Normally, you want to buy whatever assets the government tells you to buy. This time is different.

Push and Pull

It was a week of crosscurrents and contradiction

Normally, you want to buy whatever assets the government tells you to buy. This time is different.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

My pals at Grant’s are holding one of their signature distressed investing events. Here are the details:

https://grantspub.com/events/index.cfm

I do not receive compensation for this ad, though they do run the odd am/FX ad on my behalf, for free.

First, I need a quick favor, please. I am writing a new trading book, and for one section, I need some aggregate data on trader behavior. If you are a trader / risk taker and if you have about 90 seconds to complete a very short survey, please click here. The survey is anonymous. Thanks!

Regime change is here. We have pivoted from “There is no alternative” to US tech, to “Sell America” in a few short weeks. The setup is reminiscent of the rapid flip of the switch we saw when the dotcom bubble burst in 2000. The market went from buying US tech stocks and the USD all willy nilly for five straight years, to selling them both for the next five. Cycles! Up and down.

This week saw a bunch more examples of regime shift. Let me go through a few because if you are an investor or a trader, regime shifts can be the best time to make money, or the hardest time. It depends whether you keep trading and investing based on the old regime, or pivot quickly to the new one.

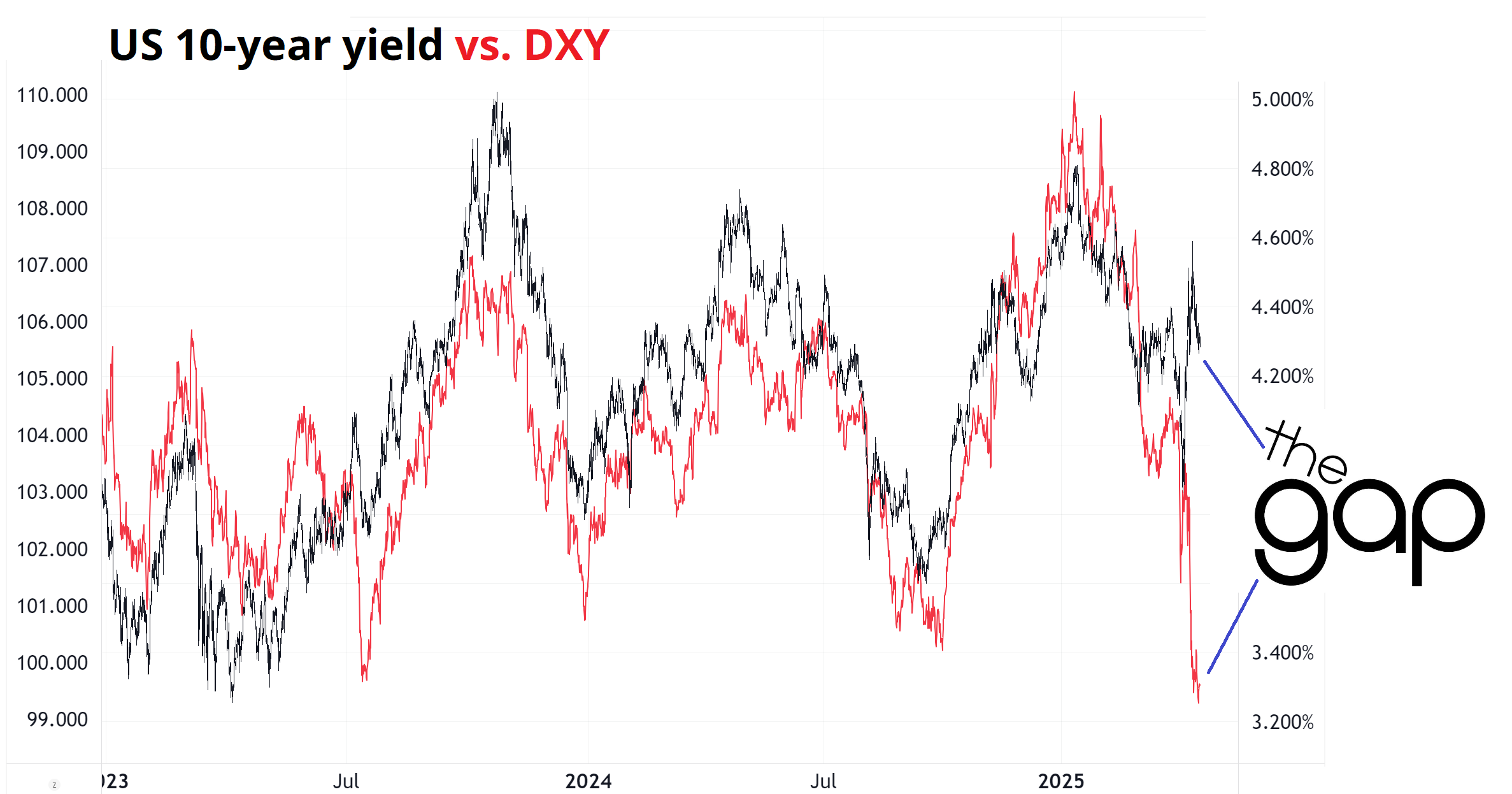

The most obvious and potentially important regime change is that interest rates are no longer driving the US dollar. Scott Bessent came into office touting lower deficits, and that helped US yields go lower. But the evidence is now stacking up that the DOGE effort is mostly cosmetic, defense spending is going up, taxes will still be cut, and spending remains out of control. In other words, deficits are about to get larger, not smaller. On top of this, if the US falls into recession after running massive deficits in boom times, that’s another huge hole in the budget. Recessions trigger massive increases in spending due to automatic stabilizers like unemployment insurance.

On top of all this, policy chaos and antagonism towards Canada and the EU has led to significant capital flight as pension funds from these jurisdictions have been liquidating US stocks, bonds, and dollars in huge amounts, every day.

You are thus seeing what you often see when investors lose faith in the governance of an emerging market country: Sell the bonds, sell the stocks, sell the currency. Normally, higher yields would attract money in a developed market like the USA, but this is not happening in the USA at the moment.

