Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Spectra School is Coming!

In a month or so, we will be launching our flagship Spectra School course:

Think Like a Market Professional

Anyone on the waitlist before launch will receive a major discount and other sweet treats on Day 1.

The Course Includes:

- 16 long-form written online lessons.

- 8 long-form “Learning from Legends” videos featuring (in alphabetical order) … well-known Wall Street experts like… Danielle DiMartino Booth, Matt Gittins, Jim Grant, Tony Greer, Ben Hunt, Leland Miller, Alf Peccatiello, and Sam Rines. (What an insane lineup!)

- 7 short-form “Behind the Screens” videos covering specific market topics.

- 2 hours per month of live discussion / AMA / Q&A with Brent Donnelly and Justin Ross.

- Online exams and certificate of completion.

Sign up for the waitlist now, with no obligation: https://spectramarkets.com/school/

Here’s what you need to know about markets and macro this week

Global Macro

First of all. If you saw this week’s featured pic and wondered “What in the name of all things holy is that?” you wondered the same thing I did when I first saw it. I had asked the AI to make an image of “hawk attacking a dove” and I got a goth painting of a semi-religious humanoid hawk and top lit dove that I find both striking and appalling. Anyway, that’s the image, explained. Let’s go.

The last two weeks have had a remarkably similar texture. An aggressive global reflation trade centered on commodities with some violent stock market selloffs unbecoming of VIX on a 14 handle.

The selloff last Thursday and today were of similar magnitude but there was a major difference to the tone this week as emerging market FX sold off hard and precious metals failed to maintain the bid into week’s end. We’ll talk individual asset classes later but the price action this week is a bit more hair-raising than last week’s one day dump. The kinks in the armor of the debasement trade (gold down, bitcoin down today, for example) are intriguing. Have the gold and crypto longs finally got over their skis? Tune in next week to find out!

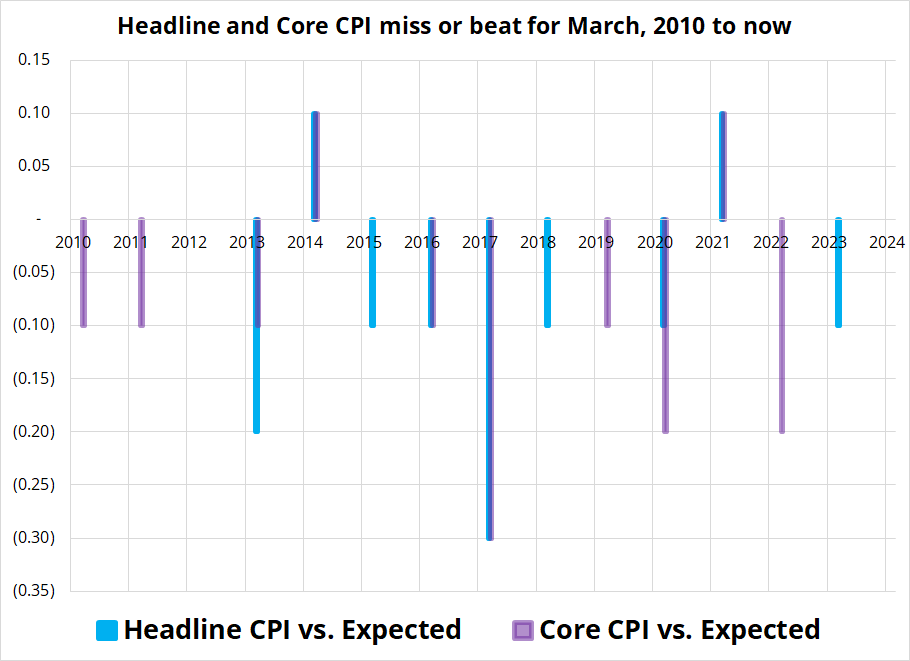

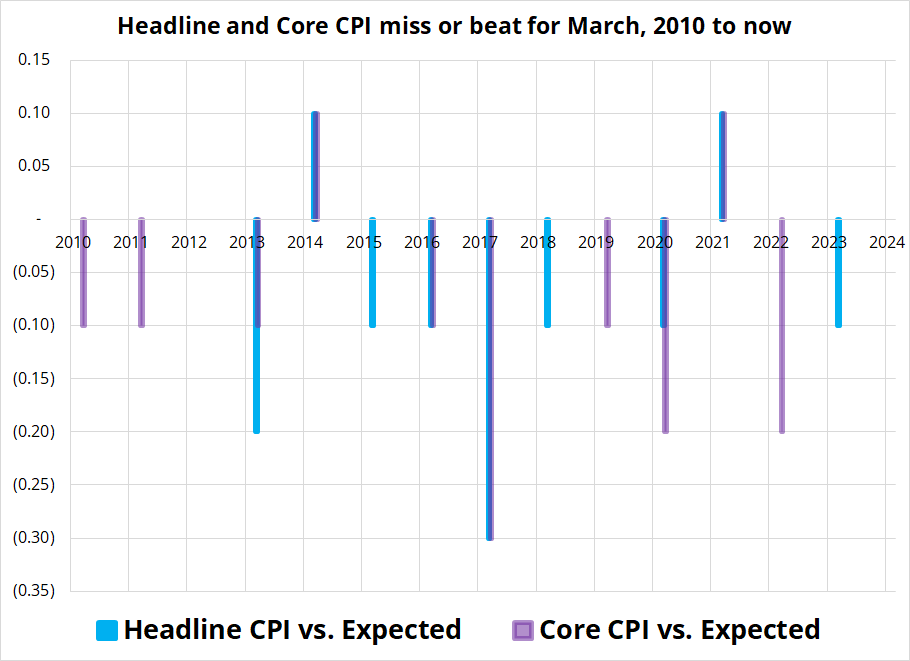

The biggest macro item this week was the US CPI release which came in hotter than expected. This is meaningful because the pattern in recent years has been for January and February data to lean on the hot side, then March comes in cool. Here, for example, is the beat or miss for March CPI over the past 13 years.

Yes, sure the sample size of 13 is not huge, but this pattern can be seen in many other US data series, especially after COVID. It is probably due to seasonal adjustment challenges posed by the pandemic shock.

