While most expect the hard data to catch down to the weak soft sentiment data… Maybe the exact opposite will happen.

Push and Pull

It was a week of crosscurrents and contradiction

While most expect the hard data to catch down to the weak soft sentiment data… Maybe the exact opposite will happen.

There is a risk of talking too much about a single topic. It can get boring and repetitive. On the other hand, if you are focused on a particular macro concept and feel that it’s underreported, maybe that’s the place to focus your energy? Anyhoo, there are still many talking about the sentiment data and how bad it looks and how that will inevitably be the canary in the coal mine for the Great Recession of 2023 2024.

While most expect the hard data to catch down to the weak soft sentiment data… Maybe the exact opposite will happen. Sentiment will improve and the hard data will remain stonking. And soft data will catch up to the real world.

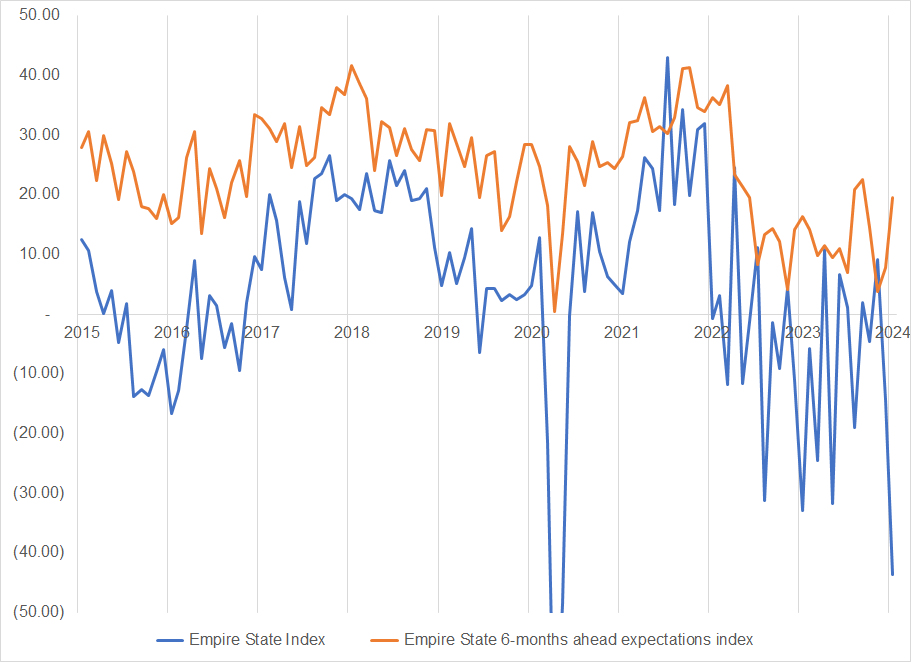

This week we got another taste of how the soft data is total nonsense as Empire State came in at -43.9 while the forward expectations side of the survey rose back to the top of the range. Here is the chart. Note the volatility in the series and the disconnect between the current and future expectations indices. Noisy.

Remember survey data is currently biased by political fragmentation, polycrisis angst, and many other factors while the nominal economy continues to chug along very nicely. Let’s look at the hard data this week.