Regime Shift, Exhibit A: The dollar is decoupling from US yields

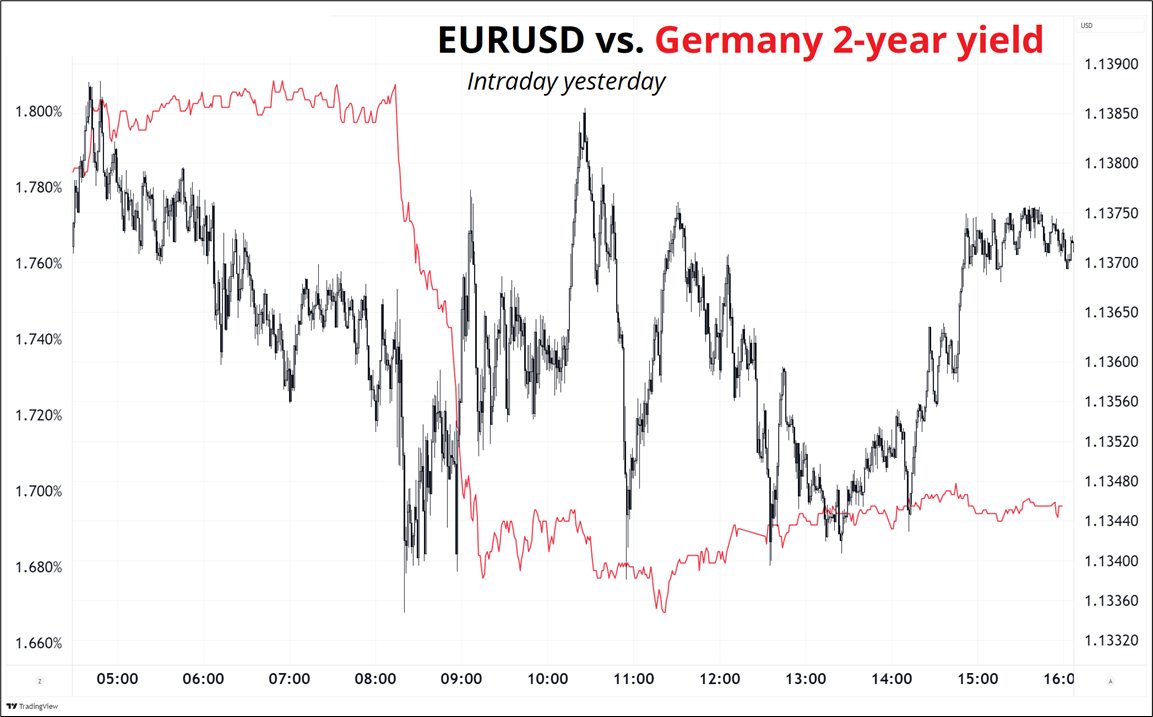

There is weirdness at all levels of zoom, and across many markets. Yesterday, the ECB was perceived to be dovish, and Euribor rallied (lower EU yields). Normally, this would mean that EURUSD goes lower as holding euros at lower yields is less attractive. If you overlay EURUSD and German 2-year yields over any normal ECB meeting day, you would see them going up and down in close lockstep.

Instead, we got this:

Regime Shift, Exhibit B: EUR ignores falling German yields on ECB Day

German yields down, EURUSD flat or small higher. Odd! Which had many clients sending me Bloomberg messages and emails like this:

“Bor” is short for Euribor, the European interest rate futures contracts

Central banks and pension funds are selling dollars and buying euros. They don’t care about intraday price action in Euribor or Schatz. They just want out. I remember this clearly from 2003/2004 because I would often get killed buying USD on strong nonfarm payrolls (or whatever) back then as EURUSD just ripped higher after a quick dip.

2001/2002 saw a pivot from a tech bubble to capital flight out of the US on fears of large US twin deficits. We are seeing the exact same thing now. Again, it’s a regime shift. Hence you see tweets like this:

When foreigners sell USA and buy anything that’s not USA, you will see the dollar go down and those foreign assets rally, even when that’s not the old relationship.

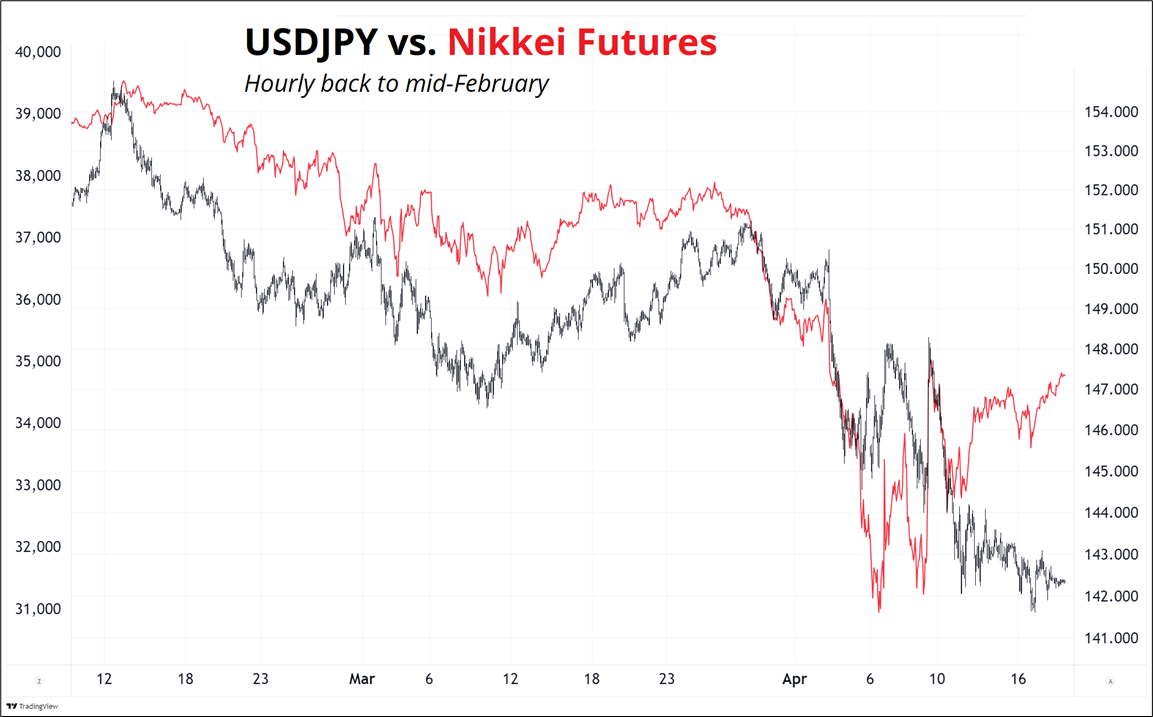

Here’s Nikkei and USDJPY, so you can see what Mr. Orr is asking about. Normally if the red line is going up, you would expect the black bars to be moving up in tandem. But if Japanese investors are selling US assets and buying Nikkei with the proceeds, you will see the lines diverge. Like this:

Is this a permanent regime shift, or a strange aberration caused by Liberation Day wonkiness? My guess is that this regime shift will last. Much as the regime shift out of the US dollar persisted for most of 2001 to 2008, and the regime shift back into US assets persisted from 2012 to 2022, this regime shift to capital flight out of the US is also likely to persist. Even if the Trump administration reverses on tariffs again, the damage is done. Trust is broken and won’t be easily restored.

Last week’s epic rally was a textbook bear market short squeeze, and we have not surpassed the April 9 highs. April 9 was the day some of the tariffs were delayed by 90 days as the government backed off under pressure from financial markets and a flurry of shrill pleas from Bill Ackman. Explosive short squeezes like we saw last week tend to be great selling opportunities in bear markets. My belief is that we will make new lows in stocks, but I’m attuned to the fact that many sentiment readings are at levels that often signal a bottom. As long as SPX cash is below 5500, the outlook remains bearish.

There is one fundamental question to be answered here, and all the money will be made by answering it correctly. Are we entering a US recession, or not? My feeling is that we are entering a modest recession, accompanied by price spikes, product shortages, and supply chain chaos that will look, in many ways, like 2022. That year, consumer prices rose, stocks fell, bonds dropped, and malaise was the word. Malaise is the word again.

