November 27, 2023

PDF version

Out of USD shorts

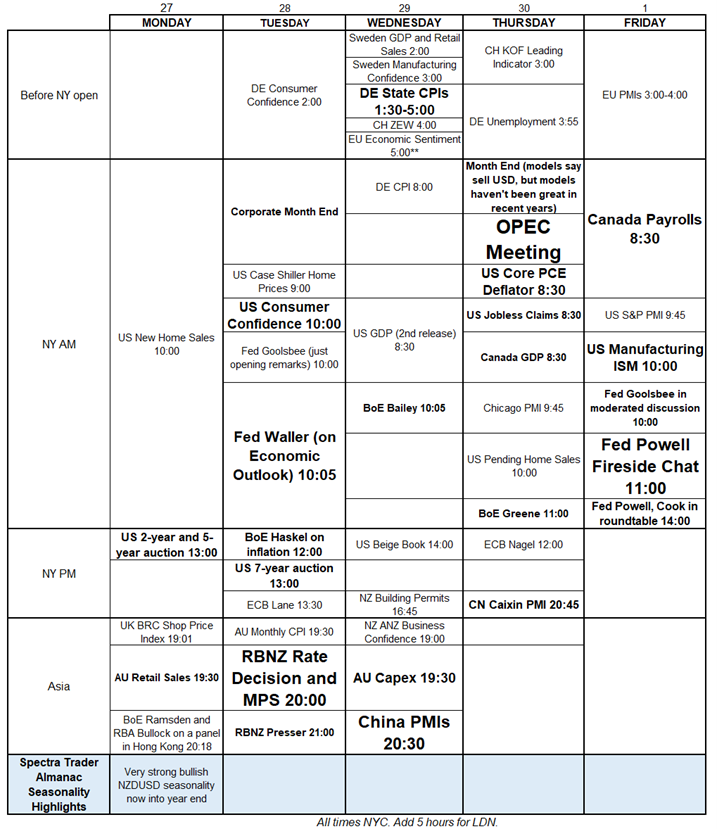

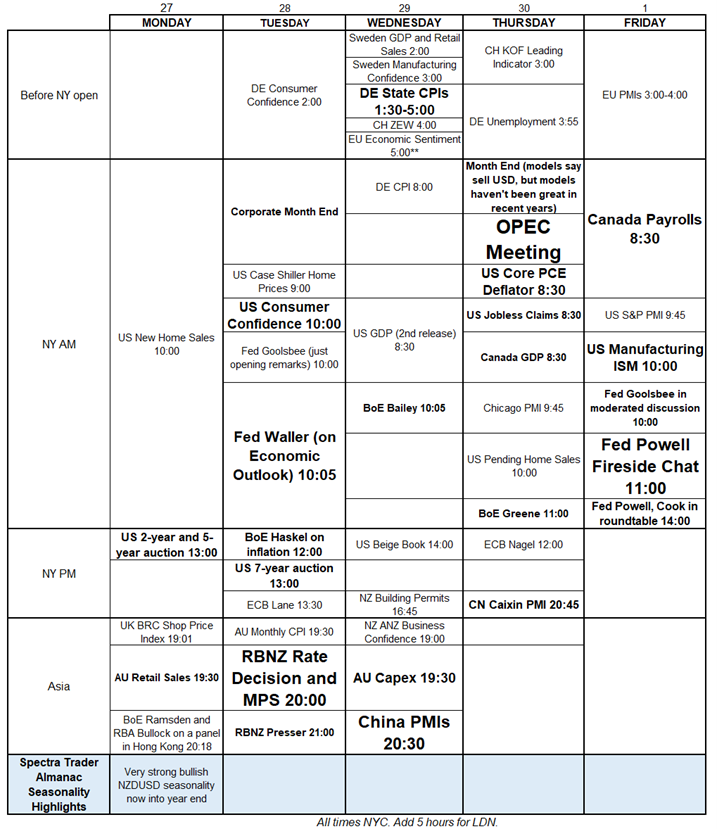

Quite the cornucopia of events this week with activity all around the globe. Everything from China PMIs, to RBNZ, major data out of Canada, some big Fed speeches (Waller and Powell) and moar. Here’s the calendar.

Note we also get corporate month end tomorrow and real money month end on Thursday. I have been long GBP and EUR and if US equities close the month here, it would be their 8th best monthly showing in the past 30 years. This would suggest there will be some dollars to sell into month end, but it’s important to note that the corporate month end signals (buy USD) have been much more reliable than the real money month end signals in recent years. I wrote a deep dive on the topic here:

am/FX: RIP Month End Models

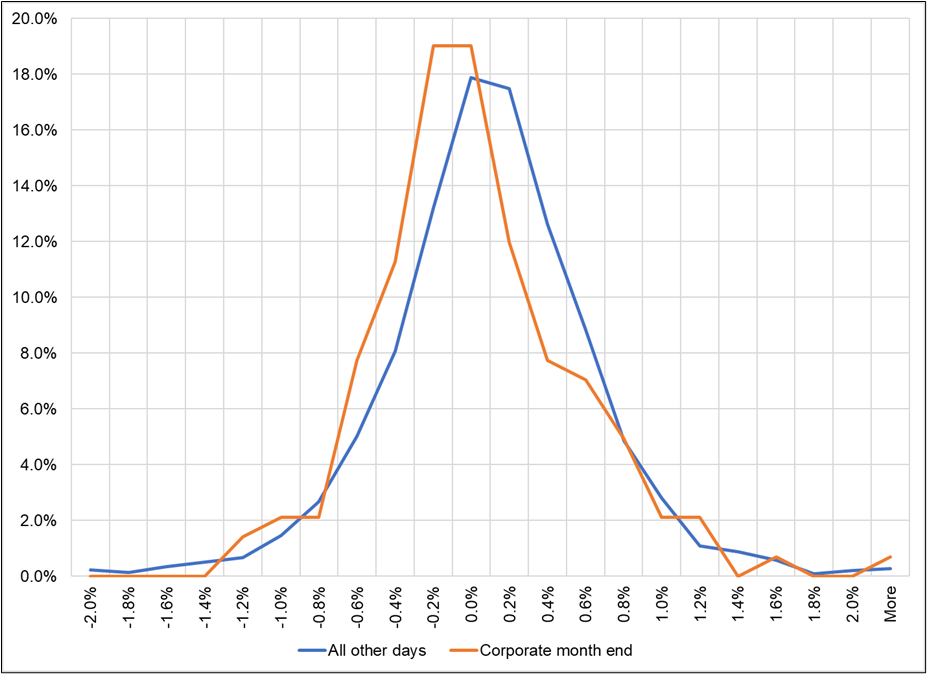

The takeaway there is that hedgers have spread out their rebalancing so the month end window is less predictable than it used to be. On the other hand, here is the performance of GBPUSD (for example) on corporate month end. Corporate month end is the day when spot settles on the last day of the month. That will be tomorrow.

GBPUSD cumulative returns on t-2 (corporate month end)

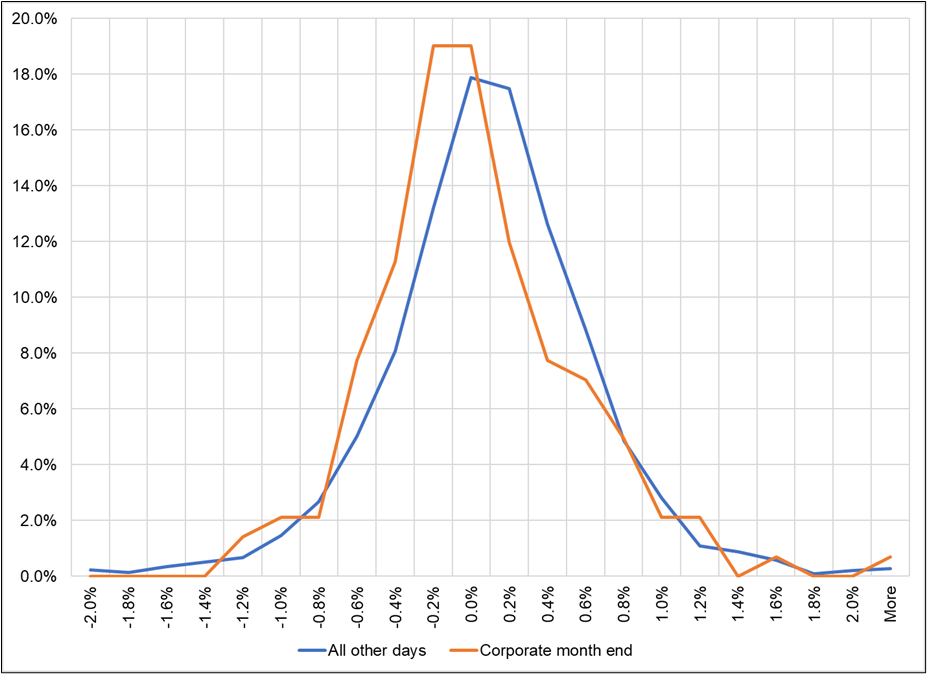

Using the same data, we can also make a histogram that looks like this. Notice the leftward lean.

Histogram of daily GBPUSD returns on corporate month end compared to all other days

The last two big up months for the SPX were June and July 2023 and GBPUSD followed the textbook pattern in both months. You can see the huge selloff on t-2 and then the rally after into month end.

GBPUSD hourly at the end of June 2022

GBPUSD hourly at the end of July 2022

The point of all this is to say that the risk/reward of holding USD shorts through tomorrow’s corporate month end is extremely unappealing, especially with GBPUSD trading just 50 pips from my take profit after a 500+ pip rally this month. Everything in the bigger picture continues to suggest higher GBP as the fiscal story there, year-end seasonality (bullish GBP, bearish USD), a move toward the center of the USD smile, and continued unwinds of CTA USD longs remain the primary story. But tomorrow could be rocky. Everything about GBPUSD applies to EURUSD too, so I will square up both trades between 3 and 4 pm NY today and look to reload at better levels when the dust settles.

Tactical considerations can create noise but, in this case, I think the signal is strong enough to suggest action is warranted.

Final Thoughts

Thanks to all those that have purchased the 2024 Trader Handbook and Almanac. If you have not got yours yet, grab it here.

Have a beautiful day.

good luck ⇅ be nimble