Does there have to be only one winner?

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Does there have to be only one winner?

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

The podcast with Alf is here !

Well, I thought every sign pointed to stronger CPI for September, and the release came in weak. That’s disappointing but probabilistic. I also thought the reaction function in the USD would be asymmetric as the market is fully priced for Fed easing, and that part was correct. The USD is unchanged and SFRH6 is only down 2bps. I suppose that with the Fed on autopilot now that’s it’s fully abandoned the 2% inflation target, the data doesn’t matter that much.

The regional bank wipeout theme from last week was, indeed, a nothingburger, and maybe the most interesting narrative going on right now is the debate around China vs. USA.

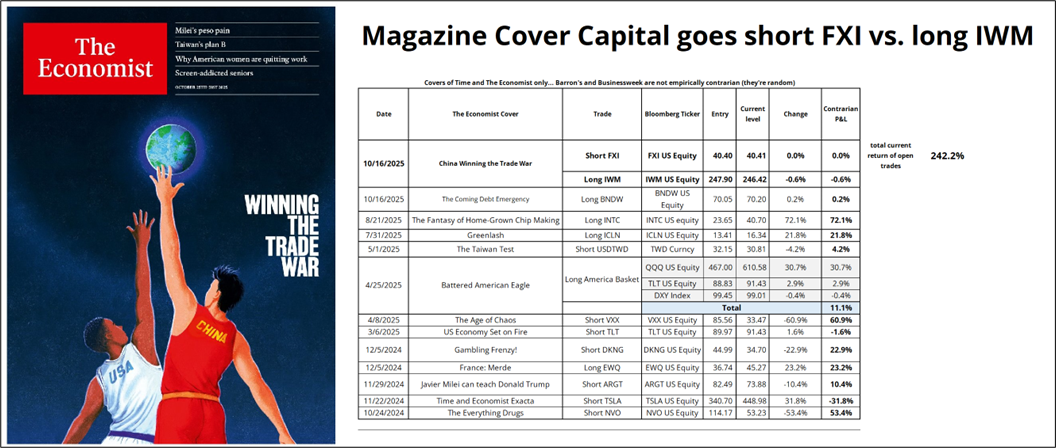

You got a pro-China cover from the Economist, which leads to a trade for Magazine Cover Capital (short FXI / long IWM, or … short China long USA).

If you are not familiar with the Magazine Cover Indicator, please see here:

https://www.spectramarkets.com/amfx/the-magazine-cover-indicator/

We have toggled from “China is uninvestable!” last year to “USA is uninvestable!” in April 2025 and now we are somewhere in the middle. The truth, as they say, is in the middle.

Tim Power puts it like this:

A pretty fascinating narrative shift is going on under the surface.

Where China once looked to America with envy and inward with frustration, and America looked down at China as a manufacturer of cheap trinkets and IP theft, we’re entering a very new era IMO… I know I harp on about it, but it’s a tectonic shift.

Accepting it and thinking through its consequences are as important as anything in macro right now. I think acceptance is growing, but it has a long way to go and that in itself is very important to note.

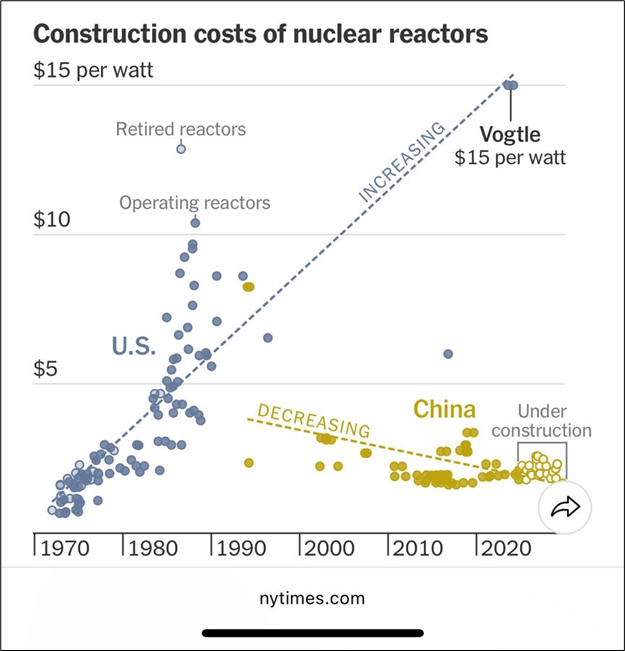

Tim features this chart as an example of how China is beating the USA:

That’s a remarkable chart, and there are similar charts of energy production, EV production, and other industries where China is massively outperforming the USA. The idea that the US is run by lawyers and China is run by engineers makes some sense. The USA is trying to move towards a more centralized form of control with more state-backed capitalism, mercantilism, isolationism, and price controls to replicate China’s model, but that’s a long slog.

