There is a common pattern where things overshoot into year-end and then reverse in the new year.

Push and Pull

It was a week of crosscurrents and contradiction

There is a common pattern where things overshoot into year-end and then reverse in the new year.

There is a common pattern where things overshoot into year-end and then reverse in the new year as the seasonal flows dominate in December and then new money comes in January and everyone who got marked to market at bad levels on 31DEC can’t take the pain of a minor reversal.

This was the pattern at the turn of 2022/2023 and again this year. Everything everyone was jammed to the gills with (bond longs, megatech longs, JPY, AUD, etc.) has been torched. We discussed this in last week’s Speedrun as the buffalo stampede idea.

My thesis going into 2024 was that interest rate markets have overshot and the return of housing inflation and steady / rising wage growth will mean that the six cuts currently priced for the Fed moves towards something closer to 3 or 4. The market clamped onto that a bit, but the reality is that these moves have been more about positioning and seasonality than any dramatic change in the macro narrative.

Nonfarm payrolls and ISM rode in to save the day for stocks as the jobs data threw up another Goldilocks figure with strong enough but not too strong employment in the United States and then a kaboom from ISM to crush any remaining day trading bears.

Something to keep in mind when you read bearish hot takes on the US jobs market:

Most analysts have a particular worldview and then sift through the data to confirm it. This is called confirmation bias and it’s a real thing. The people saying the jobs market is broken “under the hood” etc. right now have been saying the same thing for 12 months.

There are literally 100s of metrics available to analyze the US jobs market. The nonfarm payrolls report is made up of many dozens of statistics. There will always be ways to slice and dice and 2nd derivative the data to show that the US jobs market is weak. Occam’s Razor says look at the primary data and consider the secondary data with extreme caution. If Initial Claims is printing near the all-time lows, it’s highly unlikely that we are in a recession or a jobs collapse.

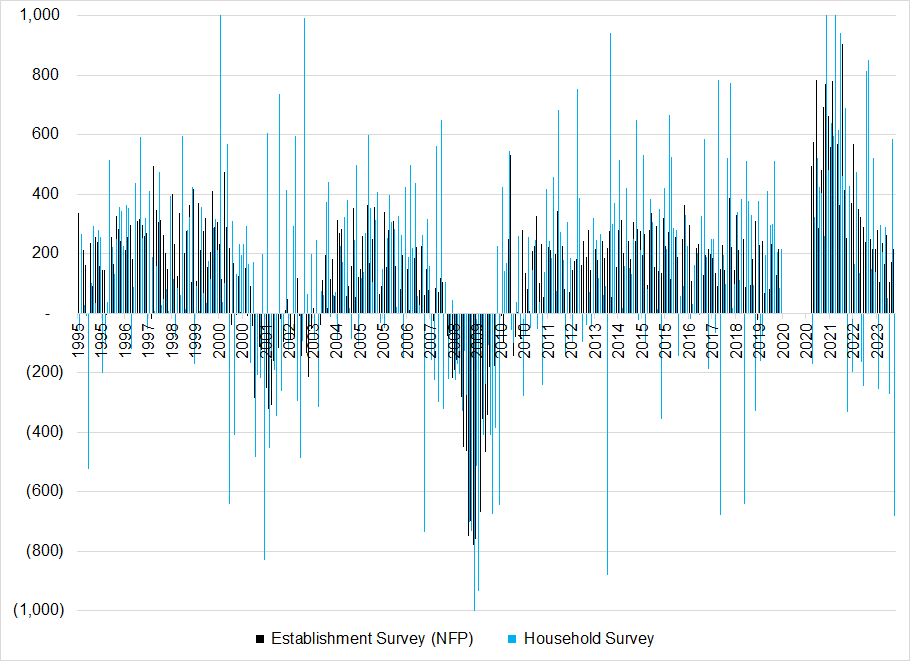

A series that bears love to point at when it supports a negative worldview (and ignore when it does not) is the Household Survey. The US labor market is measured two different ways. 1. They survey businesses. 2. They survey households. The second method is wildly volatile and yields something like the first survey but with 10X the noise and triple the volatility. Here are the two series so you can compare.