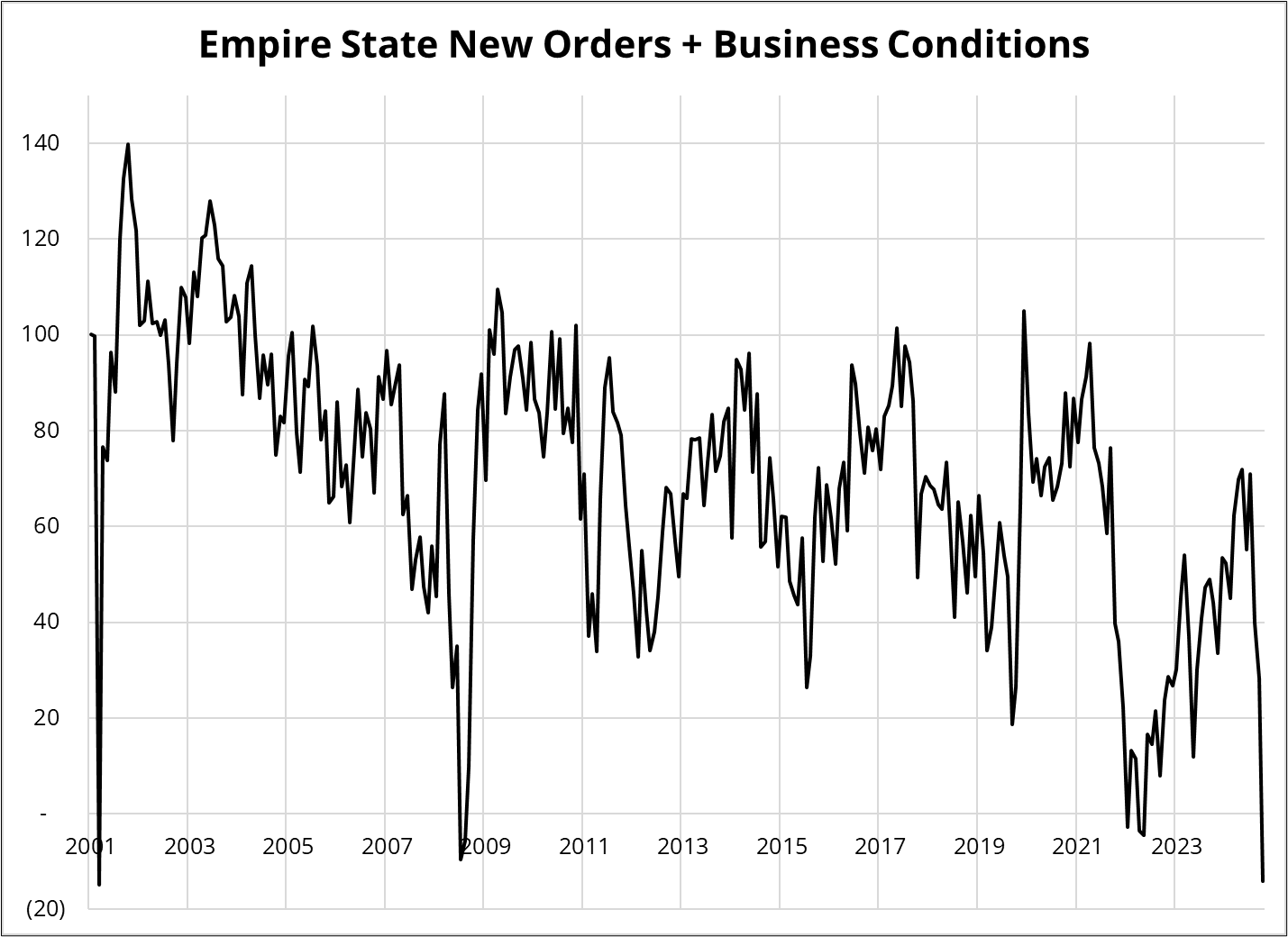

I could present 20 of these charts, but let me just present this one, which is typical of what is going on. Business and consumer confidence has collapsed. But is this just like 2022, when confidence collapsed—but it was a red herring? I don’t think so. This time, we are coming off a much lower base, excess savings have been drawn down, and we are about to see a sudden stop in hiring and investment. When nobody knows what policy is going to be next year, next month, or next week, they don’t hire and they don’t invest. Meanwhile, many small and medium sized businesses are going bankrupt as they are unable to source inputs for their manufacturing and online businesses.

And to top it all off, mortgage rates remain sky high as distrust of the US fiscal story has kept bond yields up, even as confidence falls. Normally, you would at least get a buffer from lower yields at this point in the cycle.

