The big story right now is the resurgence in commodities in a world where there is basically zero chance of rate hikes to reverse any inflationary impulse.

Push and Pull

It was a week of crosscurrents and contradiction

The big story right now is the resurgence in commodities in a world where there is basically zero chance of rate hikes to reverse any inflationary impulse.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Over the past year or so, we have been building Spectra School. We will be ready to launch in the next 6-8 weeks (approx.) You can sign up for the Spectra School waitlist here—anyone who is on this list will receive sweet deals when we launch (it’s free to sign up and there is no obligation). Our flagship first course is called “Think Like a Market Professional”. It features a ton of content (practical frameworks for trading and analyzing financial markets) plus full-length videos featuring some of my favorite people in finance. Fun.

We will cover topics like cycles, narratives, the importance of financial history, edge, bias, trading economic events, options, and much, much more.

It was a tale of two halves this week as we started with a raging global reflation trade and then stocks got hammered on Thursday and payrolls today put another cat amongst the pigeons. We have generally been seeing a pretty aggressive reflation trade as the market views the Fed as rather dovish considering financial conditions and the big turn in commodities which is likely to be inflationary at some point.

The big story right now is the resurgence in commodities in a world where there is basically zero chance of rate hikes to reverse any inflationary impulse. This sets up for a big debasement trade and that is what we have seen as it’s not just gold and bitcoin that are flying. It’s pretty much everything.

US payrolls continue to confound as we got another blockbuster report today and anyone looking for labor market weakness needs to look outside the US (like Canada, for example).

Part of the reflationary impulse is that people are thinking that the global manufacturing cycle has bottomed. ISM Manufacturing data this week was perky, and maybe, just maybe, China’s cyclical malaise is improving even if its structural woes are not.

The market was doing its happy thing for the first part of the week, then Thursday happened.

It was one of those moves that people struggled to explain as some blamed Kashkari’s hawkish comments (he’s not that important) and some blamed Iran headlines (but those were hours old already). A weird move like that definitely raises some eyebrows.

The major feature of the market lately has been the lack of volatility, so nobody was ready for that big of a move. Especially not a straight line move. It’s hard to say if it’s a random one off or not, but it definitely scared people. Then again, it didn’t scare them THAT much because the NASDAQ is up 277 points as I type this in a snappy rebound. Markets are weird sometimes. One thing that I always tell people about markets is that they don’t always have to make sense.

Here is this week’s 14-word stock market summary:

We hit new all-time highs then oops, an air pocket. People got scurred.

We are banging up against the highs in US 10-year yields again as this 4.37% area has proven to be significant on multiple occasions.

You can see in that chart that before we exploded up to 5.00%, 4.37% capped things temporarily and now we are dancing around that level and jabbing higher then reversing. The reflation story should be bad for bonds and good for yields, but there is still some global disinflation going on that offsets the commodity reflation story a bit for now. Switzerland, Germany, and Canada are all seeing their inflation rates drop fairly precipitously.

So right now we have bigger picture forces that are still disinflationary but more recent news is all about inflation and reflation as commodities skyrocket.

The Fed continues to overcommunicate as Powell has spoken twice in the past week and they are still talking cuts but nobody knows when.

