FX vol tends to pick up in August, but it has nothing to do with the Olympics.

A fun story from 2016

The 2016 election was a fait accompli, until it was not.

FX vol tends to pick up in August, but it has nothing to do with the Olympics.

A man in a cowboy hat, painting a Waffle House.

Flat

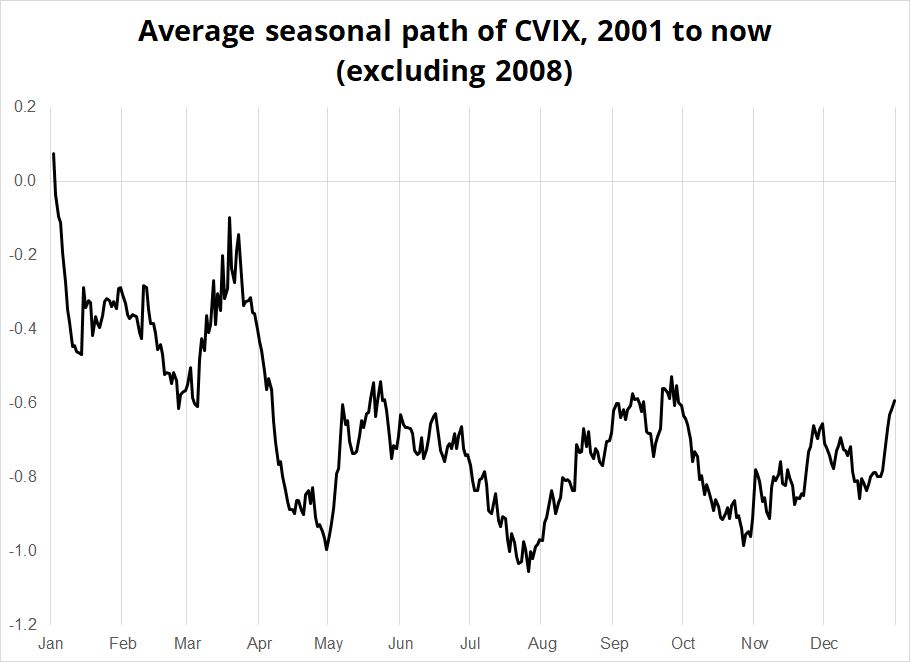

FX volatility tends to have a strong seasonal pattern where it bottoms in late July and stays bid through late September. Below, you can see the average path of the CVIX this millennium. I took out 2008 because it exaggerates the September seasonal and blows up the y-axis. The 2008 changes in CVIX were huge and unprecedented.

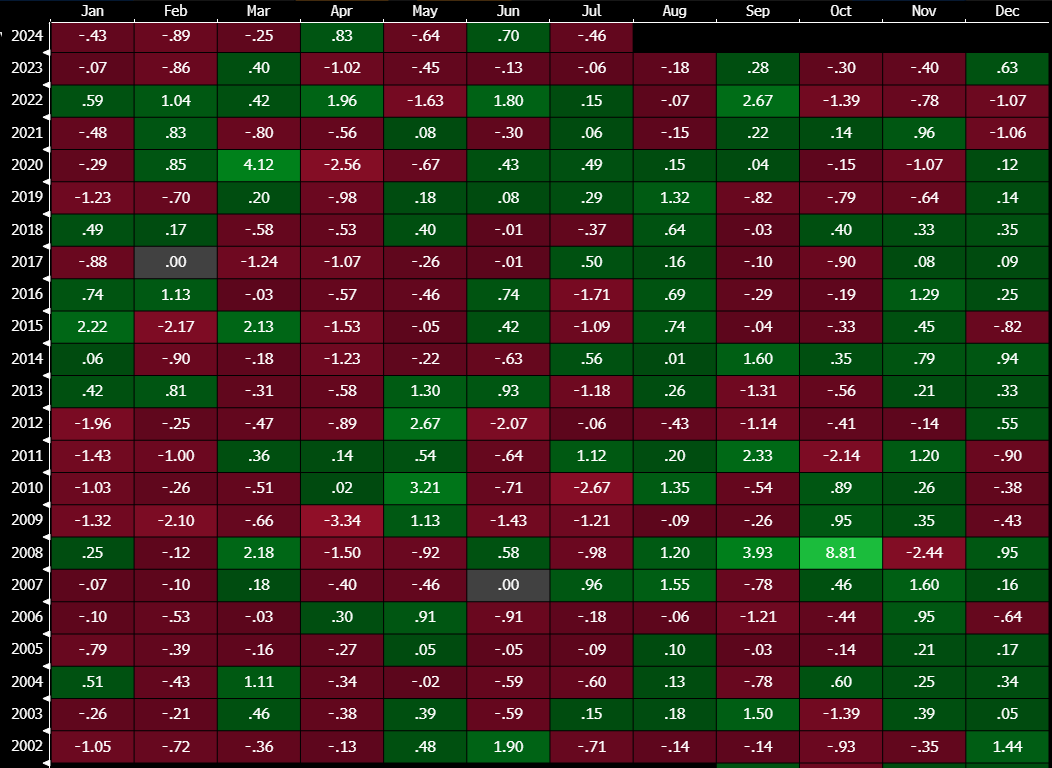

The large grid below shows the same data in a different way.

