ETH FTW

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

ETH FTW

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

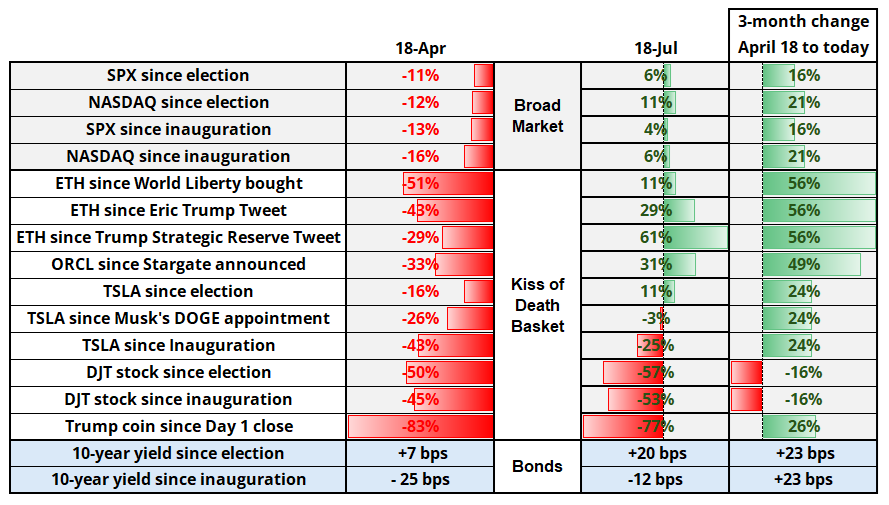

On April 18th, I wrote a somewhat snarky Friday Speedrun titled “Kiss of Death.” Therein, I noted how every single asset class targeted by the Trump regime had been Old Yellered or at least gone the wrong way.

Well, they are back from the dead! Now, it’s Crypto Week™ and ETH is ripping and stocks are at the all-time highs and as Taylor and Ed say: Everything has changed.

I have updated the graphic from April 18, adding a new column for today and then another column showing the move from April 18 to now. You can see that stocks have now eked out modest gains post-election, while ETH is lit and TSLA and TRUMPCOIN remain dogs. The idea that the administration’s number one target was the 10-year yield, not stocks, has not worked as bonds are about the only asset class that has not moved the direction most favored by the government.

Meanwhile, the Trump administration has picked up the Biden industrial policy and injected some steroids into it as particular sectors and companies receive government help (rare earths, chip technology, etc.). The anti-socialist party has even partly nationalized a public company in an attempt to match China’s policy of federal subsidies for strategically important industries. Crazy times.

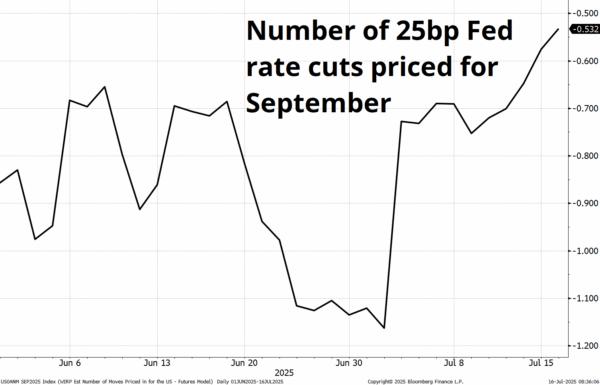

There is a ton more uncertainty for the Fed to consider as it waits for clarity on the on-again / off-again tariffs. What the Fed does know right now is that unemployment is low, inflation is above target and rising, and deficits are increasing faster than they were last year, despite four years of soft landing in the United States. As Lyn Alden says: Nothing stops this train. Again, the new boss looks a lot like the old boss as there is only unserious nonsense chatter when it comes to austerity. In reality, it’s spend more and tax less.

![]()

It makes sense that September rate cut odds are falling because Team ZeroDots has all the facts on their side for now while Team TwoDots wants to be proactive based on a sketchy belief that the Fed is restrictive.

