I want to be short USD, but not yet. In today’s piece, I explain why and where I would like to get short USDJPY and long NZDUSD.

Push and Pull

It was a week of crosscurrents and contradiction

I want to be short USD, but not yet. In today’s piece, I explain why and where I would like to get short USDJPY and long NZDUSD.

“Le Fantastic Ride”

Ad copy so bad… it’s good?

February 27, 2023

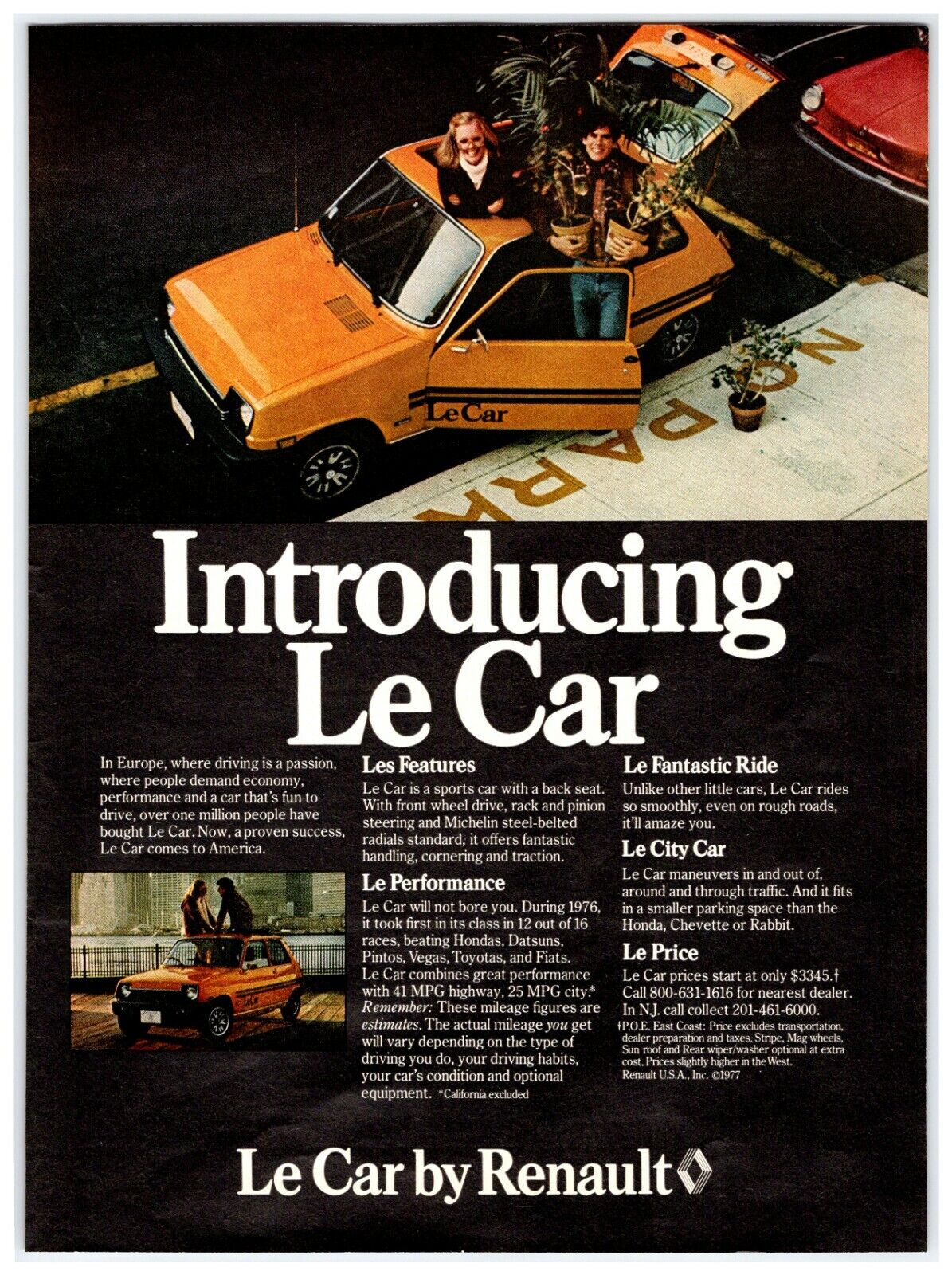

The dollar feels like it mildly overshot last week on month-end flows but I don’t have any strong compulsion to get short USD yet. Rate differential charts generally look close to equilibrium. Here are a few I would highlight:

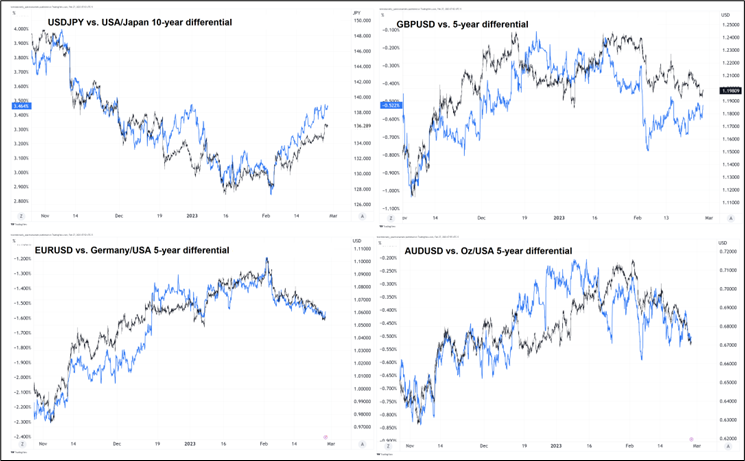

And the large divergence between copper and AUDUSD has been closed by a big reversal in copper. This chart shows the full story of the 2023 China Reopening trade so far, as we saw one month of rallying followed by one month of selling off.

This is consistent with my view that 2023 will be marked by mean reversion, confusion, Bayesian / probabilistic outlooks and low levels of narrative certainty. Here are the regimes we have been in since 2019.

JAN2020 to APR2020: COVID panic

APR2020 to NOV2020: Fiscal tsunami and Fed easing

NOV2020 to DEC2021: Vaccine success, spec bubble mania

JAN2022 to OCT2022: Inflation panic, risk parity demolition, hawkish Fed

OCT2022 to DEC2022: Peak Fed

2023: Recession? Soft landing? China Reopening? Hard landing? No Landing?

I am using hindsight to identify the narratives from those periods, but the narratives were mostly visible and tradeable in real time. The theme was not always 100% crystal clear in the beforetimes, obviously, but I would say that the 2023 regime is less clear than any of those regimes ever were. The width of the band of reasonable economic outcomes you could draw right now is incredibly wide and this is evidenced by the extremely probabilistic approach you are seeing from strategists, economists and analysts. Have you ever seen so many sell side grids showing three to five different outcomes and the probability assigned to each? I doubt it. Usually forecasters are far more deterministic.

The takeaway for trading is that trend following worked well for most of 2020 to the end of 2022 and will probably not work very well this year as we toggle back and forth and back and up and down through at least five realistic scenarios. And in the background, we also simultaneously flick the “Yay! China reopening!” switch on and off and the “UK is doomed!” switch on and off for extra fun.

With my bias toward mean reversion, I would like to find a place to sell USD around here because I think the market will slowly move towards asking “What if CPI is weak on March 14th?” The problem for now is that, other than some racy chart setups, there isn’t much reason to get short USD right here. Month end flows will lean towards USD buying (ex-USDJPY), seasonals are bullish USD in most pairs until mid-March. DXY peak seasonality is 14MAR, AUDUSD seasonal nadir is 19MAR etc. Interesting timing on the seasonal USD peak given CPI comes out 14MAR.

As I mentioned last week, my guess is that the Great American Economic Surge of January 2023 is overstating things much as the Great American Recession Consensus of December 2022 was understating things. The broader disinflation trend could easily be intact with January looking like an outlier by the end of 2023. I want to be short USD at some point, but don’t think the timing is right yet and so I’m waiting.

As suggested by my charts last week, dream levels to get short USD would be:

At these extremes, I believe you have a good margin of error and I don’t think stocks or yields have all that much further to go from here as the market will soon see January data in the rearview mirror and get chewing on a bit of softening into next month. I am not putting these as limit orders in the sidebar at the moment as I want to maintain flexibility but I will probably look to engage at those levels. I like long NZDUSD and short USDJPY best. Maybe strong ISM will get us to 137 in USDJPY.

This Philip Lane presentation is from 16FEB, but I only read it on the weekend and it is still fully relevant. It’s worth your time and it includes some lovely visuals.

Have le good day.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it