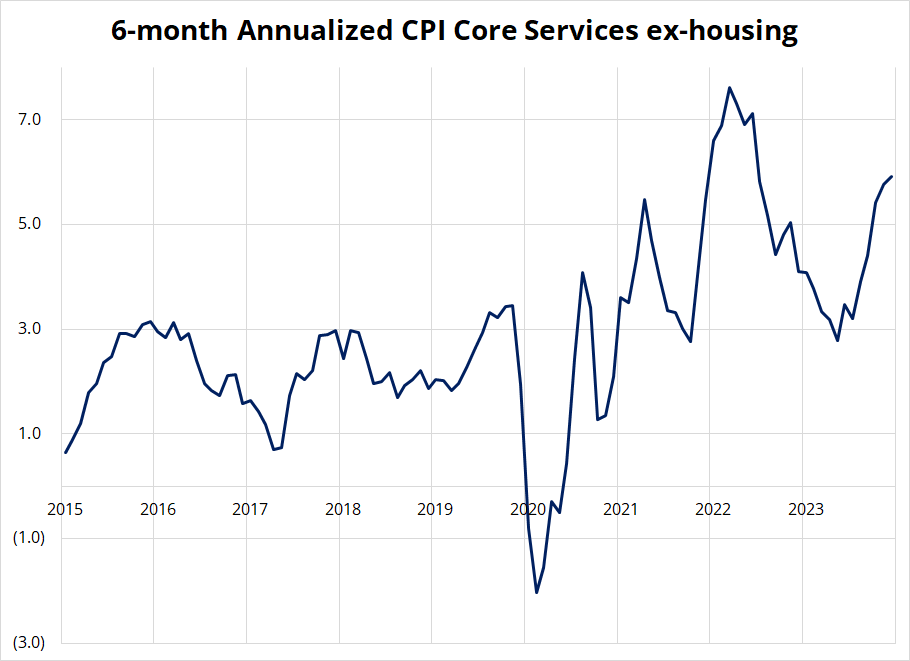

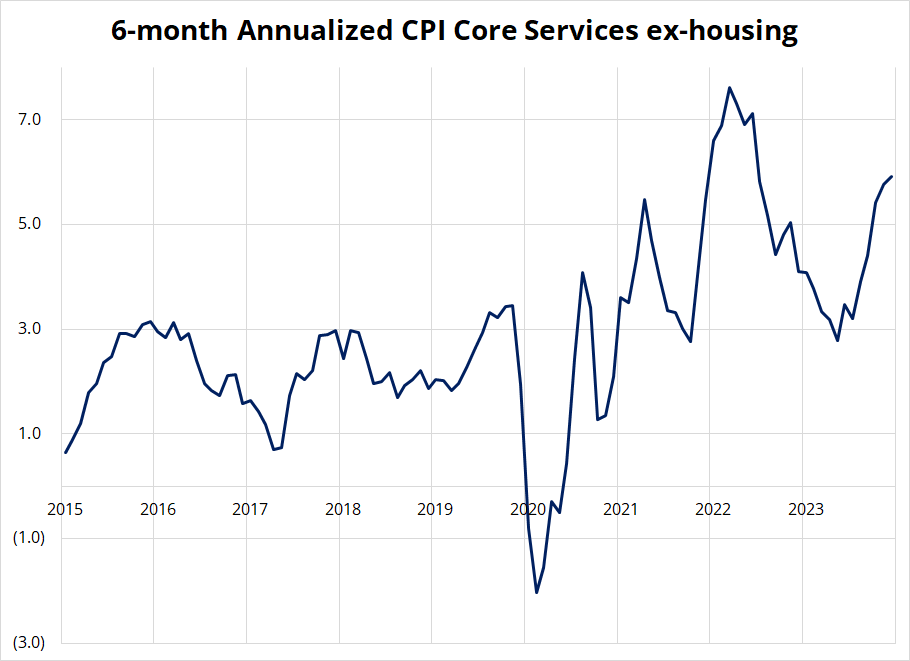

Anyhoo, a strong number in March leaves us with an inflation picture that looks like this:

There are many ways to slice and dice inflation numbers and if you exclude all the stuff that went up, as doves are apt to do, you will get a lower number. This return of inflation is probably, in good part, the responsibility of the Federal Reserve as they declared mission accomplished before accomplishing the mission of sending inflation back into its sub-2% hole.

Instead, the Fed pivoted to rate cut messaging and turbo charged a new everything rally, sending meaningless numbers on a screen like memecoins higher but also pushing the price of gasoline bought daily by Americans to multi-month highs. This is potentially the second policy error in three years as the Fed can’t help but stay true to its dovish DNA.

Arthur Burns wrote a famous speech about his own failure to kill inflation in the late 1970s and this bit resonates particularly loudly right now.

Viewed in the abstract, the Federal Reserve System had the power to abort the inflation at its incipient stage fifteen years ago or at any later point, and it has the power to end it today. At any time within that period, it could have restricted the money supply and created sufficient strains in financial and industrial markets to terminate inflation with little delay. It did not do so because the Federal Reserve was itself caught up in the philosophic and political currents that were transforming American life and culture.

If you care about history and markets at all, check out the speech. It’s a beauty.

Read it here: Arthur Burns’ 1979 mea culpa

I’m kind of obsessed with that speech these days as its description of the interplay between societal factors, loose fiscal policy, and a central bank unwilling to turn the screws is eerily familiar to those operating in financial markets from 2021 to now. Obviously, there were much more significant pressures in the 1970s, but the general setup is similar, even though there is no oil crisis or wage/price spiral going on. It’s like 1970s-lite.

There is approximately zero chance of a fiscal awakening over the next 4.75 years as the current and next president are both advocates of various forms of either lower taxes or higher spending or both. Therefore, more Fed rate hikes would be the only countervailing force that can take on rising inflation expectations, rising commodity prices, and 6% inflation in services.

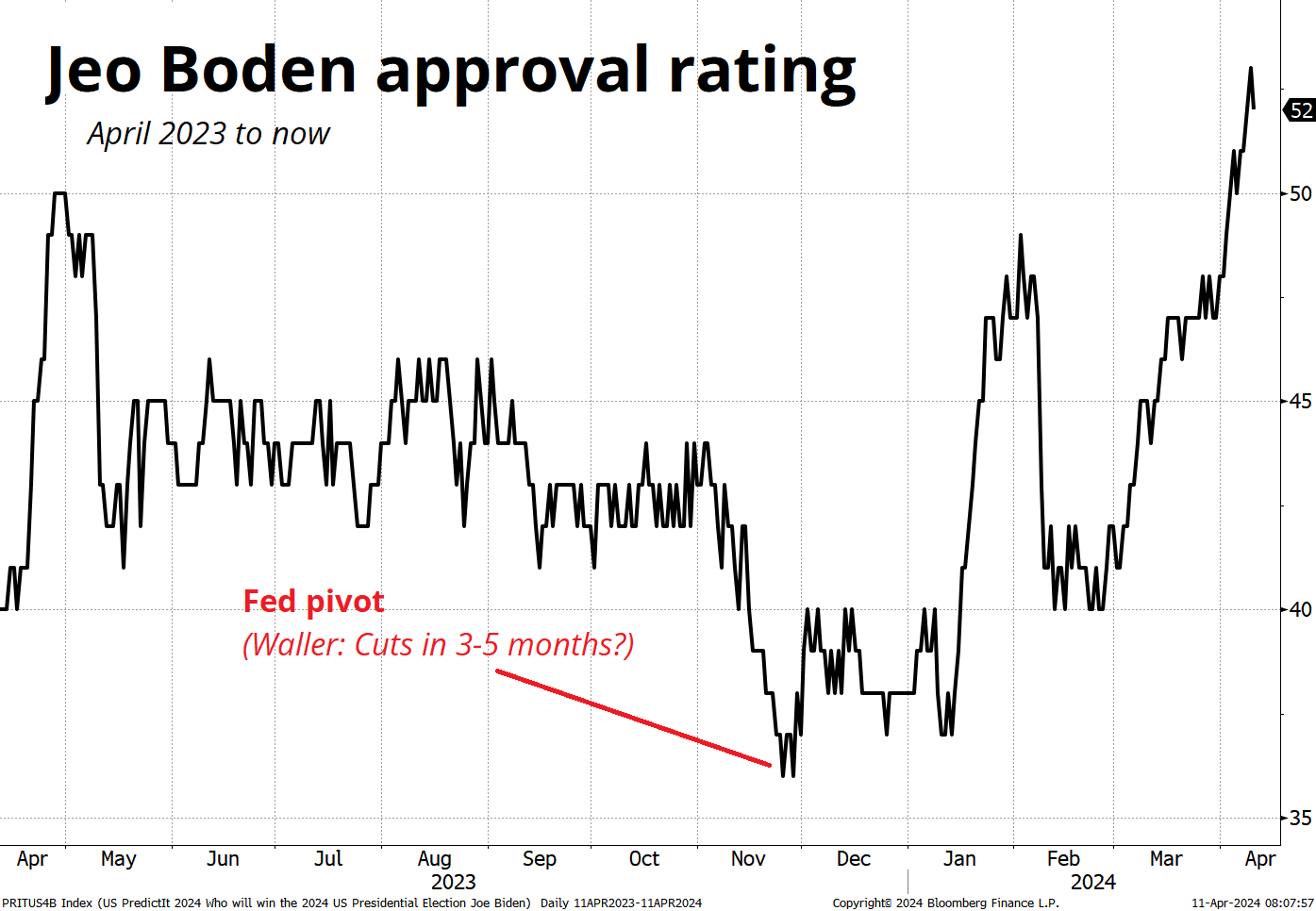

It’s worth considering, of course, that the Fed’s target is not really 2% inflation but this:

By that measure, Fed policy is working!