Waller tried to call his buddies over to the “let’s cut!” side, but only one of his colleagues followed. The rest are in wait-and-see mode as rates may or not be restrictive, financial conditions are loose, risky assets are on the moon, and government spending remains out of control. Rate cuts right now would be gasoline on this bonfire of the insanities.

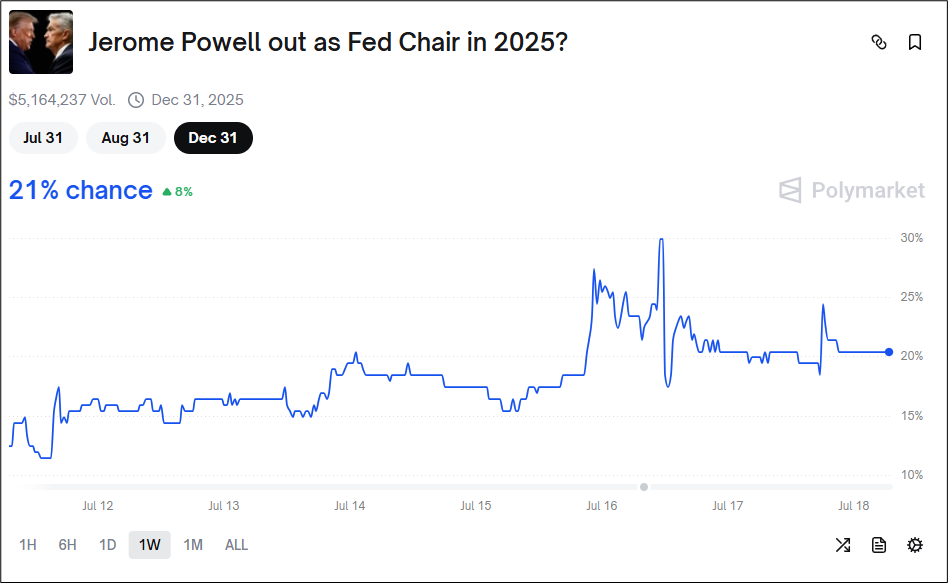

Finally, there is the matter of the cost overruns at Federal Reserve headquarters, which the government is attempting to use as legal rationale to oust Powell. This is a theme that has percolated off and on. If Powell is ousted, bonds will crater as monetary policy becomes more political and we edge towards a more Turkish policy mix. That said, firing Powell looks like the ultimate TACO trade as it’s a pointless risk for Trump to take and a potentially costly and destabilizing one.

