Chaos is come.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Chaos is come.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

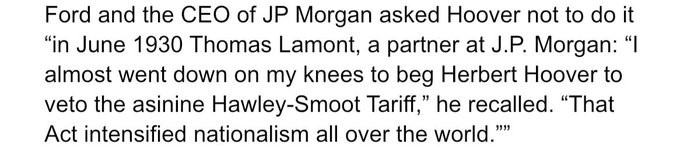

Well. We are another week into Smoot Hawley, Part Two, as the US administration has effectively announced a trade embargo against China.

That was then…

(via https://x.com/Citrini7/status/1910583939842048094)

And this his now…

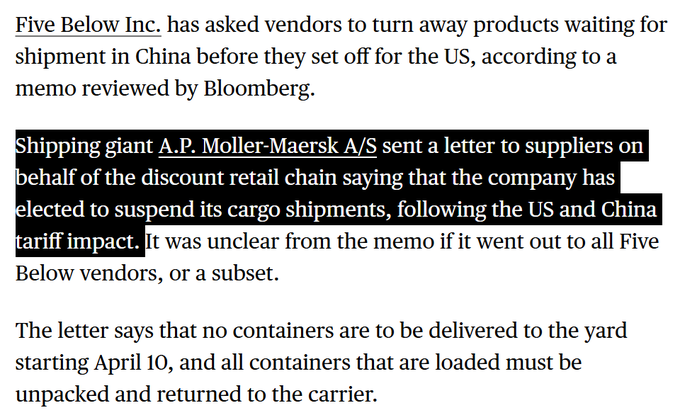

Companies are trying to figure out what do. If you have ever been to Five Below, you know why they might be worried—it’s a junk store where almost everything is made of plastic and costs less than $5. Probably 90% of it is made in China.

There are going to be some weird supply chain issues in the coming months. Stock up on all your cheap junk from China ASAP.

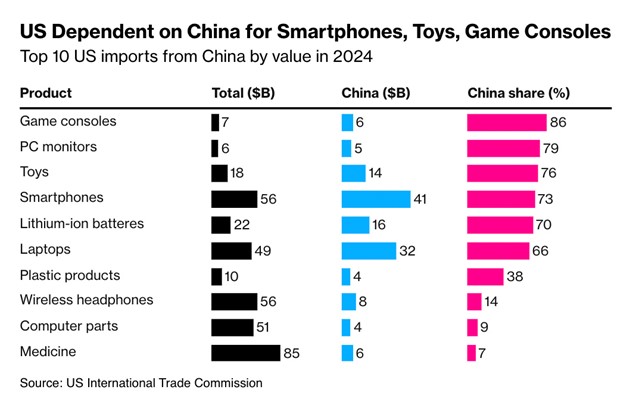

And grab some iPhones while you’re at it.

I mean… “If” being the key word there. These products will never be made in the United States because it would cost too much and the margins would be negative. Something has to give.

Anyway, markets are reacting in predictable fashion as the US burns down every alliance and international friendship it has made over the past 200 years.

The end of US hegemony trade is in full force as the Trussification of the dollar continues. Those who are old enough to remember Liz Truss (2022) remember that her policy mix was poorly received by the markets and so GBP went down as UK yields went up. Now, the embargo on Chinese trade, RNG tariffs that change daily, long-time allies stabbed in the back all at once, and a concomitant collapse in business, investor, and consumer confidence have triggered a flight out of US assets. In soccer, this is called an “own goal.”

The problem is that if someone threatens to burn down my house, and then in the interest of self-preservation, I make a deal with them not to burn it down, I’m not going to trust that my family is safe. Before I step outside, in future, I will peek through the blinds to make sure he’s not standing on my lawn, holding an axe. Especially if he has a well-known history of reneging on past deals.

In other words, the global investors, wealth funds, and pension money selling US assets are not coming back. When these Canadian or European pension funds are done selling their US overweights, they are never buying them back again (at least not until 2028 or later.) This creates hysteresis, or scarring, where the damage done cannot be fully undone, whether or not the random number generator used to choose tariff rates lands on something lower.

The flight out of US assets has triggered an emerging markets style trade where you sell the currency, the equities, and the bonds all at once.