This week also saw meetings from the ECB and Bank of Canada and while a few months ago the narrative was that the Fed will go first and every other central bank will follow, the narrative now is that everyone is cutting in June (the SNB already cut!) and the Fed might never cut again. It’s crazy how narratives change so quickly. I mean, I get it. But it’s crazy.

One last macro thing: There was angst going into last weekend about whether Iran might launch some kind of attack on Israel. We have had the same angst today. It’s a scary thing to think about, and I have no edge on attaching a probability to this possible escalation. But it needs to be on your radar for risk management reasons. Don’t wanna be short oil into the weekend, for example. If you can’t properly estimate your risk, it’s hard to manage it.

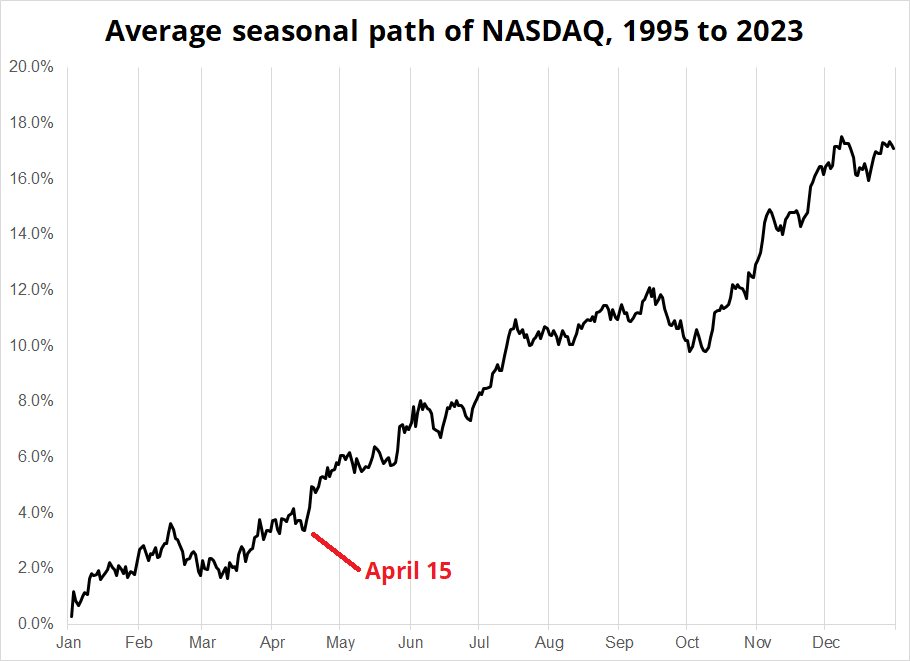

Stocks

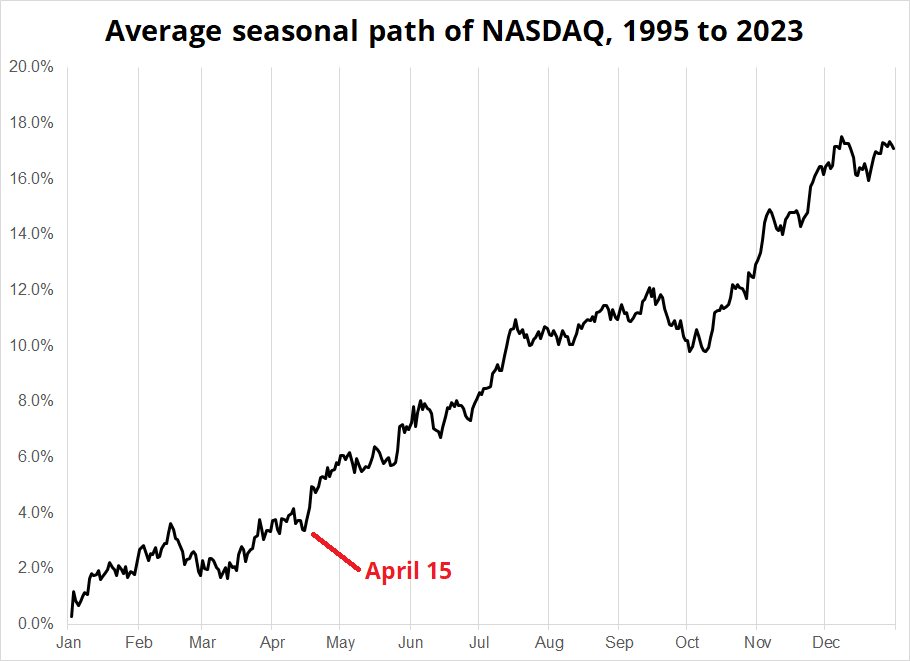

The main reason there is persistent seasonality in the price of equities is that there is persistent seasonality in the flows. People get bonuses around the turn of the year and those flow into 401ks, for example. Another more micro example is that people get tax refunds in March (bullish stocks), but then others need cash to pay their taxes into April 15. Therefore, stocks tend to rally from mid-March to early April, then sell off into Tax Day.

This effect is particularly strong in years when speculation is running rampant, like 2000 and 2022 as traders that made huge gains in 1999 and 2021 did their taxes and had the same “oh sht” moment I had myself in the year 2000 as my account had increased significantly throughout 1999 but I had spent exactly zero seconds ever thinking about the fact I was going to owe taxes on the gains.

If you are skeptical of seasonality or don’t really know much about it, you can read a longer piece I wrote on the topic here.

https://www.spectramarkets.com/amfx/seasonality-is-real/

The rate of change of the NASDAQ has flattened out after blockbuster gains month after month.

We were zipping nicely along inside that upward-sloping channel, but everything topped out somewhere between the 8th and the 20th of March and now we’re not exactly reversing but fully stalled. I’m not convinced that the recent volatility is all that indicative of anything, and I believe until there is a credible threat of US rate hikes, you probably just want to own anything that benefits from fiat debasement. Furthermore, seasonal tax-related selling of equities ends Monday and then it’s going to feel a bit safer to get back in the water.

The snazzy bounce in AAPL (see next chart) and the continued solidity of NVDA (still nearish the highs) don’t really smack of massive, imminent danger to me. Buy the dip on Monday, probably, unless Iran attacks Israel then all bets are off.

Here is this week’s 14-word stock market summary:

Prices are stalling and vol is picking up but is it just seasonal jitters?