If you care about making money, it’s worth noting that Chinese stocks are flat over the past 20 years while the SPX is up 10X in that period. So capitalism definitely made you more money. In the last two years, Chinese stocks have outperformed, though.

Chinese assets trade at a massive discount to the US because the rule of law concerns in the US are nothing like the ones that cloud China. In the end, there’s probably plenty to like and plenty to hate about both economies and plenty to hate about both political environments. You have to put your money somewhere.

Elsewhere in macro, the word “weird” has appeared in many commentaries of late as the market internals and correlations are bizarre these days. Most of the big moves have been pure momentum with narrative backfitting and not any result of debasement or macro reality.

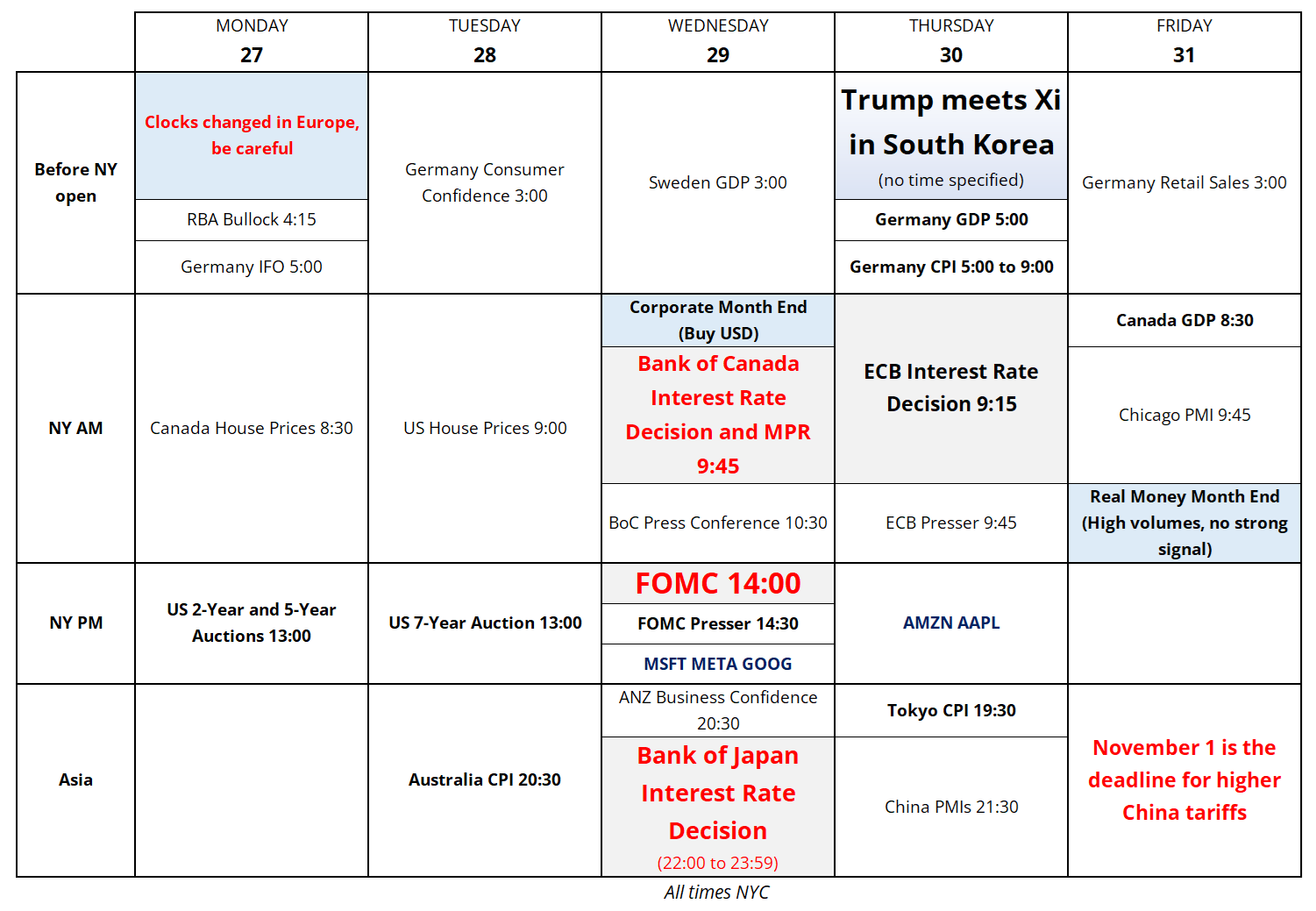

Short-term traders have been saddened by the lack of US data and my recent weekly event calendars have had the sparseness of an Agnes Martin painting. But next week is different! Check it out.