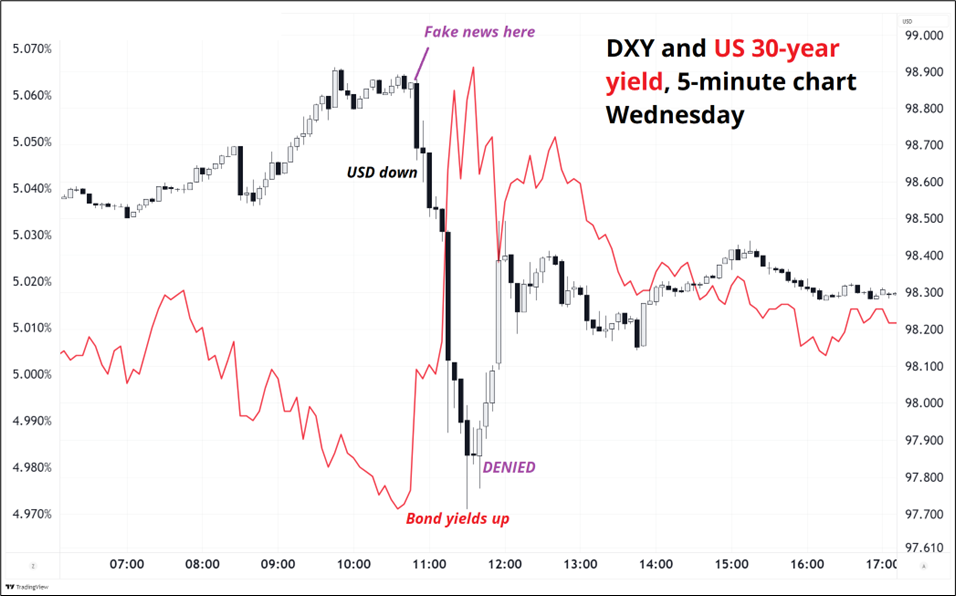

There was a flurry of fake news on Wednesday saying Trump was about to fire Powell but then Trump denied it less than an hour later. Here’s how the dollar and bonds reacted:

Firing Powell will make US borrowing costs go up, not down. Presumably at least Scott Bessent understands this.

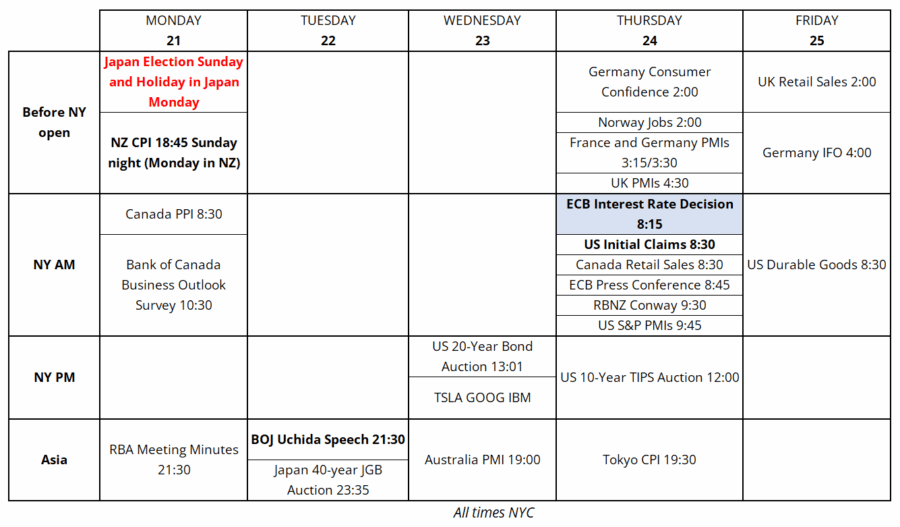

Here’s next week’s trading calendar. If you were thinking of taking a week off, next week would not be a bad choice!