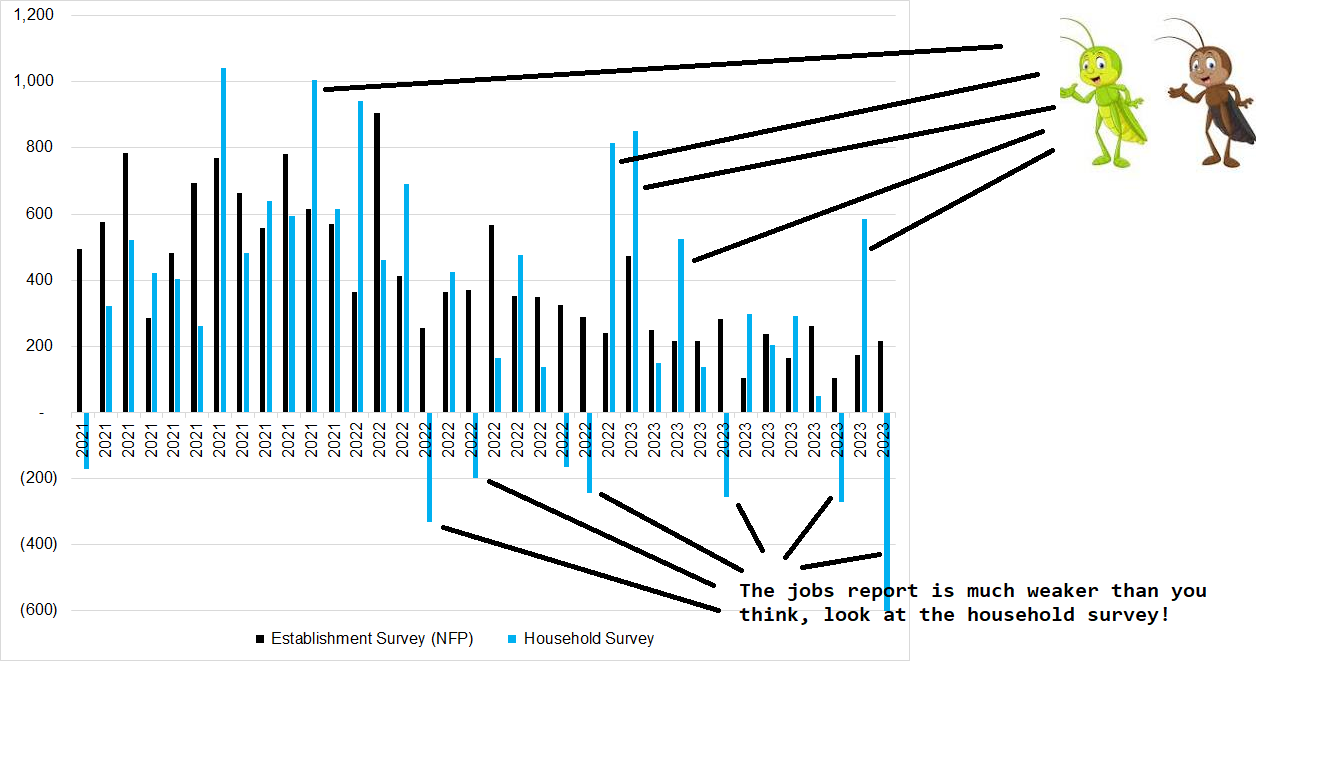

And let me zoom in and give you a sense of how the analysts interpret those jagged, random blue bars that shoot up and down all the time due obviously to sampling and measurement issues.

In case you are not an entomologist, those are crickets.

This does not mean that analyzing secondary data is pointless or a bad idea. It just means you need to know the bias of the person doing it. Ideally, you do it yourself and have no bias. But if that’s not possible because you have better things to do, make sure you know the analyst.

Is it A) They have been calling for recession since late 2022 and are just stuck in a sticky prior and high switching costs? Or B) They are analyzing data in a useful way to deliver unbiased views and/or information? My default is to assume A) and then look for people who are B).

