A week of severe pain for the most-loved narratives.

Push and Pull

It was a week of crosscurrents and contradiction

A week of severe pain for the most-loved narratives.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

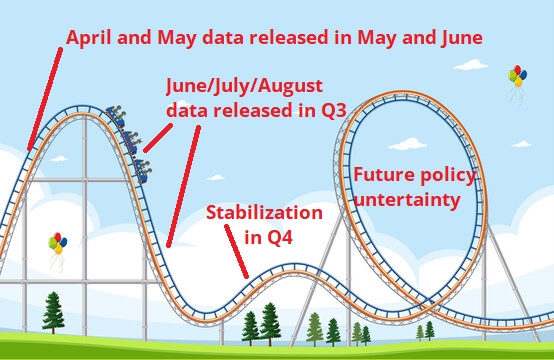

We continue to see pretty OK data in the United States as we await potential fallout from policy announced April 2. As outlined last week:

The Roller Coaster Effect

Today’s payrolls data, while backward-looking, fails to confirm the idea that the US labor market is rolling over and fails to confirm the collapse in sentiment data. My guess is that it’s a bit early to expect that, but the market can’t wait around forever. It’s expensive to wait. So, we got an aggressive reaction with 2-year yields up 14bps and 10-year yields up 11bps. Pretty spicy moves for a number that was just about on the screws.

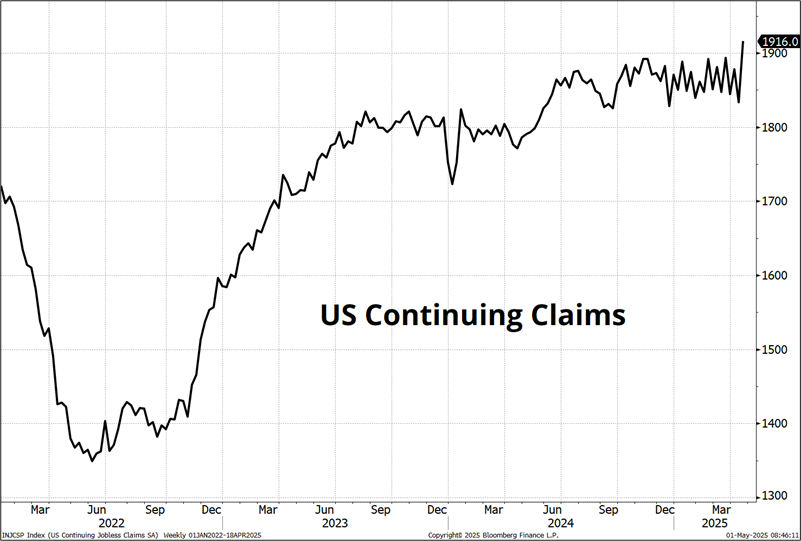

Earlier in the week, we got a flick higher in Continuing Claims, but it’s a noisy series:

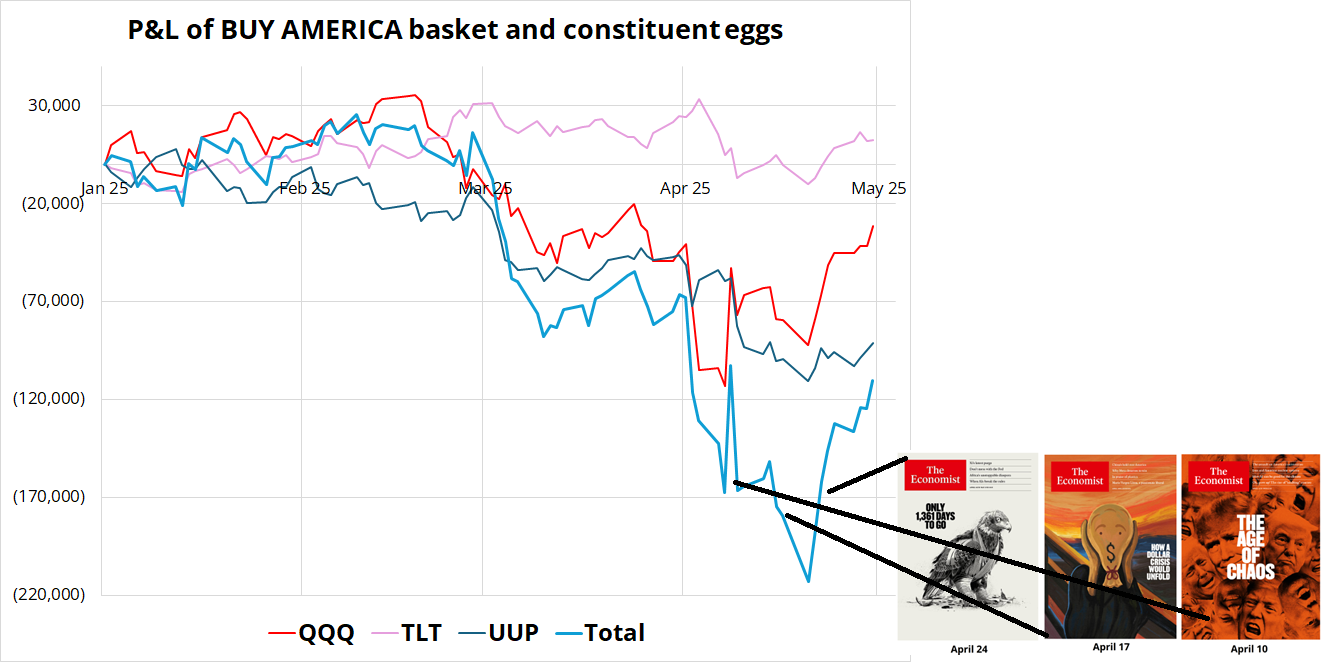

Meanwhile, it has been a nightmare for the consensus trade as micro wins over macro. Technical, sentiment, and anecdotal indicators pointed to overbought gold, oversold stocks, and an overcooked SELL AMERICA theme respectively and those indicators have won, for now. While the dollar and bonds haven’t rallied much, NASDAQ shorts and gold longs have been punished for adding at the extremes.

The unprecedented magazine cover trifecta mark peak SELL AMERICA sentiment as every commentator in the world (including me) counted up the trillions of dollars of US overweights around the world. Here’s the vol-weighted BUY AMERICA basket updated.

