China’s big stimulus feels a bit like Mario Draghi’s Whatever It Takes moment.

Push and Pull

It was a week of crosscurrents and contradiction

China’s big stimulus feels a bit like Mario Draghi’s Whatever It Takes moment.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

Here’s what you need to know about markets and macro this week

Check out the video for Spectra School right here. Time to sign up.

Let’s go!

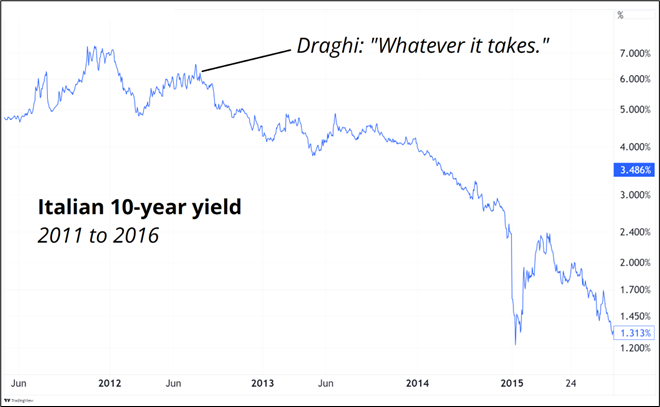

The relentless deflationary sucking sound of the Chinese balance sheet recession fell silent this week and the era of Uninvestable China is either on temporary hold, or over. Ahead of the major Golden Week holiday, China has unleashed a variety of monetary and fiscal stimulus measures, and it feels a bit like Mario Draghi’s “Whatever It Takes” moment in 2012.

If you were not around at the time, the eurozone crisis was raging in 2011/2012. People thought the euro was going to disintegrate, Greece was going bankrupt, Germany would relaunch the deutschmark, and Italian bonds could end up worthless. Then, on July 26, 2012, Super Mario Draghi went off the script of his pre-written speech and said:

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

The speech was just before NY traders woke up. I remember that day very well for a few reasons:

Initially, people were like: “Yeah, but there’s nothing he can do, yo!”

But over time, the market learned that governments have just about infinite power over markets as they can buy assets, change laws, intervene forcefully, and change the rules until markets cooperate. The visible diamond fist of government normally (but not always) conquers the invisible paper hands of the speculator class.

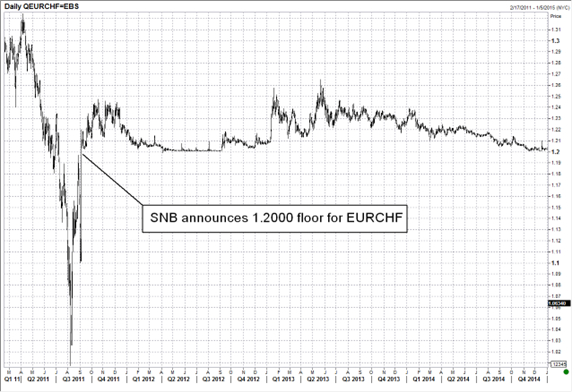

Many remember the failed CHF moves by the SNB as a salient example of a failed government intervention, but the Fed put, HKMA’s PKOs, and most other occurrences show that the SNB was an exception to the rule.

In case you’re not familiar, the SNB put in a 1.20 floor in EURCHF in 2011.

Then, they gave up in 2015 as speculators and flows overwhelmed them.

That, my friends, is a 1-second chart. EURCHF moved 37.5% in 15 minutes. That is what Nassim Taleb might call a “fat tail.” Using a normal distribution, that daily move in EURCHF measured something like 44 standard deviations. Obviously, everyone knows that financial markets are not normally distributed, but still. Bonkers.

For reference, let’s say you were visiting some never-before-visited part of the earth, deep in Honduras or something, and you discovered a man that was 44-standard deviations above normal height.

That man would be 16 feet tall. Let’s ask Midjourney to imagine that:

I digress.

China came out with a bunch of fiscal and monetary policy changes and Chinese stocks did this:

Market legend (and much-maligned NFL owner) David Tepper is all in. In that CNBC interview, he says he’s breaking his own limits to go long more Chinese stocks. When asked about VAR limits at his fund he says:

“I don’t have this VAR nonsense. I have value at what I can sleep at night.”

Sidenote: Of all the client meetings I have ever done, David used the F word more in that one meeting I had with him than every other client meeting I have attended in 30 years.

