There’s nothing left to worry about

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

There’s nothing left to worry about

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

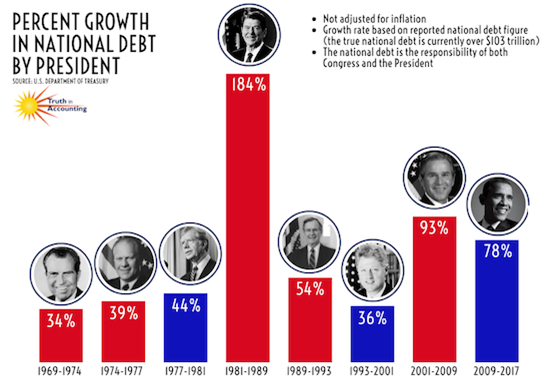

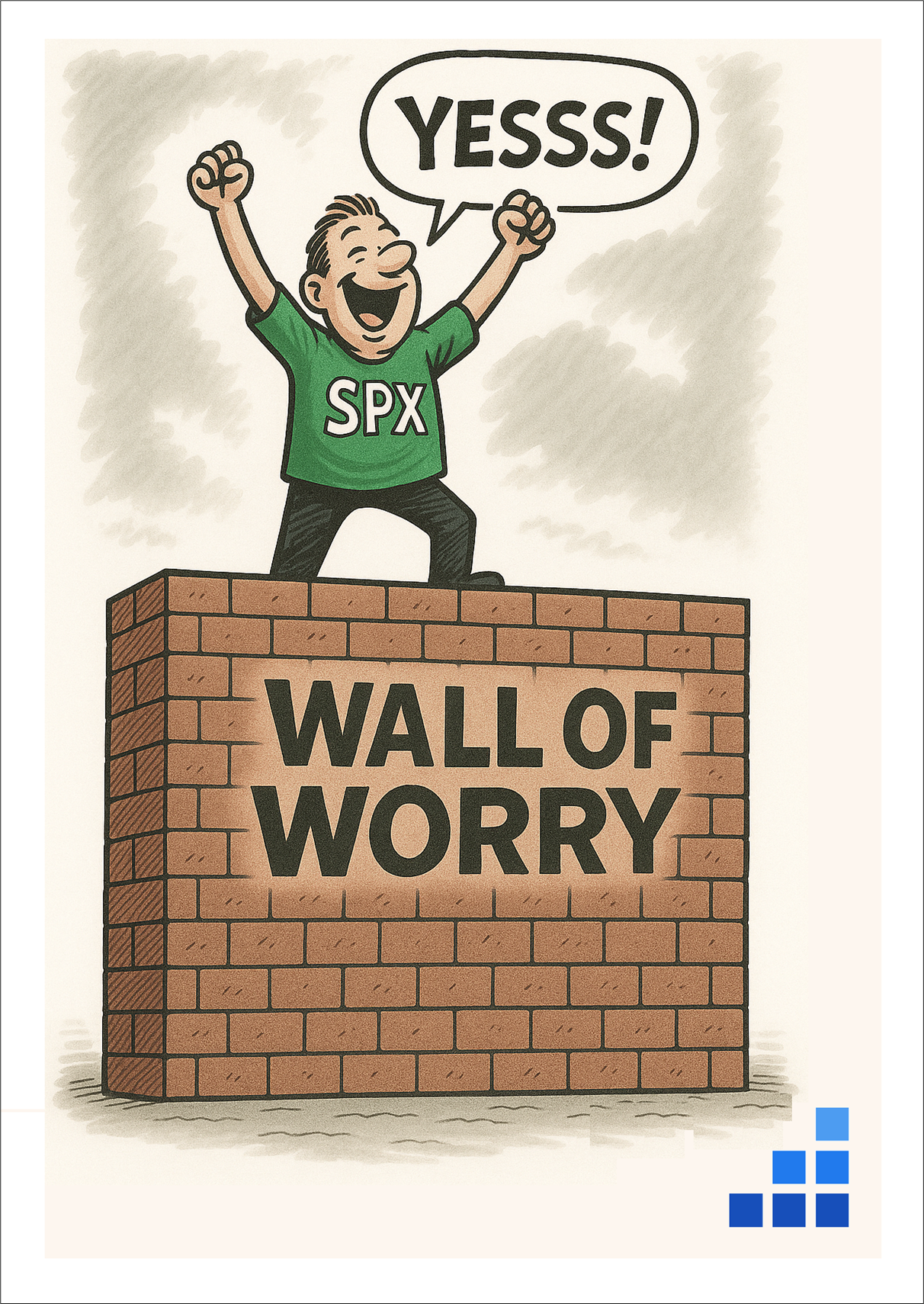

Stocks have climbed the wall of worry as tariffs and the war against Iran are both out of mind and the market is excited about the debasement effect of deficits to infinity and is thus stretching all the green candlesticks on the screen up and to the right. As Lyn Alden has been saying: Nothing stops this train.

It’s fun to worry about deficits, but it’s impossible to know when they might matter. Here’s some typical hand-wringing from 2008:

I have been scanning the horizon for danger signals even as we continue working to recover from the recent turmoil. In the distance, I see a frightful storm brewing in the form of untethered government debt. I choose the words—“frightful storm”—deliberately to avoid hyperbole. Unless we take steps to deal with it, the long-term fiscal situation of the federal government will be unimaginably more devastating to our economic prosperity than the subprime debacle and the recent debauching of credit markets that we are now working so hard to correct.

Richard Fisher, May 2008

Or looking a bit further back, here’s Ronald Reagan wringing his proverbial hands in 1981, right before he tripled the debt via unfunded tax cuts and Cold War spending.