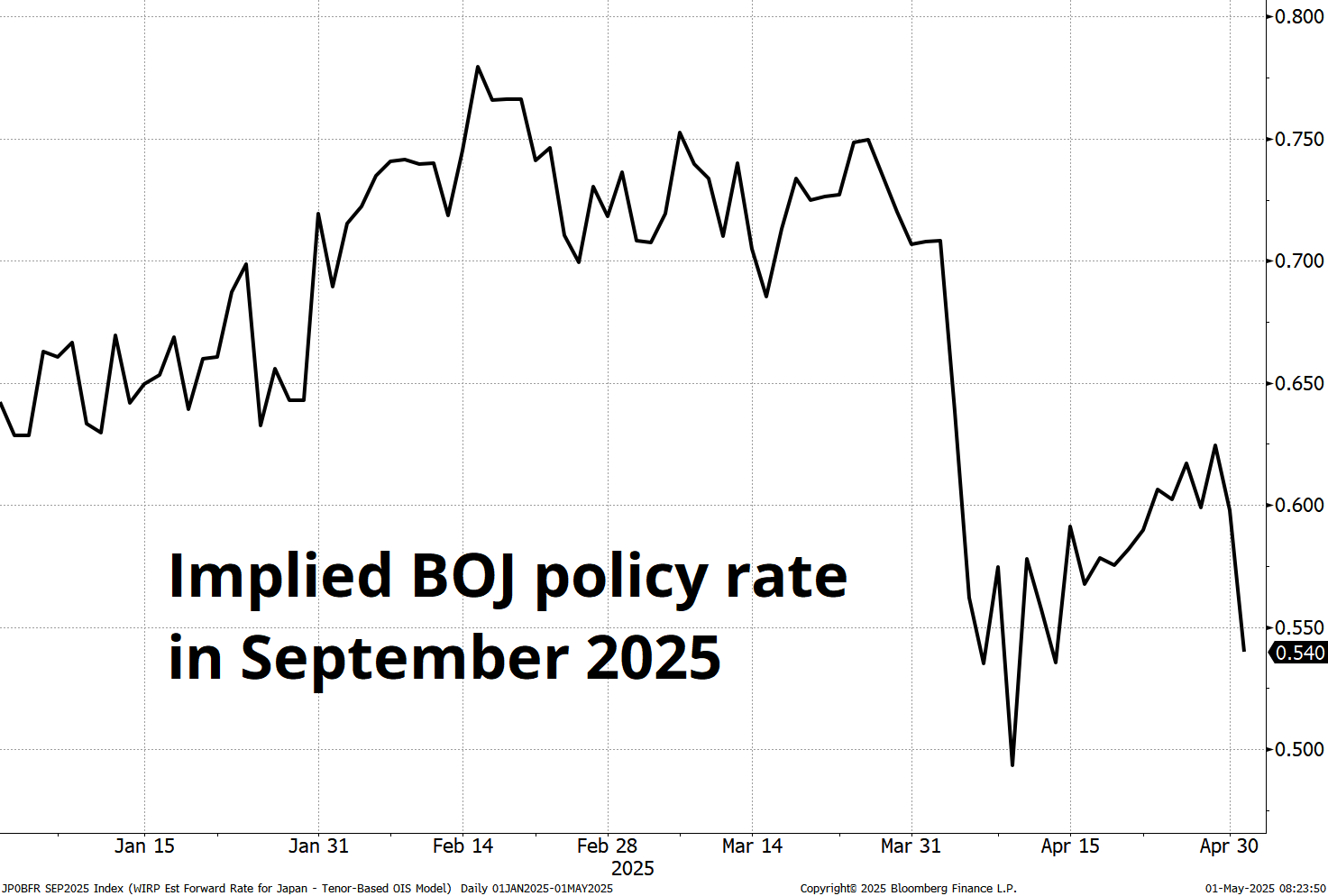

And the Bank of Japan didn’t help things this week as they came out on the dovish side. The BOJ might be done with their hiking cycle. Governor Ueda’s commentary was not great news for JPY bulls, e.g.:

Future hikes are not ruled out but look increasingly uncertain. Here is how the market pricing has evolved…

Making matters even worse for the consensus trades, there has been a dramatic reversal in the END OF AI CAPEX theme. That theme peaked the weekend of the DeepSeek Freak, as the market caught on to the fact that the December 2024 release of DeepSeek was a potentially existential moment for AI capex. Here’s how it has played out so far.

Foreign selling of US equities has burned itself out, AI Capex might not be dead yet, the BOJ is not hiking any time soon, China stopped buying gold last week, the oil collapse is capping inflation worries, and equity shorts are finding the interregnum between Liberation Day and economic deep impact too lengthy to bear. An absolute nightmare for all the trades that were working perfectly two weeks ago.

Now, we await the economic data as recession odds are quite low as we are currently living right in the midst of a potentially-generational economic shock. It’s like the tsunami wave is way out there offshore, and everyone is still sipping beers and vibing to Kendrick on the beach.

