The Fed cut into relative quiet, China is slow, Canada is back on target, Ueda sounds dovish again, and Germany is hanging on for dear life.

Push and Pull

It was a week of crosscurrents and contradiction

The Fed cut into relative quiet, China is slow, Canada is back on target, Ueda sounds dovish again, and Germany is hanging on for dear life.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

Here’s what you need to know about markets and macro this week

Check out the video for Spectra School right here. Time to sign up.

Let’s go!

It was all about the Fed this week as the much-ballyhooed first rate cut finally arrived and it was a biggie. While economists completely whiffed on this (very few called for 50bps), the market did an OK job as it priced in a 50/50 outcome and that’s probably not a bad assessment given how difficult it was for Powell to get his peeps on board.

We saw the first dissent from a governor since 2005, and from the sound of the press conference (and the confusing tone of the leadup) it does not seem like The Committee is particularly unified.

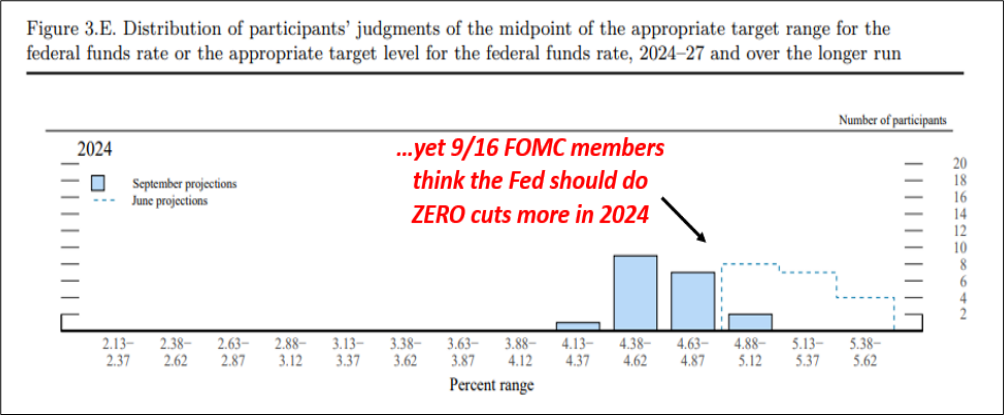

Instead, what we got was a reduction of the Fed Funds rate by 50bps with a message that leans towards data dependence, not a guarantee of more jumbo rate cuts. The dots, which are the most useless inventions since the chocolate teapot, point to significant doubt over the speed of future cuts. See this chart from Alf:

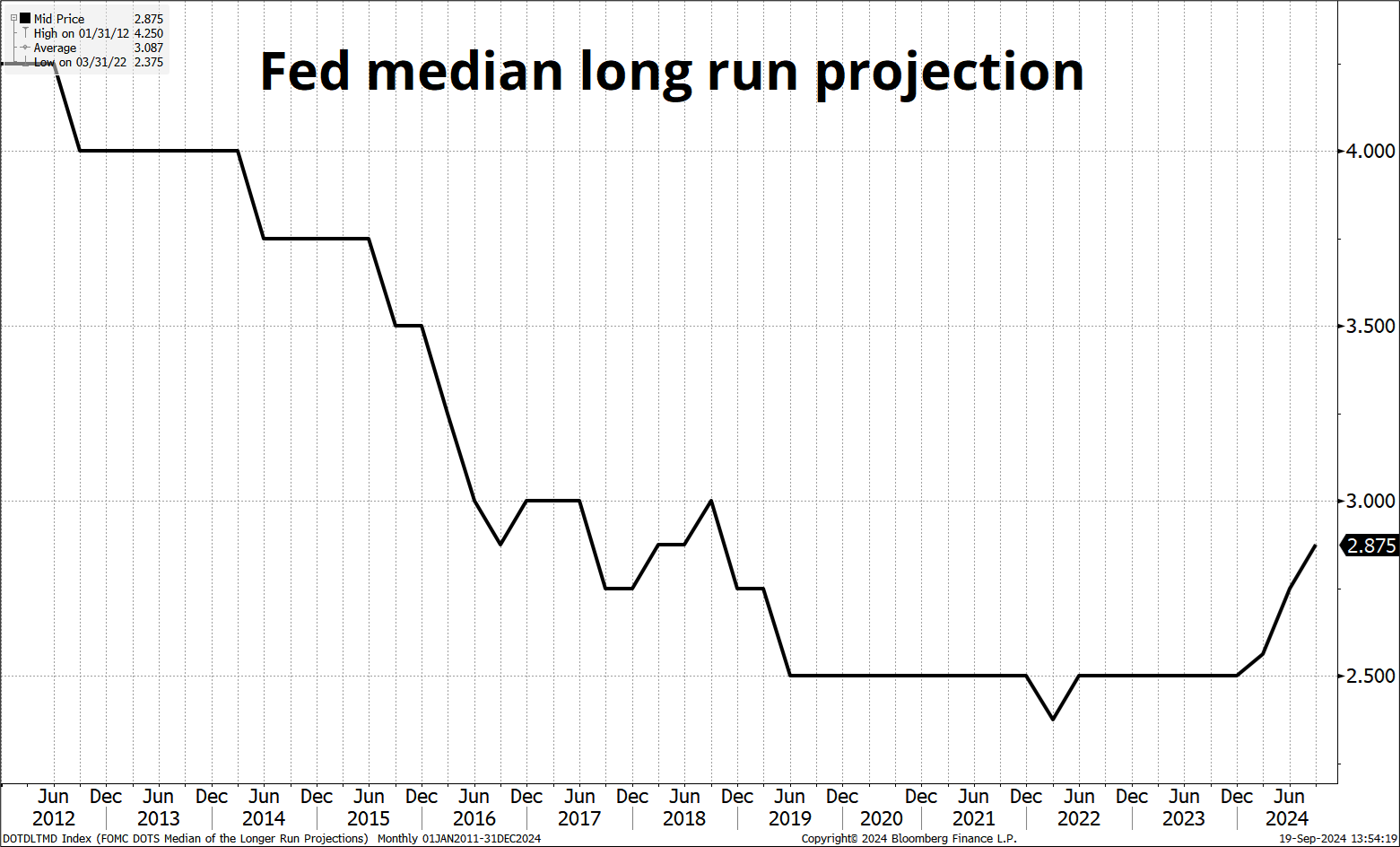

Not only do the dots fail to confirm the dovish path established by markets, they raised the terminal rate. That suggests a shallower final destination for the Fed than previously thought and confirms the difficulty in determining the neutral rate. The neutral rate of interest is an unobservable, procyclical variable that offers false precision so that shamans doing the monetary policy rain dance can claim statistical / intellectual backing for their finger in the air determinations of optimal tweaking.

Alfonso Peccatiello (Macro Alf) and I have a weekly podcast and it’s now available on YouTube! Check it out right here. Be sure to subscribe so that the algorithm deems us worthy.

While the Fed was the only story this week, there are a few other things going on. China keeps sucking wind. Canadian inflation is back to target. Ueda sounds dovish again. And Germany is hanging on for dear life.

$4.5 Trillion worth of US equity options expire today.

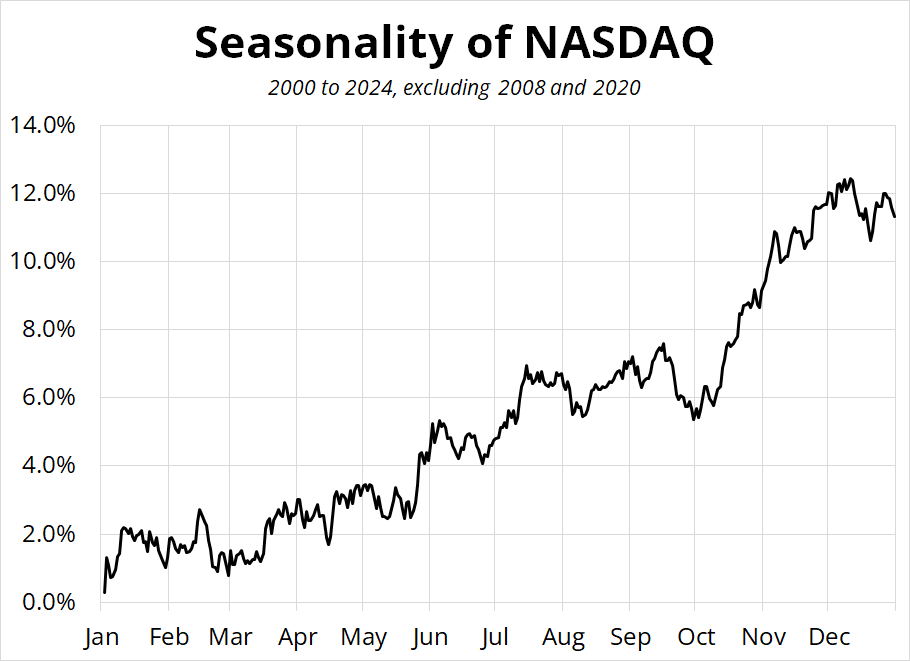

This is the largest September expiration on record. There’s also some goofy gamma in NVDA. While this article suggests the expiry is bullish for NVDA, directional outcomes after gigantic expiries are tricky. With mega bearish seasonals fighting super bullish macro, next week will be a biggie.

The macro environment for stocks looks peachy. That is, a lot like 1995 and 1998, when the Fed was cutting rates into a pretty OK economy. If this was just a soft patch (that’s my base case as discussed over and over in all my writings the past few weeks) … Rate cuts are reflationary and will reignite animal spirits. This is inflationary for assets but not necessarily for consumer goods and services. Except housing, I guess?

If you’re bullish stocks… Maybe best to wait for the end of the bad seasonals if you’re patient. But the October/December period is probably going to be mega bullish, regardless of the election outcome.

The end of September is the end of the bearish seasonal. Expect some volatility into the election, but unless there is a Red Sweep or a Blue Wave, we should be go for launch in a few weeks. Until then, keep some powder dry in case we get some random, ridiculous 4% selloff post-expiry on seasonal outflows.

