Epsilon Connect was a conference about hard mainstream topics, how things are going wrong, and what we can do about it. And it was extremely optimistic.

Push and Pull

It was a week of crosscurrents and contradiction

Epsilon Connect was a conference about hard mainstream topics, how things are going wrong, and what we can do about it. And it was extremely optimistic.

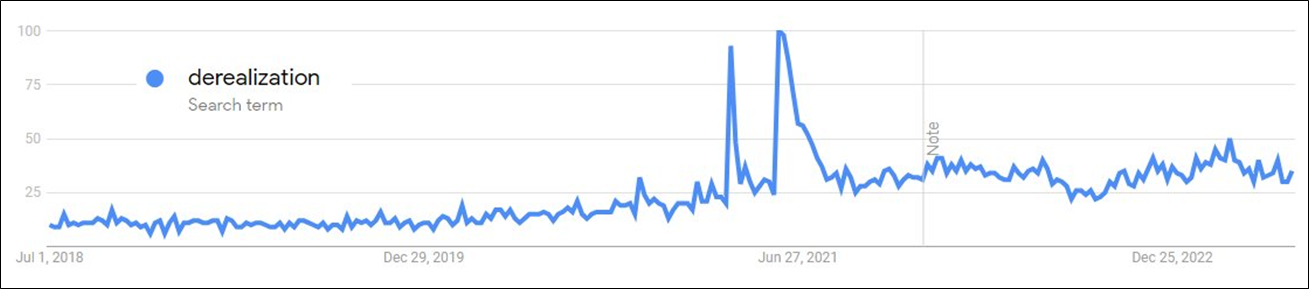

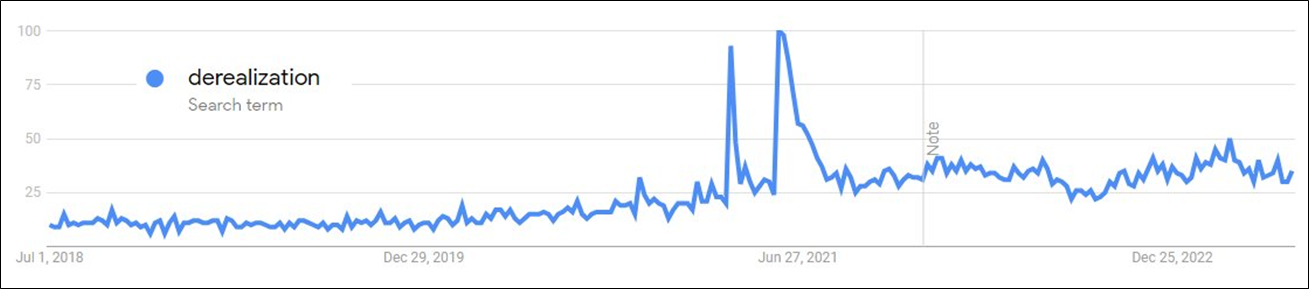

Twin peaks in Google search

activity for “derealization.”

First on the release of

Bo Burnham’s Inside.

Second on the release of

Phoebe Bridgers cover of the

song “Funny Feeling.”

Short EURUSD @ 1.0945

Stop loss 1.1126

Take profit 1.0711

June 30, 2023

At the end of May, I attended the Epsilon Connect conference, hosted by Ben Hunt and Rusty Guinn in Nashville. It took me a bit to get my notes and all the slides sorted; here are my summary and takeaways!

The conference was a meeting of like-minded people that follow Epsilon Theory and the basic premise, as nicely described by Matt Zeigler here, is:

Epsilon Connect is a gathering for people who have figured out how to make models work for them. Not in a mercenary way, but in a “We all have found success without hurting others, so how do we now make others successful while reducing the success-via-hurting-others models that seem to be everywhere and making people like us sad/jaded/cynical when we don’t want to be” way.

Sessions revolved around various strategies for the metagame of how to exist in this crazy, mad world of financialization, media insanity, and accelerated techno-futurism without losing your mind or getting angry all the time for no reason. This appeals to me because one of the most meta and whoa moments for me during peak COVID malaise was Googling “derealization” and hating what I found… After hearing these lyrics from Bo Burnham’s “Inside.”

Full agoraphobic, losing focus, cover blown

A book on getting better hand-delivered by a drone

Total disassociation, fully out your mind

Googling “derealization”, hating what you find

That unapparent summer air in early fall

The quiet comprehending of the ending of it all

There it is again, that funny feeling

That funny feeling

There it is again, that funny feeling

That funny feeling

The Phoebe Bridgers cover of the song is here. It is a perfectly-written song. One of the best combinations of wit and darkness you could ever find. Listen to the lyrics if you have a chance sometime. I find the song’s razor sharp cynical accuracy to be deeply moving.