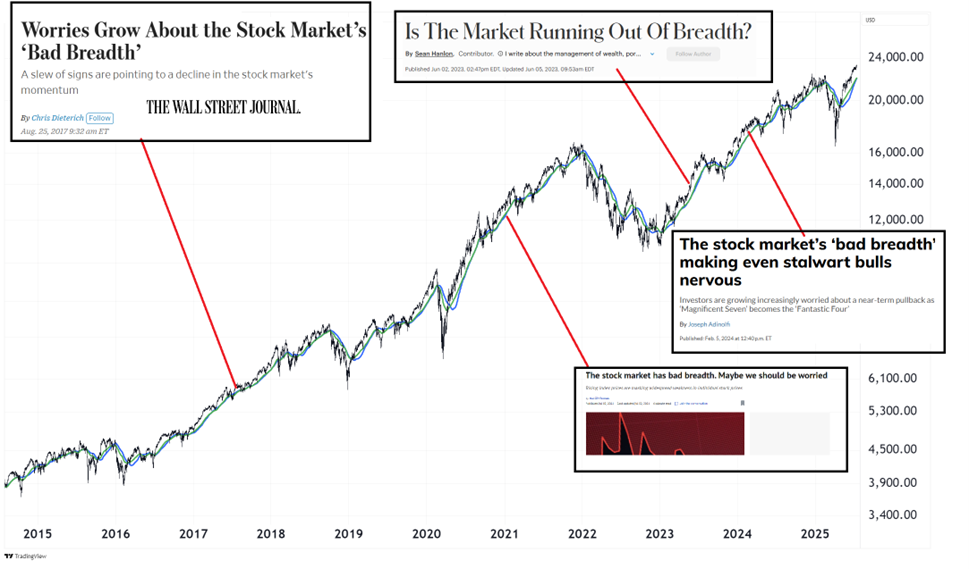

Stocks are at the all-time highs as there is not much left to worry about. The soft landing is in force, the economy is fine, the Fed is on hold, and the US government has backed down on the China chip restrictions, lighting a fire under NVDA stock. NVDA is a huge chunk of the index and when it takes flight, the indexes do too. Look at the heatmap on Monday, LOL!

How’s that for bad breadth? I’m not a fan of bad breadth as an indicator because it’s an evergreen complaint from the bears. I remember this in the 1990s, too. There are corrections and bear markets all along the way. Looking at bad breadth isn’t going to help you predict them. Be bearish for other reasons, but not because of market concentration. It’s not a useful timing tool.

A good analog for complaints about stock market breadth would be: Sure, Miami Inter is doing well, but it’s only because Messi is scoring all their goals. Without Messi, that team would suck. That’s true! Without MAG7 the stock market would be weaker! It’s like when your boss tells you that if it wasn’t for your worst 10 trading days of the year, you’d be up a lot more money. No shit.

Man, I sound really angry today. Not sure what that’s about. It’s definitely not because of my shirt.

When I feel a strong emotion, I try to figure out what information it might contain. Most emotions are there to tell you something. Guilt tells you your actions don’t align with your values. Loneliness tells you it’s time to reach out to a friend or loved one and connect. Fear is a sign that your mind is trying to protect you (but not everything unfamiliar is dangerous).

Anyway, I don’t know why I am angry today. Forgive me.

This week’s 14-word stock market summary:

Soft landing continues into its fourth year. Liquidity is plentiful. Trump things fly skyward.

As discussed, the Fed is on hold as Waller can’t get the votes for a cut anytime soon. Tariff policy, sponsored by Havaianas:

And with no visibility on US government plans, the Fed waits and wonders what to do next. Inflation is about to rise as the tariffs finally appear in the data, but real clarity now won’t be achieved until at least the September and October data (released in October and November) because the bulk of the tariffs won’t take effect until August 1. That’s if there are not more flip flops, ofc. No reasonable human being in the market can wait that long, but a central bank can. Each delay in the tariffs delays clarity and forces the Fed to wait longer. Sure, you can argue that tariffs aren’t inflationary, but you’re just guessing. Maybe they are and may they’re not. We’ll see.

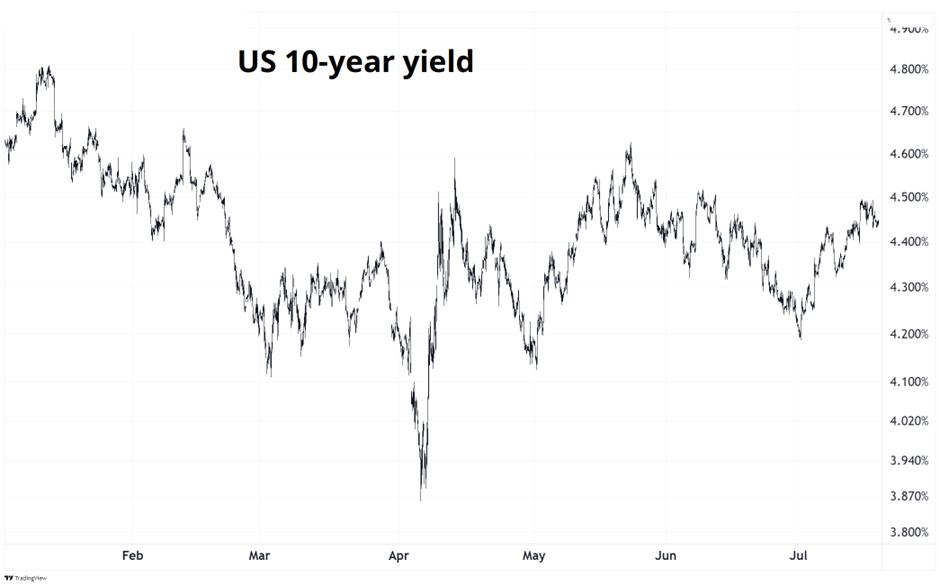

Meanwhile, 10-year yields continue to bore.