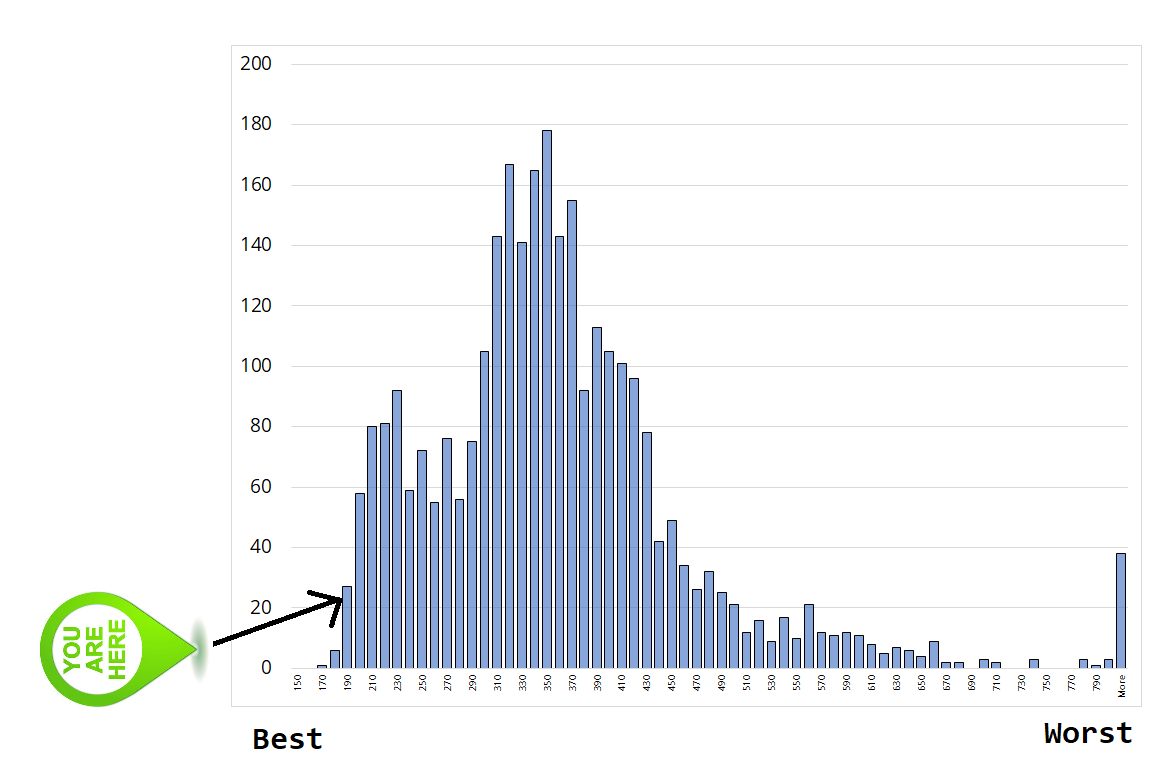

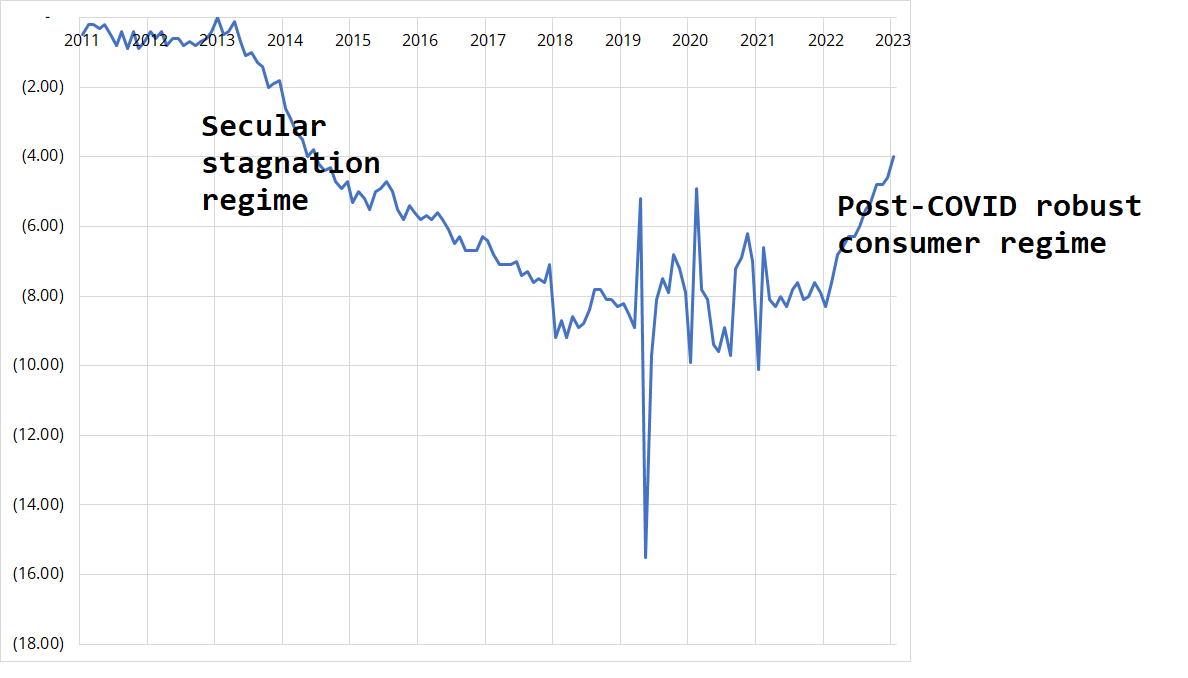

A good measure of how badly economists are leaning the wrong way it to simply look at the cumulative miss of Retail Sales. That is, what economists expected vs. what actually happened. It’s a great study in how economic forecasting models are bad at recognizing regime shifts.