Many of us have or have had that funny feeling of late… That feeling that something is off. For me, Epsilon Connect was one in a series of ongoing attempts to figure out what to do about it.

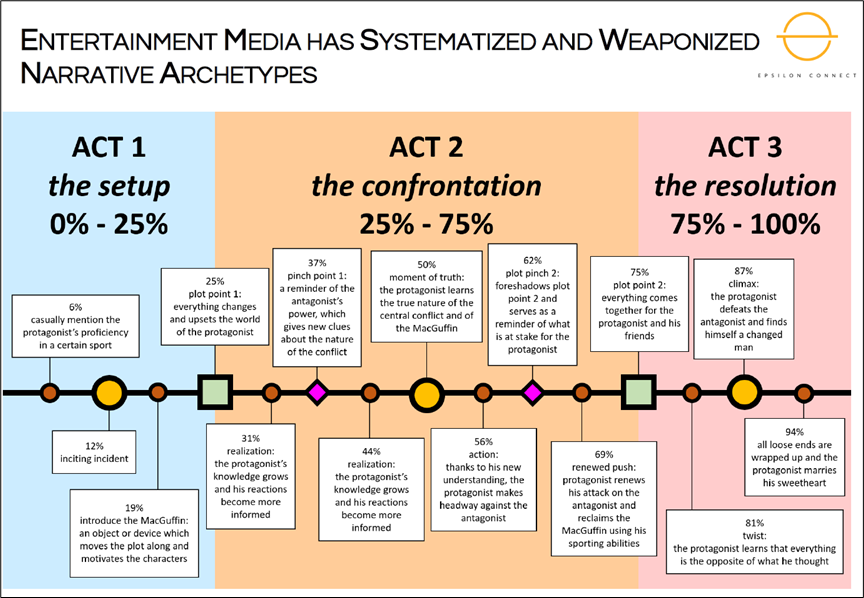

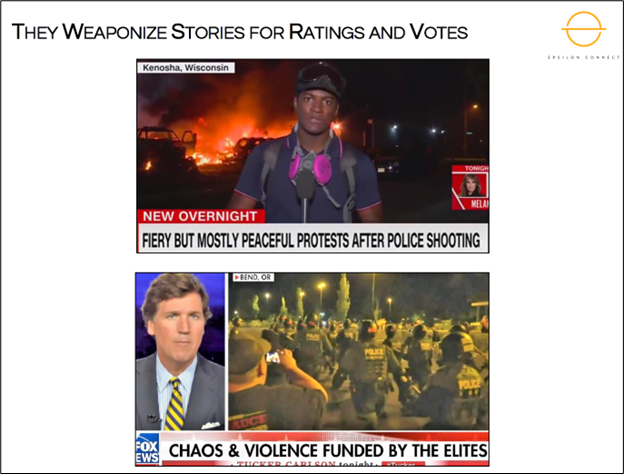

Ben opened the conference with a presentation in the main auditorium. I feel the slides are good enough to almost do it justice, so I won’t interrupt, I’ll just put them in here.