There’s some vague weakness in the labor market and consumer spending, but Initial Claims are falling back down, inflation is still firm/sticky, and term premium remains necessarily wide as deficits balloon and central bank independence is threatened. That all leads to a tie and yields continue to do pretty much nothing.

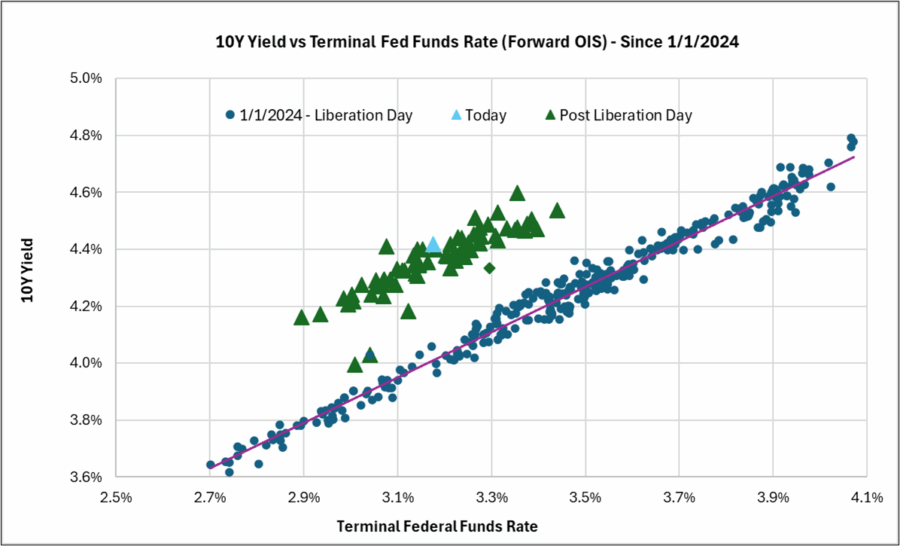

One of my clients sent me a cool chart showing the dislocation in treasuries after Liberation Day and how term premium got added and then we went back to the normal correlation between policy and the back end of the bond market. Thanks Chris, cool chart!

This is part of why it’s so hard to trade the bond market right now. There’s all the normal macro stuff, but then there’s the term premium caused by government policy weirdness.

The dollar continues to trade well as we got to a sentiment and positioning extreme at the turn of the month and the DXY has marched higher since. The “Powell will be fired in two days” craziness marked the high in the dollar as the market was in full capitulation mode (exiting USD shorts) before that whipsaw and then added short USD back and then got rinsed and here we are. The positioning story is now quite clean, though I can’t say I am quite ready to go short USD again yet.

Usually going into an event like this weekend’s election in Japan, people would be freaking out and buying vol and everyone would generally see the same tail risk and so lotto tickets would be sold out at all the FX option kiosks. This time, 1-week JPY vol is high but not crazy and while there is a medium strength consensus that the LDP will get smoked, it does not seem to be priced in. I think buying Wednesday 150s will be a good trade, but I can’t quite get myself to put it in the am/FX sidebar because the seasonality of USDJPY is so bearish for the second half of July. Still, I like the trade but view it as 3 out of 5 stars.