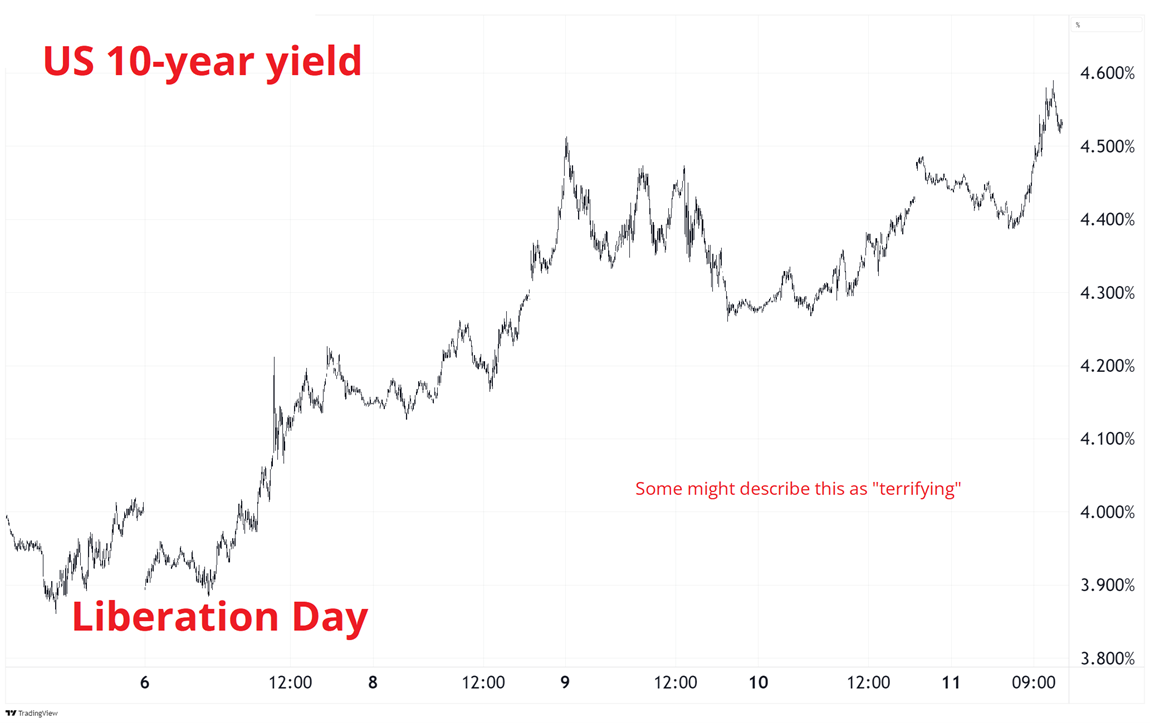

If you are new to markets, just believe me when I say that a developed country’s stocks, bonds, and currency rarely all fall at once. For it to happen to the most important capital markets in the world is mind-blowing stuff. Here are some hourly charts, starting from Liberation Day.

This is all subject to a random tweet, of course, but the damage is already done. You will see wicked countertrend rallies on fake news or fake good news, but I very strongly doubt we are making new all-time highs this year, regardless of how many policy flip flops they try on.

The optimistic take here is that if you’ve read the Fourth Turning, you know things always kind of work out OK on the other side. Hence my Nietzsche quote today as the title:

You must have chaos within you to give birth to a dancing star

Stocks actually traded well this week as the announcement that the tariffs are being delayed triggered the mother of all short squeezes. The NASDAQ closed up 12% on Wednesday. That’s a preposterous move, but that’s what happens in bear markets. You get relentless moves lower interspersed with face ripping short cover rallies. This was one of those rallies.

