After spending all of 2024 in a 7.13/7.23 range, USDCNH has broken out. A bit.

Push and Pull

It was a week of crosscurrents and contradiction

After spending all of 2024 in a 7.13/7.23 range, USDCNH has broken out. A bit.

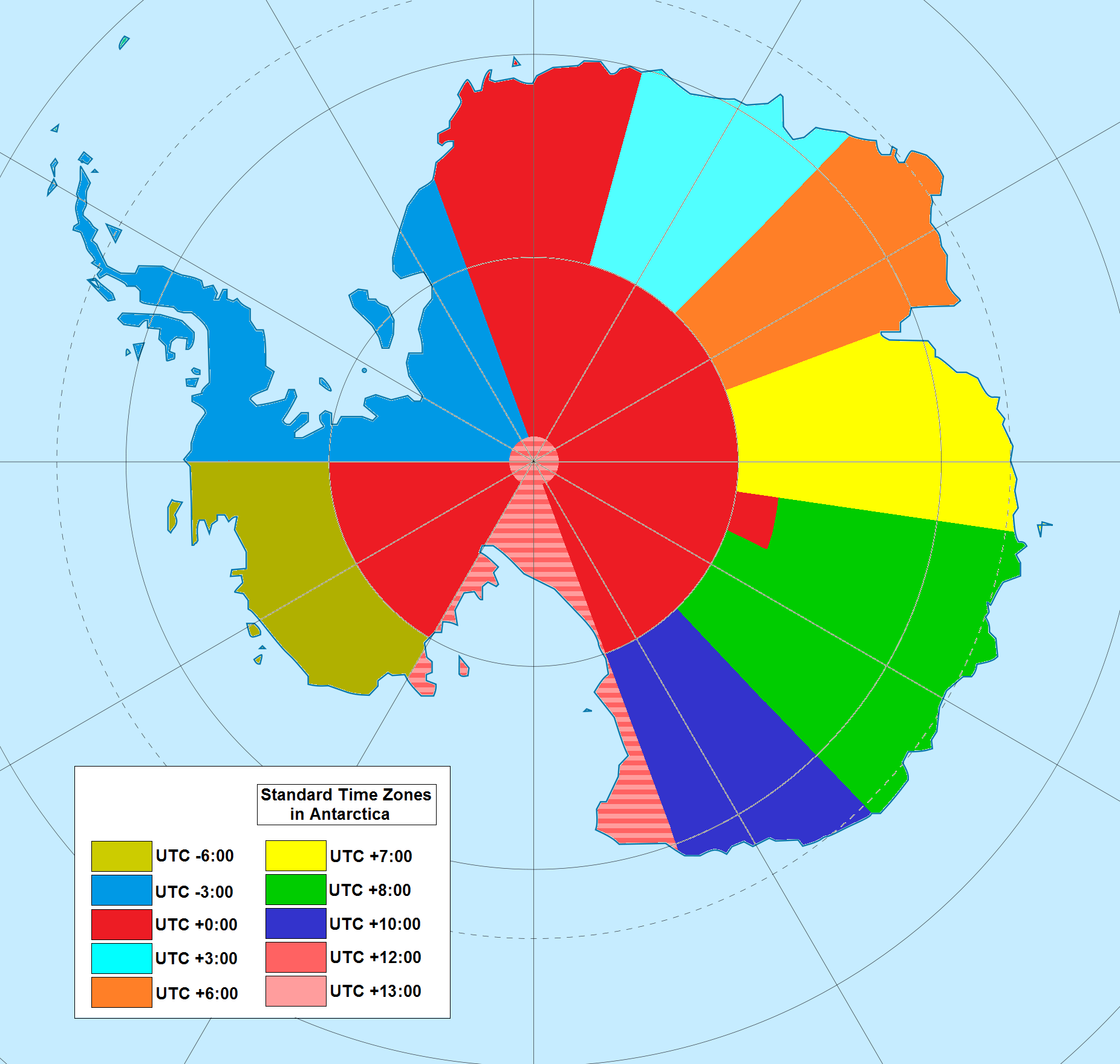

Time zones in Antarctica

Stop loss 0.8479

Take profit 0.8694

(Limit order)