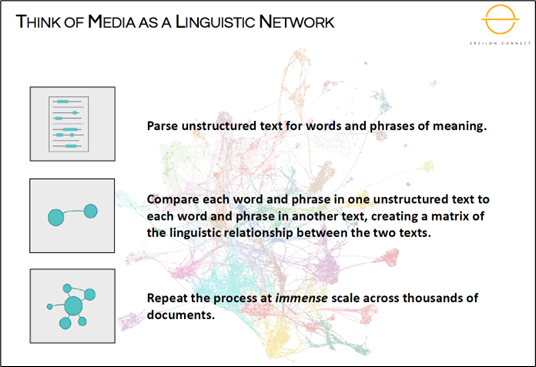

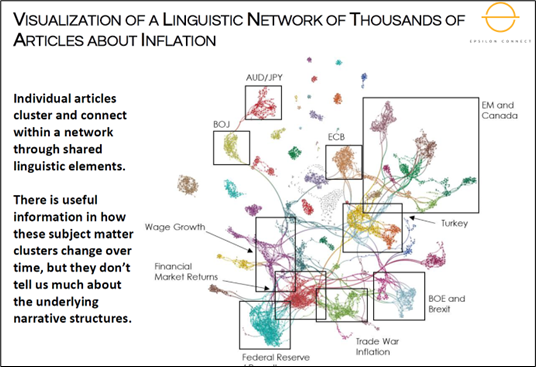

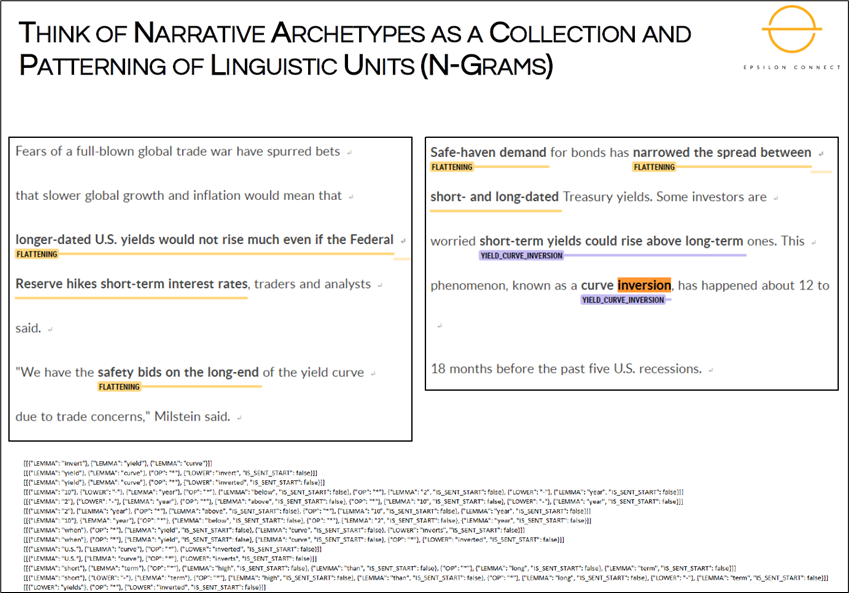

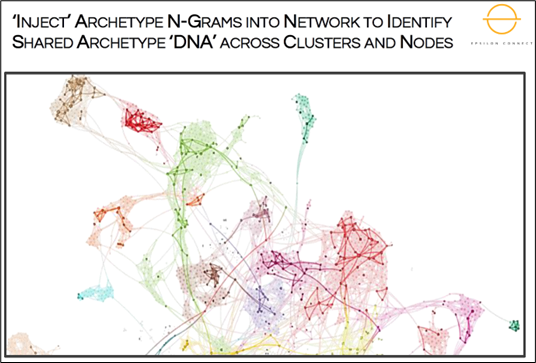

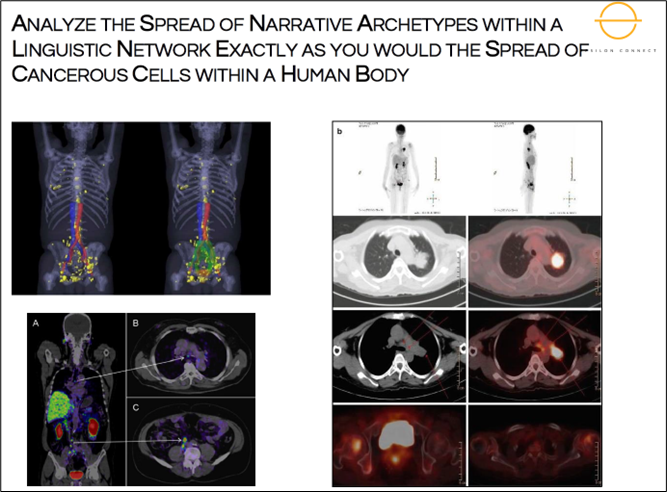

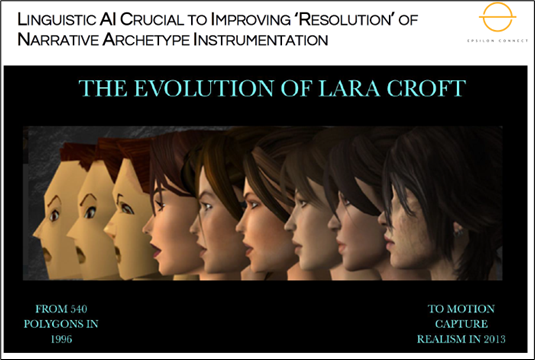

The speech works as both an introduction to the conference and an announcement of the new joint biolinguistics venture between Epsilon and Vanderbilt University. Tons of cool stuff therein.

They are building a new science: Biolinguistics. Very ambitious! I have never built a new science. That’s part of what I love about Ben. He thinks bigger than I ever could, but also does many small, kind, and thoughtful things.