Some government programs seemed so worthwhile that borrowing to fund them didn’t bother us. By 1960 our national debt stood at $284 billion. Congress in 1971 decided to put a ceiling of 400 billion on our ability to borrow. Today the debt is 934 billion. So-called temporary increases or extensions in the debt ceiling have been allowed 21 times in these 10 years, and now I’ve been forced to ask for another increase in the debt ceiling or the government will be unable to function past the middle of February — and I’ve only been here 16 days. Before we reach the day when we can reduce the debt ceiling, we may in spite of our best efforts see a national debt in excess of a trillion dollars. Now, this is a figure that’s literally beyond our comprehension.

Oops! The US debt is always “unsustainable”…

Wen reckoning?

I don’t know which string of words I find more aggravating:

A) US debt is unsustainable.

B) We will grow our way out of it.

C) Tax cuts pay for themselves.

D) 1-877-Kars-4-Kids

Anyhoo. The Liberation Day stock market collapse and subsequent v-shaped recovery have cemented the common knowledge that BTFD is the only strategy and stocks only go up. Pavlov’s Dogs keep winning. Rainbows and lollipops for everyone.

There hasn’t been much economic data to chew on, with Initial Claims back to unworrisome levels, Canadian jobs strong to very strong, and the UK showing some mild weakness. Fixed income continues its tedious range trade, the Fed is still split, and FX excitement has withered as USD bears are bored, but USD bulls find things choppy. OPEC still has its foot on the neck of the price of oil and bitcoin just turbo-thrusted past Saturn.