Stop loss 148.69

Take profit 154.44

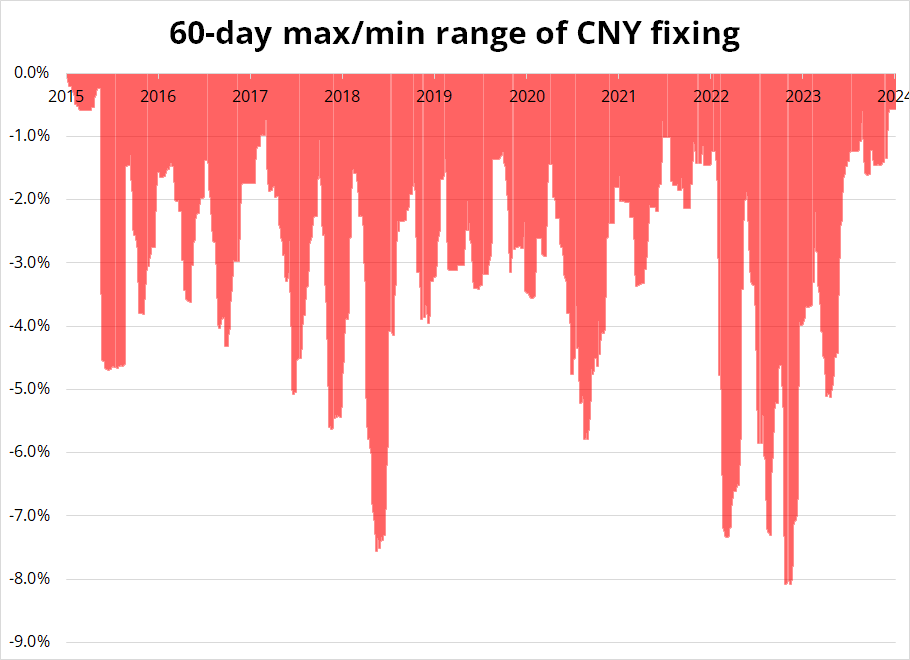

Pressure continues to build on the yuan as the PBoC maintains extremely tight fixing parameters. They have been keeping the CNY fix in a super tight range as its 60-day max/min range is now down to just 0.6%. If you zoom in on the far right of my first chart today, you can see that anything sub-1% is virtually unprecedented in the post-deval era.