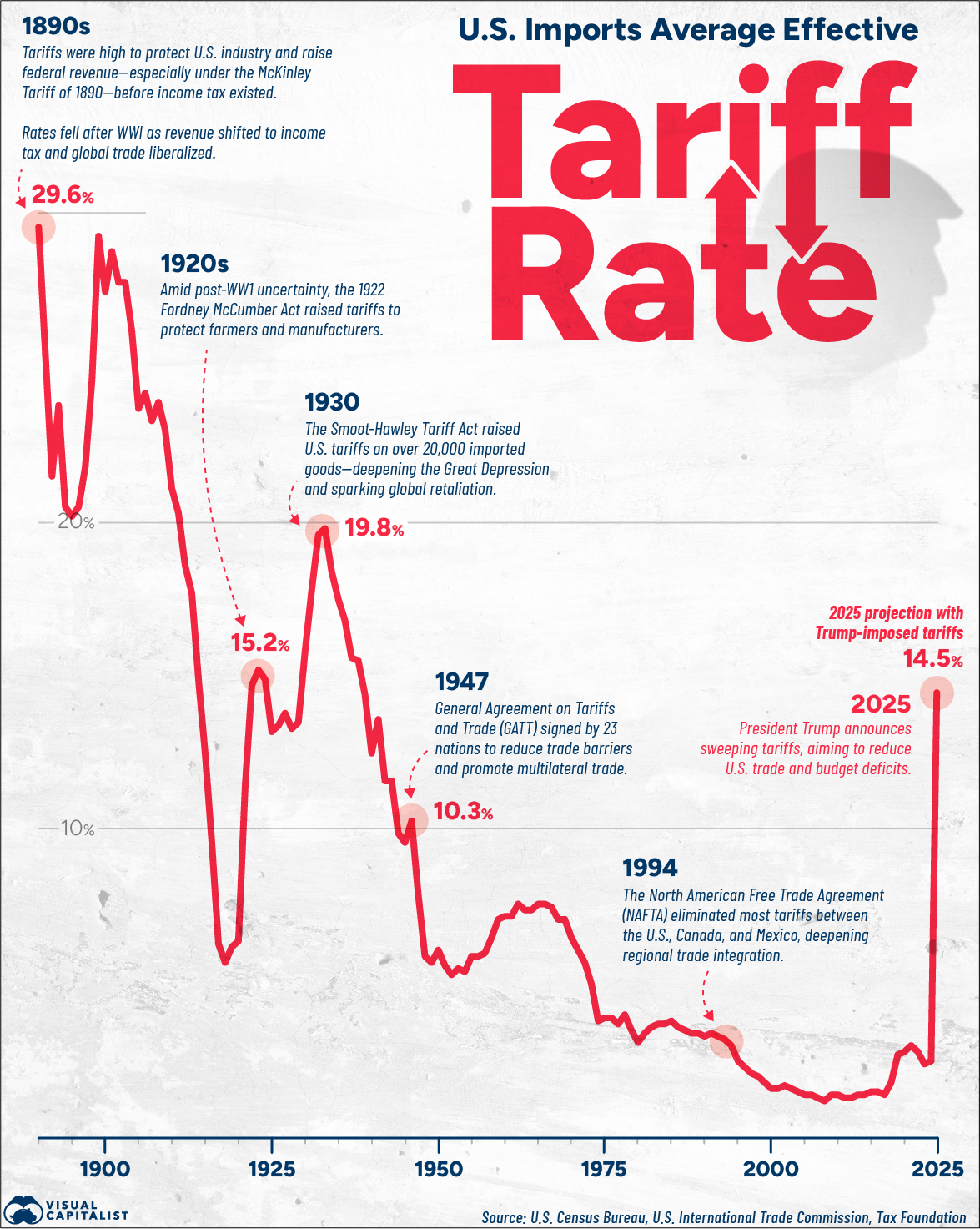

On the bullish side, low gas prices help quite a lot, and there is always hope that tariff policy will change for the better. But even if all tariffs were removed tomorrow, would businesses trust that those tariffs will not be slapped right back on 30 or 90 days later? There is a reason Smoot Hawley is widely regarded as one of the worst economic acts of self-sabotage in US history. And now we are speedrunning Smoot Hawley. The return to mercantilism and the desire to reverse Reagan’s laissez-faire ideologies is clear as aggressive government intervention in all dimensions of economics, politics, education, and culture is now the new normal.

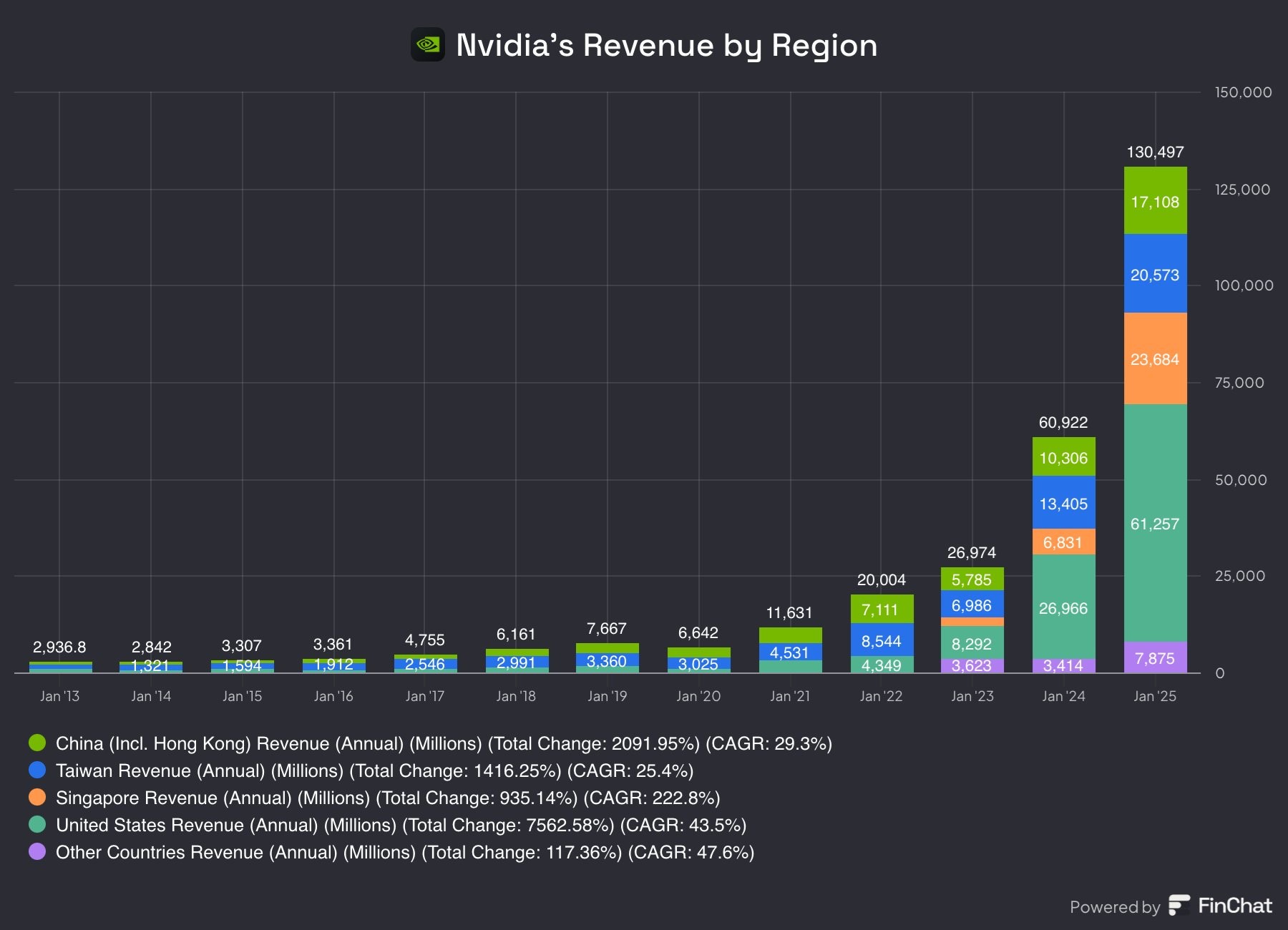

Under the hood, there was significant dispersion this week as NVDA and semis were hammered after the two month wait for a crackdown on China chip shipping loopholes finally ended. NVDA gets a substantial share of its revenue from Asia, and questions abound whether all that exporting to Asia is consistent with US attempts to isolate China. This week’s announcement could be the tip of the iceberg, and the revenue hit to NVDA is not small. It also shows the capricious nature of the current economic environment as the ban harms a company that just a few days ago bent over backwards to please the administration and got a shout out from the White House.

“Banning the H20 makes little sense to us,” wrote Bernstein analyst Stacy Rasgon in a note to investors early Wednesday. “H20 performance is low, well below already-available Chinese alternatives; a ban essentially simply hands the Chinese AI market over to Huawei.”

If you look at that chart, you can see that China, Taiwan, and Singapore make up almost half of NVDA’s revenue. One might suspect that a good portion of that Singapore revenue is actually chips going to China, and billed to Singapore. I am not an expert in this, but it’s a narrative out there for sure.