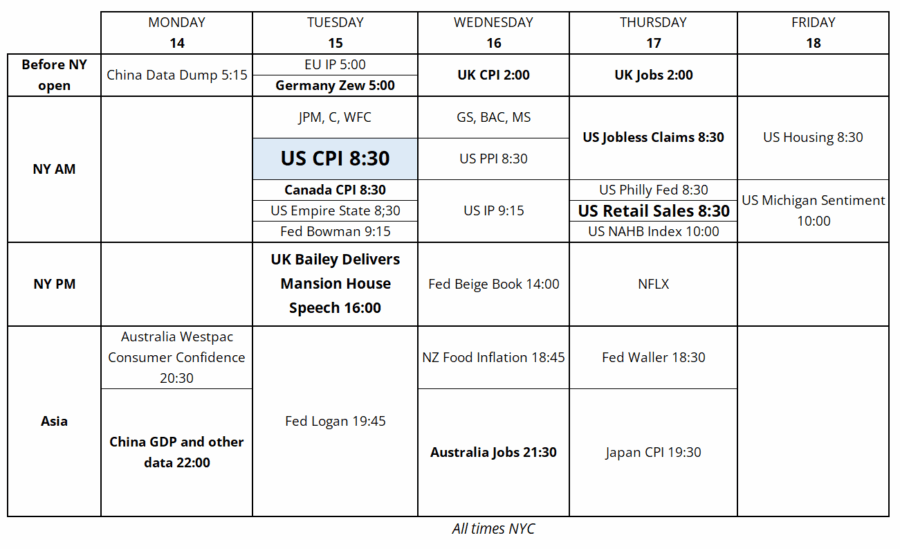

Anyone who wants to seriously evaluate the impact of tariffs on the US economy is now going to have to wait past the new August 1 “deadline” to see the September and October US data released in October and November. Everyone else (including me!) is going to need to overreact to every data point, starting with next week’s US CPI.

Here’s the handy-dandy trading calendar:

Alpha Trader is super cheap for Prime Week.

Normally $36, currently $23.

Some say it’s one of the better trading books.

If you don’t believe me, believe Jens Nordvig. He is smarter, better-looking, and more well-respected than me!

“Brent is a smart, balanced and hyper-pragmatic trader. I have known and worked with him for years, and his constant search for new paradigms is what sets him apart. ALPHA TRADER is a very, very valuable book which may save young (and old) traders from significant emotional (and monetary) pain.”

– Jens Nordvig, world-renowned currency strategist and founder of Exante Data

In my last Friday Speedrun (June 20, before I went away for two weeks) I had written about the new post-COVID seasonal tendency for stocks to rise after June OPEX because demand for calls is now relatively much, much higher than demand for puts. We got the seasonal rally. Now we are approaching the peak of seasonal equity demand just as everyone has stopped worrying about anything.

Here’s the typical path of US equities through the year:

As you can see, buying stocks on July 15 and selling them on October 15 has been a flat proposition over the past 25 years because August and September are lackluster months for the stonks. Hard to make a strong case for limit short here, other than seasonality and maybe sentiment. That said, we are entering earnings season, so if you were looking for a catalyst, I suppose that’s the one. I have no particular reason to think earnings will be bad, but you never know.

The AI CAPEX theme has become a tad more nuanced as NVDA makes new all-time highs and sets a new record for any company market cap, ever, while stocks like CRWV, NVTS, and AVGO fail to participate. Another big theme this week was a massive ramp in MP as it has been partly nationalized by the US government. Trump has taken the baton from Biden and continues to beef up industrial policy and central planning.

This week’s 14-word stock market summary:

You get a lollipop. And a rainbow. Everybody gets a lollipop and a rainbow.

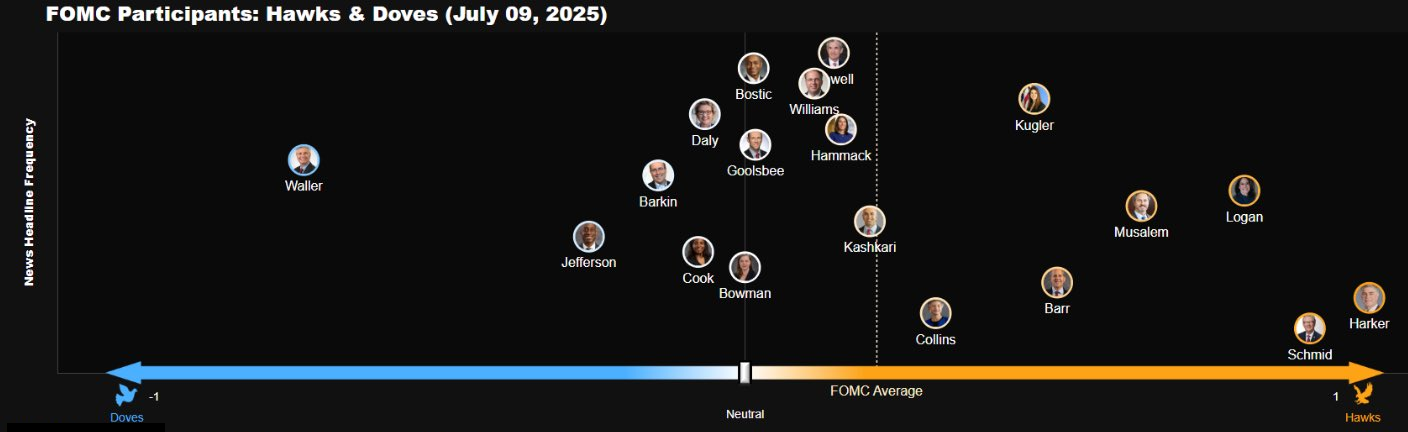

The Fed is split into two camps, one led by Chris Waller and the other featuring a majority of the committee. This chart from Bloomberg illustrates it nicely.