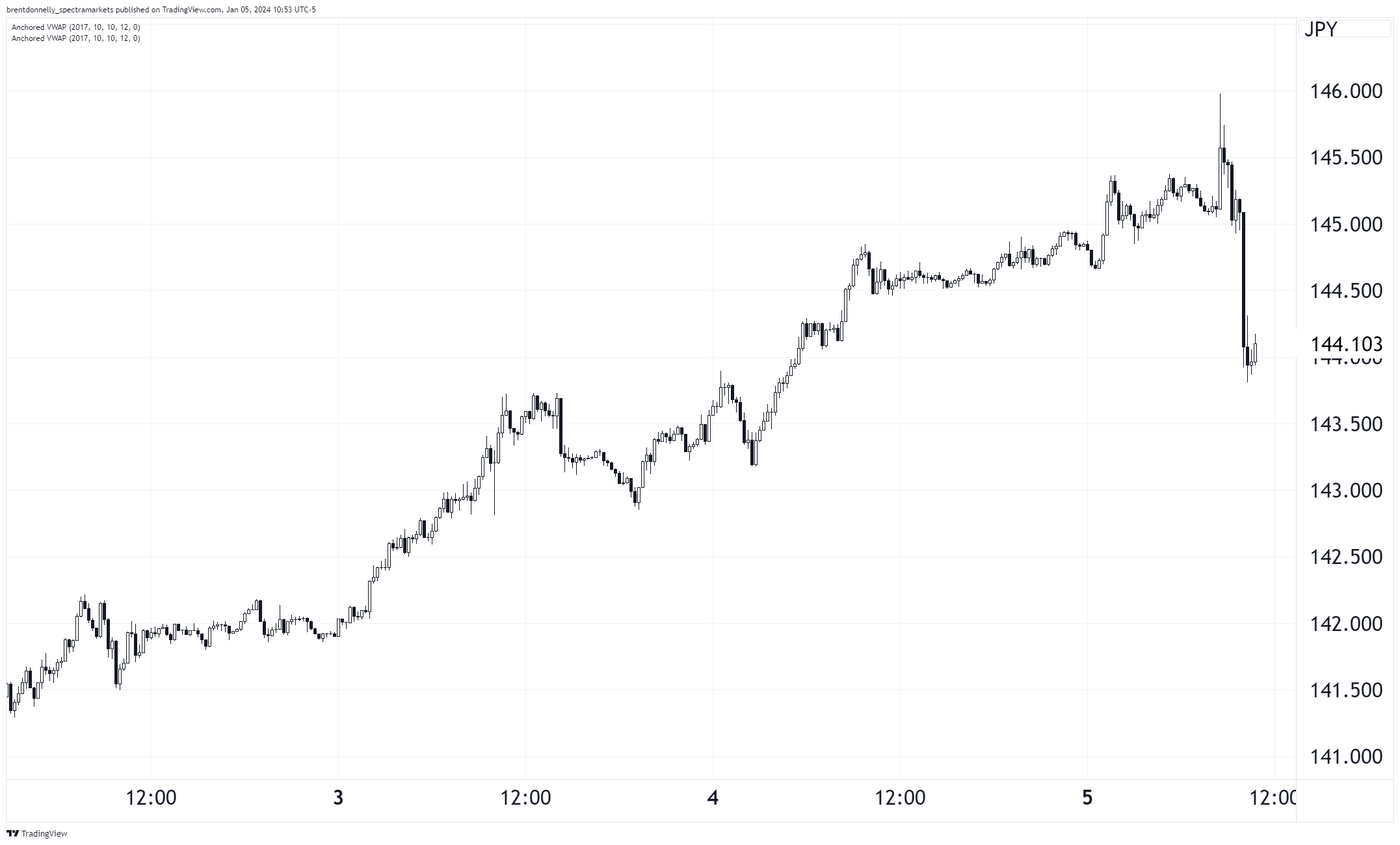

Anyway, today culminated with a bonkers-weak ISM — and yields and the USD got clobbered.