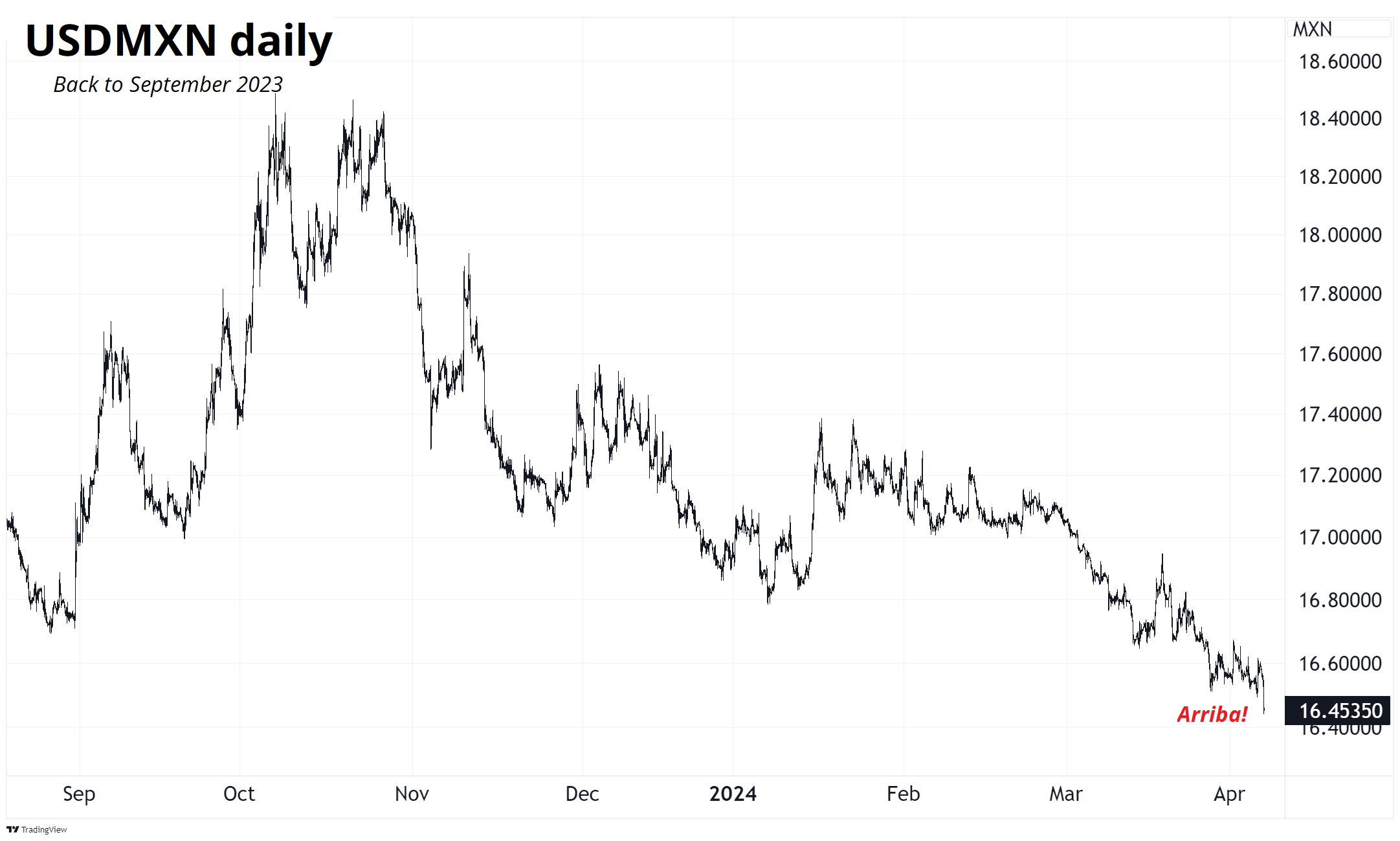

Even with Brazil blowing up this week, the Mighty Mexican peso continues to make carry traders’ dreams come true. Normally one would expect a crowded carry trade like MXN to feel some pain when VIX goes from 13 to 16 and stocks do a scary thing… But the peso is bulletproof for now.

Look at this trend and then remember you are also earning a huge amount of carry, too! It’s almost like a free lunch or something.

While commodities, technicals, positioning, and a rebound in manufacturing data (and just about everything else) pointed to the possibility of USD weakness this week, there is also the matter of a recent pause in US equity exceptionalism. As long as fixed income vol remains contained, we are in the middle of the USD smile.

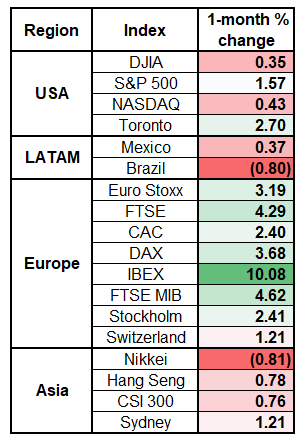

Here is 1-month performance of various global equity indices:

This mega outperformance by European equities is probably a good partial explanation for why the EUR has held in OK vs. the USD, even as US 10-year yields make new highs for 2024.

Crypto has been chopping around this week as it can’t figure out if it’s ready to truly take out the 70k level or not. It’s forming a nice triangular consolidation bounded by 65k and 72k and whichever side ends up breaking should determine the trend for a while.

The memecoin frenzy continues as numbers are going up and people are making money if they take profit at some point. While memecoins can go up for a while, there is a strong gravitational pull when the winds shift and most of them are headed towards zero.

I am surprised given the memecoin frenzy and bitcoin through the all-time highs that doge is only at 18 cents. I find that very surprising. It’s the blue chip of memecoins! What’s going on? It’s just not fun enough with Jeo Boden and friends on the move, I suppose.