How to identify and make money off persistent and predictable economic forecasting errors like this one is explained in Lesson 10 of “Think Like a Market Professional,” the flagship first course from Spectra School. We’re working on the last details right now and we plan to launch in the next few months. Keep your eyes peeled for the wait list announcement as we’re going to keep it somewhat limited at first for optimal / maximum interaction.

Anyway, the old regime was sluggish. This regime is not quite cheetah-like but it’s not sluggish or chelonian either. It’s like, hare-ish?

As I keep saying… The further someone has to go down the list to find reasons to tell you why the US economy is AcTHUallY weak, the more suspect that analysis should be. The core, workhorse economic data (NFP, Claims, Retail Sales, GDP) all say the same thing. The US economy is not bad!

China is getting interesting as everything there remains massively beaten down and the only cure is a giant stimmy that is all dream and no reality. China Beige Book have been all over the Stimulus™ vs. reality on the ground for quite some time. Good follow on Twitter. I know the founder personally and he is definitely legit smart guy / nice guy.

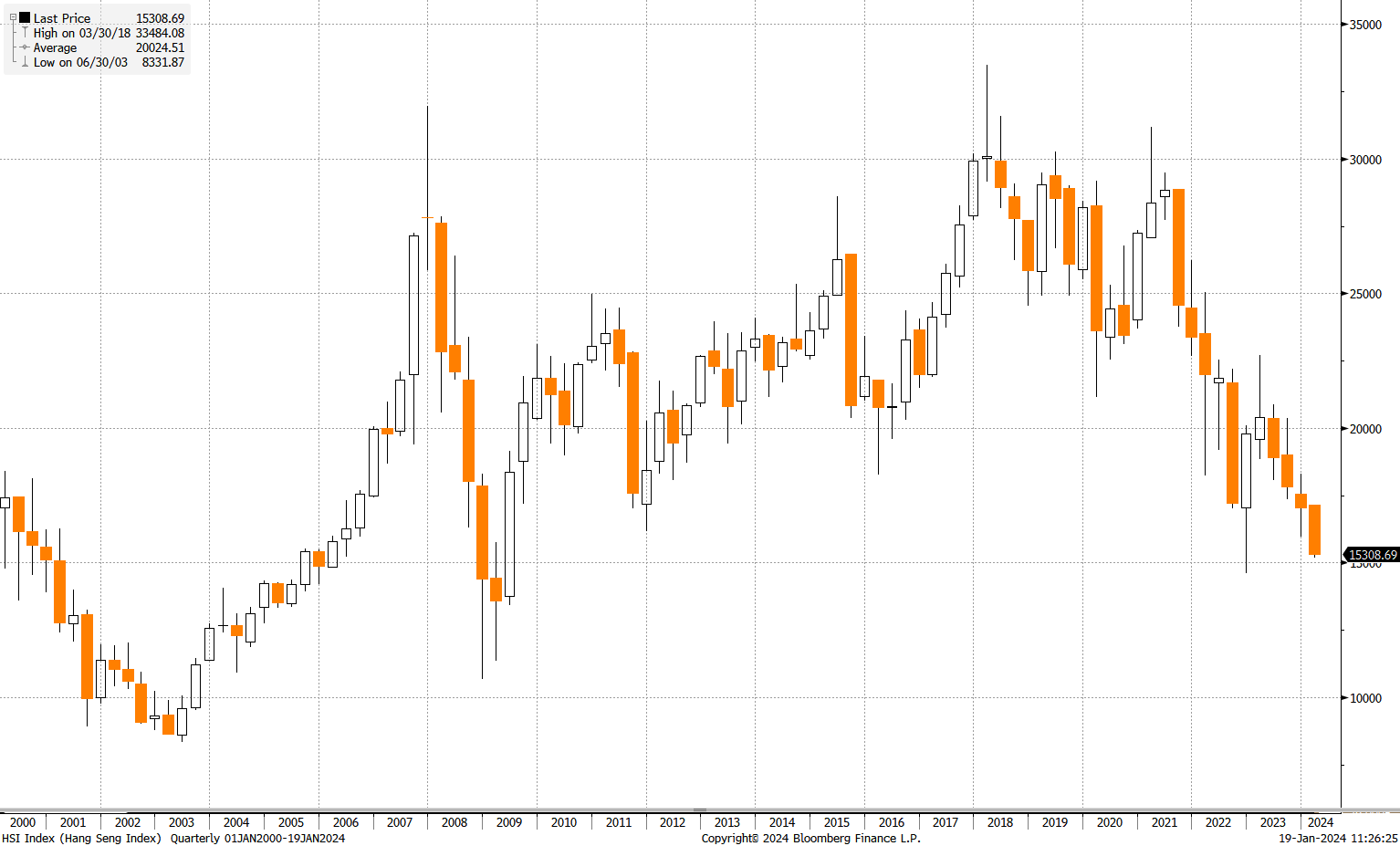

So without stimulus, you get a stock market chart that looks like this:

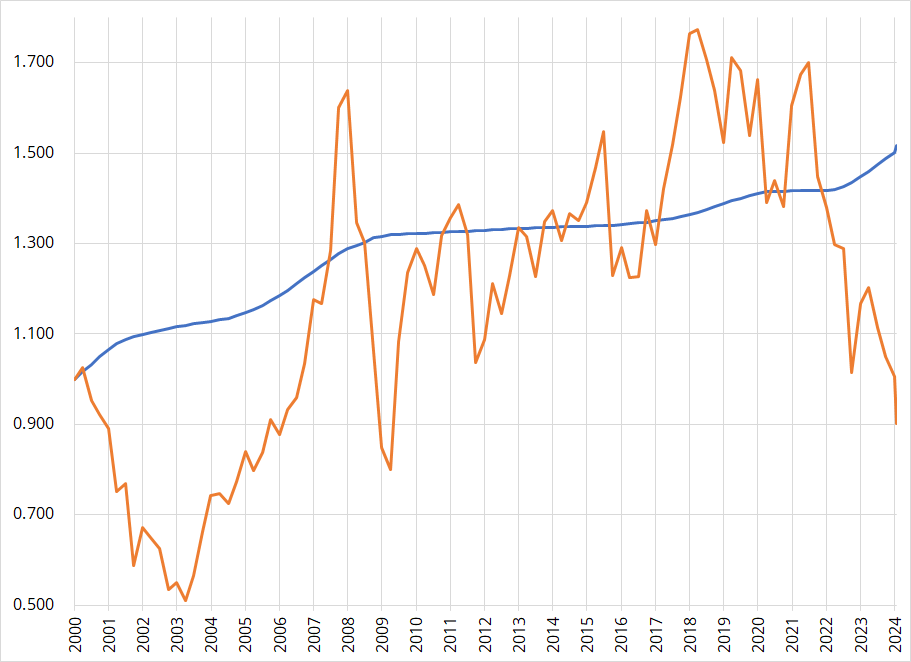

Unchanged in 23 years! That is absolutely horrendous, obviously, but it’s not just that HSI was dead money all that time. The opportunity cost vs. US T-bills looks like this.

You don’t need a Financial Mathematics degree from MIT to determine which of these two investments had a better Sharpe ratio! Jim O’Neill of GS coined the term BRICs around this time as his bullish emerging markets thesis gained serious momentum but eventually peaked at the same time as globalization in 2008.

Goldilocks keeps eating the shorts’ porridge. That is a weird sentence. Anyway, yeah the Goldilocks US economy is still the main story with inflation coming down, growth solid, jobs plentiful, and so on. This raises a tough question which is: What do you do when your view is priced in?

My view for ages has been that the soft landing is the base case. But now the soft landing is fully to more-than-fully priced in. That’s why I have been nervous about stocks. But if you think something is fully priced in, you can’t just fade it, either. Because it can get more than fully priced in. Perhaps the best thing to do then, is sit on the sidelines and wait for inspiration. That’s what I’m doing. Agnostic on stocks for now.

This is from a trading perspective. Bigger picture, investors who try to time the market and sit on the sidelines historically have had much worse returns than buy and holders. But my time horizon is always the trading view, not investment advice.

Some big breakouts in the scariest most overpriced AI stocks as MSFT and NVDA both resumed their trends. This is another reason not to get too obsessed about the short side. It ain’t working.

Arun Chopra summed up the NVDA story quite well with this 8,000 word analysis:

He’s a good follow btw. I don’t know him but his feed has a good smart/funny mixture.

Here is this week’s 14-word stock market summary:

Davey Day Trader is back. Stonks only go up. Parody and reality have merged.

We started the year with US yields at the lows and a lot of that (as discussed here for a while) was year-end chicanery. Now, the market is replaying a mini version of 2023 as everyone realizes at once that the US economy is fine. While the media would have you believe it’s this kind of fine:

It’s actually more like this kind of fine.

I specifically selected this image because she has a wary look on her face. She’s still afraid of the bears. Now if you’re well-versed in fairy tales, you know this one ends two ways and both could be fitting analogies for how this Goldilocks economy and stock market rally end.

We will see which way this bull market ends but for now, I don’t see any reason to be short. Plenty of reasons to be skeptical or nervous. No reasons to be short.