The big mean reversion trade hammered stocks right out of the gate this year, in an exact mirror image of last year. Tax-related flows and random window dressing and other nonsense are big in December, so it’s often not a coincidence when stuff flips on the turn of the calendar. Last week in the Speedrun, my view was to be flat or short … but at these levels, the risk/reward is probably the other way (i.e., long risky assets) next week with the Goldilocks NFP in the books.

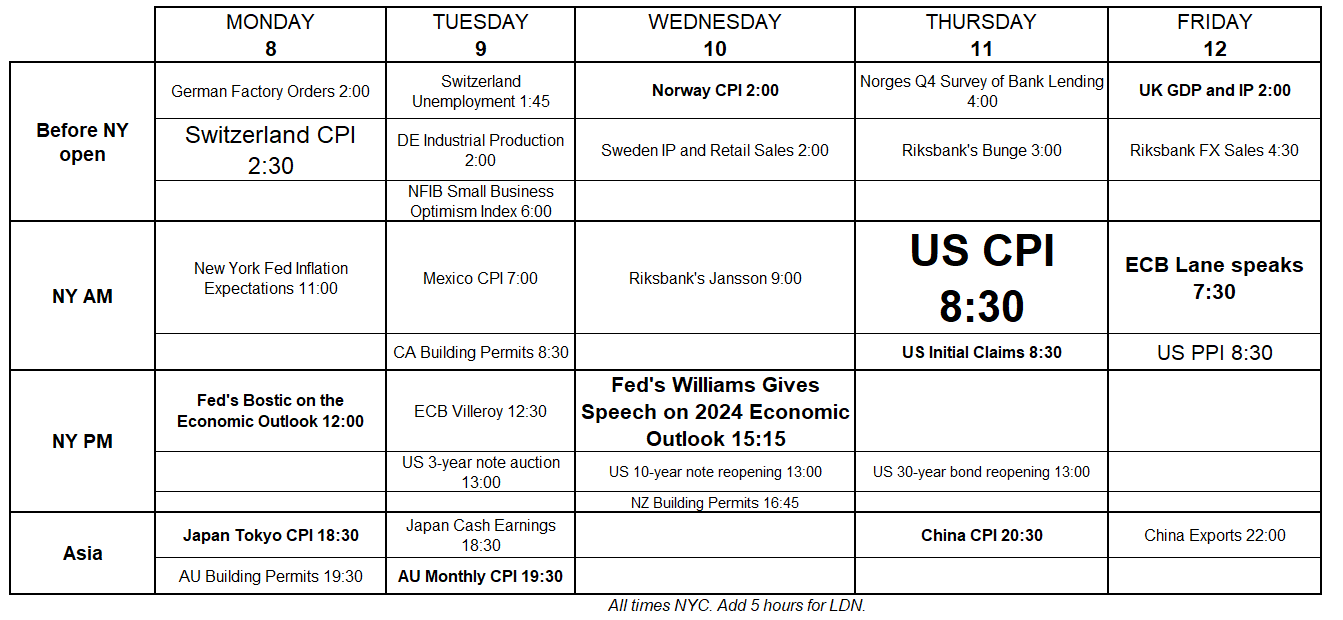

The big data point next week is CPI. Inflation data matter much more than jobs or growth data because the whole Fed targeting real rates narrative that we are in right now means that Fed pricing is about the pace of disinflation and it’s not about growth. Obviously at the extreme, jobs and growth matter, but if they are within the standard cone of uncertainty, they will be trumped by news and data on inflation.

The consensus is that inflation is falling and so the FOMO trade will be to position for weak CPI next week. This means we probably get a grinding, low-vol rally in risky assets MON/TUE/WED. Here is the calendar for next week from am/FX.

And here is this week’s 14-word stock market summary:

We cleaned out the weak longs and now it’s time to restart the rally.

The payrolls data came in good enough to drag a few more people into the higher yields trade and then ISM dropped an absolute anvil on the market.

In the end, next week’s CPI matters much more; as I said above, it’s the disinflation narrative driving the bus, not the growth story. We have a couple of auctions next week, but issuance only matters a few days per year and I doubt it will matter next week. It’s known well in advance and is generally well absorbed unless the market is totally freaking out.