Interest Rates

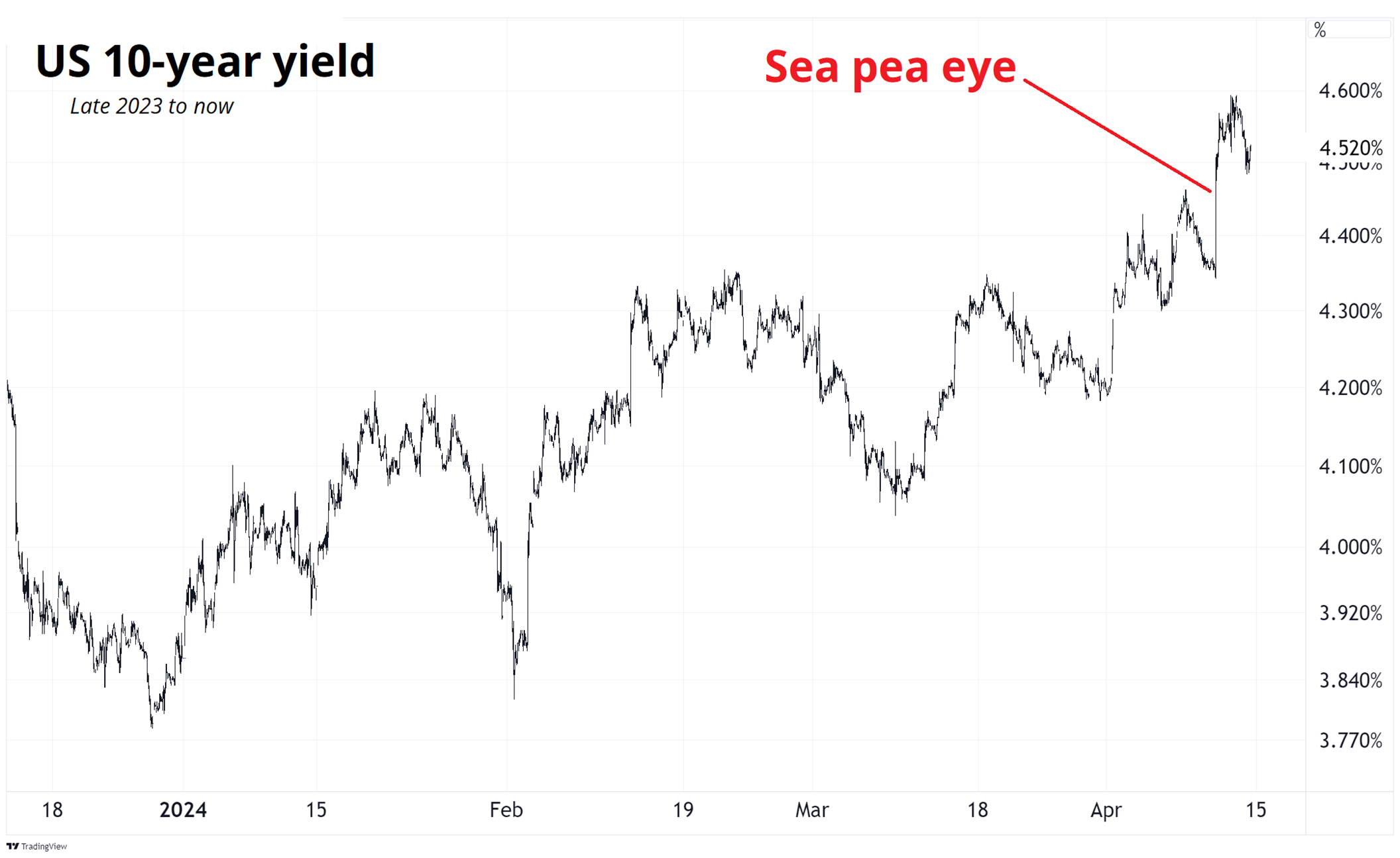

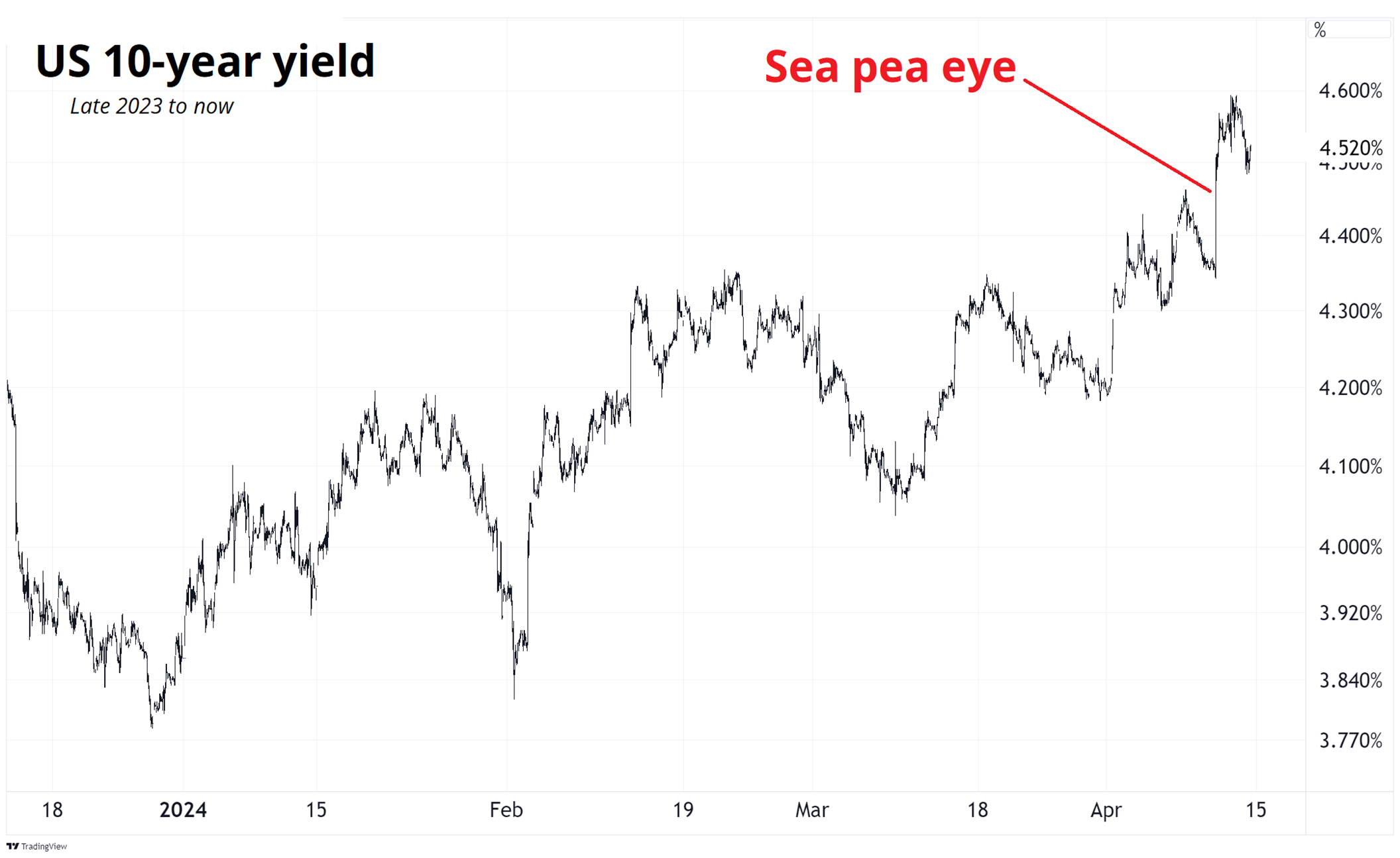

2024 has featured a remarkable up trend in US yields. While people were betting on the Bigfoot Recession, the US economy made a mockery of forecasters and kept on keeping on. There was another huge leap in yields on Wednesday’s CPI release as you can see here:

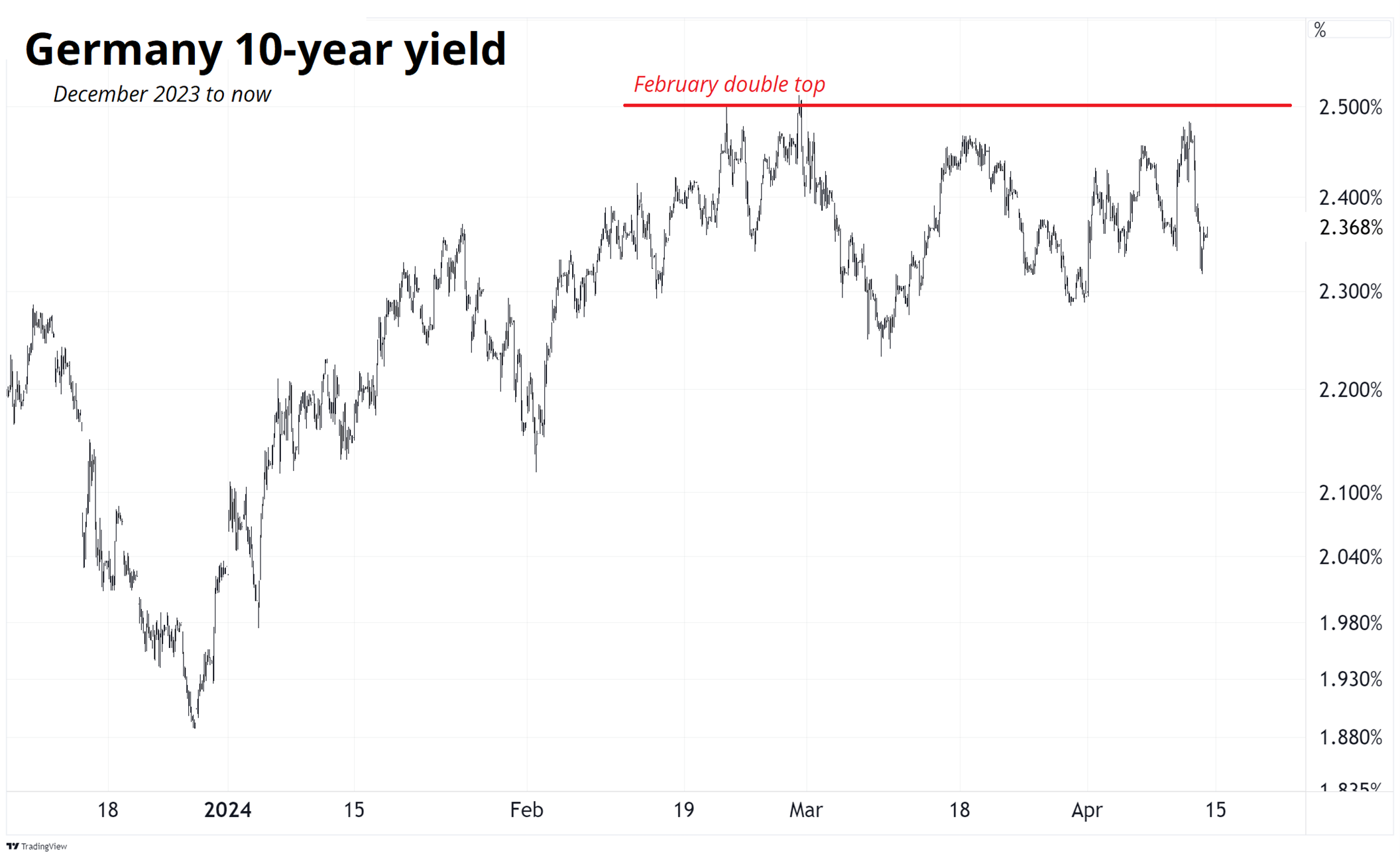

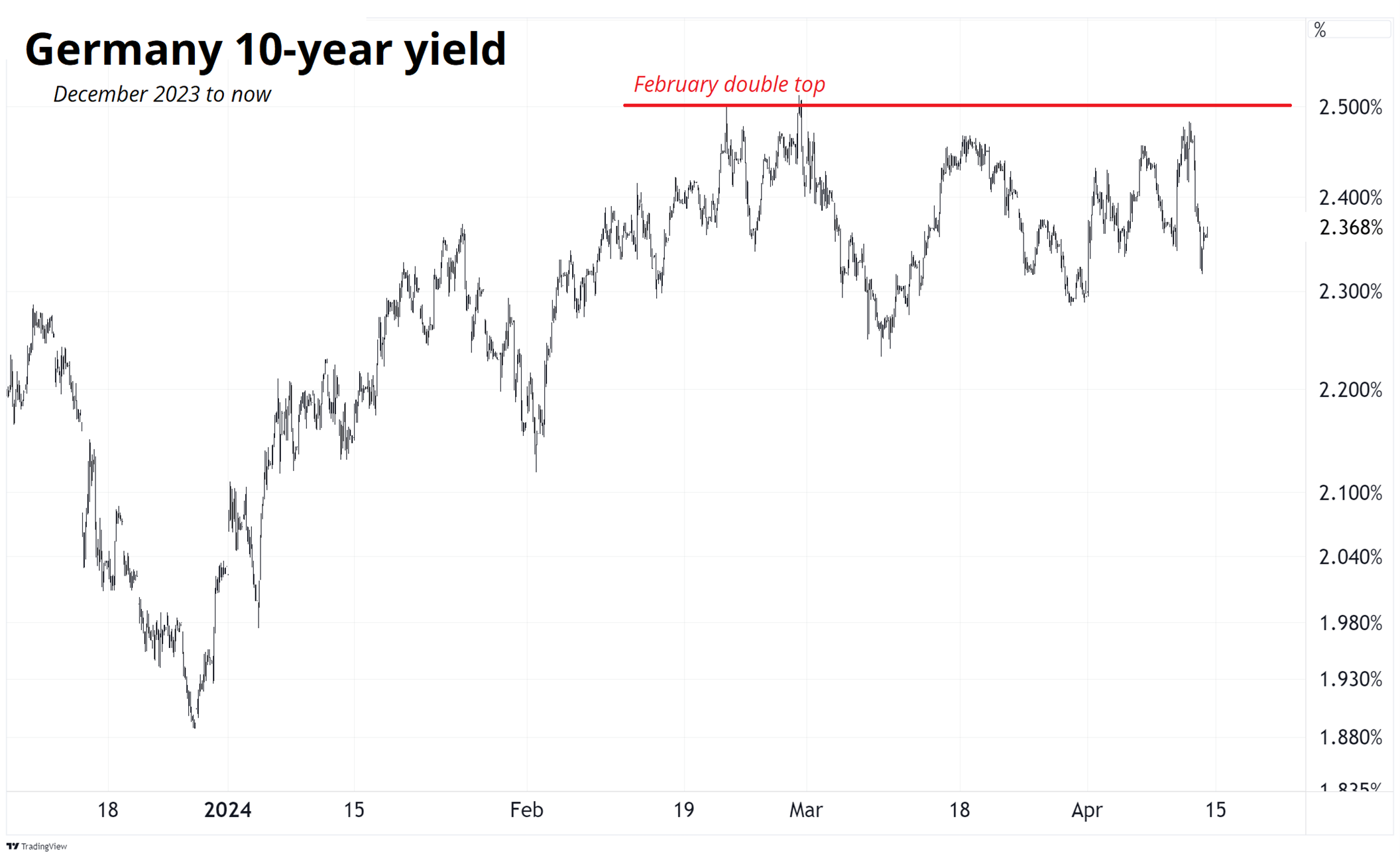

So much for the 4.37% level! Gonzo. So that must mean yields are going up all around the world, right?

Right? Nope. German yields peaked in late February at 2.50% and have failed to retest that level despite a few valiant efforts. There is quite a lot of divergence in global yields right now as the ECB and Bank of Canada are dovish, but US and Japanese yields are still flying higher. That segues nicely to the section on fiat currencies, so let’s go there now.