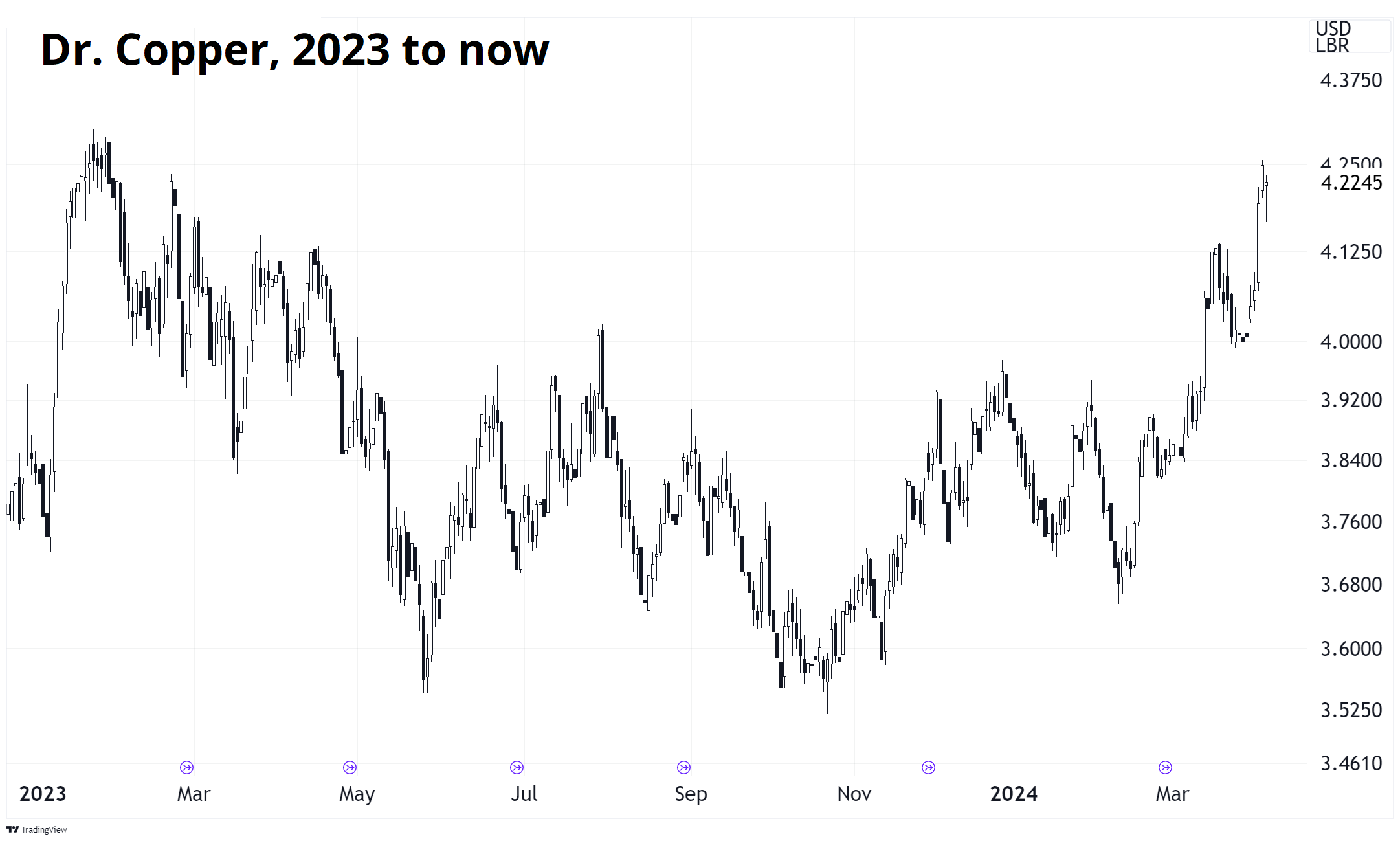

As I mentioned at the top of the show, the big story for most of this week was the huge rally in commodities. Whether it was gold, silver, cocoa, copper, or gasoline… They were all on the move. Copper exploded through old resistance and it is generally known as the commodity most tied to the global business and manufacturing cycles. So the move is consistent with the idea that the global manufacturing cycle is picking up. There are always idiosyncratic things in copper like spec positions, etc. but it has the nickname “Dr. Copper” because it has a PhD in economics.

Here she is right here:

Gold is strong to very strong and interestingly, silver has stopped lagging and zipped almost 10% higher this week.

OK! That was 5 minutes. Please share this with any aspiring finance professionals that you know! Thanks!

Get rich or have fun trying.

Join the waitlist for Spectra School. Let’s go! Improve your thinking and learn the right frameworks for trading and investing. The stuff you don’t learn in college. https://www.spectramarkets.com/school/

Kurt Cobain died 30 years ago today.

The days are long, but the years are short.

Grandma take me home. Grandma take me home. Grandma take me home. Grandma take me home.

Weekend remembrance listening:

Kurt Cobain sings “And I Love Her” by The Beatles.

And

Post Malone crushes the COVID-19 Nirvana tribute, surprising the heck out of everyone.

Feedback and criticism about Friday Speedrun are always welcome. Or about anything else.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it