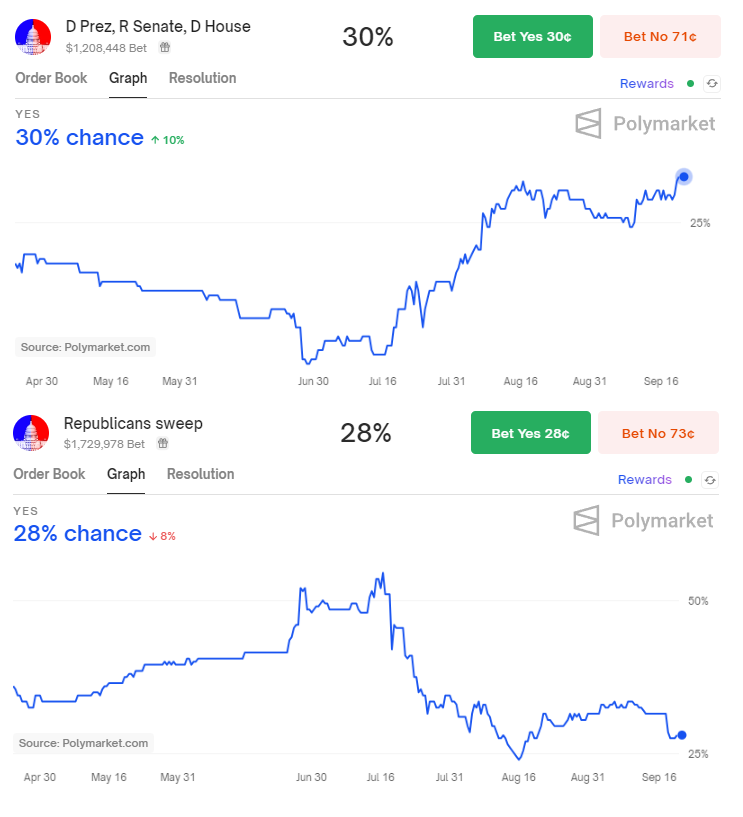

Speaking of the election, here’s the current sitch.

Gridlock has surpassed the Red Sweep as the most likely outcome; though there is plenty of time left on the clock and things can change fast.

Here is this week’s 14-word stock market summary:

The economy is peachy. The Fed is cutting. Bearish seasonality does not last forever.

Last week I said:

At this point, if you’re long bonds, this is a fair place to take some profits as positive bond market momentum has dissipated on micro timeframes and there is soooooooo much priced in.

We just went from 5.0% to 3.5% on the 10-year. In four months. I don’t think enough has changed in the world to justify much lower yields from here, and the risk now is that we stay in soft landing mode and bonds just chop.

This was a pretty good call. The Fed delivered the dovish side of a 50/50 coin toss and bonds went down! In response, I tweeted this:

Now before we discuss the good news / bad price setup that I obliquely refer to in the tweet. How the heck does this tweet get 5,000+ likes? Algorithms are so inscrutable. I have tweeted much more interesting and pithier and funnier things than this and those things have got like, 223 likes?

Super random.

Anyway, when something is supposed to go down on bad news, and it doesn’t… That’s usually bullish (though not always!) Here’s a chart of US 10-year yields this week.

Yields are not meaningfully higher yet, but my guess is that next week will see bonds sell off (and yields go up) as the market digests the OK growth / dovish Fed combo along with the data.

We get consumer confidence data served two ways next week (Conference Board and Michigan) and my guess is that these are both going to show strength. With gas prices crumpling, stocks and crypto at the highs, and a small drop in general malaise out there (opioid deaths finally peaked, for example)… Maybe the vibecession is over?

Concurrent with my view that yields will go up next week is my view that USDJPY has bottomed for now. The BOJ sounds less hawkish, the market is short USD and long bonds, and the LDP meet at the end of the week to pick a new leader. That new leader will be the new prime minister of Japan.

In many G10 countries, politics don’t have much impact on independent central banks, but the Bank of Japan is not independent. The Japanese government is an important monetary policy partner alongside the BOJ, as the success of Abenomics showed. Significant cooperation between the government and the central bank makes monetary policy more potent (pungent?)

There are 9 candidates in line for the LDP job but only three of them seem to have a chance. Koizumi (boring), Ishiba (hawkish, bullish JPY) and Takaichi (dovish, bearish JPY). Regardless of what people think the outcome will be, they are likely to reduce risk into the election result. We will know the winner around 3 a.m. on the 27th of September, probably.

Re: Dollar… The kneejerk after the Fed meeting was to sell USD, but dollar sellers mostly lost money as the greenback holds its ground. Maybe the most interesting outcome from this entire Fed week was how little the USD moved.