The chart shows “news headline frequency” on the y-axis and “dovish vs. hawkish” on the x-axis. Nice little reference for Fed followers. Look at Waller way over there hanging out by himself. I would put Bowman closer to Waller on this thing, but otherwise it’s quite good.

Meanwhile, the bond vigilantes are out in the parking lot doing pushups and maybe we will see them again at some point. US and Japanese yields are creeeeeping higher again, but remain in familiar ranges. I bought some TMF puts yesterday (the levered bond ETF) because I think there’s a chance that CPI comes in wonky high on a snapback after the front-loading weirdness in last month’s release. That said, if there’s going to be an inflationary impact from tariffs, it could still be way too early for it to show up in the data. Still, I think the convex side if there’s a move in 10-year yields next week will be upward as we already got a strong rejection of the downside sub 4.20% on Canada Day.

If you are interested in Brazil (BRL, EWZ, and/or politics) please see my trip notes from Brazil. I was in Rio for 3 days and Sao Paulo for 4. Here’s the link:

https://www.spectramarkets.com/amfx/his-name-is-tarcisio/

On G10, here’s an excerpt from Monday’s am/FX that’s still relevant.

The USD hate is strong.

All the arguments make sense. And there is no point putting on a counter trade just to be a wise guy. But still, the arguments for a weaker dollar are well-flagged, the dollar is already down 10%, and much of the stuff about the administration fully capturing the Fed is a bit fantastical to me. I don’t think Bessent or Warsh will come in and cut rates in clips of 50bps if inflation is running above 3% in May 2026. It’s all contingent on the economy. Sure, it’s fun to consider how Trump could appoint some random individual, Erdogan style, and order them to cut rates.

But that’s not how it works.

The Fed is a committee and there is a voting process. Rate cuts are not unconditional, even if Waller, Bessent, or Warsh is running the show. It’s a given that a Trump-appointed Fed Governor will be more dovish than Powell, but the idea that the Fed will just cut rates by 100bps while the Treasury moves all the issuance into T-bills and that will somehow solve everything is only realistic if the US economy is weak. If the US economy and US inflation reaccelerate, and the Fed cuts into it, the inflationary impact will be violent and politically destructive into mid-terms.

In the short term, I think suggestions of another 30% lower in the dollar right after a 10% drop are a red flag for USD shorts, positioning is universally short USD at OK but not great levels, USDJPY is showing that equity inflows and rate differentials still matter, and the risk for now is a correction higher in the dollar. Abenomics was an effort to beat deflation. There is no deflation in the United States. Anything remotely resembling Abenomics in the USA will be too painfully inflationary.