Fiat Currencies

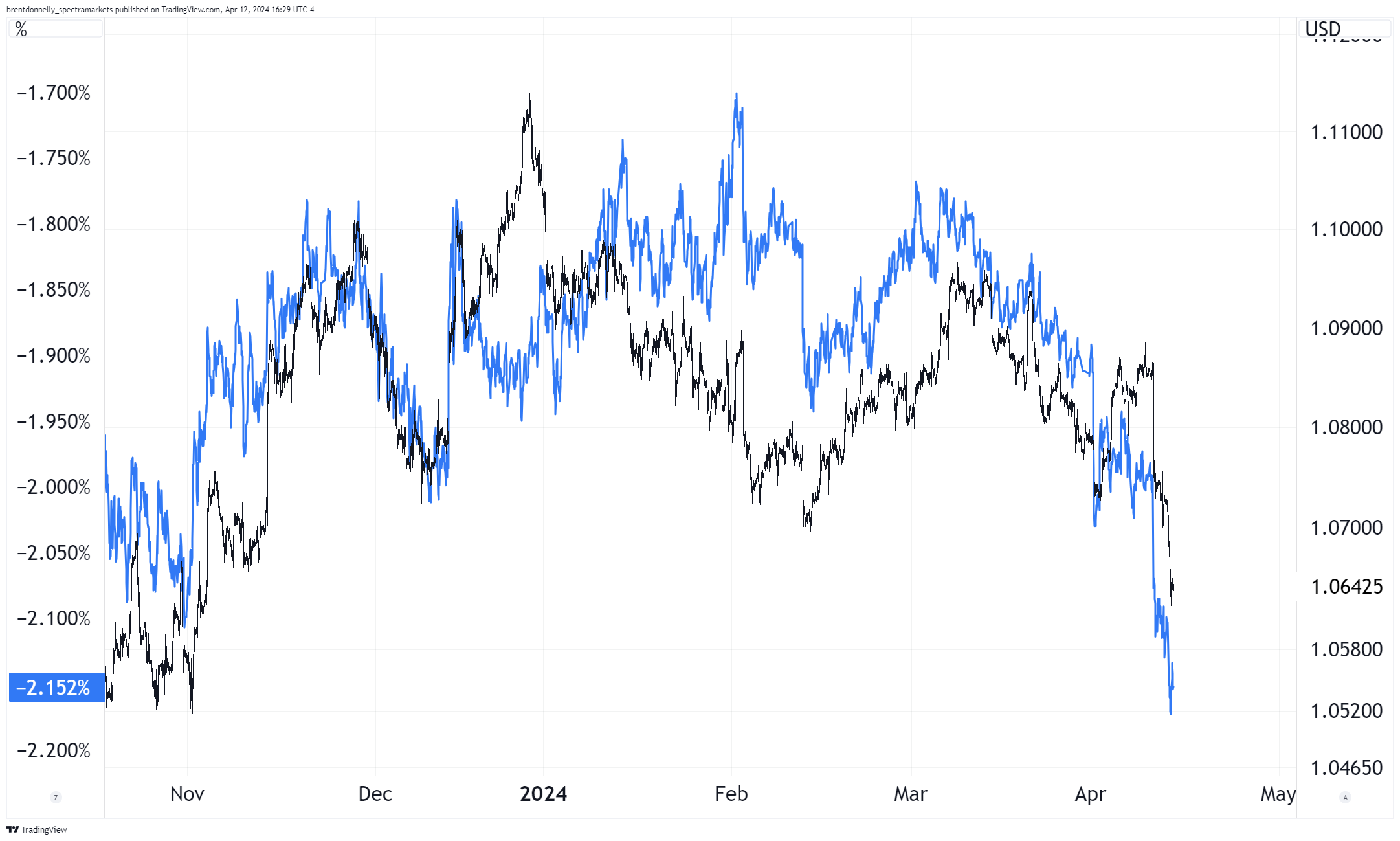

The number one driver of G10 currency direction is interest rate differentials. That is not always true every single day all the time, but it’s true most of the time. And even when it’s not true, it’s probably going to be true again soon. In other words, it’s a persistent but still moderately unstable correlation.

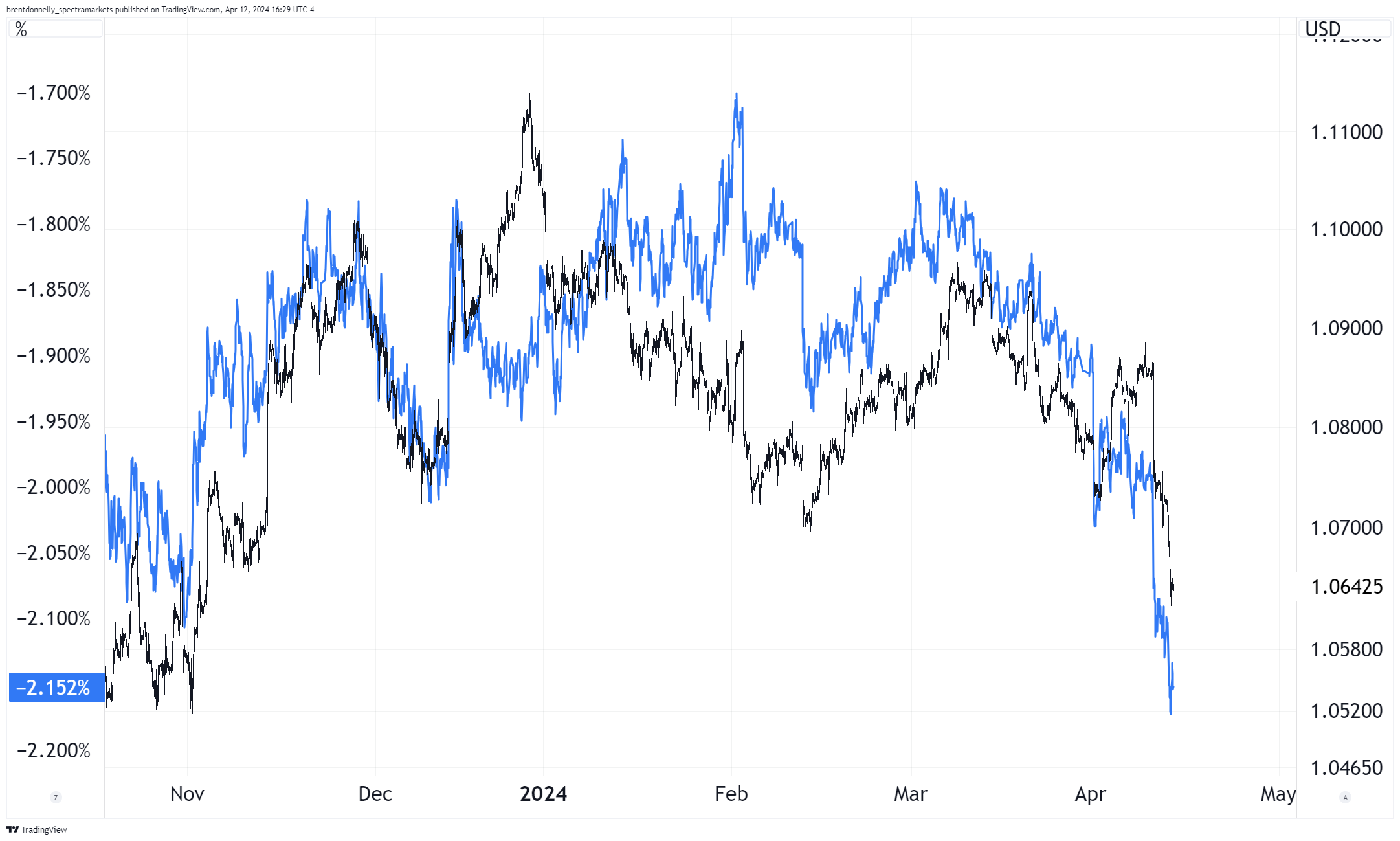

With US yields shooting higher and German yields hitting a glass ceiling, one might suspect that the USD appreciated against the EUR this week. And that is right. EURUSD went lower, following rate spreads. See here:

The USD gained against most of its peers but maybe the most interesting move of the week was the big washout in MXN longs. The past 18 months in MXN have been one of the greatest carry trades I can ever remember as the currency has appreciated relentlessly while delivering el yield pickup gigante at the same time. Corrections have been few, and Sharpes have been high. Finally, this week, it showed a bit of fear.

