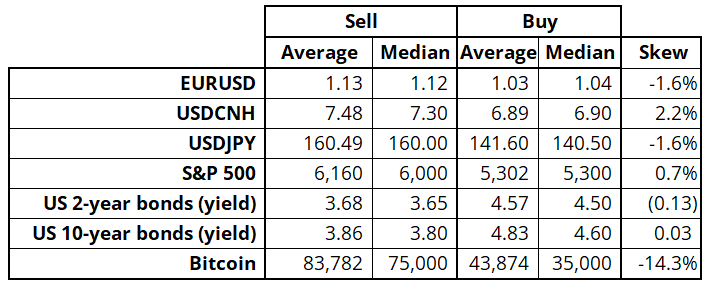

Friday, I ran a survey asking people at what extremes they would like to buy or sell a particular asset, regardless of the election outcome. Here are the results:

“Skew” measures the distance of the buy and sell level from current spot. For example, EURUSD is currently 1.0895, and thus the average buy level (1.0347, which is 5% below spot) is 1.6% farther from spot than the average sell level (1.1270, which is 3.4% above spot).

The skews make sense. People are bearish EURUSD and thus want to wait longer to buy, while USDCNH has more room to explode higher and thus respondents want to wait longer before selling. I think this is a super useful table for playing the extremes. For example, if you are long euro puts and EURUSD gets to 1.03/1.04 in the next week or two, you should cover. Same with USDJPY 142/160, etc. You can treat these as massive technical levels for the next week or two.

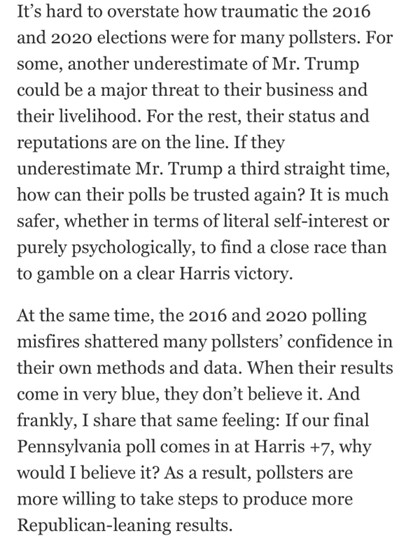

My singular theory for this election is that the polls are herding away from any Democrat-positive skew because pollsters don’t want to make the same mistake thrice. History has shown that pollsters rarely make three autocorrelated mistakes in a row and as we learn more and more about how the sausage is made, these “poll results” are heavily influenced by modelling decisions and selective omission. If the pollsters have overcorrected, the result will be much more favorable to Harris than one would expect. That’s my prior, and new information over the weekend has increased my confidence that this is the case.

There was the poll from Ann Selzer, who is known for her tendency to publish honest poll results, even when they appear to be outliers vs. the herd. This helps anyone who believes the pollsters are overcorrecting for past errors as the best known non-scrubbed poll shows Harris winning in a state presumed to be an easy win for Trump.

Second, respected pollster Nate Cohn said:

And then Nate Silver said:

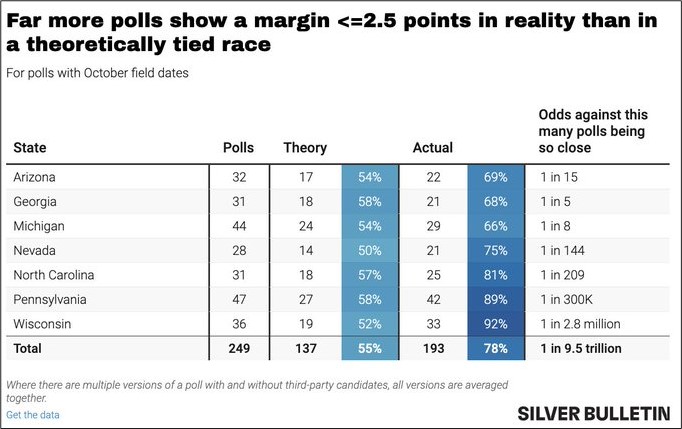

We ran the numbers. Even if all 7 swing states are actually tied, there’s only a ~1 in 9.5 trillion chance~ that so many polls would show such a close race. 🐑🐑🐑🐑🐑🐑🐑🐑🐑🐑🐑🐑

Again, it looks like there is plenty of evidence to support the idea that the pollsters are simply scrubbing all the outliers, especially Harris-friendly ones. I guess we will see but as a good Bayesian, if you believed the polls were overcorrecting before, you have to believe it even more now. Cohn, Silver, and Selzer are the three most credible people out there.

So, what’s the trade? Let me run through the various obvious ones and what I like or don’t like.