Click on the ad to subscribe. If you’re not happy, just email me and I’ll refund you. Risk free. Unlimited upside.

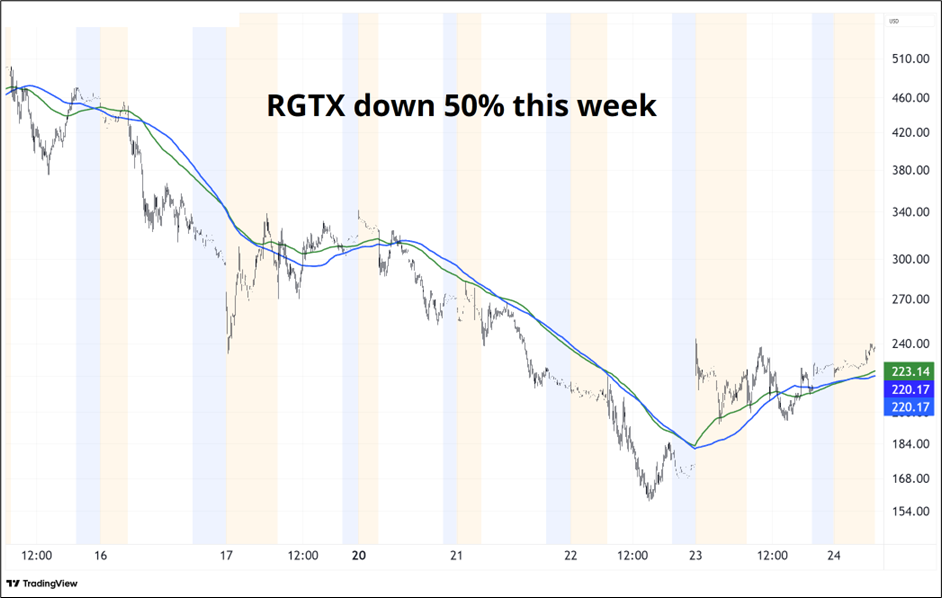

We talked last week about the precariousness of the momentum trade, and it cracked this week. The RGTI 2X ETF (RGTX), for example, lost 50% of its value while silver and gold collapsed.

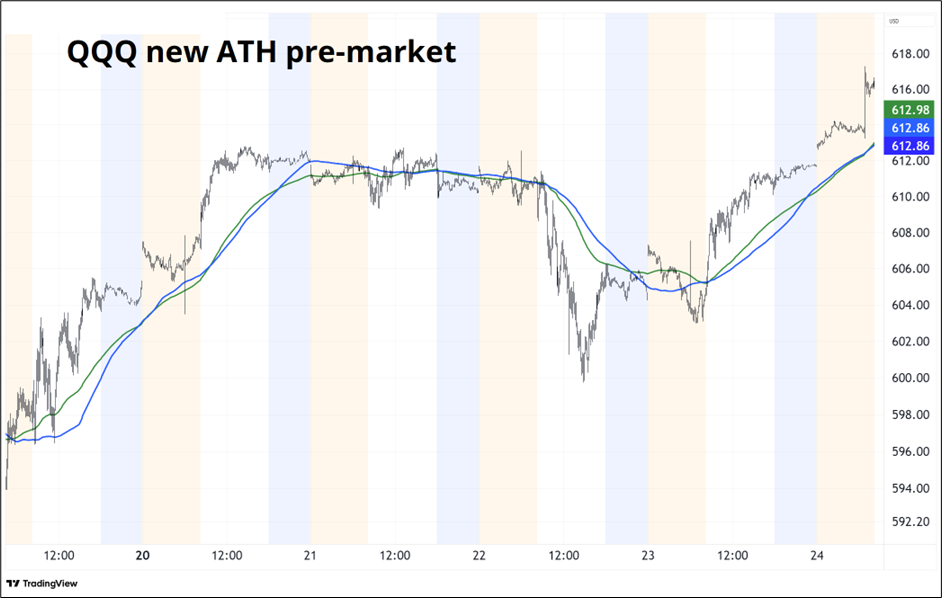

The pattern there (down half the week then back up Thursday/Friday) was the way for most stocks this week, with AAPL and a few other megacaps tickling new ATHs. QQQ is trading above the ATH pre-market (I am typing this at 9:29 a.m.)