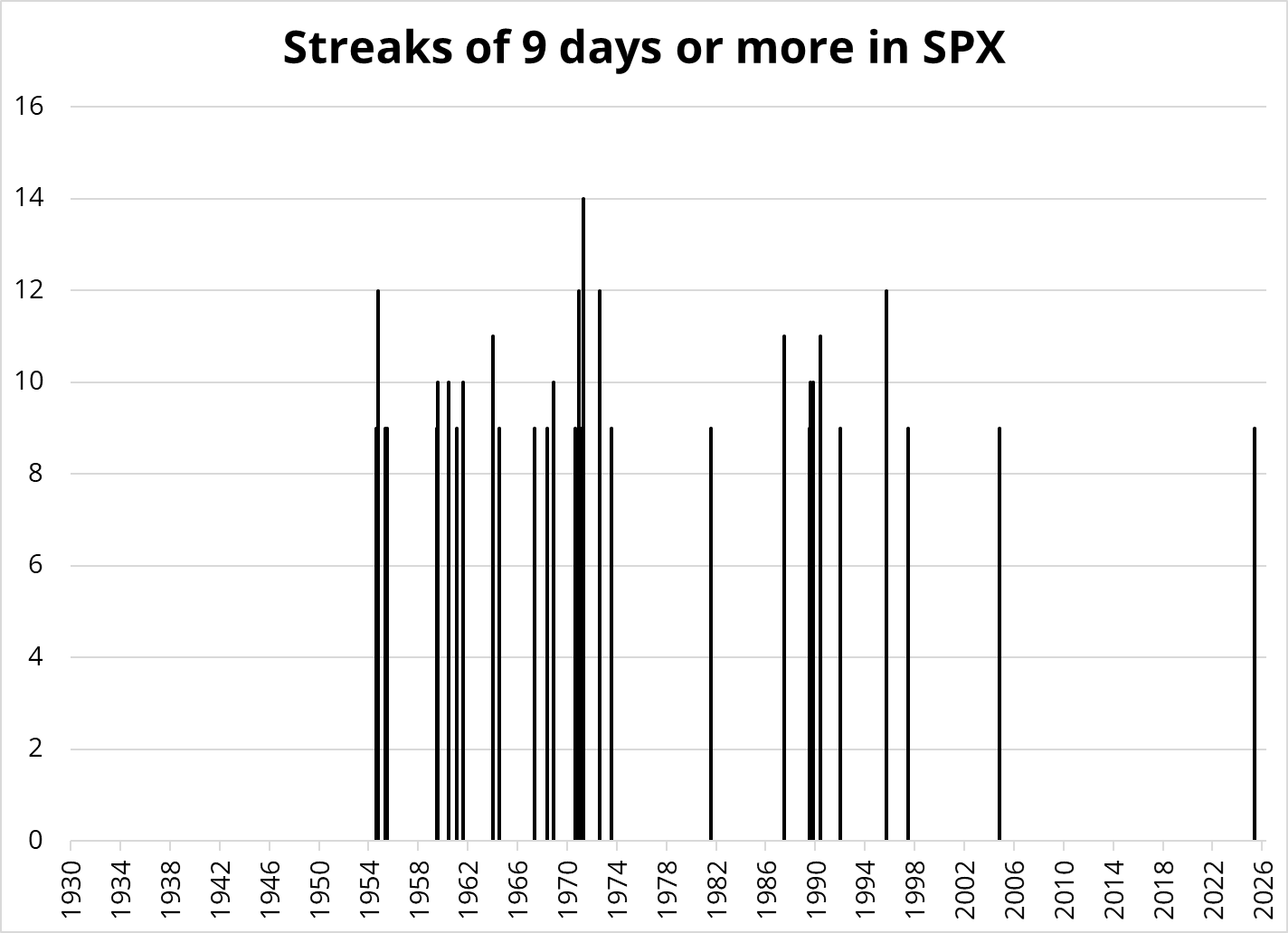

Stocks up 9 days in a row is not something you see all the time, in fact the last time it happened Maroon 5, Kelly Clarkson, Usher, and Destiny’s Child were topping the Billboard Hot 100. Here is a chart of all S&P 500 up streaks measuring 9 days or more.

Note: The coding is simply: Look for a streak of 9 or more. So it will show 9, 10, 11, 12, 13, and so on until the streak ends. Hence the clustering in 1971.

The longest streak ever was 14 straight up days, culminating on April 15, 1971.

Lots of megacap earnings this week, and the outcome was weirdly logical: META and MSFT, who mostly do not partake in the production or shipment of physical goods, did great. AAPL and AMZN, who suffer from tariffs because they DO ship goods… Did not as great. AMZN came back nicely as the market rallied and people realized they make much of their money selling cloud services and the cheap knockoffs from China are only 50% of their 3rd party sales.

The other key takeaway from the earnings barrage was that AI capex is not dead yet! MSFT, META, and others all spoke more of a shortage of AI buildout capacity than a glut. With NVDA down to 20X sales, the market was in a scooping mood.

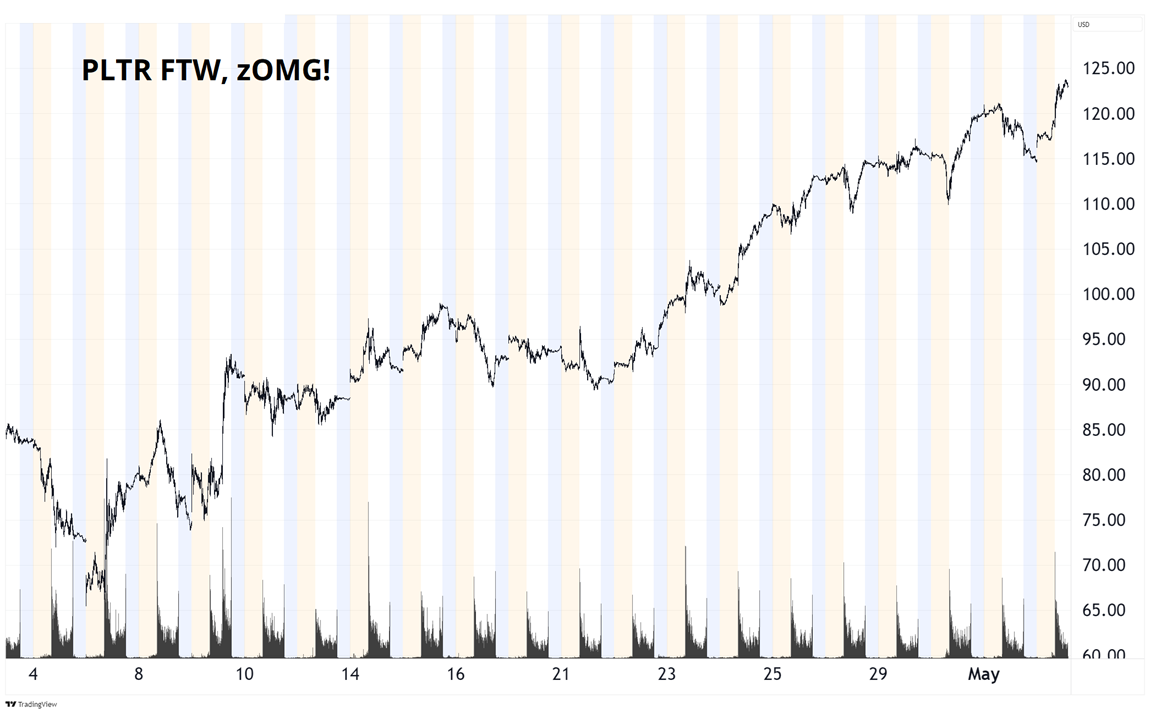

Palantir also ripped as they report earnings Monday and should benefit from massive increases in US and global government spending on defense. It’s the most overpriced stock in the history of megacaps, but I am long into earnings LOLLLLLLL. PLTR bottomed at $65 in April and is now above $123.