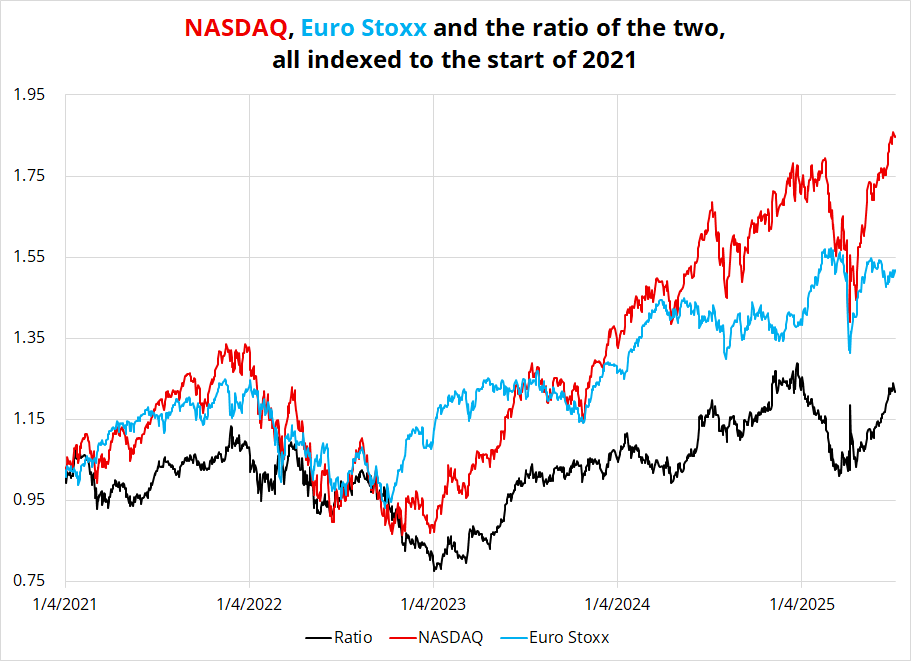

The capital flow story and the idea that money will leave the US and go to Europe is also stale as you can see in this chart:

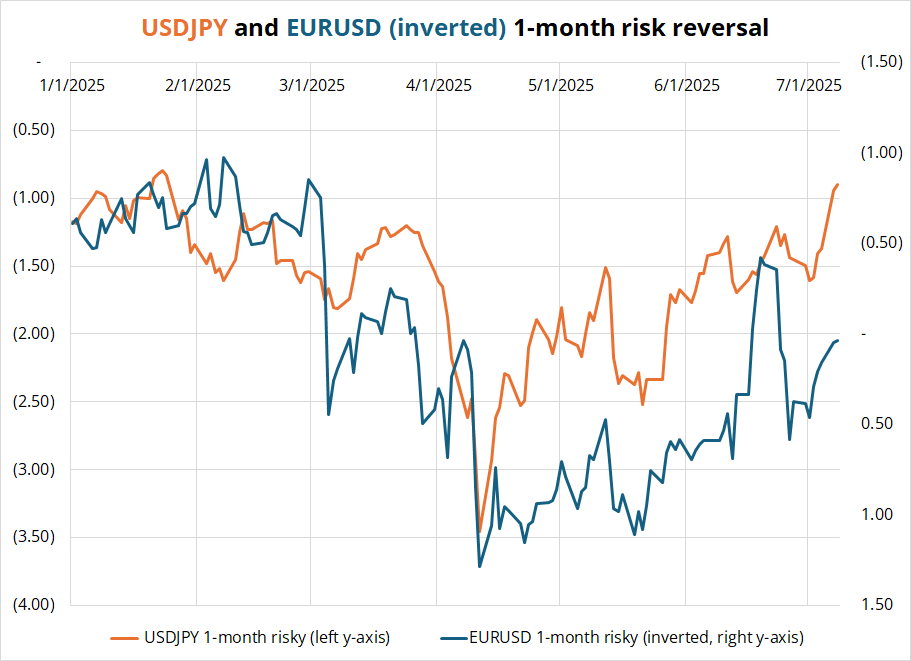

The bearish USD story doesn’t quite add up right now. Meanwhile, options markets are showing demand for USD calls, not puts.

This has been a decent call so far as my favorite currencies to short (GBP and JPY) have done well and EUR holds in. Euro is benefitting from ongoing reserve diversification and pension fund hedging while GBP and JPY are not.

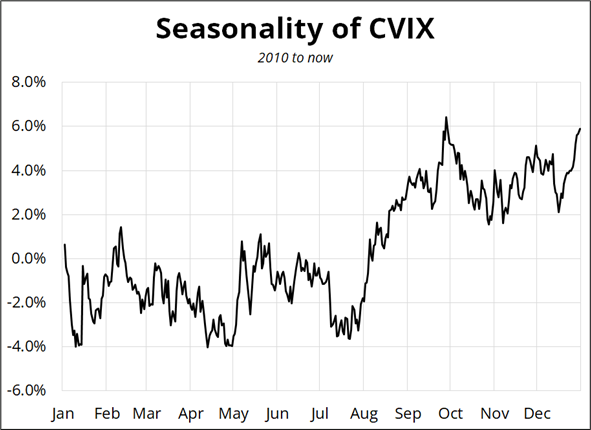

The mid-July to end of August period quite often tends to mark a turning point in macro regimes as suggested by equity seasonality chart and this chart of FX volatility (for two examples). If you were going to bet on a regime change from low-vol to higher vol, late July isn’t a bad time to do so.