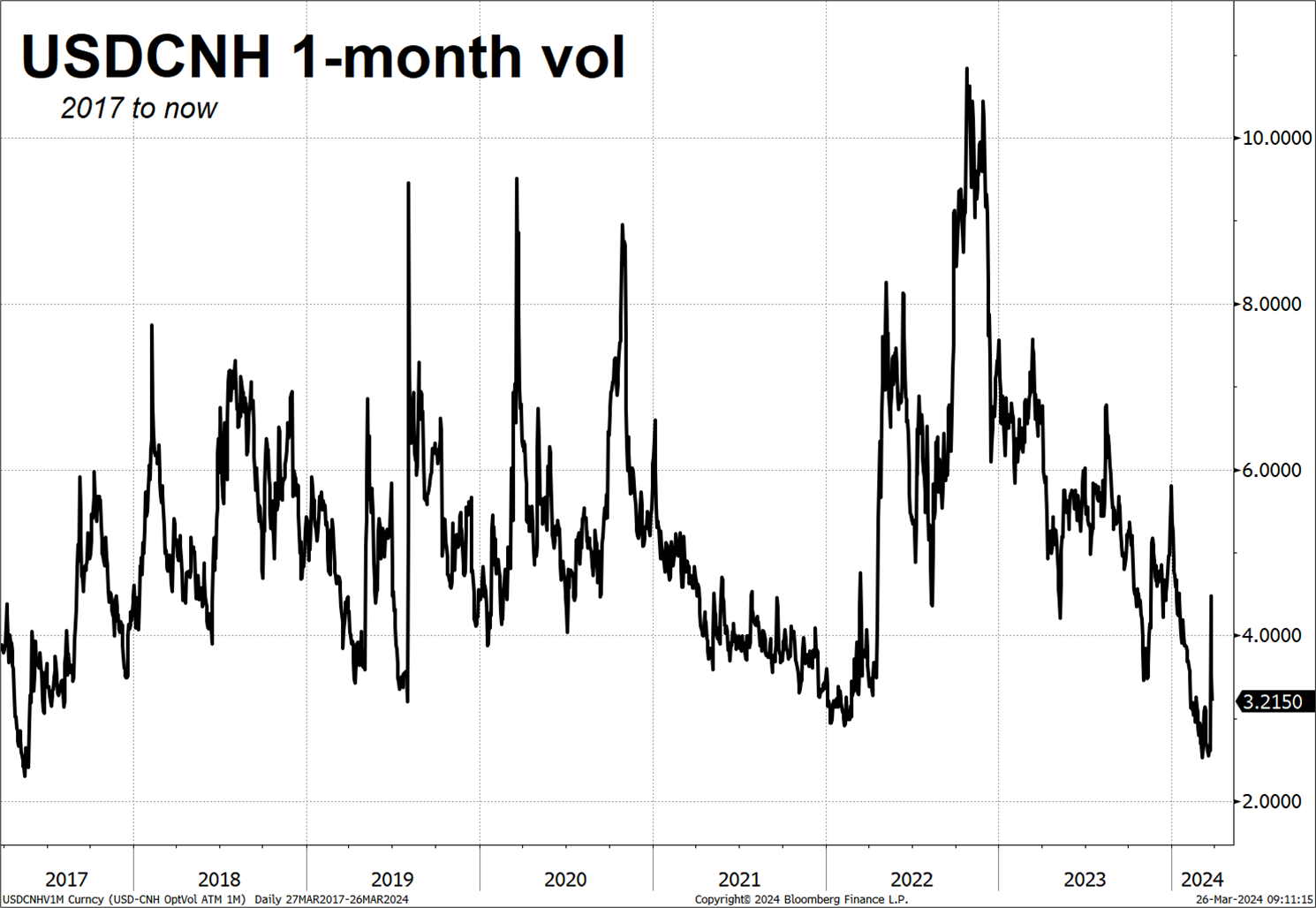

Meanwhile, positioning in CNH is close to flat now as option positions have burned off over the past six months and people are simply bored of watching the Chinese paint dry. 1-month vol is down around 3%, whereas something between 4% and 8% is more normal. It remains a bet where the future outcomes are skewed heavily towards no change or higher USDCNH. The only path to lower USDCNH is through a much lower USD vs. G10.

With commodity inflation rising again, financial conditions loose, rents bottoming, US housing prices perky and so on, back-end US yields should stay supported as the Fed shows a weak and waning commitment to the 2% target. Ironically, this is probably bullish USD, though my base case for G10 FX is that we mostly just keep chopping around.

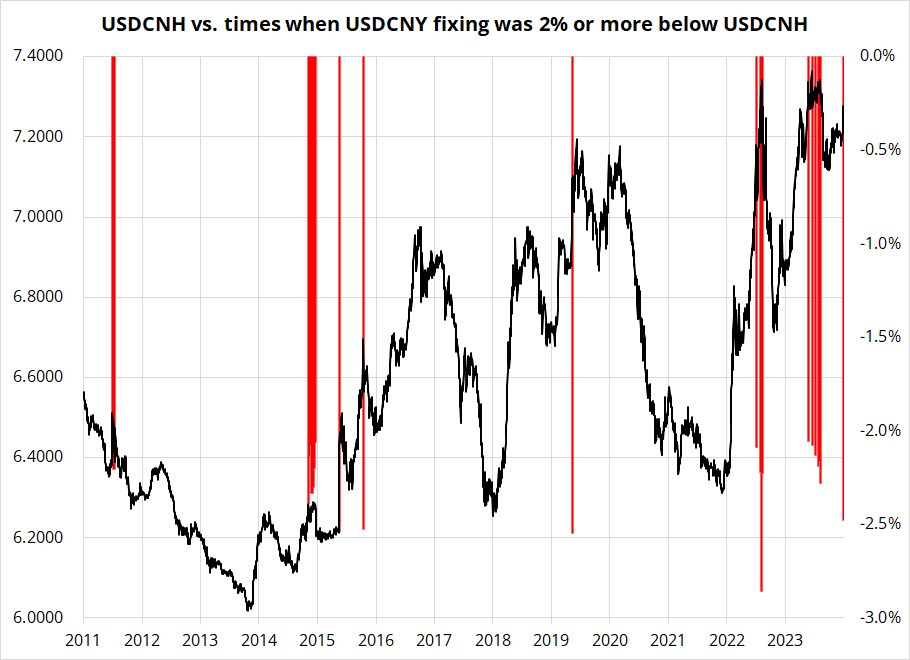

If you look at the other times the PBoC has pushed hard against the market level of USDCNY or USDCNH, they have had success some but not all of the time.