This chart is one that Dennis Gartman would say is “travelling from the lower left to the upper right.”

This week’s 14-word stock market summary:

America: Not dead.

AI capex: Not dead.

Bears in pain waiting for the recession.

As discussed last week, above 5500 in cash SPX created an airpocket as I gave up on the bearish view along with everyone else, all at the same time. It’s good to have levels in mind where you can say: “If this level trades, I’m wrong.” You can’t stay short forever because it’s too expensive and stupid things happen on the way to a recession. See 2007 and 2020, e.g.

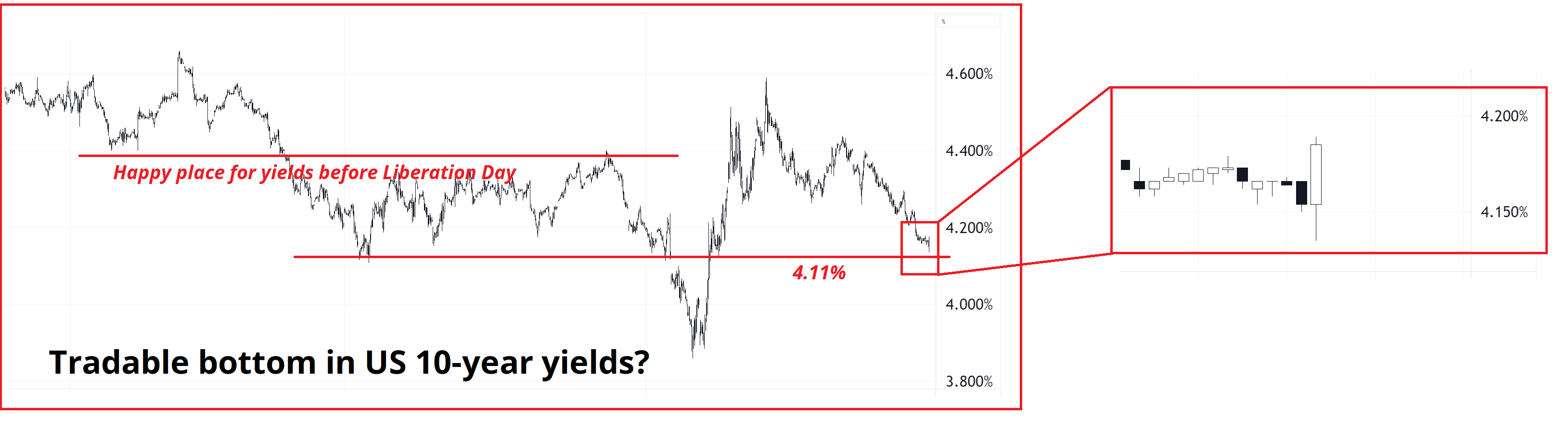

We had a nice tradable bottom in yields (tradable high in bonds) on Wednesday as noted in this chart which went out at 9:00 a.m. in am/FX:

You can subscribe to am/FX here, and use coupon code SPEEDRUN for $150 off.

That bottom was at 4.11% and we are now 4.32%. Yields are moving as foreign selling of bonds picked up again, NFP was not weak, and Japan’s Kato said the unthinkable. I am surprised this story didn’t get more coverage. Not that Japan will sell treasuries in retaliation for tariff policy, but this is something people would normally never say out loud. Especially not Japan! I suppose this is what happens when you feel threatened by a nation that was one of your closest allies for 50+ years.

https://www.axios.com/2025/05/02/japan-trump-bonds-tariffs-trade-deal

Also, I suppose Japan knows that rising bond yields keep Donald Trump awake at night and make him panic on policy.

The overall picture for bonds is confusing because we may be on the front edge of a recession, some prices are falling (crude oil) and other prices are rocketing higher. E.g., this email TW received Wednesday morning:

Dear KOHLER Valued Customer:

Thank you for your continued support and partnership as we navigate through the adjustments in the global trade policies. As a result of the policy changes that were announced on April 2nd and amendments from April 9th, KOHLER will be implementing a weighted average price adjustment of 15-18%. Kallista and Robern products will increase by 12%. These changes are effective May 10, 2025.