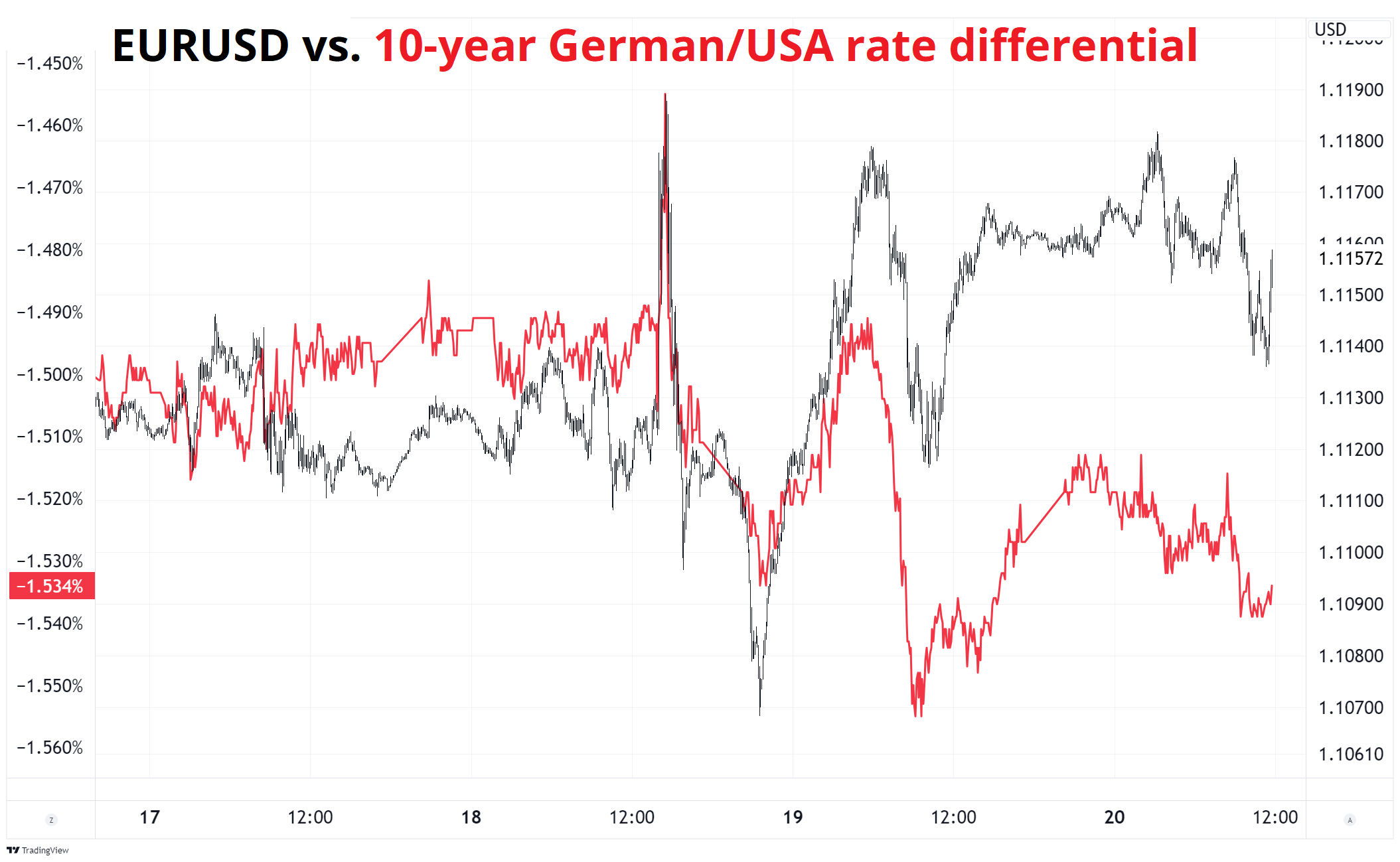

Interest rate differentials also barely moved. This chart shows the 5-minute action in EURUSD this week, mapped to the 10-year rate differential. Choppy McChopperson.

Why did the USD not sell off on a surprisingly large rate cut? It’s hard to say. Part of it is that the market was already short USD going in. By the time the first rate cut happens, many of the moves have already happened in anticipation. USDJPY already went from 160 to 140 in the past few months. EURUSD is off the 1.07 lows. The market has been gearing up for the start of this rate cut cycle for ages.