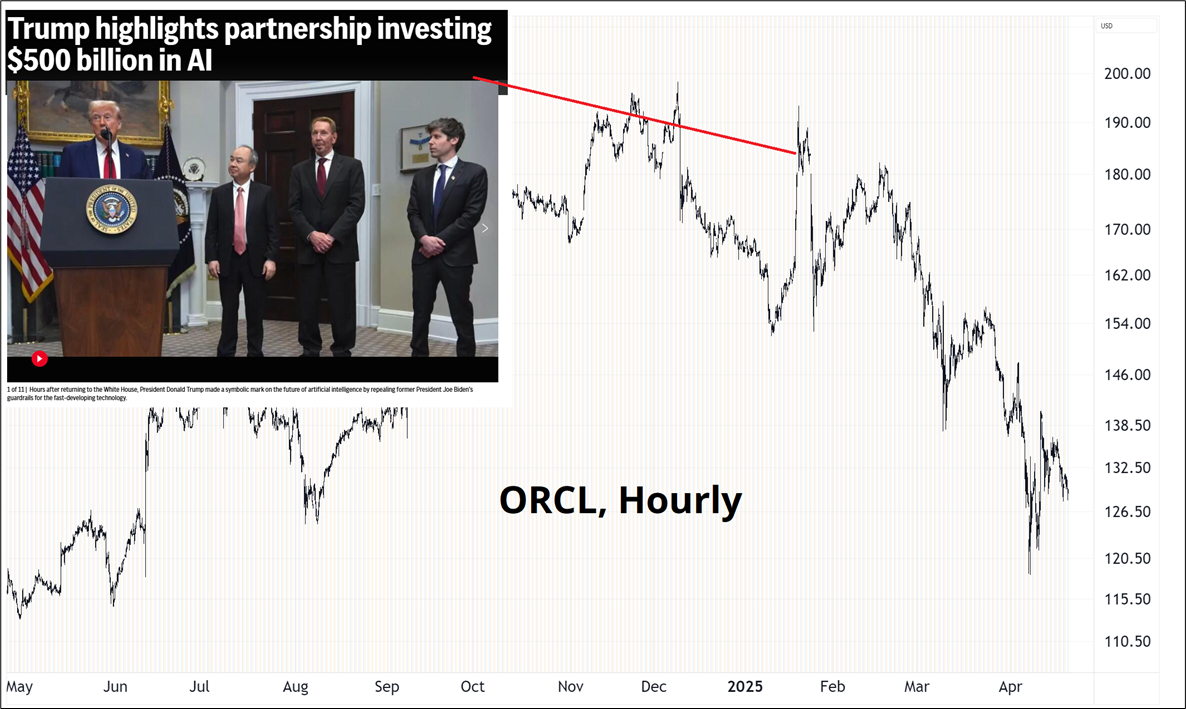

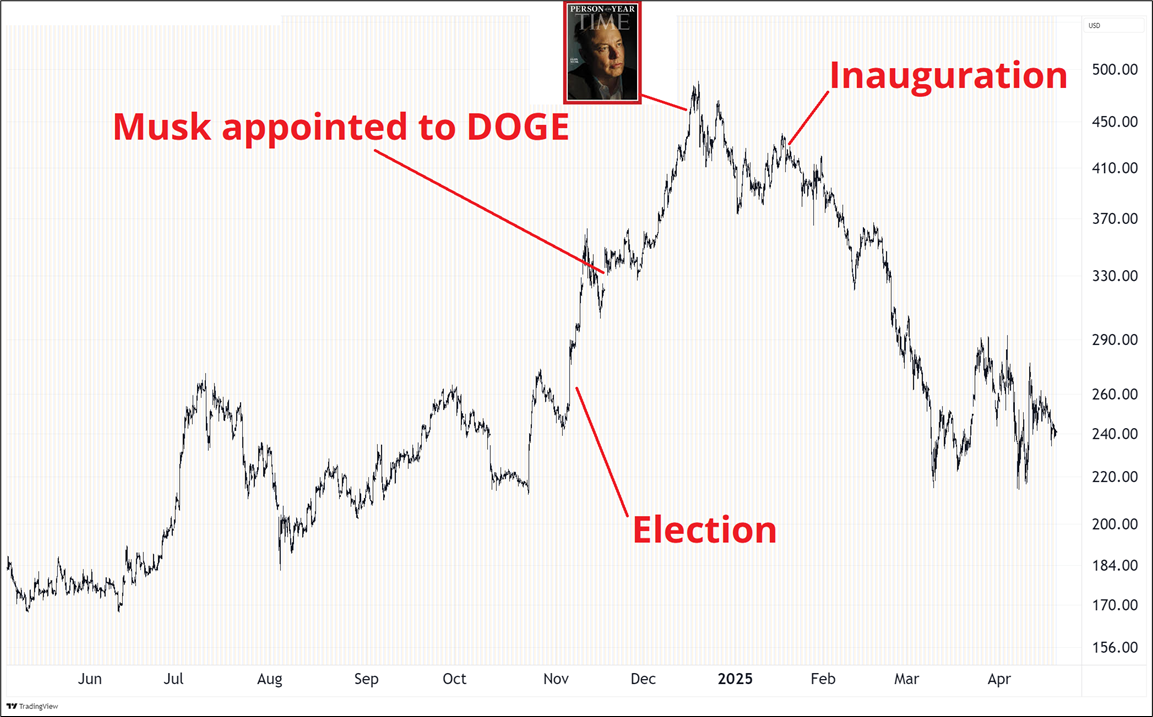

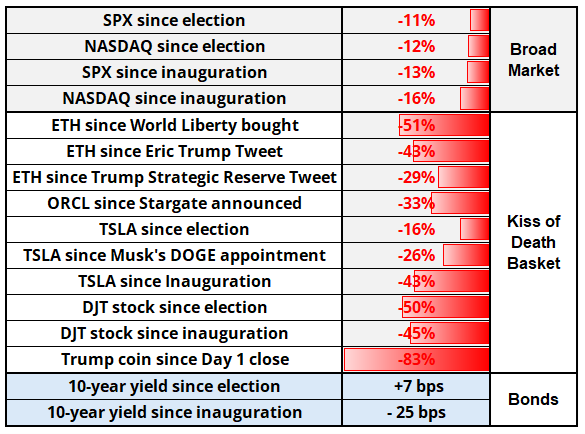

This sequence of White House backing for a company or asset, followed by that asset dropping sharply is becoming a pattern. I got sucked in a few times, buying assets that appeared to have government endorsement, and have learned that it’s actually the kiss of death when this administration pumps a particular bag.

For example:

This probably feels like I am dunking for kicks, but the main reason I bring this up is that when Trump pumps an asset, your temptation might be to buy that asset because the government has a lot of power, and usually if you buy whatever the government is buying, you make money. This time is different.

I made the mistake of buying ETH on government support at one point and learned an expensive lesson. These government pumps are not good news. They are the Kiss of Death. And it’s not simply a matter of all risky assets going down. The Kiss of Death basket has massively underperformed every possible benchmark.

This week’s 14-word stock market summary:

Government-backed assets are not strong. Dead cat can bounce, but not for long.