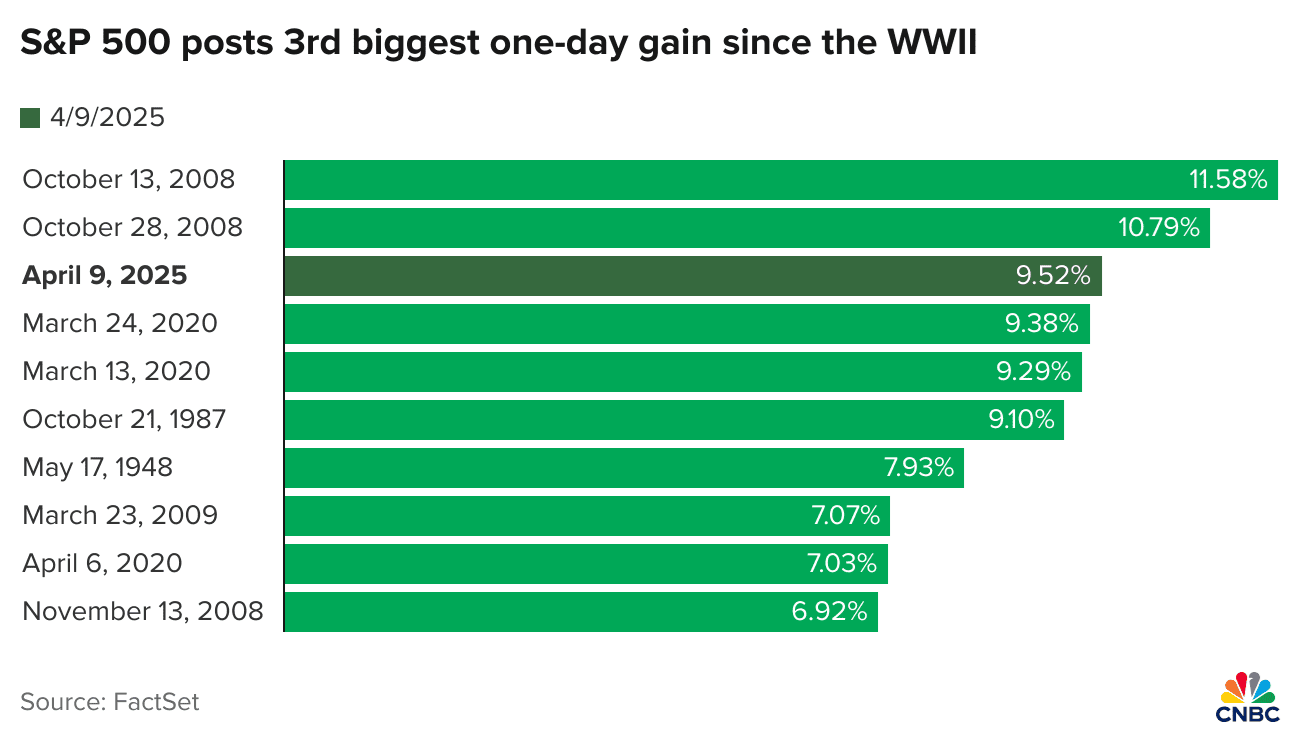

For perspective, here are the largest 1-day rallies in stock market history. You might recognize the dates.

This week’s 14-word stock market summary:

Perdition catch my soul

… and when I love thee not,

Chaos is come again..