For a bit of a zoom out, here’s China stocks back to before the 2015 bubble:

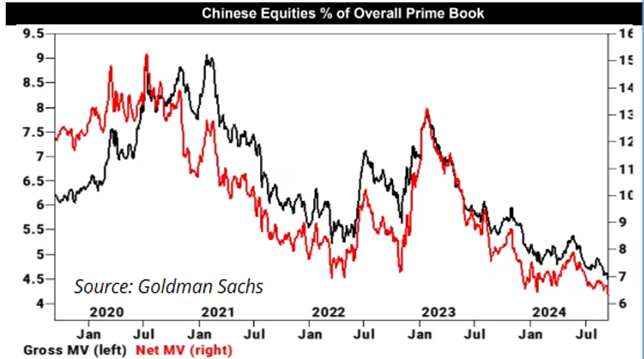

And… Here’s a check on China equity sentiment:

Investing in the stock market of a communist country comes with many pitfalls, as you might guess, given that “Communist Stock Market” is one heck of an oxymoron.

But if you were going to invest in the stock market of a communist country, I guess it makes sense to just follow whatever the government tells you! Get out when they punish the billionaires and get back in when they tell you there is a free put.

For a full breakdown of the China “Bazooka” check out this week’s podcast on YouTube or Spotify or whatever. The video one is the best because you get all the sexy visuals.

https://www.spectramarkets.com/library/podcasts/

Macro 1, seasonality 0.

The dovish Fed and the China stimulus means lights out for equity bears as it’s reflationary Goldilocks and a continuation of the US soft landing. And now we are entering the juiciest part of the year for da bulls.

Rarely do you see a more perfect macro set up for stocks as inflation falls, GDP is steady, the jobs market is normalizing from overheated back to trend, and government spending remains high. The US election lurks in the background as a risk, but even if you knew the result of the election, would you know whether to buy or sell S&P futures?

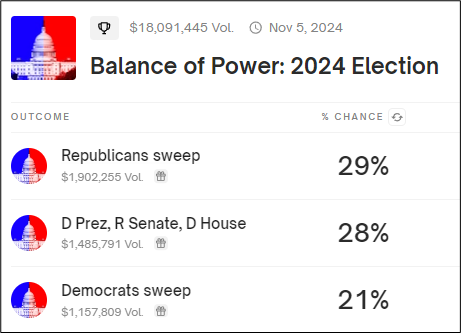

Speaking of the election, here’s the current sitch.

There’s nothing to trade election-wise right now because the odds aren’t moving. It’s a coin toss.

VIX at 15 seems high. Or is it?

I suppose it’s kinda high, yes. But not egregious.

Here is this week’s 14-word stock market summary:

The US economy is fine. China is reflating. Fed is cutting. Uptober is coming.

US yields are barely moving, which is quite eye-opening considering:

Then again, the market is mega long bonds, China is reflating, and there is sooooooooooo much priced in for the Fed. If you think this is going to be a slower rate cut cycle as the US avoids the oft seen but never real Bigfoot Recession, there is money to be made short the front end (paid rates).

In Europe, the data continues to look wet, and the market has rapidly priced in an ECB cut for October. This chart shows intraday data going back only to 17SEP. That’s a zippy move to reprice a meeting in 10 days.

Vol-o-rama in Japan. The USD performed well all week vs. the JPY right into the LDP leadership election in Japan, and then Ishiba, the hawkish candidate, won. This was a bit of a surprise as Aso had endorsed the dovish candidate, Takaichi, and markets were leaning the wrong way. Here’s what we did in USDJPY this week.

Takaichi won the first round, then lost in the second-round runoff. Madness. Here is a nice graphic from Nikkei.

Some readers of my daily (am/FX) hit a home run this week as I recommended selling Thursday 146.00 USD calls in USDJPY and buying Friday 146.00s. The trade paid more than 10:1. If you are not subscribed to am/FX, you are missing out on actionable and educational global macro writings in an easy-to-absorb format. Putting the “fun” in fundamentals, as it were. Subscribe here, right now:

https://www.spectramarkets.com/subscribe

One of my biggest arguments against a meaningful cyclical selloff in the dollar has been that there are no good places to put your money outside the US. Now, with China deemed uninvestable and foreigners mega underweight, and a multi-pronged, double-barreled monetary and fiscal stimulus announcement, we must be moving closer to the middle of the dollar smile. I am no longer bullish USD and probably should be flipping short at “bad” levels.