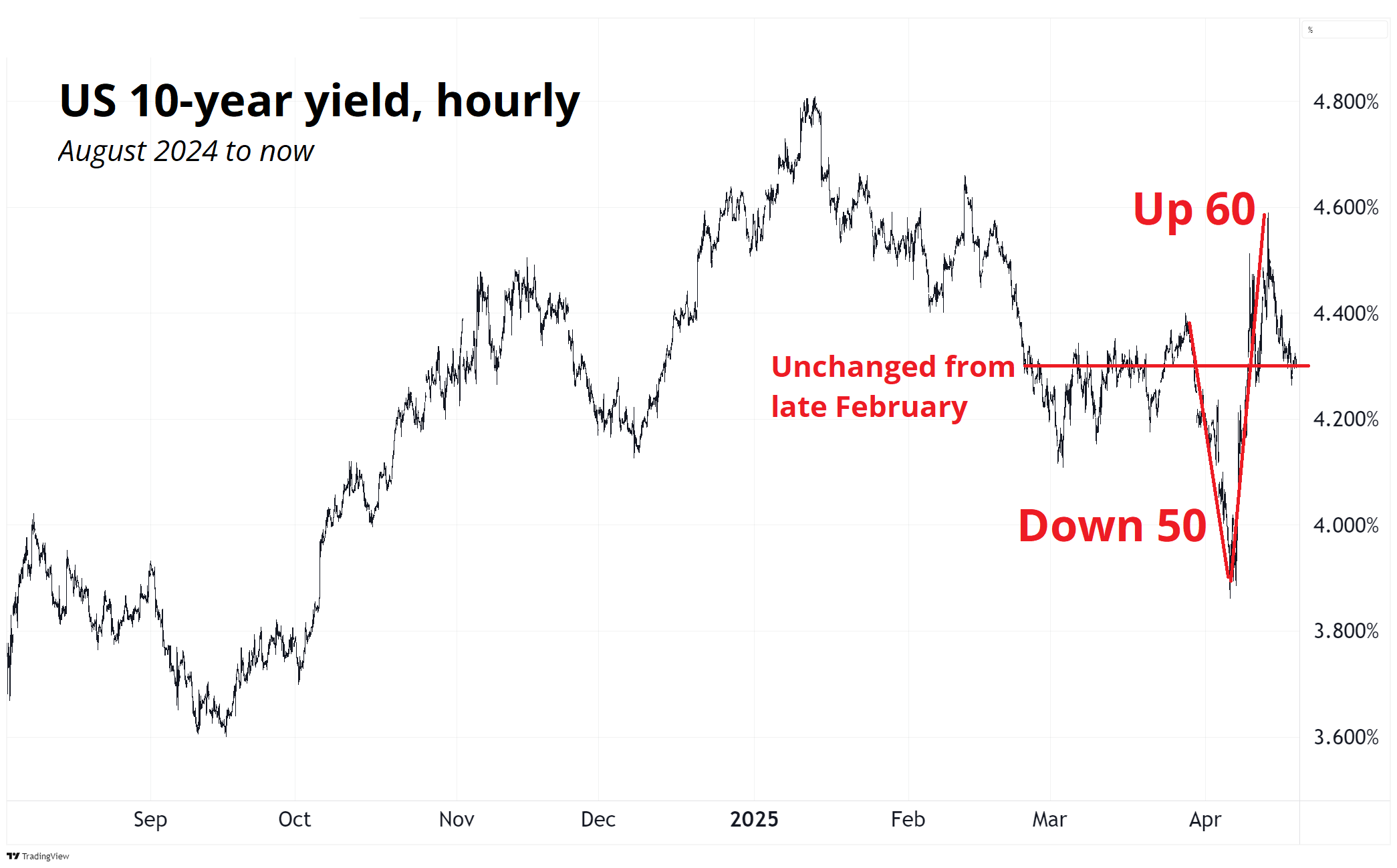

The US bond vigilante trade was hot last week and has cooled off, as The Economist trumpets the story, and a media flurry goes viral. The question now is whether the rip from 3.90% to 4.50% in 10-year yields was a one off and meaningless reversal of a meaningless drop after Liberation Day, or something more nefarious. The breathless reports citing the largest 1-week move higher in yields since 2001 fail to mention that yields went down almost as much right beforehand and currently trade at the same levels as they did in late February.

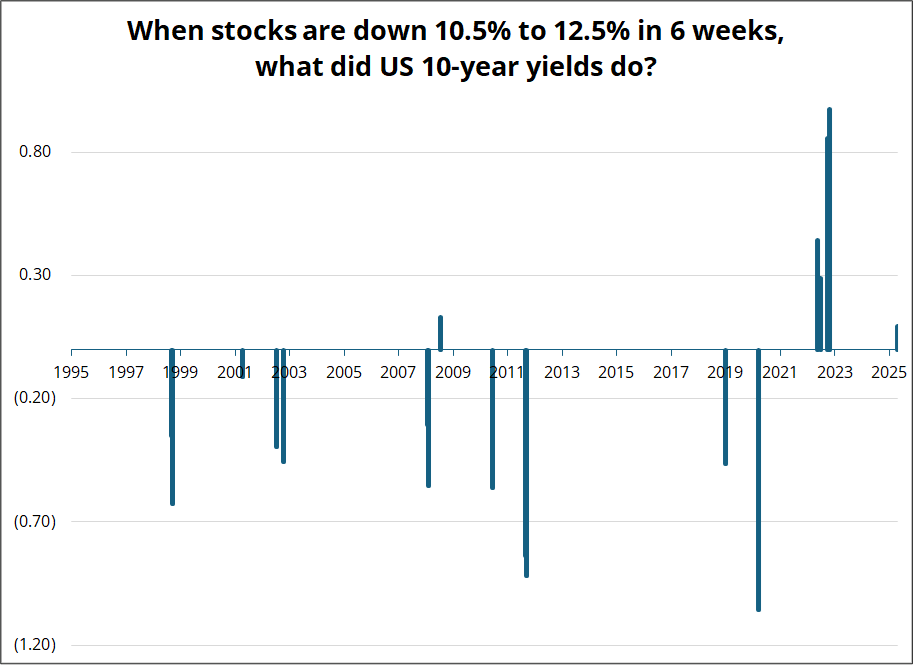

Then again, these unchanged yields come after an 11.4% drop in SPX, so that’s not totally normal. To get a sense of how abnormal it is, I looked at all the 6-week drops in SPX of 10.5% and 12.5% and then looked at the 6-week change in US 10-year yields. Here’s the chart.

So, you can see this recent action is a bit odd, and when you add the fact that the USD sold off in the same period, it’s even more strange.

As mentioned at the top of the show, I believe we have entered a new regime. I am not alone in saying that, as basically every bank strategist has moved from USD bullish at the start of the year to USD bearish now on the end of American Exceptionalism. That might make you want to fade the consensus, but we are in day 16 of a major macro regime shift. It’s just starting. As discussed in the positioning report Tuesday: Macro regime shifts are way more important than speculative positioning. The CFTC was short JPY as USDJPY rose from 90 to 125. Every single human was short EURUSD from 1.35 to 1.10 when the ECB did QE in 2015. And so on. This theme will be stale one day, but that day might be in 2028 with EURUSD at 1.37.