The USD grinded higher (ground higher? did grind higher? was grinding higher? was did grinded ground grinding higher?) along with yields all week and then Shawn Michaels came flying in off the corner turnbuckle, elbow out, and landed on the greenback, hard. Here is a chart of what happened:

Whoops, wrong image.

Take a look at that chart and then read this excerpt from today’s am/FX:

I am not even certain that a medium-strong or medium-weak (NFP) number today will yield an orthodox reaction in rates or FX. I could see 244k NFP, 3.7% UR, and 0.4% AHE and USDJPY goes 146 paid 144 given. For example.

Accurate!

The USD should continue to fall next week if my view on the FOMO runup trade into CPI is correct. Nobody wants to miss the great disinflation of 2024 just as nobody wanted to miss the great recession of 2023. I like AUDUSD the best short-term because it got smoked so badly this week and people can’t stop loving it despite its many faults.

Today’s crypto bits are brought to you by Sol Ehlrich, my colleague here at Spectra. None of this is investment advice. In fact, Friday Speedrun is the opposite of investment advice.

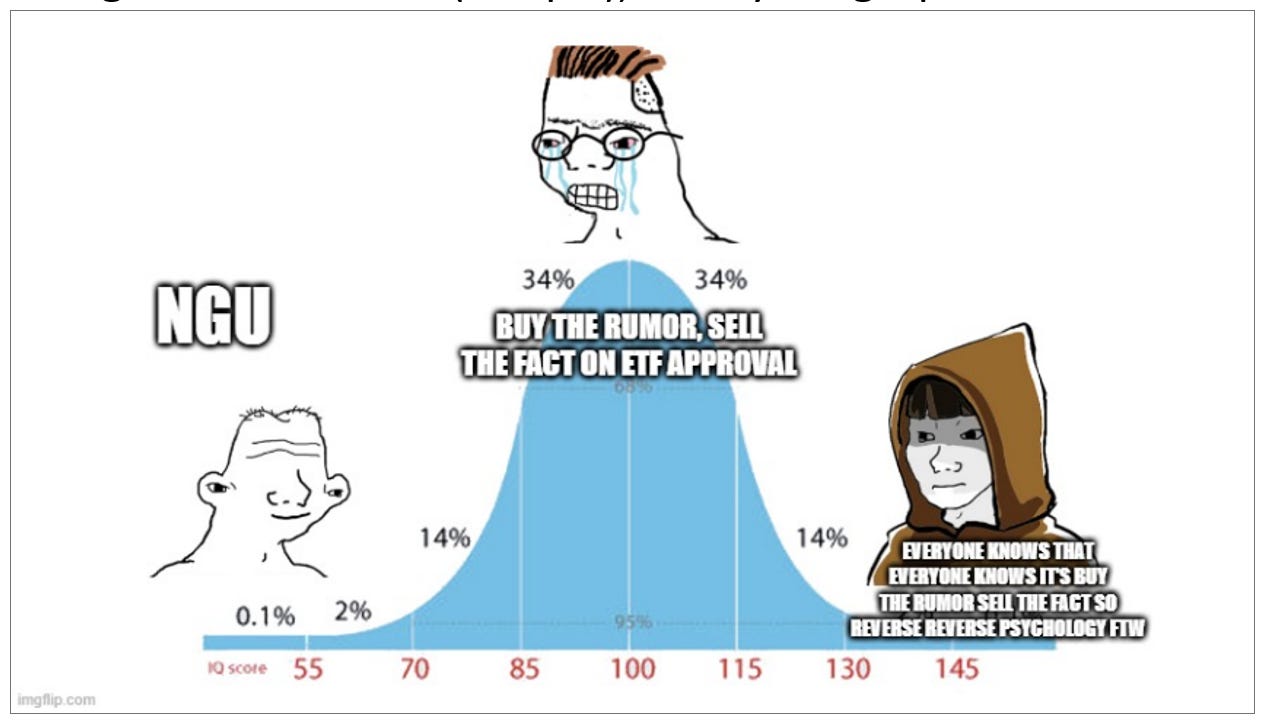

The BTC ETF story is now front and center. If you’re on crypto Twitter, it’s basically a done deal. Blackrock will seed its ETF with 10m of BTC, all the boomers will have to buy your coins. We all act like we won’t sell the fact, but everyone knows that’s what everyone plans to do.