And then, on top of all that, you have ever-present bond vigilante risk due to out of control and still-rising US deficits. It is not clear that bonds will be a good hedge if we enter a recession and the deficit explodes further. When there are many crosswinds like this, I don’t trade that market.

For more macro talk, check out this week’s podcast with me and Alfonso.

https://www.spectramarkets.com/library/podcasts/

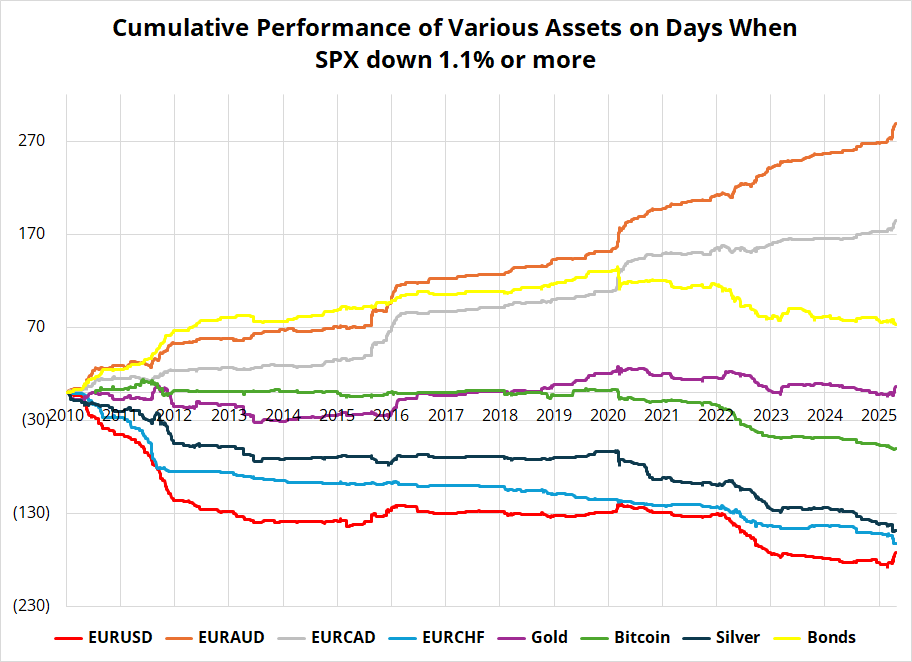

Historically, the euro mostly traded more as a low-beta risky asset, not a safe haven while the USD traded as a safe haven, and AUD, CAD, SEK, NOK, and NZD traded like risky assets.

In other words, in the past, when the S&P 500 sold off aggressively, EUR went down a bit, AUD went down a lot, and EURAUD shot higher. Post Liberation Day, large S&P selloffs have been the result of foreign exits from US assets, and EURUSD has gone up.

Here is the history of some safe havens and purported safe haven trades over the past 15 years. I screened for the worst days for the S&P 500, finding the 10% of days that were the baddest of them all. This means I screened for all S&P 500 down moves of 1.1% or more, because that’s how you get to 10% of all days. Here are the results, showing the cumulative standard deviation moves over time.

Takeaways:

This is not immediately actionable, but good forecasts first require good explanations of how and why markets move.

I think the switch from US dollar to EUR as the global safe haven currency of choice is real. As trust in US deficit credibility and confidence in US economic policy evaporates, the big down days in stocks will be rotation out of US assets and US dollars and into other large, stable capital markets like Europe. In 2011, it was popular to describe EURUSD as two garbage trucks colliding. The European garbage truck is now a bit spiffier than the American one. Europe will issue cartloads of new debt, which can be good for the currency given the low starting point of debts in Germany. And then maybe you get Joint EU Defense bonds one day and that further cements the EUR as a place to park sovereign wealth.