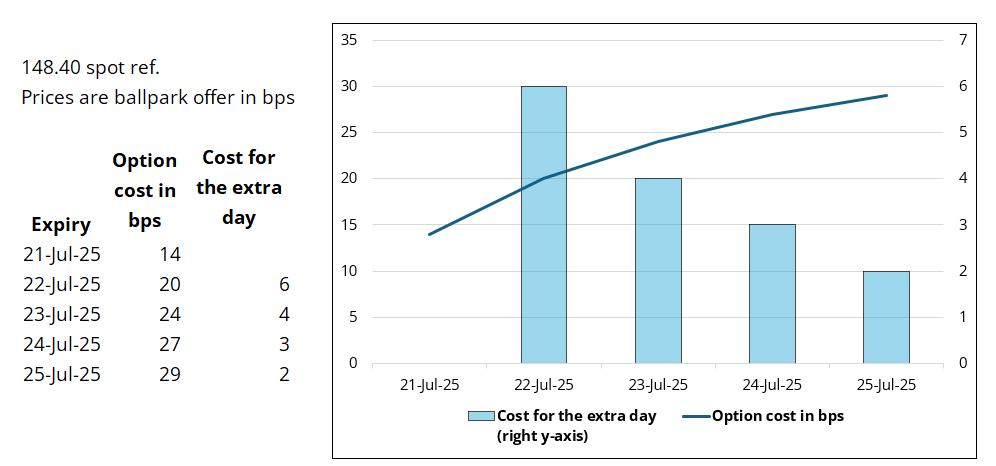

While the election results drop on Sunday, and you could therefore buy Monday USDJPY options instead of Wednesday, Matt Gittins gave me a good tip once a few years ago: If you’re buying short-dated options, always buy at least one more day than you were thinking you should buy. The price of the extra days is tiny compared to the cost of the first one or two.

Here, e.g., is the cost, in bps, of a 150 USDJPY option of various short durations:

Options professionals understand the non-linear increase in short-dated options prices (price goes up by the square root of time, not by time), especially over events, but I did not always have a good handle on this! The second day relative to the first day is particularly attractive as overnight options are not even good for 24 hours and this particular “overnight” contains a weekend.

The sweet spot here is Wednesday 150s at 24bps. Note these prices are ballpark and could change, but you get the idea. Quite a lot of punters want to fade USDJPY 150/151, though I can’t really understand the logic. I feel like people have been stuck in a sell USDJPY mindset for ages, long after it was clear that there is no rotation to JGBs and the cyclical story in the United States is not rolling over.

It’s Crypto Week in the USA and you could be forgiven for wondering if the best macro trade in the world is just to wait for “XXX week” and then buy XXX. For example:

And of course:

Sometimes it’s so easy, even a caveman could do it.

Now, my question is whether we get a buy rumor / sell fact trade here as the euphoria around crypto right now is a perfect mirror image of the emotional apocalypse in April when ETH was sub 1500.

And how many companies can copy MSTR and sell $1 bills for $2 before the market gets tired of the same stupid joke? The lame launch of CEPO yesterday (it opened at $15 and has done nothing but jiggle 13/15 since) could be a harbinger. You can buy crypto. You don’t need to pay 2X NAV to buy crypto stocks. They are just selling their bags at 200% of fair value. It’s mind melting.

I am taking a shot at the buy rumor / sell fact trade by selling BTC at 119k with a stop at 124,100 (target 110,500) and selling a basket of SBET, UPXI, CRCL, and MSTX. Bitcoin is lower as I type this but I already mentioned that trade in am/FX yesterday so this is not cheating.

These equity shorts are only suitable for complete degenerate lunatics, so please don’t do what I am doing. I am literally advising you not to do this, so it’s definitely not investment advice.