This is enough to stop out a few carry baskets, as BRL, ZAR and other EM currencies all got mildly toasted this week on the back of USD strength combined with risk aversion stemming from strong US CPI and Iran fears.

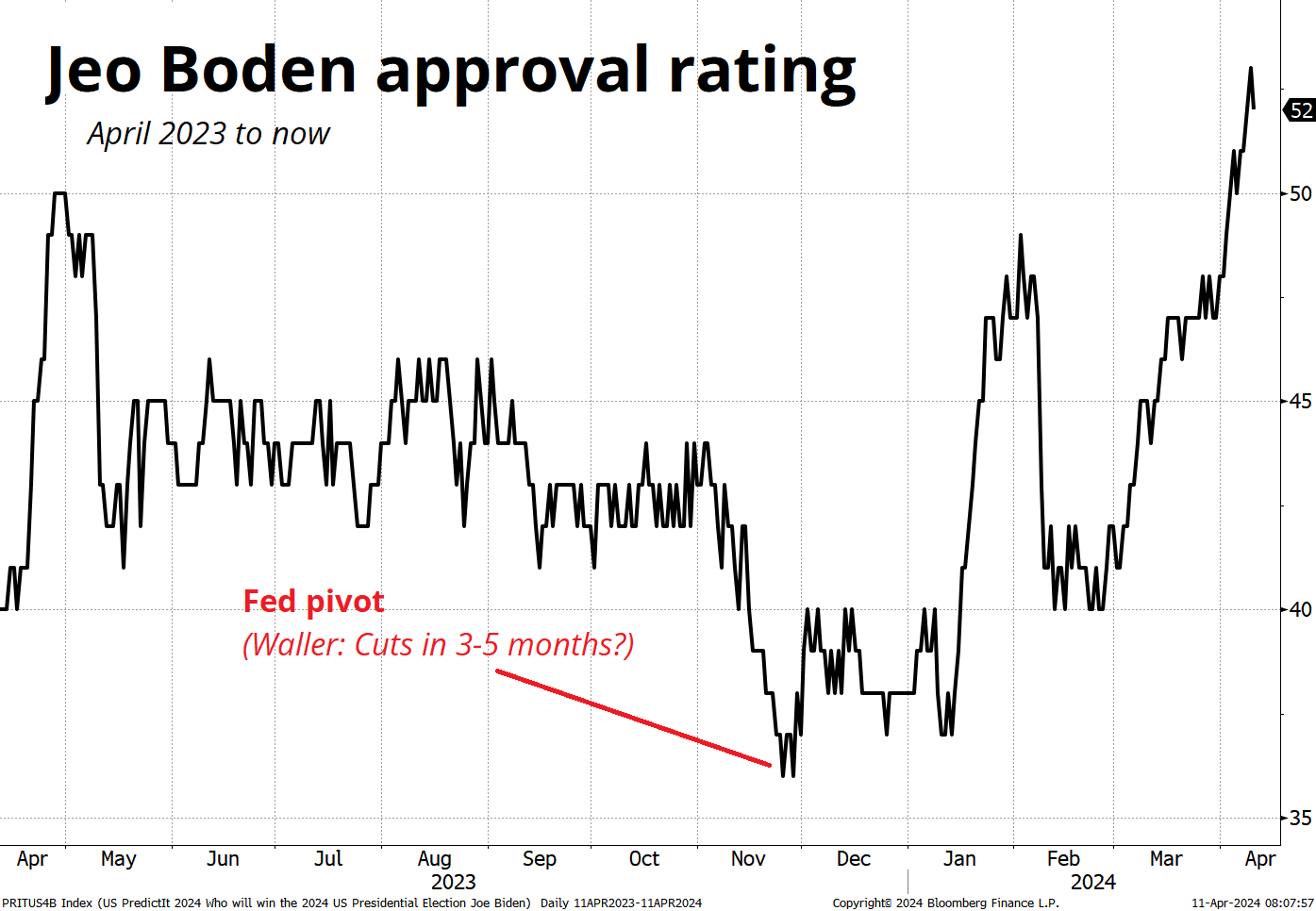

Something markets will have to start thinking about soon, but not quite yet is the 2024 Presidential election. Donald Trump has vowed to place large tariffs on US imports and possibly 100% tariffs on Chinese cars shipped through Mexico. While the terms of trade impact of these tariffs can be debated, most agree the impact on the dollar vs. EM will be bullish. When the China tariffs were enacted in 2017, for example, the USD rallied and USDCNH rallied exactly enough to offset the tariff, time after time.

Trump might not win, but markets will have to hedge his possible return as the event date nears. My experience thinking back to Brexit and the 2020 election and other events is that people start to trade it and hedge it about 3-4 months in advance. This accelerates in the final weeks as risk managers tap the option traders and politely request they cover all their vol shorts pre-event. Working backwards from November 2024, that means July or August should see the beginnings of more serious plans to hedge the US election.

Crypto

The memecoins and crypto are tracing out similar patterns to the NASDAQ where you’re not sure if it’s some major top being put in, or just consolidation. Tech stocks and crypto put in their highs in mid-March and continue to trade like brothers from another mother.

Many memecoins, like Jeo Boden, are down considerably in percentage terms but still ebullient relative to January 2024 levels. Doge is down to 17¢ from 22¢, but opened the year at 8¢, etc.

Unrelated side note. I feel like the cents sign (¢) is underutilized and I’m going to start using it more. If you would like to use it, hold down your ALT key and type 155 on the number pad. Then release the ALT key. It’s basically magic. This only works on Windows-based computers.

Meanwhile, that other memecoin that trades on the NASDAQ: DJT also crapped out somewhat this week. Perhaps calling NASDAQ: DJT a memecoin is an insult to the actual memecoins. I dunno.

Commodities

I feel kind of bad for stuffing commodities way down here at the end because they are the stars of the show right now. Gold, copper, silver, and friends are leaping higher and higher as global central banks ease into roaring commodity prices just like they did in 2007 before commodities went parabolic.