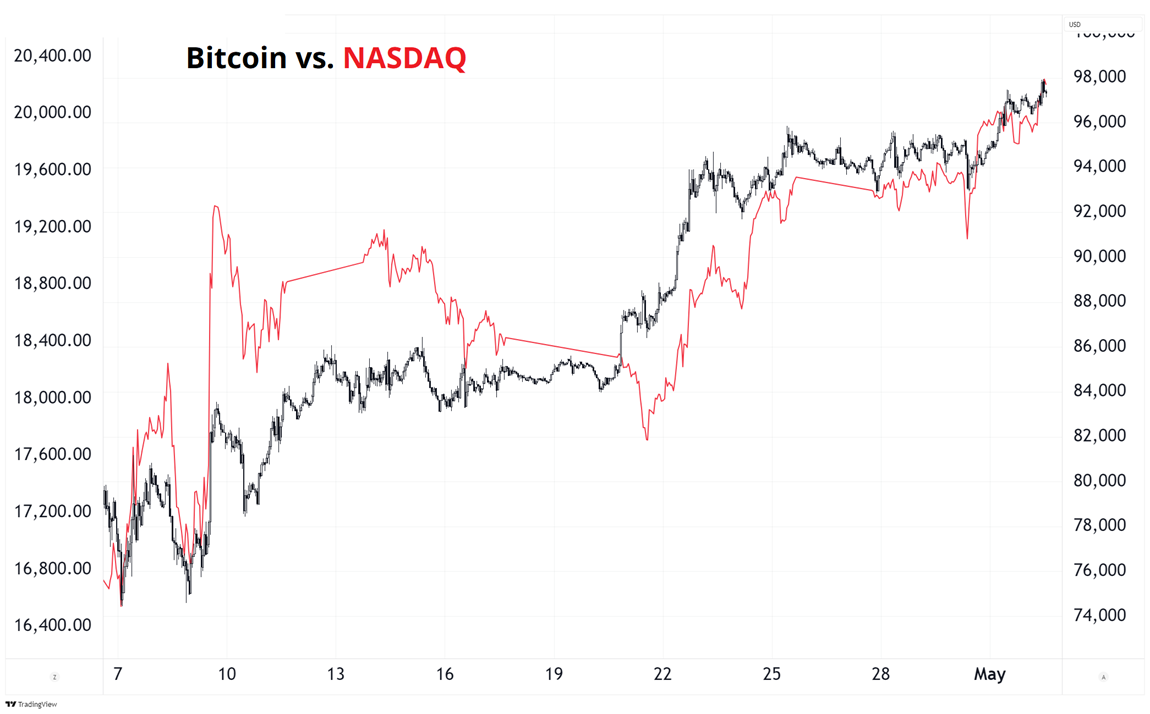

Dang the decoupling was just a fakeout! BTC was showing the way for the NASDAQ. Weird. Note the trial separation on the 10th of April or so, and then they moved back in together.

I have been trading some of the crypto stocks this week, and I have to say CEP is particularly fun. If you want a silly stock to day trade, check it out.

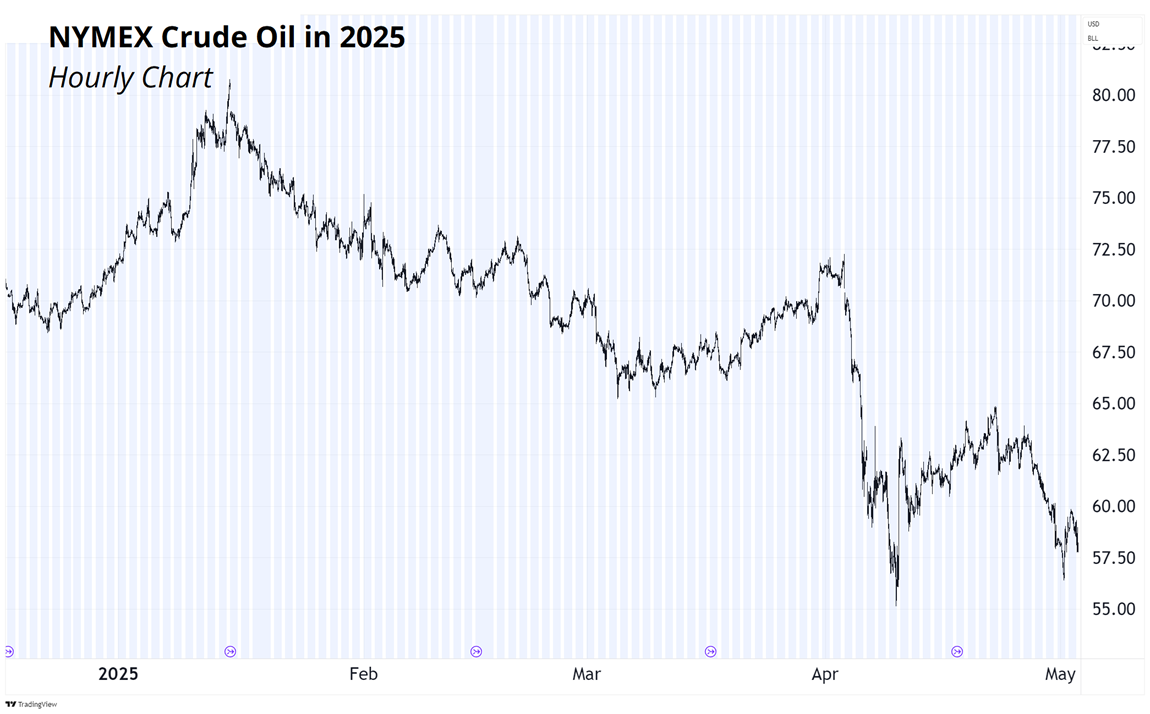

The OPEC meeting next week is interesting because oil has been absolutely crushed and sentiment and momentum are all flashing pretty bright right now. A small bullish tweak from OPEC might create a $5 launch in crude. It looks kind of convex to me, especially with US growth holding in so far.