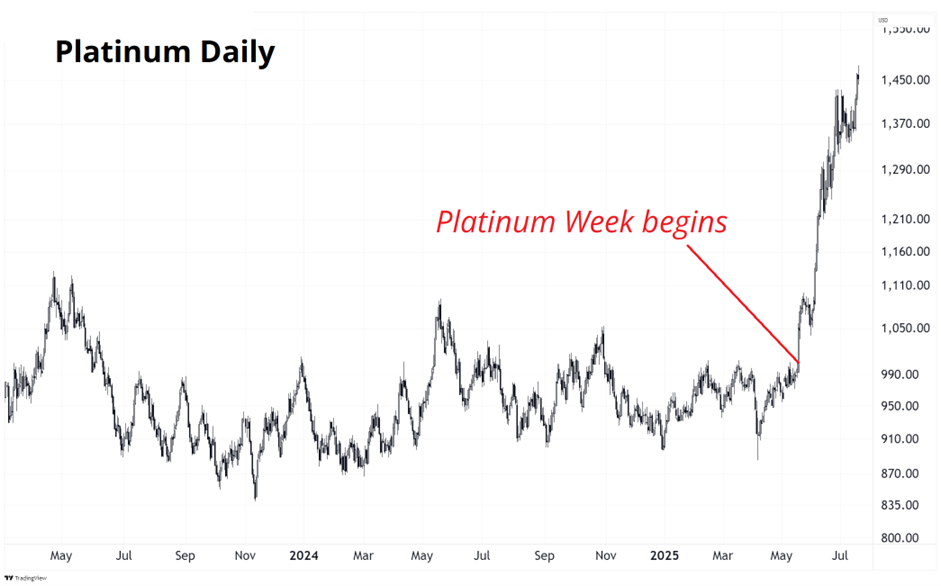

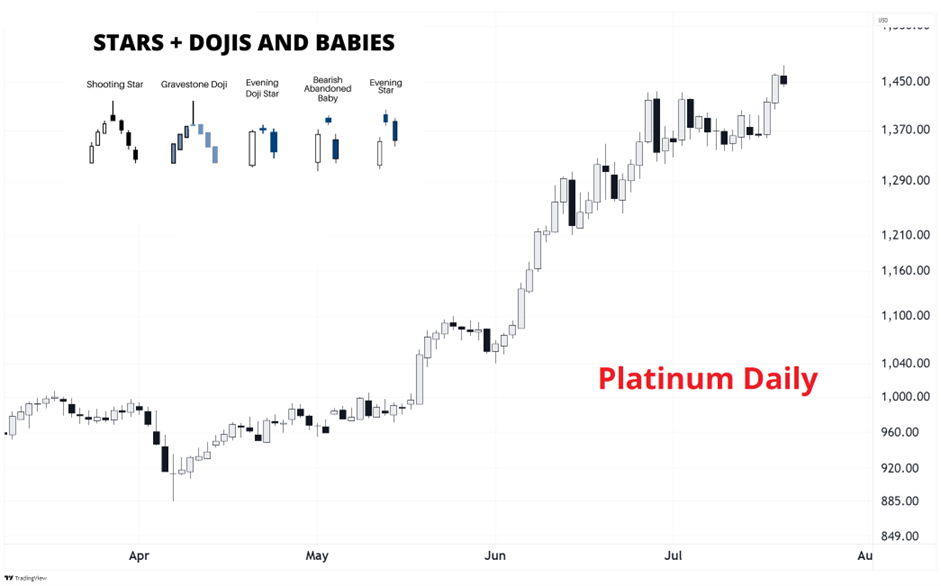

I stopped looking at platinum recently, but as I brought up that chart to show you the Platinum Week timing, I noticed a shooting star on the daily.

If you have some reason to go short platinum, the risk management here is easy as you can sell with a stop at new highs and if the shooting star is validated we might see 1365/1370 pretty quick.

Oil’s not doing much. Gold isn’t either. Silver is the metallic ETH.

That’s it for this week.

Get rich or have fun trying.

*************

One of the better songs I have heard in a while. It’s a rap song. With a sample from one of the most spanking nu metal songs of the 1990s.

And another brand new banger from Fred Again, Denzel Curry, Skepta and PlaqueBoyMax

*************

An excellent podcast about prediction markets. Has many insights for traders more generally.

Risk of Ruin Podcast: Betting on Chaos

*************

Sadness is your mind slowing down to catch up with what’s happened. Letting yourself feel isn’t weakness, it’s processing.

– Random dude on Insta, 2025

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.