This chart shows the difference between USDCNH and USDCNY in red, only when the fixing was 2% or more below spot USDCNH. I think USDCNH and USDCNY are interchangeable for this sort of analysis but obviously they are not identical.

You can see that during the pre-devaluation period in 2015, they held fast and then eventually gave up. In 2019 they fixed low and USDCNH went straight down. In 2022 they struggled but eventually won as the USD turned lower vs. G10. Same deal in mid-2023. Both of those incidents involved USDCNH stopping around 7.38 and heavy USD selling intervention in both USDCNH by PBoC and USDJPY by the MOF circa 152.00. So here we are again.

To me, this feels more reminiscent of 2021, when Evergrande was going under and USDCNH was being pinned to the lows before the PBoC finally let it fly. This time, YoY China FDI is persistently negative despite repeated efforts to stabilize things. And USDCNH has broken out on the chart, exiting the 7.13/7.23 range that has dominated 2024. This comes despite very little activity in G10 FX and no massive chart breaks in EUR, etc.

The CNH trade is impossible to do through retail, but it’s still worth tracking because it’s much easier for the USD to rally broadly when USDCNH is going up. On the institutional side, the simple trade is to buy 1-month USDCNH call spreads and fund it by selling put spreads. Or buy 3-month digitals or even 3-month 7.30/7.40 digital spreads. 7.38 remains the line in the sand for USDCNH and 152 remains the line in the sand for USDJPY. A break of either would be pretty epic with USDJPY obviously much more likely to happen first.

The flick higher in vol last week when it looked like the PBoC might be moving the fixing higher is a nice preview of how quickly vol can move off such an incredibly low base.

Owning vol outright, even at these levels, can be incredibly annoying, but there are so many ways to avoid theta when the carry is positive and the predicted skew of returns is heavily biased to topside USDCNH. You want to be putting these trades on now, not when 1-month USDCNH vol is above 6%. I like all these trades but already have the 1-year vol on from February 5.

EURGBP is grinding higher and rate differentials continue to support the trade. No change in view there. On the broad USD, I think Waller could be interesting as I always find him to be pragmatic and I would think the pragmatic view right now for a Fed official would not be to say that everything is cool. Inflation is picking back up and is above target. So the risk through Waller should be hawkish. He speaks at 6 p.m. NY time tomorrow.

Given the litany of holidays coming up, today is corporate month end for several, but not all currencies. Friday is a good day for USD and JPY but not for ARS, AUD, BRL, CAD, CHF, CLP, CNH, COP, CZK, DKK, EUR, GBP, HKD, HUF, IDR, INR, MXN, NOK, NZD, PEN, PHP, SEK, SGD, ZAR, where they take their Good Fridays a bit more seriously.

Whether or not you play poker, this Phil Galfond article on variance is excellent.

Have a timely day.