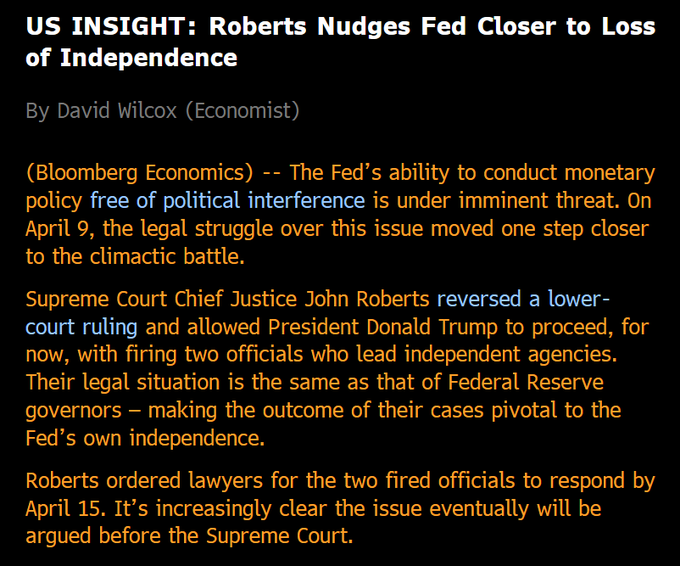

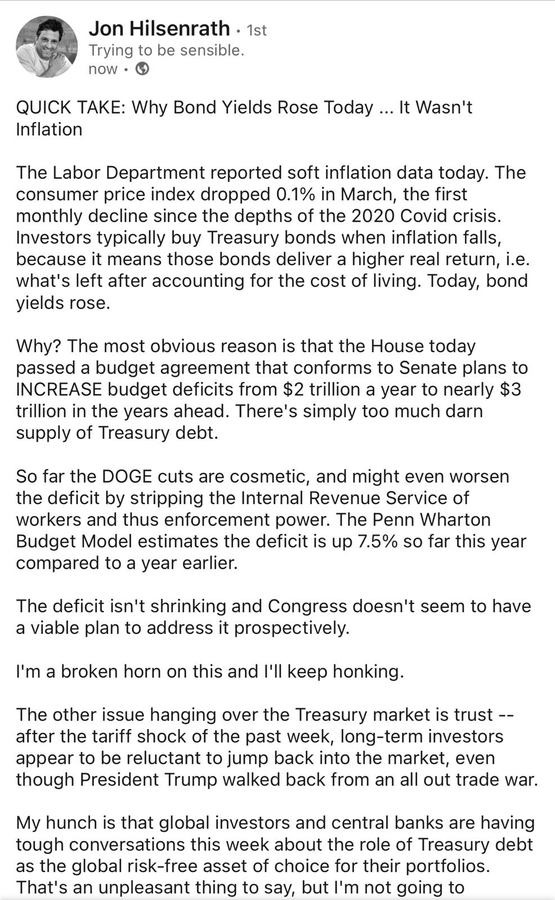

The normal thing that happens when US stocks fall is that bonds go up and you have yourself a pretty good hedge. But when inflation is boiling, the US sovereign is losing credibility, and nobody wants to hold your assets because you’re telling them all to fk off … You get this:

I don’t like assessing economic policy based on market reactions because market reactions are wrong all the time. The haters and sycophants are taking turns high-fiving all week as stocks sell off, haters say, “policy bad” and when stocks rallied that one day the sycophants say, “policy good.”

Mr. Sacks needs to read about the cheer hedge

Policy should be evaluated on its merits and when the policy fails basic arithmetic smell tests, that’s a good start towards an objective evaluation of its sophistication and professionalism. But Anyhoo, the markets don’t like it right now but the final economic outcome is TBD.

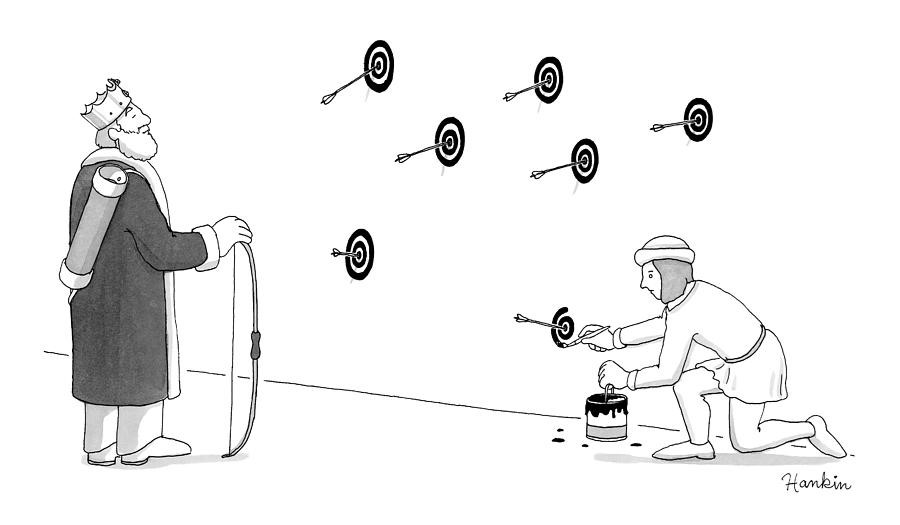

The All-In types will cheer and the haters will hate. Here’s a good cartoon making fun of the way apologists will point to a different metric of success every day, depending on what’s moving.