Note the particular tendency for August to be a month where FX volatility goes up. 15 of 22 Augusts (68%) have seen higher FX volatility as measured by the MoM change in CVIX. As a reminder, CVIX is a turnover-weighted average of three-month implied FX volatility that uses 36% EURUSD, 22% USDJPY, 18% GBPUSD and <=7% USDCHF, USDCAD, AUDUSD, EURJPY, EURGBP, and EURCHF volatilities to create something kind of like the VIX for currency markets.

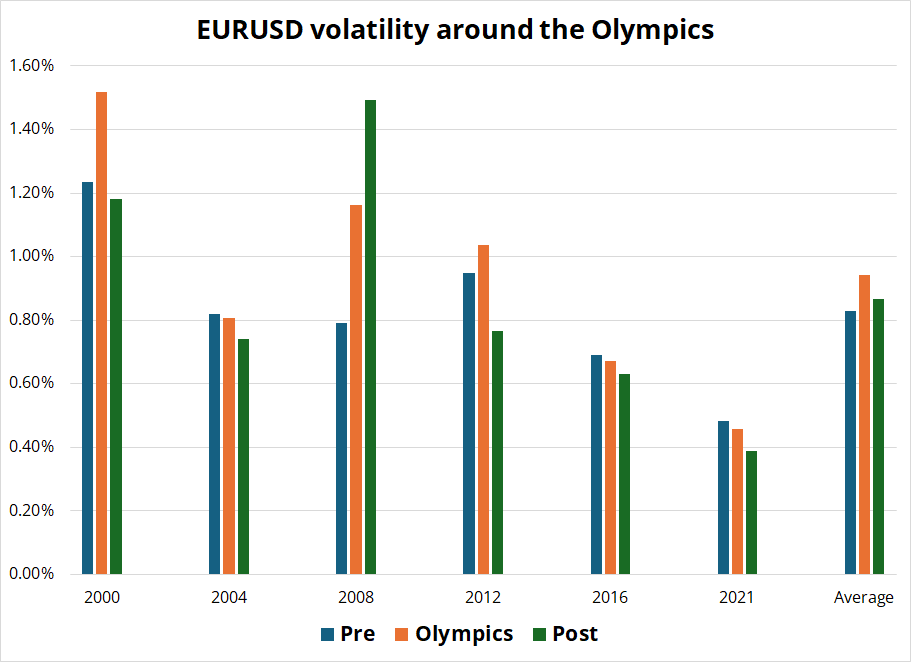

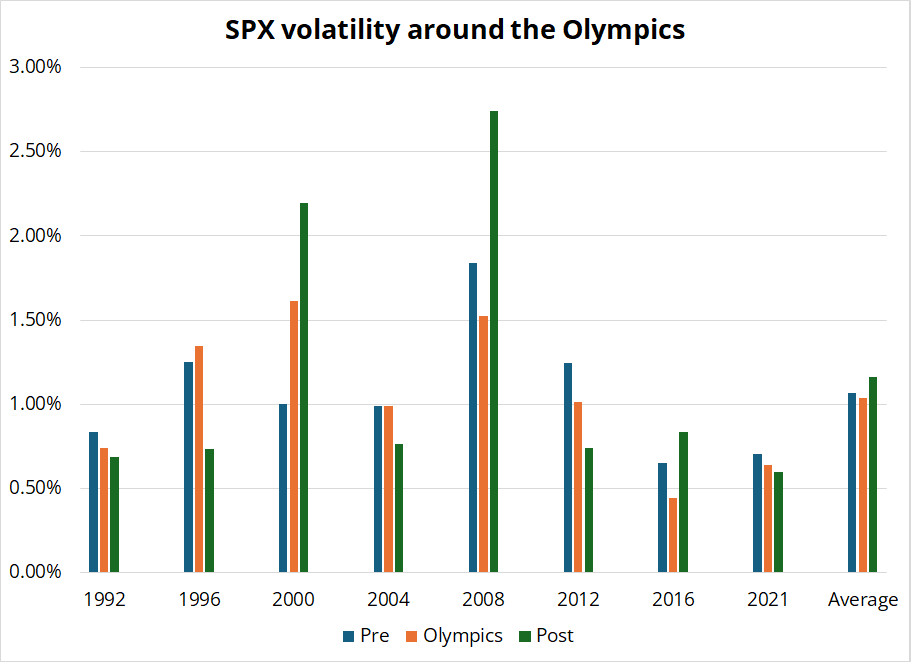

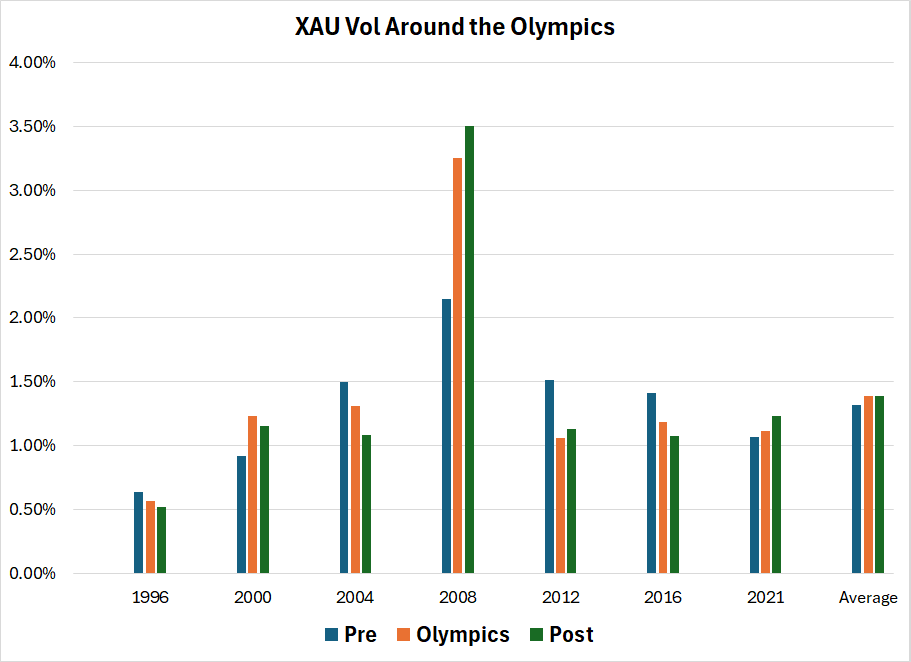

I looked at the same data only for Olympic years, because the 2024 Olympics are about to start, and there is a bit of common knowledge that assumes volatility drops during the Olympics and the World Cup. The problem with that is that you get too small of a sample size and again, 2008 blows everything up. So I decided to do something a bit different and look