Skew mean reverts, CHF is crowded, USDCNH is alive

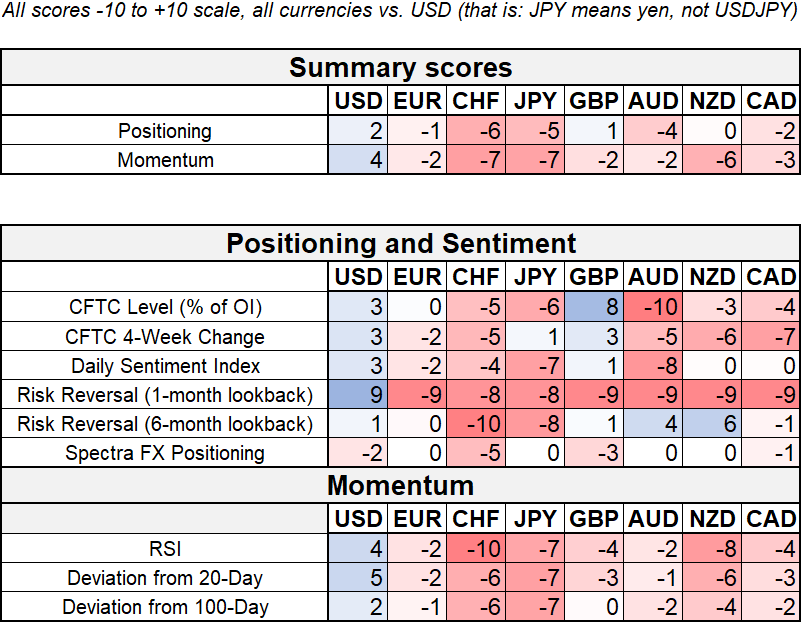

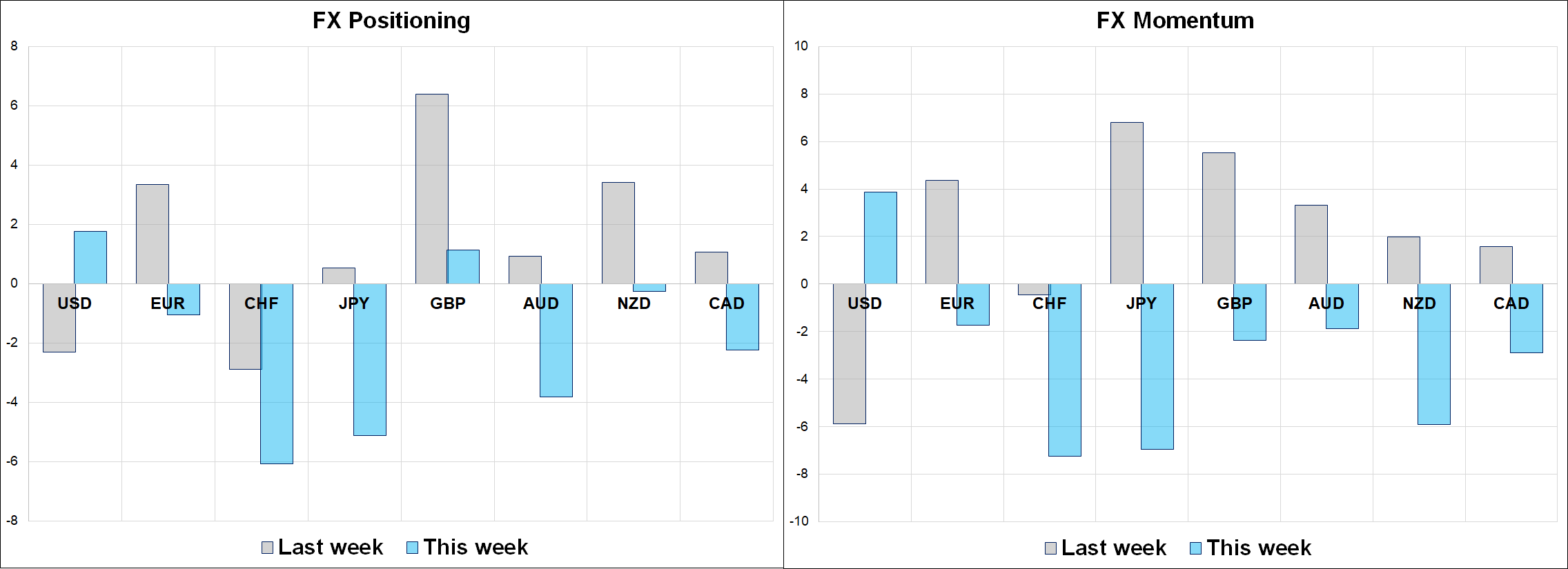

Hi. Welcome to this week’s report. The CFTC continues to trade GBP from the long side and AUD from the short side while specs remain short CHF in decent size. Options markets have come off their most extreme levels as bids have returned for currency puts (USD calls).