The final outcome of the current policy mix will probably be a much larger deficit, less trust in US rule of law, and zero net new manufacturing jobs. But hey, I could be wrong. I hope I am!

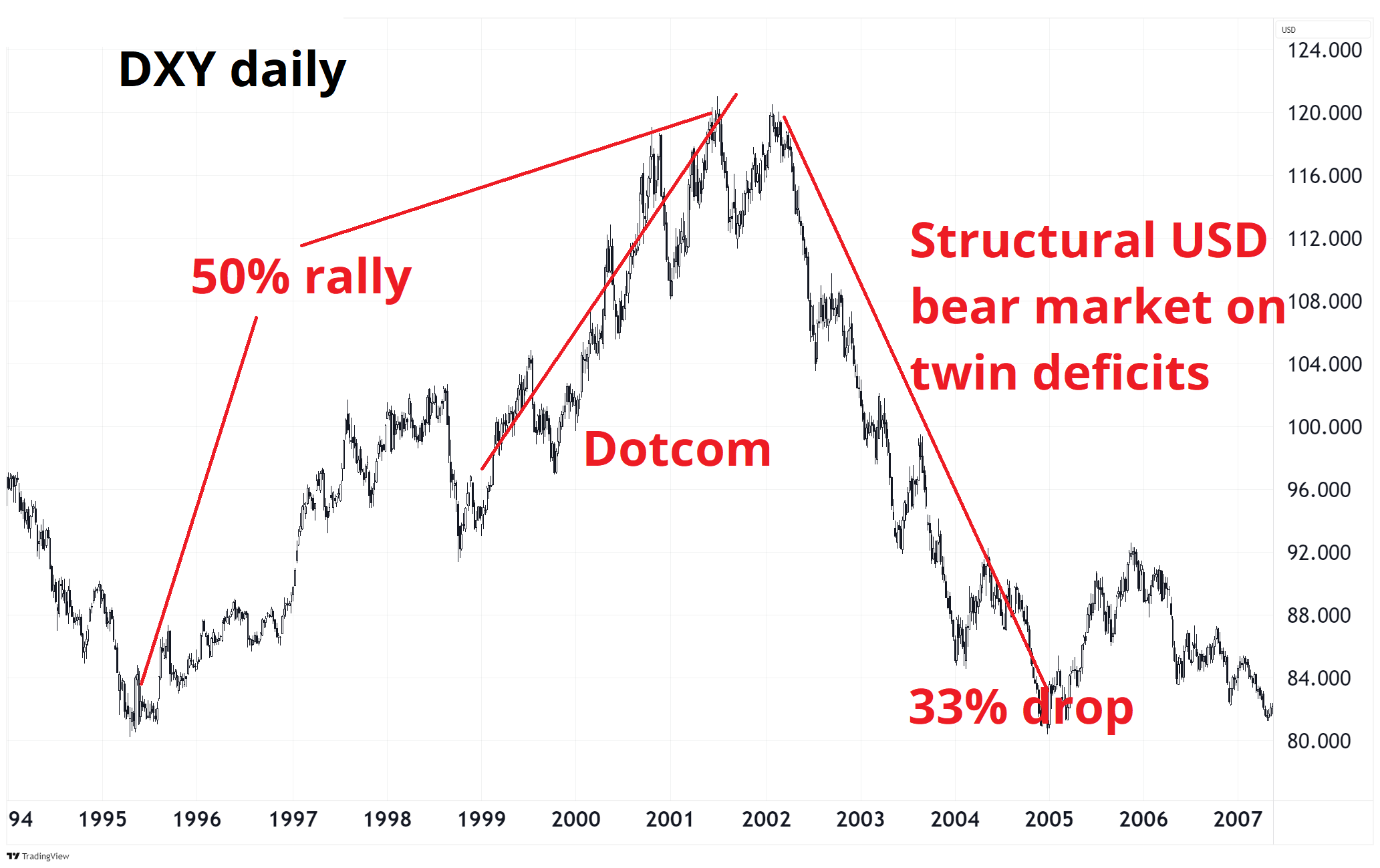

This has the makings of another great USD down move like the one from 2002 to 2008. That move saw the dotcom bubble trigger 8 years of US inflows and a 50% rally before the entire rally unwound in three years. Up 50% and down 33% = unchanged.