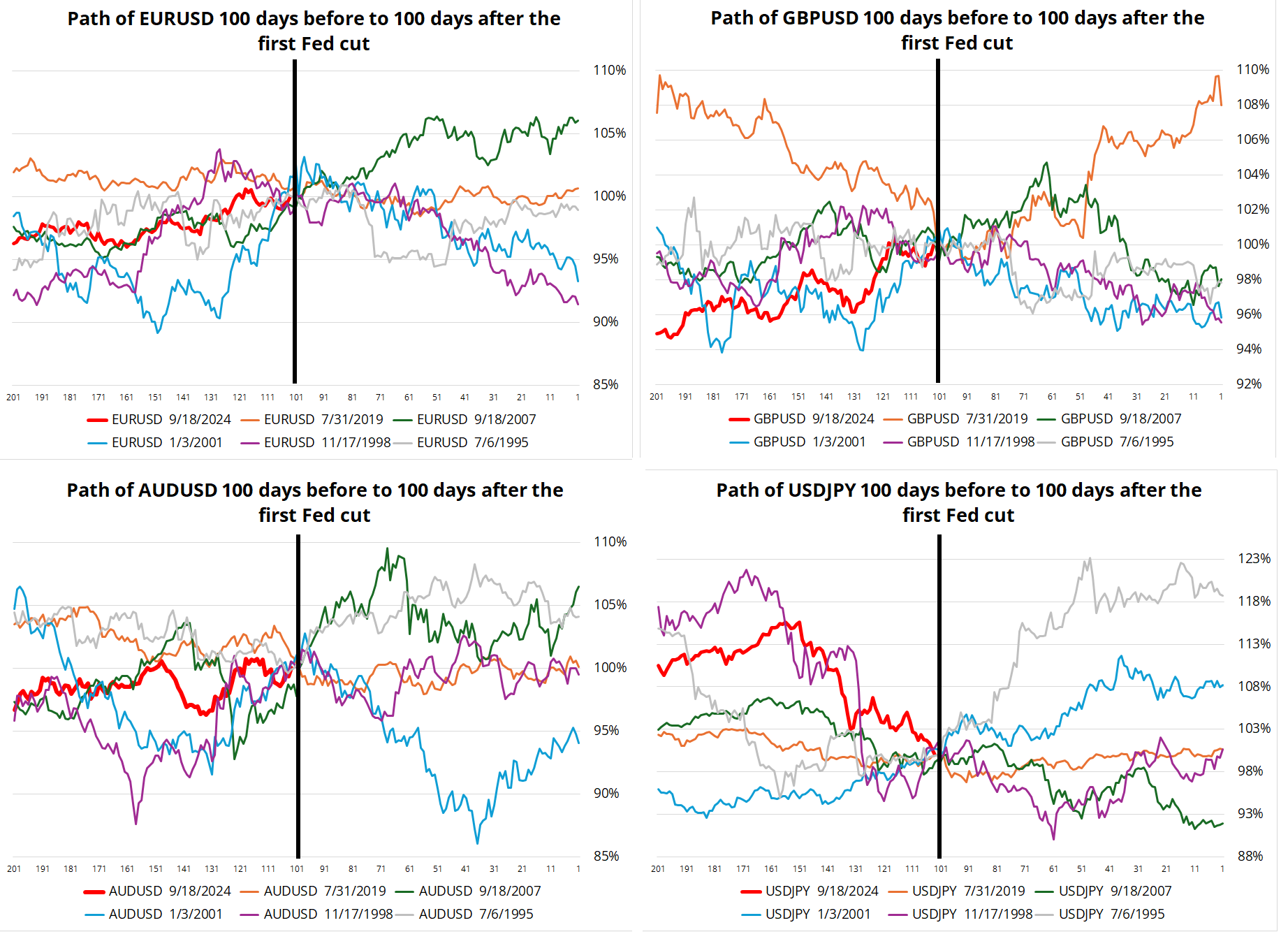

And for your reference, the next charts show the FX moves 100 days before to 100 days after the first Fed rate cut of the past six cycles so you can see the history. There is no clear USD downtrend when the Fed starts cutting. It just depends where the economy and the rest of the world go thereafter. If you’re not an FX person, just look at the bottom right quadrant (USDJPY). That’s the easiest one to understand.

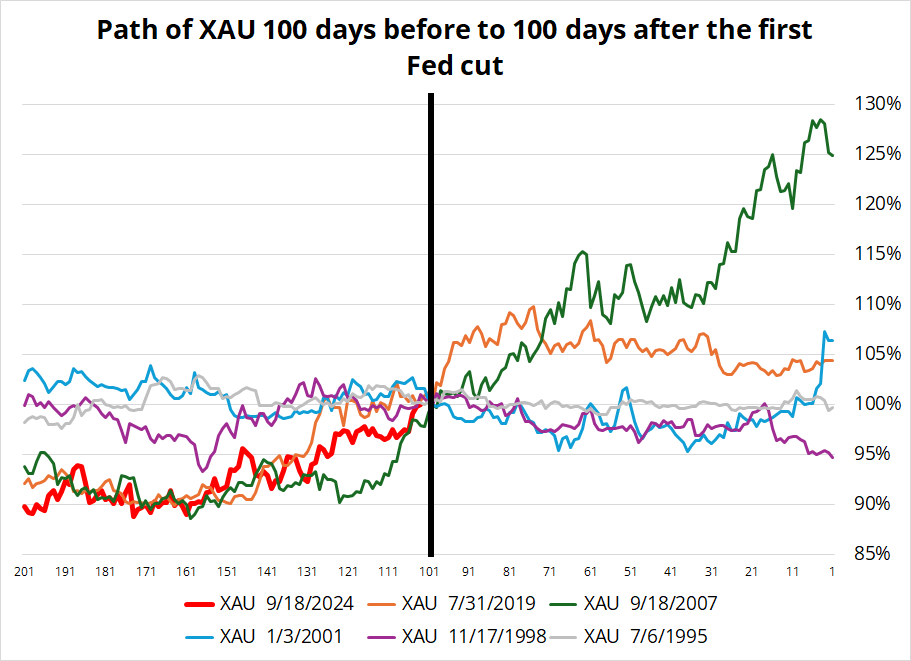

I know you are endlessly curious, so let me show you what some other things do around the first Fed cut.

First, gold. In all cases, it rallied into the first Fed cut, and other than 1998, it rallied after, too. Still, 1998 and 2001 saw profit taking after the cut, while 2007 and 2019 saw the rally continue. Gold was not very volatile in either direction in 1995, so that’s probably a useless comp.

What about interest rates? The y-axis on the next chart shows basis points. It’s intriguing to me that there was not much follow through in yields, either. 2007 obviously saw a big drop (green line), while you had much higher yields in 1998 as the LTCM and Russia crisis were resolved with a liquidity injection and the crescendo of the dotcom bubble soon followed. Even in 2001, when there was a recession, 10-year yields were higher, not lower 100 days after the Fed cut.