Looking at options, you need to go out far enough to survive a contested election (also bearish USDJPY), so 1-month makes the most sense to me. Yes, vol is high but I think it will realize if Harris wins. So, I’m buying 1-month 148/144 put spread for around 45bps. This risks 45 to make 275, approximately. Price is ballpark off 152.10 spot.

For what it’s worth, Silver has Harris winning the electoral college in 40,012 out of 80,000 simulations (50.015% chance, including 270 simulations that show a tie of 269 to 269). Yikes!

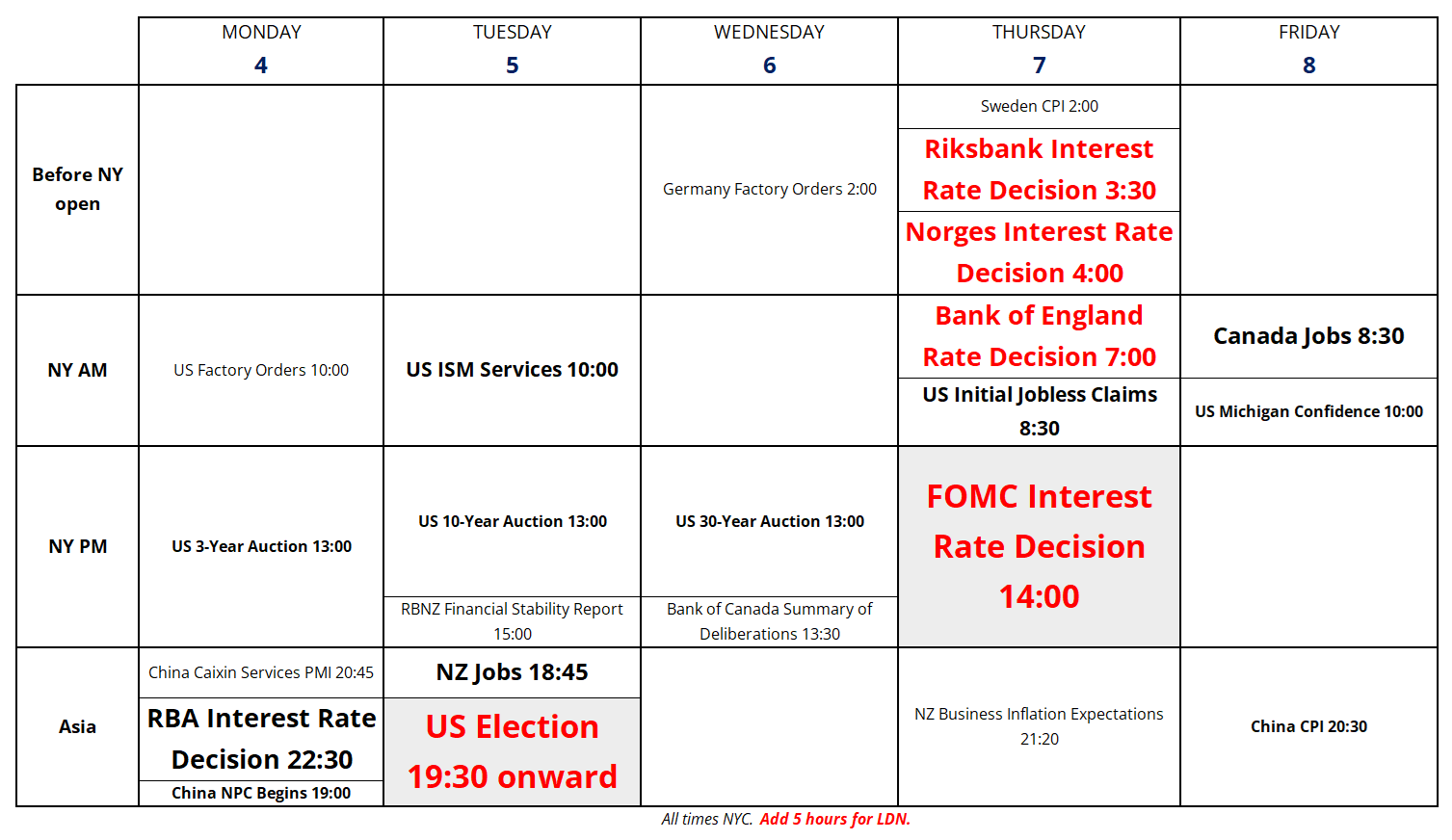

Here is this week’s calendar, with the conversion to London corrected as it was wrong in Friday’s am/FX. We’re back to five hours NY vs. LDN. Obviously, the election dominates the calendar, but we see the intensity pick up Thursday as Sweden, Norway, the UK, and the United States decide on interest rates.

Good luck tonight and God Bless America, a country with many faults—but still the country I choose to call

home. :]

As William Faulkner said:

“You don’t love because… you love despite. Not for the virtues, but despite the faults.”

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it