Everything right now is wildly reminiscent of the turn in 2002/2003 as we transitioned from “US tech is the only thing worth investing in” to “Twin deficits are the end of the US dollar”. Tech inflows turned to central bank USD selling almost overnight and it went on for six years. The only blip in the USD downtrend was the Homeland Investment Act in 2005 as that triggered $300B+ of USD buying, all concentrated in that specific 12 months. Here’s a brief history:

So now we have the same deficit issues, but much, much worse, and there is no hope in sight as Bessent’s 3/3/3 plan is a faint dream shimmering on the far horizon. Defense spending is going up, they are not touching entitlements, and DOGE cuts are cosmetic. Meanwhile, policy uncertainty looks to be driving the US towards recession (Philly Fed yesterday, yuck), and recessions are unambiguously bad for deficits. If you run crazy deficits during boom times, the recession impact on your balance sheet will be historically ugly.

The short USD and short US equities trades (outright or vs. RoW) look more attractive to me than the short bonds trade simply because in bonds you are playing fiscal premium vs. recession odds and those two factors have offsetting impacts on yields.

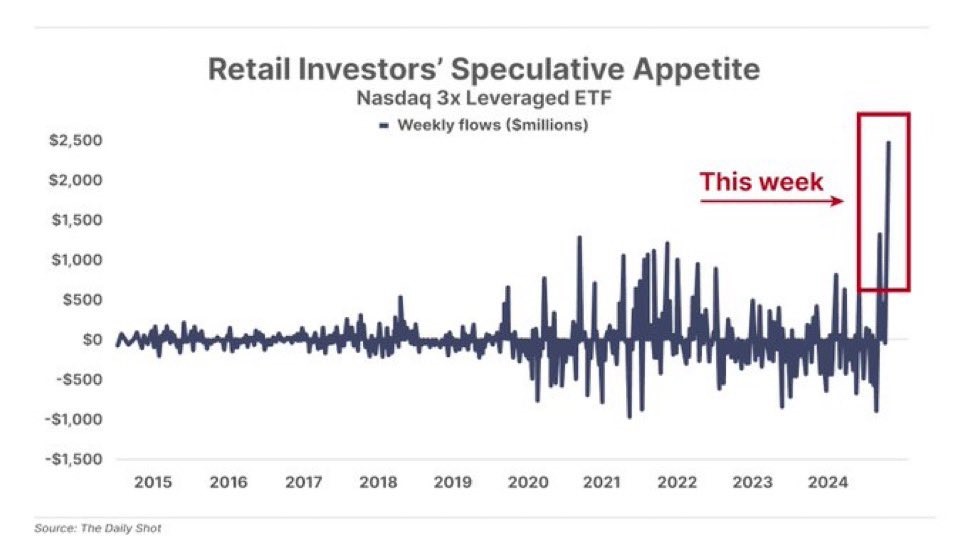

Equities are tricky because of headline risk, but I am blown away by how retail just keeps buying every single dip. Sure, some of the surveys point to bearishness, but the retail flows do not. This Pavlovian buy the dippishness needs to be eradicated by a massive purge. But: Short stocks is always hard work, and you have to sell rallies, and cover when things are dumping fast, not the other way around.

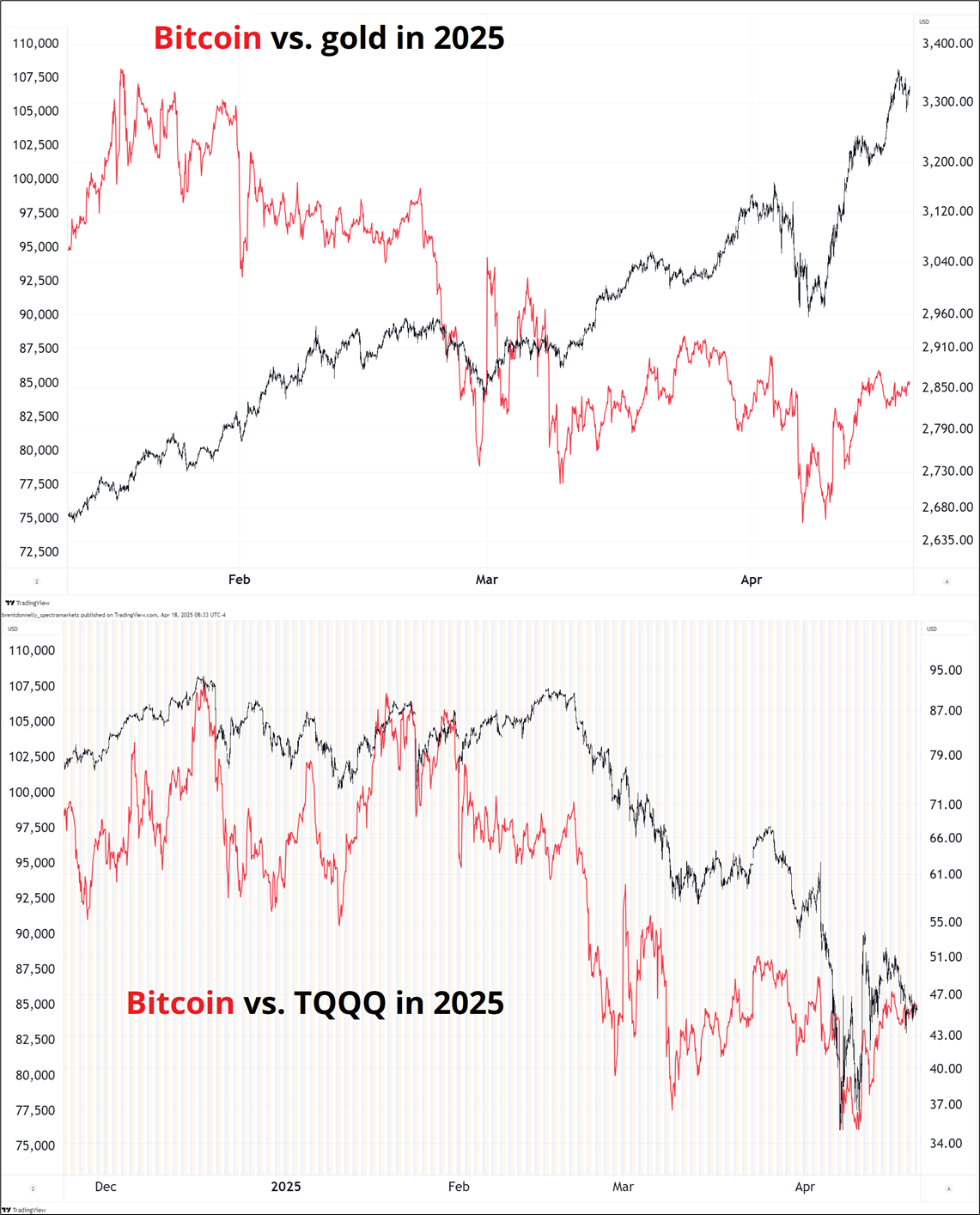

Bitcoin is tracking TQQQ (levered NASDAQ) pretty well all year and its divorce with gold appears to be nearly finalized. Overall, bitcoin is outperforming high-beta equities and dramatically underperforming gold and continues to be a hybrid that looks something like 80% tech stock and 20% “other”. The dream that the “other” factor grows and BTC can decouple from risky assets remains reasonable but highly uncertain.