Finally, stonks. Again, no real clear story to tell here. 2001 saw the dotbomb implosion, 2007 was the GFC, but 1995, 1998, and 2019 all saw higher stock markets after the first Fed cut.

This is a pretty simple one: If (recession) then stocks lower. If (soft landing) then stocks higher. Choose your fighter.

In conclusion, there is no clear buy the rumor sell the fact or continuation trade when the Fed starts a cutting cycle. The market is efficient. It’s good at pricing in upcoming rate cut cycles. So, it just comes down to whether or not we are about to enter a recession.

I’ll go with “not”.

We’ve been waiting a long time for this Godot / Bigfoot recession!

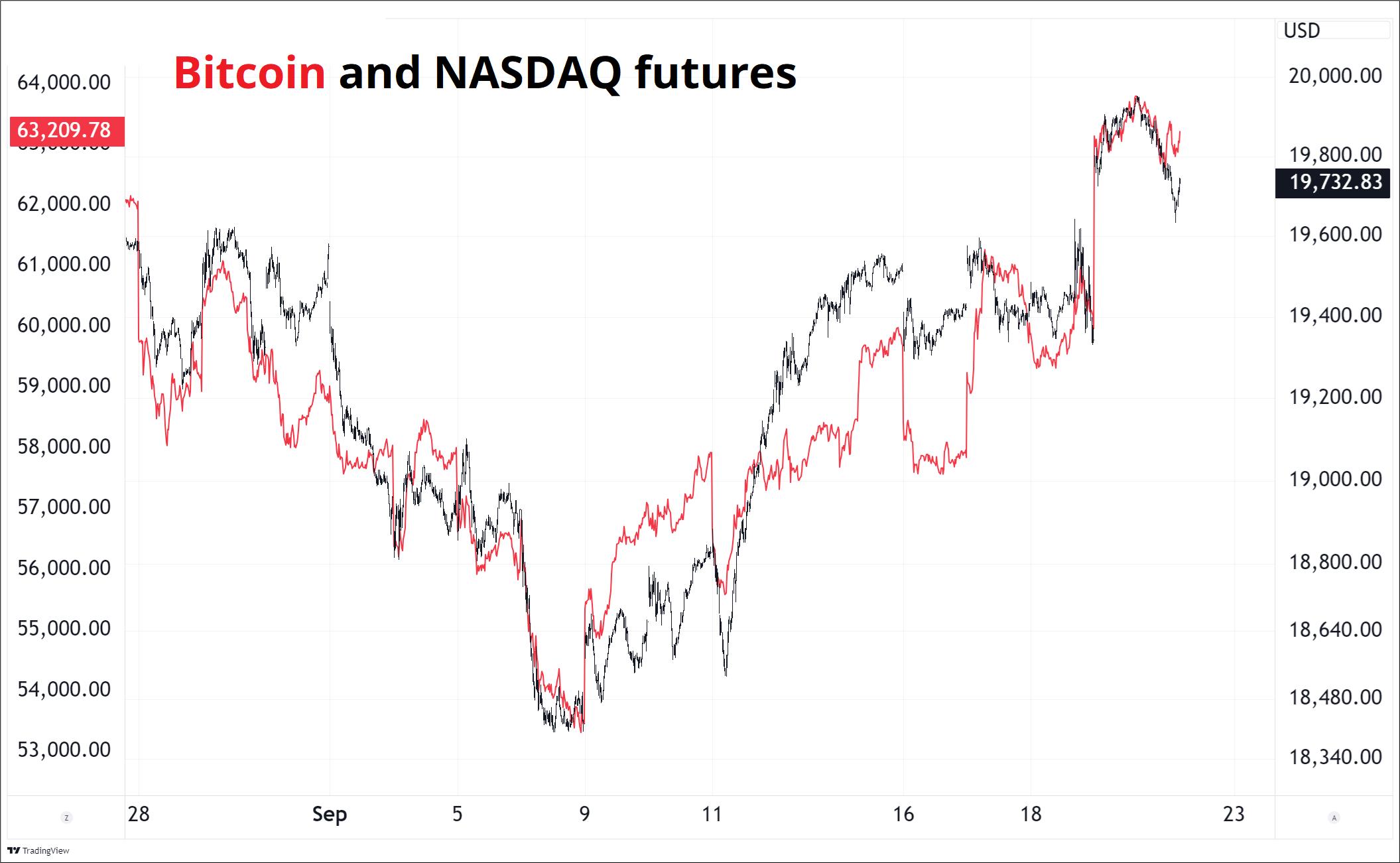

Not much to report on crypto this week as the virtual coins rise in tandem with all other risky assets. Most of the price action in bitcoin looks like high-frequency algorithms and correlation traders just following the general risky asset vibe up and down.