at the volatility before, during, and after the Summer Olympics to see if there is a persistent Olympic effect that generates lower realized volatility. Note that on page 1, I’m showing CVIX, which measures implied vol, and for this study, I’m looking at realized volatility using average daily range.

I looked at average daily ranges for the one month before and after the Olympics and compared them to the average daily range during the Olympics. The study included USDJPY, EURUSD, SPX, and XAU. My hypothesis is that the charts would look something like this:

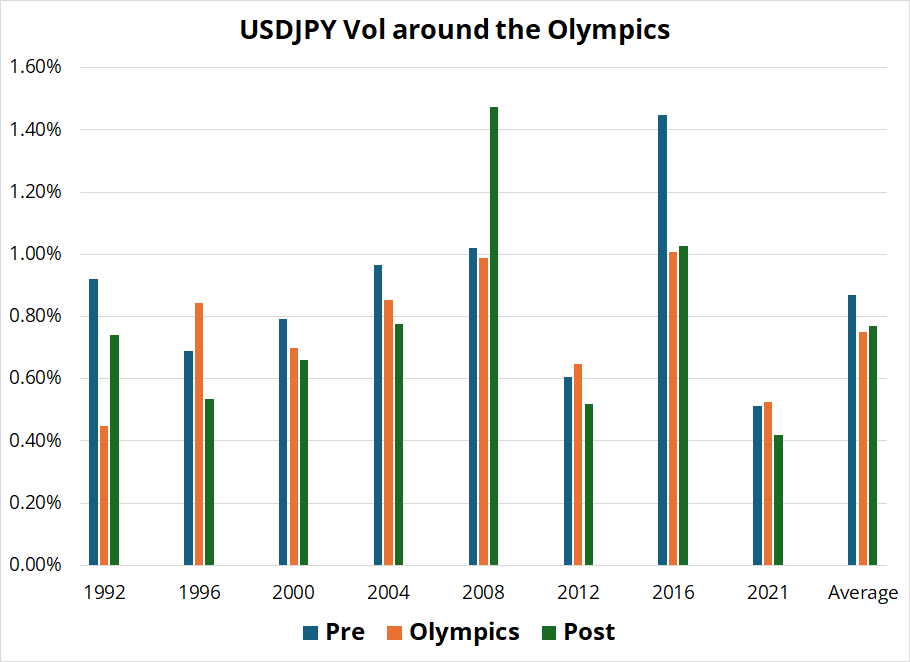

Our trusty intern, Aadit Rajangam, ran the numbers and the hypothesis proved to be incorrect. There does not seem to be a noticeable Olympic impact on realized volatility in the major markets I studied. For example, USDJPY is right here. The shape of the result is about right, but the magnitudes are too small to matter.