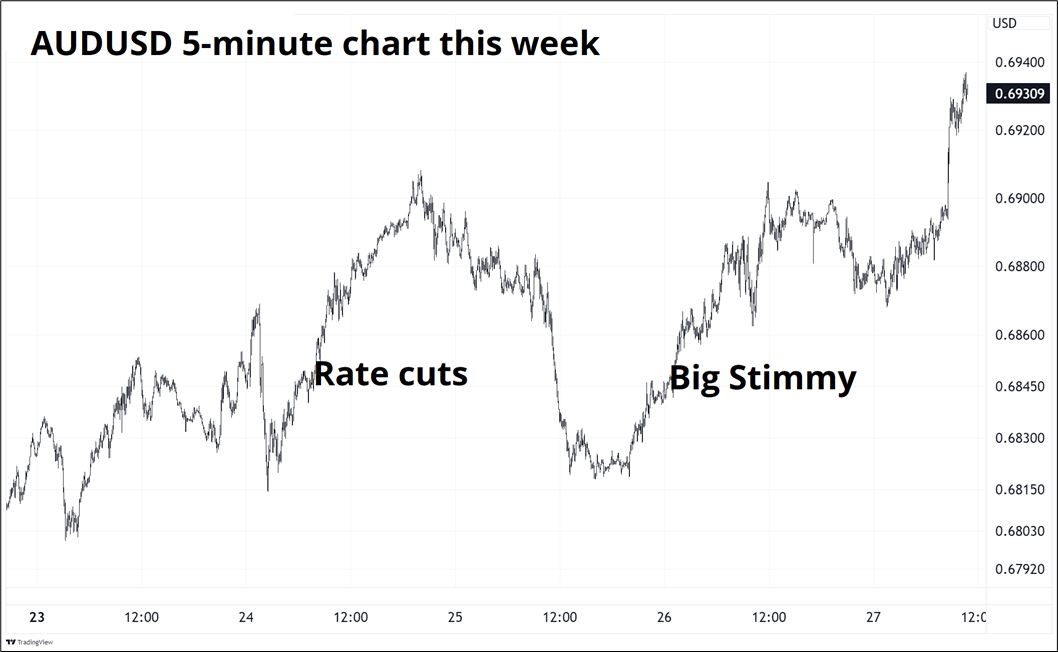

Currencies considered to be China proxies roofed this week, as one might expect. Here is AUDUSD.

You can see that “buy AUD on China stimmy” was not exactly free money as the currency rallied 1%, dropped 1%, then finally rallied 1.5%. Trading is hard, especially in real life.

There is not really enough data to assess monthly seasonality of bitcoin, because it has really only existed as a tradeable thing for most humans since 2016 or so and only became fully mainstream and institutionalized by Wall Street in 2021. Still, it’s fun to be fooled by randomness sometimes, and thus the crypto world refers fondly to next month as Uptober. Here is monthly performance of bitcoin back to 2016. I apologize to anyone that is red/green color blind, like Pete!

Whether Uptober is real or not, it is common knowledge and that suggests that going into the start of October there will be more buyers than sellers.

Bitcoin and NASDAQ continue to tango with a few different steps to the left and right here and there.

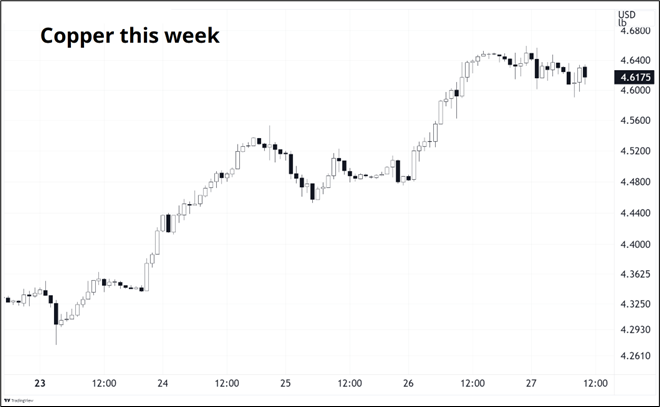

You would imagine that a China stimulus package that resuscitated subterranean Middle Kingdom sentiment might be bullish for copper. You would be right!

And of course, if you thought that would be bullish oil too, because of an impending rise in Chinese consumption, and a global reflationary impact, you would be… Not right.

Whoops. Saudi Arabia put the kibosh on crude. The long-awaited rally in crude is like the US recession. Godot-like.

Batman and robin both rallied this week on the China stuff, but maybe a bit of disappointment in silver again as it poked its head above the 2012 highs then failed. That’s what’s called a Slingshot Reversal.

Whew! OK! That was 7.34 minutes. Thanks for reading Friday Speedrun.

Get rich or have fun trying.

Smart, interesting, or funny

Credit card interest rates are usurious in the United States. There is a reason capitalism requires some amount of regulation in order to work properly.

Matt Stoller covers the case against Visa.

You don’t need to document everything

A nicely-written piece on why nobody cares about your vacation pictures on Insta and why this compulsion to photograph everything diminishes your life.

A complicated but interesting academic paper

A useful paper about how we process information.

Trading global macro is hard.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

It was a week of crosscurrents and contradiction

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it