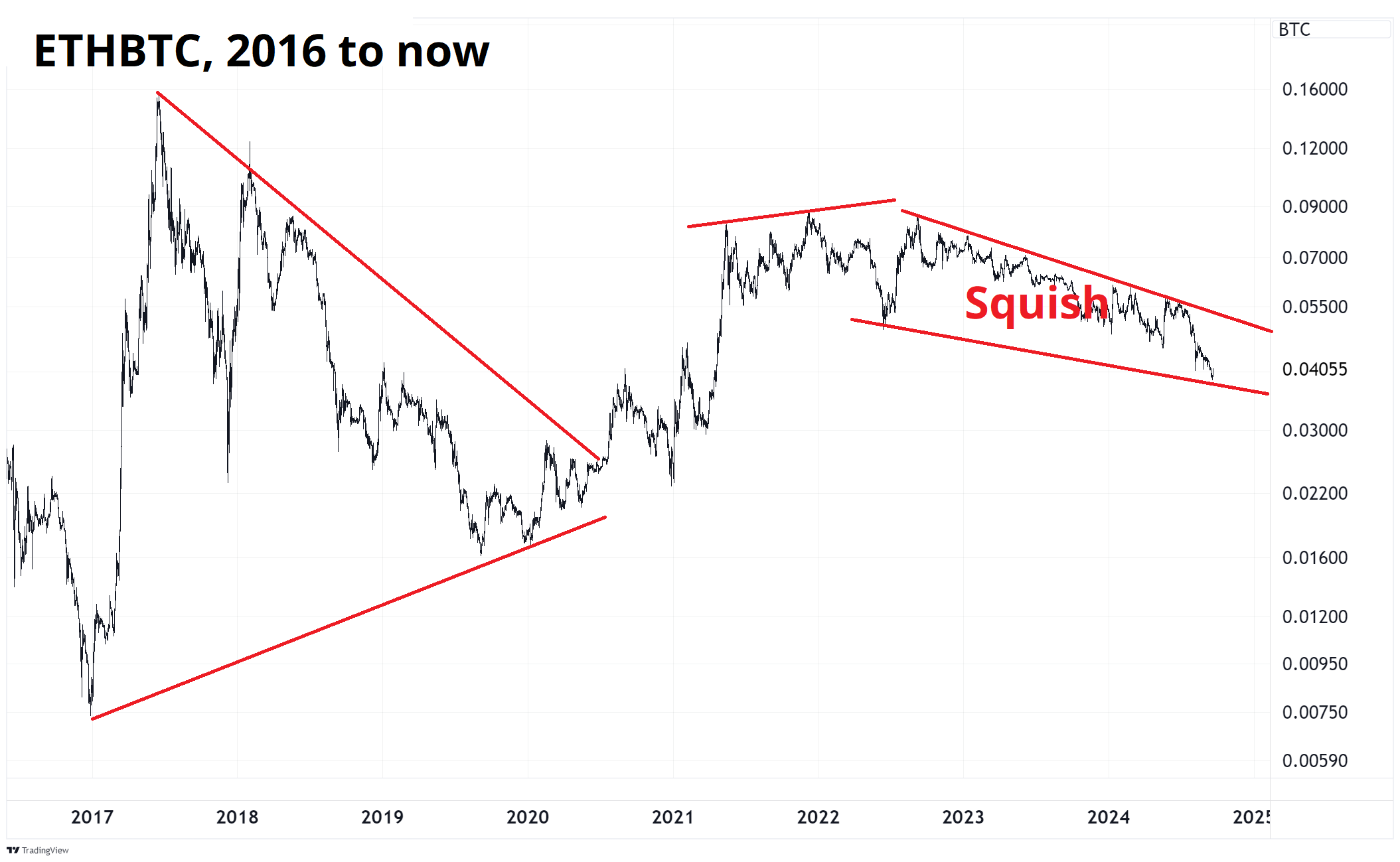

One thing that is kind of odd to me is the relentless bear market in ETHBTC. Not only is it relentless, but volatility is weirdly absent compared to how things used to be.