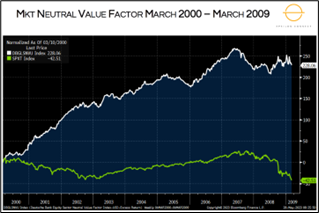

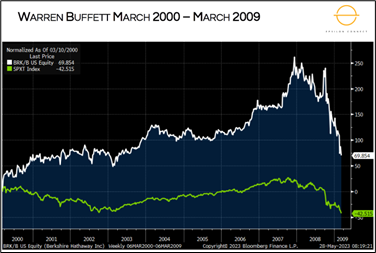

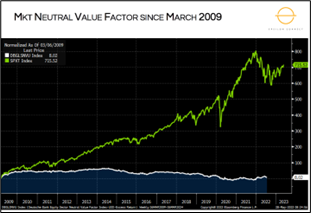

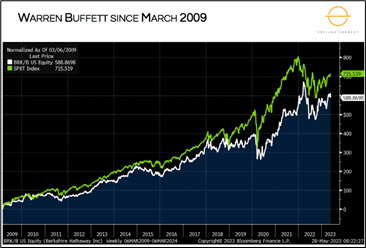

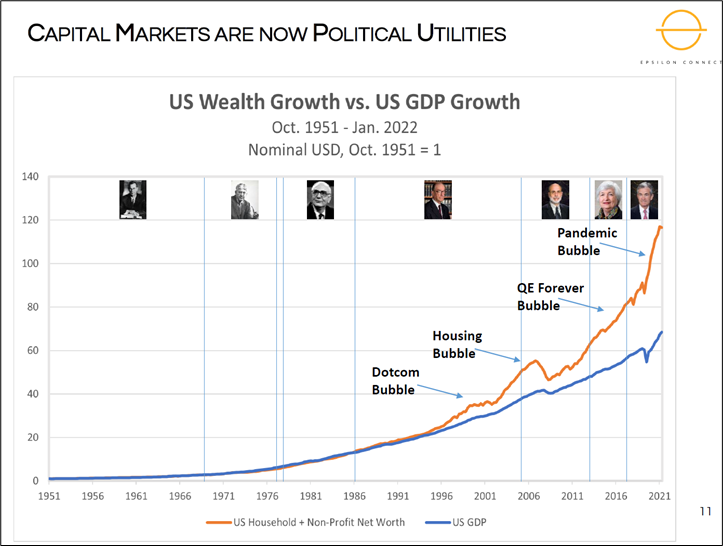

Ben Hunt hosted a session called “Investing in the Real” which put up some mildly depressing slides that capture the rise of passive and the decline of quality, value, and skill during the post-GFC era. I’m going to plop his slides in here as I think most of it is self-explanatory but I’ll interject here and there as well.

In all these charts, SPX is green and the other thing (quality, value or skill factor) is white. 2000 to 2009, quality, value and skill paid off. White beats green. 2009 to now, green crushes white. Quality, value and skill are irrelevant.

To be clear, Ben is using Warren Buffet as a proxy for skill because a) Buffett had shown skill over many decades already and b) he has access to cheap financing, sweetheart deals, and the best information in the business. If anyone should be able to outperform 2009 to now, it would be Berkshire.

This all might sound like Harry Hindsight or an investor letter from a grumpy value investor, but Ben shut down his hedge fund and returned all clients’ money in 2012, sans drawdown, because he saw the writing on the wall, early. Also, if you look at those charts on the last page, you can see that DB discontinued its quality and value indices in 2022, presumably because they too saw those factors as irrelevant.

After presenting this background context, Ben went on to explain his thesis:

We are in an unstable or fragile equilibrium that can continue for a long time, but not forever.

Eventually, a reset is necessary to reconnect capital markets to reality. Reality meaning a system where capital market exist to raise money for productive functions like investment and redistribution of profits, not as political utilities with actors mostly gaming to extract maximum compensation via stock short- or medium-term stock price maximization.

This does not mean that every story is untrue. It means that it doesn’t matter if the story is true, as long as enough people believe it. Value, quality, and skill and DCFs and all that stuff don’t matter. All that matters are flows and stories.

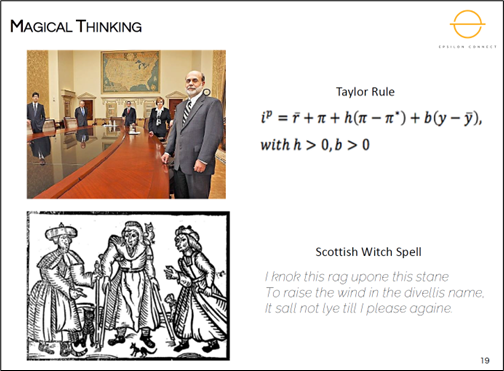

And that includes the stories told by central banks as their attempts at central planning demonstrate the most magical thinking of all.