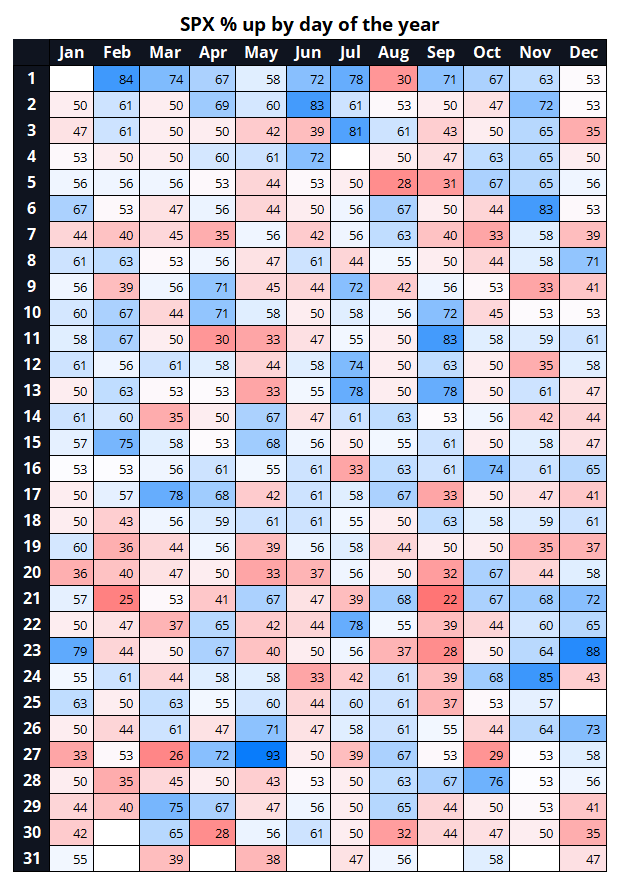

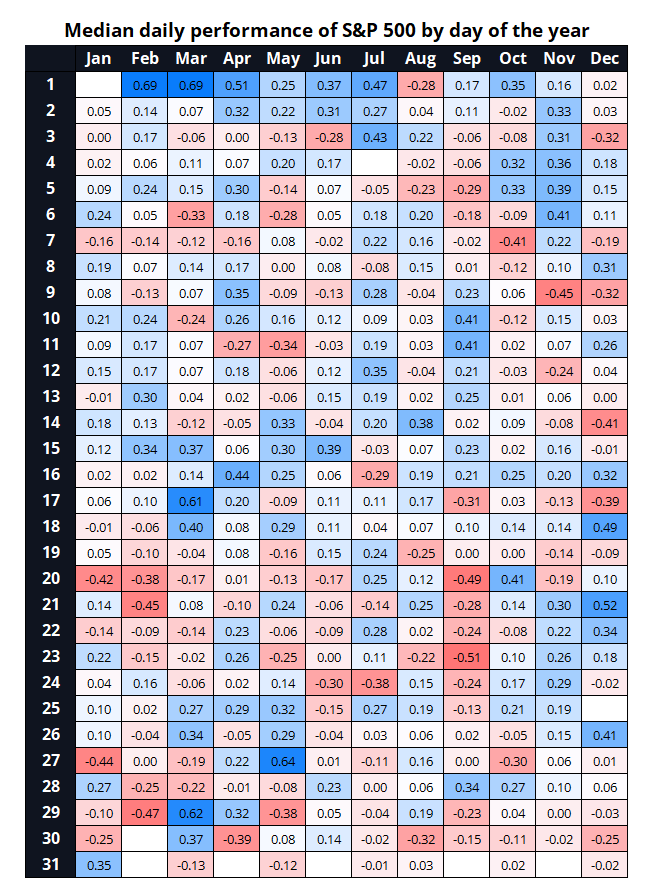

While the performance of the seasonality trades has been poor this year, the market is unlikely to ignore the coming strong bullish seasonal in stocks. Check out the median returns and win rates for the first eight days of November. Lurvly.

Seasonals have not worked well this year, but the market will still try to get ahead of this one in equities because it’s such a famous and reliable pattern. And it’s called the Santa Claus rally. And everyone loves Santa.