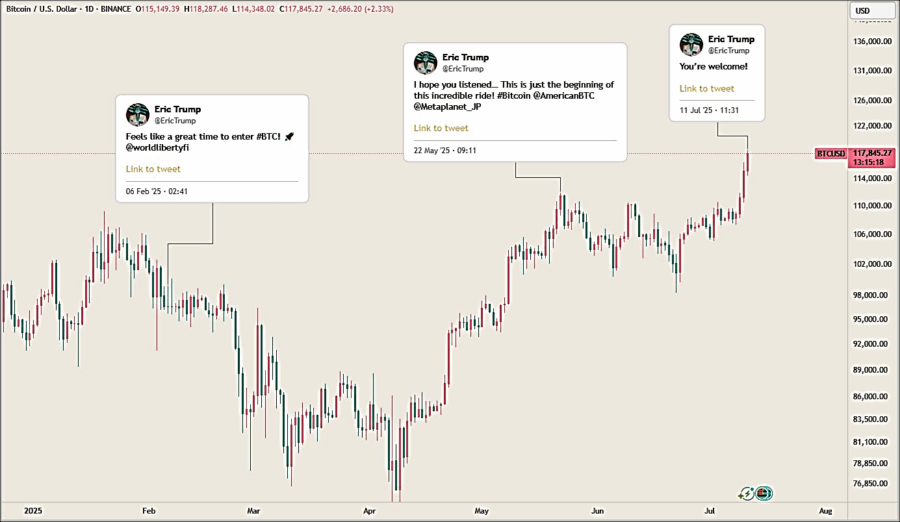

Not sure if you heard, but cryptocurrencies are going up, especially bitcoin. 🌽 hit a new all-time high this week, though some caution is warranted as Eric Trump may have just delivered his third straight Cheer Hedge.

If you’re not familiar with the Cheer Hedge, please see here.

I don’t have anything intelligent or witty to say about crypto right now. It’s impressive. Even ETH is sort of kind of keeping pace. And while it might feel like BTC is overbought, it’s really not. Here’s bitcoin vs. the 100-period on a 4-hour chart. The bottom panel shows % deviation from the moving average. If this is a real breakout, we’re not even close to overbought.

The big story in commodities this week was copper, as Trump threatened a 50% tariff on the metal, without providing any details. The market can’t sit around waiting to see if he’s joking or not, so NY metal ripped.

That is overbought! A TACO on copper will yield a zesty return to 5.00, and while options are expensive, I’m still intrigued here. There’s a limit to how high prices can go before a) Trump folds or b) buying grinds to a halt. This is inflationary and will definitely hurt US manufacturers. New sources of copper in the United States should be online in about 7 years or so, though, and then we’ll be good!

That’s it for this week.

Get rich or have fun trying.

*************

If you’re a trader who wants a job at a prop firm, or you just like entering trading contests… The Gelber contest is legit. They are a real firm that has been around for a long time and they hired two winners from the first run of this contest. As we say in Ottawa: Check it oot!

https://www.gelbergroup.com/thebreakout/

*************

The lyrics in this song from 1971 go so hard…

There’s a hole in daddy’s arm where all the money goes

Jesus Christ died for nothing, I suppose

Strange fact I noticed:

The song “Post War Dream” by Pink Floyd sounds an awful lot like the start of that Sam Stone song.

*************

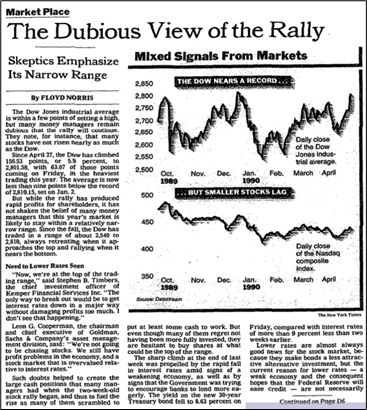

People are always worried about bad breadth.

Stocks fell about 10% shortly after this story and then entered one of the greatest bull markets of all time.

*************

On bitcoin treasury:

https://x.com/udiwertheimer/status/1941248361572552911?s=51

On single variable explanations for how markets work:

https://x.com/theflowhorse/status/1940168408689176703?s=51

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.