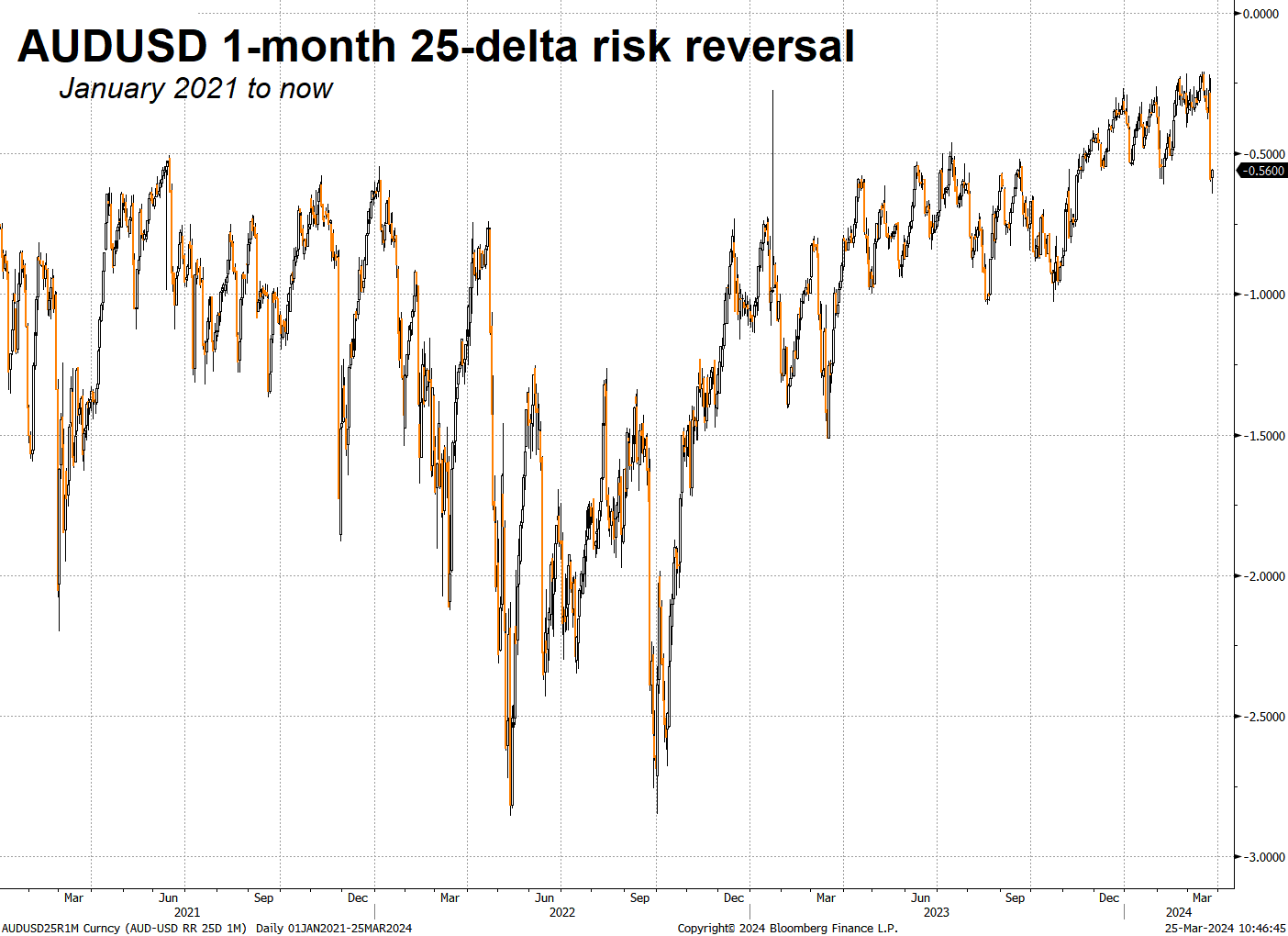

1. The charts of the risk reversals all look similar as recent USD strength has generated some demand for USD calls and pushed the 1-month risk reversals away from multi-year extremes. Here is AUD, for example.