Here is this week’s 14-word stock market summary:

Trade Wars and data blackouts are boring. Santa! I know him! I know him!

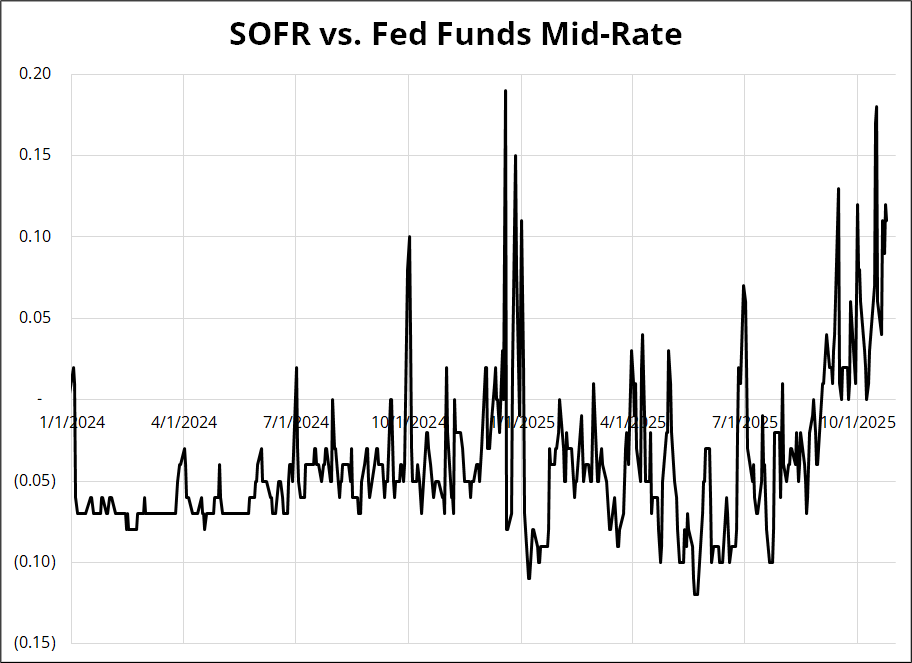

Yields have found their happy place at 4.00% in US 10’s and the deficit panic appears to have subsided in Japan and the UK. There isn’t much going on in rates these days because there is no US data. There are a variety of strange things going on in basis and in the plumbing, I suppose, with SOFR continuing to set on the very high end of normal.

We were blaming October 15 tax payments for a bit, but now it looks a bit more suspect. The timing of the end of QE from the Fed could be related as funding pressures build in the system. Or not. Hard to say. Note, however, that SOFR up here is something you would normally see around the turn of the year (a time when funding pressures always appear) not late October.

A small yellow flag for overall liquidity.

If you are a reader of am/FX, you can skip this next part because I wrote about it earlier in the week. If you are not a reader of am/FX, you should really sign up. Many people are saying it’s a great publication full of useful trading ideas and clever turns of phrase.

—

excerpt

Everything is weird

To give you a sense of how weird things have been on the correlation front post-COVID, have a look at the charts on the next few pages. I simply plot the weekly performance (change) of a variable against a currency, with separate colors for a selection of periods.

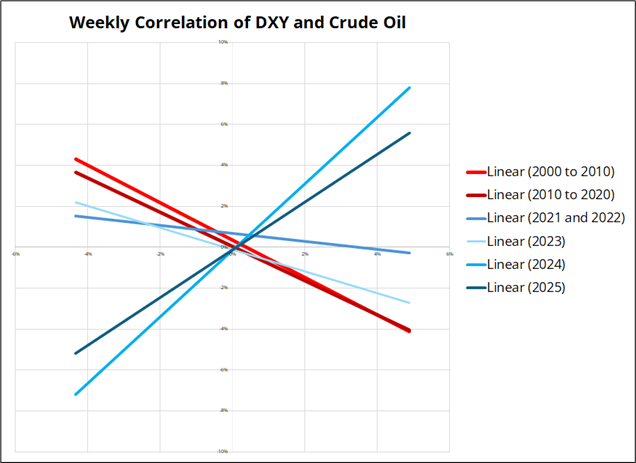

Let’s see how the standard correlations in FX have been working. I created scatterplots of some of the ye old correlations, then blanked out the dots so you can just see the trendlines. The blue lines are the post-COVID years, and the red lines are the decades before COVID. Here’s the first one:

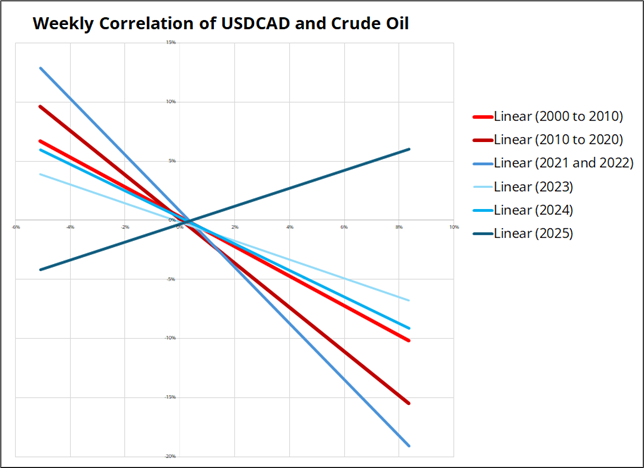

The shale boom and turn from US as net importer to net exporter of energy removed the USD’s vulnerability to higher oil and reversed the correlation. This obviously impacted the USDCAD vs. oil correlation, too, as did many other factors as discussed in am/FX: Divortium. Look at 2025!

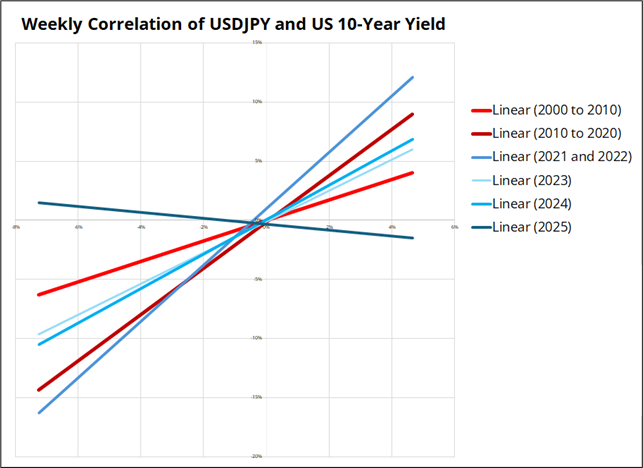

And 2025 has not been kind to the USDJPY vs. 10-year yields correlation as well!

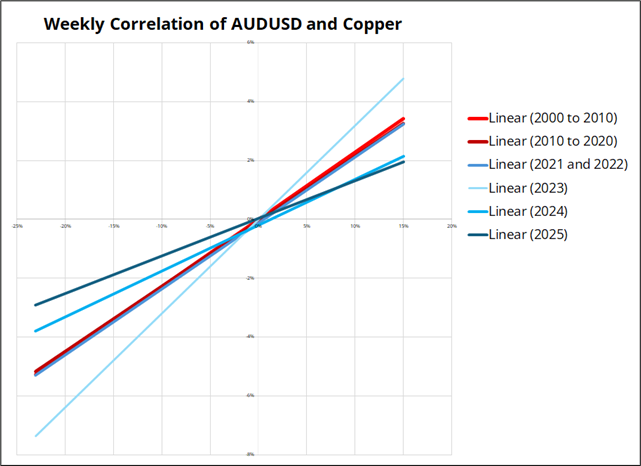

AUD vs. copper is one of the last bad, but you get the idea. Correlations have disappeared across FX.

This drop in correlation has also coincided with a year where seasonality hasn’t worked (after it worked very well in 2023 and 2024) so there is a particular aspect of this market that is nothing like we have seen in prior years.

end of excerpt

The most awe-inspiring thing about crypto is how it has been able to craft a completely new narrative for NGU, year after year. It was some new form of money to replace the USD, and now it’s the risky asset layer of the USD system and in the meantime we had the institutionalization and ETF phase and some extremely high volumes of buying from crypto treasury companies and then you had GameFi and Web3 and NFTs and ICOs and all these other narratives in between leading eventually to this endgame of government support and institutional capture.

Currently, I see the main crypto narratives as:

The bullish narrative, I suppose, would be that crypto treasury companies can always come back. And the US government has your back because most of its leaders’ net worth is tied up in crypto projects. Doesn’t feel compelling to me. If you want a risky asset, quantum computing or whatever at least has a decent narrative behind it.

I’m sure a new bull narrative will arrive for crypto, but I don’t see it on the horizon right now. The trade in BTC is probably to sell call spreads as volatility continues to collapse and BTC goes nowhere.