There doesn’t seem to be much of a new thesis for bitcoin these days as the hopes that it would become a government asset were the latest evolution of the narrative but repeated government pumps have pushed it lower, not higher.

Every year or two, bitcoin gets a completely new bull thesis to drive the next leg higher. We are due for a new one here, guys?!

Credit where credit is due, though: MSTR trades like a champ these days. Flat on the year is a good result for a levered risky asset, especially given they bought a ton of BTC above $100k. I am intrigued by its relative strength, although last time this happened was in late March and it crashed from 340 to 240 soon after. Something to watch. If you’re bearish risky assets, selling MSTR at this premium is probably nice. If you’re bullish risky assets, you can argue MSTR is leading BTC and buy some BTC.

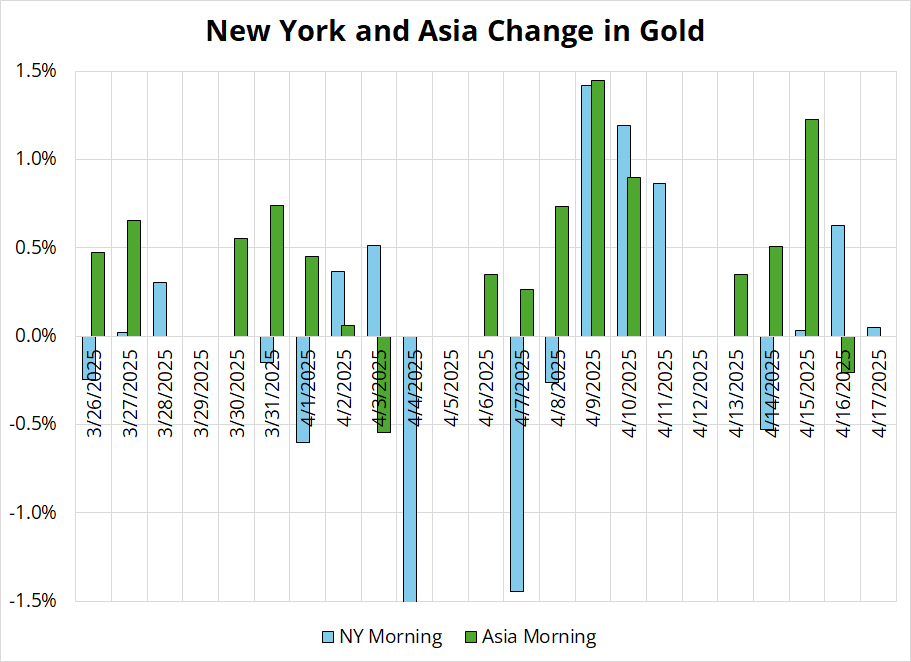

Gold is an absolute wildebeest these days as it explodes in the Asian time zone almost every night.

That’s central banks getting out of USD and into anything that isn’t US-based. The negative correlation between the dollar and gold has been low in recent years (35% in past few years, vs. >60% 2003 to 2006, for example), but the market still has an easier time ripping gold higher when the dollar is weak because it just feels more correct than ripping gold higher when the dollar is strong.

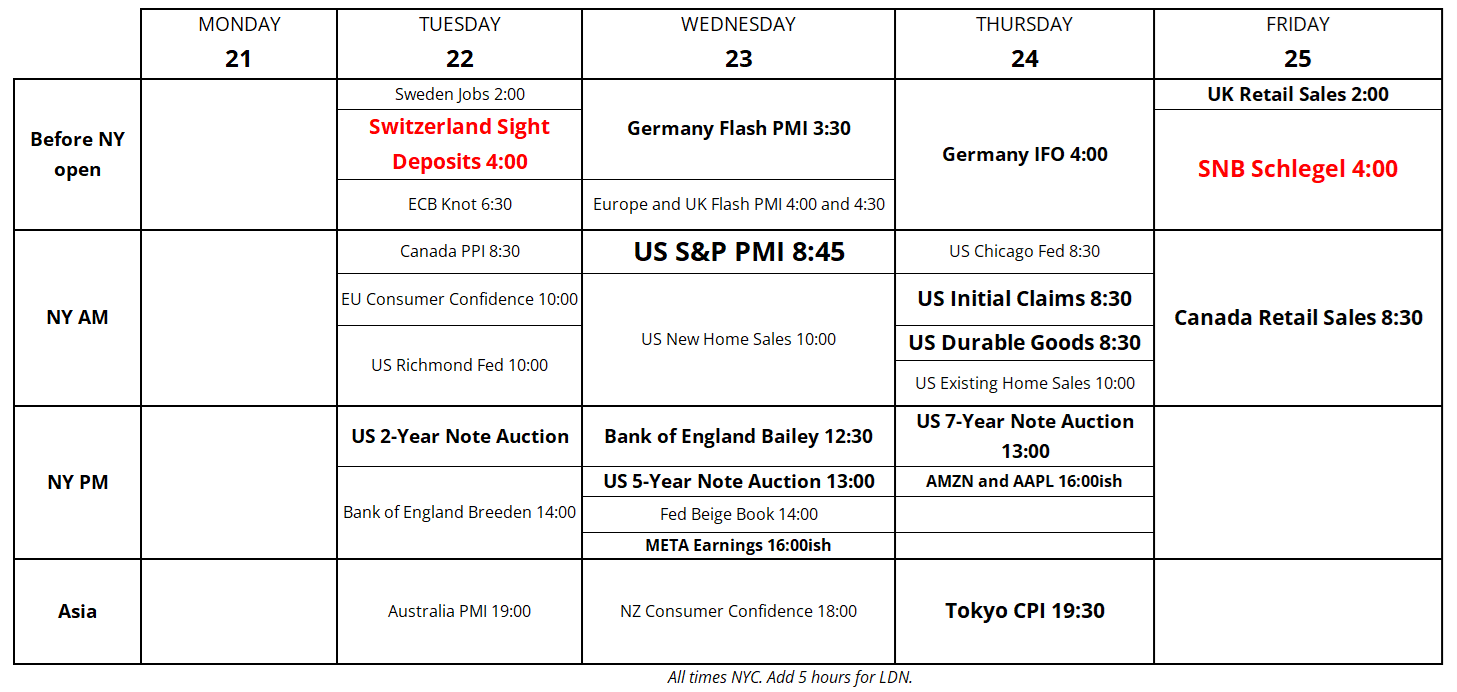

Here’s next week’s calendar:

That’s it for this week.

Get rich or have fun trying.

Global macro soundtrack for April 2025

*************

This video is cheesy, but it’s still strongly net positive for me.

Make your bed, change the world

*************

Good technical analysis from a reputable website that I trust

https://quantifiableedges.com/97-years-of-death-crosses/

*************

Until the Pavlovian retail dip buying reverses, I am going to find it hard to be structurally bullish stocks. We need a purge.

https://x.com/gnoble79/status/1911167210820641165?s=51

***************

*************

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it