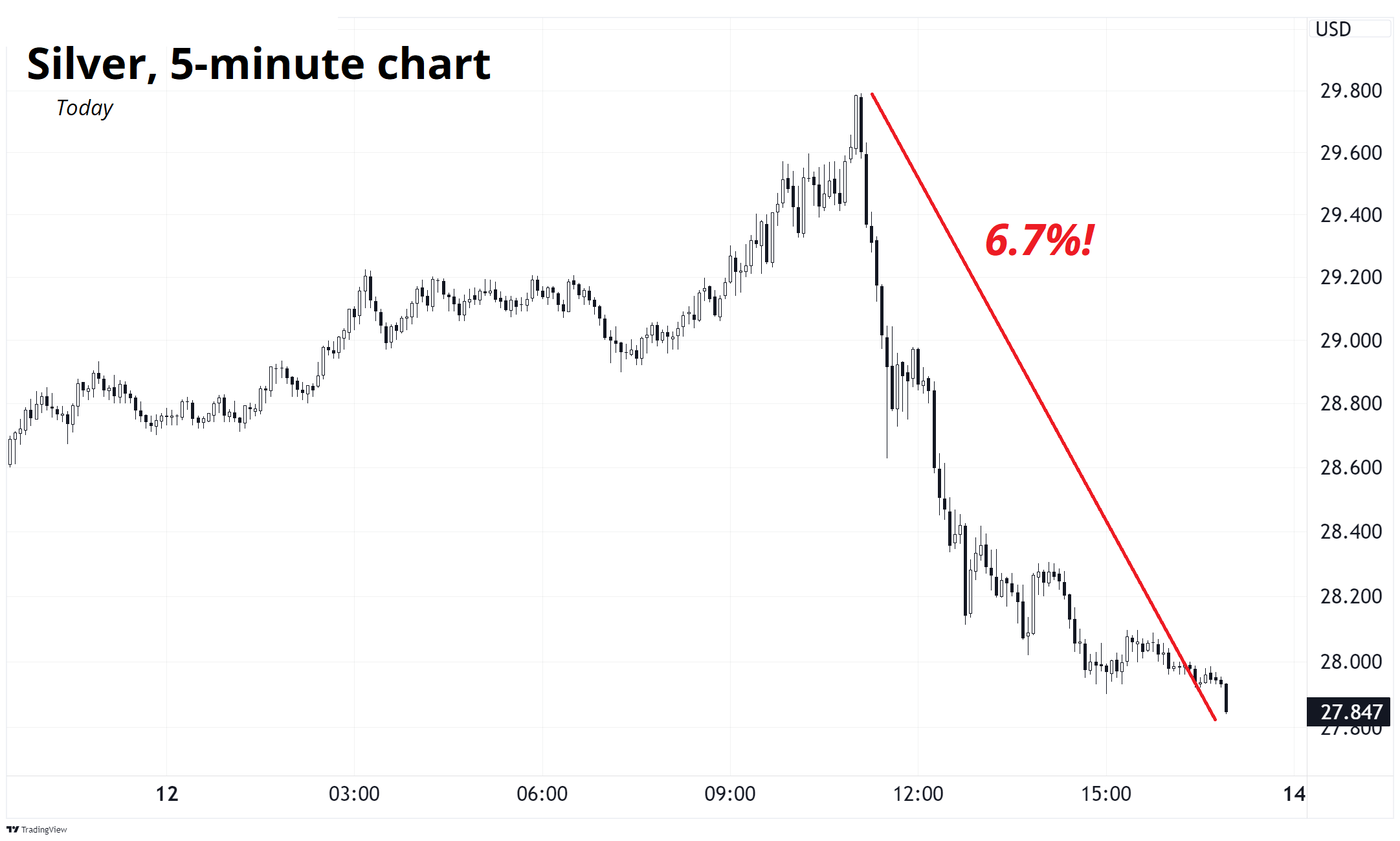

All was not rainbows for the commods this week, though, as silver and gold longs played press your luck a bit too long and got whacked at week’s end.

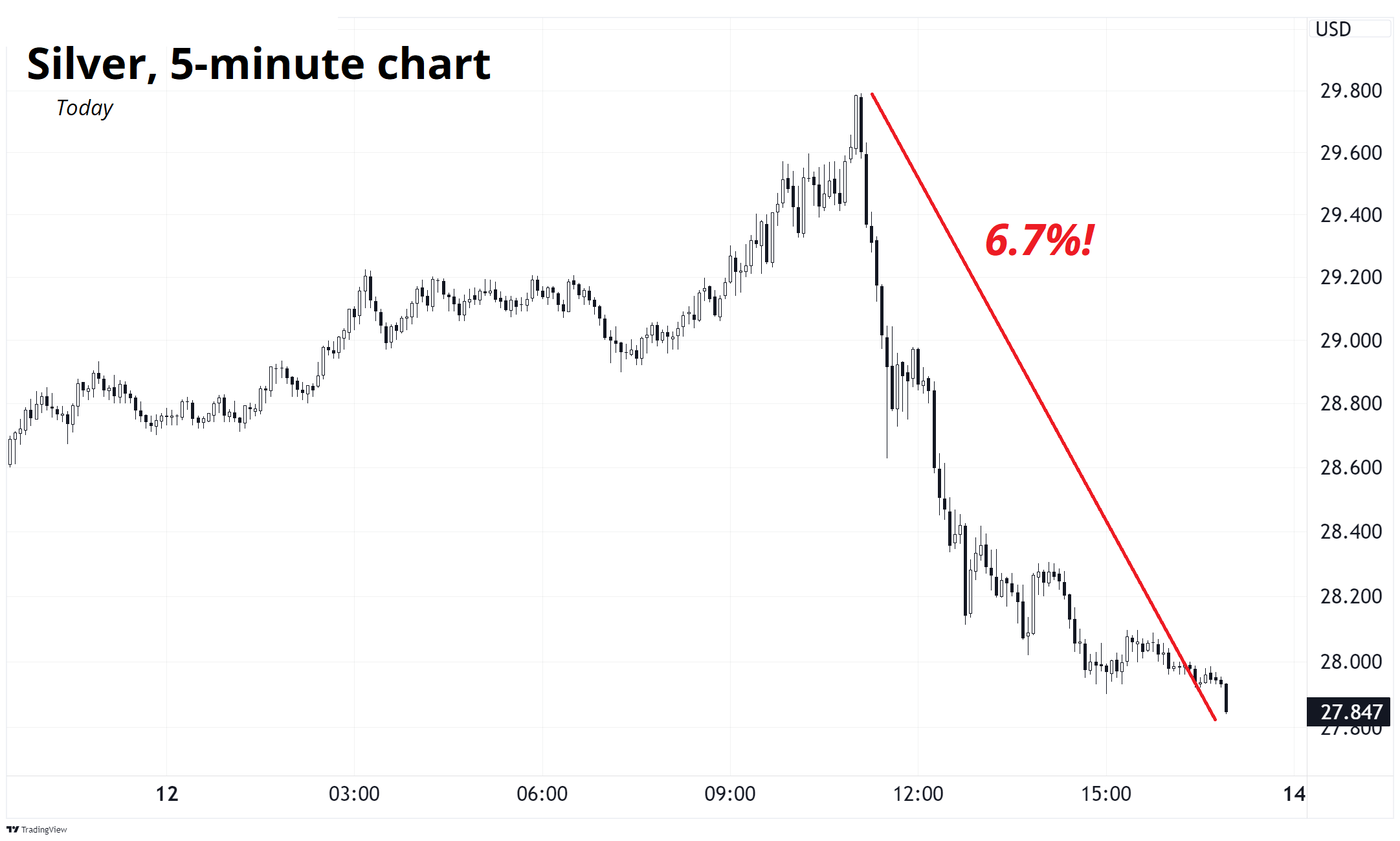

If we zoom in on the day in question (today), it looks like this.

6.7% in one day is a lot! At that pace, silver will be at zero in 15 days.

PS, that’s an extreme example of why extrapolation is very often nonsense. Always watch for “forecasts” that are more extrapolation than revelation.

OK! That was 7.7 minutes. Please share this with any aspiring finance professionals that you know! Thanks!

Get rich or have fun trying.

Links of the week

Join the waitlist for Spectra School. Let’s go! Improve your thinking and learn the right frameworks for trading and investing. The stuff you don’t learn in college. https://www.spectramarkets.com/school/

Smart, interesting, or funny

- Noah Smith: Why is the US doing so much deficit spending?

A good, not hysterical piece about US deficits.

- Self-doubt

Are you donut?

- Thinking about why you are doing what you’re doing

Nice piece from Phil Galfond reflecting on the importance of thinking about why you are doing the things you do. For money? How much, then? When do you stop? If you want more on this topic, you can read my piece Three Existential Questions: On money, self-sabotage and meaning.

Music

I like songs that tell a self-contained story. Songs like Stan by Eminem, Dance with the Devil (careful with this one, it’s hard core fr), Fast Car by Tracy Chapman, Lesley by Dave (also quite upsetting) and so on.

Another good one that you might not know, unless you’re Canadian, is 38 Years Old by The Tragically Hip.

“38 Years Old” on YouTube

RIP Gord