My Global Macro section was getting too long so I did not mention the other main theme of the week (besides continuing strong data from the US economy). The return of DJT to the mind of the market. Here’s what I wrote in am/FX this week:

This market is weird. You have an Iowa primary result that could not have possibly surprised anyone alive on Earth, and yet markets are trading like Donald Trump’s odds have jumped significantly. Oh wait, they have.

Maybe there are enough people with a subconscious or conscious bias against Trump that they were holding out some hope for a Haley or other surge and now the cold reality has hit like Battery Park winds. Meanwhile, the US data continues to stonk and the market is positioned for disinflationary Goldilocks, not a fiscal reacceleration and inflation trade.

But also: Today is January 17. Are we trading the outcome of the November 5th election here? I understand that market prices are a series of weighted probabilities, so perhaps that makes sense. We just added 5% onto the Trump outcome and this is good for 150 points in USDJPY and 10bps in US 10-year yields.

A world where China is disinflating while the US is growing faster than expected and Trump’s election odds are rising is a USD-positive world—and that’s what we traded this week. Meanwhile, the stale Bank of Japan (BOJ) story is out of the narrative completely and US yields are going up. USDJPY is approaching the level where the Ministry of Finance intervened the last two times (150/152).

The Bank of Japan meets this coming Monday and it would be hilarious if they hiked rates at the moment when absolutely nobody expects it. I don’t think they will, but I definitely would not be long USDJPY into the BOJ meeting.

Outside of USDJPY, you got a spike in USDMXN this week as the rise in yields and the rise in Trump’s election odds have scared a few people. The general view is that Trump might enact larger tariffs on trade and that would be USD bullish. The differential in fiscal stance between Trump and Biden is hard to measure. They are both strong proponents of ultra-loose, procyclical fiscal policy.

Finally, my bearish AUD thesis mentioned in Friday Speedrun last week has played out and I took profit. I’m not bearish AUD anymore. The bearish SEK thesis is working and I’m still bearish SEK.

I wrote a yuge piece on crypto this week. You can read it here. Here’s a quick excerpt that outlines where I think BTC price goes from here.

The buy rumor / sell fact trade is in progress. Leveraged longs hope 40k will hold and they hope big money comes in on the bid for the ETFs today or sometime soon. Today’s 9:30 a.m. NY stock market open will be interesting for BTC and BITI. Will there be demand?

My guess is that there will not be enough demand in the short-term. Sophisticated individual investors are already long GBTC MSTR and other stuff like MARA and are flipping out of those securities into BITI. Some marginal demand for spot BTC is generated here but not enough.

Pension funds and sovereign wealth funds look on with interest, but they need a lotta meetings and sign offs before they can pull the trigger. They hated GBTC because of the random discount / premium factor and poor liquidity, and they hated BITO because of the negative carry / rolldown. They like IBIT because it’s not a proxy and it’s cheap to hold. But they are slow moving.

This creates a baton pass problem as there is not enough immediate marginal buying for all the exit liquidity spec longs need. We break 40k and some big stop outs and liquidations happen. Things stabilize 33500/35500 as strong hands appear.

Eventually, in weeks or months ahead, a pension fund or SWF announces a huge buy and that opens the door for others to follow. Career risk will shift from “I better avoid this stuff” to “I’m gonna be behind benchmark if I don’t put on 2 percent of AUM”. That first headline from Calpers, or Ontario Teachers, or ADIA, or whoever will be a watershed moment, when it comes.

So in summary … 49k to 42k – you are here – 35k/36k – 65k. And some tiny chance of crazy topside convexity after that à la short squeeze if too many pensions get interested at once now that Blackrock has given the stamp of approval and liquidity they need. Best strategy I think is wait for 36k and then sell put spreads to buy calls.

I also expect that the huge increase in liquidity and volume brought on by the new ETFs will lead to lower volatility over time.

There’s much, much more in the full piece. In case you’re too lazy to scroll up, here’s the link again.

Oh look, oil is $73 and gold is $2026 or so. Just like they were last week.

OK! That was 6.73 minutes. Please share this newsletter with any aspiring finance professionals that you know. Thanks!

Reminds me of something one of my managers said to me when I was in the middle of a massive drawdown and feeling really low.

“The first thing you have to do is stop looking down into the darkness of the abyss. Lift up your head, and look around. Everything will be fine.”

https://x.com/sahilbloom/status/1746901049921749350?s=51&t=Z-boW5UHRWKGTmYteOnSkA

Then read this:

A Venn diagram I made about a form of cognitive dissonance I find interesting.

The freestyle that got Eminem signed. The crowd reaction is so good. It’s easy to forget that Eminem’s original horrorcore style was rooted in absurd surreal comedy, not serious violence or hate.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it