Ben showed this one-minute video of central bankers managing the economy. It’s well worth a minute of your time! It captures the essence of post-GFC central banking perfectly.

If the end of this magical thinking requires massive wealth destruction, how will this come about? Ben’s thesis is that a war, probably a war with China, will pull the rug out. While there is a common refrain that war between USA and China will never happen because it would be too economically destructive, Ben notes this exact story was the reason many thought World War I would never happen. The economic links to Germany were too strong and thus a war would be too dangerous for both sides.

I think this is a useful and viable framework. The obvious question that emerges, though, is what do we do about it. The Cold War smoldered for 45 years and never erupted. There are very few pessimists on the Forbes 100 richest list. It’s impossible to be permabearish in a world where capital markets function as utilities and financial repression is necessary due to the massive debt transfer from citizens to sovereigns post-GFC and again post-COVID.

As an investor or finance person, there are two ways to deal with Ben’s thesis if you think it’s valid, which I do.

The market can stay stupid longer than you can stay smart!

The other takeaway from this conference and the one I went to in April (see am/FX: China Alarm) is that I’m surprised that many experts believe a war with China is increasingly inevitable and probable in the next two years. Experts can be wrong! But it’s still scary.

“When did the future switch from being a promise to being a threat?”

― Chuck Palahniuk, Invisible Monsters

Well, that was kind of depressing! The conference overall was the opposite though—uplifting.

This was a bit like group therapy as everyone chimed in for a discussion about how we find our pack(s) and connect with like-minded people who share the same values but who also share a range of perspectives and ideas. My takeaways:

That last bullet reminds me of the best book I read to my kids when they were small. It’s cheesy, but in the right way. Good for ages 3 to 8.

Have You Filled a Bucket Today?

I had never met Grant before, despite reading his stuff for more than a decade and watching him in video form for years and years. He’s a nice guy! This session was a Q&A with Rusty asking Grant about his work as a professional interviewer and host of various podcasts and video interactions. Takeaways:

This was a Q&A session in the auditorium. Some quick bullets:

If you can make it to Epsilon Connect next year, I strongly recommend it. The vibe is somewhere between the Olympics or a playoff game, where everyone is excited and optimistic… And group therapy where everyone is there to talk about what’s wrong and try to figure out better ways to think and act.

There were other sessions, but I don’t want this to take more than one entire weekend for you to read (!), so I tried to offer some highlights, not a conclusive recap. My first action following the conference is to commit to a complete rejection of culture wars and mainstream media. I don’t need it. It all makes me feel bad, doesn’t teach me anything, and gets me nowhere. Whether Barack Obama or Donald Trump is president affects me much less than the immediate world I’m immersed in. I can’t vote in the US, and even if I could, my vote would be meaningless as I do not live in one of seven or eight states that are not pre-decided by the two-party system.

Instead of voting at the ballot box and worrying about Federal politics which receive much more coverage than they deserve given their impact on daily life, I’m voting with my dollars, my words, and small acts. I’m voting by spending time with my kids instead of Netflix. Etc. When it comes to Federal Politics, you can cast a null vote.

I muted “Biden, Trump, 2024, election, vaccine, Kennedy, woke, left, right, and politics” on Twitter. My feed is objectively better. You could say I’m just putting my head in the sand, but I would argue I’m just worrying about what I can control inside my own house and choosing to ignore the insane clattering calliope music blasting from the insane circus parading down the street outside. You don’t need to go to church to appreciate the Serenity Prayer:

God grant me the serenity to accept the things I cannot change, courage to change the things I can, and the wisdom to know the difference, living one day at a time; enjoying one moment at a time; taking this world as it is and not as I would have it…

By equipping ourselves to see clearly, think clearly, and find and maintain good packs, we can get off our phones, ignore that which we believe does not matter, and consume mainstream and social media with eyes wide open. We can go back to the way we want to live and turn away from the nudging, corporatist state and away from absurd and polarized political discourse. We can go back to the way it was before that funny feeling crept in and everything became this deep fried, unreal cartoon. Living in service to some real purpose in the real world. In cooperation with others in and outside our chosen packs.

Have an excellent July. All of it. Every single day.

Twin peaks in Google search activity for “derealization.”

First on the release of Bo Burnham’s Inside.

Second on the release of Phoebe Bridgers cover of the song “Funny Feeling.”

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it