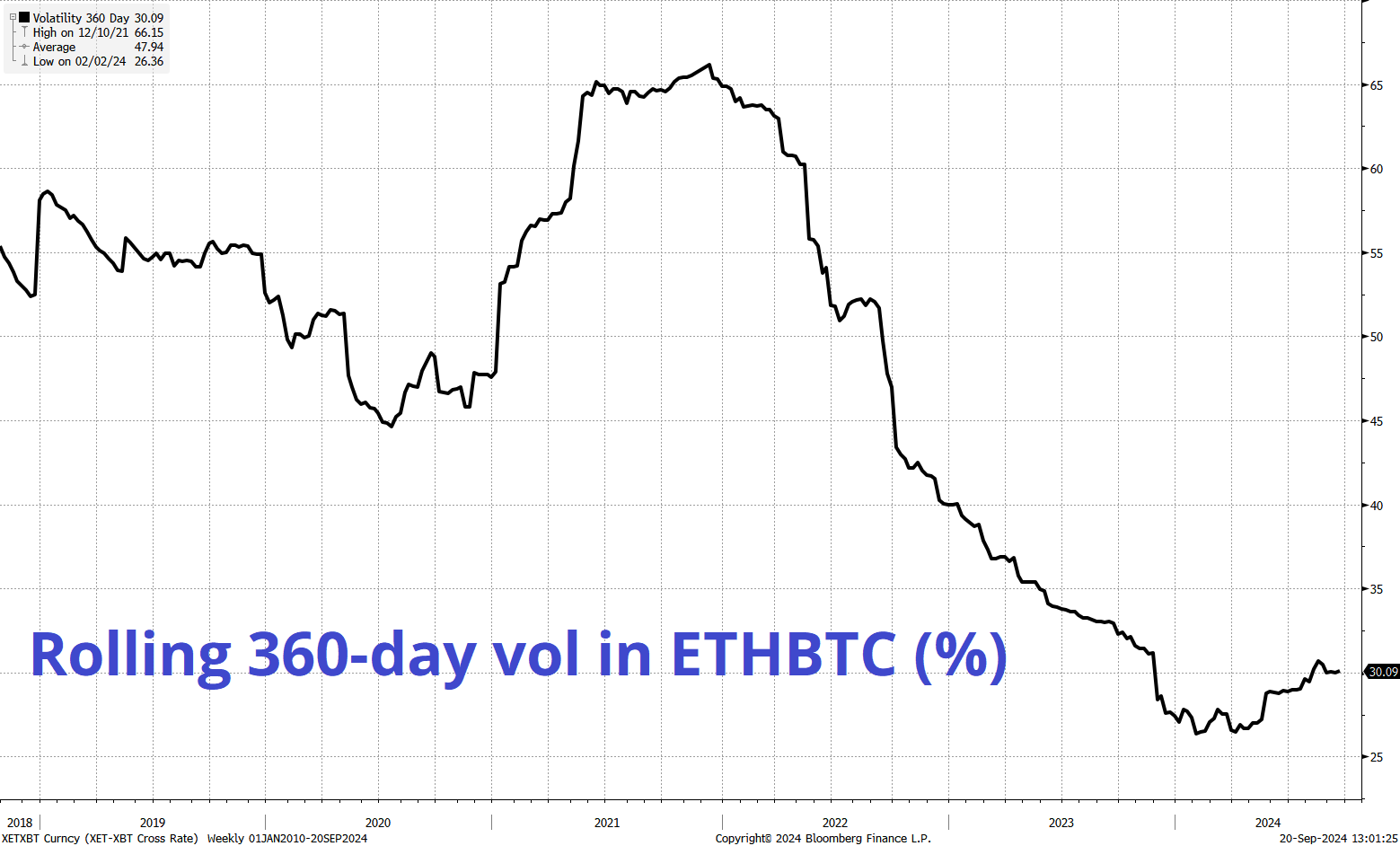

You can blame the meh launch of the spot ETH ETF for the recent dump, but overall the constriction of price is kind of shocking and interesting. It also serves as a proxy for how altcoins and overall crypto market cap is not growing in line with BTC anymore. In 2017 and 2021, ETH was the high beta. Now it’s not. Hmm. This next chart shows rolling 1-year volatility in ETHBTC.

Gold gold gold gold gold gold. And silver! Is this the time when silver finally joins the party? Sure, it’s unchanged compared to six months ago even as gold continues to defy real yields with a vengeance… But it looks a bit like silver might be ready to burst.

Through 33.00 would be a new YTD high and possibly reason to add to silver longs. Much like ETHBTC, the silver vs. gold ratio has seen the big guy outperform while the sidekick is left awkwardly behind.

Gold and bitcoin are Batman. Silver and ETH are Robin.

For refence, this is Robin:

And this is Batman:

You see what I mean? Normally people talk about the gold/silver ratio but to be consistent with ETHBTC (i.e., Robin / Batman), this chart shows the slow decline of silver vs. gold over the past zillion years.

Whew! OK! That was 9.21 minutes. Thanks for reading Friday Speedrun.

Get rich or have fun trying.

Smart, interesting, or funny

I tend to be overly skeptical about new technology sometimes. But I do try to stay open minded. This amazing 165-page essay from an ex-Open AI employee is a good antidote to the constant skepticism from Ed Zitron et al. I like to consume all viewpoints and to be honest I find Zitron’s skepticism and the fearful optimism in the essay equally compelling. AI could hit a wall as it runs out of data, or it could be a self-replicating, humanity destroying algobeyotch by 2027. The error bars are rather wide, as they say. Thanks BB for sending me this essay. It’s so good.

While the argument about when AGI will wreck the world is interesting, one can make a convincing argument that AI has already kinda done so? (e.g., YT, FB, Insta, and other AI algorithms.)

The Mr. Beast Memo is a Guide to the Gen Z Workforce

By Kyla Scanlon. I recommend you click on the PDF she references and read the actual memo yourself. It’s a good learning experience, whether you are a creator of content or not.

A time machine that lets you see how Trump’s crypto project will perform

The terminal value of all memecoins is zero.

Music

No idea why I flashed back to this song. But in the 1990s, there was this narrow lane for ironic straight-faced stupidity in music, and this song captures it well.

The Presidents of the United States of America – Peaches

The video is directed by Francis Ford Coppola’s son, Roman. The songwriter said he was emulating Nirvana in the verses by trying to sound “gnarly and growly.” :] The song accurately reflects my unshakeable existential desire to move to the country, and eat me a lot of peaches.

Weirdly, if you Google “peaches song Wikipedia” you get:

And a bunch of songs by a Canadian musician named Peaches. And her best-known album is called “The Teaches of Peaches.” I was going to link to it, but I’m too shy. It’s too raunchy, even for Friday Speedrun.

I have learned so much today.

And yet I am no smarter.

Peaches, the musician

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it