The three charts below show the average daily range of an asset in the month before and after the Olympics (blue and green) and the period captured by the Summer Olympics (orange).

All this suggests that timing any ramp higher in volatility is more about the end of July and less about the end of the Olympics. The market tends to see higher FX volatility in August, whether or not the Summer Olympics are taking place. For the record, the 2024 Olympics end on August 11, but that’s just trivia for your information.

For a different slicing and dicing of the Olympic effect, see this study. FD: I don’t really understand it.

Overall, I think it makes sense that FX volatility will pick up in early August as the market prepares for the US election. I have written in the past about how major events like the 2024 Presidential Election tend to see two waves of upside vol buying: One about two months before the event and one at the last minute as market makers and hedgers panic just before the big news. While a Trump victory is increasingly priced in post-debate, there is still plenty of room for excitement and fear as November 5 approaches. Could a dark horse surpass Kamala? Will Trump double down on tariffs and deglobalization? Are traders underappreciating the potential Trump fiscal and trade war policies because of exhaustion from so many years of political polarization and craziness? Probably. I think we are much more likely to see higher, not lower FX vol in August and September. That said, it’s only July 8th!

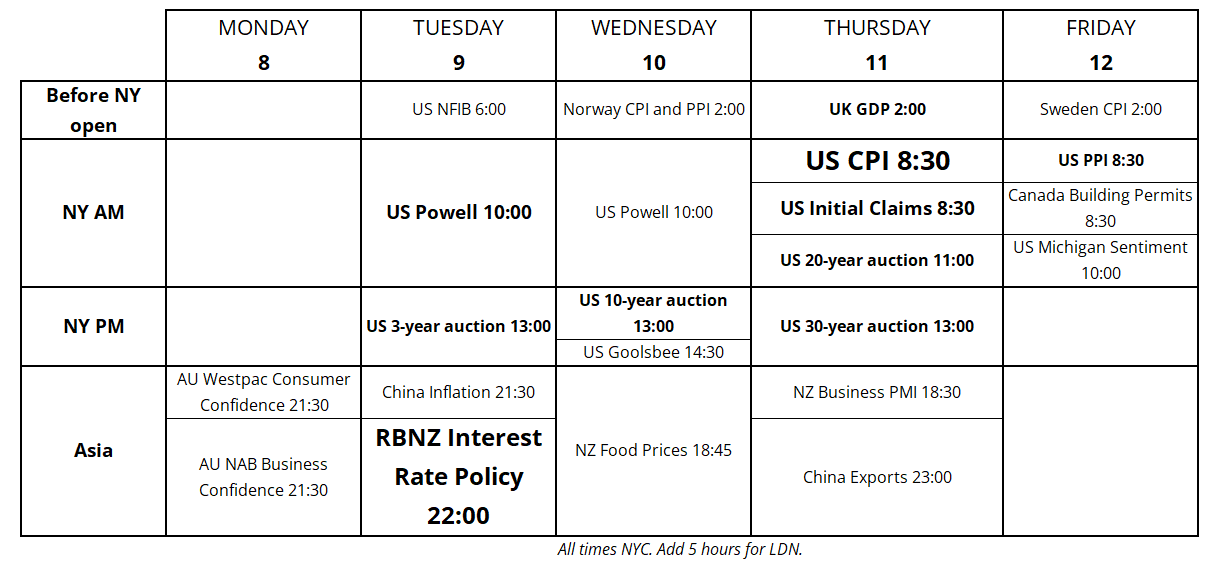

This week starts slowly and builds to a crescendo on Thursday with UK GDP, US CPI, a 20-year bond reopening and a 30-year bond auction. Recall that weeks with bond auctions tend to see stronger USD performance (see June 12 am/FX).

No strong views here yet as I am just back from summer break.

I hope your week is beautiful and glorious.

A man in a cowboy hat, painting a Waffle House.

The 2016 election was a fait accompli, until it was not.

USDCNH looks like positive EV but there are four caveats. Short USDCAD into BoC.

I think it will be very hard for 2025 Bank of Canada pricing to come true.