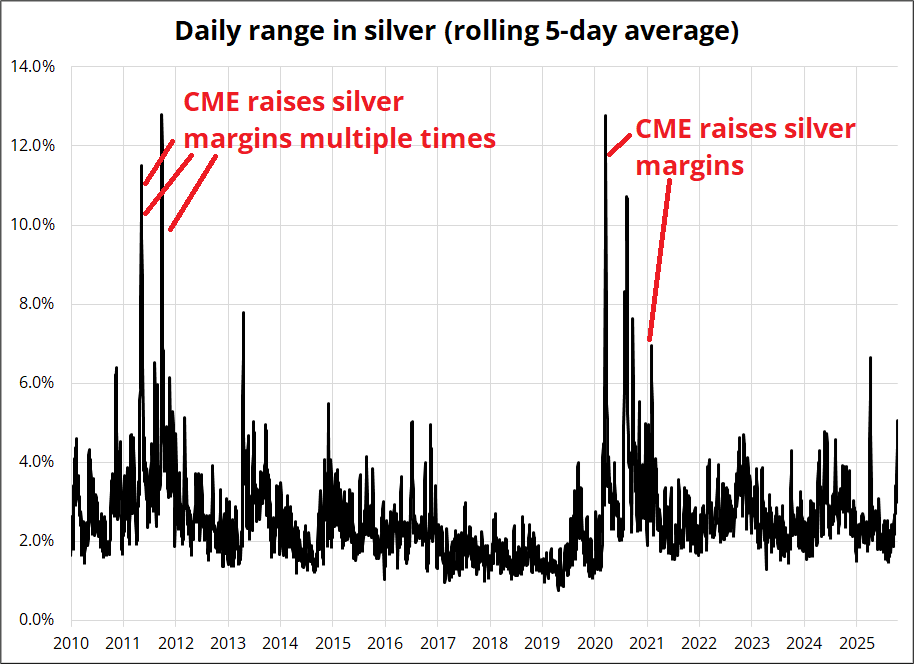

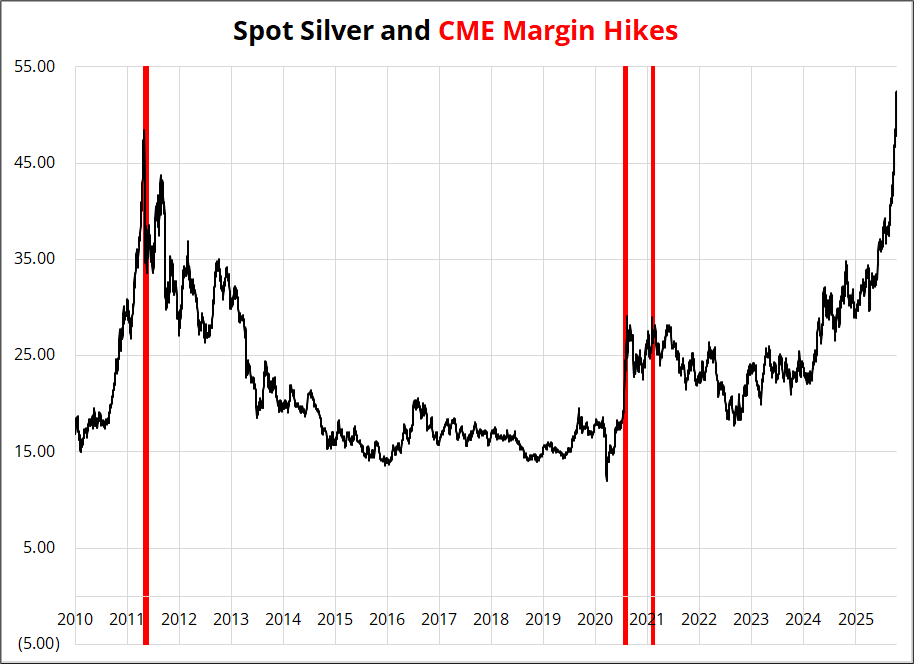

Wow! Commodities are in play again as gold and silver continued to skyrocket until the CME raised margins on October 16. Red arrows mark the margin increase announcement.

Last week I warned of this! To quote:

On silver, keep in mind that the CME raising margins was a huge contributor to the collapse in May 2011. CME margins are set based primarily on volatility, and while vol has picked up in recent days, it’s nowhere near levels where past margin hikes kicked in.

Here you can see how spot silver traded into and after the margin hikes.