I am bullish as long as we stay above $54. I don’t know much about crude oil fundamentals but this looks like a simple, convex setup where you can risk 4 bucks to make 7.50. I usually do my oil trades using USO or USO options because my time horizon is short so I don’t care that it’s a terrible ETF with a million issues. When you trade short-term, things like volatility drag in TQQQ and spot roll issues in physical ETFs don’t matter much. If your holding period is more than a few days… Those things are game-changers.

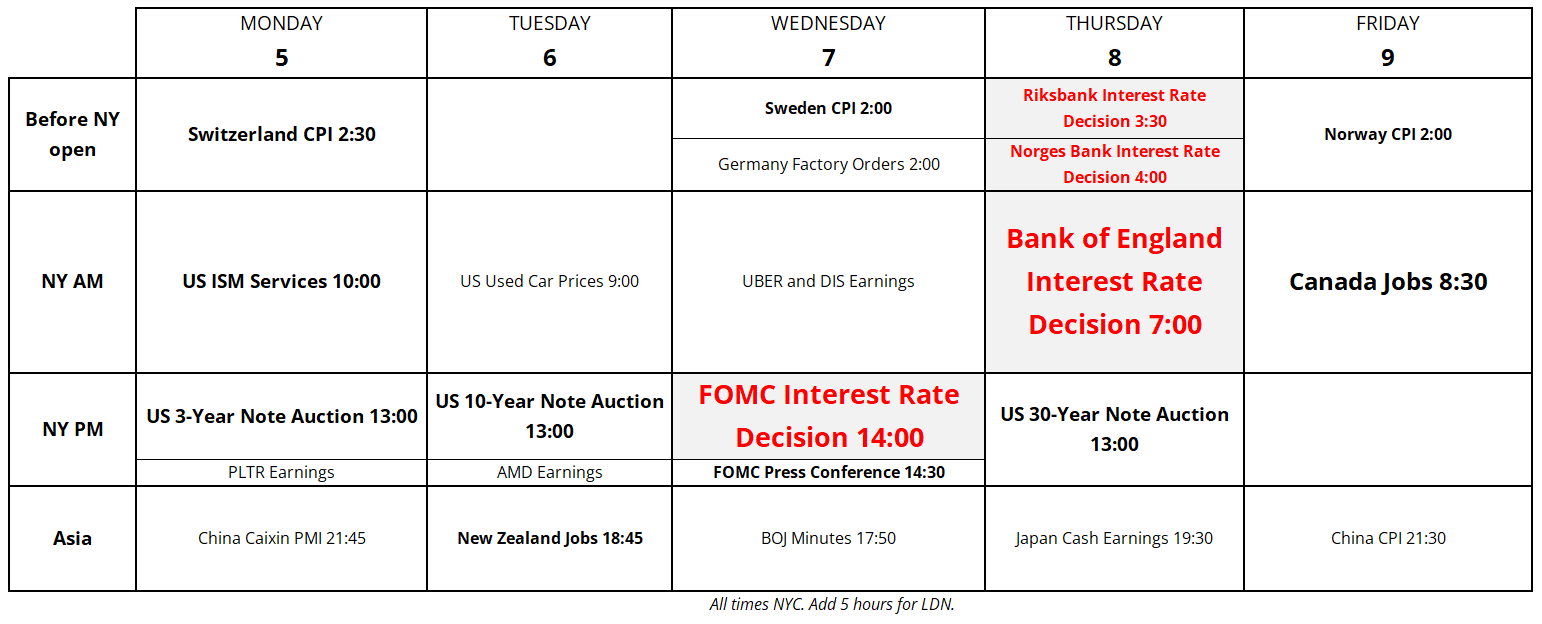

Here’s next week’s calendar

That’s it for this week.

Get rich or have fun trying.

I like 7/8 in the Derby (Luxor Café and Journalism). Here is last year’s photo finish:

Music to play while going 90 mph in the car with the windows down

Ooh ooh ooh ooh. Oooh ooh ooh oo oohhh.

*************

A 10-minute writeup by the young Canadian, Brent Donnelly

The Trading vs. Gambling Spectrum

*************

Great short bits about writing, via Justin Ross

*************

Banger:

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it