Now, we have what is a pretty similar setup with 8 years of inflows into the MAG7 / TINA boom and a new president and a peak in the AI bubble. Another full round trip would make sense.

This has been one way traffic since the German defense spending announcement at 1.0545 in EURUSD, and so tactically it’s not easy. Regime changes are not a time to be overly worried about positioning or entry points. But now we’ve had a huge move and we’re at the bottom of the DXY range and the SNB is probably getting involved in USDCHF soon and it’s all a bit less clear what to do in the short run.

Japan’s Akazawa will meet U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer for U.S. tariff talks on April 17, public broadcaster NHK reported on Friday and that should lead to a healthy runup trade in the JPY as the market needs to position for the possibility of a mini Plaza Accord where Japan makes some kind of deal.

EURCHF is likely to be supported by the SNB down here (0.9210/40) because inflation and interest rates in Switzerland are both at zero and they have no other policy tools left, really. They meet on June 19 and could go back to negative rates, but in the meantime, they need to keep the CHF from going vertical.

This makes CHFJPY downside structures attractive. People hate to do trades that have seemed good in the past and never worked and they are often referred to as widowmakers. The original widowmaker was short JGBs, and that’s been one of the best macro trades of the past few years. Just because something didn’t work before, that doesn’t mean it won’t work in the future. If that were true, extrapolation would be an excellent forecasting method in financial markets.

This is a perfect summary of the state of crypto:

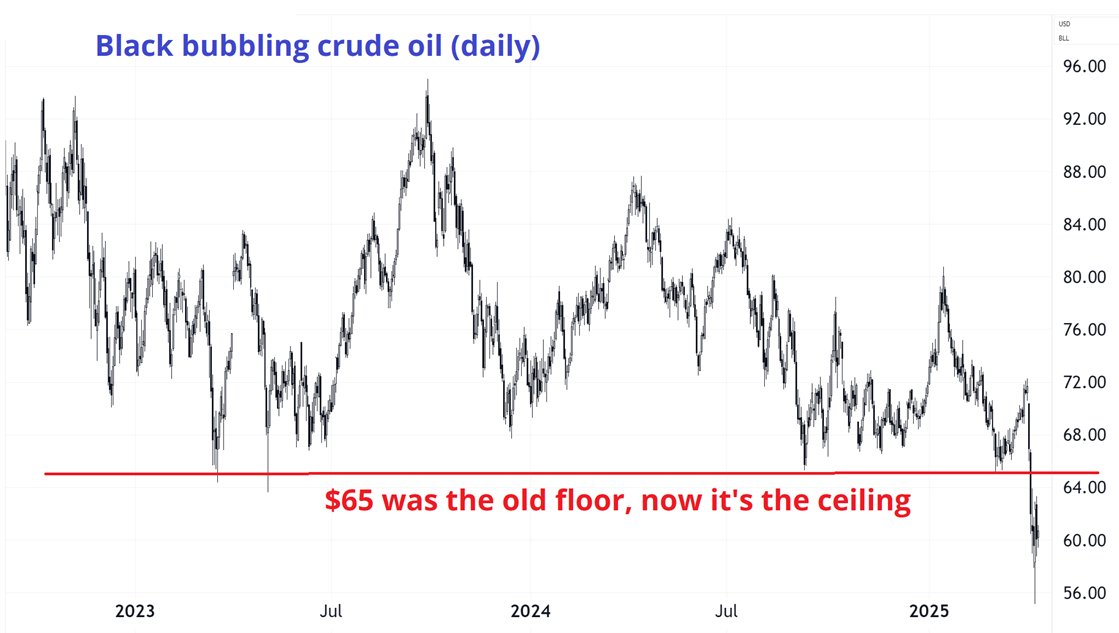

I did a podcast with Tony Greer and Jared Dillian this week and we talked about oil and I think the conclusion was pretty strong: Sell call spreads. You can see the podcast right here:

https://www.youtube.com/watch?v=ipj4SJwBu0g

We also talk GnR, Skrillex, and other random stuff. Here’s the oil chart:

That’s it for this week.

Get rich or have fun trying.

*************

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.