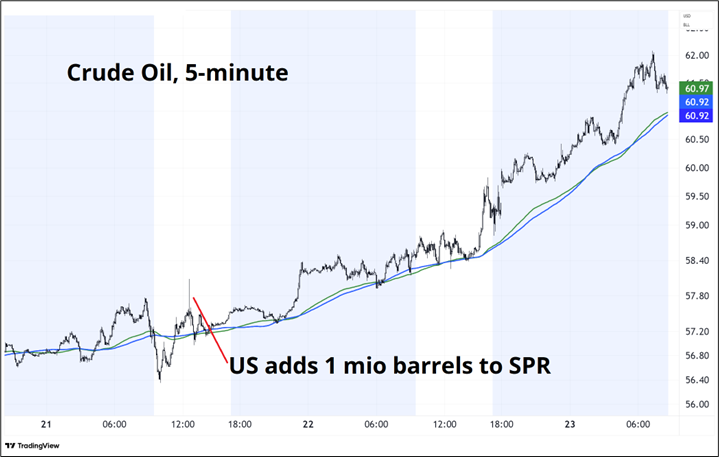

The US administration is frequently accused of front running in crypto and other asset classes (as are Democrats in Congress) and there was no better and more transparent front run than the SPR adding to reserves the day before the Russia sanctions this week. Well played, boys! You can see the SPR add in red there, and the Russia sanctions announcement came out less than 24 hours later.

This is funny, but it’s also informative. Follow the government is a great strategy! They have more money than you. Instead of fading INTC because you believe in capitalism, you could have bought it, like a true opportunistic capitalist. Much as Ayn Rand took social security and Medicare despite her supposed disgust for government largesse, you can buy INTC on state intervention, despite your disgust for communism!

Citrini did this

Do you want to be “right”, or make money?

That’s it for this week.

Get rich or have fun trying.

I read a ton — and rarely get super excited when reading. Most of it just gets sucked in and processed without much of a visceral response. This essay got me excited. It’s just so clear and accurate and on point. And unique/original.

https://josephheath.substack.com/p/populism-fast-and-slow

It’s a 10-minute read. Worth printing or saving when you can actually pay attention.

*************

An old Swedish House Mafia favorite to get you pumped for the baseball game.

*************

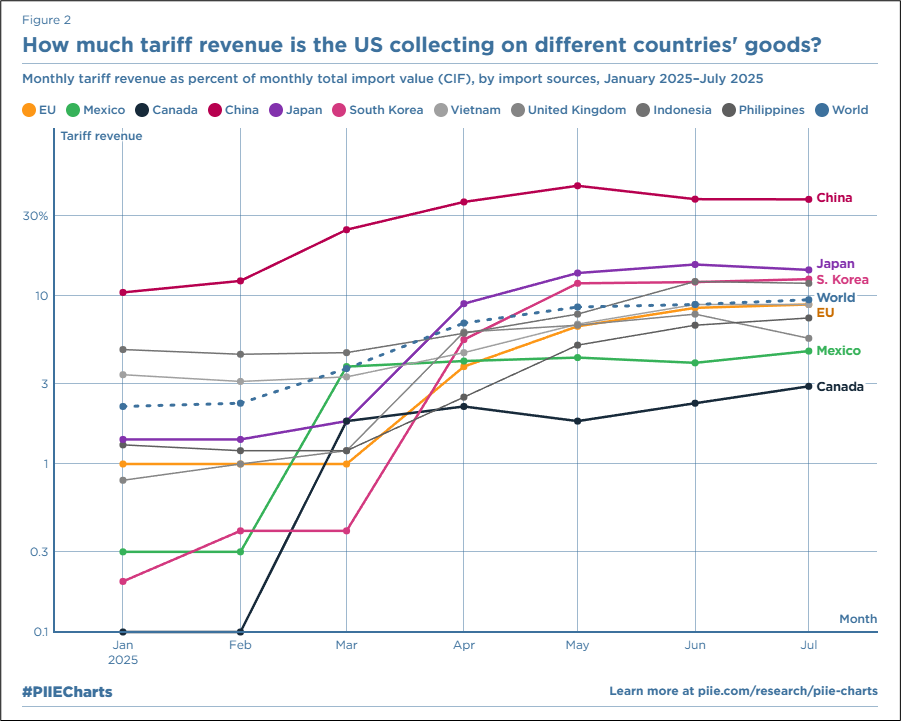

Who is getting tariffed so far. Note Canada and Mexico have been protected by the USMCA.

I question the use of log here on the y-axis but you get what you get.

*************

Remember: Social media isn’t real people.

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.