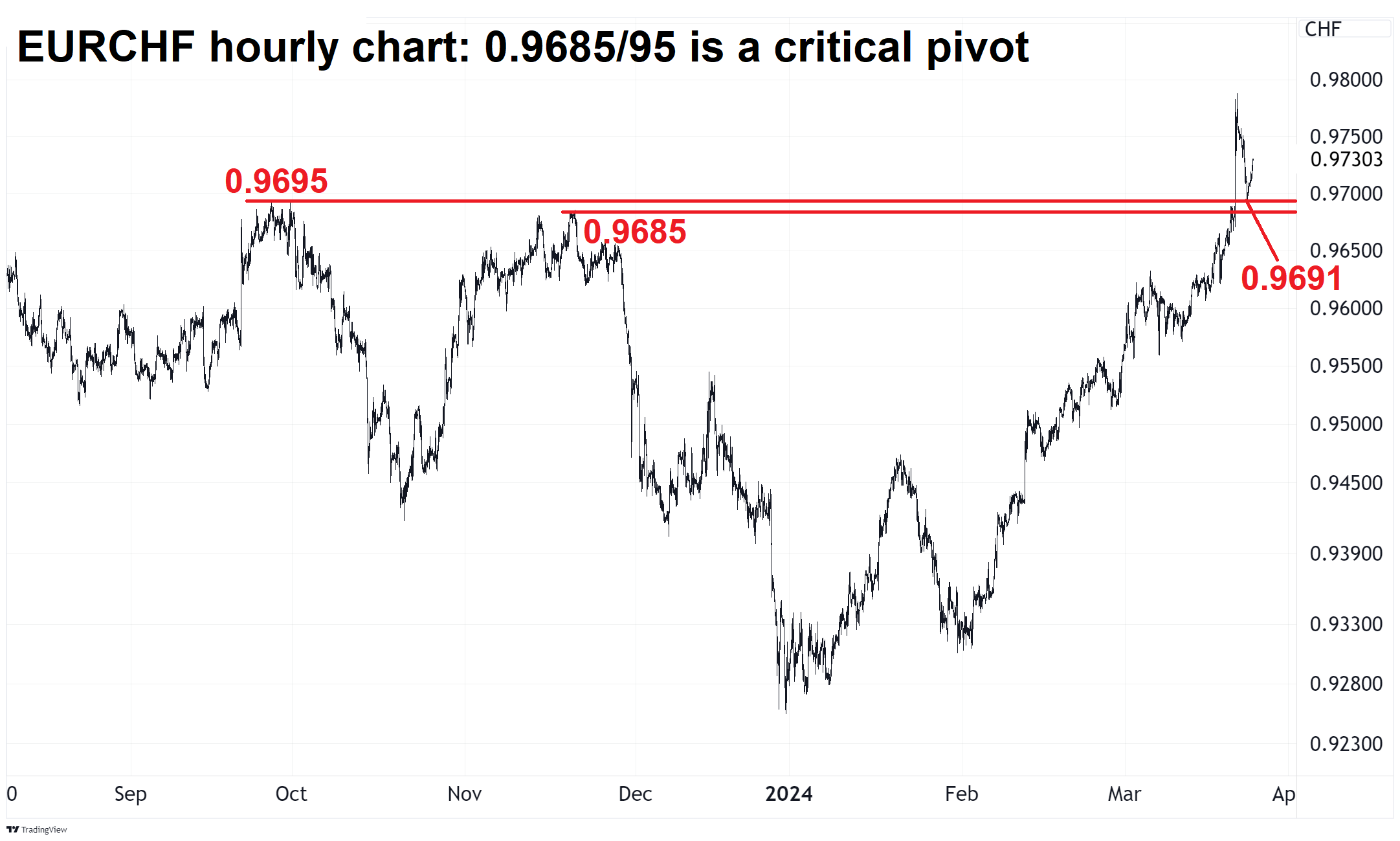

2. CHF is looking crowded at a time when the catalysts are out of the way and the current account remains enormous.

The play was to be short CHF to fade the year end overshoot and the trend was strong into the SNB meeting. Now, the SNB rate cut has happened, we have no news until the next meeting in June, and the market is loaded up. I would suggest that as long as EURCHF is above the old resistances and double top at 0.9685/95, you can make an argument for weaker CHF, but if we get a daily close below 0.9685, the risk of a large correction grows significantly.

3. USDCNH has awoken from its slumber. We continue to believe that positioning there is very light (due to boredom), and the pair is heavily skewed to either do nothing or go higher. As such, options structures that sell downside to own topside remain attractive, as do tails that capture the November 2024 US election.

https://en.wikipedia.org/wiki/Time_in_Antarctica

In most areas south of 80 degrees latitude, Coordinated Universal Time is assumed despite the limited presence of clocks.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it