I was originally in the “buy the rumor, sell the fact” camp, and had felt we were overheated in November when we entered the comment window and people were congratulating me on my long. This led to me selling at 38.2, missing this move, getting back in at 41 when my view was invalidated, then getting out cause… the perps ate my profits.

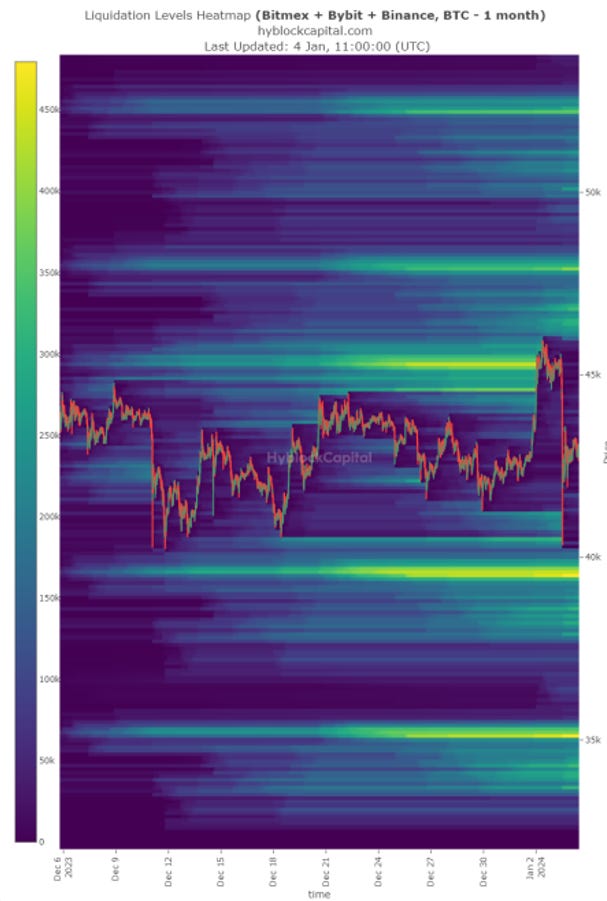

With perpetual futures contracts, the funding cost of the contract is strictly based on the balance of buyers and sellers, and is thus, subject to a large imbalance of supply and demand. This can lead to specs paying 80% annualized rates to get 10x leverage, which is nothing if you think you’ll be up 300% this month. However, this is usually a reflection of a crowded market, and thus creates more sensitivity to wild swings, just as we saw on Tuesday.

On to the fun stuff. Everyone knows that everyone knows it’s “buy rumor, sell fact” (see Brent’s meme, pic 1), even Cramer knows this. If you really want to grasp at straws, this OF model was right about The Merge being “sell the news” (see pic 2), so anything’s possible.

Buuuuut, I don’t think that’s the right setup this time because the market is leaning towards that narrative instead of a bullish one.

I invite you to consider this:

Name one person who entertains this scenario. Literally everyone who owns BTC is bullish because of the halving, from blockchain experts to crypto bros to your dentist who owns some. I don’t think there’s much EV in selling the ETF unless we break below the liquidation zone. Lots of bids at 40k, where we’ve held 4 times now, and was a crucial level of distribution after we went through the original 38-40k sell wall.

I think there’s better risk:reward in being bullish until that level fails. I will be back in time for the developments surrounding the halving.

OK, Brent here again.

Commodities are pretty boring these days, but I will say two things:

OK! That was 6.334 minutes. Please share this newsletter with any aspiring finance professionals that you know! Thanks!

Bruce Mehlman makes the best slides in the world and this quarter’s quarterly deck does not disappoint. This is a must-read for me. See here.

https://x.com/donnelly_brent/status/1741264574320390350?s=51&t=Z-boW5UHRWKGTmYteOnSkA

https://x.com/adammgrant/status/1741461769233547673?s=51&t=Z-boW5UHRWKGTmYteOnSkA

https://youtu.be/e1vlLJCr9Lo

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it